Inflatable Kayaks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431931 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Inflatable Kayaks Market Size

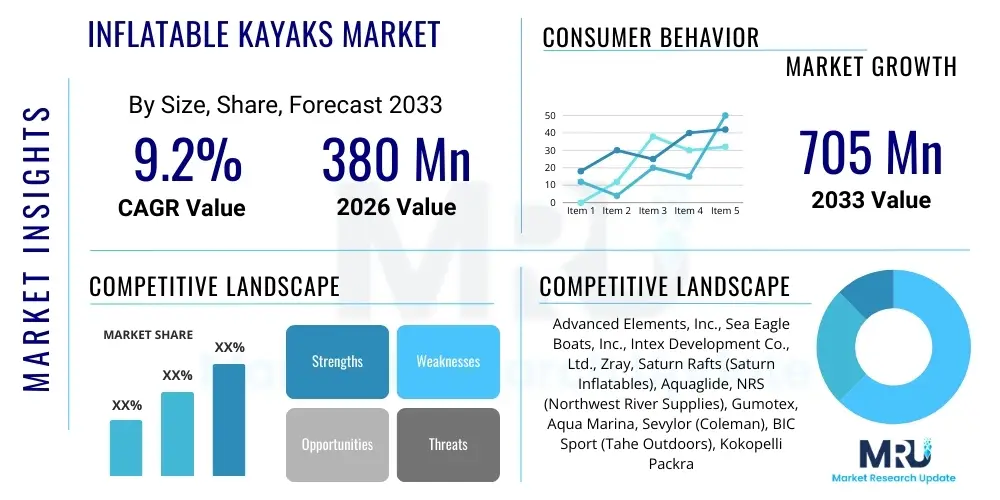

The Inflatable Kayaks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 380 Million in 2026 and is projected to reach USD 705 Million by the end of the forecast period in 2033.

Inflatable Kayaks Market introduction

The Inflatable Kayaks Market encompasses the manufacturing, distribution, and sale of watercraft designed for paddling, constructed from durable materials such as PVC, Hypalon, or reinforced fabrics, and relying on pressurized air chambers for structure and buoyancy. These portable vessels offer significant advantages over traditional hard-shell kayaks, primarily concerning ease of transportation, minimal storage requirements, and rapid setup/takedown processes, making them highly attractive to recreational users, apartment dwellers, and travelers. The primary function remains recreational paddling, fishing, and touring on lakes, slow rivers, and coastal waters, although specialized models are increasingly utilized for whitewater applications.

The core product features typically involve multiple air chambers for safety, durable outer skins to resist punctures, high-pressure drop-stitch floors for rigidity, and integrated accessories like tracking fins and cargo nets. Major applications span leisure activities, including family outings and fitness paddling, alongside specialized uses such as kayak fishing, where the stability and load capacity of inflatable models are beneficial. Furthermore, rental businesses and adventure tourism operators increasingly adopt these kayaks due to their durability and lower logistical overheads compared to traditional vessels.

The market growth is fundamentally driven by the escalating global interest in outdoor recreational activities and watersports, coupled with rising disposable incomes in emerging economies, enabling greater consumer spending on leisure equipment. Key benefits driving adoption include superior portability—often fitting into a backpack or duffel bag—and the development of high-performance materials (such as reinforced PVC and drop-stitch technology) that rival the performance characteristics of rigid kayaks while maintaining flexibility. These technological advancements have effectively mitigated past concerns regarding speed and rigidity, solidifying the inflatable kayak’s position as a viable, high-quality alternative.

Inflatable Kayaks Market Executive Summary

The Inflatable Kayaks Market is experiencing robust expansion driven by pronounced shifts in consumer preference toward portable and environmentally friendly outdoor gear. Business trends indicate strong innovation in material science, particularly the widespread adoption of high-pressure drop-stitch construction, which is blurring the performance gap between inflatable and traditional hard-shell models. This technology allows manufacturers to produce lighter, stiffer, and more durable products, appealing to both novice users and performance enthusiasts. Furthermore, the market is characterized by intense competition focused on product differentiation through specialized features like integrated fishing rod holders, superior seating systems, and advanced inflation mechanisms.

Regionally, North America and Europe currently dominate the market due to established outdoor cultures, significant recreational infrastructure, and high rates of consumer spending on leisure activities. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by expanding domestic tourism, rising middle-class income levels, and increasing governmental focus on developing coastal and riverine recreational zones. Emerging markets in Latin America and MEA are also showing steady growth, primarily focusing on entry-level and multi-purpose recreational models suitable for diverse aquatic environments.

Segmentation trends highlight the increasing demand for high-performance and tandem kayaks. The ‘Fishing Kayaks’ application segment is witnessing rapid growth, capitalizing on the stability and customization options inherent in inflatable designs. Distribution channels are shifting significantly, with e-commerce platforms and specialized online retailers capturing an increasing market share, offering greater variety and direct consumer engagement compared to traditional sporting goods stores. Overall, the market outlook is overwhelmingly positive, underpinned by sustained interest in wellness, outdoor leisure, and the continuous improvement of product quality and design.

AI Impact Analysis on Inflatable Kayaks Market

Common user questions regarding AI's impact on the Inflatable Kayaks Market typically revolve around enhancing the purchasing experience, optimizing manufacturing processes, and integrating smart technology into the product itself. Consumers frequently inquire about how AI can personalize kayak recommendations based on paddling environment and skill level, or how predictive maintenance (using embedded sensors) might warn of potential failure or wear. Furthermore, the supply chain efficiency is a major theme, with users expecting AI to forecast demand accurately, thereby preventing stockouts of popular models and ensuring rapid customization of specialized gear. The key consensus is that while AI won't change the physical act of paddling, it will profoundly transform the pre-purchase analysis, supply logistics, and post-purchase customer support, leading to a more streamlined and responsive industry structure.

- AI-driven supply chain optimization reducing manufacturing lead times and material waste.

- Personalized product recommendation engines on e-commerce sites improving conversion rates.

- AI analysis of consumer reviews and feedback accelerating product design iterations and feature implementation.

- Integration of smart accessories (e.g., automated inflation monitoring, real-time weather alerts) powered by basic embedded AI.

- Enhanced customer support through AI chatbots handling technical questions regarding inflation pressure, setup, and maintenance.

- Predictive demand modeling leading to efficient inventory management for seasonal fluctuations in watersports equipment.

DRO & Impact Forces Of Inflatable Kayaks Market

The Inflatable Kayaks Market dynamic is shaped by strong growth drivers related to outdoor recreation participation and product innovation, tempered by specific restraints concerning material durability and environmental conditions. Opportunities are abundant, particularly in product specialization and market expansion into developing regions. The primary impact forces currently favoring the market include the superior portability and convenience of inflatable models, which overcome the storage and transport hurdles associated with traditional hard-shell kayaks, thereby expanding the potential customer base to urban dwellers and travelers. Simultaneously, continuous refinement in drop-stitch technology is mitigating the traditional performance restraints associated with stability and tracking.

Key drivers include the global surge in recreational watersports participation, spurred by wellness trends and the affordability of entry-level models. Technological advances, such as high-denier polyester outer shells and multi-layer PVC construction, significantly improve puncture resistance and lifespan, boosting consumer confidence. Furthermore, the shift toward sustainable and compact outdoor gear aligns well with modern consumer preferences. However, restraints persist, notably the vulnerability of even the most durable materials to sharp objects or extreme abrasion, and the reliance on environmental factors like weather and water access, which can introduce variability into sales cycles. Also, the perception, though diminishing, that inflatable kayaks offer inferior performance to rigid counterparts still slightly impedes premium segment growth.

Significant opportunities exist in targeting specific end-user segments, such as the rapidly growing kayak fishing community, which demands high-stability, customizable platforms. Developing eco-friendly materials and fully recyclable kayak components represents a crucial future opportunity aligned with sustainability mandates. Additionally, leveraging digital platforms and augmented reality tools for product demonstrations and sizing guidance provides an opportunity to enhance the remote buying experience. The collective impact of these forces suggests a sustained upward trajectory, provided continuous R&D investment is maintained to address material and performance limitations, thus maximizing market penetration across diverse geographical and usage segments.

Segmentation Analysis

The Inflatable Kayaks Market is meticulously segmented based on key differentiators including the material composition, the intended usage type, the specific application environment, and the primary distribution channel utilized for sales. This granular segmentation allows manufacturers to tailor marketing strategies and product specifications to meet the nuanced demands of various consumer groups, ranging from casual weekend paddlers to dedicated touring enthusiasts and professional anglers. The most critical segmentation factor remains the material type, determining the kayak's pressure rating, rigidity, and overall cost, directly influencing consumer purchasing decisions regarding performance and durability expectations.

Segmentation by Type (e.g., Solo, Tandem, Convertible) addresses varying capacity needs, while segmentation by Application (e.g., Recreational, Fishing, Touring, Whitewater) reflects the required performance characteristics, stability, and ruggedness levels. For instance, whitewater models necessitate extreme durability and self-bailing features, differentiating them sharply from stable, multi-chamber recreational kayaks. Furthermore, the Distribution Channel analysis is essential for strategic planning, measuring the relative importance of online platforms versus physical retail spaces in reaching the global customer base and managing product visibility.

The continued refinement in segmentation is crucial for market stakeholders aiming for targeted growth, particularly as high-end drop-stitch models establish a distinct premium category separate from traditional entry-level PVC options. Understanding these segment dynamics facilitates targeted product development—such as integrating specialized mounts for electronics in fishing models or optimizing hull design for speed in touring kayaks—ensuring that product offerings remain highly relevant and competitive within the rapidly evolving watersports landscape.

- By Material:

- PVC

- Hypalon

- Nitrylon

- Drop-stitch Fabric

- By Type:

- Solo Kayaks

- Tandem Kayaks (Two-person)

- Convertible Kayaks

- By Application:

- Recreational Paddling

- Fishing

- Touring/Expedition

- Whitewater

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Sporting Goods Stores, Specialized Outdoor Equipment Stores)

Value Chain Analysis For Inflatable Kayaks Market

The value chain for the Inflatable Kayaks Market commences with upstream activities centered on raw material procurement and preparation. Key materials include heavy-duty PVC membranes, high-tensile polyester threads used in drop-stitch fabrication, specialized adhesives, and high-quality valve components. The effectiveness of the upstream segment dictates the final product quality and durability, requiring strong relationships with chemical manufacturers and textile suppliers. Suppliers achieving certifications for material longevity and environmental compliance often gain a competitive advantage, enabling manufacturers to integrate superior strength-to-weight ratios into their kayak designs.

The middle segment of the value chain involves the complex manufacturing process, including precision cutting of materials, high-frequency welding or gluing of seams, assembly of multiple air chambers, and quality assurance testing for pressure integrity. This stage is crucial for ensuring product safety and performance. Manufacturing efficiency, particularly the utilization of automation for repetitive tasks and stringent quality control protocols, directly impacts production costs and market competitiveness. After manufacturing, logistics and distribution channels connect the finished product to the end consumer, spanning warehousing, inventory management, and freight services.

Downstream activities focus on reaching the potential customer base through both direct and indirect channels. Direct distribution includes manufacturers selling through their proprietary e-commerce platforms, offering greater control over pricing and customer data. Indirect distribution involves specialized outdoor retailers (online and physical), mass-market sporting goods chains, and third-party e-commerce giants. Specialized retail often provides expert advice and in-store demonstrations, which is critical for complex equipment like high-end touring kayaks, while the convenience and broad reach of indirect online channels cater effectively to the mass recreational segment. The effective management of this distribution nexus is paramount to achieving broad market coverage and optimizing final sale prices.

Inflatable Kayaks Market Potential Customers

Potential customers for the Inflatable Kayaks Market are broadly segmented into three main groups: recreational consumers, specialized hobbyists (primarily anglers), and commercial entities. The largest segment, recreational consumers, includes individuals and families seeking convenient, portable options for casual paddling on calm bodies of water during weekends or holidays. This demographic highly values ease of storage, rapid setup, and affordability, making entry-level and tandem recreational kayaks particularly popular. Marketing efforts aimed at this group focus heavily on demonstrating portability and family fun, utilizing digital and social media platforms for high visual impact demonstrations.

The second major group consists of specialized hobbyists, notably the rapidly expanding kayak fishing community and serious touring paddlers. These end-users prioritize performance, stability, and durability above absolute cost. For anglers, high-pressure drop-stitch platforms offering stand-up stability, coupled with integrated features like rod holders and gear tracks, are essential. Touring enthusiasts demand designs optimized for tracking and speed over long distances, often preferring models made from advanced materials like Hypalon. Targeting this segment requires specialized marketing through fishing forums, adventure blogs, and partnerships with professional paddlers to establish product credibility and technical superiority.

Finally, commercial entities constitute a significant segment, including rental operators at tourist resorts, adventure tour companies, summer camps, and municipal park services. These buyers prioritize fleet durability, ease of maintenance, and stacking/storage capacity. Inflatable kayaks offer a logistical advantage to these businesses by simplifying storage during off-season periods and reducing transportation costs when relocating fleets. Sales strategies for commercial customers often involve large volume contracts, requiring robust warranty support and demonstrable return on investment based on low long-term maintenance costs and high user throughput.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 380 Million |

| Market Forecast in 2033 | USD 705 Million |

| Growth Rate | CAGR 9.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advanced Elements, Inc., Sea Eagle Boats, Inc., Intex Development Co., Ltd., Zray, Saturn Rafts (Saturn Inflatables), Aquaglide, NRS (Northwest River Supplies), Gumotex, Aqua Marina, Sevylor (Coleman), BIC Sport (Tahe Outdoors), Kokopelli Packraft, AIRE, BOTE, Driftsun, Star Inflatables, Itiwit (Decathlon), Tributary (AIRE), Red Paddle Co., Oru Kayak (Indirect Competitor due to portability focus) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inflatable Kayaks Market Key Technology Landscape

The technological landscape of the Inflatable Kayaks Market is primarily defined by advancements in materials science, inflation engineering, and construction methodologies aimed at maximizing rigidity and durability while minimizing weight. The single most impactful technology has been the widespread adoption of drop-stitch construction. This method utilizes thousands of internal polyester threads connecting the top and bottom layers of the kayak, allowing the chamber to be inflated to significantly higher pressures (10-15 PSI or more) compared to traditional low-pressure inflatables. This high pressure yields a rigid, flat surface, essential for enhanced stability, better tracking, and allowing users to stand up—a vital feature for fishing models. The integration of high-pressure floors fundamentally transforms performance, narrowing the gap with hard-shell kayaks.

Beyond drop-stitch technology, manufacturers continually refine the outer skin materials. Reinforced PVC (Polyvinyl Chloride), often layered with high-denier nylon or polyester fabrics, remains the industry standard, offering a favorable balance of cost, puncture resistance, and flexibility. However, premium and military-grade models utilize advanced materials like Hypalon (Chlorosulfonated Polyethylene) or Nitrylon. Hypalon offers superior resistance to UV light, chemicals, extreme temperatures, and abrasion, significantly extending the lifespan of the kayak, though at a higher cost. Technological focus is increasingly shifting toward developing lighter, more environmentally sustainable thermoplastic elastomers (TPEs) that can match the performance characteristics of PVC while offering easier recyclability.

In terms of systems technology, innovations in inflation mechanisms are crucial for user convenience. Automated electric pumps and specialized valves that prevent over-inflation are becoming standard features, speeding up the setup time. Furthermore, design technologies related to hull shape, such as incorporating rocker profiles for improved maneuverability in whitewater or using rigid plastic inserts (skeletons) to enhance tracking and rigidity in touring models, are defining product differentiation. The integration of proprietary fin systems and self-bailing cockpit designs also represents continuous technological improvements aimed at optimizing performance for specific paddling environments.

Regional Highlights

The global Inflatable Kayaks Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by local outdoor recreation infrastructure, climatic conditions, and economic maturity.

- North America: This region holds a leading market share, driven by a deeply ingrained culture of outdoor adventure, readily accessible inland waterways, and high disposable incomes that support spending on recreational gear. The market here is mature but highly dynamic, characterized by strong demand for high-end, specialized models, particularly drop-stitch fishing kayaks and solo touring kayaks. Key countries like the U.S. and Canada benefit from extensive national parks and lake systems, ensuring sustained demand.

- Europe: Europe represents another dominant market, particularly across Western and Northern Europe (Germany, UK, France), fueled by a strong focus on wellness and watersports tourism along the Mediterranean and Atlantic coasts. The European market shows a strong preference for multi-purpose and convertible models due to varied water environments and space constraints typical of urban living.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing region during the forecast period. This rapid growth is primarily attributed to rising economic prosperity, the expansion of adventure tourism industries in countries like China, Australia, and India, and increasing governmental investment in water-based recreational facilities. Demand is initially focused on entry-level recreational kayaks, but the premium segment is rapidly emerging, especially in Australia and Japan.

- Latin America (LATAM): Growth in LATAM is steady, driven mainly by coastal tourism and increasing domestic interest in watersports in Brazil and Mexico. The market often leans towards cost-effective, durable models suitable for both rental fleets and personal use, but economic instability occasionally acts as a constraint on premium purchases.

- Middle East and Africa (MEA): This region currently holds the smallest market share, though growth is anticipated, driven by leisure infrastructure development in the UAE and Saudi Arabia. The market is highly localized, focusing on recreational use in coastal resorts, limited by climatic conditions in many inland areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inflatable Kayaks Market.- Advanced Elements, Inc.

- Sea Eagle Boats, Inc.

- Intex Development Co., Ltd.

- Zray

- Saturn Rafts (Saturn Inflatables)

- Aquaglide

- NRS (Northwest River Supplies)

- Gumotex

- Aqua Marina

- Sevylor (Coleman)

- BIC Sport (Tahe Outdoors)

- Kokopelli Packraft

- AIRE

- BOTE

- Driftsun

- Star Inflatables

- Itiwit (Decathlon)

- Tributary (AIRE)

- Red Paddle Co.

- Hobie Cat Company (Specialized high-end inflatables)

Frequently Asked Questions

Analyze common user questions about the Inflatable Kayaks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is drop-stitch technology and how does it affect kayak performance?

Drop-stitch technology utilizes thousands of internal threads connecting the top and bottom fabric layers, allowing the inflatable kayak to be pressurized to much higher levels (typically 10-15 PSI). This results in a rigid, board-like floor which dramatically improves tracking, speed, and stability, making performance comparable to hard-shell models.

Are inflatable kayaks suitable for serious kayak fishing applications?

Yes, modern inflatable kayaks, particularly those utilizing high-pressure drop-stitch construction, are highly suitable for kayak fishing. They offer superior stability, often allowing the angler to stand up safely, and feature customizable platforms for mounting fishing gear, making them a portable and effective alternative to traditional fishing kayaks.

What are the primary advantages of inflatable kayaks over hard-shell kayaks?

The key advantages include superior portability and storage convenience, as they can be compactly folded and transported in a backpack or car trunk. They are generally lighter, easier to set up, and often more stable than equivalent hard-shell models, appealing significantly to travelers and urban dwellers with limited storage space.

Which geographical region leads the global market for inflatable kayaks?

North America currently leads the global Inflatable Kayaks Market in terms of revenue, driven by a large consumer base dedicated to outdoor recreational activities, extensive waterway access, and high consumer spending on specialized leisure equipment.

What materials provide the best durability and puncture resistance for inflatable kayaks?

High-end inflatable kayaks typically use multi-layer reinforced PVC, often paired with high-denier polyester or nylon fabric. For extreme durability and resistance to UV and chemicals, premium models utilize materials like Hypalon (Chlorosulfonated Polyethylene), though this increases the overall product cost.

How long does a typical inflatable kayak take to fully inflate?

Inflation time varies based on the kayak size and the pump used. With a standard high-volume foot or hand pump, a typical solo recreational kayak takes approximately 5 to 10 minutes. Using an automated electric pump can reduce this time significantly, often achieving full inflation in 3 to 5 minutes.

Are inflatable kayaks safe for use in mild whitewater conditions?

Specialized inflatable kayaks, often referred to as 'inflatable canoes' or 'duckies,' are designed with robust, self-bailing features and multiple air chambers, making them highly safe and effective for navigating up to Class III whitewater rapids. Standard recreational models, however, are typically limited to Class I or flat water.

What is the expected lifespan of a quality inflatable kayak?

With proper care, maintenance, and storage (avoiding prolonged exposure to extreme UV and chemicals), a high-quality inflatable kayak made from reinforced materials like Hypalon or strong PVC can have a lifespan ranging from 5 to 10 years, or even longer for premium brands.

What considerations should be made when choosing between solo and tandem inflatable models?

Choosing between solo and tandem depends on the intended use: solo models are lighter, easier to paddle alone, and faster for touring. Tandem models offer higher weight capacity for gear or two paddlers, promoting family or social recreational use, but they require synchronized paddling for optimal performance.

How is the market addressing sustainability concerns regarding plastic materials?

The market is slowly moving towards sustainability by exploring non-PVC materials and prioritizing fully recyclable components, such as high-performance thermoplastic elastomers (TPEs). Manufacturers are also optimizing production to reduce material waste and designing products for easier end-of-life recycling programs.

How do technological advancements influence the price point of inflatable kayaks?

Technological advancements, particularly the incorporation of high-pressure drop-stitch floors and premium materials like Hypalon, often increase the manufacturing complexity and raw material costs, leading to higher price points for high-performance models compared to basic entry-level PVC recreational kayaks.

What role does e-commerce play in the distribution of inflatable kayaks?

E-commerce plays a vital and dominant role, offering consumers extensive product comparisons, detailed specifications, and customer reviews. Online retail allows specialized brands to reach global audiences without massive physical store footprints, resulting in highly efficient direct-to-consumer distribution channels.

How important is the presence of multiple air chambers in inflatable kayak design?

The presence of multiple, independent air chambers (usually 3 or more) is a fundamental safety feature. Should one chamber become punctured, the remaining chambers retain sufficient buoyancy to keep the kayak afloat and stable, allowing the user to reach shore safely.

Are there inflatable kayaks designed specifically for cold weather environments?

While standard materials perform well across diverse temperatures, specialized models may use materials like Hypalon, which maintains flexibility and integrity better in extremely cold conditions. Users in colder environments typically focus on insulation features within the cockpit design rather than major material changes.

What are the key drivers for market growth in the Asia Pacific region?

Growth in APAC is primarily driven by rapidly increasing disposable income among the middle class, growing enthusiasm for domestic and international adventure tourism, and improving access to recreational waterways infrastructure supported by government initiatives.

How do manufacturers ensure the tracking performance of inflatable kayaks?

Tracking performance (the ability to travel straight) is ensured through design features such as a rigid high-pressure floor (drop-stitch), the integration of large, removable tracking fins (skegs), and the incorporation of rigid plastic elements or bows/sterns to enhance the hull's structure and rigidity.

What is the difference between PVC and Hypalon in kayak manufacturing?

PVC is more cost-effective and commonly used but can degrade over time with high UV exposure. Hypalon is a synthetic rubber known for its exceptional resistance to abrasion, UV radiation, chemicals, and extreme temperatures, resulting in a much longer-lasting and higher-performing, albeit more expensive, product.

How does the market cater to the growing demand for specialized fishing kayaks?

Manufacturers cater to fishing demand by designing wider, extremely stable platforms, often with high-pressure floors, and integrating specific features such as rod holders, anchor points, accessory tracks for GPS/fish finders, and reinforced seating areas for comfortable, extended use.

What are the common restraints impacting the adoption rate of inflatable kayaks?

The primary restraints include the inherent risk of puncture despite material improvements, the time required for drying and cleaning after use (compared to simply storing a hard-shell), and the lingering perception among some consumers that performance is inferior to traditional rigid boats.

How is AI expected to influence the customer service aspect of the market?

AI is anticipated to significantly enhance customer service through advanced chatbots capable of instantly providing detailed, accurate information regarding setup, maintenance schedules, warranty claims, and technical specifications (like optimal inflation pressure) without requiring human intervention.

What is the significance of the density of the drop-stitch threads in performance kayaks?

The density (number of threads per square inch) of the drop-stitch material directly dictates the maximum pressure the kayak can sustain. Higher thread density allows for greater inflation pressure, leading to superior rigidity, which is essential for performance, speed, and weight carrying capacity.

In what ways do commercial rental operators utilize inflatable kayaks?

Rental operators favor inflatable kayaks due to their logistical benefits: ease of storage during the off-season, reduced transportation costs when moving fleets, and greater resistance to minor impacts compared to fragile fiberglass, thereby lowering long-term maintenance expenditures.

Which kayak segment is predicted to experience the fastest growth during the forecast period?

The specialized Application segment, particularly 'Kayak Fishing,' is projected to exhibit the fastest growth, driven by product innovations that provide high stability and customization necessary for serious angling, appealing to a rapidly expanding global hobbyist community.

How do market leaders ensure product safety and compliance?

Market leaders ensure safety and compliance through stringent internal quality assurance processes, multi-chamber designs for inherent buoyancy redundancy, adherence to international standards for materials (like CE certification), and comprehensive pressure testing before final assembly.

What future design innovations are anticipated in inflatable kayak manufacturing?

Future innovations are expected to focus on integrated structural elements (skeleton systems), lighter and greener composite materials, modular designs allowing easy conversion between solo/tandem and fishing/touring setups, and fully integrated smart pump and pressure monitoring systems.

How does urban living influence the demand for inflatable kayaks?

Urban living strongly drives demand for inflatable kayaks because they solve critical logistical problems: they require minimal storage space (easily fitting in closets or small apartments) and can be transported via public transit or small vehicles, overcoming the storage restrictions associated with rigid kayaks.

What are the typical weight capacity ranges for tandem inflatable kayaks?

Tandem inflatable kayaks typically offer high weight capacity, ranging broadly from 450 lbs (200 kg) to over 600 lbs (270 kg). This capacity accommodates two adults plus substantial gear, making them ideal for multi-day expeditions or family outings.

What is the role of specialized online retailers versus general e-commerce platforms?

Specialized online retailers offer in-depth expertise, curated product selections, and community engagement crucial for expert buyers. General e-commerce platforms provide mass accessibility, competitive pricing, and logistical convenience, catering primarily to entry-level and recreational buyers.

How does the quality of the inflation valve system impact the kayak experience?

A high-quality inflation valve system is critical as it ensures a fast, secure, and reliable seal, maintaining optimal pressure over extended periods. Poor valve quality can lead to slow air leaks, pressure loss during paddling, and frustrating maintenance issues.

What economic factors are driving consumer adoption of inflatable kayaks globally?

Key economic drivers include increasing global disposable incomes, particularly in emerging economies, the cost-effectiveness of inflatable kayaks compared to purchasing and transporting rigid counterparts, and the overall affordability of watersports gear entry points.

What differentiates touring inflatable kayaks from recreational models?

Touring models are typically longer, narrower, and feature improved hull shapes designed for better hydrodynamics and tracking over long distances. They often utilize higher-pressure drop-stitch construction throughout and include robust storage/deck rigging for extended expeditions, unlike shorter, wider recreational models designed purely for stability.

How do manufacturers mitigate the effects of UV damage on materials?

Manufacturers mitigate UV damage by incorporating UV-inhibitors into the PVC and other plasticizers used in the construction materials. Premium materials like Hypalon inherently possess superior UV resistance, significantly extending the usable lifespan when exposed to prolonged sunlight.

What is the relationship between kayak rigidity and performance?

Rigidity is directly correlated with performance. A stiffer kayak flexes less in the water, resulting in more efficient energy transfer from the paddle stroke, better tracking (less yawing), and higher maximum speeds, which is why high-pressure floors are critical for high-performance models.

What considerations are involved in the upstream supply chain for inflatable kayaks?

Upstream considerations focus on securing consistent, high-quality supplies of reinforced PVC or Hypalon fabric, managing volatility in chemical input costs, and ensuring reliable sourcing of specialized high-pressure air valves and precision cutting/welding equipment.

How are environmental concerns influencing market development?

Environmental concerns are driving market development through increased demand for eco-friendly and recyclable materials, reducing reliance on single-use plastics in packaging, and encouraging brands to adopt more sustainable manufacturing processes and supply chain traceability.

What are the primary logistical challenges for manufacturers in this market?

Logistical challenges include managing the seasonal demand peaks typical of watersports equipment, optimizing international shipping and freight costs for bulky, packaged items, and ensuring rapid fulfillment through distributed warehouse networks to minimize delivery times for e-commerce customers.

How does product customization factor into market growth?

Product customization is a strong growth factor, especially in the fishing segment, where users demand modular attachment points, integrated rod holders, and customizable seating options. Manufacturers offering accessory compatibility and flexible platform designs capture a significant portion of this high-value segment.

Which materials are best suited for whitewater inflatable kayaks?

Whitewater inflatable kayaks require the highest level of abrasion resistance and typically utilize extremely durable materials such as commercial-grade Hypalon or heavy-denier, double-coated PVC. Self-bailing features and multiple structural air chambers are essential design components for this application.

How do manufacturers utilize digital tools for pre-purchase consumer education?

Manufacturers heavily utilize digital tools such as detailed instructional videos (for setup and maintenance), augmented reality (AR) apps for visualizing the kayak size, and interactive comparison tools on their websites to educate potential buyers and reduce purchasing friction.

What is the significance of the base year (2025) and historical year (2019-2024) in the report?

The historical period (2019-2024) provides the data baseline for analyzing market dynamics, growth patterns, and the impact of recent global events (like supply chain disruptions). The base year (2025) serves as the reference point against which all projected growth rates and forecast values are calculated for the period 2026-2033.

How does the market differentiate between recreational and expedition usage needs?

Differentiation is achieved through design: Recreational models prioritize stability and short-term comfort. Expedition models prioritize tracking, speed, cargo capacity, and long-term seating comfort, often featuring durable material construction suitable for continuous paddling over several days.

What role do warranty and after-sales support play in consumer purchasing decisions?

Warranty and after-sales support are highly influential factors, particularly for high-value drop-stitch models, as consumers require assurance regarding the durability and longevity of the material and seam welding, viewing robust warranties as protection against potential manufacturing defects.

How have recent global supply chain disruptions affected the production and pricing?

Recent supply chain disruptions, especially affecting chemical inputs (PVC, adhesives) and logistics, led to increased raw material costs and longer lead times between 2021 and 2023. These factors pressured manufacturers, often resulting in slightly higher final retail prices for consumers.

What are the limitations of AI integration in the physical product itself?

Current limitations include the high cost of embedding durable sensors resistant to water and impacts, the need for reliable battery life in a non-powered environment, and the complexity of maintaining connectivity or processing power necessary for advanced real-time performance feedback.

How are manufacturers ensuring optimal tracking and stiffness without excessive weight?

Manufacturers achieve optimal tracking and stiffness without excessive weight by using lightweight yet high-tensile drop-stitch core materials, minimizing unnecessary external accessories, and employing advanced hull geometry that requires less material while maximizing structural integrity and performance efficiency.

What emerging market trends are influencing product design in 2026?

Emerging trends in 2026 include hyper-specialization in fishing platforms, integration of electronic mounts (action cameras, sonar), focus on rapid dry-time materials, and modular designs that allow users to easily convert their kayak setup for different activities or crew sizes.

How is the European market addressing the logistics of kayaking in various water bodies?

The European market emphasizes portability and versatility, favoring inflatable kayaks that can be used across diverse environments—from calm canals and reservoirs to rugged coastal seas—addressing the varied water access laws and transportation demands across multiple countries.

What key attributes do consumers prioritize when purchasing an inflatable touring kayak?

Consumers purchasing touring models prioritize efficient tracking, hull speed, high load capacity for gear, durable construction for long-term use, and advanced seating systems designed for ergonomic comfort during extended hours of paddling.

How does the seasonality of watersports affect the market forecasting?

Seasonality mandates rigorous inventory management and production scheduling, with peak sales occurring in spring and summer. Market forecasting must account for weather variability and optimize inventory allocation to distribution channels months in advance to maximize revenue during the primary buying season.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Whitewater Inflatable Kayaks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Inflatable Kayaks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (1 Person Inflatable Kayak, 2 Person Inflatable Kayak, 3 Person Inflatable Kayak), By Application (General Recreation, Fishing, Other Applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager