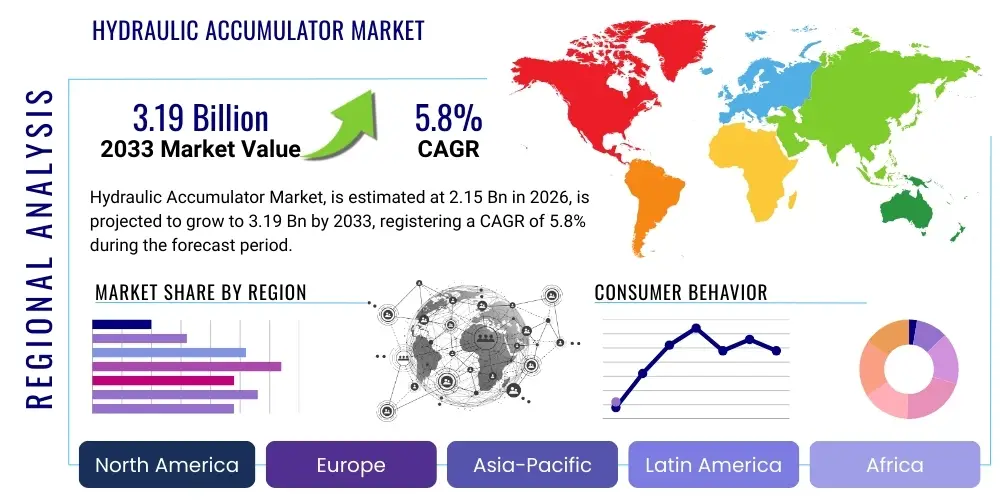

Hydraulic Accumulator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440100 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hydraulic Accumulator Market Size

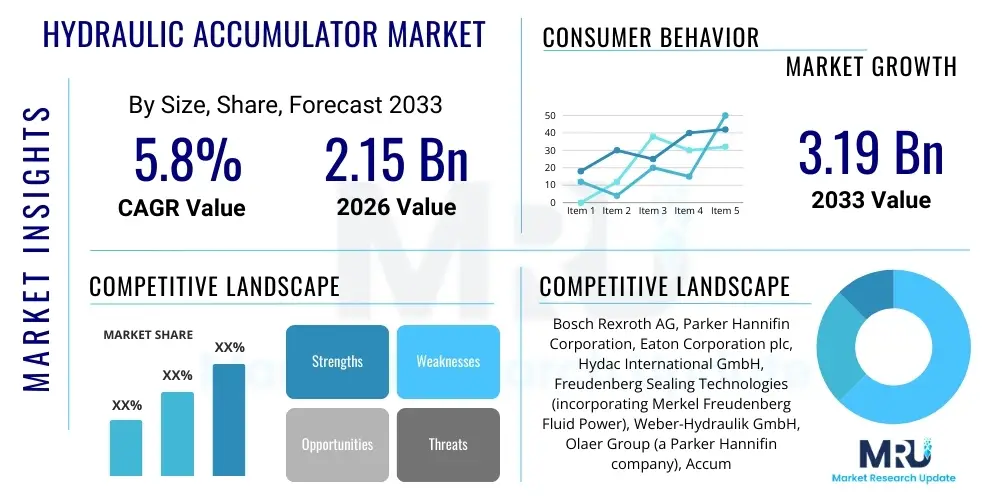

The Hydraulic Accumulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.19 Billion by the end of the forecast period in 2033.

Hydraulic Accumulator Market introduction

The hydraulic accumulator market encompasses the manufacturing, distribution, and sales of devices designed to store hydraulic energy, absorb shocks, damp pulsations, and provide emergency power in hydraulic systems. These essential components play a critical role in enhancing system efficiency, prolonging equipment life, and ensuring operational stability across various industrial and mobile applications. Their ability to manage fluid pressure fluctuations makes them indispensable for smooth and reliable hydraulic system performance.

Major applications for hydraulic accumulators span a broad spectrum of industries, including construction, agriculture, automotive, marine, oil and gas, and general manufacturing. In construction equipment, they improve ride comfort and absorb shocks, while in manufacturing presses, they provide quick bursts of energy for rapid operations. Their versatility extends to energy recovery systems, where they capture and release energy to optimize power consumption.

The primary benefits of integrating hydraulic accumulators include significant energy savings by storing excess power, reduced wear and tear on pumps and other hydraulic components due to pulsation damping, improved system response times, and enhanced safety through the provision of emergency power. The market is primarily driven by the increasing demand for automation in various industrial sectors, the global emphasis on energy efficiency, and the continuous expansion of infrastructure and manufacturing capabilities worldwide, necessitating robust and reliable fluid power solutions.

Hydraulic Accumulator Market Executive Summary

The hydraulic accumulator market is experiencing robust growth, primarily propelled by global industrialization, the widespread adoption of automation technologies, and the escalating demand for energy-efficient hydraulic systems across diverse sectors. Key business trends indicate a strong focus on product innovation, with manufacturers investing in advanced materials, smart accumulator technologies featuring integrated sensors, and designs that offer increased durability and efficiency. Strategic partnerships and mergers are also prevalent as companies seek to expand their product portfolios and geographical reach, catering to evolving industrial requirements and stricter environmental regulations.

Regionally, the market exhibits dynamic growth patterns, with Asia Pacific emerging as a dominant force due to rapid industrial development, infrastructure expansion, and a burgeoning manufacturing base in countries like China, India, and Southeast Asian nations. North America and Europe also maintain significant market shares, driven by technological advancements, stringent safety standards, and the modernization of existing industrial infrastructure. Latin America, the Middle East, and Africa are showing promising growth, attributed to increasing investments in mining, oil and gas exploration, and agricultural mechanization.

From a segmentation perspective, bladder accumulators continue to hold a substantial share due to their high efficiency and suitability for a wide range of applications, while piston accumulators are favored in high-pressure, large-volume systems. Diaphragm accumulators find niche applications where compact size and low maintenance are prioritized. End-use industries such as mobile equipment, industrial machinery, and oil and gas are major contributors to market revenue, reflecting the critical need for accumulators in these demanding environments. The overall market outlook remains positive, with continued technological advancements and expanding industrial applications poised to sustain growth throughout the forecast period.

AI Impact Analysis on Hydraulic Accumulator Market

User questions regarding the impact of Artificial Intelligence (AI) on the hydraulic accumulator market frequently center on how AI can enhance operational efficiency, extend component lifespan, and enable predictive maintenance strategies. Common inquiries explore the integration of AI with sensors for real-time monitoring of pressure, temperature, and fluid levels within hydraulic accumulators, aiming to move beyond traditional scheduled maintenance to more intelligent, condition-based servicing. Users are keen to understand how AI can process vast amounts of operational data to anticipate failures, optimize performance, and reduce unscheduled downtime, thereby improving overall system reliability and cost-effectiveness.

A key concern for users involves the practical implementation challenges, including the cost of integrating AI-powered monitoring systems, the complexity of data interpretation, and the need for skilled personnel to manage and maintain these advanced technologies. There is also interest in data security and privacy implications when connecting hydraulic systems to broader digital networks. Expectations are high for AI to transform hydraulic system management, leading to smarter, more adaptive accumulators that can self-diagnose, communicate their status, and even self-adjust to changing operational demands, moving towards fully autonomous hydraulic circuits.

Furthermore, users anticipate AI playing a significant role in optimizing the energy management capabilities of hydraulic accumulators. By precisely predicting energy demands and storage requirements, AI can help hydraulic systems operate at peak efficiency, minimizing energy waste and contributing to sustainability goals. The integration of AI for anomaly detection can also prevent catastrophic failures, ensuring safer operation of heavy machinery and industrial equipment. This intelligent approach transforms accumulators from passive components into active, data-driven elements of modern hydraulic systems.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from accumulators (pressure, temperature, vibration) to predict potential failures, enabling proactive maintenance and reducing downtime.

- Optimized Energy Management: AI-driven control systems can intelligently manage energy storage and release from accumulators, maximizing efficiency and minimizing power consumption in hydraulic circuits.

- Real-time Performance Monitoring: AI facilitates continuous, real-time monitoring of accumulator health and performance, providing immediate insights into operational deviations.

- Anomaly Detection: Machine learning models can identify unusual patterns in accumulator behavior, signaling potential issues before they escalate into major malfunctions.

- Autonomous System Integration: AI can enable accumulators to dynamically adjust their parameters (e.g., pre-charge pressure) based on real-time system demands, leading to more adaptive and self-optimizing hydraulic systems.

- Extended Lifespan of Components: By ensuring optimal operating conditions and timely intervention, AI contributes to extending the operational life of accumulators and associated hydraulic components.

- Data-driven Design and Innovation: Performance data collected and analyzed by AI can inform future accumulator designs, leading to more efficient, durable, and application-specific products.

- Improved Safety Protocols: AI-powered monitoring and control enhance safety by detecting critical faults and preventing over-pressurization or sudden depressurization events.

DRO & Impact Forces Of Hydraulic Accumulator Market

The hydraulic accumulator market is significantly influenced by a confluence of driving forces, prominent among which is the escalating demand for advanced hydraulic systems across critical sectors such as construction, agriculture, mining, and automotive. The global push towards energy efficiency and sustainability mandates the integration of accumulators, which store excess hydraulic energy, reduce pump cycling, and stabilize pressure, thereby minimizing power consumption. Furthermore, the relentless pace of industrial automation, requiring precise and reliable fluid power solutions, coupled with the increasing adoption of heavy machinery and mobile equipment, directly translates into a higher demand for these essential components that enhance operational smoothness and longevity.

Despite the robust growth drivers, the market faces notable restraints that could temper its expansion. High initial capital investment required for hydraulic accumulator systems, particularly for advanced or customized solutions, can be a barrier for smaller enterprises or projects with limited budgets. Moreover, the inherent maintenance requirements associated with certain accumulator types, such as regular nitrogen recharging for bladder and diaphragm accumulators, and seal replacements for piston accumulators, contribute to operational costs. Intense competition from alternative energy storage solutions or evolving electronic control systems that reduce the need for certain hydraulic components also poses a challenge, pushing manufacturers towards continuous innovation to maintain market relevance.

Opportunities for growth are abundant, particularly in emerging markets where industrialization and infrastructure development are accelerating, creating new avenues for hydraulic system deployment and upgrades. Technological advancements in materials science, leading to the development of lighter, more durable, and corrosion-resistant accumulators, alongside the integration of smart technologies like IoT sensors for predictive maintenance, represent significant growth prospects. The retrofitting of older hydraulic systems with modern accumulators to enhance efficiency and extend operational life also presents a substantial market opportunity. Collectively, these impact forces shape a dynamic market landscape where technological innovation and strategic market penetration are crucial for sustained success.

Segmentation Analysis

The hydraulic accumulator market is comprehensively segmented to provide granular insights into its diverse applications, technologies, and end-user industries. This segmentation allows for a detailed understanding of market dynamics, growth drivers, and specific opportunities within each sub-segment, aiding manufacturers and stakeholders in strategic planning and product development. The primary segmentation revolves around accumulator type, application, and end-use industry, reflecting the varied requirements across the global industrial landscape.

- By Type

- Bladder Accumulator

- Standard Bladder

- High Flow Bladder

- Pulsation Dampeners

- Piston Accumulator

- Standard Piston

- High Pressure Piston

- Low Friction Piston

- Diaphragm Accumulator

- Welded Diaphragm

- Threaded Diaphragm

- Metal Bellows Accumulator

- Spring Accumulator

- Weight-Loaded Accumulator

- Bladder Accumulator

- By Application

- Energy Storage

- Shock Absorption

- Pulsation Damping

- Leakage Compensation

- Emergency Power/Auxiliary Power

- Suspension Systems

- Hydraulic Hybrid Drives

- By Operating Pressure

- Low Pressure (< 100 bar)

- Medium Pressure (100-350 bar)

- High Pressure (> 350 bar)

- By End-Use Industry

- Mobile Equipment

- Construction Machinery

- Agricultural Machinery

- Mining Equipment

- Material Handling Equipment

- Marine Vessels

- Industrial Machinery

- Machine Tools

- Presses

- Injection Molding Machines

- Power Generation

- Wind Turbines

- Oil and Gas Equipment

- Testing Equipment

- Steel Manufacturing

- Chemical Processing

- Automotive

- Aerospace and Defense

- Renewable Energy

- Medical

- Food and Beverage

- Mobile Equipment

- By Fluid Type

- Mineral Oil

- Phosphate Ester

- Water Glycol

- Biodegradable Fluids

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Hydraulic Accumulator Market

The value chain for the hydraulic accumulator market begins with the upstream analysis, which primarily involves the sourcing and processing of raw materials crucial for manufacturing these components. This stage includes suppliers of high-grade steel for accumulator shells, various elastomer compounds (such as NBR, HNBR, FKM) for bladders and seals, and specialized plastics for diaphragms. The quality and availability of these materials are paramount, as they directly impact the performance, durability, and safety of the final product. Strategic relationships with reliable material suppliers are critical to ensure consistent quality and cost-effectiveness, alongside adherence to environmental and ethical sourcing standards.

Midstream activities encompass the manufacturing and assembly processes. This involves precision machining of metal components, molding of elastomers, welding of accumulator shells, and the assembly of various parts into a complete hydraulic accumulator unit. Quality control at each stage, including pressure testing, leak detection, and material integrity checks, is vital to meet stringent industry standards and customer expectations. Additionally, this stage includes the integration of advanced technologies, such as sensor integration for smart accumulators, which adds complexity and value to the manufacturing process. Manufacturers often invest heavily in research and development to innovate designs, improve performance, and reduce production costs.

Downstream analysis focuses on the distribution, sales, and aftermarket services. Distribution channels can be direct, where manufacturers sell directly to large Original Equipment Manufacturers (OEMs) or key industrial clients, offering customized solutions and technical support. Indirect channels involve a network of specialized distributors, resellers, and system integrators who reach a broader customer base, including smaller businesses and maintenance operations. Aftermarket services, including maintenance, repair, spare parts supply (like bladders and seals), and recharging services for gas-charged accumulators, form a crucial part of the value chain, ensuring continued operational efficiency and providing recurring revenue streams. Effective logistics and a responsive service network are essential for customer satisfaction and brand loyalty.

Hydraulic Accumulator Market Potential Customers

Potential customers for hydraulic accumulators are diverse and span a wide array of industries that rely on fluid power systems for their operations. The largest segment of end-users includes manufacturers of heavy mobile equipment, such as construction machinery (excavators, loaders, bulldozers), agricultural machinery (tractors, harvesters), and mining equipment (drills, haul trucks). These entities utilize accumulators to absorb shocks, provide auxiliary power, and enhance the overall efficiency and lifespan of their robust hydraulic systems, ensuring smooth operation in demanding environments and reducing operator fatigue.

Another significant customer base comprises various industrial machinery manufacturers. This includes producers of machine tools, presses, injection molding machines, and steel manufacturing equipment, where accumulators are critical for energy storage, pulsation damping, and rapid force delivery. The oil and gas industry also represents a key segment, utilizing accumulators in drilling rigs, offshore platforms, and pipeline systems for blowout preventers, valve actuation, and surge protection. Power generation facilities, including those leveraging renewable energy sources like wind turbines, also integrate accumulators for pitch control systems and braking mechanisms.

Beyond these core sectors, potential customers extend to marine and aerospace industries for steering and landing gear systems, automotive manufacturers for suspension and braking applications, and even medical equipment producers requiring precise and reliable hydraulic power. Essentially, any industry seeking to enhance the performance, reliability, safety, and energy efficiency of its hydraulic systems, while also aiming to reduce operational costs and extend equipment life, stands as a potential buyer for hydraulic accumulators, underscoring the broad applicability and value proposition of these essential components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.19 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation plc, Hydac International GmbH, Freudenberg Sealing Technologies (incorporating Merkel Freudenberg Fluid Power), Weber-Hydraulik GmbH, Olaer Group (a Parker Hannifin company), Accumulators, Inc., Roth Hydraulics GmbH, Pacoma GmbH, Nikkiso Co., Ltd., EPE Italiana S.p.A., Hannon Hydraulics, Saip S.r.l., Fox S.r.l., Hydratech Engineering Ltd., Technetics Group, Tobul Accumulator, Inc., Hunger Hydraulik GmbH, Metal Improvement Company LLC (a Curtiss-Wright Corporation company) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Accumulator Market Key Technology Landscape

The hydraulic accumulator market is continuously evolving with significant technological advancements aimed at improving performance, reliability, and integration within modern hydraulic systems. A primary area of innovation involves the development of advanced materials for accumulator construction. This includes the use of lighter, stronger, and more corrosion-resistant alloys for shells, extending operational life and reducing weight, particularly critical for mobile applications. Concurrently, new elastomer compounds for bladders, diaphragms, and seals are being engineered to withstand extreme temperatures, aggressive fluids, and higher pressures, thereby enhancing accumulator durability and expanding their range of applications.

Another crucial technological trend is the integration of smart accumulator technologies. This involves embedding sensors directly into accumulators to monitor key operational parameters such as pressure, temperature, fluid levels, and gas pre-charge pressure in real-time. These smart accumulators can communicate data wirelessly, enabling condition-based monitoring and predictive maintenance. This shift from reactive to proactive maintenance significantly reduces downtime, optimizes service intervals, and ensures the continuous efficiency and safety of hydraulic systems, aligning with broader industry trends towards Industry 4.0 and the Internet of Things (IoT).

Furthermore, there is a strong focus on developing more compact and energy-efficient accumulator designs. This includes innovations in bladder and piston technologies that allow for higher energy storage density in smaller footprints, making them suitable for space-constrained applications. Research and development efforts are also concentrated on enhancing accumulator performance in energy recovery systems, particularly in hybrid drives and regenerative braking systems, by optimizing their ability to rapidly store and release hydraulic energy. These technological strides are not only improving the functionality of accumulators but also positioning them as integral components for the next generation of intelligent, sustainable, and highly efficient hydraulic solutions.

Regional Highlights

- North America: This region demonstrates a mature market driven by strong industrial automation, significant investments in infrastructure, and a robust demand from the construction, mining, and automotive sectors. The presence of key market players, coupled with stringent safety and environmental regulations, encourages the adoption of high-performance and energy-efficient hydraulic accumulators. Technological advancements and the modernization of existing hydraulic systems further contribute to steady market growth.

- Europe: Europe is characterized by advanced manufacturing capabilities, a strong emphasis on research and development, and a significant focus on energy efficiency and sustainability. Countries such as Germany, Italy, and the UK are major contributors, with demand stemming from industrial machinery, agriculture, and the growing renewable energy sector, particularly wind power. The adoption of smart accumulators and adherence to high engineering standards are key regional trends.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, burgeoning manufacturing bases, and extensive infrastructure development projects, especially in China, India, and Southeast Asian nations. Increasing investments in construction, automotive production, and heavy industries are fueling the demand for hydraulic accumulators. The region's expanding economy and growing disposable income also contribute to the mechanization of agriculture, further driving market expansion.

- Latin America: This region is experiencing growth driven by increased mining activities, agricultural expansion, and investments in infrastructure development. Countries like Brazil and Mexico are leading the demand for hydraulic accumulators, particularly in mobile equipment and industrial applications. Economic reforms and foreign investments are stimulating industrial growth, creating new opportunities for market players, though political and economic stability can influence market dynamics.

- Middle East and Africa (MEA): The MEA market is primarily driven by the oil and gas industry, significant infrastructure projects, and developing industrial sectors. Investments in energy exploration, construction of smart cities, and modernization of industrial facilities contribute to the demand for hydraulic accumulators. While still nascent compared to other regions, increasing industrialization and diversification efforts are expected to spur market growth in the coming years, with a focus on robust and reliable solutions for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Accumulator Market.- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation plc

- Hydac International GmbH

- Freudenberg Sealing Technologies (incorporating Merkel Freudenberg Fluid Power)

- Weber-Hydraulik GmbH

- Olaer Group (a Parker Hannifin company)

- Accumulators, Inc.

- Roth Hydraulics GmbH

- Pacoma GmbH

- Nikkiso Co., Ltd.

- EPE Italiana S.p.A.

- Hannon Hydraulics

- Saip S.r.l.

- Fox S.r.l.

- Hydratech Engineering Ltd.

- Technetics Group

- Tobul Accumulator, Inc.

- Hunger Hydraulik GmbH

- Metal Improvement Company LLC (a Curtiss-Wright Corporation company)

Frequently Asked Questions

What is a hydraulic accumulator and what are its primary functions in a hydraulic system?

A hydraulic accumulator is a device that stores hydraulic energy in the form of pressurized fluid, typically using a compressible gas (like nitrogen) separated from the fluid by a bladder, piston, or diaphragm. Its primary functions include storing energy to supplement pump flow, absorbing shocks and pulsations to reduce wear, compensating for leakage, and providing emergency power in the event of pump failure, thereby enhancing system efficiency, stability, and safety.

Which industries are the largest consumers of hydraulic accumulators?

The largest consumers of hydraulic accumulators include mobile equipment manufacturers (for construction, agriculture, and mining machinery), industrial machinery manufacturers (for presses, machine tools, and injection molding equipment), and the oil and gas industry for various drilling and control systems. These sectors rely heavily on hydraulic systems where accumulators are crucial for performance optimization, energy efficiency, and operational reliability in demanding applications.

What are the main types of hydraulic accumulators available in the market?

The main types of hydraulic accumulators are bladder accumulators, piston accumulators, and diaphragm accumulators. Bladder accumulators are highly efficient and suitable for a wide range of applications, offering good shock absorption. Piston accumulators are ideal for high-pressure, large-volume systems, providing robust performance. Diaphragm accumulators are compact, cost-effective, and low-maintenance, typically used in smaller systems or for pulsation damping.

How do hydraulic accumulators contribute to energy efficiency and sustainability?

Hydraulic accumulators contribute significantly to energy efficiency by storing excess hydraulic fluid under pressure when system demand is low and releasing it when demand is high, preventing the pump from running continuously or cycling excessively. This reduces energy consumption, minimizes heat generation, and extends the lifespan of the pump and other components. By optimizing power usage, accumulators support sustainability goals by reducing overall energy footprints and operational costs.

What technological advancements are impacting the hydraulic accumulator market?

Technological advancements in the hydraulic accumulator market include the development of advanced materials for enhanced durability and performance, such as lighter and stronger alloys for shells and improved elastomers for bladders and seals. A key trend is the integration of smart technologies, including sensors for real-time monitoring of pressure, temperature, and pre-charge, enabling predictive maintenance and IoT connectivity. There is also a focus on more compact designs and solutions for energy recovery systems in hybrid hydraulic applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bladder and Diaphragm Hydraulic Accumulator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bladder and Diaphragm Hydraulic Accumulator Market Size Report By Type (Bladder Accumulators, Diaphragm Accumulators), By Application (Construction Equipment, Machine Tools, Agriculture, Automotive, Wind & Solar Industry, Fluid Power Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hydraulic Accumulator Market Statistics 2025 Analysis By Application (Construction Equipment, Machine Tools, Agriculture Equipment, Automotive, Wind & Solar, Fluid Power), By Type (Bladder Hydraulic Accumulator, Piston Hydraulic Accumulator, Diaphragm Hydraulic Accumulator, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Bladder and Diaphragm Hydraulic Accumulator Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bladder Accumulators, Diaphragm Accumulators), By Application (Construction Equipment, Machine Tools, Agriculture, Automotive, Wind and Solar Industry, Fluid Power Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager