Golf Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435179 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Golf Market Size

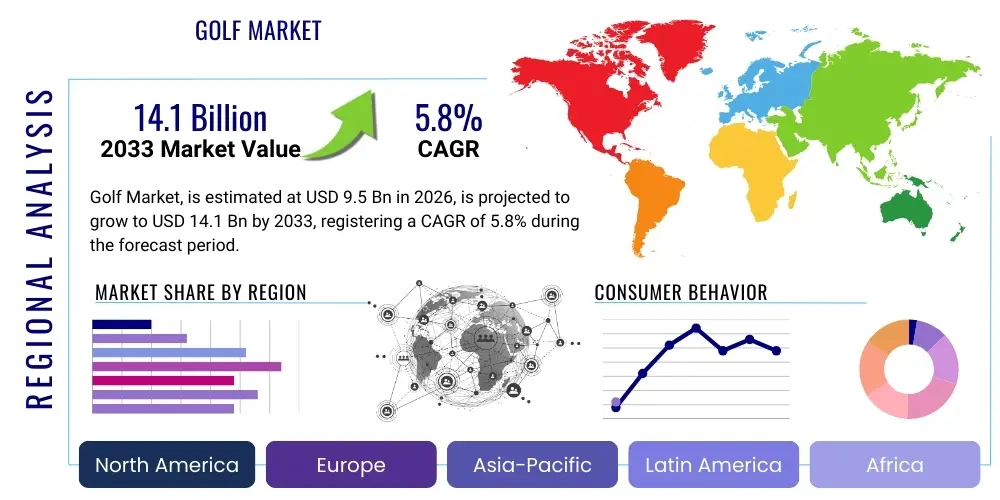

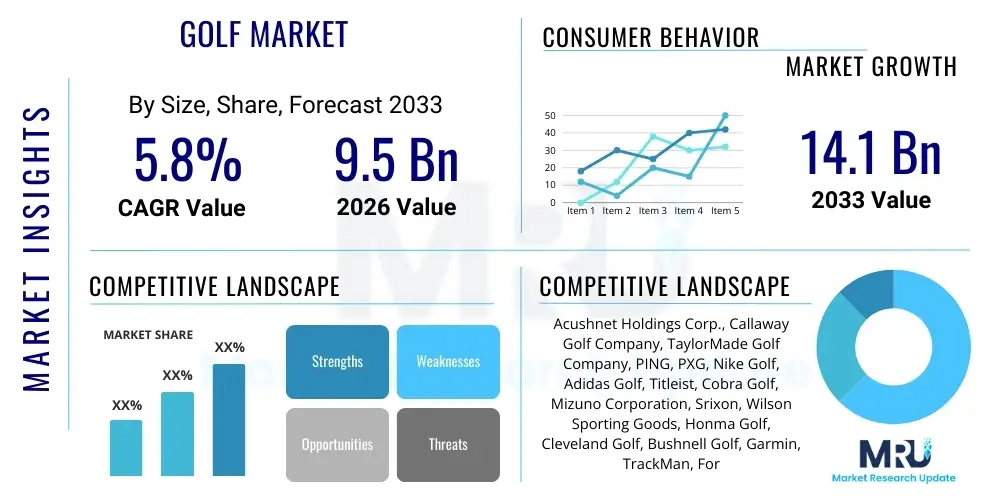

The Golf Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $9.5 Billion in 2026 and is projected to reach $14.1 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by a global resurgence in golf participation, especially among younger demographics and women, coupled with significant technological advancements in equipment design and simulation technologies. Market valuation is being propelled by increasing disposable incomes in key developing economies and the strategic expansion of golf tourism worldwide. The capital investments in golf course infrastructure development, coupled with the rising adoption of smart golf accessories, are contributing substantially to the overall market expansion and revenue generation across various segments, including clubs, balls, apparel, and related services.

Golf Market introduction

The Golf Market encompasses the comprehensive ecosystem surrounding the sport of golf, including the manufacturing and distribution of golf equipment (clubs, balls, bags, carts), apparel and footwear, accessories, specialized services (coaching, fitting, repair), and course operations and tourism. This global market is characterized by high levels of brand loyalty and continuous innovation driven by performance enhancement and regulatory compliance regarding equipment specifications. The market structure involves a highly consolidated core group of manufacturers specializing in high-performance equipment, alongside a fragmented segment dealing with accessories and apparel, catering to both professional athletes and amateur enthusiasts across various skill levels.

Major applications of golf products span competitive professional tournaments, recreational amateur play, corporate outings, and fitness and leisure activities. The sport's inherent social nature and the increasing recognition of golf as a valuable form of physical and mental exercise are critical benefits driving consumption. Furthermore, the integration of digital technology, such as GPS devices, launch monitors, and swing analysis software, has revolutionized both practice and play, enhancing accessibility and improving the learning curve for new players. The continued globalization of golf, evidenced by the growth of participation in Asia Pacific and Latin America, also contributes significantly to demand expansion across all product categories.

Key driving factors include the proliferation of golf entertainment venues (e.g., Topgolf), which serve as crucial introductory platforms for new participants; the renewed focus on health and wellness post-pandemic, encouraging outdoor activities; and continuous R&D investments by major manufacturers focused on materials science to maximize distance and forgiveness in clubs and balls. These technological advancements not only attract experienced players looking for performance upgrades but also make the game more enjoyable and accessible for beginners, ensuring sustained market vitality and upward trajectory through the forecast period.

Golf Market Executive Summary

The Golf Market is exhibiting strong momentum driven by global participation recovery, strategic digitalization, and increased consumer spending on premium and performance-enhancing products. Business trends highlight a significant shift towards personalized equipment fitting and the integration of sophisticated analytics in coaching and training services, transforming traditional golf into a tech-enabled sport. Manufacturers are focusing on sustainable practices and lightweight, durable material development to meet evolving consumer preferences regarding environmental responsibility and product longevity. Furthermore, the rise of specialized retail channels and e-commerce platforms has optimized supply chain efficiency and improved direct-to-consumer engagement, fostering higher revenue capture.

Regional trends indicate North America maintains its dominance due to a deeply entrenched golf culture and high consumer purchasing power, especially within the United States. However, the Asia Pacific region, particularly countries like South Korea, Japan, and China, is emerging as the fastest-growing market, propelled by rapid urbanization, infrastructure development supporting new course construction, and a rapidly expanding middle class with heightened interest in status and leisure sports. Europe demonstrates stable growth, largely centered on golf tourism and the sustained popularity of the sport in Western European nations, focusing on maintaining existing high-quality course infrastructure and attracting international players.

Segment trends reveal that the Equipment segment (particularly clubs and balls) remains the largest contributor to market revenue, driven by cyclical replacement rates and technological obsolescence. The Services segment, encompassing golf instruction and course fees, is experiencing robust growth due to increased participation and demand for professional coaching utilizing advanced simulators and tracking technology. The Apparel and Accessories segment is influenced heavily by athleisure trends, with brands integrating high-performance fabrics and sustainable materials, appealing to a broader consumer base interested in fashion, comfort, and functionality both on and off the course. This multifaceted growth across segments ensures market resilience against economic fluctuations.

AI Impact Analysis on Golf Market

User queries regarding AI's impact on the Golf Market primarily revolve around personalization, performance enhancement, and operational efficiency. Users are keenly interested in how Artificial Intelligence can optimize equipment fitting (analyzing swing data to recommend precise specifications), revolutionize instruction (providing real-time feedback and personalized drills), and automate golf course maintenance (optimizing irrigation, pest control, and turf health). Common concerns include the potential cost barriers for adopting AI-driven technologies, the accuracy of predictive analytics in highly variable outdoor environments, and the ethical implications of using advanced tracking and biomechanical analysis for player development. The overarching expectation is that AI will democratize access to elite-level analysis and radically improve playing ability and course management effectiveness.

The implementation of AI algorithms, particularly machine learning models, is critical in processing the vast amounts of swing data captured by modern launch monitors and sensor systems. This enables golf professionals and coaches to move beyond generalized advice toward highly granular, data-driven strategies tailored to an individual’s unique biometrics and swing characteristics. This level of customization extends the lifecycle of specialized equipment and increases consumer satisfaction by directly linking investment in technology to measurable performance improvements. For instance, AI can detect subtle flaws in a swing that human observation might miss, providing immediate, actionable feedback to the player.

Furthermore, AI is instrumental in streamlining the operational side of the golf industry. Course superintendents are leveraging predictive maintenance models and sensor data integrated with AI platforms to anticipate turf diseases, optimize water usage based on hyper-local weather patterns, and manage labor schedules more efficiently. In retail, AI-driven inventory management and customer relationship management (CRM) systems are enhancing the personalized shopping experience, predicting demand for seasonal apparel, and ensuring optimal stock levels for high-demand equipment, thus minimizing waste and maximizing profit margins across the value chain.

- AI-Powered Personalized Equipment Fitting: Analyzing thousands of data points to optimize shaft flex, loft, lie angle, and clubhead characteristics for individual swings.

- Real-Time Coaching and Instruction: Utilizing computer vision and machine learning to provide instantaneous feedback on swing mechanics and ball flight parameters.

- Predictive Course Maintenance: Optimizing irrigation, nutrient delivery, and disease prevention using sensor networks and localized climate forecasting models.

- Automated Swing Analysis Platforms: Converting raw sensor data into easily digestible, actionable insights for amateur players through mobile applications.

- Enhanced Golf Simulator Realism: Improving physics engines and graphics processing units (GPUs) through AI optimization for more accurate virtual ball flight simulation.

- Dynamic Pricing and Tee Time Management: Implementing algorithms to optimize revenue yield based on demand forecasting and time slots.

DRO & Impact Forces Of Golf Market

The dynamics of the Golf Market are shaped by a complex interplay of internal growth mechanisms and external economic and social pressures. Key market drivers include the rising global participation rate, catalyzed by accessibility initiatives like municipal courses and alternative golf entertainment venues, which significantly broaden the potential consumer base. Technological advancements in equipment design, particularly lightweight materials and advanced aerodynamics, continue to fuel replacement cycles as golfers seek marginal gains in performance. The increasing professionalization and global media coverage of major tours also enhance the visibility and appeal of the sport, spurring demand for related merchandise and services, functioning as a powerful promotional impact force.

Restraints primarily center on the high capital expenditure required for maintaining or developing traditional 18-hole golf courses, particularly concerning land use, water consumption, and environmental regulation compliance, which can limit geographical expansion. The perception of golf as an expensive and time-consuming sport remains a barrier to entry for lower-income demographics or individuals with limited leisure time, constraining the speed of market penetration in certain segments. Furthermore, the volatility of raw material prices (e.g., carbon fiber, titanium) used in high-performance equipment production introduces uncertainty into manufacturing costs and end-user pricing strategies, potentially dampening consumer demand for premium products.

Opportunities reside predominantly in untapped geographical markets, especially Southeast Asia and Africa, where economic development is generating new affluent consumer classes. The integration of augmented reality (AR) and virtual reality (VR) technologies into training and simulation offers significant growth potential, making practice more engaging and accessible outside of traditional courses. Moreover, sustainability initiatives and the development of eco-friendly equipment and course maintenance practices represent a major opportunity for brands to differentiate themselves and appeal to environmentally conscious consumers, transforming challenges into growth avenues. These forces collectively dictate the pace and direction of market evolution, ensuring continuous innovation and adaptation across the industry landscape.

Segmentation Analysis

The Golf Market is rigorously segmented based on product type, end-user demographics, and sales channels, providing a clear map of consumption patterns and commercial strategies. Product segmentation allows manufacturers to target specific performance requirements, ranging from professional-grade forged clubs to beginner-friendly composite equipment. End-user classification differentiates between individuals who play recreationally versus those engaged in competitive golf, influencing marketing efforts and product feature development. Sales channel analysis highlights the increasing importance of direct-to-consumer models and specialized retail outlets, which offer personalized services such as custom fitting, enhancing the overall consumer experience and driving higher average transaction values across the market ecosystem.

- By Product Type:

- Golf Equipment (Clubs, Balls, Bags, Carts)

- Golf Apparel (Shirts, Trousers, Outerwear, Headwear)

- Golf Footwear (Spiked, Spikeless)

- Golf Accessories (Gloves, Headcovers, GPS/Rangefinders, Training Aids)

- Golf Services (Course Fees, Coaching, Tourism)

- By End-User:

- Professional Golfers

- Amateur Golfers (Casual, Dedicated)

- Golf Course Operators

- By Distribution Channel:

- Specialty Golf Stores

- Sporting Goods Retail Chains

- Online Retail (E-commerce Platforms and D2C Websites)

- On-Course Pro Shops

- Departmental Stores

Value Chain Analysis For Golf Market

The Golf Market value chain begins with upstream activities focused on raw material sourcing and design. This involves the meticulous selection and procurement of high-performance materials such as titanium alloys, carbon fiber composites, high-density polymers for balls, and specialized textiles for apparel. R&D is a critical upstream component, where extensive testing and intellectual property protection surrounding new aerodynamic designs and material science breakthroughs define competitive advantage. Key players invest heavily in computer-aided design (CAD) and simulation to optimize performance parameters before large-scale manufacturing commences, ensuring compliance with strict regulatory standards set by governing bodies like the USGA and The R&A.

Midstream processes encompass the actual manufacturing and assembly of equipment, apparel, and accessories, often involving complex global supply chains with specialized production facilities in Asia. Quality control and precision engineering are paramount, especially for golf clubs, where slight variations in weight distribution or loft can significantly impact performance. Following manufacturing, products move into distribution channels. The distribution model is hybrid, relying heavily on specialized retail to provide necessary custom fitting and expert advice—a critical service element that justifies premium pricing. Direct distribution (D2C) through brand websites is rapidly gaining prominence, offering higher margin potential and better control over the customer experience.

Downstream activities involve marketing, sales, and post-sale services. Indirect distribution through third-party e-commerce platforms and mass-market sporting goods stores ensures wide reach, appealing to amateur and beginner segments. Direct sales, typically through owned retail locations or professional endorsement agreements, target high-end consumers and professional golfers. The service component, including coaching, club repair, and the operation of golf courses, closes the loop, utilizing the manufactured products and driving recurring revenue. This structure emphasizes the interplay between technological product superiority and high-touch consumer services, with distribution strategy being pivotal to market access.

Golf Market Potential Customers

Potential customers in the Golf Market are highly segmented, ranging from affluent, dedicated amateur players seeking the latest technological upgrades to younger, time-constrained individuals attracted to the social and accessible format of golf entertainment venues. The primary end-users or buyers include dedicated golfers (who regularly replace clubs and consume high volumes of consumables like balls and gloves), casual players (who purchase equipment less frequently but contribute significantly to course fee revenue), and institutional buyers such as golf course operators and corporate organizations (purchasing carts, maintenance equipment, and bulk branded merchandise). Market strategies are increasingly focused on the millennial and Gen Z demographics, who exhibit a strong preference for data-driven improvement, fashion-forward apparel, and technologically integrated accessories.

A significant segment consists of seniors and retired individuals, who form a stable base of participation and spending, especially in established markets like North America and Europe, requiring comfortable and forgiving equipment designs. Conversely, the professional segment, while small in volume, drives innovation and brand visibility, acting as critical influencers for amateur purchasing decisions. Identifying and targeting customers based on their specific equipment needs—distance, forgiveness, or control—and their preferred playing environment (traditional course vs. simulator) is essential for effective product positioning and market penetration, ensuring that offerings match both skill level and lifestyle requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $9.5 Billion |

| Market Forecast in 2033 | $14.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acushnet Holdings Corp., Callaway Golf Company, TaylorMade Golf Company, PING, PXG, Nike Golf, Adidas Golf, Titleist, Cobra Golf, Mizuno Corporation, Srixon, Wilson Sporting Goods, Honma Golf, Cleveland Golf, Bushnell Golf, Garmin, TrackMan, Foresight Sports, Full Swing Golf, True Temper |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Golf Market Key Technology Landscape

The technological landscape of the Golf Market is defined by relentless innovation aimed at optimizing performance, enhancing data capture, and improving the overall user experience. Core technological advancements center on materials science, involving the sophisticated use of composites such as multi-layer carbon fiber and exotic metals like titanium and tungsten to achieve optimal weight distribution, maximizing ball speed and forgiveness across the clubface. This engineering focus allows manufacturers to push the limits of Moment of Inertia (MOI) and Coefficient of Restitution (COR), offering demonstrable performance benefits that drive consumer desire for the latest models and necessitate frequent equipment upgrades among serious golfers.

Beyond equipment manufacturing, digitalization represents a significant technological pillar. This includes the widespread adoption of precise measurement tools such as Doppler radar-based launch monitors (e.g., TrackMan, Foresight Sports) and laser rangefinders (e.g., Bushnell, Garmin) that provide professional-grade data on ball flight characteristics, swing path, and clubhead speed. These technologies have moved from niche professional tools to consumer-grade devices, enabling amateurs to use data analytics to monitor and improve their game. Furthermore, wearable technology and smart apparel are integrating physiological tracking with swing analysis, offering holistic feedback on performance factors like fatigue and balance.

The emerging technological frontiers involve the integration of Artificial Intelligence and Virtual Reality (VR). AI algorithms are being deployed in custom fitting processes to instantly process millions of swing combinations and recommend the precise club specifications, moving far beyond traditional static matrix fitting. VR and augmented reality (AR) are enhancing the realism and accessibility of golf simulation, making off-course practice more immersive and effective. These digital platforms not only attract new players but also provide critical training resources regardless of geographical location or weather conditions, fundamentally changing how instruction is delivered and consumed in the modern golf ecosystem.

Regional Highlights

- North America: This region, led by the United States, represents the largest and most mature market globally. Its dominance is underpinned by a massive, established base of golfers, high levels of consumer disposable income, and the presence of major industry players and leading golf courses. Growth is fueled by the continuous renewal of equipment, heavy investment in golf entertainment facilities, and the rapid adoption of digital training technologies. The region sets key trends in premium equipment and advanced instruction methodologies, maintaining a strong market share.

- Europe: The European market demonstrates steady, resilient growth, often driven by golf tourism and the historical significance of the sport in the UK and Ireland. Western European countries contribute most significantly to revenue, characterized by demand for high-quality, sustainable course operations and premium golf apparel. The market is slightly constrained by land availability but benefits from a deeply ingrained golf culture and robust participation rates among high-net-worth individuals.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is primarily attributed to rising economic prosperity, urbanization leading to the development of new luxury courses, and the growing popularity of golf in nations like South Korea, Japan, and China. Japan remains a powerhouse in golf equipment innovation and consumption, while South Korea leads in golf simulator technology and youth participation, signifying enormous future potential.

- Latin America (LATAM): While smaller in absolute terms, the LATAM market is expanding steadily, driven by increasing recognition of golf as a valuable sport and leisure activity among the expanding middle class, particularly in countries like Mexico and Brazil. Market development is slower than APAC due to infrastructure limitations, but major professional tournaments hosted in the region are boosting visibility and encouraging investment in both courses and retail infrastructure.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is emerging as a critical luxury destination for golf. High government investment in sports tourism and the development of world-class, floodlit golf resorts attract international players. The region often serves as a showcase for sustainable course technologies, addressing the unique challenges of maintaining turf in arid climates, which creates niche opportunities for specialized equipment and course services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Golf Market.- Acushnet Holdings Corp.

- Callaway Golf Company

- TaylorMade Golf Company (a subsidiary of KPS Partners)

- PING (Karsten Manufacturing Corporation)

- PXG (Parsons Xtreme Golf)

- Nike Golf

- Adidas Golf

- Titleist

- Cobra Golf (a brand of Puma SE)

- Mizuno Corporation

- Srixon (a brand of Dunlop Sports Co. Ltd.)

- Wilson Sporting Goods Co.

- Honma Golf

- Cleveland Golf

- Bushnell Golf

- Garmin Ltd.

- TrackMan A/S

- Foresight Sports

- Full Swing Golf

- True Temper Sports

Frequently Asked Questions

Analyze common user questions about the Golf market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Golf Market?

The Golf Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by increased global participation and technological advancements in equipment and simulation platforms, ensuring sustained market expansion.

Which region dominates the global Golf Market in terms of revenue?

North America, particularly the United States, currently dominates the Golf Market due to its extensive golf infrastructure, high consumer spending on premium equipment, and deeply established golf culture. However, Asia Pacific is emerging as the fastest-growing market.

How is technology influencing amateur golfer performance and training?

Technology significantly enhances amateur performance through affordable access to launch monitors, GPS devices, and AI-driven swing analysis applications. These tools provide instant, data-backed feedback, enabling highly personalized and efficient training outside of traditional coaching sessions.

What are the primary factors restraining growth in the Golf Market?

Major restraints include the high costs associated with premium golf equipment and annual club membership fees, along with the significant environmental requirements (land and water) for maintaining traditional golf course infrastructure, which can limit expansion in water-stressed regions.

Which segment contributes most significantly to Golf Market revenue?

The Golf Equipment segment, specifically clubs (drivers, irons, putters) and golf balls, remains the largest contributor to market revenue. This dominance is sustained by continuous technological innovation leading to cyclical upgrades and the high consumption rate of specialized golf balls.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Kids Golf Apparel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Golf Cap Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Golf Putting Green Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Indoor Golf Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Golf Carts Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager