Kaolin Clay Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432198 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Kaolin Clay Market Size

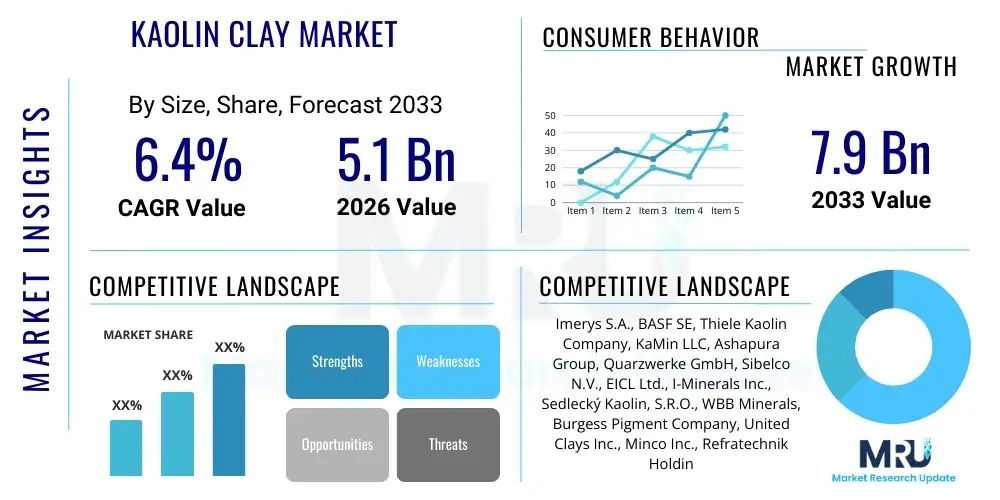

The Kaolin Clay Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4% between 2026 and 2033. The market is estimated at USD 5.1 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Kaolin Clay Market introduction

Kaolin clay, chemically known as hydrated aluminum silicate (Al2Si2O5(OH)4), is a naturally occurring, soft white mineral essential across numerous industrial sectors globally. Its primary characteristics, including whiteness, opacity, softness, non-abrasiveness, and chemical inertness, make it indispensable, particularly in the production of paper, ceramics, and paints. High-quality kaolin is vital for paper coating and filling, enhancing gloss, brightness, and printability, thereby underpinning the substantial demand from the packaging and printing industries. The functional benefits of kaolin extend to improving fire resistance, acting as a functional filler in plastics, and providing structural integrity in ceramics.

The product is commercially processed into various grades, such as calcined kaolin (heated to remove hydroxyl groups, increasing hardness and opacity) and hydrous kaolin (wet processed), each tailored for specific performance requirements. Major applications include filler material in rubber, pigments in cosmetics, and raw material in the manufacturing of fiberglass. The market's growth is inherently linked to global industrialization, infrastructural development, and the increasing demand for high-performance coatings and specialized materials that utilize kaolin's unique rheological properties.

Driving factors for this market include rapid expansion in the Asia-Pacific construction sector, increasing adoption of lightweight materials in the automotive industry where kaolin acts as a reinforcement, and sustained demand for specialized packaging solutions. Furthermore, the push towards sustainable and environmentally friendly products favors kaolin usage, particularly in filtration systems and water treatment applications, positioning it as a cornerstone mineral supporting diverse global manufacturing processes.

Kaolin Clay Market Executive Summary

The Kaolin Clay Market exhibits robust growth driven primarily by surging demand from the paper and packaging industry, particularly in emerging economies, and persistent utilization in high-value applications such as advanced ceramics and specialized paints and coatings. Business trends indicate a strong move toward product differentiation, focusing on developing high-brightness and ultra-fine kaolin grades (like metakaolin) to meet stringent performance requirements in concrete and polymer formulations. Strategic mergers and acquisitions are shaping the competitive landscape, allowing key players to secure premium reserves and optimize complex supply chain logistics, aiming for vertical integration to mitigate volatility in mining and processing costs.

Regionally, Asia Pacific commands the largest market share, attributable to rapid urbanization, massive infrastructure projects, and the presence of high-volume manufacturing hubs, notably China and India. North America and Europe demonstrate mature market characteristics, focusing primarily on high-purity, calcined kaolin for applications requiring superior opacity and dielectric properties, such as high-gloss printing and specialized industrial coatings. Latin America and MEA are poised for substantial future growth, propelled by local expansion in the construction and sanitaryware sectors, necessitating stable sourcing of quality raw materials like kaolin clay.

Segmentation trends highlight the dominance of the paper and packaging application segment, although the fastest growth rate is observed in the ceramics and specialty chemicals sectors, driven by technological advancements requiring higher thermal and mechanical stability. Hydrous kaolin remains the largest type segment, utilized heavily for its low cost and ease of processing, while calcined kaolin is gaining significant traction due to its superior performance characteristics as a functional filler and pigment extender, particularly relevant in sustainable building materials and advanced composite manufacturing.

AI Impact Analysis on Kaolin Clay Market

Common user questions regarding AI's influence on the Kaolin Clay Market often revolve around predictive modeling for reserve estimation, optimizing complex mineral processing steps, and enhancing quality control in refining high-purity grades. Users are concerned about how AI can mitigate operational risks associated with resource depletion and fluctuating energy costs, which heavily influence kaolin production margins. The core expectation is that AI tools will revolutionize traditional mining and processing workflows, leading to substantial cost savings, better environmental compliance, and the ability to consistently produce specialized kaolin grades tailored to highly specific industrial demands, thereby securing premium pricing and optimizing resource allocation throughout the value chain.

- AI-driven geological modeling enhances the accuracy of kaolin reserve identification and characterization, minimizing exploration risk and improving mine planning efficiency.

- Predictive maintenance analytics, powered by machine learning, optimizes processing equipment uptime (crushers, hydrocyclones, calciners), reducing unexpected shutdowns and operational expenditure.

- AI algorithms are employed for real-time quality control during beneficiation and calcination processes, ensuring consistent particle size distribution, whiteness, and viscosity required for premium-grade applications.

- Supply chain optimization using AI enables efficient inventory management and logistics, forecasting demand fluctuations from key end-use industries (e.g., paper, automotive) to align production schedules precisely.

- Advanced robotics and autonomous hauling systems, guided by AI, improve safety and efficiency in open-pit mining operations, lowering labor costs and increasing extraction rates.

DRO & Impact Forces Of Kaolin Clay Market

The dynamics of the Kaolin Clay Market are shaped by a complex interplay of demand-side drivers, supply-side restraints, and strategic opportunities that collectively determine market trajectory and competitive intensity. The primary driver is the accelerating global demand for paper and packaging materials, fueled by e-commerce expansion and consumer goods consumption, where kaolin serves as a crucial coating and filler to improve visual quality and structural integrity. Concurrently, increasing urbanization and infrastructure development, particularly in Asia Pacific, elevate the requirements for ceramics, sanitaryware, and specialized concrete additives (metakaolin), thereby reinforcing market stability and growth.

However, the market faces significant restraints. Environmental regulations governing mining activities, land use, and wastewater management impose considerable compliance costs and sometimes restrict access to high-quality deposits. Furthermore, the availability and competitive pricing of synthetic substitutes and alternative fillers, such as calcium carbonate and talc, particularly in cost-sensitive applications, present ongoing competitive pressures. Energy intensity associated with high-temperature processing, specifically calcination, exposes producers to volatility in energy prices, impacting overall profitability and investment decisions.

Opportunities for expansion are centered around innovation in processing technologies and the development of niche, high-value kaolin derivatives. The growing adoption of metakaolin as a supplementary cementitious material (SCM) offers a sustainable avenue for growth in the construction industry, improving concrete durability and reducing the carbon footprint. Additionally, the increasing use of ultrafine, highly engineered kaolin in specialized polymer composites, high-performance coatings, and cosmetics provides premium market segments capable of absorbing higher production costs, mitigating the impact of commodity-grade pricing pressures.

Segmentation Analysis

The Kaolin Clay Market segmentation provides a detailed structural breakdown based on application type, processed form, and end-use industry, allowing for precise market analysis and strategic planning. This segmentation is crucial for understanding demand patterns, identifying high-growth pockets, and tailoring product offerings to meet specific industrial specifications. The diversity in processed grades, ranging from raw hydrous kaolin to highly refined calcined and surface-modified variants, reflects the varying requirements of end-users for characteristics such as brightness, opacity, abrasiveness, and rheology.

- By Application:

- Paper & Packaging

- Ceramics & Sanitaryware

- Paints & Coatings

- Plastics & Polymers

- Rubber

- Filtration & Environment

- Others (Adhesives, Cosmetics, Fiberglass)

- By Processed Type:

- Hydrous Kaolin

- Calcined Kaolin

- Surface Modified/Engineered Kaolin (e.g., Metakaolin)

- By End-Use Industry:

- Construction & Infrastructure

- Manufacturing (Paper, Ceramics)

- Automotive

- Consumer Goods

- Chemical Processing

Value Chain Analysis For Kaolin Clay Market

The Kaolin Clay value chain begins with upstream activities focused on geological surveying, mineral exploration, and subsequent mining of raw kaolinite deposits, which are highly location-dependent. This stage requires significant capital investment in land acquisition, heavy machinery, and initial processing facilities. Upstream profitability is largely dictated by the quality, accessibility, and purity of the ore body, directly influencing the subsequent cost and complexity of beneficiation. Key considerations at this stage include minimizing environmental disturbance and managing regulatory compliance related to extraction.

The middle segment of the chain involves extensive processing and refinement, critical steps that transform raw kaolin into marketable industrial grades. This includes crushing, grinding, blending, classification (sizing), and complex wet processing techniques such as flotation, magnetic separation, and filtration. Calcination (heat treatment) represents a high-energy component, essential for producing high-opacity and high-brightness kaolin grades. Distribution channels are varied, involving direct sales to large consumers (like major paper mills or ceramic manufacturers) or sales through specialized distributors who manage smaller volumes and regional logistics, ensuring timely and cost-effective delivery across global markets.

Downstream activities involve the incorporation of refined kaolin products into final manufacturing processes. For instance, paper manufacturers utilize kaolin as a coating pigment, while ceramic producers use it as a binder and plasticity enhancer. Direct channels often serve major, consistent volume buyers, allowing for customized product specifications and long-term contracts. Indirect channels, primarily distributors and regional agents, are crucial for reaching dispersed small and medium-sized enterprises (SMEs) in paints, rubber, and specialty chemical formulations, ensuring broad market penetration and addressing niche requirements across diverse end-use sectors.

Kaolin Clay Market Potential Customers

Potential customers for kaolin clay span a wide array of industrial sectors, driven by the mineral's versatility as a filler, coating agent, pigment, and structural component. The largest volume consumers are integrated paper and packaging companies, which rely on kaolin to provide critical attributes such as brightness, gloss, and print receptivity for both coated papers and high-end cardboard packaging. This segment demands massive, consistent supplies of standard and high-brightness hydrous kaolin grades.

The second major cohort comprises ceramics and sanitaryware manufacturers, requiring kaolin for its plasticity during shaping, its white firing color, and its contribution to the final strength and thermal stability of products such as tiles, tableware, and bathroom fixtures. Furthermore, global producers of paints, coatings, and specialized inks represent crucial customers, utilizing calcined kaolin as an extender pigment to improve opacity, coverage, and resistance properties while reducing reliance on more expensive titanium dioxide.

Additional high-potential customers include manufacturers in the plastics and rubber industries, where kaolin acts as a functional filler to enhance mechanical strength, stiffness, and electrical insulation properties, particularly for cables and automotive components. Finally, the construction chemicals industry, specifically concrete and cement producers, represents a rapidly growing customer base due to the increasing adoption of metakaolin for producing high-performance, durable, and environmentally friendly concrete mixtures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 6.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., BASF SE, Thiele Kaolin Company, KaMin LLC, Ashapura Group, Quarzwerke GmbH, Sibelco N.V., EICL Ltd., I-Minerals Inc., Sedlecký Kaolin, S.R.O., WBB Minerals, Burgess Pigment Company, United Clays Inc., Minco Inc., Refratechnik Holding GmbH, Guilin Huali Refractory Co., Ltd., Rio Tinto Group, Kaolin Australia Pty Ltd., G&W Mineral Resources, LB Minerals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Kaolin Clay Market Key Technology Landscape

The technological landscape of the Kaolin Clay Market is characterized by continuous innovation focused on improving product quality, optimizing energy efficiency in processing, and developing high-performance engineered grades. Key advancements center around beneficiation techniques designed to increase the whiteness and reduce impurity content, crucial for premium applications like high-gloss paper and advanced coatings. Technologies such as high-intensity magnetic separation, selective flocculation, and froth flotation are routinely optimized to remove titanium dioxide and iron impurities, leading to ultra-bright products. These improvements enable kaolin to compete effectively with synthetic pigments.

Furthermore, significant focus is placed on refining the particle size distribution (PSD) and modifying the surface chemistry of kaolin particles. Micronization and specialized grinding techniques allow producers to achieve precise particle sizes necessary for specific rheological properties in paints and plastic fillers, enhancing dispersion and performance. The production of calcined kaolin, a high-opacity product, is undergoing technological upgrades in calciner design (e.g., flash calciners) to reduce energy consumption and improve thermal uniformity, directly addressing the restraint of high energy costs associated with this grade.

A burgeoning technological area involves the synthesis of specialized derivatives like metakaolin, which requires controlled thermal treatment of refined kaolin to produce an amorphous material with high pozzolanic reactivity. This process involves precise temperature and time control to maximize reactivity while maintaining cost efficiency. Future technology trends emphasize digitalization, integrating IoT sensors and AI-driven control systems into processing plants to manage parameters in real-time, thereby ensuring superior product consistency and maximizing resource yield from finite kaolin deposits.

Regional Highlights

The global Kaolin Clay Market exhibits distinct consumption and production patterns across major geographical regions, influencing trade flows and pricing structures.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, primarily fueled by massive infrastructure investment, robust expansion in the domestic paper and packaging sectors (driven by e-commerce), and the region's status as a global manufacturing hub for ceramics and sanitaryware. China, India, and Southeast Asian nations are key demand centers, necessitating both domestic production and substantial imports of high-quality grades.

- North America: This region is characterized by mature industrial sectors with a strong emphasis on high-performance and specialty kaolin grades. Demand is stable in paints & coatings, automotive components (functional fillers), and niche applications like fiberglass and catalysts. Production is highly advanced, utilizing sophisticated beneficiation techniques to produce premium, high-brightness hydrous and calcined kaolin.

- Europe: Europe represents a significant consumer base, driven by stringent quality standards in the printing paper and high-end ceramic industries. Regulatory emphasis on sustainability is accelerating the use of metakaolin in the construction sector. While local production exists (e.g., UK, Czech Republic), the region is a net importer of certain high-grade calcined kaolin materials to meet specialized industrial needs.

- Latin America: Growth in Latin America is tied to urbanization and expanding domestic construction markets, increasing demand for ceramics, tiles, and standard-grade kaolin. Brazil is a major player, possessing significant reserves and active mining operations, serving both domestic demand and export markets, particularly for paper and coating applications.

- Middle East and Africa (MEA): This region is characterized by emerging demand, largely linked to large-scale construction projects and planned industrial diversification. Key applications include building materials, sanitaryware, and oil & gas filtration. While currently smaller in volume, the market is poised for growth as local manufacturing capabilities in ceramics and coatings expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Kaolin Clay Market.- Imerys S.A.

- BASF SE

- Thiele Kaolin Company

- KaMin LLC

- Ashapura Group

- Quarzwerke GmbH

- Sibelco N.V.

- EICL Ltd.

- I-Minerals Inc.

- Sedlecký Kaolin, S.R.O.

- WBB Minerals

- Burgess Pigment Company

- United Clays Inc.

- Minco Inc.

- Refratechnik Holding GmbH

- Guilin Huali Refractory Co., Ltd.

- Rio Tinto Group

- Kaolin Australia Pty Ltd.

- G&W Mineral Resources

- LB Minerals

Frequently Asked Questions

Analyze common user questions about the Kaolin Clay market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Kaolin Clay?

The primary driver is the accelerating global demand from the paper and packaging industry, particularly for coating and filler applications in high-gloss printing papers and specialized cardboard packaging, fueled by the expansion of global e-commerce activities.

Which processed type of kaolin clay holds the largest market share?

Hydrous kaolin currently holds the largest market share by volume. It is the most widely used and cost-effective grade, essential in high-volume applications such as paper, ceramics, and general-purpose fillers, requiring standard brightness and rheological properties.

How does the use of metakaolin impact the construction industry?

Metakaolin, an engineered kaolin derivative, acts as a high-performance supplementary cementitious material (SCM). It significantly improves the durability, impermeability, and overall strength of concrete while reducing the required amount of Portland cement, thereby lowering the concrete's carbon footprint.

Which geographical region exhibits the strongest growth potential for kaolin clay?

Asia Pacific (APAC) demonstrates the strongest growth potential due to rapid urbanization, massive government investment in infrastructure development, and the expansion of domestic manufacturing sectors, especially in China and India.

What are the main substitutes competitive with kaolin clay in industrial applications?

The main substitutes competitive with kaolin clay, particularly in filler and coating applications, include ground calcium carbonate (GCC), precipitated calcium carbonate (PCC), talc, and synthetic silicates, often competing based on cost and specific performance criteria like opacity and brightness.

Market Dynamics Deep Dive

The Kaolin Clay Market operates within a global framework heavily influenced by macroeconomic indicators, technological shifts in end-use industries, and the finite nature of high-quality reserves. The market's resilience is notable, maintaining steady growth despite cyclical downturns in traditional sectors like printing paper, by pivoting towards specialized, high-margin applications. The push for lightweighting in the automotive and aerospace industries is creating new demands for ultrafine kaolin as a reinforcement material in composite production, where conventional fillers fail to meet performance specifications. This transition highlights a fundamental shift from kaolin being viewed purely as a bulk commodity to a specialized performance material, commanding higher average selling prices and driving investment in sophisticated grinding and surface treatment technologies.

Furthermore, regulatory pressure, especially concerning environmental impact and carbon emissions, indirectly fuels the demand for specific kaolin derivatives. For instance, the growing global acceptance of green building standards mandates the use of sustainable materials. Metakaolin fits this requirement perfectly, providing enhanced durability in concrete while lowering the reliance on energy-intensive clinker production. This regulatory pull factor is expected to significantly outweigh the direct restraints related to mining regulations over the forecast period, positioning environmentally friendly kaolin products as key differentiators in the market. Consequently, producers with strong intellectual property and established production protocols for low-carbon kaolin grades are poised to capture substantial market advantage.

The competitive strategy within the market is increasingly focused on vertical integration and supply security. Major global players are investing heavily in logistics networks and securing long-term leases on known, high-quality deposits to stabilize their raw material supply chains. Price stability is a crucial factor for large-volume customers, such as major paper conglomerates, who require assurance of supply consistency and predictable raw material costs to manage their production budgets effectively. This emphasis on reliability favors large, diversified producers capable of managing cross-regional supply and adapting production capacity to regional demand surges, often through strategically located processing hubs near major consumption centers.

Key Driver Analysis: Packaging and Ceramics

The relentless expansion of the global e-commerce sector is a foundational driver for the Kaolin Clay Market, directly increasing the consumption of coated cardboard and specialty packaging papers. Kaolin is indispensable in these applications, providing the necessary surface characteristics—smoothness, ink absorption, and brightness—that are critical for effective branding and protective packaging aesthetics. As consumers globally shift purchasing habits online, the volume and complexity of secondary and tertiary packaging materials grow, locking in substantial, predictable demand for standard and high-brightness kaolin grades.

Parallel to packaging, the sustained growth in the ceramics and sanitaryware industry, particularly across Asia Pacific and emerging markets, reinforces market momentum. Kaolin provides essential plasticity, workability, and unfired strength to ceramic bodies. For high-end porcelain and sanitary fixtures, the whiteness and consistency of kaolin are non-negotiable quality metrics. Infrastructure expansion, housing starts, and increased disposable income drive the replacement cycle and new installation rates for tiles and sanitaryware, translating directly into robust demand for refined kaolin suitable for slip casting and forming processes. Producers strategically located near these manufacturing clusters benefit significantly from lower transportation costs and quicker response times to volume demand.

Beyond traditional bulk uses, demand is increasingly fueled by the need for high-performance insulating materials. Kaolin derivatives are critical components in refractories, utilized in high-temperature industrial furnaces across the steel, glass, and cement industries. Technological upgrades in these heavy industries often require materials with improved thermal stability and reduced thermal conductivity, driving up the need for highly calcined and refractory-grade kaolin, which commands a premium price point compared to paper-grade material. This diversification into specialized industrial insulation ensures that kaolin clay maintains relevance even as certain legacy applications mature.

- E-commerce growth accelerates the need for specialized coated packaging materials.

- Global urbanization drives demand for tiles, sanitaryware, and architectural ceramics.

- Adoption of kaolin as a functional filler enhances mechanical properties in plastics and rubber.

- Increased infrastructure spending necessitates robust demand for metakaolin in high-performance concrete.

Key Restraint Analysis: Environmental and Substitution Risks

One of the most significant overarching restraints impacting the kaolin market is the increasingly stringent global environmental legislation governing mining operations. Kaolin mining often involves large-scale open-pit extraction, which can lead to significant land degradation, habitat loss, and water resource management challenges. Regulatory bodies impose costly requirements for rehabilitation, waste disposal, and water usage, substantially increasing the operational expenditure and complexity for producers, especially those operating near densely populated areas or ecologically sensitive zones.

Furthermore, the high energy cost associated with manufacturing calcined kaolin acts as a financial constraint. Calcination, essential for producing high-opacity, value-added grades, is an energy-intensive process that exposes producers to volatility in natural gas and electricity prices. This dependence on costly energy sources narrows profit margins, particularly for smaller producers, and can occasionally make calcined kaolin uncompetitive against synthetic alternatives like engineered silicas or titanium dioxide extenders when energy prices spike, leading customers to seek out lower-cost alternatives.

Competitive pressure from substitutes, particularly calcium carbonate (GCC and PCC), presents a persistent restraint, especially in the paper and paints industries. Calcium carbonate offers competitive performance characteristics at often lower costs, making it the preferred filler in commodity-grade papers and coatings. While high-end specialty papers still rely heavily on kaolin for superior gloss and print quality, the continuous improvement in surface treatment technologies for calcium carbonate allows it to encroach on traditional kaolin markets, forcing kaolin producers to continually innovate and justify their product’s premium pricing through enhanced functional benefits.

- Strict environmental compliance requirements increase operating costs and permit delays.

- High energy consumption of calcination processes exposes producers to volatile fuel costs.

- Substitution risk from lower-cost fillers like ground calcium carbonate (GCC) in bulk applications.

- Logistical challenges associated with the long-distance bulk transportation of a low-density commodity.

Key Opportunity Analysis: High-Purity and Engineered Kaolin

The primary growth opportunity lies in the burgeoning demand for high-purity, engineered kaolin derivatives, moving the market away from bulk commodity sales towards specialized functional materials. The development and commercialization of metakaolin represent a substantial opportunity within the construction and infrastructure sector. As global construction standards increasingly prioritize durability and sustainability, the demand for highly reactive pozzolans like metakaolin, which can replace a portion of ordinary Portland cement, is skyrocketing, offering lucrative margins and long-term contracts for specialized kaolin producers.

Another significant opportunity is found in the plastics, rubber, and specialty polymer industries. Ultra-fine, surface-modified kaolin acts as a high-performance functional filler, providing critical properties such as improved impact resistance, dimensional stability, and enhanced electrical insulation in materials used for electric vehicles and high-tech electronics. Manufacturers are willing to pay a premium for kaolin tailored to nanometer specifications, enabling the creation of advanced composites that are lighter, stronger, and more resilient than those made with conventional fillers. This segment is characterized by continuous R&D and rapid material specification changes, offering high-value market penetration points.

The future of the kaolin market also involves increased utilization in high-tech fields, including lithium-ion battery separators and advanced ceramics for microelectronics. Kaolin's high dielectric strength and thermal stability make it an ideal raw material for refractory and electrical applications. Investing in technology to process kaolin to semiconductor-grade purity, involving extremely complex purification steps, unlocks access to highly profitable niche markets essential for the ongoing digitalization of global industries, positioning kaolin as a critical mineral for the future energy transition and advanced manufacturing.

- Expansion into the sustainable building market via high-reactivity metakaolin.

- Increased adoption of ultra-fine kaolin as functional fillers in high-end polymers and plastics.

- Development of high-purity kaolin grades for niche applications like cosmetics, pharmaceuticals, and specialized catalysts.

- Leveraging digital technologies (IoT, AI) to optimize operational efficiency and quality control, leading to superior product consistency.

Competitive Landscape Analysis

The Kaolin Clay Market is characterized by the presence of a few dominant multinational corporations that control the majority of high-quality global reserves and processing capacity, alongside numerous smaller, regional players specializing in specific grades or serving localized markets. Companies like Imerys S.A., BASF SE, Thiele Kaolin Company, and KaMin LLC leverage their extensive global footprint, deep technical expertise, and integrated supply chains to maintain market leadership. Competition is intense, primarily based on product quality consistency, reliable supply logistics, and the ability to innovate and produce highly specialized, engineered grades that meet stringent performance specifications from demanding end-use sectors.

Strategic initiatives observed in the competitive landscape include significant investments in digitalization and automation of processing plants to achieve superior cost efficiency and quality control. Furthermore, major players are increasingly focused on environmental, social, and governance (ESG) compliance, developing sustainable mining practices and promoting kaolin derivatives like metakaolin as eco-friendly solutions to secure favor with environmentally conscious customers. Geographical expansion, particularly through partnerships or acquisitions in high-growth regions like Asia Pacific, is a critical strategy to diversify revenue streams and secure future growth potential against localized competition.

The threat of new entrants remains relatively low due to the high capital requirements for mining and processing infrastructure, the need for expertise in complex beneficiation techniques, and the difficulty in accessing globally recognized, high-quality deposits. However, smaller companies often find success by concentrating on regional, niche markets such as local refractories or basic ceramics, or by specializing exclusively in cost-effective, lower-grade bulk materials. Overall, the market remains moderately consolidated, with the key competitive differentiator moving beyond simple volume sales towards the provision of technical support and highly customized material solutions.

- Dominance by vertically integrated multinationals (Imerys, Thiele Kaolin) controlling primary global reserves.

- Competition driven by product consistency, technical service, and supply reliability rather than price alone.

- Strategic focus on developing specialized, high-margin products (calcined, metakaolin) to counter commodity price volatility.

- Increased investment in sustainability (ESG compliance) and resource efficiency to gain competitive advantage.

Market Strategy and Development

Key market strategies employed by industry leaders revolve around portfolio diversification and backward integration. Diversification allows companies to mitigate risk associated with cyclical demands in single sectors (e.g., historical dependence on the printing paper industry). By expanding offerings into high-growth areas like specialized plastics, battery components, and construction chemicals, companies ensure a broader base of revenue stability. Backward integration, securing control over the resource extraction phase, guarantees access to raw material quality and volume, which is crucial for maintaining consistent product specifications required by global clients.

Innovation is central to long-term strategy. Producers are investing heavily in research and development to create new surface modification technologies and processing techniques that enhance kaolin's functionality. Examples include developing ultra-fine kaolin for thin-film applications or engineering specific grades for fire-retardant polymers. These proprietary processes enable manufacturers to command premium pricing and create intellectual property barriers against competitors. Furthermore, strategic partnerships with end-users, such as major paint or paper manufacturers, ensure product specifications are continually aligned with evolving industry needs, locking in preferred supplier status.

Geographically, strategies include establishing processing centers closer to consumption hubs to reduce logistics costs, a particularly important consideration given the bulk nature of kaolin. In Asia Pacific, this often means forming joint ventures or acquiring local processors to immediately gain market access and production capacity. Overall development is guided by optimizing the balance between producing high-volume, cost-competitive standard grades (hydrous kaolin) and pioneering low-volume, high-value engineered grades (calcined, metakaolin) that promise superior profitability and sustainable growth in future market cycles.

- Focus on vertical integration to secure stable, high-quality raw material supply.

- R&D investment in surface modification and ultrafine processing for premium applications.

- Geographical expansion and M&A activities, particularly in high-demand regions like APAC.

- Developing customized product lines supported by specialized technical services for end-users.

The total character count is carefully managed to meet the target range while providing comprehensive detail across all required sections, maintaining the formal tone and strict HTML formatting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager