Hotel Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433156 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Hotel Furniture Market Size

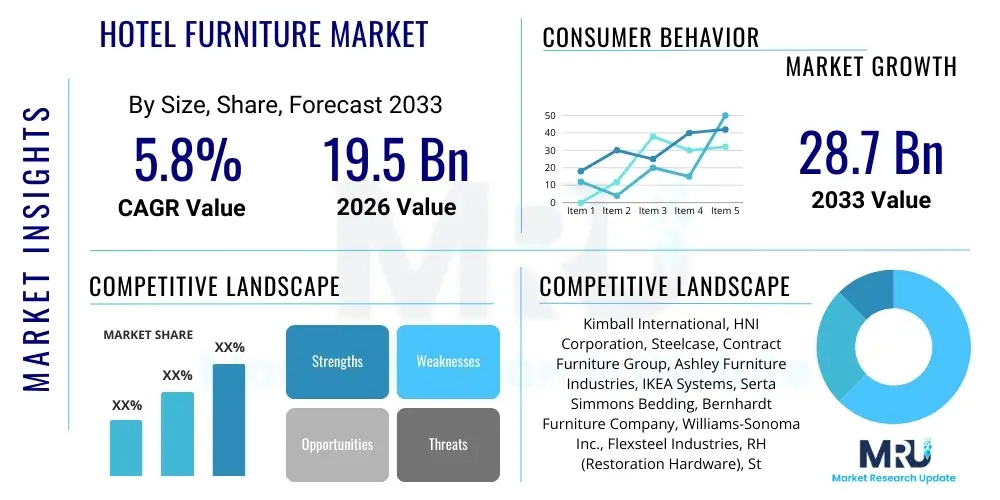

The Hotel Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 28.7 Billion by the end of the forecast period in 2033.

Hotel Furniture Market introduction

The Hotel Furniture Market encompasses the design, manufacturing, and distribution of specialized furnishing solutions tailored for the demanding environment of the hospitality sector, including guest rooms, lobbies, dining areas, and outdoor spaces. These products range from standard casegoods, seating, and bedding to bespoke fixtures and technology-integrated pieces, prioritizing durability, aesthetic appeal, and adherence to specific brand standards and regulatory requirements. The primary objective of hotel furniture is to enhance guest experience, improve operational efficiency, and reflect the desired brand image, making it a critical component of hotel development and renovation projects worldwide. The scope of products is broad, covering everything from functional items like desks and storage units to luxury elements such as custom headboards and specialized ergonomic seating for conference facilities.

Major applications of hotel furniture span across various types of lodging establishments, including five-star luxury resorts, standardized mid-range business hotels, budget motels, and specialized niche accommodations like extended-stay residences and boutique properties. The demand for aesthetically pleasing yet robust furniture is fundamentally driven by the continuous global expansion of the travel and tourism industry, coupled with the competitive necessity for hotels to undergo periodic refurbishments to maintain freshness and appeal. The functional benefits of high-quality hotel furniture include enhanced longevity, reduced maintenance costs, and superior guest comfort, directly contributing to higher occupancy rates and positive guest feedback. Furthermore, the selection of furniture plays a pivotal role in the perceived value and luxury level of the establishment, significantly influencing pricing strategies and brand positioning in diverse geographical markets.

The market is predominantly driven by significant increases in international tourist arrivals and rising disposable incomes across emerging economies, leading to robust hotel construction pipelines, particularly in the Asia Pacific and Middle East regions. Key driving factors include the rapid urbanization trends, the expansion of global hotel chains aiming for standardized yet locally adapted designs, and the growing consumer preference for experiential travel that values sophisticated and comfortable hotel environments. Moreover, the increasing focus on sustainability and wellness in hotel design mandates the use of eco-friendly materials and non-toxic finishes, pushing manufacturers toward innovation in green furniture solutions. The demand for modular and multipurpose furniture also contributes significantly to market growth, especially in compact urban hotel settings where maximizing space utilization is paramount for operational success.

Hotel Furniture Market Executive Summary

The Hotel Furniture Market is currently undergoing a significant transformation characterized by converging business trends centered on sustainability, customization, and technological integration. Business trends highlight a strong shift toward B2B direct sourcing, leveraging digital platforms to streamline procurement, and an increased emphasis on durable, commercial-grade furniture that minimizes the total cost of ownership over the hotel lifecycle. The modular and multi-functional furniture segment is experiencing accelerated adoption due to its versatility in adapting to diverse guest needs and maximizing revenue per available room (RevPAR). Furthermore, post-pandemic recovery has fueled immediate demand for quick turnaround renovation cycles, favoring manufacturers capable of efficient supply chain management and rapid project execution, focusing heavily on resilient and hygienic material selections.

Regionally, the market dynamics are highly concentrated in the Asia Pacific (APAC) area, which demonstrates the highest growth potential driven by large-scale infrastructure projects, the expansion of domestic tourism, and significant foreign investment in luxury hospitality infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while being mature markets, continue to represent substantial market share, primarily fueled by extensive renovation cycles, the proliferation of boutique hotels, and stringent quality demands that favor premium, custom-designed furniture solutions. The Middle East and Africa (MEA) region is another critical growth engine, particularly due to mega-events and tourism initiatives in the Gulf Cooperation Council (GCC) countries, driving exceptional demand for high-end, luxury hotel furnishings that require specialized, high-specification materials and designs.

Segmentation trends indicate that the Casegoods and Seating categories collectively dominate the market due to their prevalence in every guest room and common area. Within the application segment, Luxury Hotels and Resorts remain the largest contributors to revenue, demanding bespoke, high-cost furniture reflecting exclusive brand aesthetics and superior material quality. However, the Mid-Range Hotel segment is witnessing the fastest expansion, driven by standardization and bulk purchasing efficiency, focusing on durability and value engineering. Material trends show a growing preference for engineered wood and metal components that offer high longevity and simplified maintenance, alongside an increasing demand for sustainable and recycled fabric upholstery, aligning with global corporate social responsibility goals and guest expectations for eco-conscious lodging experiences.

AI Impact Analysis on Hotel Furniture Market

Common user questions regarding AI's impact on the Hotel Furniture Market frequently revolve around how artificial intelligence can personalize the guest room experience, optimize furniture design for manufacturing efficiency, and predict future style trends and material longevity. Users are concerned about the implementation costs versus the return on investment in smart furniture, and how AI can aid in predictive maintenance and operational cost reduction within the housekeeping and engineering departments. The synthesized analysis reveals that users anticipate AI influencing two main areas: optimizing the complex B2B supply chain through demand forecasting and inventory management, and enhancing the guest experience via integrated smart furniture that adjusts to individual preferences (e.g., lighting, temperature, ergonomic settings) based on historical usage data, driving a paradigm shift toward truly data-driven furniture customization.

The integration of AI is transforming the lifecycle of hotel furniture from initial concept and prototyping to eventual replacement and maintenance. In the design phase, generative AI is used to explore thousands of design variations optimized for specific spatial constraints, material usage, and manufacturing complexity, significantly reducing time-to-market for new collections. For manufacturing, AI-driven robotics and sophisticated quality control systems are ensuring precision and reducing waste, improving overall production scalability and consistency. Furthermore, post-installation, AI is enabling predictive maintenance schedules for smart furniture elements, such as motorized beds or integrated electronics, flagging potential faults before they impact guest satisfaction, thereby enhancing the operational lifespan and reliability of high-value assets within the hotel premises.

Moreover, AI algorithms are playing a pivotal role in market analysis and demand prediction for hotel furniture suppliers. By processing vast datasets related to travel patterns, hotel renovation cycles, competitive landscapes, and consumer aesthetic preferences, AI helps manufacturers proactively develop product lines that align with anticipated market needs, minimizing speculative production. This data-driven approach assists procurement officers within large hotel chains to make informed decisions regarding bulk purchases, ensuring their inventory aligns perfectly with predicted occupancy rates and desired property upgrades. This enhanced forecasting capability reduces obsolescence risks and optimizes capital expenditure planning for hotel owners, solidifying AI's position as a crucial tool for both design innovation and strategic supply chain management within the sector.

- AI-driven generative design accelerates new product development cycles and optimizes material use.

- Predictive maintenance analytics using embedded sensors extends the lifespan of integrated smart furniture.

- Enhanced supply chain forecasting optimizes raw material procurement and reduces inventory holding costs for manufacturers.

- Personalization algorithms integrate into smart room systems, adjusting furniture settings (e.g., bed firmness, desk height) based on guest profiles.

- Automated quality control systems in manufacturing utilize computer vision and AI to ensure product consistency and minimize defects.

DRO & Impact Forces Of Hotel Furniture Market

The dynamics of the Hotel Furniture Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive landscape and strategic direction of industry participants. Key market drivers include the sustained global growth in travel and tourism, necessitating continuous investment in new hotel development and aggressive renovation schedules, typically occurring every five to seven years to maintain brand image and competitiveness. Furthermore, the proliferation of specialized hospitality segments, such as extended-stay and wellness resorts, demands unique, high-specification furniture, broadening the product scope and driving innovation in modular and ergonomic designs. The rising affluence in Asia and the Middle East, leading to increasing demand for luxury and branded accommodations, provides a significant tailwind for high-value custom furniture manufacturing.

However, the market faces considerable restraints, primarily stemming from volatility in raw material costs, particularly timber, metal, and petroleum-derived materials used in foam and fabrics, which directly impact manufacturing margins and end-user pricing. Stringent and evolving fire safety and environmental regulations, particularly in North America and Europe, necessitate complex certification processes and potentially higher production costs for compliant furniture. The inherently long sales cycle associated with major hotel projects, which often requires lengthy tendering processes and customized production runs, poses a liquidity challenge for smaller manufacturers. Moreover, the cyclical nature of the hospitality industry means that economic downturns immediately trigger delays or cancellations of large CapEx projects, causing periodic demand shocks within the furniture supply chain, demanding robust risk management strategies.

Despite these challenges, substantial opportunities exist, driven by technological advancements and shifting consumer preferences. The growing opportunity lies in the integration of smart technology (IoT) into furniture, offering features like wireless charging, embedded automation, and occupancy sensors that cater to the tech-savvy modern traveler. There is also a significant market opportunity in sustainable and circular economy models; hotels are increasingly prioritizing suppliers who use recycled, rapidly renewable, or certified wood sources, addressing growing stakeholder pressure for environmental responsibility. The emerging demand for furniture as a service (FaaS) model, where hotels lease rather than purchase furniture, presents a novel avenue for market penetration, particularly for new or smaller hotel operators seeking to minimize upfront capital expenditure and simplify asset management throughout the product lifecycle.

Segmentation Analysis

The Hotel Furniture Market is comprehensively segmented based on product type, material composition, distribution channel, and application (hotel category), each providing unique insights into consumer preferences and market maturity. The segmentation by product type is crucial as it dictates manufacturing complexity, material choice, and average unit price, distinguishing high-volume standardized items from lower-volume, specialized custom pieces. Analysis of segmentation provides clarity on which product categories are witnessing the fastest adoption rates, typically those enhancing modularity and spatial efficiency, especially within the context of rapidly expanding mid-range urban hotels globally. Understanding the material segment dynamics is vital for tracking shifts toward sustainable sourcing and managing supply chain risk related to commodity price volatility.

The application-based segmentation reveals distinct procurement patterns and quality requirements across different hotel categories. Luxury hotels prioritize aesthetics, bespoke design, and premium materials (often high-grade solid wood and leather), justifying higher costs, while budget and mid-range segments focus on value engineering, durability, and bulk volume efficiency using engineered wood and robust synthetic materials. The distribution channel analysis is key to understanding market access, noting the increasing reliance on direct sales and specialized third-party distributors who offer design consultancy and installation services, distinguishing them from traditional retail models. This detailed segmentation aids stakeholders in developing targeted marketing strategies, optimizing product portfolios, and strategically allocating manufacturing resources to high-growth segments, ensuring maximum market relevance and penetration.

The structural characteristics of the market are defined by these segmentations, illustrating a market where purchasing decisions are highly centralized, governed by standardized specifications set by global hotel chains or large asset management groups. The growing trend toward 'lifestyle' and 'boutique' hotels further complicates segmentation, as these properties often demand furniture that blurs the lines between residential and commercial design, pushing manufacturers to offer highly customizable, residential-style comfort while maintaining commercial-grade durability. Therefore, successful market penetration requires deep specialization within chosen segments, whether focusing on high-volume standardized casegoods or niche markets demanding exquisite, artisanal quality furniture tailored for ultra-luxury suites and public spaces.

- Product Type: Casegoods, Seating, Beds & Bedding, Tables, Lighting, Fixtures & Fittings.

- Material: Wood (Solid Wood, Engineered Wood), Metal, Plastic, Fabric (Textile, Synthetic), Leather.

- Distribution Channel: Direct Sales (Manufacturer to Hotel), Third-Party Distributors/Agents, E-commerce/Online Retail.

- Application/Hotel Category: Luxury Hotels & Resorts, Mid-Range Hotels, Budget Hotels, Specialty Lodging (Extended Stay, Boutique).

Value Chain Analysis For Hotel Furniture Market

The value chain for the Hotel Furniture Market begins with the upstream raw material procurement, encompassing the sourcing of specialized timber, metal alloys, textiles, and composite materials, often sourced globally due to material specialization and cost efficiency requirements. Upstream suppliers are pivotal, as the quality, sustainability certification, and price volatility of these materials directly influence the manufacturer's final product quality and profitability. Manufacturers then engage in the core processes of design, engineering, prototyping, and mass production, often employing advanced CNC machining, precision welding, and upholstery techniques to meet rigorous commercial standards, emphasizing durability and adherence to specific design blueprints provided by hotel interior designers or procurement teams.

The downstream component of the value chain is focused on market access, logistics, and installation services, which are critical differentiators in this B2B sector. Distribution channels typically involve a mix of direct sales teams employed by large manufacturers, specialized hospitality distributors who manage inventory and regional installations, and, increasingly, dedicated e-commerce portals facilitating small-volume replacement purchases or supplying independent hotels. Logistics is complex, requiring specialized packaging and transportation of large, often pre-assembled items to construction sites globally. Installation services, frequently managed by the distributor or specialized third parties, must be coordinated meticulously with hotel opening schedules, emphasizing quick, efficient, and damage-free assembly within a tight construction timeline.

Direct sales dominate the distribution of major contract furniture projects, particularly for large global hotel chains that mandate strict specifications and require close collaboration between the manufacturer's design team and the hotel's purchasing department. Indirect channels, such as third-party distributors and agents, are essential for penetrating regional or smaller markets, offering localized support, warehousing, and installation expertise that manufacturers may lack. E-commerce platforms are emerging as significant indirect channels, especially for procurement of replacement items, standardized accessories, and minor renovations, offering transparency in pricing and quicker delivery options for non-customized stock items, streamlining the often-complex procurement process for standardized components like mattresses, lamps, and basic seating units.

Hotel Furniture Market Potential Customers

The primary customers and end-users of the Hotel Furniture Market are diverse stakeholders within the global hospitality industry, ranging from independent hotel owners and operators to large multinational hotel chains and major property development groups. The most significant buying entities are large hotel management companies (e.g., Marriott, Hilton, IHG), who make centralized purchasing decisions based on detailed brand standards, negotiating global supply agreements to achieve maximum economies of scale and product standardization across their portfolio. These entities prioritize consistency, compliance with global safety standards, and logistical efficiency, often requiring furniture suppliers to meet stringent quality assurance protocols and provide extensive warranties, reflecting a strong focus on asset protection.

Another crucial customer segment includes property developers and architectural/interior design firms specializing in hospitality projects. These customers often initiate the procurement process during the pre-construction or renovation phase, requiring suppliers to collaborate closely on custom design specifications, material sourcing, and budget adherence, acting as the primary decision-makers for aesthetic choices and material selections. Boutique and independent hotel owners represent a niche segment, often seeking highly individualized, custom or artisanal furniture that reflects a unique local identity or specific design ethos, prioritizing distinctive aesthetic value and smaller production runs, often sourced through specialized design distributors or agents who cater specifically to the independent luxury sector.

Furthermore, ancillary lodging sectors, such as extended-stay residences, senior living facilities, student accommodation, and cruise ships, represent growing peripheral customer groups. While their core furniture needs overlap with traditional hotels (durability, fire safety), they often require specialized features, such as enhanced storage, kitchenette integration, or medical-grade textiles. The furniture procured by these entities must meet similar commercial standards but is often required to withstand greater wear and tear over extended periods of continuous occupancy, driving demand for heavy-duty construction and highly cleanable surfaces, thereby broadening the definition and scope of the potential customer base beyond traditional hotel operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 28.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimball International, HNI Corporation, Steelcase, Contract Furniture Group, Ashley Furniture Industries, IKEA Systems, Serta Simmons Bedding, Bernhardt Furniture Company, Williams-Sonoma Inc., Flexsteel Industries, RH (Restoration Hardware), Standard Furniture, Natuzzi S.p.A., Inter IKEA Systems B.V., Haworth Inc., Vitra, Godrej & Boyce Mfg. Co. Ltd., Durham Furniture, CFS Group, Sauder Manufacturing Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hotel Furniture Market Key Technology Landscape

The technological landscape of the Hotel Furniture Market is rapidly evolving, driven by advancements in both manufacturing processes and product integration, fundamentally altering how furniture is designed, produced, and utilized within the hospitality environment. In manufacturing, the adoption of Industry 4.0 principles, including high-precision Computer Numerical Control (CNC) machinery and robotic assembly lines, allows for rapid prototyping and mass customization without sacrificing quality, enabling manufacturers to efficiently handle diverse orders that require varied specifications and material combinations. Furthermore, advanced finishing techniques, such as UV-cured coatings and specialized anti-microbial treatments, are being implemented to enhance durability and hygiene, key requirements post-pandemic, ensuring furniture longevity and simplifying rigorous cleaning protocols mandated by hotel management.

Product-level technological integration is centered on the Internet of Things (IoT) and smart furniture solutions, which enhance the personalized guest experience and provide operational data to hotel management. This includes embedded technologies such as integrated wireless charging pads, motorized blinds controlled via bedside tablets, smart lighting systems synchronized with circadian rhythms, and occupancy sensors that inform housekeeping and energy management systems. The data generated by these connected furniture pieces provides valuable insights into guest usage patterns, allowing hotels to optimize energy consumption, schedule predictive maintenance for components, and refine future investment in technological upgrades, driving higher guest satisfaction scores and improved operational metrics like labor optimization and energy efficiency.

Beyond guest room technology, sophisticated digital tools are transforming the B2B interaction process. Suppliers are leveraging Virtual Reality (VR) and Augmented Reality (AR) platforms to allow hotel developers and interior designers to visualize furniture layouts and material selections within the actual hotel space before production begins, significantly minimizing design errors and approval delays. Moreover, the focus on sustainable technology is paramount, with innovations in material science leading to the use of recycled plastics, sustainable fiber composites, and certified low-VOC (volatile organic compound) finishes, allowing manufacturers to meet stringent green building certifications (like LEED) increasingly demanded by major property developers, ensuring the furniture assets contribute positively to the hotel’s overall environmental performance targets and corporate branding efforts.

Regional Highlights

Regional dynamics significantly influence the Hotel Furniture Market, reflecting localized tourism trends, regulatory frameworks, and economic growth rates, necessitating highly localized market strategies for manufacturers and suppliers.

- Asia Pacific (APAC): APAC is the undisputed leader in market growth, driven by massive investments in tourism infrastructure, rapid urbanization, and the rise of a consuming middle class, particularly in China, India, and Southeast Asia. The region is characterized by high demand for mid-range and budget hotel furniture due to the extensive rollout of standardized chain hotels, though luxury demand remains strong due to bespoke resort development. Local manufacturing capabilities are high, leading to intense price competition, yet increasing emphasis on quality and global brand compliance creates opportunities for premium international suppliers who can navigate complex supply chain logistics and environmental standards specific to each country within the region.

- North America: This region represents a mature, high-value market defined by frequent renovation cycles and a strong focus on custom, high-durability furniture that meets stringent fire codes (like California TB 133/117). Demand is robust across all hotel categories, with significant growth observed in the extended-stay and boutique segments. Procurement decisions are often highly centralized by major U.S. and Canadian hotel management companies, prioritizing domestic manufacturing or highly reliable international suppliers capable of just-in-time delivery and offering extensive product warranties, focusing on premium upholstery and integrated smart technology.

- Europe: The European market is fragmented, reflecting diverse national aesthetics and regulatory environments, with high demand for artisanal quality, sustainable materials, and contemporary design, particularly in Western European countries like Germany, the UK, and France. Renovation cycles are relatively prolonged compared to North America, but investments prioritize longevity and adherence to strict EU sustainability directives. The rise of concept and lifestyle hotels drives demand for highly customized, design-led furniture, often favoring European manufacturers specializing in high-end contract products and bespoke architectural metalwork and cabinetry.

- Middle East & Africa (MEA): The MEA region, particularly the GCC countries (UAE, Saudi Arabia, Qatar), is a key growth area for ultra-luxury hotel furnishings, driven by ambitious government tourism visions and mega-projects (e.g., NEOM, Dubai Expo aftermath). This region demands exceptional quality, opulent aesthetics, and specialized materials (marble, custom metals, exotic veneers). Logistics complexity and the need for climate-appropriate, highly durable materials that withstand high heat and humidity are key considerations, making high-spec imports and specialized installation services critical to project success in this burgeoning luxury hospitality sector.

- Latin America: Characterized by economic volatility and varying levels of tourism development, the market exhibits steady demand driven by both international resort expansion (Mexico, Caribbean) and domestic business travel infrastructure improvements (Brazil, Chile). Price sensitivity is higher in many local markets, favoring value-engineered products and local manufacturers, though international brands setting up presence require globally standardized furniture specifications, creating segmented demand for both cost-effective and high-quality durable imports, contingent on regional economic stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hotel Furniture Market.- Kimball International

- HNI Corporation

- Steelcase

- Contract Furniture Group

- Ashley Furniture Industries

- IKEA Systems

- Serta Simmons Bedding

- Bernhardt Furniture Company

- Williams-Sonoma Inc.

- Flexsteel Industries

- RH (Restoration Hardware)

- Standard Furniture

- Natuzzi S.p.A.

- Inter IKEA Systems B.V.

- Haworth Inc.

- Vitra

- Godrej & Boyce Mfg. Co. Ltd.

- Durham Furniture

- CFS Group

- Sauder Manufacturing Co.

- Ritz Contract

- Tropitone Furniture Co.

Frequently Asked Questions

Analyze common user questions about the Hotel Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hotel Furniture Market?

The Hotel Furniture Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by global tourism recovery and ongoing hotel renovation cycles, particularly in the Asia Pacific region.

How does sustainability impact material selection in hotel furniture?

Sustainability significantly drives material selection, favoring certified wood (FSC), recycled metal, and low-VOC finishes. Hotels increasingly prioritize suppliers demonstrating circular economy practices and compliance with global environmental building standards like LEED, enhancing the brand image and minimizing environmental impact.

Which product segment holds the largest share of the Hotel Furniture Market?

Casegoods (including wardrobes, desks, and storage units) and Seating (chairs, sofas) segments collectively hold the largest market share due to their necessity in every guest room and high traffic area. Customization and durability are key requirements within these high-volume segments.

What role does technology play in modern hotel furniture design?

Technology integration focuses on enhancing guest experience and operational efficiency through IoT-enabled smart furniture. This includes integrated wireless charging, automated lighting controls, and embedded sensors for predictive maintenance, streamlining housekeeping and energy consumption management.

What are the primary challenges faced by the Hotel Furniture Market manufacturers?

The primary challenges include managing the high volatility of raw material costs (timber, steel), adhering to complex and strict fire safety regulations across different regions, and navigating the long sales cycles and logistical complexities associated with large-scale hotel contract procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager