High Purity Ethyl Trifluoroacetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433568 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Purity Ethyl Trifluoroacetate Market Size

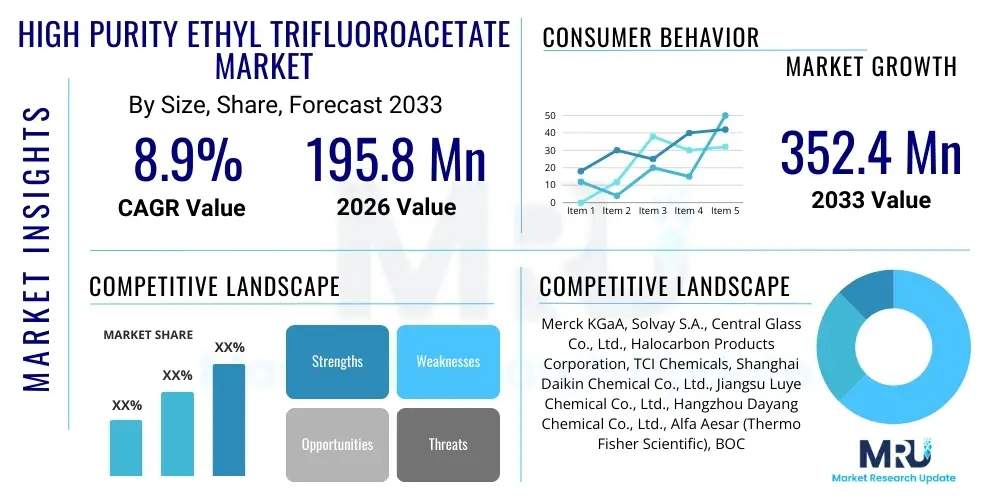

The High Purity Ethyl Trifluoroacetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 195.8 Million in 2026 and is projected to reach USD 352.4 Million by the end of the forecast period in 2033.

High Purity Ethyl Trifluoroacetate Market introduction

High Purity Ethyl Trifluoroacetate (HPETFA) is a specialized fluorinated ester characterized by its strong electron-withdrawing trifluoromethyl group, making it an indispensable intermediate in advanced chemical synthesis. This colorless liquid is prized for its high reactivity and ability to introduce trifluoroacetyl groups efficiently, which are crucial structural components in pharmaceuticals, agrochemicals, and novel electronic materials. The demand for exceptional purity grades, often exceeding 99.9%, stems directly from its sensitivity to impurities when used in highly regulated or performance-critical applications, such as electrolyte formulations for next-generation lithium-ion batteries and the synthesis of complex active pharmaceutical ingredients (APIs). The stringent requirements across these industries necessitate rigorous quality control and specialized manufacturing processes, positioning HPETFA as a premium commodity within the fine chemicals sector.

The primary applications driving market expansion are centered around the rapid globalization of the electric vehicle (EV) industry and the continuous innovation within pharmaceutical research and development, particularly in oncology and antivirals, where fluorine chemistry plays a vital role in enhancing bioavailability and metabolic stability. HPETFA acts as a pivotal trifluoroacetylation reagent, facilitating the efficient and selective modification of complex organic molecules. Its superior performance compared to traditional trifluoroacetylating agents, such as better handling characteristics and minimized side reactions, cements its status as the preferred choice for large-scale industrial synthesis. The stability and low boiling point of HPETFA also make it an effective solvent or reaction medium in specialized chemical processes requiring an aprotic, polar environment, further broadening its utility beyond just a mere intermediate.

Market growth is significantly bolstered by driving factors including increased investment in fluorochemical R&D, the global shift towards sustainable energy solutions accelerating EV battery production, and stricter regulatory frameworks that demand higher purity levels in chemical inputs to ensure consumer safety and product efficacy. The benefits associated with utilizing HPETFA include enhanced reaction yields, reduced processing complexity, and the ability to synthesize sophisticated molecules rapidly. As manufacturers increasingly seek cost-effective, high-performing synthetic routes, the role of HPETFA becomes more pronounced, especially in regions like Asia Pacific, which is rapidly expanding its capacity for advanced battery manufacturing and generic drug production. This convergence of technological push and market pull defines the trajectory for this high-value niche market.

High Purity Ethyl Trifluoroacetate Market Executive Summary

The High Purity Ethyl Trifluoroacetate (HPETFA) market exhibits robust growth driven by structural shifts in global manufacturing, focusing heavily on sustainability and high-performance materials. Business trends indicate a movement toward vertical integration among specialized chemical manufacturers to secure reliable access to raw materials, specifically trifluoroacetic acid derivatives, mitigating supply chain volatility and ensuring high purity standards. Furthermore, strategic alliances between HPETFA suppliers and major downstream consumers—particularly electrolyte producers and pharmaceutical CMOs—are becoming common practice to facilitate application-specific product development and quality assurance protocols. Capacity expansion, especially in emerging economies, is a defining business trend aimed at meeting the accelerating demand from the electronics and healthcare sectors, while adherence to stringent environmental, social, and governance (ESG) criteria is increasingly influencing purchasing decisions.

Regional trends highlight the undeniable dominance of the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, which collectively house the largest global production bases for lithium-ion batteries and possess expansive pharmaceutical manufacturing capabilities. This region benefits from favorable government incentives supporting domestic battery supply chains and a competitive manufacturing environment, which attracts investment in specialized chemical production. North America and Europe, while maintaining slower growth rates, focus intensely on premium, ultra-high-purity grades required for proprietary pharmaceutical synthesis and advanced material research, prioritizing quality and regulatory compliance over sheer volume. The shifting geographical manufacturing landscape dictates that suppliers must establish diversified distribution networks to effectively serve these distinct regional demands, managing logistical complexities associated with transporting specialized hazardous chemicals.

Segment trends underscore the significant influence of application segmentation, where the Lithium-ion Battery Electrolyte Additives segment is projected to experience the fastest growth due to the exponential expansion of the electric vehicle market globally. Purity grade segmentation reveals that ultra-high-purity grades (99.9% and above) command a substantial price premium and market share, reflecting the non-negotiable quality requirements in sensitive applications. Conversely, the Agrochemical segment, while mature, continues to provide a stable foundation for demand, utilizing HPETFA for synthesizing novel herbicides and fungicides. Successful market penetration relies on providing traceable purity documentation and consistent quality, which dictates the differentiation strategies employed by key market players across all segment categories.

AI Impact Analysis on High Purity Ethyl Trifluoroacetate Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Purity Ethyl Trifluoroacetate (HPETFA) market frequently center on how these advanced tools can address challenges related to purity consistency, synthesis yield optimization, and complex supply chain management. Users are specifically concerned about AI's ability to predict and prevent batch variations, a critical issue for high-purity chemicals where minute impurities can derail downstream applications like battery performance. Key themes involve the implementation of machine learning for real-time quality control based on spectral analysis, the use of predictive modeling for optimizing complex reaction kinetics in HPETFA synthesis, and the application of cognitive computing to forecast sudden demand spikes from volatile markets such as EV battery manufacturing. Expectations are high regarding AI's potential to accelerate new trifluoroacetate derivative discovery and improve sustainability by minimizing waste streams through process precision.

The adoption of AI and machine learning platforms within HPETFA manufacturing facilities is beginning to transform operational efficiency. AI algorithms are being trained on vast datasets of historical reaction parameters, temperature profiles, catalyst usage, and purification efficiency to establish predictive models for optimal synthesis pathways. This allows manufacturers to move away from empirical, trial-and-error approaches towards deterministic chemical production, significantly reducing the time required for scale-up and improving the first-pass yield of high-purity grades. By simulating various operational scenarios, AI aids in identifying bottlenecks in the complex multi-step synthesis and purification processes, ensuring consistent product quality which is paramount for sensitive end-use applications like advanced electronics and regulated pharmaceuticals.

Furthermore, AI plays a pivotal role in augmenting quality assurance and supply chain resilience within the HPETFA ecosystem. Spectroscopic data from techniques like NMR or mass spectrometry are continuously fed into machine learning models, enabling instantaneous detection of subtle changes in purity profiles that might otherwise be missed by traditional endpoint testing. This predictive quality maintenance ensures that only compliant material enters the downstream supply chain. From a strategic perspective, AI-driven demand forecasting leverages complex algorithms to analyze global semiconductor, pharmaceutical pipeline, and EV registration data, providing HPETFA producers with highly accurate projections necessary to manage feedstock procurement and production scheduling, thereby stabilizing prices and ensuring availability during periods of rapid market shifts.

- AI optimizes reaction conditions (temperature, pressure, catalyst load) for maximum HPETFA purity and yield.

- Machine learning models predict synthesis failure or impurity formation in real-time, enhancing batch consistency.

- AI-powered spectral analysis enables instantaneous, non-destructive quality control of finished high-purity product batches.

- Predictive analytics enhance supply chain resilience by forecasting shifts in demand from the EV and pharmaceutical sectors.

- Cognitive automation assists in rapid discovery and screening of novel fluorinated compounds utilizing HPETFA as a precursor.

- AI platforms aid in energy consumption minimization and waste stream reduction during the intensive purification stages.

DRO & Impact Forces Of High Purity Ethyl Trifluoroacetate Market

The High Purity Ethyl Trifluoroacetate (HPETFA) market is currently shaped by a powerful confluence of driving forces stemming primarily from technological advancements in energy storage and healthcare, balanced against significant regulatory and structural restraints inherent to specialized chemical manufacturing. The most significant driver is the unparalleled growth trajectory of the global electric vehicle market, which requires vast quantities of high-performance electrolyte components, where HPETFA derivatives often serve as performance-enhancing additives ensuring thermal stability and long cycle life. Simultaneously, the pharmaceutical industry’s increased reliance on fluorination, recognized for its ability to improve drug efficacy and metabolic profiles, fuels sustained demand for HPETFA as a preferred trifluoroacetylation agent. These primary drivers create a market environment focused on expansion and innovation.

However, the market is severely restricted by several key factors. The specialized synthesis and purification processes required to achieve ultra-high purity grades are inherently capital intensive and technically complex, leading to high production costs and limited economies of scale for specialized producers. Furthermore, HPETFA manufacturing involves the handling of hazardous and corrosive raw materials, imposing stringent environmental and safety regulations globally, which increases operational expenditure and acts as a significant barrier to entry for new market participants. Supply chain volatility, particularly concerning key precursors like trifluoroacetic acid (TFAA), also poses a persistent restraint, leading to price fluctuations and potential supply bottlenecks that impact downstream industries reliant on consistent HPETFA availability.

Significant opportunities for future market expansion lie in the customization of HPETFA derivatives for emerging applications, such as specialized refrigerants, advanced functional polymers, and high-performance electronic cleaning agents. The development of greener, more sustainable synthesis technologies, potentially leveraging biocatalysis or continuous flow chemistry, represents a critical opportunity to mitigate environmental compliance costs and improve manufacturing efficiency, appealing to increasingly ESG-conscious consumers. The impact forces acting on the market structure are strong; these include increasing supplier concentration due to the technical barriers, intense pricing pressure in lower-purity segments, and high substitution threat from less expensive, non-fluorinated alternatives in non-critical applications, necessitating continuous innovation in performance enhancement to maintain market share.

Segmentation Analysis

The High Purity Ethyl Trifluoroacetate market is segmented based on Purity Grade, which reflects the stringent requirements of its end-use sectors; by Application, distinguishing between the high-growth sectors such as batteries and the stable, established sectors like pharmaceuticals and agrochemicals; and by End-User, identifying the direct consumers of this specialized chemical. Understanding these segments is crucial for strategic market positioning, as pricing power and growth rates vary drastically between the ultra-high purity grades required for electrolytes versus the standard grades used in commodity chemical synthesis. The market structure is highly dependent on meeting the specific quality requirements of the target application, which drives both technological investment in purification and specialized distribution methodologies.

- By Purity Grade:

- Standard Purity (Below 99.5%)

- High Purity (99.5% - 99.9%)

- Ultra-High Purity (99.9% and above)

- By Application:

- Lithium-ion Battery Electrolytes (Additives/Co-solvents)

- Pharmaceutical Synthesis (APIs and Intermediates)

- Agrochemical Production (Herbicides and Fungicides)

- Specialty Polymers and Monomers

- Electronic Chemicals and Solvents

- By End-User Industry:

- Chemical Manufacturing (General)

- Energy and Power (Battery Manufacturers)

- Pharmaceutical and Biotechnology Companies

- Agrochemical Companies

- Academic and Research Institutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For High Purity Ethyl Trifluoroacetate Market

The value chain for High Purity Ethyl Trifluoroacetate (HPETFA) is characterized by high complexity and dependency on the upstream supply of specialized raw materials. Upstream analysis begins with the sourcing of key precursors, predominantly trifluoroacetic acid (TFAA) or its derivatives, and ethanol. TFAA production itself is a highly specialized process, often controlled by a limited number of global fluorochemical giants, granting them significant leverage over input costs and supply consistency for HPETFA manufacturers. The synthesis phase involves complex reaction engineering, typically via esterification or similar catalytic methods, followed by rigorous, multi-stage purification protocols—such as fractional distillation and chromatography—necessary to achieve the demanding ultra-high purity grades required by downstream battery and pharma sectors. Any disruption or quality lapse in the upstream segment directly impacts the cost structure and final product viability.

The midstream segment involves the specialized HPETFA manufacturing and quality control processes. Given the product's sensitivity and the strict regulatory environment, manufacturers invest heavily in advanced analytical instrumentation (GC, NMR, ICP-MS) to certify purity levels, often down to parts per billion for trace metal content, critical for battery applications. Distribution channels for HPETFA are highly specialized, often involving cold chain logistics or handling protocols for hazardous materials, necessitating strong partnerships with specialized chemical logistics providers. Direct sales channels are common for large, strategic accounts (e.g., major pharmaceutical companies or top-tier battery electrolyte producers), allowing for custom specification compliance and technical support, ensuring high margins and strong customer retention.

Downstream analysis focuses on the end-use applications, which are highly diversified but quality-sensitive. The largest volumes are consumed indirectly by electrolyte solution providers who incorporate HPETFA as a functional additive into complex battery formulations. Conversely, pharmaceutical companies are direct users, employing HPETFA as a critical reagent in API synthesis. The end-user demand dictates the distribution requirements: while pharmaceutical and agrochemical delivery is typically B2B and highly regulated, the electronics and battery sector requires just-in-time delivery in high volumes. This structure highlights the market’s reliance on efficient, controlled, and traceable indirect and direct distribution networks to maintain the integrity and purity of the chemical until it reaches its final, highly specialized application.

High Purity Ethyl Trifluoroacetate Market Potential Customers

The primary potential customers for High Purity Ethyl Trifluoroacetate are concentrated within high-technology sectors requiring fluorinated intermediates to enhance product performance or efficacy. Leading the demand are specialized electrolyte manufacturers serving the Electric Vehicle (EV) and consumer electronics markets. These companies utilize HPETFA, or its derived products, as critical additives in lithium-ion battery electrolytes. The trifluoroacetyl group contributes significantly to improving the thermal stability, cycle life, and overall safety profile of the battery, making HPETFA an irreplaceable component for high-density energy storage solutions. As the global push for electrification accelerates, these battery chemical specialists represent the fastest-growing and most high-volume buyer segment, prioritizing consistency and ultra-high purity (99.99% grades).

Another crucial customer segment consists of global pharmaceutical companies and their Contract Manufacturing Organizations (CMOs). In drug discovery and synthesis, the introduction of fluorine atoms is a standard practice to modulate physiochemical properties, such as increasing lipophilicity and resistance to metabolic degradation. HPETFA serves as an efficient and selective reagent for introducing the trifluoroacetyl moiety during the complex synthesis of Active Pharmaceutical Ingredients (APIs) for treatments targeting high-value therapeutic areas like cancer, diabetes, and infectious diseases. These buyers prioritize documented traceability, strict adherence to GMP standards, and supplier stability, often entering into long-term supply agreements to ensure continuous production of regulated drug intermediates.

Furthermore, agrochemical producers remain foundational customers. They employ HPETFA in the synthesis of specialized fluorinated herbicides, insecticides, and fungicides that offer improved potency and environmental persistence compared to their non-fluorinated counterparts. Beyond these major sectors, emerging customer segments include manufacturers of advanced functional materials, where HPETFA is used in creating specialized fluoropolymers, and academic or industrial research laboratories that require the chemical for novel compound synthesis and catalysis research. Each potential customer segment shares a common requirement for exceptional quality control and specific impurity profiles tailored to their proprietary processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.8 Million |

| Market Forecast in 2033 | USD 352.4 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Solvay S.A., Central Glass Co., Ltd., Halocarbon Products Corporation, TCI Chemicals, Shanghai Daikin Chemical Co., Ltd., Jiangsu Luye Chemical Co., Ltd., Hangzhou Dayang Chemical Co., Ltd., Alfa Aesar (Thermo Fisher Scientific), BOC Sciences, Oakwood Chemical, Xingtai Rencai Chemical Co., Ltd., Nantong Sibo Chemical Co., Ltd., J&K Scientific, Lianyungang Jindong Chemical Co., Ltd., Fluorochem Ltd., Time Chemical Co., Ltd., Daystar Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Ethyl Trifluoroacetate Market Key Technology Landscape

The technology landscape for the High Purity Ethyl Trifluoroacetate (HPETFA) market is dominated by sophisticated chemical synthesis and purification methodologies designed to meet demanding purity specifications, particularly concerning trace metal contamination. Traditionally, HPETFA synthesis relies on batch processing using conventional esterification of trifluoroacetic acid or its anhydride with ethanol. However, to enhance throughput, safety, and consistency, the industry is increasingly adopting continuous flow chemistry. Flow reactors allow for precise control over reaction parameters, enabling rapid mixing and heat exchange, which is critical for exothermic fluorination reactions, resulting in higher yield, better selectivity, and drastically improved batch-to-batch reproducibility. This shift toward continuous processing minimizes human error and exposure, addressing key safety concerns associated with high-pressure, high-temperature synthesis, while also offering the ability to scale production flexibly based on fluctuating downstream demand from the volatile battery market.

Purification technology is arguably the most critical component of the HPETFA value chain, particularly for achieving the ultra-high purity required for lithium-ion battery applications (where trace transition metals can severely degrade battery performance). Advanced fractional distillation remains the backbone of initial purification, but it is often supplemented by highly specialized techniques. These include proprietary solvent extraction methods, various forms of chromatography (preparative or flash), and specialized adsorption techniques utilizing activated carbon or molecular sieves to meticulously remove residual moisture, unreacted precursors, and problematic metallic ions. Innovators are focusing on developing reusable, energy-efficient purification matrices and implementing closed-loop systems to minimize environmental impact and waste generation, thereby enhancing the sustainability profile of the production process.

A key technological development also includes the integration of advanced inline analytical monitoring systems. Techniques such as near-infrared (NIR) spectroscopy, coupled with sophisticated chemometrics, allow manufacturers to monitor reaction completion and impurity profiles in real-time, moving beyond traditional laboratory sampling. This predictive quality control (PQC) framework, often enhanced by AI-driven feedback loops, ensures that production remains within tight purity tolerances throughout the entire process, minimizing off-spec material. Furthermore, the development of novel catalytic conversion methods to synthesize HPETFA from more readily available and less hazardous starting materials is an ongoing R&D focus, aiming to reduce dependence on expensive and environmentally challenging precursors like TFAA, potentially disrupting the upstream value chain and lowering overall production costs in the long term.

Regional Highlights

The global High Purity Ethyl Trifluoroacetate market exhibits distinct geographical dynamics, heavily influenced by regional manufacturing capabilities in electronics, energy storage, and pharmaceuticals.

- Asia Pacific (APAC): APAC commands the largest share of the HPETFA market and is expected to record the highest growth rate. This dominance is primarily driven by the region's massive manufacturing footprint in lithium-ion batteries, concentrated heavily in China, South Korea, and Japan. China, in particular, serves as both a major producer and consumer, leveraging strong governmental support for the domestic EV supply chain. High domestic competition and large-scale capacity allow for competitive pricing, catering to the huge appetite for battery electrolyte additives and generic pharmaceutical intermediates.

- North America: North America represents a mature, high-value market segment. Demand is concentrated in specialized, proprietary pharmaceutical synthesis and advanced research into high-performance materials for defense and aerospace. While volume consumption is lower than in APAC, the region commands premium pricing for ultra-high-purity grades, reflecting the stringent regulatory oversight (FDA) and the advanced nature of its R&D activities. There is a growing focus on securing domestic supply chains for critical battery components, boosting investment in local HPETFA production capacity.

- Europe: European market growth is steady, fueled by the established pharmaceutical industry and the rapidly expanding European gigafactories for EV batteries, driven by the EU's Green Deal initiatives. Germany, Switzerland, and Ireland are key centers for chemical and pharmaceutical manufacturing. The focus here is on sustainability and environmental compliance, pushing manufacturers toward cleaner synthesis technologies and localized sourcing to meet strict REACH regulations. European demand is characterized by a strong preference for suppliers demonstrating excellent transparency and ESG adherence.

- Latin America & Middle East and Africa (MEA): These regions currently hold smaller market shares but offer emerging opportunities. Latin America, particularly Brazil, sees potential growth in agrochemical production, requiring HPETFA for novel pesticide synthesis. The MEA region, though modest, is investing in diversifying its economies, with nascent growth in specialized chemical manufacturing and pharmaceutical sectors, potentially creating niche demand for high-purity intermediates in the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Ethyl Trifluoroacetate Market.- Merck KGaA

- Solvay S.A.

- Central Glass Co., Ltd.

- Halocarbon Products Corporation

- TCI Chemicals

- Shanghai Daikin Chemical Co., Ltd.

- Jiangsu Luye Chemical Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- BOC Sciences

- Oakwood Chemical

- Xingtai Rencai Chemical Co., Ltd.

- Nantong Sibo Chemical Co., Ltd.

- J&K Scientific

- Lianyungang Jindong Chemical Co., Ltd.

- Fluorochem Ltd.

- Time Chemical Co., Ltd.

- Daystar Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Ethyl Trifluoroacetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for High Purity Ethyl Trifluoroacetate (HPETFA)?

The primary applications driving demand are the synthesis of specialized components for lithium-ion battery electrolytes, where HPETFA derivatives enhance thermal stability and cycle life, and the synthesis of Active Pharmaceutical Ingredients (APIs) where fluorination improves drug efficacy and metabolism.

Why is the "Purity Grade" segmentation so crucial for the HPETFA market?

Purity grade is crucial because trace impurities, especially metal ions (parts per billion level), can severely impact the performance and lifetime of sensitive downstream products like EV battery cells. Ultra-High Purity (99.9%+) commands a significant premium and is non-negotiable for electronic and certain pharmaceutical uses.

Which geographical region is expected to dominate the HPETFA market and why?

The Asia Pacific (APAC) region is expected to dominate the market, fueled by the concentration of global manufacturing capacity for lithium-ion batteries and bulk pharmaceutical intermediates in countries like China, South Korea, and Japan, which require vast volumes of HPETFA.

What technological advancements are shaping the future production of HPETFA?

Key advancements include the transition from traditional batch processing to continuous flow chemistry for higher yield and consistency, and the implementation of advanced inline analytical monitoring and proprietary purification techniques (e.g., specialized fractional distillation) to achieve ultra-low impurity levels.

What are the key restraints affecting the growth of the High Purity Ethyl Trifluoroacetate market?

Major restraints include the high capital investment and technical complexity required for achieving ultra-high purity, resulting in high production costs, coupled with strict regulatory hurdles related to handling hazardous fluorinated raw materials and volatility in the supply of precursors like trifluoroacetic acid.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager