High Temperature Filter Media Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432850 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Temperature Filter Media Market Size

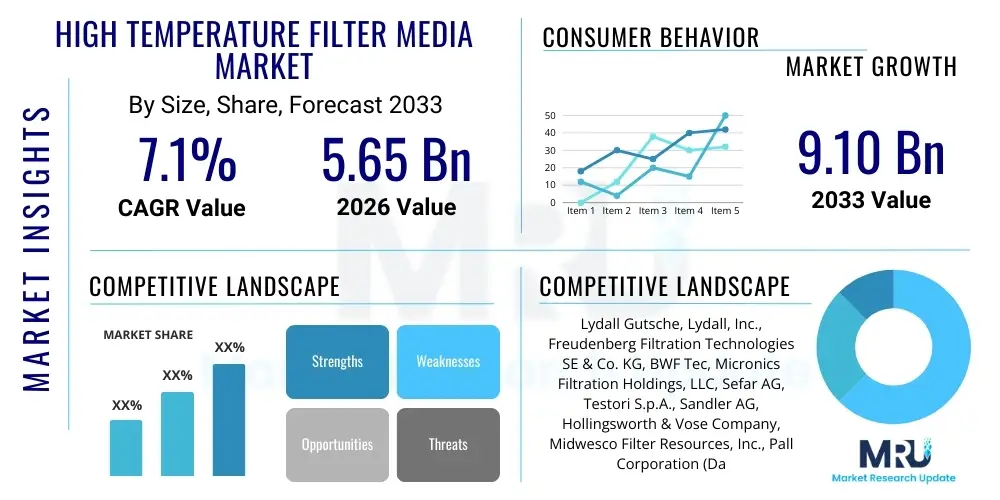

The High Temperature Filter Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 5.65 Billion in 2026 and is projected to reach USD 9.10 Billion by the end of the forecast period in 2033.

High Temperature Filter Media Market introduction

The High Temperature Filter Media Market encompasses specialized materials designed to effectively capture particulate matter (PM) and harmful pollutants from industrial gas streams operating at extremely high temperatures, often exceeding 150°C (300°F). These materials are crucial components in various air pollution control systems, particularly baghouses and dust collectors, ensuring compliance with stringent environmental regulations worldwide. The filter media must exhibit exceptional thermal stability, chemical resistance, and mechanical strength to withstand harsh operating environments, which often include exposure to abrasive particles, corrosive acids, and high gas flow rates. Key products include specialized felts, woven fabrics, and ceramic materials made from high-performance polymers like PTFE (Polytetrafluoroethylene), P84 polyimide, fiberglass, and aramids.

Major applications driving the demand for these sophisticated filtration solutions are concentrated in energy-intensive sectors, including coal-fired power generation, cement manufacturing, metallurgical production (iron and steel), and waste incineration plants. The necessity for these high-performance materials stems directly from increasingly strict emission standards mandated by regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Union’s Industrial Emissions Directive. Beyond regulatory compliance, the use of efficient high-temperature filter media contributes significantly to operational efficiency by protecting downstream equipment from fouling and abrasion, thereby extending the service life of critical industrial assets.

The primary driving factors for market expansion include rapid industrialization, particularly in developing economies across the Asia Pacific region, leading to increased installation of new manufacturing facilities requiring robust pollution control systems. Furthermore, global initiatives focusing on sustainability and minimizing carbon footprint necessitate continuous improvement in gas cleaning technologies. The benefits derived from deploying high-temperature filter media extend beyond environmental compliance to include the potential for heat recovery from exhaust gases and the reduction of maintenance downtime, ultimately offering a favorable total cost of ownership (TCO) for large industrial operators.

High Temperature Filter Media Market Executive Summary

The High Temperature Filter Media Market exhibits robust growth driven primarily by escalating global regulatory pressure concerning industrial air pollution and the necessary shift toward high-efficiency filtration solutions. Business trends indicate a strong focus on material science innovation, particularly the development of media with enhanced pore structure, improved chemical resistance (especially to sulfur compounds), and lower pressure drop capabilities, which directly translates to reduced energy consumption for filtration systems. Manufacturers are increasingly prioritizing the development of composite media that combine the thermal stability of inorganic fibers (like glass or ceramics) with the excellent filtration characteristics of synthetic fibers (like PTFE), catering to diverse application requirements, such as ultra-fine particulate capture in challenging processes like waste-to-energy.

Regionally, Asia Pacific maintains its dominant position and is projected to be the fastest-growing market due to the proliferation of cement, steel, and power generation facilities, particularly in China and India, coupled with the mandatory adoption of advanced filtration technology to combat severe urban air quality issues. North America and Europe, characterized by mature industrial landscapes, focus heavily on replacement markets, system upgrades (retrofitting existing baghouses), and the adoption of premium, ultra-high temperature resistant media suitable for complex industrial processes like hazardous waste incineration, driven by continuous downward revision of permissible emission limits. The Middle East and Africa (MEA) region shows accelerating potential, supported by major investments in oil and gas processing and petrochemical refining, sectors that inherently generate high-temperature exhaust streams requiring specialized media.

Segmentation trends highlight the dominance of ceramic and fiberglass filter media by volume, attributed to their cost-effectiveness and stability in extremely high-temperature environments (above 260°C). However, the synthetic polymer segment, specifically P84 and PTFE, is experiencing rapid value growth owing to its superior chemical resistance and high filtration efficiency, making it the preferred choice for chemically aggressive applications such as flue gas treatment systems. The rise in demand for specialized pulse-jet baghouses, which necessitate durable, robust filter bags capable of frequent cleaning cycles, is also influencing material preference, favoring needled felts over traditional woven fabrics in high-throughput operations.

AI Impact Analysis on High Temperature Filter Media Market

User inquiries regarding AI's influence on the High Temperature Filter Media Market frequently center on predictive maintenance, optimization of baghouse operation, and the potential for AI-driven material formulation. Users are keen to understand how machine learning models can process vast amounts of operational data—such as temperature spikes, pressure differential trends, and gas composition variability—to preemptively predict filter bag failure, thus minimizing expensive unplanned downtime. Another core theme is the role of AI in optimizing the energy consumption of pulse-jet cleaning systems. Traditional cleaning schedules are often time-based or fixed, leading to unnecessary compressed air usage; users anticipate AI algorithms will develop dynamic cleaning strategies based on real-time permeability and dust loading, extending filter lifespan and reducing operational expenditure (OPEX). Furthermore, researchers are exploring AI tools for accelerating the discovery and development of novel high-performance filter materials by simulating molecular structures and predicting thermal and chemical performance characteristics under varying conditions, significantly shortening the material science development cycle required for next-generation media.

- AI-Powered Predictive Maintenance: Algorithms analyze sensor data (temperature, pressure drop, flow rate) to forecast potential filter blinding or failure, enabling proactive replacement schedules and maximizing baghouse uptime.

- Optimized Cleaning Cycles: Machine learning adjusts pulse-jet frequency and intensity dynamically based on real-time dust cake buildup and permeability, reducing compressed air usage and extending filter media longevity.

- Digital Twin Simulation: Creation of virtual models of baghouse operations allows for testing different filter media types, gas loads, and temperature profiles without physical disruption, optimizing system design and material selection.

- Quality Control Automation: AI-vision systems detect microscopic flaws or irregularities in manufactured filter media (e.g., inconsistencies in fiber density or coatings) during production, ensuring higher product quality standards.

- Accelerated Material R&D: Utilizing AI for computational chemistry and material informatics to simulate and design novel high-temperature resistant polymers or ceramic composites, expediting time-to-market for specialized media.

DRO & Impact Forces Of High Temperature Filter Media Market

The dynamics of the High Temperature Filter Media Market are heavily influenced by a combination of stringent environmental regulations (Drivers), high initial investment and technical complexity (Restraints), and the emerging necessity for energy recovery (Opportunities). The central impact force remains governmental legislation demanding reduced particulate and hazardous air pollutant emissions from industrial sources. This force not only creates mandatory demand for filtration products but also compels industrial operators to continuously upgrade their existing systems to comply with increasingly tighter standards, often necessitating the shift from basic low-efficiency media to advanced, durable high-temperature equivalents. This regulatory push ensures market stability and consistent growth in key industrial sectors globally.

The primary driver is the accelerating stringency of air quality standards, particularly in large industrial economies, which mandates the use of Best Available Techniques (BAT) for emission reduction. This regulatory environment forces end-users to adopt premium, high-efficiency filter media capable of sustained performance under high thermal stress and corrosive conditions. Coupled with this, the rapid pace of industrial expansion and urbanization, especially in Asia, generates substantial volumes of industrial exhaust gas, providing a consistently expanding installation base for new pollution control equipment. The development of advanced composite materials offering superior thermal stability combined with chemical resistance further fuels market growth, enabling application in previously challenging environments like incinerators or biomass boilers.

However, significant restraints impede market acceleration. The most notable constraint is the high initial capital expenditure (CAPEX) associated with installing and integrating specialized high-temperature baghouse systems and the filter media itself, which are inherently more costly than standard low-temperature alternatives. Furthermore, the operational challenge of filter blinding and premature failure due to unexpected chemical attacks (e.g., acid dew point corrosion or volatile organic compounds) requires frequent, costly replacements and maintenance downtime. Opportunities primarily reside in the increasing global focus on energy efficiency and sustainable resource management. High-temperature filtration facilitates heat recovery from flue gases, enabling the use of recovered thermal energy for other processes, offering a compelling long-term return on investment (ROI) that attracts environmentally conscious industrial stakeholders. Additionally, the development of functionalized filter media with catalytic properties (known as filter SCR or DeNOx filters) presents a vast opportunity for simultaneous PM and NOx/SOx reduction.

Segmentation Analysis

The High Temperature Filter Media Market is segmented across multiple dimensions, primarily defined by the material type used, the specific application within the industrial process, and the filtration technology employed. Material segmentation is crucial as it dictates the maximum operating temperature, chemical compatibility, and overall cost profile of the filter media. The market shows a distinct preference for materials that balance high thermal resistance with favorable cost-performance metrics, leading to continuous evolution in the development of hybrid and composite media designed to overcome the limitations of single-fiber solutions, such as PTFE coating on fiberglass substrates to enhance chemical resistance.

Application segmentation reveals that the Power Generation sector, specifically coal-fired power plants transitioning to tighter emission controls, constitutes the largest demand segment, followed closely by Cement manufacturing due to the intense thermal processes involved in clinker production. Segmentation by technology focuses on the format of the media, such as needled felts (favored for high-efficiency pulse-jet cleaning systems) versus woven fabrics (often used in slower, lower-pressure reverse air or shaker systems). Understanding these segmentations is vital for manufacturers to tailor product specifications, ensuring that the filter media provides optimal mechanical strength and permeability suitable for the rigorous cleaning mechanisms and high flow rates of specific industrial dust collectors.

- By Material Type:

- Fiberglass (Woven and Non-Woven)

- PTFE (Polytetrafluoroethylene)

- P84 (Polyimide)

- Aramid (e.g., Nomex, Kevlar)

- Ceramic Fibers (e.g., Alumina, Silica)

- PPS (Polyphenylene Sulfide)

- Composite and Hybrid Media

- By Application/End-Use Industry:

- Power Generation (Coal, Biomass)

- Cement Manufacturing

- Metal and Metallurgy (Steel, Non-Ferrous)

- Waste Incineration/Waste-to-Energy

- Chemical Processing and Petrochemicals

- Asphalt and Road Construction

- Glass Manufacturing

- By Technology/Filter Type:

- Needle Felts

- Woven Fabrics

- Rigid Media (Ceramic Filter Elements)

- Expanded PTFE Membranes (ePTFE Laminates)

Value Chain Analysis For High Temperature Filter Media Market

The value chain for the High Temperature Filter Media Market begins with the upstream sourcing and preparation of specialized raw materials, which are often high-performance polymers (PTFE resin, P84 polymers, PPS chips) or high-grade inorganic fibers (alkali-resistant glass fibers, ceramic precursor materials). This stage is characterized by high technical expertise and stringent quality control, as the purity and properties of the raw fibers directly determine the thermal, chemical, and mechanical performance of the final filter product. Key suppliers in the upstream segment include specialized chemical manufacturers and textile fiber producers. Vertical integration is observed where major filter media manufacturers secure exclusive agreements or internal production capabilities for critical raw materials to ensure supply stability and cost control, particularly for proprietary fibers like P84.

The midstream segment involves the complex manufacturing processes, including fiber spinning, weaving, and needling (to create felt media), often followed by critical post-processing steps such as singeing, calendering, heat setting, and applying specialized surface treatments or coatings (e.g., PTFE membrane lamination or chemical finishes). This manufacturing stage requires high-precision machinery and significant capital investment. Finished filter media, usually produced in rolls or sheets, are then converted into the final usable form—filter bags, cartridges, or rigid elements—by specialized fabricators. These converters often work directly with end-users or engineering, procurement, and construction (EPC) firms to ensure the bags are tailored to fit specific baghouse designs and operational parameters.

The downstream distribution channels are critical for market reach. Direct distribution is common for large, customized projects, where the filter media manufacturer or converter deals directly with the end-user (e.g., a major power utility or cement conglomerate) or the EPC firm managing the plant construction. This ensures technical specifications are accurately met. Indirect channels involve industrial distributors and local agents who supply smaller industrial clients, providing localized stock and replacement services. Effective logistics and prompt replacement services are essential in the downstream segment, as filter bags are consumable items crucial to continuous plant operation. Maintenance and service providers also play a vital role, installing and replacing media, providing technical support, and contributing valuable feedback to manufacturers regarding performance in real-world conditions.

High Temperature Filter Media Market Potential Customers

The potential customers for High Temperature Filter Media are predominantly large industrial operators and utility companies whose processes necessitate the treatment of large volumes of hot flue gas containing abrasive and corrosive particulate matter. These end-users prioritize product durability, guaranteed thermal and chemical stability, and high filtration efficiency (especially PM2.5 capture) to meet compliance targets. Key buyer criteria include the media’s ability to withstand frequent cleaning cycles, resistance to specific gaseous contaminants (like SOx and halogen acids), and a favorable long-term performance-to-cost ratio, minimizing the total cost of ownership over the plant's operational lifespan.

The largest group of buyers originates from heavy industry segments that employ combustion or high-heat processes. Power producers, particularly those operating older coal-fired stations, are undergoing substantial filter media upgrades to meet new emission standards. Cement and lime manufacturers represent another major customer base, requiring media that can handle the extremely high temperatures and alkaline dust characteristic of kiln exhaust gases. Furthermore, the burgeoning Waste-to-Energy sector constitutes a rapidly growing customer segment, demanding highly robust PTFE-laminated or P84 media capable of handling the chemically complex and variable gas streams generated by municipal and hazardous waste incineration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.65 Billion |

| Market Forecast in 2033 | USD 9.10 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lydall Gutsche, Lydall, Inc., Freudenberg Filtration Technologies SE & Co. KG, BWF Tec, Micronics Filtration Holdings, LLC, Sefar AG, Testori S.p.A., Sandler AG, Hollingsworth & Vose Company, Midwesco Filter Resources, Inc., Pall Corporation (Danaher), Donaldson Company, Inc., Ahlstrom-Munksjö Oyj, Jiangsu Guoxin Union Energy Co., Ltd., Wuxi TR Filter Bag Co., Ltd., China National Building Material Group Co., Ltd., Sumitomo Chemical Co., Ltd., 3M Company, Clear Edge Filtration, GEA Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Temperature Filter Media Market Key Technology Landscape

The High Temperature Filter Media market is characterized by continuous technological refinement focused on improving filtration efficiency, extending service life, and reducing operational energy consumption (pressure drop). A critical technology involves the utilization of high-performance polymer fibers, such as P84 polyimide and expanded PTFE (ePTFE). P84 fibers are particularly favored in baghouse applications where temperatures are high but chemical resistance is also paramount, offering a unique multilobal cross-section that enhances filtration efficiency by providing a larger surface area for dust cake formation and retention. ePTFE membrane technology represents a significant leap forward, as these membranes are laminated onto conventional felt substrates, providing excellent surface filtration characteristics. Surface filtration means that particulate matter is captured on the outer layer of the membrane rather than embedded deep within the felt, facilitating easier and more complete cleaning and drastically lowering particulate emissions.

Another crucial technological advancement is the development of composite media and functionalized coatings. Composite media often combine the mechanical strength and thermal stability of fiberglass or aramid cores with the chemical resistance of synthetic outer layers (e.g., PTFE coating or immersion baths), allowing the media to operate effectively in harsh, fluctuating thermal and chemical conditions that a single material could not withstand. Functionalized coatings, including specialized catalysts embedded within the filter media structure (often referred to as Filter-SCR or DeNOx filtration), are gaining traction. This integration allows for the simultaneous removal of particulate matter and gaseous pollutants (Nitrogen Oxides, NOx) within a single filtration unit, significantly simplifying the pollution control system and enhancing overall emission reduction performance. This integrated technology is particularly relevant in demanding applications like cement production and waste incineration.

Furthermore, advancements in manufacturing techniques, specifically optimized needling and finishing processes, play a vital role. Modern needled felt production techniques ensure controlled fiber density and loft, leading to lower air-to-cloth ratios and minimizing the pressure drop across the filter, which directly reduces the energy required for fan operation. The transition from traditional shaker or reverse-air cleaning systems to high-velocity pulse-jet cleaning systems necessitates media capable of withstanding severe mechanical shock and repeated stress cycles. Technological efforts are thus heavily invested in enhancing the mechanical durability of the filter bags, including robust seam construction, reinforced collars, and specialized anti-abrasion finishes, thereby maximizing the usable lifespan of the filter media in high-throughput environments.

Regional Highlights

The market exhibits distinct regional dynamics driven by differing regulatory environments, industrial growth rates, and prevailing energy generation methods.

- Asia Pacific (APAC): Dominates the global market, fueled by rapid industrialization, particularly in China and India, across heavy industries such as coal power generation, cement manufacturing, and steel production. The region is characterized by high volume consumption and an accelerating shift toward advanced filtration solutions as governments introduce and enforce stricter PM emission standards (e.g., China’s Ultra-Low Emission standard for power plants). This creates massive demand not only for new installations but also for continuous retrofitting of existing industrial facilities.

- North America: A mature market characterized by replacement and upgrade cycles, driven primarily by EPA regulations, notably the Mercury and Air Toxics Standards (MATS) and ongoing revisions to NSPS (New Source Performance Standards). Demand here focuses on high-efficiency, premium media such as ePTFE laminates and P84, essential for achieving ultra-low PM limits and handling complex gas compositions often found in industrial boilers and waste incinerators.

- Europe: Growth is primarily mandated by the Industrial Emissions Directive (IED), pushing heavy industry towards Best Available Techniques (BAT), including the adoption of catalytic filter media (Filter-SCR) for simultaneous PM and NOx reduction. The European market demands highly specialized, sustainable, and energy-efficient solutions, supporting the transition away from high-carbon energy sources while maintaining strict air quality control in existing facilities.

- Latin America (LATAM): Represents an emerging market with steady growth tied to infrastructure development and mining activities. While regulations are generally less stringent than in Europe or North America, rapid urbanization and regional investments in thermal power generation and cement plants are increasing the uptake of high-temperature filtration solutions, albeit often focused on fiberglass and basic PTFE options due to cost sensitivity.

- Middle East and Africa (MEA): A high-potential region, driven by significant investments in the oil and gas sector, petrochemical refining, and infrastructure projects. The harsh operating environments, characterized by high ambient temperatures and dusty conditions, necessitate durable, high-temperature resistant media. Growth is episodic, tied to the commissioning of large-scale industrial complexes and power plants requiring robust emission control measures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Temperature Filter Media Market.- Lydall Gutsche

- Lydall, Inc.

- Freudenberg Filtration Technologies SE & Co. KG

- BWF Tec

- Micronics Filtration Holdings, LLC

- Sefar AG

- Testori S.p.A.

- Sandler AG

- Hollingsworth & Vose Company

- Midwesco Filter Resources, Inc.

- Pall Corporation (Danaher)

- Donaldson Company, Inc.

- Ahlstrom-Munksjö Oyj

- Jiangsu Guoxin Union Energy Co., Ltd.

- Wuxi TR Filter Bag Co., Ltd.

- China National Building Material Group Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- 3M Company

- Clear Edge Filtration

- GEA Group

Frequently Asked Questions

Analyze common user questions about the High Temperature Filter Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high temperature filter media?

The core driver is the increasing global stringency of governmental air quality regulations, specifically mandating lower permissible limits for particulate matter (PM) and hazardous air pollutants (HAPs) emitted by industrial processes operating at elevated temperatures, forcing the adoption of high-efficiency filtration systems.

How does the choice of filter media material relate to operational temperature?

Material selection is strictly governed by the maximum operating temperature of the industrial gas stream. Fiberglass and ceramic media are typically used above 260°C (500°F), while specialized synthetic polymers like P84 and PTFE are favored in the 190°C to 260°C range, balancing thermal resistance with superior filtration efficiency and chemical compatibility.

Which industry segment is the largest consumer of high temperature filter media?

The Power Generation sector, particularly coal and biomass-fired power plants undergoing modernization and retrofitting to meet ultra-low emission standards, represents the largest single application segment for high temperature filter media due to the massive volume of flue gas requiring treatment.

What are the main performance advantages of using ePTFE membrane laminated media?

ePTFE laminated media offers superior performance by providing surface filtration, which ensures near-perfect PM capture (especially PM2.5), easier and more efficient cleaning (lower pressure drop), and enhanced chemical resistance, significantly extending the operational lifespan compared to deep-loading felt media.

What challenges are associated with filter media usage in cement manufacturing?

Cement manufacturing poses unique challenges including extremely high temperatures from kiln exhaust, highly abrasive alkaline dust, and potential issues with acid dew point corrosion during shutdowns, necessitating media with exceptional thermal stability, mechanical strength, and robust resistance to chemical attack, often leading to the selection of specialized fiberglass or composite felts.

How does AI impact the maintenance cycle of baghouses using high temperature media?

AI improves maintenance by using predictive analytics on sensor data (e.g., pressure differential fluctuations) to detect subtle anomalies indicating premature blinding or mechanical failure, allowing operators to transition from time-based, reactive maintenance to proactive, condition-based replacement, maximizing media life and minimizing unplanned downtime.

What distinguishes woven filter media from needled felt media?

Woven fabrics provide mechanical stability and are often used in lower-efficiency shaker or reverse-air baghouses. Needled felts, however, possess superior depth filtration capabilities and higher dust loading capacity, making them the standard choice for high-efficiency pulse-jet cleaning systems due to their robust structure and ability to withstand repeated mechanical stress.

Why is P84 (Polyimide) fiber considered highly valued in this market?

P84 fiber is highly valued due to its exceptional thermal stability, high continuous operating temperature (up to 260°C), and unique multi-lobal fiber cross-section, which significantly enhances the filtration surface area and mechanical particle retention, making it ideal for chemically aggressive and high-efficiency applications like municipal waste incinerators.

What is the role of composite media in modern filtration systems?

Composite media combines different materials (e.g., PTFE layer on fiberglass felt) to leverage the strengths of each—such as the thermal resistance of fiberglass and the chemical inertness of PTFE. This approach provides a high-performance, cost-effective solution for complex gas streams that exhibit both high temperatures and corrosive chemical components, expanding the operational window.

How do emission standards in Asia Pacific compare to those in Europe and North America?

While historically less stringent, key Asian economies (like China) have rapidly adopted ultra-low emission standards, especially for power plants, often mirroring or even surpassing existing European limits for PM emissions. This convergence of regulatory requirements is rapidly accelerating the demand for advanced, high-performance filter media across the APAC region.

What are Filter-SCR or DeNOx filters?

Filter-SCR technology represents a key innovation where catalytic material (used for Selective Catalytic Reduction of NOx) is integrated directly into the high-temperature filter media. This allows the system to simultaneously filter particulate matter and chemically convert gaseous Nitrogen Oxides into harmless substances, offering an integrated, space-saving pollution control solution.

What are the market opportunities related to energy efficiency?

High temperature filtration enables the recovery of thermal energy present in the hot flue gases before they are released into the atmosphere. The efficiency of the filter media (low pressure drop) reduces fan energy consumption, while the ability to clean gas at high temperatures supports integrated heat recovery exchangers, contributing to significant plant energy savings and sustainability goals.

How does chemical resistance affect filter media lifespan?

Chemical resistance is crucial as industrial flue gases often contain corrosive elements (e.g., sulfur compounds forming sulfuric acid). Media lacking chemical resistance will degrade rapidly, leading to loss of mechanical integrity, lower efficiency, and premature failure, necessitating expensive, frequent replacement, thus increasing OPEX substantially.

What specific filtration requirements does the asphalt mixing industry have?

The asphalt mixing industry requires high temperature media capable of handling heavy dust loads and fluctuating temperatures. Crucially, the media must resist blinding from sticky particulate matter and hydrocarbons present in the exhaust stream, making chemically treated aramid or specialized PPS media often preferred for their robustness and ease of cleaning.

What is the primary constraint regarding market growth in mature economies?

In mature economies like North America and Europe, the primary constraint is the limited growth in new construction of heavy industrial plants. Market expansion is therefore largely reliant on the replacement, modernization, and mandatory upgrading (retrofitting) of existing filtration systems to meet increasingly stringent regulatory mandates.

How is the filtration efficiency generally measured for high temperature media?

Filtration efficiency is typically measured by the filter media’s ability to capture particulate matter (PM), often expressed as a percentage removal rate, focusing heavily on fine particulates (PM2.5 and PM10). High-performance media usually achieve greater than 99.9% efficiency, crucial for meeting modern ultra-low emission targets.

What role do EPC firms play in the value chain?

Engineering, Procurement, and Construction (EPC) firms serve as crucial intermediaries, specifying the required baghouse system and the corresponding high-temperature filter media during the design and build-out of new industrial facilities. They often liaise between the end-user requirements and the media manufacturer's technical capabilities to ensure optimal system integration.

What are the future trends in high temperature filter media development?

Future trends focus on developing smart filter media embedded with micro-sensors for real-time performance monitoring, materials with superior catalytic activity for combined pollution control, and the creation of ultra-lightweight ceramic fibers capable of operating efficiently at extreme temperatures exceeding 400°C.

Why is the control of pressure drop crucial for baghouse operation?

Pressure drop (the resistance to airflow through the media) dictates the power consumption of the system fans. Minimizing pressure drop through optimized filter design and material science reduces operational energy costs significantly, making it a critical metric for long-term economic viability and system sustainability.

In which material category does ceramic filter media offer unique advantages?

Ceramic filter media offers unique advantages in applications requiring thermal stability above the limit of even high-performance synthetic polymers (typically above 350°C), making them essential for harsh, ultra-high temperature processes such as hot gas filtration in some chemical reactors or specialized metallurgical operations, often offering high acid and alkali resistance.

How do manufacturers ensure the quality and consistency of high temperature filter media?

Manufacturers employ stringent quality control protocols, including sophisticated testing for thermal stability (TGA), air permeability, mechanical tensile strength, fiber density, and resistance to chemical aging, often utilizing automated inspection systems and following international standards (e.g., ISO, ASTM) to guarantee consistent media performance.

What impact does the use of biomass fuel have on filter media requirements?

Biomass combustion introduces unique challenges due to varying fuel compositions, which can lead to complex flue gas chemistry, including higher moisture content and corrosive alkaline dust. This requires filter media with excellent chemical resistance (like PTFE-coated fiberglass) to prevent rapid degradation and maintain high efficiency.

What is the significance of the shift from shaker baghouses to pulse-jet baghouses?

The shift to pulse-jet technology allows for continuous online cleaning, higher air-to-cloth ratios, and smaller system footprints, leading to greater productivity. This necessitates the use of mechanically robust needled felt media that can endure the high-frequency, high-energy cleaning pulses required by this technology, driving demand for specialized composite felts.

How do fluctuations in global oil and gas prices affect this market?

Fluctuations in oil and gas prices indirectly affect the market. Lower energy prices can slow down investment in energy-efficient filtration upgrades. Conversely, sustained high prices in the petrochemical sector lead to new capital investments in refineries and chemical plants, boosting demand for high-performance filter media specific to processes like cracking and sulfur recovery units.

What type of filtration media is commonly used in metallurgical industries like steel production?

In steel and non-ferrous metal production, filter media must handle extremely high temperatures and large volumes of abrasive, heavy dust loads. Fiberglass and aramid fibers are common, often combined with specialized surface finishes to resist spark damage and enhance dust release during cleaning cycles.

Why is P84 often preferred over standard PTFE in certain applications?

While PTFE offers superior chemical inertness, P84 (Polyimide) offers higher thermal stability, maintaining structural integrity at continuous operating temperatures up to 260°C, slightly higher than standard PTFE. Furthermore, P84’s multi-lobal fiber structure provides inherently superior filtration efficiency compared to conventional round-fiber PTFE, making it the preferred choice when efficiency at high heat is critical.

What role do anti-abrasion and anti-static finishes play in filter media performance?

Anti-abrasion finishes (often PTFE coatings) protect the media fibers from mechanical wear caused by high-velocity dust particles, significantly extending the bag life. Anti-static finishes are critical in environments where explosive dust mixtures are handled, preventing static charge buildup that could ignite the environment, thereby enhancing operational safety.

In which market segment are rigid ceramic filters most commonly utilized?

Rigid ceramic filters are primarily utilized in specialized, ultra-high temperature industrial applications (above 350°C) and in processes requiring catalytic filtration or high-pressure gas cleaning, such as fluidized bed combustion systems and advanced chemical processes where fabric media cannot survive the extreme conditions.

How does the market address the sustainability concerns related to synthetic filter media?

Sustainability concerns are addressed through extending product lifespan, minimizing system pressure drop (reducing energy use), and increasing research into recyclable or bio-degradable high-temperature polymer alternatives. Emphasis is also placed on advanced cleaning techniques that preserve the media, reducing the frequency of disposal.

What is the impact of localized manufacturing in the Asia Pacific region?

Localized manufacturing in APAC, particularly in China, has driven down the cost of fiberglass and basic synthetic filter media, increasing regional competitiveness. However, for highly specialized media like P84 or ePTFE laminates, reliance on international suppliers for high-grade raw materials often remains, creating a bifurcated market structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Temperature Filter Media Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Temperature Filter Media Market Statistics 2025 Analysis By Application (Power Generation, Steel & Mining, Cement, Municipal Waste), By Type (PPS, P84, PTFE, Nomex, PSA, Fiber Glass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager