Goat Milk Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435113 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Goat Milk Market Size

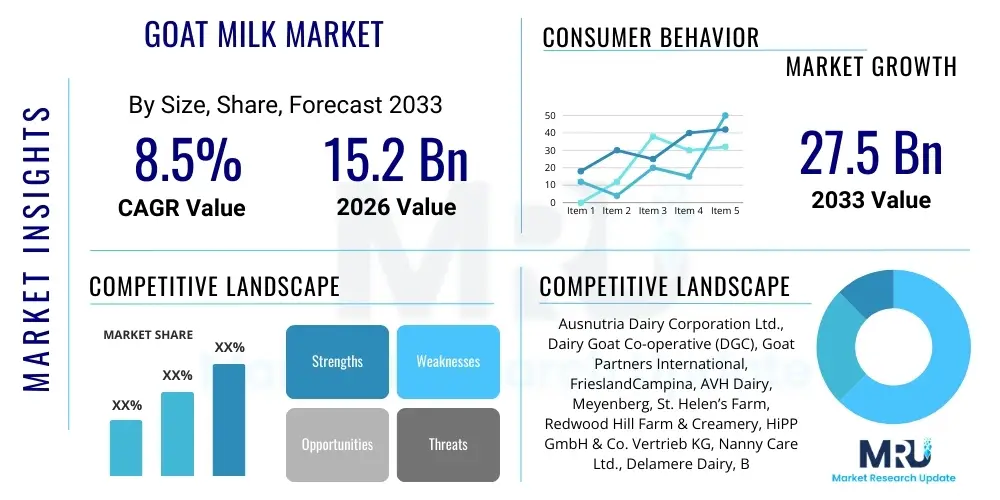

The Goat Milk Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Goat Milk Market introduction

The Goat Milk Market encompasses the global production, processing, distribution, and consumption of milk derived from goats, as well as derived products such as cheese, yogurt, infant formula, and nutritional supplements. Goat milk is increasingly recognized globally for its superior digestibility, lower allergenic properties compared to cow’s milk, and higher concentration of essential nutrients, including short- and medium-chain fatty acids. This intrinsic nutritional profile positions goat milk as a premium alternative, especially appealing to consumers with lactose sensitivity or those seeking functional foods. Major applications span across infant nutrition, where goat milk formula is gaining significant traction due to its casein structure similarity to human breast milk, and specialized dietary products targeting health-conscious adults and the elderly. The market benefits significantly from growing awareness regarding digestive health and the rising prevalence of food allergies, driving demand beyond traditional geographical strongholds in Europe and Asia.

Product categories within the market are diverse, ranging from fresh liquid goat milk to processed forms like powdered milk, which facilitates easier global distribution and storage. The processing segment is evolving rapidly with advancements in pasteurization and homogenization techniques designed to preserve the milk's nutritional integrity and extend shelf life. Key driving factors include increasing disposable incomes in emerging economies, shifting dietary patterns influenced by health and wellness trends, and strong endorsements from pediatric and nutritional bodies regarding the benefits of goat dairy products. Furthermore, the diversification of goat milk use into cosmetic and personal care products, leveraging its moisturizing and therapeutic properties, provides new avenues for market expansion and premiumization.

Goat Milk Market Executive Summary

The global Goat Milk Market is characterized by robust expansion driven primarily by consumer migration towards nutrient-dense, easily digestible dairy alternatives and the rapid proliferation of goat milk infant formula in high-growth regions like Asia Pacific. Business trends indicate a focus on technological innovation in farm management, including smart farming techniques to optimize yield and reduce environmental impact, alongside strategic mergers and acquisitions aimed at securing supply chains and expanding product portfolios into specialized nutritional supplements. Major players are investing heavily in research and development to enhance flavor profiles and integrate goat milk proteins into sports nutrition and clinical dietetics, moving the product from a niche dairy substitute to a mainstream functional ingredient.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive demand for infant nutrition products in countries such as China and India, where goat rearing is also culturally established. Europe, despite being a mature market, remains a powerhouse for high-value segments, particularly artisan goat cheese and specialized dairy derivatives, benefiting from strict quality control standards and established dairy infrastructure. Segment trends reveal that the liquid milk and milk powder categories maintain the largest market share, but the derivative segment, specifically yogurt and ice cream, is exhibiting the highest growth trajectory, reflecting increasing consumer willingness to pay a premium for specialized goat milk treats. The imperative for sustainability and ethical sourcing is also becoming a key competitive differentiator, influencing procurement strategies across all segments.

AI Impact Analysis on Goat Milk Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Goat Milk Market reveals a significant interest in how AI can optimize farm efficiency, predict market fluctuations, and ensure product traceability. Users frequently inquire about the feasibility of AI-driven livestock monitoring systems to detect diseases early, enhance breeding programs for higher milk yield, and automate complex milking processes. Concerns often center on the initial high investment costs for AI integration and the required specialized technical expertise among dairy farmers. Key expectations revolve around using predictive analytics for better supply chain management, minimizing waste, and aligning production cycles with fluctuating consumer demand, especially in the high-stakes infant formula segment where supply stability is critical. Ultimately, users anticipate AI serving as a catalyst for efficiency, quality control, and transparency in an increasingly demanding global food market.

AI adoption is profoundly reshaping the operational landscape of the goat milk industry, moving far beyond traditional agricultural practices. Data-driven farming, powered by machine learning algorithms, allows for precise feed management based on individual animal metrics, optimizing resource allocation and significantly lowering production costs per liter. For example, sensor data collected via wearables provides real-time health indicators, identifying subclinical mastitis or nutritional deficiencies long before human intervention, thereby safeguarding animal welfare and maintaining milk quality. Furthermore, large-scale processing facilities utilize AI-powered vision systems for quality assurance, rapidly identifying impurities or inconsistencies in milk powder batches, ensuring adherence to stringent international standards, a crucial requirement for infant formula exporters.

The impact of Generative AI (GenAI) is also being felt in market strategy and consumer engagement. GenAI tools are deployed to analyze vast datasets of consumer preferences, social media sentiment, and regional dietary trends, enabling companies to rapidly prototype and launch highly customized goat milk products tailored to specific demographic needs, such as geriatric nutritional shakes or sports recovery drinks. In the supply chain, AI models simulate logistical bottlenecks and predict optimal storage and distribution routes, significantly reducing spoilage, a major financial risk in the fresh milk segment. This shift towards smart supply chain optimization not only improves profitability but also enhances the market’s resilience to unforeseen disruptions, solidifying its competitive edge against conventional dairy sectors.

- AI optimization of goat breeding and genetics programs for maximizing yield and disease resistance.

- Implementation of precision agriculture using IoT sensors and machine learning for individual animal health monitoring.

- Predictive analytics for demand forecasting, inventory management, and minimizing supply chain waste.

- AI-driven quality control systems in processing plants for rapid contamination detection and purity assurance.

- Automated milking systems and barn climate control optimized by real-time environmental data.

- Generative AI used for customized product development and hyper-targeted marketing campaigns.

DRO & Impact Forces Of Goat Milk Market

The Goat Milk Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its growth trajectory and competitive intensity. Primary drivers include the increasing consumer preference for healthy, natural, and easily digestible alternatives to cow’s milk, largely spurred by the rising incidence of lactose intolerance and allergies globally. Opportunities arise from expanding applications beyond liquid consumption, notably in specialized nutrition, clinical foods, and premium cosmetic formulations, opening new high-margin revenue streams. However, the market faces significant restraints, chiefly high production costs associated with specialized goat husbandry, coupled with challenges in scaling operations compared to large-scale bovine dairy farming. These forces necessitate strategic resource management and technological adoption to mitigate risks and capitalize on emerging consumer trends.

The primary driving force underpinning market expansion is the documented nutritional superiority of goat milk, particularly its smaller fat globules and higher concentrations of medium-chain triglycerides, which enhance absorption and digestibility. This scientific backing resonates strongly with parents seeking alternatives for infant feeding and health-conscious adults. Conversely, a major restraining factor is the established cultural preference and infrastructure dominance of cow’s milk globally. Overcoming the existing infrastructural gaps in goat milk processing, distribution, and cold chain management remains a persistent challenge, particularly in developing markets where consumption is traditionally high but commercialization is nascent. Furthermore, regulatory complexity in classifying and marketing goat milk infant formula across different countries adds friction to cross-border trade.

Opportunities for exponential growth are concentrated in the functional food and nutraceutical sectors. Integrating goat milk proteins (such as whey and casein derivatives) into high-performance sports nutrition and clinical diet formulas represents a significant untapped market segment. The impact forces acting on the market, including competitive rivalry from plant-based alternatives (oat, almond, soy), regulatory scrutiny regarding labeling claims, and the power of consumers demanding ethical sourcing (Impact Force of Buyers), dictate that manufacturers must continuously innovate. Success hinges on robust marketing campaigns emphasizing the unique health advantages of goat milk and establishing efficient, vertically integrated supply chains that guarantee consistent quality and competitive pricing across diverse geographical regions.

Segmentation Analysis

The Goat Milk Market is segmented based on product type, form, application, and distribution channel, providing a granular view of consumer preferences and market dynamics across various categories. Understanding these segments is crucial for stakeholders to tailor production, marketing, and distribution strategies effectively. The segmentation highlights the diversification of the product portfolio, moving beyond traditional fresh milk to value-added derivatives such that maximize profit margins and address specialized consumer needs. The inherent nutritional characteristics of goat milk—its ease of digestion and high mineral content—drive the growth within the infant formula and nutritional supplement segments, demonstrating a strong correlation between health benefits and market uptake.

The core segments demonstrate distinct growth patterns. While liquid milk and milk powder remain foundational, derivatives such as cheese, yogurt, and specialty beverages are witnessing accelerated adoption, especially in Western markets where premium dairy products command higher prices. Furthermore, the segmentation by application reveals the prominence of the food and beverage sector, followed closely by the fast-expanding cosmetics and personal care industry, which leverages goat milk's moisturizing and skin-soothing properties. The growth in the cosmetics application is indicative of the market's successful transition from a purely food commodity to a versatile, high-value raw material utilized across multiple consumer goods categories.

Strategic analysis of distribution channels shows a shift towards e-commerce and specialized retail outlets, particularly for niche products like high-end infant formula and imported specialty cheeses, reflecting consumers' increasing reliance on online platforms for premium health goods. Traditional supermarket and hypermarket channels continue to dominate the distribution of standardized liquid and powdered milk volumes. The sophistication of these segmentation strategies allows market players to optimize inventory management, target specific consumer demographics effectively, and respond proactively to regulatory changes affecting different product forms, ensuring sustained market penetration and volume growth.

- By Product Type:

- Liquid Milk

- Processed Milk (Powdered Milk)

- Cheese

- Yogurt

- Others (Butter, Ice Cream, Kefir)

- By Form:

- Liquid

- Powdered

- Solid (Cheese, etc.)

- By Application:

- Food & Beverages (Dairy, Baked Goods)

- Infant Formula & Baby Food

- Nutraceuticals/Functional Foods

- Cosmetics & Personal Care

- By Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

Value Chain Analysis For Goat Milk Market

The value chain for the Goat Milk Market initiates with the upstream activities of goat rearing and feeding, encompassing genetics, animal health management, and feed production. Unlike bovine operations, goat husbandry often involves smaller, specialized farms, requiring precise nutritional input and stringent sanitary conditions to ensure high-quality raw milk. Upstream efficiency is critically dependent on optimizing feed conversion ratios and implementing smart farming technologies to monitor animal welfare, thereby ensuring a stable supply of raw material that meets the demanding specifications for further processing, particularly for sensitive applications like infant formula. Securing sustainable and ethical sourcing practices at this initial stage is vital for maintaining brand integrity and meeting consumer expectations.

The midstream phase focuses on processing and manufacturing, where raw goat milk is pasteurized, homogenized, and converted into various forms such as liquid milk, powder, cheese, or specialized proteins. This stage involves complex technological processes, including spray drying for powdered milk, which requires significant capital investment and adherence to global food safety standards like HACCP and ISO certifications. The differentiation in this phase occurs through the creation of value-added products, utilizing fractionation and filtration technologies to extract high-purity components for the nutraceutical and cosmetic industries. Efficient processing minimizes wastage and preserves the unique nutritional integrity of the milk, which is the primary value proposition of goat dairy.

The downstream activities involve distribution and final consumption. Distribution channels are bifurcated into direct channels, often utilized by small artisan producers selling premium products directly to consumers or specialized retailers, and indirect channels, which involve large-scale logistics networks (cold chain management) distributing high-volume products (like powdered infant formula) through wholesalers, supermarkets, and increasingly, e-commerce platforms. The dominance of indirect channels for mass-market products necessitates reliable cold storage infrastructure and effective shelf-life management. The value chain concludes with marketing and sales, where branding emphasizes health benefits and natural origin, directly influencing consumer perception and willingness to pay the premium price associated with goat milk products.

Goat Milk Market Potential Customers

Potential customers for the Goat Milk Market are highly diverse, spanning various age groups, health statuses, and purchasing power segments. The primary and highest-value customer segment includes parents seeking superior nutrition for their infants, particularly those whose babies exhibit sensitivities or minor allergic reactions to cow’s milk formulas. The perceived ease of digestion and the structural similarities between goat milk proteins and human breast milk drive significant loyalty within this demographic, particularly in high-growth, affluent urban centers across Asia Pacific and North America. This customer group demands rigorous quality assurance, robust scientific evidence, and transparent sourcing information, making them highly responsive to premium branding.

Another crucial customer base consists of health-conscious adults, including athletes and individuals with specific dietary restrictions, such as mild lactose intolerance or irritable bowel syndrome (IBS). These consumers actively seek functional foods and nutraceuticals derived from goat milk, recognizing its benefits in gut health improvement and overall wellness. The growth in geriatric populations globally also contributes significantly, as goat milk products, especially powdered supplements, are valued for their nutrient density and high protein content, supporting muscle maintenance and bone health. Marketing efforts targeting this segment often emphasize longevity, natural ingredients, and low inflammatory properties.

Furthermore, specialty segments include consumers of artisan dairy products, such as gourmet goat cheese enthusiasts in European and North American markets who value traditional production methods and unique flavor profiles. The cosmetic industry represents an emerging B2B customer segment, utilizing goat milk derivatives as potent ingredients in high-end skincare, capitalizing on its moisturizing and gentle properties for sensitive skin types. These B2B buyers purchase raw ingredients in bulk, focusing on consistency, purity, and certification standards. Therefore, the market strategy must be multifaceted, addressing both the high-volume needs of general consumers and the niche, high-specification demands of specialty manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ausnutria Dairy Corporation Ltd., Dairy Goat Co-operative (DGC), Goat Partners International, FrieslandCampina, AVH Dairy, Meyenberg, St. Helen’s Farm, Redwood Hill Farm & Creamery, HiPP GmbH & Co. Vertrieb KG, Nanny Care Ltd., Delamere Dairy, Bubs Australia, CapriLac, Holle Baby Food AG, New Era Nutrition, Courtyard Dairy, Stickney Hill Dairy, Jackson Mitchell, Inc., Hewitt’s Dairy, The Good Goat Milk Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Goat Milk Market Key Technology Landscape

The technology landscape in the Goat Milk Market is rapidly evolving, driven by the need for enhanced efficiency, stringent quality control, and extended product shelf life. Advanced dairy processing technologies are crucial, including Ultra-High Temperature (UHT) processing and membrane filtration techniques (such as ultrafiltration and microfiltration). UHT processing allows for the aseptic packaging of liquid goat milk, significantly extending its shelf stability without refrigeration, which is vital for export markets and regions with poor cold chain infrastructure. Membrane filtration is increasingly used to isolate specific goat milk protein fractions (whey and casein) for high-value nutraceutical and sports nutrition applications, ensuring purity and concentration far exceeding traditional separation methods.

On the farming front, precision livestock farming (PLF) technologies are revolutionizing upstream operations. This includes the deployment of Internet of Things (IoT) sensors, wearable devices, and sophisticated farm management software integrated with AI and machine learning capabilities. These technologies facilitate real-time monitoring of goat health, reproductive cycles, and individual milk yield, allowing farmers to optimize feeding regimes and detect early signs of illness, thereby maximizing efficiency and minimizing antibiotic usage. Automated milking systems tailored for goats, utilizing robotics and specialized cluster technology, are also becoming more common, addressing labor shortages and ensuring consistent hygiene standards throughout the milking process.

Furthermore, technology plays a critical role in supply chain integrity and consumer trust. Blockchain technology is emerging as a critical tool for end-to-end product traceability, especially important for premium infant formula. By recording every transaction, processing step, and quality check on an immutable ledger, companies can provide consumers with transparent information regarding the milk's origin, processing conditions, and journey to the shelf. This level of transparency enhances consumer confidence in the authenticity and quality of goat milk products, providing a significant competitive advantage against generic or less traceable dairy alternatives. Continuous investment in these technological spheres is essential for maintaining growth momentum and meeting future regulatory and consumer demands.

Regional Highlights

Geographically, the Goat Milk Market exhibits diverse consumption patterns and production capacities, with growth concentrated in high-demand, high-population density regions. Asia Pacific (APAC) stands out as the primary engine of market growth, characterized by strong consumer preference for goat milk infant formula, particularly in China and Southeast Asia, driven by rising disposable incomes and robust birth rates. Traditional goat husbandry practices are widespread in India and Pakistan, contributing significantly to local consumption, although commercialization and processed product export potential remain areas of opportunity. The regulatory environment in key APAC nations is increasingly adapting to support imported specialty dairy products, further accelerating market penetration.

Europe represents a mature yet high-value market, historically the epicenter of goat cheese production (e.g., in France, Spain, and the Netherlands). While liquid milk consumption is steady, the innovation landscape focuses heavily on high-quality, artisan derivative products, including premium yogurt and specialized dairy supplements, adhering to stringent European Union quality and traceability standards. The European consumer base is generally well-informed about the health attributes of goat milk and is willing to pay a premium for organic and sustainably sourced offerings. North America, led by the US and Canada, is characterized by its niche market status, driven by health and wellness trends; demand is particularly strong for specialized supplements and easily digestible milk alternatives, with rapid expansion seen in online retail and health food stores.

The Middle East and Africa (MEA) and Latin America (LATAM) markets, while smaller in commercial scale, possess substantial potential. In MEA, goat rearing is deeply embedded in pastoral traditions, with significant local consumption, and recent investments are being directed towards modernizing processing facilities to meet urban demands. LATAM markets, particularly in Brazil and Mexico, show growing interest in imported goat milk products, primarily due to rising consumer awareness about allergies and digestive issues, presenting strategic expansion points for international producers targeting new demographics seeking novel dairy alternatives.

- Asia Pacific (APAC): Dominates growth due to massive infant formula demand in China and rising health consciousness in India; represents high potential for powdered milk export volumes.

- Europe: Leading market for high-value derivatives, including artisan cheese and organic goat yogurt; characterized by strict regulatory frameworks and established dairy tradition.

- North America: Strong niche market driven by consumer seeking digestible alternatives and nutritional supplements; high adoption rate through specialty retail and e-commerce channels.

- Latin America (LATAM): Emerging market with increasing urbanization and awareness of nutritional benefits; focused on imported specialty products.

- Middle East & Africa (MEA): High traditional consumption, with recent government focus on industrialization of domestic goat milk production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Goat Milk Market.- Ausnutria Dairy Corporation Ltd.

- Dairy Goat Co-operative (DGC)

- Goat Partners International

- FrieslandCampina

- AVH Dairy

- Meyenberg

- St. Helen’s Farm

- Redwood Hill Farm & Creamery

- HiPP GmbH & Co. Vertrieb KG

- Nanny Care Ltd.

- Delamere Dairy

- Bubs Australia

- CapriLac

- Holle Baby Food AG

- New Era Nutrition

- Courtyard Dairy

- Stickney Hill Dairy

- Jackson Mitchell, Inc.

- Hewitt’s Dairy

- The Good Goat Milk Co.

Frequently Asked Questions

Analyze common user questions about the Goat Milk market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the accelerated demand for goat milk infant formula?

The rising demand is primarily driven by the milk's nutritional profile, which is naturally easier for infants to digest compared to cow's milk. Goat milk proteins form softer curds in the stomach and contain smaller fat globules, reducing digestive discomfort and providing a perceived closer alternative to human breast milk.

Is goat milk considered a suitable option for individuals with lactose intolerance?

While goat milk naturally contains lactose, it often has slightly lower lactose levels than cow’s milk. More importantly, its superior digestibility, attributed to its unique protein and fat structure, often allows individuals with mild lactose sensitivity to consume it with fewer gastrointestinal symptoms compared to conventional dairy.

Which geographical region dominates the production and consumption of goat milk products?

The Asia Pacific (APAC) region currently dominates the market in terms of consumption volume, particularly for powdered milk and infant formula, driven by large populations and growing middle-class purchasing power. However, Europe holds strong dominance in the high-value derivative segments like specialized cheeses and artisan dairy.

What are the primary restraints impacting the mass-market growth of the goat milk industry?

Major restraints include the comparatively high cost of production due to smaller-scale farming operations and specialized animal husbandry requirements. Challenges in establishing and maintaining robust, complex cold chain logistics, coupled with high initial investment needed for advanced processing technologies, also hinder rapid mass-market expansion.

How is technology influencing efficiency and quality control within the goat milk supply chain?

Technology is crucial for market advancement. Precision livestock farming (PLF) utilizing IoT and AI optimizes animal health and yield. Furthermore, blockchain technology is being adopted to enhance product traceability and ensure transparent quality control from farm to consumer, which is essential for premium products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Goat Milk Infant Formula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Goat Milk Formula Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Goat Milk Infant Formula Market Size Report By Type (First Class (0-6 months), Second Class (6-12 months), Third Class (1-3 years)), By Application (Supermarkets/Hypermarkets, Retail Stores, Online Selling), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Skim Milk Powder (SMP) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Goat Milk Powder, Cow Milk Powder), By Application (Dairy, Prepared Dry Mixes, Confectionery, Bakery, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager