Hot Forging Press Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434146 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hot Forging Press Market Size

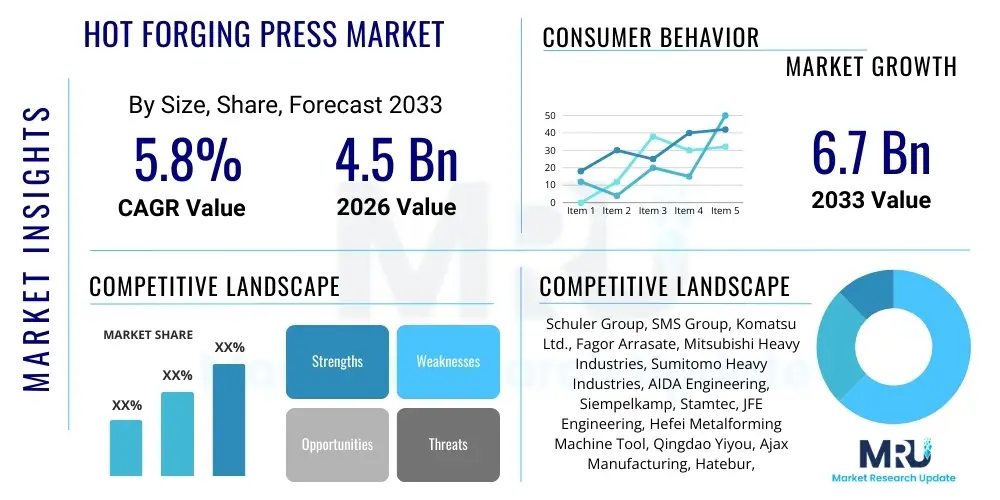

The Hot Forging Press Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Hot Forging Press Market introduction

The Hot Forging Press Market encompasses the manufacturing and deployment of specialized machinery used to shape metals at high temperatures, typically above their recrystallization point. This process enhances material properties such as strength, toughness, and fatigue resistance, making hot forged components crucial across various heavy industries. Hot forging presses are primarily utilized for creating complex, high-stress parts that require dimensional accuracy and structural integrity, differentiating them significantly from cold or warm forging methods which operate at lower temperatures and are often suited for smaller, less complex components. The inherent ability of hot forging to process large sections and difficult-to-form materials, like certain alloys and specialty steels, under immense pressure, underscores its essential role in modern manufacturing supply chains.

Key products within this market include mechanical presses, hydraulic presses, and screw presses, each offering distinct advantages in terms of speed, force control, and energy efficiency. Mechanical presses are renowned for their high speed and productivity in mass production, while hydraulic presses offer superior control over force and stroke length, ideal for complex geometries and specialized alloys. Screw presses, often preferred for flexibility and energy management, bridge the gap by combining controlled force delivery with relatively high cycle times. The major applications span critical sectors where component failure is unacceptable, demanding the highest quality standards and material integrity.

The market expansion is fundamentally driven by the robust growth in end-use sectors, particularly the global automotive industry's push towards lightweighting and electric vehicle (EV) production, which still rely heavily on high-strength forged components for chassis, suspension, and driveline systems. Furthermore, increasing infrastructure development worldwide, coupled with intensified investments in aerospace and defense manufacturing, significantly boosts demand for high-tonnage presses capable of producing large, critical structural parts. The benefits of using hot forging presses—including superior grain structure refinement, reduction of internal porosity, and material savings—continue to solidify their indispensable position in high-specification metal forming operations globally, providing a sustained impetus for market growth and technological refinement.

Hot Forging Press Market Executive Summary

The Hot Forging Press Market is poised for stable expansion, underpinned by secular trends in industrial automation and precision engineering across Asia Pacific and Europe. Business trends indicate a strong move toward hydraulic presses due to their adaptability and precision necessary for forging complex parts used in the aerospace and advanced machinery sectors. Manufacturers are prioritizing the integration of IoT and smart monitoring systems into press machinery, enhancing operational efficiency, predictive maintenance capabilities, and overall yield rates. This digital transformation is critical for maintaining competitiveness, particularly among suppliers catering to Tier 1 automotive and specialty component producers who demand stringent quality assurance protocols. Mergers and acquisitions focusing on vertical integration and niche technology acquisition remain prominent strategies among leading press manufacturers aiming to expand their geographical footprint and technological portfolio, especially concerning large-tonnage press capabilities.

Regionally, the Asia Pacific (APAC) region continues to dominate the market, driven by massive manufacturing output in China, India, and Southeast Asian countries, coupled with substantial government investments in domestic infrastructure and electric vehicle production capacity. Europe, while mature, focuses intensely on technology upgrades and sustainability, driving demand for energy-efficient servo and electric screw presses that reduce operational costs and environmental impact, particularly serving the highly regulated aerospace and high-end automotive segments. North America demonstrates consistent demand, fueled by the resurgence in domestic aerospace manufacturing, defense spending, and oil and gas sector activity, necessitating robust, heavy-duty forging equipment capable of handling superalloys and specialized materials essential for these mission-critical applications.

Segment trends reveal that the Automotive sector remains the primary end-user, though the fastest growth rate is observed in the Aerospace and Defense segment, requiring extremely high-tonnage presses and sophisticated control systems for complex airframe components and engine parts. By press type, hydraulic presses are gaining traction due to superior flexibility and force control, vital for high-precision forging, contrasting with the dominance of mechanical presses traditionally used for high-volume automotive parts like connecting rods and crankshafts. The mid-tonnage segment (1,500–5,000 Tons) constitutes the largest share, balancing versatility needed for general industrial components and specialized parts, while the demand for presses exceeding 5,000 tons is increasing, correlated directly with the manufacturing scale-up for large civil aircraft and heavy industrial equipment components.

AI Impact Analysis on Hot Forging Press Market

Users frequently inquire about AI's role in optimizing press operational parameters, reducing material waste, and enhancing predictive maintenance cycles within the Hot Forging Press Market. Key user concerns revolve around the feasibility of integrating AI into legacy equipment, the required data infrastructure investment, and the ability of AI algorithms to handle the high variability inherent in the hot forging process, particularly temperature fluctuations and material behavior under stress. Expectations are high regarding AI’s capacity to achieve zero-defect manufacturing through real-time feedback loops and autonomous quality control. Users seek systems that can analyze forging data (temperature, pressure, velocity, deformation) to automatically adjust press settings dynamically, minimizing downtime and optimizing energy consumption per forged component, thereby addressing critical issues related to cost efficiency and quality consistency in high-volume production environments.

- AI-driven Predictive Maintenance: Analyzing machine sensor data (vibration, temperature, oil pressure) to forecast equipment failure, dramatically reducing unscheduled downtime and improving operational throughput.

- Real-time Process Optimization: Utilizing machine learning algorithms to adjust ram speed, stroke length, and die temperature dynamically based on material feedback, ensuring consistent quality and minimizing scrap rates.

- Autonomous Quality Control: Implementing computer vision and AI models to inspect forged parts immediately post-process, identifying subtle defects or dimensional inaccuracies far faster and more consistently than human inspectors.

- Simulation and Design Optimization: Employing generative AI and deep learning to model complex metal flow during forging, rapidly optimizing die design and reducing the expensive trial-and-error phases in product development.

- Energy Efficiency Management: AI monitoring of press cycles and power consumption to recommend optimal operating schedules and settings, leading to significant reductions in energy usage, particularly for large hydraulic systems.

DRO & Impact Forces Of Hot Forging Press Market

The Hot Forging Press Market is significantly influenced by macro-economic indicators, technological advancements in material science, and stringent regulatory demands from key end-use industries like automotive and aerospace. The primary drivers include robust industrialization in developing nations and the increasing global necessity for high-performance, lightweight components, particularly within the burgeoning electric vehicle and aerospace maintenance, repair, and overhaul (MRO) sectors, which demand superior component reliability achieved through hot forging. Conversely, the market faces restraints such as the extremely high capital expenditure required for purchasing and installing heavy-duty forging presses and the associated skilled labor shortage required for operating and maintaining these complex machines. Furthermore, fluctuating commodity prices, especially for steel and specialty alloys, introduce volatility into the production cost structure, occasionally slowing down large-scale procurement decisions by forging companies.

Key opportunities arise from the ongoing development of advanced materials, such as titanium and nickel-based superalloys, which require specialized high-force hydraulic or servo presses designed for precise thermal management and deformation control, opening niche markets for highly specialized equipment manufacturers. Furthermore, the global emphasis on sustainability drives opportunities for manufacturers to develop and market energy-efficient solutions, particularly servo presses, which offer reduced energy consumption compared to traditional hydraulic or mechanical systems. The push towards Industry 4.0 integration, including advanced monitoring, data analytics, and automation, presents a substantial opportunity for press manufacturers to deliver value-added services and smart machinery capable of seamless integration into automated production lines, enhancing overall manufacturing flexibility.

The impact forces within the market are predominantly technological and economic. Economic fluctuations directly influence capital investment cycles in key sectors, impacting press demand significantly. Technologically, the shift towards servo-electric drives is a major disruptive force, challenging the established dominance of traditional press types by offering unmatched precision and efficiency. The collective impact of these forces dictates the adoption rate of new press technologies and regional investment levels. For instance, the high cost (Restraint) is mitigated by the long-term operational efficiency (Opportunity) provided by advanced servo systems, creating a high-impact force that favors technologically advanced solutions despite initial financial hurdles. Furthermore, increasing quality standards (Driver) act as a strong force compelling manufacturers to invest in newer, more precise presses (Opportunity) to meet zero-defect mandates from critical aerospace clients.

Segmentation Analysis

The Hot Forging Press Market is highly segmented based on the press technology utilized, the size (tonnage) of the equipment, and the diverse applications across heavy industries. Understanding these segments is crucial as procurement decisions are highly dependent on the required production volume, part complexity, material type, and necessary cycle time. The core segmentation by press type reflects the trade-off between speed (mechanical presses), precision and control (hydraulic presses), and energy efficiency/flexibility (screw and servo presses). Technological evolution is continuously blurring the lines, with hybrid systems emerging to combine the benefits of different press mechanisms, driven largely by the automotive industry's demand for high-strength, lightweight components produced at speed.

Further segmentation by tonnage categorizes presses based on their maximum force capacity, which directly correlates with the size and type of component they can forge. Small to mid-range presses are highly utilized for mass-produced components like engine valves and flanges, while high-tonnage presses (above 5,000 tons) are indispensable for large structural parts in aerospace, defense, and heavy construction equipment. Geographically, market behavior is differentiated by regional manufacturing maturity; mature markets prioritize upgrades and automation, while emerging markets focus on capacity expansion using proven, cost-effective technologies. This detailed segmentation allows manufacturers and stakeholders to precisely target investment and marketing efforts based on specific industrial requirements and regional dynamics.

- By Type:

- Mechanical Press

- Hydraulic Press

- Screw Press (Friction and Servo)

- By Tonnage:

- Up to 1,500 Tons

- 1,500 – 5,000 Tons

- Above 5,000 Tons

- By Application/End-Use Industry:

- Automotive (Driveline, Engine, Chassis components)

- Aerospace & Defense (Airframe parts, Engine components)

- Industrial Machinery & Equipment

- Oil & Gas (Valves, Flanges, Connectors)

- Construction & Mining

- By Operation:

- Manual

- Semi-Automatic

- Fully Automatic

Value Chain Analysis For Hot Forging Press Market

The value chain of the Hot Forging Press Market begins with the upstream suppliers providing raw materials and sophisticated components necessary for press construction, including high-grade steel, complex hydraulic systems, electrical controls, and advanced automation components (PLCs, sensors). The upstream segment is crucial as the quality and lifespan of the forging press machinery are directly dependent on the durability and precision of these input components. Key strategic relationships in this phase involve long-term supply agreements between press OEMs and specialized component manufacturers to ensure reliability, cost stability, and technological alignment, particularly concerning advanced servo drive technologies and heavy-duty structural frames designed to withstand intense cyclic loads inherent in hot forging operations.

The core manufacturing stage involves the press builders (OEMs), who design, assemble, and test the complex forging systems. This stage involves significant intellectual property related to frame design, slide guides, energy management systems, and proprietary control software. OEMs differentiate themselves through after-sales services, technological innovation, and customization capabilities tailored to specific customer material and application needs. Distribution channels are varied, incorporating both direct sales teams, especially for large, highly customized projects (e.g., aerospace presses exceeding 10,000 tons), and indirect distribution through regional distributors and agents who handle sales, installation, and localized support for standard or mid-range press models, particularly prevalent in fragmented markets like Southeast Asia and Eastern Europe.

The downstream segment involves the end-users—the forging companies and captive forging divisions within major OEMs (e.g., automotive or aerospace giants)—who utilize the presses to produce finished or semi-finished components. These customers rely heavily on the efficiency and reliability of the press equipment to maintain tight production schedules and quality standards. The final part of the value chain includes maintenance, repair, and overhaul (MRO) services, often provided by the press OEM or specialized third-party service providers, which constitute a significant revenue stream over the press's lifespan (often 30+ years). Understanding the flow from specialized component manufacturing (upstream) through complex assembly (core manufacturing) to intensive usage in high-stress applications (downstream) highlights where value addition and competitive leverage points lie within the market ecosystem.

Hot Forging Press Market Potential Customers

Potential customers for Hot Forging Presses are predominantly large-scale manufacturing entities that require high-strength metal components for safety-critical applications and high-volume production. The primary customer base resides within the automotive sector, comprising Tier 1 suppliers that produce drivetrain, transmission, and structural components (e.g., crankshafts, connecting rods, constant velocity joints) for global vehicle platforms. These customers prioritize high speed (using mechanical presses) and consistent dimensional accuracy to support massive production targets. The shift towards electric vehicles, while reducing engine component demand, increases the need for high-strength aluminum and specialty steel forgings for battery housings, suspension mounts, and motor shafts, keeping the automotive forging industry robust.

Another crucial customer segment is the aerospace and defense industry, including both aircraft manufacturers and their specialized component suppliers. These customers demand presses capable of handling demanding materials like titanium, Inconel, and various superalloys, often requiring the superior force control and dwell capabilities offered by hydraulic presses, typically in the high-tonnage range (above 5,000 tons). Components manufactured include turbine blades, landing gear components, and large structural airframe members where material integrity is paramount. These procurement processes are characterized by long lead times and stringent qualification requirements, often favoring established press manufacturers with proven track records in precision forging technologies and regulatory compliance.

Furthermore, general industrial manufacturers, encompassing the oil and gas sector (for fittings, flanges, and high-pressure valves), construction machinery (for large axle shafts and gear blanks), and the rail industry, represent significant ongoing demand. These customers typically invest in a mix of mid-to-high tonnage presses depending on the size and complexity of the parts. The decision to purchase new presses is often linked to plant capacity expansions, replacement of aging equipment, or the adoption of new forging techniques (like near-net-shape forging) to reduce machining costs and material waste, making cost-efficiency and operational durability key purchasing criteria for this diverse group of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler Group, SMS Group, Komatsu Ltd., Fagor Arrasate, Mitsubishi Heavy Industries, Sumitomo Heavy Industries, AIDA Engineering, Siempelkamp, Stamtec, JFE Engineering, Hefei Metalforming Machine Tool, Qingdao Yiyou, Ajax Manufacturing, Hatebur, Lasco Umformtechnik, TMP (Taylor-Winfield), Italpresse Gauss, Kurimoto Ltd., Verson, Erie Press Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hot Forging Press Market Key Technology Landscape

The technological landscape of the Hot Forging Press Market is rapidly evolving, driven primarily by the pursuit of higher energy efficiency, enhanced precision, and deeper integration into automated production ecosystems (Industry 4.0). The most significant technological shift involves the transition from traditional mechanical and hydraulic systems toward servo-driven presses. Servo presses, utilizing precise electric motors and drive systems, offer superior control over the ram movement profile (speed, position, force), allowing forging companies to tailor the forging cycle exactly to the material requirements, resulting in reduced material waste, extended die life, and significant energy savings compared to conventional presses, particularly hydraulic ones which dissipate energy through heat and constant pump operation.

Another crucial technological advancement is the incorporation of advanced monitoring and data collection systems. Modern hot forging presses are equipped with sophisticated sensors (for temperature, pressure, vibration, acoustic emissions) and integrated control systems (PLCs and HMI interfaces) that collect massive amounts of operational data in real-time. This data facilitates advanced process control, allowing operators and automated systems to make immediate adjustments, thereby ensuring repeatable quality. The integration of IoT capabilities means presses can communicate with other components in the forging line—such as furnaces, robots, and trimming machines—creating a fully automated, synchronized manufacturing cell, which is key for maximizing productivity and minimizing material handling risks inherent in high-temperature operations.

Furthermore, advancements in die design technology and rapid heating methods are complementary technologies bolstering the press market. Near-net-shape forging techniques, enabled by the precision of modern presses, reduce the amount of material required and minimize subsequent machining needs. Induction heating technology, which rapidly and uniformly heats billets just prior to forging, is increasingly preferred over traditional gas or electric furnaces due to its speed and efficiency. Collectively, these technologies, coupled with sophisticated simulation software (Finite Element Analysis) used in press design and process development, contribute to a high level of sophistication in the manufacturing of complex, high-integrity forged components, ensuring the market remains centered around technological excellence and continuous improvement in efficiency metrics.

Regional Highlights

The global Hot Forging Press Market exhibits highly differentiated regional dynamics influenced by local industrial policy, automotive production volumes, and aerospace manufacturing capabilities. The Asia Pacific (APAC) region stands out as the undisputed leader, commanding the largest market share and exhibiting the highest growth trajectory. This dominance is attributed primarily to the massive manufacturing bases in China and India, which are rapidly industrializing and expanding infrastructure, along with significant government support for domestic automotive and defense production. The region sees high demand for mid-range mechanical presses for high-volume automotive parts, alongside increasing demand for specialized presses needed to support the rapidly growing electric vehicle (EV) supply chain.

Europe represents a mature yet highly technologically advanced market. Countries like Germany, Italy, and France are leaders in adopting sophisticated press technologies, particularly high-precision hydraulic and servo presses. The European market is characterized by stringent quality standards, a strong focus on energy efficiency and sustainability, and a high concentration of premium automotive, aerospace, and advanced machinery manufacturers. While volume growth may be slower than APAC, the revenue generation from high-value, specialized press systems and associated automation equipment remains substantial, driven by constant investment in upgrading existing forging facilities to meet Industry 4.0 requirements and environmental regulations.

North America maintains a robust market position, supported by significant defense spending, a revitalized domestic aerospace sector, and strong oil and gas industry activity. Demand in this region is weighted towards large, high-tonnage presses capable of handling specialty and superalloys necessary for critical aerospace and energy components. The U.S. market is also seeing investment in modernizing aging infrastructure and incorporating automation and digitalization into forging plants to improve competitiveness against global suppliers. Latin America and the Middle East and Africa (MEA) represent emerging markets, with demand primarily tied to localized infrastructure projects and the automotive assembly capacity present in countries like Mexico, Brazil, and Turkey, favoring cost-effective and durable press solutions for general industrial applications.

- Asia Pacific (APAC): Dominates market size and growth, fueled by China and India's expansive automotive production, infrastructure development, and substantial capacity additions in the general machinery sector. High adoption of both mechanical and increasingly sophisticated hydraulic and screw presses.

- Europe: Characterized by high technological adoption, focusing on high-precision forging, advanced materials processing, and energy-efficient servo press deployment, driven by premium automotive (OEMs) and aerospace manufacturers.

- North America: Strong demand concentrated in high-tonnage and specialized presses, catering specifically to the defense, commercial aerospace (titanium and superalloys forging), and critical heavy machinery sectors.

- Latin America (LATAM): Market demand closely tied to local automotive manufacturing hubs (Brazil, Mexico) and infrastructure projects, focusing on resilient and cost-effective forging solutions.

- Middle East and Africa (MEA): Emerging markets driven primarily by oil and gas infrastructure requirements (flanges, valves) and initial stages of industrial diversification and domestic defense manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hot Forging Press Market.- Schuler Group

- SMS Group

- Komatsu Ltd.

- Fagor Arrasate

- Mitsubishi Heavy Industries

- Sumitomo Heavy Industries

- AIDA Engineering

- Siempelkamp

- Stamtec

- JFE Engineering

- Hefei Metalforming Machine Tool

- Qingdao Yiyou

- Ajax Manufacturing

- Hatebur

- Lasco Umformtechnik

- TMP (Taylor-Winfield)

- Italpresse Gauss

- Kurimoto Ltd.

- Verson

- Erie Press Systems

Frequently Asked Questions

Analyze common user questions about the Hot Forging Press market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Hot Forging Press Market between 2026 and 2033?

The Hot Forging Press Market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by increasing global demand for high-integrity, lightweight components across automotive and aerospace industries.

Which type of hot forging press technology is experiencing the fastest adoption rate?

Servo-driven screw presses are seeing the fastest rate of adoption due to their superior energy efficiency, precise control over ram velocity, and flexibility in tailoring the forging cycle, which minimizes operational costs and enhances the quality of complex forged parts.

How is the electric vehicle (EV) trend influencing the demand for hot forging presses?

While traditional engine component forging is shifting, the EV transition boosts demand for specialized hot forging presses capable of handling aluminum and high-strength steels needed for critical structural parts, suspension components, battery tray mounts, and motor shafts, requiring high tonnage and precision.

Which geographical region holds the largest market share in the Hot Forging Press Market?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly fueled by significant industrial investments, robust automotive manufacturing output, and substantial capacity expansion, particularly in China and India.

What are the primary factors restraining the growth of the Hot Forging Press Market?

The major restraints include the substantial initial capital investment required for high-tonnage press machinery, complexity in integrating advanced automation systems (Industry 4.0), and persistent challenges related to finding and retaining highly skilled technical labor for operation and maintenance.

What role does AI play in optimizing hot forging press operations?

AI is increasingly used for advanced predictive maintenance, analyzing machine sensor data to forecast failures. It also optimizes real-time process control by dynamically adjusting press parameters (force, speed) based on material feedback, leading to reduced defects and enhanced energy management.

What is the typical lifespan expected for a major hot forging press investment?

A well-maintained, heavy-duty hot forging press, especially those from reputable OEMs, typically has a functional operational lifespan exceeding 30 years, emphasizing the long-term strategic nature of this capital equipment investment.

How does hot forging differ from cold forging, and why is hot forging press preferred for aerospace components?

Hot forging involves forming metal above its recrystallization temperature, enhancing ductility and allowing for greater deformation and complex shapes, which is critical for large, high-stress parts. Aerospace relies on hot forging to achieve superior mechanical properties, refined grain structure, and material integrity in superalloys like titanium and Inconel, crucial for safety-critical components.

What is the significance of the 1,500 – 5,000 Tons tonnage segment?

The 1,500 – 5,000 Tons segment is highly significant as it offers the versatility required for a wide range of common industrial and automotive components, balancing the speed of high-volume production with the necessary force for robust part creation, making it the most balanced and widely utilized segment globally.

What critical applications drive the demand for presses exceeding 5,000 Tons?

Presses above 5,000 Tons are primarily demanded by the aerospace industry for forging large airframe structures, landing gear components, and specialized engine discs, as well as the heavy industrial sector for large shafts, turbine rotors, and oversized equipment parts where immense force is required to shape difficult-to-form metals.

How do hot forging press manufacturers address environmental concerns and sustainability?

Manufacturers are addressing sustainability by developing highly energy-efficient servo presses, optimizing hydraulic systems to reduce oil consumption, and integrating advanced cooling and filtration systems. This focus lowers operational carbon footprints and meets increasingly strict global environmental regulations.

What are the key components included in the upstream segment of the hot forging press value chain?

The upstream segment includes high-grade steel suppliers for the press frame, specialized manufacturers of hydraulic pumps and valves, precise electrical control systems, automation components (PLCs, sensors), and robust cooling and lubrication systems essential for the press’s long-term operational integrity and performance.

How important are customized press solutions in the current market?

Customization is highly important, especially for aerospace and heavy industrial clients requiring presses tailored for specific materials (like titanium or superalloys) or unique process requirements (like controlled dwell times or rapid die change systems), differentiating high-end press OEMs.

What is the role of automation in enhancing the profitability of hot forging operations?

Automation (robotics, automatic billet feeding, die spraying) minimizes labor costs, significantly improves production consistency and cycle times, and enhances worker safety by removing human interaction from the high-heat, high-stress forging area, directly boosting overall equipment effectiveness (OEE) and profitability.

Which factors contribute to Asia Pacific's continued market leadership?

APAC’s leadership is cemented by sustained high rates of industrialization, continuous governmental investment in domestic manufacturing capabilities, massive consumer demand driving the automotive sector, and established, cost-competitive manufacturing ecosystems in countries such as China and India.

What kind of service demands follow the sale of a hot forging press?

Post-sale services include complex installation and commissioning, comprehensive operator training, periodic preventative maintenance, sourcing of critical spare parts, and offering technological upgrades or refurbishments over the machine’s extended lifespan, forming a substantial part of OEM revenue streams.

How are press manufacturers responding to the global labor shortage?

Manufacturers are addressing labor shortages by accelerating the development and deployment of fully automatic, highly integrated forging cells that require less direct human intervention, focusing on user-friendly HMI interfaces, and providing extensive training programs centered on digital controls and maintenance.

In the context of hot forging, what is ‘near-net-shape’ technology?

Near-net-shape forging is a technique, enabled by modern high-precision presses, that produces a forged component very close to its final required dimensions. This drastically reduces the subsequent machining time, decreases material waste, and lowers overall component production costs.

What advantages do hydraulic presses offer over mechanical presses in hot forging?

Hydraulic presses provide superior control over the ram speed, force, and stroke length, allowing for programmable force application and controlled dwell times. This precision is vital for forging specialty alloys and complex components requiring deep penetration or specific material flow characteristics.

What impact does fluctuating raw material cost have on the Hot Forging Press market?

Volatile raw material costs (e.g., steel, nickel) increase the operational costs for end-users (forging companies). This volatility sometimes delays their decisions to invest in new presses, although it simultaneously drives demand for advanced presses that offer better material utilization and scrap reduction to mitigate cost risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hot Forging Press Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hot Forging Press Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (> 100000 KN, 10000-100000 KN, < 10000 KN), By Application (Engineering Machinery, Hardware Tools, Automotive Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager