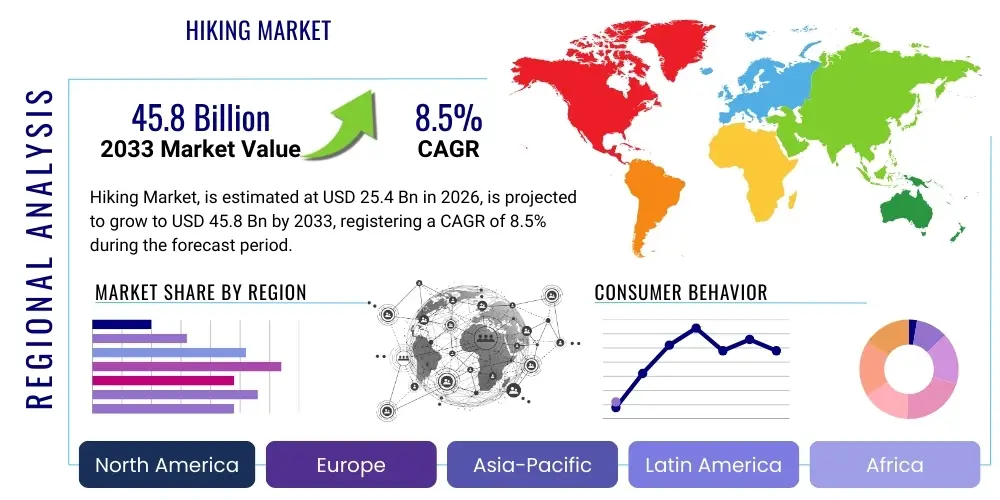

Hiking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437567 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hiking Market Size

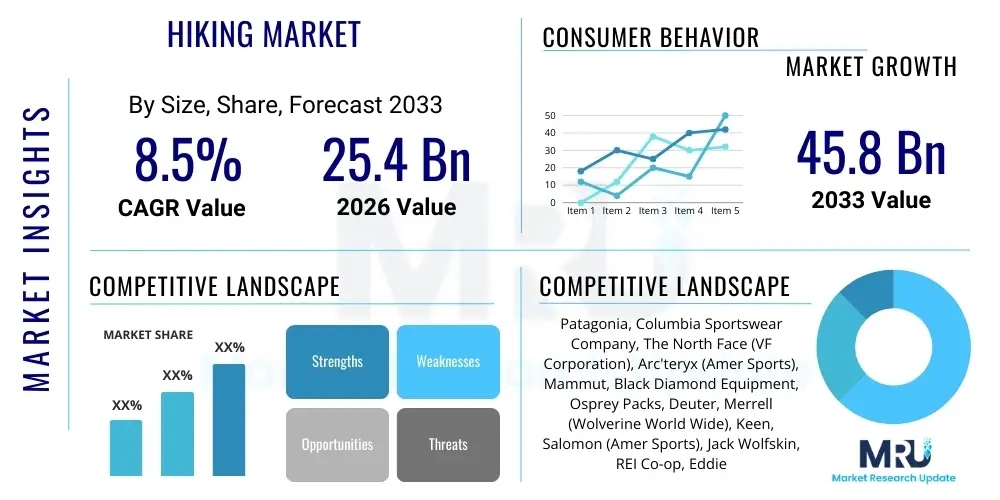

The Hiking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.4 Billion in 2026 and is projected to reach USD 45.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing global emphasis on health and wellness, coupled with a surging interest in sustainable tourism and outdoor recreational activities. The valuation reflects the high demand across various product categories, including specialized footwear, technical apparel, advanced navigation equipment, and lightweight camping gear, essential for diverse hiking environments ranging from day hikes to multi-day expeditions.

The calculation of market size incorporates revenue generated through sales across multiple distribution channels, including dedicated specialty sports stores, expansive online retail platforms, and large format department stores globally. The sustained momentum is further supported by innovations in material science, leading to the development of lighter, more durable, and performance-enhancing products that appeal to both amateur enthusiasts and professional trekkers. Emerging economies, particularly in Asia Pacific, are contributing significantly to this market expansion as disposable incomes rise and domestic tourism gains prominence, translating into higher consumer spending on premium outdoor gear and accessories necessary for safe and comfortable hiking experiences.

Hiking Market introduction

The Hiking Market encompasses the manufacturing, distribution, and retail of equipment, apparel, accessories, and services utilized by individuals engaged in trekking, backpacking, and recreational walking on natural trails. The product description spans critical categories such as technical outerwear (waterproof jackets, insulating layers), specialized footwear (hiking boots, trail runners), navigation tools (GPS devices, maps), and camping necessities (tents, sleeping bags, cooking systems). These products are engineered for durability, comfort, and performance under varying topographical and meteorological conditions, catering to the needs of day hikers, thru-hikers, mountaineers, and casual walkers. The fundamental goal of these products is to enhance safety, reduce physical strain, and maximize the enjoyment derived from outdoor exploration.

Major applications of hiking gear include backcountry exploration, trekking tourism, recreational exercise, and professional expeditionary use. The benefits associated with market products are manifold, primarily centering on improved physical health, mental well-being, and ecological awareness. High-performance gear ensures protection against harsh weather, prevents injuries, and facilitates self-sufficiency in remote areas. The market serves as a crucial economic driver, supporting innovation in textile technology and sustainable manufacturing practices, aligning with the growing consumer preference for environmentally responsible products that minimize ecological footprint while maximizing utility.

Driving factors propelling market growth include the post-pandemic surge in outdoor activities, governmental promotion of national parks and trail development, and aggressive digital marketing strategies employed by major brands to target health-conscious millennials and Gen Z consumers. Furthermore, technological integration, such as smart textiles offering temperature regulation and GPS-enabled applications enhancing navigational capabilities, is continually broadening the product appeal. The globalization of adventure tourism, coupled with greater media visibility of long-distance trails, further cements hiking as a globally accessible and desirable recreational activity, necessitating specialized equipment that meets rigorous safety and performance standards demanded by informed consumers.

Hiking Market Executive Summary

The Hiking Market exhibits robust growth propelled by significant shifts in consumer behavior towards experiential spending and nature-based recreation, defining the primary business trends. Key market forces include sustained investment in material science innovation to produce ultralight and sustainable gear, and the strategic expansion of direct-to-consumer (D2C) online channels, which bypass traditional retail bottlenecks and improve margin potential for specialized brands. Furthermore, consolidation is occurring among large sporting goods corporations acquiring niche, high-performance hiking brands to diversify their portfolios and capture a broader segment of the premium outdoor consumer base. Sustainability mandates, focusing on ethical sourcing and circular economy models (such as gear repair and resale programs), are becoming non-negotiable business imperatives that dictate operational efficiency and brand loyalty among environmentally conscious buyers.

Regional trends indicate North America and Europe retaining dominant market share due to established outdoor cultures, extensive trail networks, and high consumer spending power on durable goods. However, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by burgeoning middle classes in countries like China and India, increased government investment in ecotourism infrastructure, and a rapid urbanization trend fostering a greater appreciation for accessible natural escapes. Specific regional variations exist in product demand, with colder regions favoring insulated and extreme-weather apparel, while tropical and subtropical areas necessitate quick-dry, UV-protective, and highly ventilated gear, guiding regional inventory management and product development strategies tailored to local climatic demands.

Segmentation trends highlight the rapid growth in the Equipment segment, particularly specialized footwear and technical backpacks, due to their essential role in ensuring safety and comfort over long distances. Within distribution channels, the Online Retail segment is witnessing accelerated adoption, capitalizing on convenience, detailed product information, and personalized recommendations, thereby democratizing access to specialized gear regardless of geographical proximity to physical stores. The Apparel segment is also evolving significantly, blending high-performance functionality with contemporary urban styling, leading to the rise of 'Gorpcore' fashion, effectively blurring the lines between outdoor utility and everyday wear, which expands the segment's total addressable market beyond core hikers.

AI Impact Analysis on Hiking Market

Common user questions regarding AI's impact on the Hiking Market often revolve around personalized gear recommendations, real-time safety enhancements, and optimizing expedition planning. Users frequently inquire: "How can AI select the perfect hiking boot based on my gait and typical trail conditions?", "Will AI-powered apps replace traditional navigation, offering predictive trail conditions and weather warnings?", and "How are apparel brands using AI to design lighter, more functional materials?" The consensus theme centers on AI acting as an advanced personalization engine and a critical safety augmentation tool, moving beyond simple data aggregation to proactive, real-time assistance tailored to the individual's physiological needs and dynamic environmental variables. Concerns often focus on data privacy related to biometric and location tracking, and the potential over-reliance on technology, which might diminish traditional map-reading skills essential for backcountry self-reliance.

The key expectations users have involve AI-driven predictive logistics, such as optimizing resupply points on long trails, dynamic gear packing lists based on forecast changes, and virtual fitting rooms that utilize computer vision to ensure optimal sizing and fit for technical clothing and footwear, drastically reducing return rates. Furthermore, the industry is expected to leverage machine learning for advanced material science research, speeding up the development of textiles that exhibit superior thermal regulation and moisture management characteristics. This shift positions AI not merely as a marketing tool but as a foundational element in product design, supply chain efficiency, and the enhancement of the overall safety and personalized experience of the hiker, addressing the specific challenges associated with variability in terrain, climate, and human performance.

- AI-powered personalized gear recommendation systems based on biometric data, trip duration, and trail difficulty.

- Predictive analytics for real-time weather changes and trail hazard alerts via smart wearables and applications.

- Optimized supply chain management and inventory forecasting for seasonal hiking gear demand.

- Machine learning acceleration in the research and development of sustainable and high-performance technical textiles.

- Enhanced navigational safety through computer vision and augmented reality overlays integrated into mapping applications.

DRO & Impact Forces Of Hiking Market

The Hiking Market is primarily propelled by key Drivers (D) such as the increasing awareness of health benefits derived from outdoor activities, the global expansion of adventure tourism, and continuous product innovation resulting in lighter, more durable, and functionally specific equipment. Restraints (R) include the high initial cost of specialized, premium hiking gear, which can be a significant barrier to entry for budget-conscious consumers, coupled with seasonal fluctuations in demand influenced by extreme weather conditions that limit outdoor access in certain months. Opportunities (O) are centered on the rapid growth of the experiential economy, the development of ecotourism infrastructure in developing regions, and the integration of smart technology (wearables, IoT) into hiking equipment, creating new value propositions for technologically adept consumers. These forces collectively shape the market's trajectory, determining investment priorities in R&D and geographic expansion strategies for market participants.

The Impact Forces (IF) governing the market demonstrate a high influence from regulatory standards related to environmental protection and product safety, especially regarding chemical usage in textiles and the durability standards for safety-critical gear like climbing harness components or headlamps. Consumer expectations related to sustainability exert a significant, high-impact force, compelling brands to adopt circular economy practices, utilize recycled materials, and ensure transparency in their manufacturing processes. Furthermore, the competitive intensity, driven by frequent product launches and aggressive digital marketing campaigns from global athletic and dedicated outdoor brands, maintains pressure on pricing and necessitates continuous innovation to maintain market relevance and customer loyalty.

The dynamic interplay between these factors determines the long-term viability of market players. For instance, the restraint of high cost is being mitigated by the opportunity presented by the rental and resale market for high-end gear, which broadens accessibility without compromising quality standards. Similarly, the driver of innovation is inextricably linked to sustainability efforts, as consumers increasingly view durable, long-lasting products as inherently more sustainable than fast-fashion alternatives. Understanding the magnitude and direction of these impact forces allows stakeholders to strategically position themselves to capitalize on favorable trends while proactively addressing critical challenges, particularly concerning supply chain resilience and adherence to evolving ethical consumption demands.

Segmentation Analysis

The Hiking Market is rigorously segmented based on product type, distribution channel, and consumer group to address the diverse needs of the global hiking community, ranging from casual day hikers to professional mountaineers. This segmentation allows companies to tailor their product development, marketing campaigns, and inventory management strategies effectively. The Product Type category, which includes Footwear, Apparel, and Equipment, represents distinct categories with unique technological requirements and pricing sensitivities. Footwear, for example, demands specialized design based on ankle support, sole rigidity, and waterproofing technology, whereas Equipment focuses on lightweight materials and multi-functionality. Analyzing these segments provides crucial insights into where the highest consumer spending and fastest growth rates are concentrated, guiding capital expenditure and merger and acquisition activity within the specialized outdoor sector.

- By Product Type:

- Equipment (Backpacks, Tents, Sleeping Bags, Trekking Poles, Cooking Systems)

- Apparel (Outerwear, Base Layers, Mid-Layers, Socks, Headwear)

- Footwear (Hiking Boots, Trail Running Shoes, Hiking Sandals)

- Accessories (Navigation Devices, Lighting, Hydration Systems, Safety Gear)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company-owned Portals, Third-Party Marketplaces)

- Specialty Stores (Dedicated Outdoor Retailers, Local Outfitters)

- Department Stores and Hypermarkets

- Direct-to-Consumer (D2C) Channels

- By Consumer Group:

- Men

- Women

- Children

- Unisex/General

Value Chain Analysis For Hiking Market

The Value Chain of the Hiking Market begins with Upstream Analysis, which focuses heavily on the procurement and preparation of raw materials. This stage involves complex sourcing of specialized textiles (like Gore-Tex, proprietary insulation, and technical fibers), high-performance plastics, specialized metals (for trekking poles and tent frames), and advanced rubber compounds for footwear soles. Sustainability and ethical sourcing are paramount here, driving brands to establish long-term relationships with certified suppliers who adhere to strict environmental and labor standards. Research and Development (R&D) is a critical upstream activity, where continuous technological advancements in material science are leveraged to create lighter, more durable, and more weather-resistant products that justify premium pricing and sustain competitive advantage in a crowded market.

The midstream section involves manufacturing and assembly, where raw materials are transformed into finished hiking products. This stage is dominated by specialized manufacturing facilities, often concentrated in Asia (for apparel and footwear) and Central Europe (for precision equipment like high-end mountaineering tools). Quality control, precision stitching, seam-sealing, and rigorous testing for waterproof and breathability standards are essential operational steps. Direct and indirect distribution channels define the movement of goods in the Downstream Analysis. Direct channels include company-owned D2C e-commerce platforms and flagship retail stores, allowing for maximum control over brand presentation and customer data collection. Indirect channels utilize global third-party distributors, large online marketplaces (like Amazon or specialized outdoor retailers), and independent specialty stores, ensuring broad geographical reach and inventory access for consumers.

The successful execution of the value chain relies on optimized logistics and effective demand forecasting. Downstream activities are crucial for profitability, with customer service, warranty provision, and increasingly, product repair and recycling services, extending the product lifecycle and reinforcing brand loyalty. The shift towards online retail necessitates sophisticated digital marketing and logistical infrastructure capable of handling global shipping and managing complex international customs regulations. Overall efficiency and ethical transparency across the entire value chain—from sourcing sustainable materials to offering end-of-life recycling programs—are central to maintaining brand reputation and meeting the discerning demands of the modern outdoor consumer.

Hiking Market Potential Customers

Potential customers in the Hiking Market represent a broad and diverse spectrum, primarily categorized into three distinct end-user/buyer groups: the Recreational Hiker, the Professional/Expeditionary Hiker, and the Urban/Lifestyle Consumer. The Recreational Hiker constitutes the largest volume segment, including weekend warriors, families, and tourists who engage in day hikes or short overnight trips. This group seeks reliable, comfortable, moderately priced gear that balances performance with versatility and ease of use. Their purchasing decisions are heavily influenced by mainstream retail reviews, accessibility, and recognizable brand names that offer good value for money and reliable basic functionality required for local trails and accessible state parks.

The Professional/Expeditionary Hiker segment includes mountaineers, long-distance thru-hikers (e.g., Appalachian Trail, PCT), and organized trekking groups undertaking high-altitude or extreme weather expeditions. This clientele demands the highest quality, most technologically advanced, and specialized equipment, such as technical outerwear, precise navigation tools, and ultralight yet extremely durable backpacks. They prioritize performance, safety, weight reduction, and material integrity above cost, often relying on specialized high-end brands and professional recommendations. This segment drives innovation and dictates the performance standards adopted across the broader market, requiring specialized product lines and expert guidance from retailers.

The third group, the Urban/Lifestyle Consumer, or "Gorpcore" adherent, purchases technical hiking apparel and footwear for everyday use, valuing the aesthetic, durability, and practical features (like waterproofing or insulation) for city life. While they may not use the gear for rigorous trails, their spending habits significantly influence the fashion trends and market volumes for certain product categories, especially technical jackets and hiking-inspired shoes. Targeting this segment requires fusing technical specifications with contemporary design and leveraging collaborations with fashion influencers, expanding the market’s reach beyond purely functional applications into the realm of lifestyle consumption, thereby creating a crucial secondary revenue stream for outdoor brands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.4 Billion |

| Market Forecast in 2033 | USD 45.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Patagonia, Columbia Sportswear Company, The North Face (VF Corporation), Arc'teryx (Amer Sports), Mammut, Black Diamond Equipment, Osprey Packs, Deuter, Merrell (Wolverine World Wide), Keen, Salomon (Amer Sports), Jack Wolfskin, REI Co-op, Eddie Bauer, Helly Hansen, Montbell, Berghaus, Haglöfs, Fjällräven, L.L. Bean. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hiking Market Key Technology Landscape

The Hiking Market's technological landscape is rapidly evolving, driven primarily by advancements in material science, wearable electronics, and sustainable manufacturing processes. A foundational technology involves proprietary membrane and insulation technologies, such as Gore-Tex, eVent, and various synthetic down alternatives, which provide superior waterproofing, breathability, and thermal efficiency while reducing overall garment weight. The focus has shifted towards smart textiles that incorporate sensory elements capable of monitoring the user's physiological data (heart rate, temperature, fatigue level) and microclimate conditions, enhancing safety and performance optimization in real-time. Furthermore, specialized footwear technology emphasizes adaptive cushioning systems and highly durable, traction-focused outsoles (e.g., Vibram) engineered through 3D scanning and dynamic pressure mapping to improve fit and stability across diverse, unstable terrain.

Digital technologies play a critical role, particularly in navigation and safety equipment. This includes highly accurate Global Positioning System (GPS) devices integrated into smartwatches and dedicated handheld units, coupled with advanced altimeter and barometer functions. There is a growing adoption of satellite communication devices (e.g., satellite messengers) that ensure connectivity and emergency signaling outside cellular range, a crucial safety innovation for remote backcountry travel. The integration of Augmented Reality (AR) into mobile mapping applications is also emerging, allowing hikers to overlay geographical information, trail markers, and points of interest onto their live view of the landscape, simplifying navigation and contextualizing the environment without relying solely on traditional paper maps.

Sustainability technology is now integral to product design, focusing on reducing the environmental footprint throughout the product lifecycle. This includes using recycled polyester and nylon derived from plastic waste, employing PFC-free Durable Water Repellent (DWR) coatings to eliminate harmful chemicals, and implementing closed-loop manufacturing systems that minimize waste. Technology also extends to the design phase through advanced computer-aided design (CAD) and simulation software that optimizes the structural integrity of equipment like backpacks and tents, ensuring maximum load-bearing capability and resistance to extreme wind stress while maintaining minimal material usage, thus embodying the core technological goal of providing high performance through efficient, responsible innovation.

Regional Highlights

North America, spearheaded by the United States and Canada, represents the most mature and significant market for hiking gear, characterized by a well-established outdoor culture, expansive national park systems, and high consumer expenditure on specialized leisure goods. The market here is defined by high demand for premium, technologically advanced equipment, driven by active communities engaged in long-distance hiking, backpacking, and mountaineering. Key trends include the dominance of major domestic brands (e.g., REI, The North Face, Patagonia) and a strong focus on sustainability, ethical sourcing, and localized D2C engagement. Marketing campaigns often emphasize the technical performance and heritage of the products, resonating with a consumer base deeply familiar with the rigors of backcountry exploration and demanding lifetime warranties and repair services.

Europe holds a substantial market share, with specific demand variations across sub-regions; Germanic and Nordic countries prioritize highly technical, weather-resistant apparel suitable for alpine and arctic conditions, while Mediterranean countries focus more on lightweight gear for trekking in warmer, dry climates. The market is highly fragmented, featuring numerous specialized, heritage European brands (e.g., Mammut, Haglofs, Berghaus) alongside global players. Regulatory adherence to strict EU environmental standards concerning chemical inputs (REACH) significantly influences product formulation and manufacturing processes, driving Europe to be a leader in sustainable textile innovation and the implementation of robust circular economy models within the outdoor gear industry.

Asia Pacific (APAC) is the fastest-growing region, presenting vast market potential fueled by burgeoning middle classes, rapid urbanization, and government initiatives promoting domestic ecotourism, particularly in China, South Korea, and Australia. While the market is currently dominated by international brands, local manufacturers are rapidly gaining traction by offering affordable yet functionally adequate alternatives. The demand structure in APAC is characterized by a strong emphasis on multi-functional gear suitable for diverse climates—from Himalayan treks to tropical jungle hiking. Online retail penetration is exceptionally high in this region, serving as the primary distribution channel for both major international and emerging local brands seeking to quickly establish market presence and overcome geographical logistics challenges across the diverse regional terrain.

- North America: Dominance in premium, high-tech gear; strong presence of established major brands; leading adoption of D2C models and sustainability initiatives.

- Europe: High market fragmentation with strong regional brands; stringent environmental regulations driving textile innovation; diverse product demand catering to alpine and varied coastal trails.

- Asia Pacific (APAC): Highest projected CAGR; rapid growth driven by middle-class expenditure and ecotourism promotion; high reliance on online retail distribution channels.

- Latin America (LATAM): Emerging market characterized by increasing interest in trekking (e.g., Patagonia, Andes); price sensitivity is high; growth potential tied to adventure travel infrastructure development.

- Middle East and Africa (MEA): Niche market focused on desert trekking and seasonal mountaineering; dependence on imports of specialized gear; limited but growing local manufacturing focused on extreme heat and sun protection apparel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hiking Market.- Patagonia

- Columbia Sportswear Company

- The North Face (VF Corporation)

- Arc'teryx (Amer Sports)

- Mammut

- Black Diamond Equipment

- Osprey Packs

- Deuter

- Merrell (Wolverine World Wide)

- Keen

- Salomon (Amer Sports)

- Jack Wolfskin

- REI Co-op

- Eddie Bauer

- Helly Hansen

- Montbell

- Berghaus

- Haglöfs

- Fjällräven

- L.L. Bean

Frequently Asked Questions

Analyze common user questions about the Hiking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global Hiking Market?

The primary driver is the significant increase in consumer prioritization of health, wellness, and outdoor recreational activities, accelerated by post-pandemic shifts and coupled with technological advancements leading to lighter, more durable, and functionally superior gear.

Which segment is expected to show the highest growth rate in the Hiking Market?

The Online Retail distribution channel segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by global e-commerce adoption, convenience, and the ability of specialized brands to leverage D2C strategies for broader market reach.

How is sustainability impacting product development in hiking gear?

Sustainability is profoundly impacting development by mandating the use of recycled materials (e.g., polyester, nylon), eliminating harmful chemicals (PFC-free DWR coatings), and promoting circular economy models, such as repair services and take-back programs, to extend product lifecycles.

What role does Artificial Intelligence (AI) play in enhancing the hiking experience?

AI is used to enhance the hiking experience through personalized gear recommendations based on user biometrics and terrain data, providing predictive analytics for weather and trail safety, and optimizing supply chain logistics for retailers.

Why is the Asia Pacific (APAC) region critical for future market expansion?

APAC is critical due to its rapidly expanding middle class, increasing disposable income, and government investments in ecotourism infrastructure, leading to a high demand increase for both entry-level and specialized imported hiking equipment across its diverse geographical markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hiking Pants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hiking & Trail Footwear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hiking Apps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hiking Shoes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Men, Women, Kids), By Application (Online, Offline), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Athletic Shoes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Sports shoes, Running and walking shoes, Hiking and backpacking shoes, Aerobic and gym wear shoes), By Application (Men, Women, Kids), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager