Grab Bar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439899 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Grab Bar Market Size

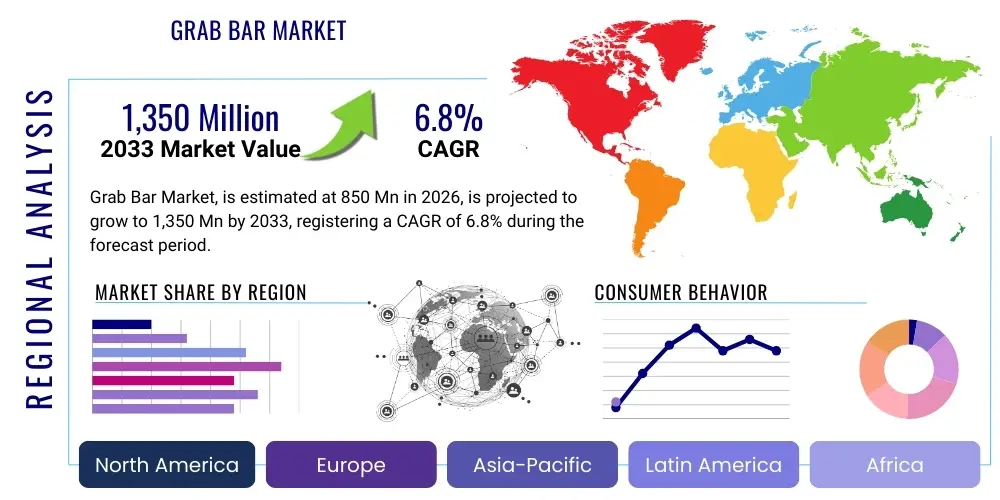

The Grab Bar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,350 million by the end of the forecast period in 2033.

The consistent growth in the grab bar market is primarily attributable to an aging global population and increasing emphasis on accessibility and safety across various residential, commercial, and public environments. As demographics shift towards a higher proportion of elderly individuals, the demand for assistive devices that prevent falls and enhance independence becomes critical. This demographic trend forms a fundamental driver for market expansion, particularly in developed economies where senior care infrastructure is more established.

Moreover, evolving building codes and regulations in many regions mandate the inclusion of accessibility features, including grab bars, in new constructions and renovations, especially in healthcare facilities, hospitality sectors, and public restrooms. This regulatory push, combined with a heightened awareness of safety standards among consumers and institutions, contributes significantly to the market's upward trajectory. Innovations in material science and design are also enhancing the appeal and functionality of grab bars, moving beyond purely utilitarian purposes to integrate seamlessly with modern aesthetics, thereby broadening their market adoption.

Grab Bar Market introduction

The grab bar market encompasses a range of safety and support devices designed to provide stability and prevent falls for individuals in various settings, primarily focusing on bathrooms, showers, and other high-risk areas. These products serve a critical function for an aging population, people with disabilities, and anyone requiring additional support to maintain balance or mobility. Key applications extend beyond residential use to include commercial establishments like hospitals, nursing homes, hotels, and public facilities, where accessibility and safety compliance are paramount. The inherent benefits include enhanced personal safety, increased independence for users, and a reduction in fall-related injuries, thereby contributing to overall well-being. Market growth is significantly driven by demographic shifts, stringent safety regulations, and a growing societal emphasis on inclusive design and universal accessibility.

Grab bars are typically manufactured from durable materials such as stainless steel, chrome-plated brass, aluminum, and high-strength plastics, often featuring textured or ergonomic grips to ensure secure handling even in wet conditions. Their design variations include straight, angled, L-shaped, and wavy configurations, catering to diverse spatial requirements and user preferences. Advanced models may incorporate features such as integrated soap dishes, towel racks, or LED lighting, blending utility with aesthetic appeal. The product’s versatility allows for installation in a multitude of locations, from private residences to large-scale institutional settings, adapting to specific structural and user needs.

The primary applications of grab bars are centered on areas where slips and falls are most common. In residential settings, they are indispensable in bathrooms, particularly near toilets and within shower or bathtub enclosures, and also on stairways or beside beds. For commercial and healthcare sectors, grab bars are a mandatory component in accessible restrooms, patient rooms, and assisted living facilities, supporting patient transfer and staff assistance. The core benefits extend to improving the quality of life for seniors and individuals with mobility challenges, offering them the confidence and physical aid needed for daily activities, while also providing peace of mind for caregivers and families. Driving factors for market expansion include the increasing number of elderly individuals globally, heightened awareness regarding fall prevention, and government initiatives promoting accessible infrastructure.

- Market Overview: The global grab bar market is experiencing robust growth driven by demographics and safety mandates.

- Product Description: Safety devices offering stability and support, available in diverse materials and designs.

- Major Applications: Primarily bathrooms, showers, toilets in residential, healthcare, and commercial settings.

- Key Benefits: Enhanced safety, increased user independence, reduced fall risks, compliance with accessibility standards.

- Driving Factors: Aging population, disability prevalence, stringent regulations, technological advancements in design.

Grab Bar Market Executive Summary

The grab bar market demonstrates sustained growth, underpinned by significant business, regional, and segment-specific trends. Business trends highlight a shift towards innovative product development, including smart grab bars with integrated sensors and modular designs that prioritize both functionality and aesthetics. Manufacturers are increasingly focusing on customization and offering a broader range of styles and finishes to cater to varied consumer preferences and interior designs, moving away from purely clinical appearances. Strategic collaborations between grab bar manufacturers and home automation companies are also emerging, signaling a future where accessibility solutions are seamlessly integrated into smart living environments. Furthermore, robust marketing efforts are expanding consumer awareness beyond traditional medical contexts to general household safety and universal design principles.

Regional trends indicate that developed economies in North America and Europe are leading the market, driven by comprehensive accessibility regulations, well-established healthcare infrastructure, and a substantial aging demographic. These regions exhibit high per capita spending on home modifications and assistive technologies. However, the Asia Pacific region is rapidly emerging as a significant growth hub, propelled by its large and rapidly aging population, increasing urbanization, improving healthcare facilities, and rising disposable incomes. Governments in countries like Japan and South Korea, with their advanced elder care policies, are particularly influential, while emerging economies such as China and India are witnessing a surge in demand due as public awareness regarding safety and accessibility grows. Latin America and the Middle East & Africa also present nascent opportunities, with increasing investments in healthcare and hospitality sectors stimulating market development.

Segmentation trends reveal a strong demand for wall-mounted grab bars due to their stability and widespread application, while floor-mounted and freestanding options cater to specific installation challenges and temporary needs. In terms of materials, stainless steel remains dominant due to its durability, hygiene, and aesthetic versatility, though plastic and aluminum options are gaining traction for their cost-effectiveness and lighter weight. The residential end-user segment, particularly the elderly and disabled populations, constitutes the largest market share, with a growing emphasis on home modifications for aging in place. Concurrently, the commercial and healthcare segments continue to drive significant volume, driven by regulatory compliance and institutional requirements for patient and guest safety. The online sales channel is experiencing accelerated growth, offering convenience and a wider product selection to consumers, complementing traditional retail channels like hardware stores and specialty medical equipment suppliers.

- Business Trends: Emphasis on product innovation, aesthetic integration, smart features, and strategic partnerships.

- Regional Trends: North America and Europe lead; Asia Pacific shows rapid growth; emerging markets offer new opportunities.

- Segments Trends: Wall-mounted and stainless steel dominate; residential and healthcare sectors are key end-users; online sales rising.

AI Impact Analysis on Grab Bar Market

Common user questions regarding AI's impact on the Grab Bar Market often revolve around how artificial intelligence could enhance product functionality, improve user safety, personalize accessibility solutions, and optimize manufacturing processes. Users are keen to understand if AI can move grab bars beyond passive safety devices into intelligent, proactive support systems. Concerns frequently touch upon data privacy, the cost implications of integrating AI, and the reliability of smart features in critical safety applications. Expectations include features like predictive fall prevention, adaptive support based on user biometrics or gait patterns, and seamless integration with smart home ecosystems to create truly intelligent living environments for individuals with mobility challenges.

The integration of Artificial Intelligence within the grab bar market represents a transformative shift, moving these essential safety devices from purely mechanical aids to smart, responsive health companions. AI algorithms can be embedded into smart grab bars to analyze user interaction patterns, detect subtle changes in posture or grip strength, and identify potential fall risks before an incident occurs. For instance, sensors connected to AI can monitor weight distribution and movement, alerting caregivers or emergency services if an irregular event is detected or if a user remains in a compromised position for an extended period. This proactive fall prevention capability is a significant leap forward, offering a new layer of security and peace of mind for both users and their families.

Beyond immediate safety, AI can contribute to the personalized experience and operational efficiency within the grab bar industry. AI-driven design tools can optimize grab bar configurations for specific user needs and architectural constraints, taking into account anthropometric data and user-specific mobility profiles to suggest optimal placement and style. In manufacturing, AI can enhance quality control by identifying defects with higher precision, predict maintenance needs for equipment, and streamline supply chain logistics for raw materials and finished products, leading to cost efficiencies and faster market deployment. Furthermore, AI can process feedback from user wearables or smart home devices to continuously improve grab bar design and functionality, making them more intuitive and effective over time and fostering a new generation of adaptive assistive technologies.

- Enhanced fall detection and prediction through integrated sensors and AI algorithms.

- Personalized placement and design recommendations based on user data and AI analysis.

- Integration with smart home ecosystems for voice control, emergency alerts, and ambient monitoring.

- Optimized manufacturing processes, including predictive maintenance and quality control using AI.

- Adaptive grip strength and texture adjustments based on user needs, potentially using haptic feedback.

- Data analytics on usage patterns to inform future product development and accessibility research.

DRO & Impact Forces Of Grab Bar Market

The Grab Bar Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside various impact forces that influence its trajectory. Key drivers include the significant global demographic shift towards an aging population, which inherently increases the demand for safety and mobility aids, coupled with a heightened awareness of fall prevention strategies. Simultaneously, stringent government regulations and building codes mandating accessibility features in public and commercial spaces further propel market expansion. However, the market faces restraints such as the relatively high initial installation costs, aesthetic concerns among consumers who perceive grab bars as purely utilitarian or institutional, and a lack of standardized design across the industry. Opportunities for growth lie in technological advancements, leading to the development of smart grab bars with integrated sensors, as well as an increasing demand for customizable and aesthetically pleasing solutions that blend seamlessly with modern interiors. The market is also impacted by technological innovation, demographic shifts, regulatory environments, evolving consumer preferences, and economic conditions.

Further elaborating on the drivers, the escalating prevalence of chronic diseases and age-related conditions that impair mobility directly contributes to the necessity for assistive devices like grab bars. Healthcare expenditure is also on the rise globally, with a growing focus on preventative care and home-based support for seniors and individuals with disabilities, which naturally extends to the adoption of grab bars for safer living environments. The desire for independent living among the elderly population is a powerful socio-economic factor driving the market, as grab bars enable individuals to maintain autonomy in daily tasks for longer periods. Additionally, the growing number of rehabilitation centers and specialized care facilities, all requiring accessible infrastructure, contributes substantially to the commercial demand for grab bars, ensuring that these institutions meet the highest standards of patient safety and care. The continuous research and development efforts in materials science also result in more durable, corrosion-resistant, and aesthetically versatile grab bar options, broadening their appeal.

Regarding restraints, the perception of grab bars as solely a medical or disability aid can deter a broader consumer base from adopting them for general home safety and universal design purposes. This stigma can limit their integration into mainstream home aesthetics, despite advances in design. Moreover, the fragmented nature of the market, with numerous manufacturers offering similar products, can lead to intense price competition and limited opportunities for differentiation, particularly in basic models. From an opportunity perspective, the emergence of smart home technologies offers a fertile ground for integrating grab bars with other connected devices, providing real-time data on user activity or fall incidents, thereby enhancing their value proposition. The untapped potential in developing economies, where awareness and infrastructure for accessibility are still evolving, also represents a significant long-term growth opportunity. Impact forces such as rapid urbanization and increased investment in public infrastructure, particularly in emerging markets, create new avenues for grab bar installation in transportation hubs, community centers, and commercial complexes, further solidifying the market’s growth prospects.

- Drivers:

- Aging global population and increased longevity.

- Rising awareness of fall prevention and home safety.

- Stringent government regulations and building codes for accessibility.

- Growing prevalence of chronic conditions and mobility impairments.

- Increased demand for independent living solutions.

- Restraints:

- High initial installation and product costs.

- Aesthetic concerns and perception as medical equipment.

- Lack of industry standardization across certain product lines.

- Limited product differentiation in basic models.

- Potential for incorrect installation leading to safety hazards.

- Opportunities:

- Technological advancements in smart grab bars (sensors, IoT integration).

- Demand for customizable and design-centric aesthetic solutions.

- Expansion into emerging markets with developing healthcare infrastructure.

- Integration with broader smart home and assisted living ecosystems.

- Educational initiatives to promote universal design and general home safety.

- Impact Forces:

- Technological innovation in materials and smart features.

- Demographic shifts, particularly global aging trends.

- Regulatory environment and evolving accessibility mandates.

- Consumer preferences shifting towards integrated and aesthetic solutions.

- Economic conditions influencing construction and healthcare investments.

Segmentation Analysis

The Grab Bar Market is extensively segmented to reflect the diverse needs of consumers and commercial entities, offering a granular view of market dynamics. These segmentations typically categorize products based on material, installation type, application, end-user, and sales channel, each providing unique insights into consumer behavior and market potential. This comprehensive breakdown allows stakeholders to identify key growth areas, understand competitive landscapes, and tailor product development and marketing strategies to specific niches. The interplay between these segments ultimately defines the overall market structure and future trajectory, highlighting where innovation and investment can yield the most significant returns.

- By Material:

- Stainless Steel: Preferred for durability, corrosion resistance, and sleek appearance.

- Plastic: Cost-effective, lightweight, and often used in temporary or less strenuous applications.

- Aluminum: Lightweight, rust-resistant, and versatile for various finishes.

- Brass: Offers a premium aesthetic, often used in high-end residential or hospitality settings.

- Other Metals: Includes chrome-plated steel or specialized alloys for specific applications.

- Composite Materials: Emerging for strength-to-weight ratio and design flexibility.

- By Installation Type:

- Wall-Mounted: Most common, offering permanent and secure support.

- Floor-Mounted: Used when wall support is insufficient or for specific accessibility needs.

- Freestanding: Portable solutions for temporary support or travel.

- Suction Cup: Temporary, non-invasive installation, suitable for travel or rental properties.

- By Application:

- Bathrooms: Primary application area, including near toilets, showers, and bathtubs.

- Toilets: Specific models designed for toilet area support.

- Showers: Essential for stability in wet, slippery shower environments.

- Stairways: Provides support for ascending and descending stairs.

- Bedsides: Assists with getting in and out of bed.

- Commercial Restrooms: Mandated in public and commercial facilities for accessibility.

- Healthcare Facilities: Hospitals, clinics, and nursing homes for patient safety.

- Public Spaces: Entrances, hallways, and accessible routes in public buildings.

- By End-User:

- Residential:

- Elderly Population: Main consumer group for aging in place solutions.

- Disabled Individuals: Essential for mobility and independence.

- General Public: Growing adoption for general home safety and fall prevention.

- Commercial:

- Hospitals & Clinics: For patient transfer and safety in medical settings.

- Nursing Homes & Assisted Living: Critical for resident care and fall prevention.

- Hotels & Hospitality: Ensuring accessibility and safety for guests.

- Public Buildings: Compliance with accessibility regulations.

- Industrial: Limited use in specific industrial safety applications.

- Residential:

- By Sales Channel:

- Online Retail: Growing due to convenience, wider selection, and price comparison.

- Offline Retail:

- Hardware Stores: Direct access for DIY installations and home renovations.

- Home Improvement Stores: Offer a range of styles and installation services.

- Specialty Stores (Medical Equipment): Cater to specific medical and disability needs.

- Direct Sales: For large institutional orders and specialized projects.

Value Chain Analysis For Grab Bar Market

The value chain for the Grab Bar Market outlines the sequential stages involved in bringing the product from raw materials to the end-consumer, encompassing upstream analysis, downstream activities, and distribution channels. Upstream processes involve the sourcing and processing of raw materials such as stainless steel, aluminum, brass, and various plastics, alongside the manufacturing of specialized components like grips, fasteners, and coatings. This stage is critical for ensuring material quality, cost-effectiveness, and sustainability. Midstream activities focus on the actual manufacturing, assembly, and quality control of the grab bars, often involving precision engineering and adherence to safety standards. Downstream analysis then concentrates on market penetration, sales, and after-sales services, ensuring product availability and customer satisfaction through a mix of direct and indirect distribution strategies.

Upstream analysis reveals that suppliers of metals, polymers, and coating materials play a pivotal role, with their pricing, quality, and supply chain reliability directly impacting the final product cost and market competitiveness. Manufacturers often establish long-term relationships with reputable raw material providers to ensure consistent quality and mitigate supply chain risks. Research and development in this segment also focuses on creating lighter, stronger, and more aesthetically appealing materials, or those with enhanced anti-microbial properties, adding value early in the chain. The efficiency of these upstream operations, including logistics and inventory management, significantly affects the lead time and overall production cost of grab bars.

Downstream activities primarily involve the distribution, sales, and installation of grab bars. Distribution channels are varied, including direct sales to large commercial clients and healthcare facilities, as well as indirect channels through wholesalers, distributors, hardware stores, home improvement retailers, and increasingly, online marketplaces. The choice of channel often depends on the target end-user and the scale of the operation. Direct sales offer greater control over customer relationships and pricing for large orders, while indirect channels provide broader market reach and accessibility for individual consumers. The final stage involves professional installation services, which are crucial for ensuring the safety and reliability of grab bars, especially in residential settings where improper installation can lead to severe safety hazards. Post-purchase support, including warranties and maintenance, also forms an integral part of the downstream value proposition, contributing to customer loyalty and brand reputation.

- Upstream Analysis: Sourcing of raw materials (metals, plastics), component manufacturing (grips, fasteners).

- Midstream Activities: Grab bar design, manufacturing, assembly, quality assurance, packaging.

- Downstream Analysis: Marketing, sales, distribution (wholesale, retail, online), installation services, after-sales support.

- Distribution Channels: Direct sales (institutional), indirect sales (retailers, e-commerce platforms).

Grab Bar Market Potential Customers

The potential customer base for the Grab Bar Market is remarkably diverse, extending beyond the traditionally perceived demographic to encompass a broader spectrum of individuals and institutions prioritizing safety, accessibility, and independent living. While the elderly and individuals with disabilities remain core end-users, there is a growing recognition among the general public about the benefits of proactive fall prevention and universal design in homes and public spaces. This expansion includes families with young children, individuals recovering from injuries or surgeries, and those seeking to enhance home safety as a precautionary measure. Institutional buyers such as healthcare providers, hospitality businesses, and public sector organizations also represent significant customer segments, driven by regulatory compliance and a commitment to inclusive environments.

A primary segment of potential customers comprises the rapidly growing global elderly population. As individuals age, their risk of falls increases due to declining balance, strength, and vision, making grab bars an essential aid for maintaining independence and safety in their homes. Families of seniors are also key decision-makers, often investing in grab bars during home modifications to enable their loved ones to "age in place." Similarly, individuals with various forms of disabilities, whether temporary or permanent, rely on grab bars to navigate their living spaces and public facilities with greater ease and security. Advocacy groups and caregivers often influence purchasing decisions in these demographics, emphasizing product reliability and ergonomic design.

Beyond the immediate needs of the elderly and disabled, the market is increasingly targeting consumers interested in universal design principles—creating environments that are accessible to all people, regardless of age, disability, or other factors. This includes new homeowners or those undertaking renovations who wish to future-proof their homes, making them safe and comfortable for all stages of life. Commercial entities, including hospitals, clinics, nursing homes, assisted living facilities, hotels, restaurants, and public municipal buildings, are also significant buyers. For these institutions, installing grab bars is not only a matter of legal compliance with accessibility standards like the Americans with Disabilities Act (ADA) but also a commitment to providing a safe and welcoming environment for their diverse clientele and patients, enhancing their reputation and service quality.

- Elderly Individuals: Primary users seeking support for aging in place and fall prevention.

- Individuals with Disabilities: Essential for mobility, independence, and accessibility.

- Caregivers and Family Members: Purchase on behalf of dependents for enhanced safety.

- Hospitals and Healthcare Facilities: For patient safety, transfer, and regulatory compliance.

- Nursing Homes and Assisted Living Facilities: Critical for resident care and fall prevention.

- Hotels and Hospitality Sector: Ensuring accessibility for guests and meeting industry standards.

- Public Sector (Municipalities, Government Buildings): Compliance with accessibility laws and universal design.

- Residential Homeowners: Increasingly adopting for general safety, universal design, and future-proofing.

- Individuals Recovering from Injury/Surgery: Temporary or long-term support during rehabilitation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1,350 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moen Incorporated, Kohler Co., Delta Faucet Company, Bobrick Washroom Equipment, Franklin Brass, Medline Industries, Graham-Field Health Products, Drive DeVilbiss Healthcare, Invacare Corporation, Etac AB, Handicare AB, Ponte Giulio, Frost Products, NRS Healthcare, Allegro Medical, TOTO Ltd., Roca Sanitario, Villeroy & Boch, American Standard, Bathla & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Grab Bar Market Key Technology Landscape

The technological landscape of the Grab Bar Market is evolving beyond simple mechanical aids, increasingly incorporating advanced materials, smart features, and ergonomic designs to enhance user safety, comfort, and independence. Innovations are focusing on integrating sensing technologies, connectivity, and modularity to create more dynamic and responsive solutions. This includes the development of grab bars with integrated sensors for fall detection, vital sign monitoring, or environmental sensing, as well as the use of antimicrobial coatings to improve hygiene in healthcare settings. Furthermore, advancements in mounting systems and materials are leading to easier installation processes, greater load-bearing capabilities, and more aesthetically pleasing options that blend seamlessly with modern interior designs, moving away from the purely utilitarian perception.

A significant aspect of the current technological evolution involves the integration of Internet of Things (IoT) capabilities into grab bars. Smart grab bars can feature pressure sensors that detect unusual weight distribution or prolonged periods of inactivity, triggering alerts to caregivers or emergency services. Some models are being designed with ambient lighting, proximity sensors, or even voice-activated controls, enhancing usability for individuals with visual impairments or limited dexterity. The data collected from these intelligent devices can provide valuable insights into user mobility patterns and potential risks, allowing for proactive interventions and personalized care strategies. These technological enhancements are transforming grab bars from passive support devices into active components of a comprehensive elder care or rehabilitation ecosystem.

Moreover, material science continues to play a crucial role in advancing grab bar technology. Manufacturers are experimenting with composite materials that offer superior strength-to-weight ratios, enhanced grip textures, and greater resistance to corrosion and wear, prolonging product lifespan and reducing maintenance. Ergonomic design principles are being applied more rigorously, leading to grab bars that are easier to grasp, provide better leverage, and reduce strain on joints, particularly for users with arthritis or limited hand strength. The focus on modular and adaptable designs allows for easier customization and re-configuration to suit changing user needs or different architectural layouts, promoting flexibility and cost-effectiveness. These technological shifts are not only improving functionality but also addressing the aesthetic concerns that have historically limited broader adoption of grab bars in residential settings.

- Smart Sensor Integration: Pressure sensors, motion detectors, and gyroscopes for fall detection and activity monitoring.

- IoT Connectivity: Wireless communication for remote alerts to caregivers or emergency services via smartphone apps.

- Advanced Materials: High-strength composites, antimicrobial coatings, enhanced grip textures, and corrosion-resistant alloys.

- Ergonomic Design: Research into optimal grip diameters, shapes, and angles for diverse user populations.

- Modular and Adaptable Systems: Grab bars designed for easy configuration, adjustment, and relocation.

- Integrated Lighting: LED lighting for enhanced visibility and safety in low-light conditions.

- Voice Activation/Smart Home Integration: Compatibility with smart assistants for hands-free control and ecosystem integration.

Regional Highlights

- North America: The North American market, particularly the United States and Canada, holds a dominant share in the global grab bar market, driven by a well-established healthcare infrastructure, a significant aging population, and stringent accessibility regulations. Government initiatives such as the Americans with Disabilities Act (ADA) in the U.S. mandate the installation of grab bars in public and commercial facilities, ensuring a consistent demand. The region also benefits from high consumer awareness regarding home safety and a proactive approach to adopting assistive technologies.

- High adoption rates due to advanced healthcare systems and strong regulatory frameworks.

- Significant expenditure on home modifications for aging-in-place initiatives.

- Leading market for product innovation and smart grab bar solutions.

- Europe: Europe represents another key market, characterized by its rapidly aging demographic and comprehensive social welfare programs that support independent living for seniors and individuals with disabilities. Countries like Germany, the UK, France, and the Nordic nations have well-developed elder care services and a strong emphasis on universal design in public and private constructions. The European Union's directives on accessibility further bolster market growth, alongside a cultural preference for high-quality, durable, and aesthetically integrated home solutions.

- Strong governmental support for senior care and accessibility.

- High demand for premium and design-conscious grab bar solutions.

- Robust market for retrofitting existing buildings to meet accessibility standards.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for grab bars, primarily due to its massive and rapidly aging population, particularly in countries like Japan, China, and South Korea. Rapid urbanization, increasing disposable incomes, and improving healthcare facilities are driving greater awareness and adoption of assistive devices. While regulatory frameworks are still evolving in some parts, the sheer demographic scale and growing focus on elder care infrastructure present immense opportunities for market expansion.

- Largest aging population globally, creating substantial demand.

- Increasing investment in healthcare infrastructure and accessible public spaces.

- Growing consumer awareness and rising disposable incomes fueling market growth.

- Latin America: The Latin American market is emerging as a growth region, albeit from a lower base, with increasing awareness of accessibility needs and investments in public infrastructure and healthcare. Countries like Brazil and Mexico are seeing a rise in construction activities that incorporate accessibility features, driven by social and economic development. However, challenges such as lower disposable incomes and less stringent regulatory enforcement compared to developed regions can impact market penetration, though the potential for growth remains significant.

- Developing regulatory frameworks and growing awareness of accessibility.

- Increasing investments in public and private infrastructure projects.

- Opportunity for cost-effective and adaptable grab bar solutions.

- Middle East and Africa (MEA): The MEA region is characterized by nascent market development, with growth largely tied to increasing healthcare expenditure, tourism infrastructure development, and nascent efforts towards improving accessibility in public spaces. The GCC countries, with their high per capita income and ambitious construction projects, are leading the adoption of modern accessibility solutions. However, the broader African continent faces challenges related to infrastructure, awareness, and affordability, indicating a long-term growth trajectory dependent on socio-economic development.

- Growth driven by tourism, hospitality, and healthcare sector investments.

- Emerging market for advanced and luxury grab bar solutions in high-income areas.

- Increasing focus on international accessibility standards in new developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Grab Bar Market.- Moen Incorporated

- Kohler Co.

- Delta Faucet Company

- Bobrick Washroom Equipment

- Franklin Brass

- Medline Industries

- Graham-Field Health Products

- Drive DeVilbiss Healthcare

- Invacare Corporation

- Etac AB

- Handicare AB

- Ponte Giulio

- Frost Products

- NRS Healthcare

- Allegro Medical

- TOTO Ltd.

- Roca Sanitario

- Villeroy & Boch

- American Standard

- Bathla & Co.

Frequently Asked Questions

What is the projected growth rate for the Grab Bar Market?

The Grab Bar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by an aging global population and increasing focus on safety and accessibility.

Who are the primary end-users of grab bars?

Primary end-users include the elderly, individuals with disabilities, and commercial sectors such as hospitals, nursing homes, and hotels, all seeking enhanced safety and accessibility solutions.

How is AI impacting the Grab Bar Market?

AI is transforming grab bars into smart, proactive safety devices through integrated sensors for fall detection, personalized design, and seamless integration with smart home systems to enhance user safety and independence.

What are the key drivers for the Grab Bar Market?

Key drivers include the aging global population, stringent government regulations on accessibility, and increasing awareness of fall prevention, all contributing to a growing demand for safety and mobility aids.

Which regions are leading the Grab Bar Market?

North America and Europe currently lead the market due to robust healthcare infrastructure and strong regulatory frameworks, while the Asia Pacific region is expected to exhibit the fastest growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Grab Bar Assist Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Grab Bar Market Size Report By Type (Wall-Mounted, Floor-Mounted, Other), By Application (Household, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager