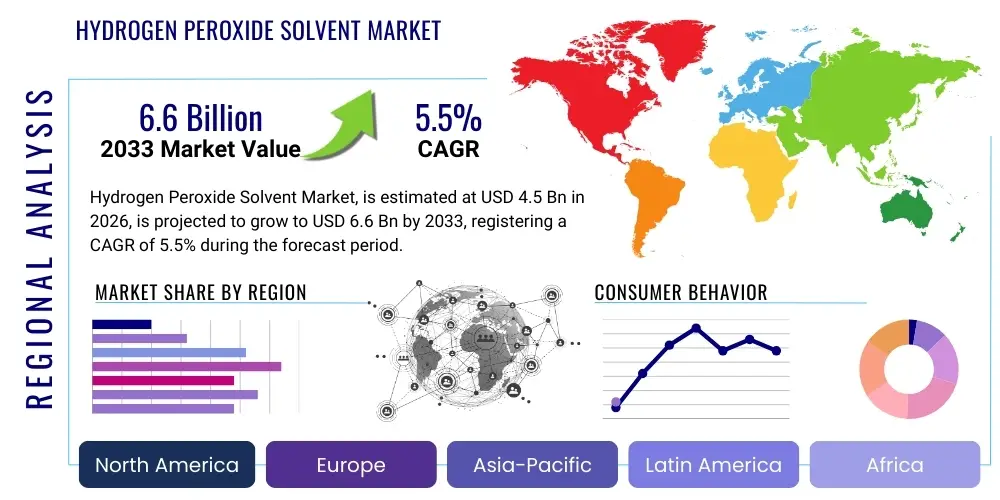

Hydrogen Peroxide Solvent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438637 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hydrogen Peroxide Solvent Market Size

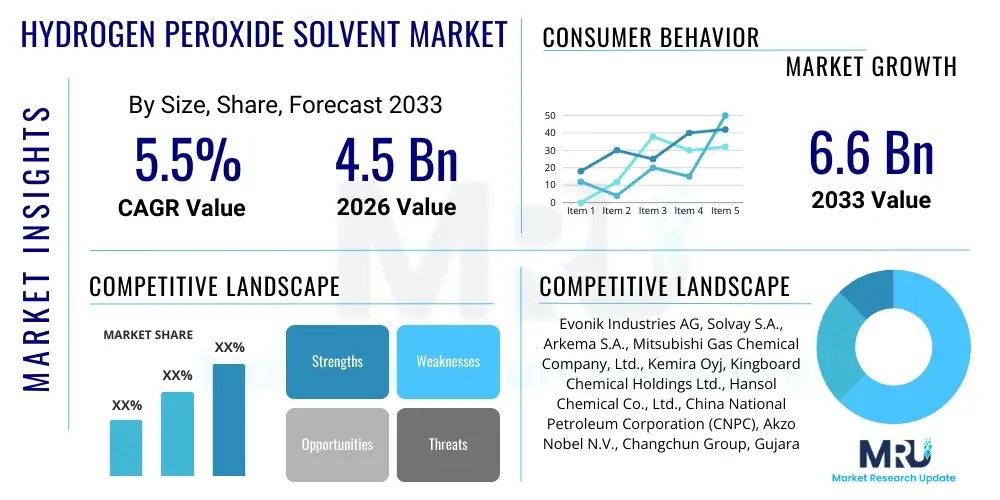

The Hydrogen Peroxide Solvent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033.

Hydrogen Peroxide Solvent Market introduction

The Hydrogen Peroxide (H2O2) market encompasses the production, distribution, and application of this chemical compound, utilized extensively for its powerful, yet environmentally benign, oxidizing and solvent properties. H2O2 serves as a critical agent in numerous industrial processes where its decomposition results only in water and oxygen, making it a preferred 'green chemistry' alternative to halogen-based compounds. This characteristic drives its adoption across high-growth sectors such as advanced material cleaning, wastewater remediation, and large-scale industrial bleaching. The market growth is intricately linked to global sustainability initiatives and the increasing stringency of environmental regulations worldwide, compelling industries to transition away from harsher chemicals.

Hydrogen peroxide is available in various concentrations and grades, ranging from low concentrations for personal care products to highly concentrated technical grades required for industrial processes like chemical synthesis and pulp bleaching. The highest-purity grades, often exceeding 30%, are indispensable in niche markets, particularly the semiconductor and electronics manufacturing sectors, where ultra-clean environments and minimal residue are essential for advanced chip fabrication. The primary method of industrial synthesis remains the Anthraquinone process, although continuous research focuses on developing more energy-efficient and direct synthesis methods to lower production costs and reduce the carbon footprint associated with manufacturing.

Major applications driving market volume include the paper and pulp industry, where it is used as a primary bleaching agent; the textile industry for fabric preparation and bleaching; and the comprehensive water and wastewater treatment sectors for disinfection, oxidation of recalcitrant organic pollutants, and odor control. Furthermore, its role as a polymerization initiator and a solvent medium in specialized chemical synthesis further solidifies its position as a foundational industrial chemical. The market structure is highly competitive, characterized by high capital expenditure for production facilities and complex logistics associated with the safe transport and storage of concentrated H2O2 solutions.

Hydrogen Peroxide Solvent Market Executive Summary

The Hydrogen Peroxide Solvent Market is experiencing robust growth fueled primarily by global shifts toward sustainable manufacturing practices and increasing demand from the Asia Pacific (APAC) region, driven by rapid industrialization and escalating water treatment infrastructure projects. Business trends indicate a strong move toward high-purity and specialized grades, particularly in response to the burgeoning global semiconductor shortage and the accompanying investment in advanced manufacturing facilities in countries like South Korea, Taiwan, and China. Strategic partnerships and vertical integration among leading producers are becoming common strategies to secure raw material supply chains and maintain competitive pricing in bulk markets. Furthermore, innovation in stabilization and logistics technology is crucial for mitigating the inherent handling risks associated with concentrated H2O2, which in turn supports wider application adoption.

Regionally, APAC currently dominates the market share due to its massive pulp and paper industry, coupled with significant governmental investment in water treatment facilities addressing urbanization pressures. North America and Europe maintain high demand, characterized by stringent environmental enforcement that mandates the use of cleaner oxidizing agents, particularly in remediation and specialized cleaning applications. European markets, in particular, are focusing heavily on circular economy models, utilizing H2O2 for enhanced chemical recycling and process efficiency. The Middle East and Africa (MEA) are emerging as high-potential regions, primarily driven by expanding mining operations and large-scale desalination projects that utilize hydrogen peroxide for pre-treatment and disinfection.

Segment trends reveal that the Water Treatment application segment is poised for the fastest growth, given the global scarcity of potable water and the necessity for effective, scalable purification methods. By Grade, the high-purity (Electronic/Reagent Grade) segment, though smaller in volume, generates disproportionately high revenue due to its necessity in the highly sensitive electronics and pharmaceutical sectors. In terms of end-users, the Chemical Synthesis sector is demonstrating increasing uptake, leveraging H2O2 as a safer, versatile solvent and oxidant in the production of epoxides, propylene oxide, and other intermediary chemicals, thus supporting the industry-wide push for greener synthetic routes.

AI Impact Analysis on Hydrogen Peroxide Solvent Market

User queries regarding AI's influence in the Hydrogen Peroxide market typically revolve around optimizing the complex and energy-intensive production process (Anthraquinone synthesis), enhancing safety protocols for handling and storage, and improving demand forecasting within a volatile chemical commodity market. Users are keenly interested in how machine learning algorithms can minimize energy consumption per unit produced, which directly impacts the profitability of manufacturers. Key themes emerging from these inquiries include the application of predictive analytics for equipment maintenance, ensuring operational uptime, and utilizing AI-driven sensors for real-time quality control and detecting deviations in concentration and stability, which are critical parameters for end-use industries like electronics.

The implementation of Artificial Intelligence and advanced process controls (APC) allows manufacturers to create digital twins of production facilities, simulating various operational conditions to optimize yield and purity levels. AI models analyze continuous streams of data from reactors, stabilizers, and purification units, adjusting flow rates, temperature, and pressure dynamically, minimizing waste by-products and enhancing overall resource efficiency. This is particularly relevant given the high energy footprint of H2O2 production. Furthermore, AI-powered systems are deployed in logistics and supply chain management to model optimal routes for the transport of hazardous chemicals, factoring in regulatory constraints, real-time weather conditions, and inventory levels across global distribution hubs, thereby enhancing safety and reducing delivery lead times.

Beyond production and logistics, AI is playing a role in market analysis and demand sensing. Predictive algorithms analyze macroeconomic indicators, end-user industry performance (e.g., housing starts influencing pulp and paper demand, or semiconductor fabrication projections), and seasonal trends to provide highly accurate forecasts. This capability is vital for managing capital-intensive inventory and production schedules. For the highly regulated end-use applications, particularly in water treatment and healthcare disinfection, AI-driven sensor networks monitor H2O2 application rates in real time, ensuring efficacy against pathogens while preventing overdose or under-dosing, maximizing efficiency and compliance with environmental discharge limits.

- AI optimizes the Anthraquinone process parameters, leading to up to 15% reduction in energy consumption per ton of H2O2 produced.

- Predictive Maintenance (PdM) algorithms forecast equipment failure in reactors and compressors, maximizing operational uptime and reducing unplanned downtime costs.

- AI enhances logistics and routing for hazardous material transport, improving regulatory compliance and supply chain security.

- Machine Learning (ML) models improve real-time quality control checks for concentration and stabilization, crucial for electronic-grade H2O2.

- Advanced Demand Forecasting minimizes inventory holding costs and helps stabilize pricing in commodity markets.

DRO & Impact Forces Of Hydrogen Peroxide Solvent Market

The market dynamics for hydrogen peroxide are shaped by a complex interplay of robust environmental drivers, significant safety and regulatory restraints, and expansive technological opportunities, all contributing to the overall impact forces on industry growth. Key drivers center on the global acceptance of H2O2 as a superior, non-toxic alternative to chlorine compounds, particularly within water purification and industrial bleaching, bolstered by increasingly stringent global environmental mandates targeting zero liquid discharge and reduced persistent organic pollutants. However, the high reactivity and potential hazardous nature of concentrated H2O2 pose substantial restraints related to complex handling, specialized storage infrastructure, and high transportation costs, demanding significant capital investment in safety protocols.

Opportunities for market expansion are primarily found in advanced and high-growth end-user sectors. The burgeoning demand for ultra-high-purity hydrogen peroxide (often referred to as Super D-grade or Electronic Grade) is a major growth avenue, driven by the geometric expansion of the semiconductor and printed circuit board manufacturing industries globally. Furthermore, the development of specialized grades for biomedical applications, including advanced sterilization techniques and pharmaceutical synthesis, offers premium revenue streams. These opportunities often involve strategic collaborations between chemical producers and technology firms to meet exceptionally high purity specifications and ensure stability during application.

The principal impact forces are characterized by two opposing pressures: regulatory push toward green chemicals (positive force) versus high operational and logistical safety costs (negative force). The inherent risks associated with H2O2, especially in concentrations above 35%, require significant investment in training, specialized infrastructure, and advanced monitoring systems, acting as a barrier to entry for smaller players. Conversely, the continuous global need for clean water and the shift toward sustainable industrial production ensure a stable and expanding demand base, particularly in rapidly urbanizing regions. Technological advancements in direct synthesis methods and novel stabilizing agents are acting as a strong moderating force, potentially easing production costs and enhancing product safety, thus reinforcing the market's long-term growth trajectory and minimizing the impact of current restraints.

Segmentation Analysis

The Hydrogen Peroxide Solvent Market is comprehensively segmented based on its Purity Grade, End-User Application, and Regional Consumption patterns, reflecting the diverse requirements of various industries from bulk chemical processing to highly specialized electronics manufacturing. The segmentation by grade is critical as it dictates pricing and application suitability, with Electronic Grade H2O2 commanding a significant premium over technical or standard grades. Application segmentation highlights the dominance of mass volume industries like Pulp & Paper and Textiles, which consume the majority of the technical grade output, while the faster growth trajectory is observed in niche, high-value segments such as Mining and Healthcare Disinfection, driven by regulatory demands and technological adoption.

Analysis of the end-user landscape reveals the intricate relationship between H2O2 consumption and global industrial activity. Pulp & Paper remains the largest single consumer due to its widespread use in environmentally friendly bleaching processes. However, the Water Treatment segment is projected to show accelerated growth due to escalating global clean water initiatives, where H2O2 is deployed for advanced oxidation processes (AOPs) to neutralize emerging contaminants and micro-pollutants. Regional segmentation confirms Asia Pacific as the largest and fastest-growing region, capitalizing on massive investments in manufacturing, particularly in infrastructure, electronics fabrication, and textile production across China, India, and Southeast Asian nations.

- By Grade:

- Technical Grade (Standard Concentration 35%, 50%, 70%)

- Food Grade

- High Purity/Reagent Grade (HPC Grade)

- Electronic Grade (Ultra-High Purity - UHP)

- By Application:

- Bleaching (Pulp & Paper, Textiles)

- Chemical Synthesis (Propylene Oxide, Epoxides)

- Water Treatment (Disinfection, AOPs, Odor Control)

- Mining (Uranium and Gold Leaching)

- Disinfectant and Antiseptic (Healthcare, Personal Care)

- Electronics (Etching, Cleaning, Photoresist Stripping)

- Environmental Remediation

- By End-Use Industry:

- Pulp and Paper

- Chemical Manufacturing

- Textiles

- Water and Wastewater Treatment Utilities

- Electronics and Semiconductor

- Healthcare and Pharmaceutical

- Mining and Metallurgy

Value Chain Analysis For Hydrogen Peroxide Solvent Market

The value chain for the Hydrogen Peroxide Solvent Market begins with the upstream sourcing of crucial raw materials, primarily hydrogen, oxygen (from air), and Anthraquinone derivatives used in the foundational synthesis process. Since H2 and O2 production often require significant energy, energy sourcing and cost management are central to upstream profitability. Major manufacturers often integrate backward by producing their own hydrogen or securing long-term contracts with large industrial gas suppliers to stabilize input costs, which are highly volatile due to fluctuations in natural gas or electricity prices. Efficiency in catalyst usage and recovery systems within the production phase is another key upstream focus, directly impacting final product cost and environmental footprint.

The midstream segment involves the highly technical and capital-intensive manufacturing process, predominantly utilizing the Anthraquinone auto-oxidation process. This stage requires rigorous process control, stabilization treatments (using proprietary stabilizers like stannates and pyrophosphates), and subsequent purification steps to achieve the necessary concentration and grade. Producers focused on high-purity Electronic Grade H2O2 must invest substantially in specialized cleanroom facilities and ultra-filtration technologies to minimize metallic and organic impurities to parts per trillion levels. Manufacturing efficiency is a primary competitive differentiator, relying on continuous operational improvements and scale to achieve cost leadership in the commodity segment.

The downstream distribution channel is complex due to the product's hazardous nature, requiring specialized, often refrigerated, tank trucks, railcars, and dedicated port infrastructure for bulk shipments. Distribution channels can be direct, where major producers supply high-volume contracts (Pulp & Paper mills, large chemical facilities) directly, or indirect, utilizing regional distributors and specialized chemical brokers for smaller volume orders or for reaching dispersed end-users (e.g., small textile mills or municipal water treatment plants). The complexity of safe storage and transportation adds significant logistics costs, influencing the final landed cost for the end-user. Effective customer service and technical support regarding safe handling and application efficacy are essential components of the downstream service offering.

Hydrogen Peroxide Solvent Market Potential Customers

The primary customer base for the Hydrogen Peroxide Solvent Market spans multiple capital-intensive and highly regulated industries, necessitating products tailored to specific purity and concentration requirements. One of the largest customer segments is the Pulp and Paper industry, where mills utilize H2O2 extensively for elemental chlorine-free (ECF) bleaching processes, driven by consumer demand for whiter paper products and regulatory bans on older, chlorine-intensive methods. These customers prioritize volume, stable pricing, and reliable long-term supply agreements due to their continuous, large-scale operations. For these buyers, H2O2 serves as both a bleaching agent and a key component in optimizing chemical recovery circuits within the mill.

Another rapidly expanding customer segment comprises Municipal Water Treatment Plants and large Industrial Wastewater Processors. These customers use H2O2 as a powerful yet safe oxidant for advanced oxidation processes (AOPs), targeting micro-pollutants, pharmaceutical residues, and other emerging contaminants that conventional treatments fail to remove. For these utilities, the key purchase criteria are regulatory compliance, minimal environmental residue, and efficient dosage control. The shift toward tertiary treatment methods, mandated by increasing urbanization and water recycling needs, guarantees continuous demand growth from this sector globally, particularly in arid and densely populated regions.

Finally, the Electronics and Semiconductor Fabrication industry represents a critical, high-value customer group. These manufacturers require ultra-pure, high-concentration Electronic Grade H2O2 (typically 30% to 50%) for critical cleaning, etching, and surface preparation steps in microchip production. Customers in this field, including large foundries and specialized component makers, demand stringent impurity specifications (trace metals measured in parts per trillion) and rely heavily on supplier consistency and quality assurance protocols. Although this segment consumes lower volume compared to Pulp & Paper, the premium pricing associated with Electronic Grade H2O2 makes these customers highly attractive targets for market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Solvay S.A., Arkema S.A., Mitsubishi Gas Chemical Company, Ltd., Kemira Oyj, Kingboard Chemical Holdings Ltd., Hansol Chemical Co., Ltd., China National Petroleum Corporation (CNPC), Akzo Nobel N.V., Changchun Group, Gujarat Alkalies and Chemicals Limited (GACL), Khimprom, National Peroxide Limited (NPL), BASF SE, Dow Inc., Santoku Chemical Industries Co., Ltd., OCI Company Ltd., and Hawkins, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Peroxide Solvent Market Key Technology Landscape

The primary technology utilized in the Hydrogen Peroxide Solvent Market remains the Anthraquinone Auto-oxidation (AO) process, which accounts for the vast majority of global production capacity. Recent technological improvements within this landscape focus on enhancing the efficiency of the reaction and regeneration steps to reduce capital expenditure and operating costs. Innovations include the development of new, highly efficient catalysts and improved solvent systems that maximize the conversion yield and selectivity, thereby reducing the consumption of Anthraquinone working solution and lowering the energy demands associated with the hydrogenation and oxidation phases. Furthermore, sophisticated column design and advanced filtration techniques are continuously being refined to enhance the purification of standard technical grade H2O2, driving down overall cost structures in high-volume applications.

A significant technological shift currently underway involves the exploration and scaling of Direct Synthesis of Hydrogen Peroxide (DSHP) processes. This technology seeks to synthesize H2O2 directly from hydrogen and oxygen, circumventing the complex, multi-stage AO process. DSHP offers the potential for smaller, modular production facilities located closer to the point of use (POU), which dramatically reduces hazardous material transportation costs and risks. The successful implementation of DSHP hinges on developing robust, highly selective, and durable catalysts (often based on palladium or gold alloys) that operate safely and efficiently under mild conditions. Although currently limited by challenges in achieving high concentration and catalyst longevity, DSHP represents the long-term future for decentralized and sustainable H2O2 production.

Another crucial technological area involves stabilization and high-purity processing. For the semiconductor industry, achieving Electronic Grade (EG) quality requires highly specialized purification technologies, including continuous ion-exchange systems, distillation under vacuum, and membrane separation to remove trace metallic and ionic impurities that can contaminate microchips. Concurrently, advancements in chemical stabilization are critical for maintaining the integrity and shelf life of concentrated H2O2 during storage and transit. New proprietary stabilizers are being developed to prevent decomposition, enabling safer handling and ensuring the product meets stringent specifications required by end-users in electronics, pharmaceuticals, and sensitive medical applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by unparalleled industrial expansion, particularly in China, India, and Southeast Asia. The region benefits from massive governmental investment in manufacturing infrastructure, robust pulp and paper output, and the concentration of over 70% of global semiconductor manufacturing capacity, which drives exceptional demand for Electronic Grade H2O2. Rapid urbanization and subsequent pressure on water resources necessitate large-scale infrastructure projects, bolstering the use of H2O2 for water and wastewater treatment applications.

- North America: This region represents a mature, high-value market characterized by high regulatory standards and a strong focus on environmental remediation and specialized applications. Growth is stable, propelled by demand from the electronics manufacturing sector (especially in the US), stringent EPA regulations on industrial discharge, and increasing adoption in mining (for gold and uranium leaching). Innovation focus is heavily on efficiency and safety in logistics and distribution.

- Europe: Europe is characterized by stringent environmental protection policies (e.g., REACH), which strongly favor H2O2 as a green oxidizing agent, particularly in the Nordic countries for pulp bleaching and across Central Europe for advanced industrial cleaning. Although manufacturing growth is slower than in APAC, demand is high for high-purity grades for pharmaceutical synthesis and advanced chemical production. The focus is on circular economy applications and sustainable chemical alternatives.

- Latin America: This region shows significant potential growth, primarily driven by expanding mining operations (especially copper and gold), which use H2O2 for leaching processes, and increasing investment in municipal water treatment facilities spurred by demographic growth. Market maturity is varied, with Brazil and Mexico being key consumption hubs, requiring suppliers to manage complex regional logistics and regulatory frameworks.

- Middle East and Africa (MEA): MEA is an emerging region for H2O2 consumption, linked largely to rapidly expanding oil and gas industry processing (using H2O2 for sulfide scavenging), desalination projects, and the initial stages of industrial diversification in the GCC nations. Growth is expected to accelerate as large-scale infrastructure and manufacturing projects move forward, requiring stable sourcing of basic industrial chemicals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Peroxide Solvent Market.- Evonik Industries AG

- Solvay S.A.

- Arkema S.A.

- Mitsubishi Gas Chemical Company, Ltd.

- Kemira Oyj

- Kingboard Chemical Holdings Ltd.

- Hansol Chemical Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Akzo Nobel N.V. (now part of Nouryon)

- Changchun Group

- Gujarat Alkalies and Chemicals Limited (GACL)

- Khimprom

- National Peroxide Limited (NPL)

- BASF SE

- Dow Inc.

- Santoku Chemical Industries Co., Ltd.

- OCI Company Ltd.

- FMC Corporation (now focused on specialty applications)

- Aditya Birla Chemicals (Thailand) Ltd.

- Hawkins, Inc.

Frequently Asked Questions

Analyze common user questions about the Hydrogen Peroxide Solvent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the Hydrogen Peroxide market growth?

The primary driving force is the global adoption of environmentally friendly 'green chemistry' practices. Hydrogen Peroxide (H2O2) is preferred over chlorine-based chemicals because its decomposition yields only water and oxygen, aligning with stringent international environmental regulations concerning industrial wastewater and air emissions, particularly in the Pulp & Paper and Water Treatment sectors.

How does the electronics industry utilize Electronic Grade Hydrogen Peroxide?

The electronics industry requires ultra-high-purity (UHP) Electronic Grade H2O2 for critical cleaning, etching, and surface preparation processes during semiconductor and printed circuit board fabrication. It is essential for removing photoresists and organic contaminants without leaving metallic or particulate residues, which are detrimental to microchip performance.

What are the main constraints impacting market expansion for concentrated H2O2?

The main constraints include the inherent safety risks and logistical complexities associated with storing and transporting concentrated hydrogen peroxide. Its strong oxidizing nature necessitates specialized, compliant infrastructure, high security protocols, and significant transportation costs, which pose barriers to entry and increase operational expenditure.

Which region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is due to rapid, large-scale industrialization, massive consumption from the regional Pulp & Paper and Textile industries, and the significant concentration of semiconductor and electronics manufacturing facilities across countries like China, South Korea, and Taiwan.

What is Direct Synthesis and how will it change H2O2 production?

Direct Synthesis of Hydrogen Peroxide (DSHP) is an emerging technology that produces H2O2 directly from hydrogen and oxygen, bypassing the complex, energy-intensive Anthraquinone process. DSHP aims to enable smaller, modular production units located near end-users, potentially reducing logistical costs and safety risks, and accelerating the deployment of H2O2 in decentralized applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager