Jaw Crushers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435197 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Jaw Crushers Market Size

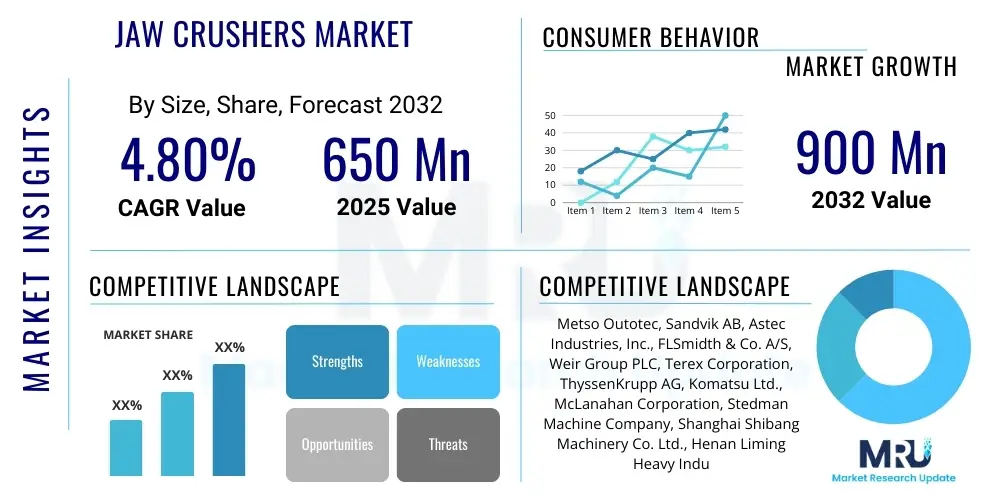

The Jaw Crushers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1285 million by the end of the forecast period in 2033.

Jaw Crushers Market introduction

Jaw crushers are essential primary crushing equipment utilized across diverse heavy industries, including mining, construction, infrastructure development, and aggregate production. These machines function by compressing materials between a stationary jaw (fixed plate) and a moving jaw (swing plate), effectively reducing large rocks, ores, and concrete debris into smaller, manageable sizes. The robust design and capability to handle extremely hard and abrasive materials make jaw crushers indispensable for the first stage of material processing, setting the foundation for subsequent crushing and screening operations. Their high reduction ratio and simple, reliable mechanism contribute significantly to their continued adoption globally, particularly in environments requiring high throughput and minimized downtime.

The primary applications driving the demand for jaw crushers include the extraction and processing of metallic and non-metallic ores in the mining sector, preparation of raw materials for road building and concrete production in the construction industry, and efficient processing of construction and demolition (CD) waste in recycling operations. Benefits derived from deploying advanced jaw crushing technology encompass improved operational efficiency, reduced specific energy consumption due to optimized crushing angles, and enhanced safety features through sophisticated monitoring systems. Furthermore, modern jaw crushers are designed with adjustable settings, allowing operators to precisely control the output size, thereby maximizing the value derived from the quarried material and meeting stringent project specifications.

Market growth is predominantly fueled by rapid global urbanization, leading to massive infrastructure spending on highways, bridges, and commercial complexes, especially in emerging economies of Asia Pacific and Latin America. Government initiatives promoting sustainable development and recycling also boost the utilization of mobile jaw crushers for on-site processing of recycled aggregates. Concurrently, the persistent demand for minerals and metals, driven by the electric vehicle (EV) battery industry and renewable energy infrastructure, ensures sustained investment in new mining projects, consequently driving the procurement of high-capacity crushing equipment capable of handling diverse geological conditions and processing large volumes of raw input.

Jaw Crushers Market Executive Summary

The Jaw Crushers Market is experiencing substantial growth propelled by robust global infrastructure spending and the resurgence of large-scale mining activities focused on critical minerals. Business trends indicate a clear shift toward highly efficient, fuel-optimized, and interconnected crushing solutions, with manufacturers increasingly integrating telematics and IoT sensors to facilitate predictive maintenance and remote operational diagnostics. Key market players are prioritizing the development of mobile jaw crushing plants, which offer unparalleled flexibility and operational cost advantages by eliminating the need for extensive material transportation, thus catering directly to project-based crushing requirements in remote or temporary construction sites.

Regional trends highlight the Asia Pacific (APAC) as the dominant market, primarily driven by China and India’s extensive road and railway network expansion projects and massive residential construction needs. North America and Europe, while mature markets, demonstrate significant demand for advanced stationary crushers characterized by higher automation levels and adherence to stringent noise and emission regulations. These regions are also leading the adoption of recycling-focused crushing equipment, utilizing jaw crushers to process concrete, asphalt, and rubble, aligning with circular economy mandates and contributing to sustainable construction practices.

Segment trends reveal that the Mobile Jaw Crushers segment is registering the fastest growth rate, surpassing stationary units in several application areas due to their ease of relocation and quick setup time, which drastically reduces project mobilization costs. By application, the aggregate and construction segment holds the largest market share, directly correlating with the volume of public and private investment in physical infrastructure. Furthermore, advancements in wear parts—specifically, the utilization of manganese steel alloys with enhanced lifespan—are becoming crucial differentiators, optimizing maintenance schedules and improving the overall total cost of ownership (TCO) for end-users operating in highly abrasive environments.

AI Impact Analysis on Jaw Crushers Market

Analysis of common user questions regarding AI's impact on the Jaw Crushers Market reveals core concerns centered on operational predictability, autonomous functions, and optimization of energy consumption. Users frequently inquire about the feasibility of integrating AI models to predict component failure—specifically the jaw plates and liners—based on real-time vibration and wear data, aiming to minimize unplanned downtime. There is also significant interest in how AI can optimize feed rate control and crushing chamber settings autonomously in response to fluctuating material hardness and size distribution, ensuring maximum throughput and consistent product quality without constant manual intervention. Expectations are high for AI-driven systems to refine the crushing process parameters, leading to substantial energy savings and a reduction in operational expenditure for large-scale mining and aggregate processing facilities.

The influence of Artificial Intelligence (AI) is fundamentally transforming the operational paradigm of jaw crushers, moving them from static mechanical assets to intelligent, self-optimizing systems. AI applications are primarily leveraged to enhance machine learning algorithms that interpret vast datasets collected by on-board sensors (e.g., pressure transducers, accelerometers, current monitors). This data analysis capability allows the crushing equipment to identify subtle performance degradations before they escalate into major mechanical failures, thereby enabling true condition-based maintenance strategies. This shift drastically improves equipment uptime and reliability, which are critical metrics in high-volume, continuous operation environments typical of major mining and quarrying projects.

- AI-powered Predictive Maintenance: Forecasting wear plate replacement schedules with high accuracy, minimizing unplanned shutdowns.

- Autonomous Feed Optimization: Adjusting crusher settings (e.g., closed side setting) and feed conveyor speed dynamically based on material characteristics (hardness, size).

- Energy Consumption Reduction: Utilizing algorithms to maintain optimal crushing efficiency, reducing specific energy consumption per ton of processed material.

- Remote Diagnostics and Troubleshooting: Enabling sophisticated analysis of operational anomalies from a central control hub, reducing the need for on-site technical expertise.

- Enhanced Safety Protocols: AI systems monitor operational patterns and detect potential hazardous conditions (e.g., severe clogging or overloading) faster than human operators.

DRO & Impact Forces Of Jaw Crushers Market

The Jaw Crushers Market is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively dictate investment decisions and technological focus within the industry. The primary drivers are the massive governmental investments in infrastructure upgrades and the sustained global demand for key construction aggregates and base metals required for industrialization. These growth factors are consistently tempered by restraints, notably the inherently high initial capital expenditure required for acquiring heavy crushing equipment and the increasing regulatory burden concerning environmental noise pollution and dust emissions, particularly in proximity to urban centers.

Opportunities for growth are significant, centered around the burgeoning construction and demolition (CD) recycling sector, which utilizes mobile jaw crushers to convert waste into reusable aggregates, aligning with global sustainability goals. Furthermore, the push towards digitalization and automation presents an opportunity for manufacturers to differentiate their offerings by integrating advanced sensors and remote monitoring capabilities, addressing end-users' increasing focus on operational efficiency and Total Cost of Ownership (TCO). The impact forces acting on this market are characterized by high leverage on macroeconomic indicators, where market buoyancy directly correlates with GDP growth, commodity prices, and the velocity of large infrastructure project financing globally.

Specifically, the long operational lifespan of jaw crushers and the high cost of replacement parts serve as both a market barrier for new entrants and a source of stable revenue for established OEMs through aftermarket services. The development of specialized crushers for niche applications, such as ultra-hard rock mining (e.g., basalt, granite), further diversifies revenue streams. The most significant impact force remains the cyclical nature of the mining and construction sectors; geopolitical stability, which influences commodity prices and project timelines, exerts strong pressure on market revenue generation and capital equipment investment schedules.

Segmentation Analysis

The Jaw Crushers Market is meticulously segmented based on type, operation, application, and end-use, allowing for a granular understanding of specific market dynamics and consumption patterns. Segmentation by type differentiates between primary crushers, designed for initial, large-scale reduction, and secondary crushers, which handle smaller input sizes for further material refinement. Operational segmentation divides the market into stationary (fixed installation, high capacity) and mobile (skid-mounted or wheeled, high flexibility) units, reflecting the diversity of project scopes from permanent quarries to temporary construction sites. This comprehensive breakdown assists stakeholders in tailoring equipment design, distribution strategies, and pricing models to specific industry demands and geographical constraints.

Application-based segmentation is crucial, identifying the largest consumption sectors, namely aggregates production (sand, gravel, crushed stone), mining (ore processing), recycling (CD waste management), and heavy construction (on-site processing). The demand drivers, performance requirements, and maintenance schedules vary significantly across these segments. For instance, mining applications prioritize robustness and high capacity, whereas recycling applications emphasize portability and contaminant separation capabilities. Analyzing these segments helps in forecasting material flow requirements and identifying bottlenecks in the crushing value chain, ensuring that product development aligns with the evolving needs of the end-user base, particularly the increasing requirement for sustainable and energy-efficient solutions.

- By Type:

- Single Toggle Jaw Crushers

- Double Toggle Jaw Crushers

- By Mobility:

- Stationary Jaw Crushers

- Mobile Jaw Crushers (Tracked and Wheeled)

- By Application:

- Aggregate Production

- Mining (Metallic and Non-Metallic)

- Recycling (Construction and Demolition Waste)

- Infrastructure Development

- By End-Use Industry:

- Cement Industry

- Quarrying

- Mineral Processing

- Road and Railway Construction

Value Chain Analysis For Jaw Crushers Market

The value chain for the Jaw Crushers Market begins with the upstream sourcing of specialized raw materials, primarily high-grade steel alloys, manganese steel, and specialized casting metals necessary for manufacturing the robust frame, swing jaw, and crucial wear parts (jaw plates). This upstream segment is highly critical, as the quality and durability of these materials directly determine the crusher's lifespan, resistance to abrasion, and ultimate crushing efficiency. Suppliers in this phase must adhere to strict metallurgical specifications, and volatility in global steel and energy prices often impacts the final manufacturing cost, requiring stringent inventory management and procurement strategies by major OEMs.

The core manufacturing and assembly stage involves complex engineering processes, precision machining of large components, and the integration of hydraulic and electrical control systems. Research and Development (RD) investment focuses on optimizing the crushing chamber geometry (kinematics), improving material flow, and reducing maintenance complexity. Downstream analysis reveals a reliance on efficient distribution channels, predominantly heavy machinery dealerships and authorized distributors who provide sales support, financing options, and, critically, comprehensive aftermarket services, including spare parts supply and specialized technical maintenance, which often represent a significant and stable revenue stream for the OEMs.

Distribution channels for jaw crushers are bifurcated into direct sales for large-scale mining or quarrying clients requiring bespoke solutions and indirect sales through dealer networks, particularly for standardized mobile units catering to smaller contractors and regional aggregate producers. Direct channels facilitate closer customer relationships and customized service contracts, whereas indirect channels offer broader market penetration and localized support. The value chain concludes with the end-users—large construction companies, mining operators, and recycling facilities—who prioritize factors such as throughput capacity, energy efficiency, ease of maintenance, and the total cost of ownership over the equipment's operational life cycle.

Jaw Crushers Market Potential Customers

The primary potential customers for jaw crushers are major entities operating within the resource extraction and infrastructure development sectors globally, demanding machinery capable of high-volume, continuous material reduction. These include multinational mining corporations focused on gold, iron ore, copper, and critical mineral extraction, which require high-capacity, stationary jaw crushers integrated into permanent processing plants. Aggregate producers, encompassing large quarrying operations that supply crushed stone for concrete and asphalt manufacturing, represent the largest volume segment of customers, often utilizing a mix of high-throughput stationary crushers and flexible mobile units depending on the geological site characteristics and operational scale.

A rapidly expanding customer base is found within the urban and infrastructure construction sector. General contractors and specialized demolition companies increasingly purchase mobile jaw crushers to process construction and demolition (CD) waste on-site, converting rubble into reusable base material, which meets sustainability requirements and reduces disposal costs. Furthermore, government agencies or public-private partnerships undertaking large-scale civil engineering projects, such as highway construction, railway development, and dam building, often mandate or directly procure crushing equipment for captive use to ensure quality control and cost efficiency in material preparation, constituting a stable, albeit cyclical, demand source.

Additionally, smaller regional contractors and rental fleet operators form a substantial segment. These customers often opt for flexible, mid-sized mobile jaw crushers due to lower initial capital outlay and the ability to serve multiple short-term contracts across different locations. For all customer types, the purchasing decision is heavily influenced by equipment reliability, fuel efficiency, availability of local service support, and compliance with regional noise and dust emission standards, making the aftermarket service network a crucial determinant in vendor selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1285 million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metso Outotec, Sandvik AB, ThyssenKrupp AG, Astec Industries Inc., Terex Corporation, McLanahan Corporation, FLSmidth, Wirtgen Group (John Deere), Komatsu Ltd., Shanghai Shibang Machinery Co. Ltd., Masaba Inc., Dragon Machinery, SBM Mineral Processing, Stedman Machine Company, Telsmith Inc., Lippmann-Milwaukee Inc., Hazemag & EPR GmbH, Chengdu Dahongli Machinery, Weir Group, IROCK Crushers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Jaw Crushers Market Key Technology Landscape

The Jaw Crushers Market is undergoing continuous technological refinement focused on maximizing throughput, extending component lifespan, and enhancing operator safety and control. A key technological advancement involves the integration of advanced hydraulic adjustment systems. These systems allow for rapid, automated changes to the closed side setting (CSS) even under load, enabling operators to quickly adjust the final product grading and compensate for wear, thereby maximizing efficiency and reducing manual intervention time which translates directly to higher operational uptime. Furthermore, modern jaw crushers are incorporating heavier, more robust flywheels and optimized eccentric shafts, improving kinetic energy storage and enabling the processing of harder, more heterogeneous materials with reduced risk of stalling and mechanical stress.

Material science plays a pivotal role in the technology landscape, specifically the development and use of proprietary, high-manganese steel alloys and specialized casting techniques for wear parts such as jaw plates and cheek plates. These advancements result in superior resistance to abrasive wear, significantly extending the time between plate replacements and substantially lowering maintenance costs. Concurrently, the incorporation of advanced telematics and sensor technology (IoT integration) is becoming standard. These digital tools monitor vital operational metrics—including bearing temperature, vibration analysis, tramp iron detection, and lubrication status—providing real-time data to control rooms for proactive management and predictive failure analysis, a crucial aspect of maximizing asset utilization in remote locations.

The shift towards automation and electric power drives is another significant technological trend shaping the market. While diesel remains dominant for mobile crushers, there is increasing development of hybrid and fully electric mobile jaw crushers, driven by stricter emission standards in North America and Europe, offering substantial reductions in noise pollution and operational fuel costs. Additionally, enhanced dust suppression systems, often integrated with automated water spraying or foam injection mechanisms, are essential technological features that ensure compliance with environmental regulations and improve working conditions on site, reflecting the industry’s commitment to sustainable and responsible operational practices.

Regional Highlights

The global Jaw Crushers Market exhibits distinct regional consumption patterns dictated by infrastructure maturity, mining activity levels, and regulatory frameworks. Asia Pacific (APAC) stands out as the highest growth region, driven by unparalleled levels of governmental investment in infrastructure projects across populous nations like China, India, and Southeast Asian countries. The rapid pace of urbanization necessitates continuous demand for aggregates, cement, and road materials, fueling the procurement of both high-capacity stationary plants for permanent quarries and flexible mobile crushers for numerous decentralized project sites.

North America and Europe represent mature markets characterized by replacement demand, modernization, and a strong emphasis on highly automated and compliant machinery. In North America, demand is robust due to federally funded highway bills and renewed interest in domestic critical mineral mining. European demand is shaped by rigorous environmental standards, promoting the adoption of low-emission, highly efficient equipment, and a significant market concentration on construction and demolition waste recycling, positioning mobile jaw crushers as central to the circular economy initiatives within the continent.

Latin America, and the Middle East and Africa (MEA), offer promising growth potential linked to significant mineral resource endowments and large-scale, planned infrastructure projects (e.g., GCC national visions, African railway expansions). While these regions face challenges related to financing and political stability, long-term resource exploitation projects necessitate considerable investment in primary crushing equipment, favoring suppliers who can provide rugged, high-reliability machinery coupled with resilient local support and service capabilities.

- Asia Pacific (APAC): Dominant market share fueled by large-scale infrastructure and urbanization projects in China, India, and Indonesia; strong demand for both mobile and high-throughput stationary crushers.

- North America: Stable demand driven by infrastructure renewal projects, increasing recycling rates, and technological preference for advanced, connected crushing plants.

- Europe: Focus on high-specification, environmentally compliant equipment; strong market penetration of mobile units for construction and demolition waste recycling.

- Latin America (LATAM): Growth potential tied to sustained mining operations (copper, iron ore) and initial stages of major regional infrastructure development.

- Middle East and Africa (MEA): Significant investment projected in quarrying and construction to support ambitious national development plans, favoring robust, high-durability jaw crushers suitable for harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Jaw Crushers Market.- Metso Outotec

- Sandvik AB

- Terex Corporation

- Astec Industries Inc.

- Wirtgen Group (John Deere)

- Komatsu Ltd.

- FLSmidth

- McLanahan Corporation

- ThyssenKrupp AG

- Shanghai Shibang Machinery Co. Ltd.

- Weir Group

- Dragon Machinery

- SBM Mineral Processing

- Lippmann-Milwaukee Inc.

- Telsmith Inc.

- IROCK Crushers

- Pew Jaw Crusher

- Hazemag & EPR GmbH

- Gyratory Crushers (as part of a broader portfolio)

- Hewitt Robins International

Frequently Asked Questions

Analyze common user questions about the Jaw Crushers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Jaw Crushers Market?

The market growth is fundamentally driven by escalating global investment in public and private infrastructure projects, particularly road networks and urban development in Asia Pacific. Additionally, the persistent demand for aggregates and the accelerated adoption of mobile crushers for sustainable construction and demolition waste recycling contribute significantly to market expansion.

How does the choice between single toggle and double toggle jaw crushers affect operational efficiency?

Single toggle jaw crushers are favored for high-throughput primary crushing applications requiring high capacity and high reduction ratios due to their simple kinematics. Double toggle jaw crushers, offering superior force distribution and better control over the discharge setting, are typically preferred for crushing extremely hard or highly abrasive materials, particularly in heavy-duty mining environments where reliability and controlled output are critical.

What role does Artificial Intelligence (AI) play in modern jaw crusher operations?

AI is crucial for optimizing modern jaw crusher operations by facilitating predictive maintenance through real-time sensor data analysis, minimizing unplanned downtime. AI algorithms also enable autonomous adjustment of feed rates and crushing settings in response to fluctuating material inputs, ensuring maximized throughput and significant energy savings per ton of material processed.

Which geographical region dominates the consumption of jaw crushers and why?

Asia Pacific (APAC) currently dominates the consumption of jaw crushers. This is primarily attributed to the region’s massive infrastructure expansion plans, including extensive road construction and residential building programs in countries like China and India, which create immense, sustained demand for processed aggregates and minerals.

What are the main technical considerations when selecting a jaw crusher for aggregate production?

Key technical considerations include the maximum capacity required (tonnes per hour), the hardness and abrasiveness of the raw material, the desired final product size distribution (Closed Side Setting), and the mobility requirement (stationary vs. mobile). Fuel efficiency and the availability of durable, high-wear-resistant jaw plates are also critical factors influencing the total cost of ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Jaw Crushers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Jaw Crushers Market Size Report By Type (Less than 300tph, 300tph-800tph, More than 800tph), By Application (Mining, Construction), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Jaw Crushers Market Statistics 2025 Analysis By Application (Mining, Construction), By Type (Less Than 300tph, 300tph-800tph, More Than 800tph), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager