Ignition Coil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436383 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ignition Coil Market Size

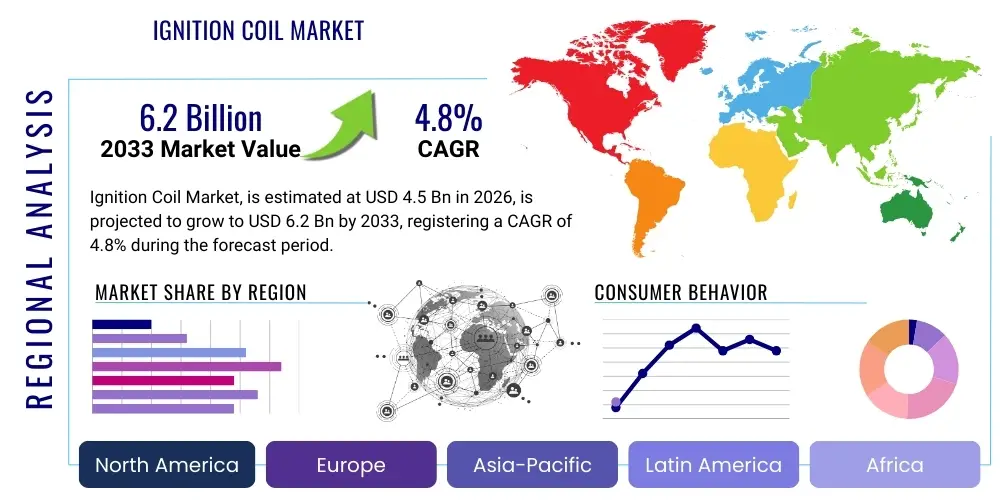

The Ignition Coil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.2 billion by the end of the forecast period in 2033.

Ignition Coil Market introduction

The Ignition Coil Market is integral to the functioning of internal combustion engine (ICE) vehicles, serving the essential purpose of transforming the low voltage from the vehicle battery into the thousands of volts required to generate a spark in the spark plug, initiating the combustion process. These devices, primarily used in gasoline engines and increasingly sophisticated in modern turbocharged and direct injection (TGDI/GDI) systems, are critical for maximizing fuel efficiency and minimizing harmful emissions. The design evolution has shifted significantly from traditional distributor coils to modern coil-on-plug (COP) and pencil coils, which offer enhanced performance, durability, and precise control over ignition timing. This technological shift is driven by stringent global environmental regulations and consumer demand for higher engine performance and reduced fuel consumption.

Major applications of ignition coils span the entire spectrum of automotive vehicles, including passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), alongside applications in powersports and industrial engines. The primary benefits derived from advanced ignition systems include improved cold starting capability, enhanced engine output power, lower engine idle roughness, and most critically, precise control over combustion timing which directly impacts compliance with emissions standards like Euro 6 and CAFE requirements. Furthermore, the robust construction of modern coils contributes to longer service intervals and increased reliability for the end-user.

Driving factors for the continued growth of this market include the sustained high global production and sale of ICE and hybrid electric vehicles (HEVs), particularly in developing economies where full electric vehicle (EV) adoption is slower. The rapid increase in vehicle miles traveled (VMT) globally boosts the aftermarket segment, as ignition coils are wear-and-tear components requiring periodic replacement. Furthermore, the trend toward engine downsizing coupled with turbocharging (the 'downsized, boosted' approach) demands high-performance, higher-energy ignition coils to cope with increased cylinder pressures and temperatures, thereby fostering innovation and market expansion for premium products.

Ignition Coil Market Executive Summary

The global Ignition Coil Market exhibits robust business trends anchored by the continuous innovation in Coil-on-Plug (COP) technologies and the expanding global vehicle parc. Key business strategies include strategic partnerships between OEM suppliers and automotive manufacturers to co-develop ignition systems optimized for highly efficient direct injection (GDI) engines. A significant trend involves the aftermarket focusing on providing high-quality replacement parts that often match or exceed OEM specifications, capitalizing on the increasing average age of vehicles globally. While electrification poses a long-term threat, the immediate future is characterized by demand stability, driven by the strong penetration of hybrid electric vehicles (HEVs) which continue to rely on advanced ICE components, including sophisticated ignition coils for optimal performance and emissions control.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of volume, attributed to massive automotive production bases in China, India, and Japan, coupled with rapidly growing vehicle ownership rates. North America and Europe, while seeing slower growth in pure ICE sales, represent high-value markets demanding premium, technologically advanced coils due to strict emissions regulations and high integration of GDI/TGDI technologies. Trends in these developed regions emphasize durability, miniaturization, and integration with advanced electronic control units (ECUs) to facilitate precise monitoring and diagnostic capabilities. Latin America and MEA are emerging markets characterized by strong growth in the aftermarket segment as vehicle maintenance becomes a priority.

Segmentation trends highlight the increasing dominance of the Coil-on-Plug (COP) segment over older technologies like distributor-based systems, reflecting the modern architecture of most newly produced engines. By vehicle type, the passenger car segment holds the largest market share due to sheer volume, but commercial vehicles are seeing rapid adoption of high-durability coils to minimize downtime. The aftermarket segment, driven by the necessity of replacement and repair, is experiencing faster growth rates compared to the OEM segment, offering lucrative opportunities for component manufacturers to establish strong brand presence and distribution networks focused on reliability and cost-effectiveness. The future segmentation will increasingly differentiate between ignition systems for pure gasoline engines and those specifically optimized for high-performance HEV applications.

AI Impact Analysis on Ignition Coil Market

User inquiries regarding AI's impact on the Ignition Coil Market primarily revolve around predictive maintenance, optimization of manufacturing processes, and integration with advanced vehicle diagnostics systems. Common concerns center on whether AI can extend the lifespan of components, predict catastrophic failure with higher accuracy than current telematics, and how machine learning algorithms might influence future ignition coil design specifications to better suit engine operation under varying environmental conditions. Users are keen to understand the shift from reactive replacement to proactive, condition-based monitoring, seeking assurance that new AI-driven systems will be cost-effective and reliable across diverse operational fleets.

AI's role is currently subtle but growing, focusing heavily on enhancing manufacturing efficiency and quality control. Machine learning is being implemented in production facilities for automated visual inspection, detecting microscopic defects in coil windings or casing materials that human inspectors might miss, thereby significantly reducing defect rates and improving product consistency. Furthermore, complex algorithms are optimizing supply chain logistics and inventory management, predicting demand fluctuations in key aftermarket regions based on vehicle registration data and historical failure rates. This optimization ensures parts availability and reduces operational costs for major suppliers.

In the context of vehicle operation, AI-powered diagnostic systems analyze real-time data from the engine control unit (ECU)—including misfire counts, combustion pressure variations, and coil charging times—to predict imminent coil failure. This integration allows for precise, condition-based servicing, moving beyond standard mileage-based maintenance schedules. As vehicles become more connected, AI will facilitate over-the-air updates for ECU parameters that might affect ignition timing, requiring ignition coils to be digitally integrated and responsive to software-driven performance adjustments, ultimately boosting overall engine longevity and performance optimization.

- AI optimizes coil manufacturing quality via automated visual inspection and defect detection.

- Machine learning algorithms enhance supply chain efficiency and aftermarket inventory forecasting.

- Predictive maintenance systems utilize ECU data to forecast ignition coil failure, enabling proactive replacement.

- AI assists in optimizing engine combustion timing, requiring smarter, digitally integrated coils.

- Generative AI tools may accelerate the design and simulation of new high-energy coil architectures.

DRO & Impact Forces Of Ignition Coil Market

The Ignition Coil Market dynamics are dictated by a confluence of accelerating drivers, structural restraints, and evolving opportunities, all subject to powerful impact forces originating from technology shifts and regulatory environments. A primary driver is the global increase in automotive production, especially the sustained demand for vehicles equipped with gasoline engines, including the rapid expansion of hybrid architectures which still rely heavily on high-performance ignition systems. Opportunities arise from technological advancements, such as the development of multi-spark ignition systems and coils designed specifically for extreme pressure environments found in highly downsized and boosted engines. However, the market faces significant restraint from the long-term global shift toward battery electric vehicles (BEVs), which entirely eliminate the need for ignition coils, pushing manufacturers to seek diversification or focus intensely on optimizing their offerings for the robust HEV and aftermarket sectors. The impact forces are currently skewed toward regulatory compliance and emission standards, which mandate the adoption of superior ignition technologies to ensure clean and efficient combustion.

The principal drivers involve the high demand for aftermarket replacements due to wear and tear, coupled with increasing average vehicle age in developed markets, ensuring a stable revenue stream even if new vehicle sales slow. Furthermore, the stringent emissions norms (like Euro 7 proposals) necessitate coils capable of delivering higher voltage and longer spark duration to ensure complete combustion, pushing manufacturers towards advanced materials and designs. The restraining factor of BEV adoption, while critical, is moderated by the slow, uneven transition pace globally, allowing the ICE component market a substantial runway, particularly in regions like Asia and Latin America. The fluctuating raw material prices, especially copper and specialized plastics, also act as a constraint, pressurizing profit margins and forcing manufacturers to implement aggressive cost-control measures and explore material substitution.

Opportunities are strongly present in optimizing components for hybrid drivetrains. HEVs require highly reliable ignition systems that operate intermittently and under diverse thermal cycling stresses, presenting a niche market for specialized coil designs. Additionally, the emergence of advanced diagnostic protocols and the need for data communication capabilities within the coil system itself (smart coils) open avenues for high-margin product offerings. The impact forces prominently feature globalization of supply chains and the need for counterfeiting prevention, pushing key players to invest in secure, traceable manufacturing and distribution systems to maintain brand integrity and product quality standards across various geographical markets.

Segmentation Analysis

The Ignition Coil Market is rigorously segmented across multiple dimensions, allowing for a precise understanding of demand patterns and technological preferences. The core segmentations are based on coil design type, component structure, vehicle application, and sales channel. This detailed breakdown reflects the diverse engineering requirements across different engine architectures, ranging from older distributor-based systems to the highly precise, individually controlled Coil-on-Plug (COP) systems that dominate modern vehicle production. Analyzing these segments is crucial for identifying high-growth areas, particularly where technological innovation, such as integration with engine management systems, is most intense.

The segmentation by Type reveals the shift toward individualized ignition solutions, driven by performance and packaging needs, moving away from centralized ignition systems. The Sales Channel segmentation is vital, contrasting the large-volume, price-competitive Original Equipment Manufacturer (OEM) market with the high-margin, longevity-focused Aftermarket segment. Geographic segmentation remains critical, highlighting the difference in coil technology adoption rates between developed markets, focused on GDI/TGDI optimization, and emerging markets, where robust, cost-effective solutions for standard port injection engines maintain high demand. The continuous evolution of engine technology, particularly the increasing penetration of partial hybridization in powertrain systems, necessitates ongoing refinement of these segmentation categories.

- By Type:

- Pencil Coil (Coil-on-Plug - COP)

- Block Coil

- Distributor Coil (Less Common in New Vehicles)

- Rail Coil (Multi-cylinder integration)

- By Component:

- Coil Windings

- Core

- Housing/Casing

- Igniter (Integrated Circuitry)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light, Medium, Heavy)

- Powersports and Other Vehicles

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent and Authorized Distributors)

- By Engine Type:

- Gasoline Port Fuel Injection (PFI)

- Gasoline Direct Injection (GDI) / Turbocharged GDI (TGDI)

- Hybrid Electric Vehicles (HEV)

Value Chain Analysis For Ignition Coil Market

The value chain for the Ignition Coil Market begins with upstream activities, predominantly focusing on the sourcing and processing of specialized raw materials. This includes high-grade copper wire for primary and secondary windings, ferrite cores, high-temperature resistant insulating epoxy resins, and specialized plastic polymers for coil casings that must withstand extreme heat and vibration. Suppliers of these raw materials, often operating in concentrated global markets, exert moderate influence on pricing and lead times. Manufacturing involves complex, high-precision winding processes, epoxy encapsulation, and integration of sophisticated igniter circuitry (often incorporating IGBTs - Insulated Gate Bipolar Transistors) supplied by semiconductor firms. Quality control at this stage is paramount, as defects lead directly to engine misfires and warranty claims. Major coil manufacturers differentiate themselves through proprietary winding techniques and thermal management solutions.

Midstream activities are characterized by component assembly and module creation, where the coil is integrated with its housing and connector systems, often specific to OEM requirements. Distribution channels vary significantly between the OEM and Aftermarket segments. Direct distribution is typical for the OEM channel, involving long-term contracts and Just-In-Time (JIT) delivery systems directly to vehicle assembly plants worldwide. This requires exceptionally tight quality tolerance and global logistics capabilities. The OEM channel demands competitive pricing and extensive R&D collaboration.

Downstream activities center on the final installation and service market. The aftermarket relies heavily on a multi-tiered distribution network involving large national and regional parts distributors, wholesalers, and independent garages or authorized service centers. This channel is driven by brand reputation, part availability, and competitive pricing for replacement units. Indirect sales dominate the aftermarket, emphasizing the role of major brand distributors who must manage complex product catalogs covering thousands of vehicle applications. Success in the downstream market hinges on effective inventory management, robust marketing, and technician training programs to ensure correct product selection and installation, thereby maximizing the product lifespan and customer satisfaction.

Ignition Coil Market Potential Customers

The primary potential customers and end-users of ignition coils fall into two distinct but overlapping categories: the Original Equipment Manufacturers (OEMs) and the massive global Aftermarket sector, consisting of distributors, service garages, and ultimately, vehicle owners. OEMs, including global automotive giants such as Volkswagen Group, Toyota, General Motors, and Hyundai-Kia, are the largest volume purchasers, integrating the coils directly into new vehicle powertrains. These customers prioritize technological partnership, quality assurance (zero-defect tolerance), compliance with specific engine performance parameters, and adherence to cost targets negotiated over multi-year supply contracts. The relationship with OEMs requires intensive collaboration in the design and validation phase, ensuring the ignition system is perfectly matched to the specific internal combustion or hybrid engine platform.

The aftermarket represents the secondary, yet equally vital, customer segment, characterized by high growth potential and greater price elasticity. This segment is driven by the cyclical replacement nature of ignition coils due to degradation caused by heat, vibration, and high voltage stress over time. Key buyers in the aftermarket include large global automotive parts wholesalers (e.g., Bosch Service, Denso Service), independent parts distributors, large chain auto repair shops, and online retailers specializing in automotive components. These customers seek broad coverage across vehicle models, competitive pricing, reliable warranty policies, and fast inventory fulfillment to minimize vehicle downtime. The aftermarket customer base is projected to expand significantly as the global vehicle fleet continues to age and hybrid vehicle technology requires specialized maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Delphi Technologies (BorgWarner Inc.), NGK Spark Plug Co. Ltd. (Niterra), Federal-Mogul LLC, Continental AG, Mitsubishi Electric Corporation, Standard Motor Products, Tenneco Inc., Hitachi Astemo, Inc., Valeo, Spark Plug International GmbH, Visteon Corporation, TDK Corporation, HELLA GmbH & Co. KGaA, BorgWarner Inc., SMP, BBAC, Magneti Marelli. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ignition Coil Market Key Technology Landscape

The technology landscape of the Ignition Coil Market is defined by the necessity for systems that can deliver higher energy and precise timing under extreme operating conditions, largely driven by the adoption of Gasoline Direct Injection (GDI) and turbocharging. The dominant technological innovation is the continued refinement of Coil-on-Plug (COP) or pencil coils. These systems eliminate high-tension ignition wires, reduce energy loss, and allow the Engine Control Unit (ECU) to manage each cylinder's ignition process independently. Modern COP systems utilize advanced magnetic core materials and optimized winding configurations (e.g., bobbin-less designs) to generate outputs exceeding 45,000 volts reliably, ensuring efficient ignition even under high compression ratios and lean-burn conditions common in performance-oriented and fuel-efficient engines.

A significant emerging technology is the deployment of multi-spark ignition (MSI) systems. MSI technology enables the coil to fire the spark plug multiple times in very quick succession during a single combustion cycle, especially beneficial at idle and low engine speeds. This process stabilizes the flame front, leads to more complete fuel burn, and significantly reduces the emission of unburnt hydrocarbons and carbon monoxide during critical engine operation phases. MSI requires sophisticated control electronics integrated within the coil structure (smart coils) or managed directly by the ECU, demanding high-speed switching capabilities from the integrated igniter circuit, often leveraging high-power IGBTs.

Furthermore, materials science plays a crucial role, with manufacturers focusing on developing durable, thermally efficient encapsulation materials and insulation systems. This is particularly important for coils subjected to under-hood temperatures intensified by modern compact engine designs. The incorporation of diagnostics and communication capability (smart coils) represents the future, allowing coils to report their operating status, temperature, and performance data back to the ECU. This integration facilitates proactive maintenance and provides highly granular data for engine management systems to dynamically adjust ignition parameters, thereby ensuring peak efficiency throughout the coil's operational life. The ongoing reduction in size and weight while maximizing energy output remains a core focus of current R&D efforts.

Regional Highlights

The geographical analysis of the Ignition Coil Market reveals distinct growth patterns and technological adoption rates across the globe, primarily segmented into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA). Each region’s market trajectory is closely tied to local automotive production volumes, regulatory frameworks concerning emissions, and the overall pace of vehicle fleet electrification. Understanding these regional nuances is essential for market players planning manufacturing, distribution, and product specialization strategies.

Asia Pacific (APAC) is the undisputed leader in market size, driven predominantly by China and India, which house enormous automotive manufacturing hubs and experience rapid growth in vehicle sales and ownership. While the shift toward EVs is accelerating in China, the sheer volume of new ICE and hybrid vehicle production ensures sustained high demand for ignition coils, particularly in the OEM segment. Japan and South Korea lead the region in the adoption of advanced coil technologies (like COP for GDI engines), reflecting their focus on producing high-efficiency, premium vehicles for the global market. The aftermarket in India and Southeast Asia is booming due to less rigorous maintenance schedules and the prevalence of older vehicles requiring replacement parts.

North America and Europe represent mature markets characterized by stringent environmental regulations (CAFE, Euro standards) that necessitate the use of high-energy, high-precision ignition coils optimized for GDI and TGDI engines. The OEM segment demands state-of-the-art COP technology to meet fuel economy and emissions targets. While overall new ICE sales are being impacted by EV proliferation, the sophisticated nature of hybrid systems and the large, aging vehicle fleet ensure a stable, high-value aftermarket segment in both regions. Europe, in particular, drives innovation in miniaturization and integration due to the widespread adoption of downsized, turbocharged engines.

Latin America (LATAM) and Middle East & Africa (MEA) are considered emerging markets offering substantial growth potential, particularly in the aftermarket sector. Vehicle longevity is often extended in these regions due to economic factors, leading to a consistent need for replacement coils. These markets are typically price-sensitive but increasingly prioritize quality as vehicle complexity rises. Growth in these regions is underpinned by urbanization and rising middle-class vehicle ownership, with a focus on robust and reliable coil systems suitable for diverse fuel quality and challenging operational climates.

- Highlight key countries or regions and their market relevance

- Asia Pacific (APAC): Dominates the market in volume (China, India), driven by large-scale OEM production and robust aftermarket demand for both basic and advanced coils.

- Europe: High-value market focused on premium, sophisticated COP technology necessary for meeting stringent Euro emissions standards in GDI/TGDI and hybrid engines.

- North America: Significant aftermarket activity due to high vehicle utilization and aging vehicle fleet; strong adoption of high-performance coils for truck and SUV segments.

- Latin America & MEA: Emerging markets with accelerating demand, heavily reliant on the aftermarket segment for cost-effective, reliable replacement parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ignition Coil Market.- Robert Bosch GmbH

- Denso Corporation

- Delphi Technologies (BorgWarner Inc.)

- NGK Spark Plug Co. Ltd. (Niterra)

- Federal-Mogul LLC (Tenneco Inc.)

- Continental AG

- Mitsubishi Electric Corporation

- Standard Motor Products (SMP)

- Hitachi Astemo, Inc.

- Valeo

- TDK Corporation

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Spark Plug International GmbH

- Visteon Corporation

- BBAC (Beijing Benz Automotive Co., Ltd.)

- Magneti Marelli

- Wai Global

Frequently Asked Questions

Analyze common user questions about the Ignition Coil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Ignition Coil Aftermarket?

The primary factor is the increasing average age of the global vehicle fleet combined with the inherent nature of ignition coils as high-wear electrical components susceptible to degradation from extreme engine heat and high-voltage stress, requiring periodic replacement to maintain engine performance and prevent misfires.

How does the shift to Hybrid Electric Vehicles (HEVs) impact ignition coil manufacturers?

The shift to HEVs positively impacts manufacturers in the short to medium term as HEVs utilize ICE technology but often require specialized, high-durability coils designed to withstand frequent start-stop cycles and rapid thermal variations, demanding higher performance and reliability than conventional coils.

What technological advancement is currently most significant for new ignition coil design?

The most significant advancement is the integration of Coil-on-Plug (COP) technology with advanced electronics to enable multi-spark ignition (MSI) systems. This allows for multiple, precise sparks per combustion cycle, optimizing fuel efficiency and meeting stringent global emissions regulations by ensuring more complete combustion.

Which geographical region holds the largest market share for ignition coils?

The Asia Pacific (APAC) region holds the largest market share, predominantly driven by the massive automotive production volumes in China and the sustained, high volume of both OEM installation and aftermarket replacement demand across the densely populated markets of India and Southeast Asia.

Will the growth of Battery Electric Vehicles (BEVs) immediately stop the demand for ignition coils?

No, the growth of BEVs will restrain long-term demand but will not cause an immediate cessation. The existing vast global fleet of ICE and HEV vehicles ensures stable replacement demand for decades in the aftermarket, while new HEV production continues to sustain OEM demand in the immediate forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Distributor And Ignition Coil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Single and Multi-spark Ignition Coil Market Size Report By Type (Single-spark, Multi-spark), By Application (OEM, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ignition Coil Market Statistics 2025 Analysis By Application (OEM, Aftermarket), By Type (Single-Spark, Multi-Spark), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager