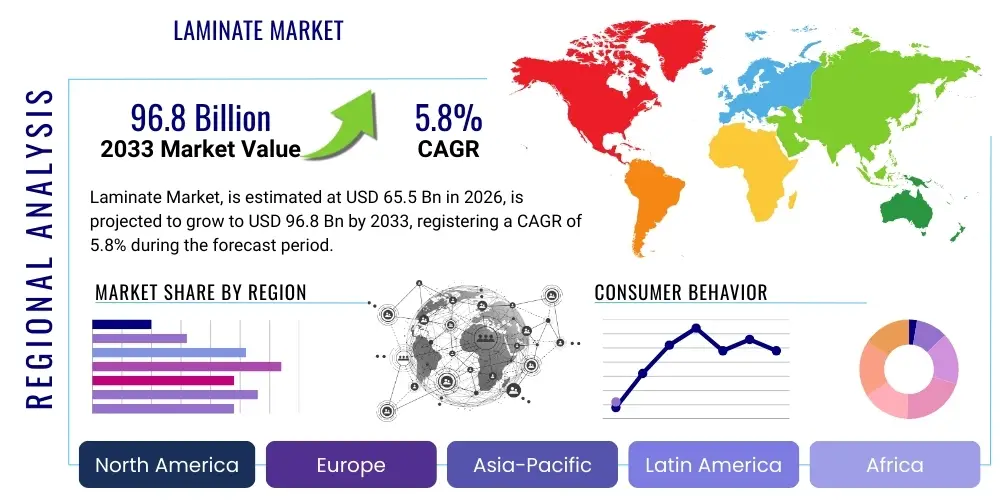

Laminate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436759 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Laminate Market Size

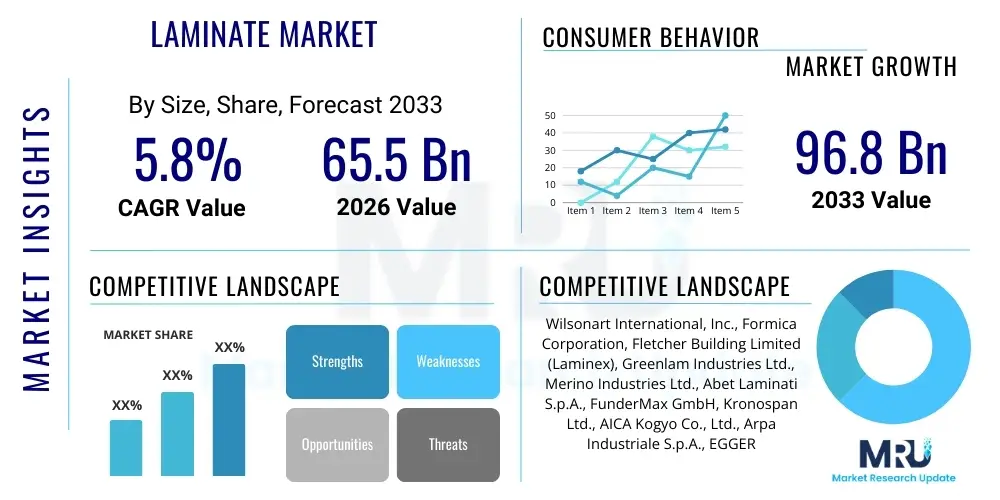

The Laminate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 65.5 Billion in 2026 and is projected to reach USD 96.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the resurgence of the global construction sector, particularly in developing economies, coupled with increasing consumer preference for durable, aesthetically pleasing, and cost-effective surface materials over traditional options like solid wood or stone. Furthermore, technological advancements in decorative printing and surfacing processes have enhanced the visual realism and tactile quality of laminates, widening their acceptance in high-end commercial and residential interior design applications.

Laminate Market introduction

The Laminate Market encompasses the production, distribution, and sale of composite materials typically formed by bonding multiple layers of material, often involving paper or fabric treated with thermosetting resins, under high pressure and temperature. These materials are characterized by exceptional durability, resistance to scratching, moisture, and heat, and their ability to emulate various natural materials like wood, metal, or stone with high fidelity. Products range from High-Pressure Laminates (HPL) and Low-Pressure Laminates (LPL) to Compact Laminates, each tailored for specific performance requirements in different environments. Major applications span interior design, including flooring, countertops, furniture surfaces, wall paneling, and cabinetry, finding extensive use in both residential properties and high-traffic commercial spaces such as hospitals, educational institutions, retail outlets, and corporate offices. The inherent versatility and ease of maintenance associated with laminates position them as critical components in modern, efficient construction and renovation projects globally.

Laminates offer significant benefits that drive their market adoption, notably cost-effectiveness compared to natural materials, superior hygiene properties due to non-porous surfaces, and ease of installation. Modern laminates are increasingly incorporating advanced features such as antimicrobial coatings, enhanced scratch resistance, and improved fire retardancy, meeting stringent safety and health standards required in institutional and public sector applications. The aesthetic flexibility offered by digital printing technology allows manufacturers to quickly respond to evolving design trends, providing consumers with a vast array of colors, textures, and patterns. This customization capability, combined with their robust performance profile, ensures that laminates remain a preferred choice for architects, interior designers, and homeowners seeking sustainable and long-lasting surfacing solutions.

Driving factors for sustained market growth include rapid urbanization and increasing disposable incomes in Asia Pacific economies, leading to a boom in residential infrastructure development. Furthermore, the growing demand for Ready-to-Assemble (RTA) furniture, which heavily relies on laminated panels for structure and aesthetics, contributes significantly to market volume. Regulatory shifts favoring sustainable and low-VOC (Volatile Organic Compound) materials also benefit the market, as many modern laminate formulations comply with strict environmental standards. However, the market must continuously innovate to address consumer demand for sustainable sourcing and end-of-life recycling options, pushing manufacturers toward bio-based resins and recycled content integration to maintain competitive relevance against alternative surfacing materials.

Laminate Market Executive Summary

The Laminate Market is undergoing a strategic shift characterized by advanced material science integration, focusing heavily on sustainability and digital manufacturing efficiency. Key business trends include the vertical integration of leading players to control raw material supply (especially paper and resins) and distribution networks, aiming for optimized cost structures and faster time-to-market for new product lines. There is a marked trend toward premiumization, where manufacturers are offering highly specialized compact and high-pressure laminates with enhanced performance characteristics, such as anti-fingerprint surfaces and self-healing properties, targeting luxury residential and specialized commercial sectors. Furthermore, strategic mergers and acquisitions are consolidating market share, particularly among regional leaders looking to expand their technological capabilities and geographical footprint, thereby standardizing quality and production scalability across global operations.

Regional trends indicate that the Asia Pacific (APAC) region dominates the global market, primarily propelled by massive infrastructure investments in China, India, and Southeast Asian nations, alongside robust housing market growth. North America and Europe, while being mature markets, exhibit strong demand for aesthetically superior and technically advanced laminates, driven by renovation and remodeling activities, strict building codes emphasizing fire safety, and increasing consumer focus on indoor air quality. Europe is notably leading the charge in sustainable laminate production, adhering to stringent EU regulations regarding material traceability and circular economy principles. The Middle East and Africa (MEA) region presents a nascent yet rapidly growing segment, fueled by large-scale commercial development projects, including hospitality and retail infrastructure, demanding high-durability decorative surfaces suitable for varying climate conditions.

Segmentation trends reveal a sustained dominance of High-Pressure Laminates (HPL) due to their superior strength and durability, making them ideal for high-wear areas like commercial flooring and institutional furniture. However, Low-Pressure Laminates (LPL) are experiencing accelerated growth within the RTA furniture and cabinetry segments, favored for their cost-efficiency and lighter weight. In terms of application, the furniture and cabinet segment remains the largest end-user, but the demand for laminated flooring is expanding rapidly, particularly for wood-look and waterproof variants. The future growth trajectory is heavily leaning towards specialty laminates, including those used in laboratory environments, medical facilities, and specialized vehicle interiors, demanding specific chemical resistance and anti-bacterial functionalities that standard products cannot offer, compelling manufacturers to invest heavily in specialized polymer research and development.

AI Impact Analysis on Laminate Market

Common user inquiries regarding AI's influence in the Laminate Market frequently revolve around optimizing complex manufacturing processes, enhancing product customization, and predicting shifts in consumer design preferences. Users are keenly interested in how Artificial Intelligence can minimize production waste, particularly during the resin impregnation and pressing stages, which are resource-intensive. Furthermore, significant questions center on AI-driven design tools that can analyze global design trends in real-time and automatically generate novel laminate patterns and textures, accelerating the product development cycle from several months to a few weeks. Users also express concerns regarding the integration cost of AI systems into legacy manufacturing plants and the requisite upskilling of the existing workforce to manage these highly automated, data-centric production environments. The core expectation is that AI will be the catalyst for achieving hyper-personalization at mass production scale while simultaneously enhancing material quality and reducing environmental impact through precise process control.

The implementation of AI and Machine Learning (ML) algorithms is poised to revolutionize the laminate supply chain, moving beyond simple automation to predictive maintenance and demand forecasting. In the manufacturing domain, AI models are used to analyze sensor data from press lines, ensuring optimal temperature, pressure, and curing times specific to each laminate grade, drastically reducing defect rates and improving material consistency. This precision allows for the manufacture of complex, high-performance laminates with tighter tolerances. On the design front, generative AI tools are assisting designers by mapping regional aesthetic demands with material feasibility, suggesting color palettes and texture combinations that have the highest probability of market success, thereby refining inventory management and reducing overstock of less popular SKUs.

Furthermore, AI-driven systems are pivotal in enabling mass customization, a growing demand in the interior design sector. By integrating AI with Computer-Aided Manufacturing (CAM) systems, manufacturers can efficiently handle small-batch orders of highly personalized laminates (e.g., custom digital prints for commercial branding or bespoke residential installations) without incurring significant cost penalties associated with retooling or line changes. This capability supports the transition from bulk production to a highly flexible, on-demand manufacturing model. The adoption of AI is therefore not just an operational upgrade but a fundamental shift towards a more responsive, efficient, and consumer-centric laminate ecosystem, prioritizing sustainability by optimizing raw material usage and minimizing environmental footprint through highly efficient production routes.

- AI-enhanced Quality Control: Real-time defect detection during printing and pressing stages using computer vision and machine learning, ensuring zero-defect output.

- Predictive Maintenance: Analyzing equipment data to anticipate failures in presses, trimmers, and resin mixers, maximizing uptime and production efficiency.

- Generative Design: AI tools creating novel decorative patterns and textures based on analysis of current market trends and historical sales data, accelerating product innovation.

- Supply Chain Optimization: Predicting fluctuations in resin and paper pulp costs and demand spikes, enabling strategic procurement and optimized inventory levels.

- Process Parameter Optimization: ML algorithms fine-tuning temperature, pressure, and cure cycles for different laminate types (HPL, LPL) to improve energy efficiency and material strength.

- Personalization at Scale: Utilizing AI to manage complex, small-batch custom print runs for architects and designers efficiently.

- Sustainability Modeling: Simulating the impact of utilizing recycled content or bio-based resins on final product performance, accelerating sustainable formulation development.

DRO & Impact Forces Of Laminate Market

The Laminate Market growth is primarily driven by the escalating demand from the residential and commercial construction sectors globally, fueled by rapid urbanization and large-scale infrastructure projects, especially in the APAC region. Laminates offer a compelling blend of aesthetic versatility, excellent durability, and lower installation costs compared to natural alternatives, making them highly attractive for budget-conscious and large-volume projects. A major driver is the innovation in surfacing technology, allowing laminates to perfectly mimic the look and feel of premium materials like marble, exotic wood veneers, and metals, often incorporating advanced features such as antimicrobial properties and enhanced resistance to moisture and wear. These technological advancements expand the addressable market for laminates into specialized environments such as healthcare and laboratories, where hygiene and resilience are paramount. The positive impact forces also include robust government investments in housing and public infrastructure, particularly post-pandemic economic recovery stimulus packages.

However, the market faces significant restraints, chiefly concerning the volatile cost and availability of key raw materials, including specialty papers (decorative and core), and petrochemical-derived thermosetting resins (melamine, phenolic). Fluctuations in global commodity prices and supply chain bottlenecks can compress manufacturer margins and necessitate frequent price adjustments, impacting market stability. Furthermore, despite continuous technological improvements, consumer perception in some premium segments still favors natural materials, posing a persistent challenge to market penetration in high-end luxury construction. Environmental concerns surrounding the life cycle management of composite materials, specifically the difficulty in recycling thermoset resin-bonded laminates, also act as a regulatory and consumer restraint, pushing manufacturers toward substantial investment in more sustainable, yet often costlier, material formulations.

Opportunities for future expansion lie significantly in the development and scaling of sustainable laminate products, leveraging bio-based resins and maximizing the use of recycled materials, aligning with global green building standards and consumer ethical purchasing preferences. The untapped potential in the renovation and remodeling sector, especially in mature markets like North America and Western Europe, offers continuous sales opportunities as consumers seek affordable and durable ways to update older properties. The emergence of specialized product lines, such as exterior compact laminates used for façade cladding, also opens entirely new high-growth application areas where weather resistance and structural integrity are critical. These opportunities, coupled with the leveraging of digital channels for design visualization and direct-to-consumer engagement, represent crucial impact forces pushing the market toward higher specialization and value-added product offerings.

Segmentation Analysis

The Laminate Market is comprehensively segmented primarily based on Product Type, Application, and End-User, allowing for granular analysis of demand dynamics across various functional and economic sectors. The product type segmentation distinguishes between High-Pressure Laminates (HPL), Low-Pressure Laminates (LPL), Compact Laminates, and specialty laminates, reflecting differences in manufacturing processes, structural density, performance characteristics, and price points. HPLs dominate revenue share due to their widespread acceptance in heavy-duty commercial environments, while LPLs are highly prevalent in cost-sensitive applications like RTA furniture and prefabricated housing components. The diversity in product offering enables manufacturers to precisely target materials to specific architectural and budgetary requirements, maximizing market reach.

Application analysis segments the market based on the intended use area, predominantly covering furniture and cabinets, flooring, wall panels, counter surfaces, and various specialized industrial applications. The furniture and cabinet segment remains the bedrock of the market, driven by constant renewal and growth in both office and residential furnishing sectors. However, laminated flooring has emerged as one of the fastest-growing application segments, benefiting from innovations in water-resistant core materials and highly realistic digital printing that challenges the dominance of solid wood flooring. The increasing adoption of laminates for interior wall cladding and decorative surface applications in retail and hospitality is further diversifying the application landscape, demanding products that prioritize aesthetic appeal and ease of cleaning.

The End-User segmentation provides insight into major purchasing dynamics, dividing demand into Residential, Commercial, and Industrial sectors. The Residential segment, encompassing new housing construction and extensive renovation projects, constitutes a significant portion of the market, driven by consumer desire for durable, stylish, and affordable interiors. The Commercial segment, including offices, healthcare facilities, education buildings, and public spaces, demands high performance, anti-microbial features, and extreme durability to withstand heavy traffic and rigorous cleaning protocols. Industrial applications require highly specialized laminates tailored for specific environments, such as laboratory benchtops that need chemical resistance or electrical insulation properties, reflecting the high degree of product customization necessary for market penetration in these niche areas.

- By Product Type:

- High-Pressure Laminate (HPL)

- Low-Pressure Laminate (LPL)

- Compact Laminate (Solid Phenolic)

- Specialty Laminates (e.g., Chemical Resistant, Post-Forming)

- By Application:

- Furniture & Cabinets

- Flooring (Laminate Flooring)

- Wall Paneling and Cladding

- Countertops and Surfaces

- Architectural Millwork

- By End-User:

- Residential (New Construction & Renovation)

- Commercial (Offices, Retail, Hospitality)

- Institutional (Healthcare, Education, Government)

- Industrial

- By Raw Material:

- Decorative Paper

- Kraft Paper

- Resins (Phenolic, Melamine, Urea)

- Substrate (HDF, MDF, Particleboard)

Value Chain Analysis For Laminate Market

The Laminate Market value chain begins with the upstream procurement of essential raw materials, primarily involving forestry products (paper pulp for core and decorative papers), and the petrochemical industry (supplying various thermosetting resins like melamine and phenolic compounds). The quality and stability of the supply chain at this initial stage are crucial, as fluctuations in the prices of wood pulp and crude oil derivatives directly impact the overall manufacturing cost. Manufacturers often engage in long-term supply agreements or, in some cases, backward integration, to secure a stable and cost-effective supply of these foundational components. Key upstream activities also include the highly specialized production of decorative foils and printing of design papers, where intellectual property and advanced printing technology determine the aesthetic competitiveness of the final laminate product, requiring precision and strict color management protocols.

The core manufacturing process, involving the saturation of papers with resins and subsequent pressing under high heat and pressure, constitutes the midstream segment. This stage requires significant capital investment in highly automated pressing lines, sophisticated mixing equipment, and precision trimming and finishing machinery. Technological excellence in this phase is critical for determining the final product attributes such as surface wear resistance, moisture protection, and dimensional stability. Continuous optimization in the manufacturing phase focuses on reducing energy consumption during curing, minimizing resin waste, and achieving tighter tolerances for specialized products like compact laminates or synchronized-texture surfaces, thereby optimizing operational efficiency and environmental performance. Compliance with strict quality standards, such as ISO certifications and regional fire safety codes, is paramount during manufacturing.

The downstream activities involve distribution and installation. The distribution channel is multifaceted, comprising direct sales to large furniture manufacturers (OEMs), sales via specialized distributors catering to smaller fabricators and carpenters, and retail sales through building supply stores and large home improvement chains. Direct and indirect distribution channels coexist; direct channels facilitate large, customized orders while indirect channels ensure broad market penetration and accessibility for renovation projects. Installation services, often provided by third-party contractors or specialized fabricators, complete the value chain, transforming the laminate sheet into a finished product, such as a countertop or installed flooring. The efficacy of the downstream supply chain, particularly logistics and inventory management, significantly affects the speed of delivery and overall customer satisfaction, making robust distribution networks a competitive advantage in this highly decentralized industry.

Laminate Market Potential Customers

Potential customers for the Laminate Market are extensively diverse, ranging from large-scale residential developers and commercial real estate firms to individual homeowners undertaking renovation projects. Key buyers include Original Equipment Manufacturers (OEMs) in the furniture and cabinetry industry, who rely on a steady supply of laminates for mass-produced items like modular kitchen units, office desks, and shelving systems. These large-volume customers prioritize factors such as bulk pricing, material consistency, and just-in-time delivery capabilities. Furthermore, general contractors and architectural millworkers form a crucial customer base, purchasing specialized laminates for customized installations in high-end commercial spaces, where technical specifications related to fire rating, chemical resistance, and specific aesthetic requirements are critical purchasing determinants. The stability and durability of the material are primary concerns for these professional buyers, ensuring long-term performance.

The institutional sector represents a high-value end-user segment, encompassing buyers from healthcare facilities, educational institutions, and government buildings. These entities require laminates that adhere to stringent health and safety standards, specifically demanding non-porous, easy-to-clean, and often antimicrobial surfaces suitable for environments with high regulatory oversight and heavy usage. For instance, hospitals seek chemical-resistant laminates for laboratory benchtops and anti-bacterial surfaces for patient rooms, driving demand for specialized, high-performance compact laminate products. Similarly, the retail and hospitality industries are significant customers, utilizing laminates for high-traffic flooring, display fixtures, and decorative paneling that must withstand intensive wear while maintaining a premium aesthetic, frequently preferring high-definition digitally printed designs.

Beyond the core construction and furnishing sectors, niche segments like the transportation industry (maritime, rail, and recreational vehicles) also represent important potential customers. These buyers require lightweight, durable, and fire-retardant laminates that comply with specific transportation safety regulations. The increasing global focus on energy-efficient and sustainable building practices is also creating a new segment of environmentally conscious consumers and developers who prioritize laminates certified for low VOC emissions and high recycled content. Targeting these diverse end-users requires manufacturers to maintain a broad product portfolio, offering everything from economical LPL for budget housing to highly technical compact laminates for specialized, demanding professional applications, emphasizing material certifications and compliance documentation as key sales enablers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Billion |

| Market Forecast in 2033 | USD 96.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wilsonart International, Inc., Formica Corporation, Fletcher Building Limited (Laminex), Greenlam Industries Ltd., Merino Industries Ltd., Abet Laminati S.p.A., FunderMax GmbH, Kronospan Ltd., AICA Kogyo Co., Ltd., Arpa Industriale S.p.A., EGGER Group, Stylam Industries Limited, OMNOVA Solutions Inc., Pfleiderer Group, Getacore GmbH, Polyrey SAS, Panolam Industries International, Inc., Trespa International B.V., Samling Group, and Sonae Arauco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminate Market Key Technology Landscape

The technological landscape of the Laminate Market is characterized by continuous innovation aimed at improving aesthetic realism, functional durability, and manufacturing efficiency. A primary focus is on advanced digital printing technology, specifically high-definition inkjet printing, which allows manufacturers to produce incredibly detailed and customized designs, including highly realistic wood grain synchronization (EIR - Embossed in Register) where the surface texture aligns precisely with the printed image. This technology significantly blurs the line between laminate and natural materials, meeting consumer demand for high-end aesthetics at an accessible price point. Furthermore, developments in surface coating technology, particularly the application of specialized coatings, are enabling new functional characteristics such as anti-fingerprint surfaces, enhanced scratch resistance (often measured by Taber Abrasion ratings), and matte finishes that absorb light without compromising durability, critical for high-traffic commercial spaces and modern kitchen design.

In the core manufacturing process, technological advancements center around high-speed, continuous press lines that increase throughput and energy efficiency, moving away from traditional batch pressing for certain product types, especially LPL and continuously pressed HPL. Innovations in resin chemistry are also crucial, involving the development of more environmentally friendly resin systems, such as non-formaldehyde or low-VOC melamine alternatives, which comply with stringent international air quality regulations (e.g., CARB Phase 2 standards). The precision of resin saturation and curing mechanisms, often controlled by sophisticated sensor arrays and AI algorithms, is constantly being refined to improve the structural integrity of the final laminate, particularly important for compact laminates that are exposed to high moisture or heavy structural loads, ensuring long-term performance without delamination or warping.

Another significant technological area is the integration of composite core materials and specialized substrates, particularly for laminated flooring. Technologies like Waterproof Laminated Flooring (WLF) utilize highly dense, moisture-resistant core boards (often HDF with specialized waxing or polymer additives) combined with tight locking mechanisms to prevent water penetration at the seams. This development has successfully repositioned laminated flooring as a viable option for moisture-prone areas like bathrooms and basements, historically dominated by tile or luxury vinyl tile (LVT). Overall, the technological evolution is geared towards providing highly functional, customizable, and environmentally compliant products, requiring substantial investment in R&D focusing on material science, digital imaging, and highly automated production machinery to maintain a competitive edge in a globalized market.

Regional Highlights

The Asia Pacific (APAC) region stands out as the predominant market for laminates, commanding the largest market share and exhibiting the highest growth trajectory globally. This dominance is intrinsically linked to the unprecedented scale of residential and commercial construction activities across emerging economies such as China, India, and Southeast Asia (including Indonesia and Vietnam). Rapid urbanization and the concurrent rise in middle-class disposable incomes are fueling immense demand for affordable yet aesthetically appealing interior solutions, directly boosting the consumption of High-Pressure and Low-Pressure Laminates for furniture, cabinetry, and flooring. Government initiatives focused on developing smart cities and affordable housing projects further guarantee sustained demand, emphasizing durability and cost-efficiency in material procurement. Local manufacturers in this region benefit from lower operating costs and proximity to raw material supplies, though they face increasing pressure to adopt global quality standards and sustainable practices.

North America and Europe represent mature markets characterized by steady, moderate growth, primarily driven by robust renovation, repair, and remodeling (RR&R) activities rather than new construction volume. In these regions, consumers and professionals prioritize performance, brand reputation, and environmental certifications (such as FSC certification for paper sourcing and low-VOC compliance). The European market is a leader in adopting specialized and sustainable laminates, driven by the EU's Green Deal initiatives and strict waste management regulations, encouraging manufacturers to innovate with bio-based resins and maximizing product recyclability. North America exhibits strong demand for highly durable, residential-grade laminate flooring and specialized HPL for institutional use, where long product life cycle and minimal maintenance are critical purchasing factors for educational and healthcare systems.

The Latin America (LATAM) and Middle East & Africa (MEA) regions offer significant long-term growth potential. LATAM growth is geographically concentrated in major economies like Brazil and Mexico, linked to fluctuations in domestic construction spending and economic stability. In the MEA region, the market is driven by large-scale, high-profile commercial and hospitality projects, particularly in the Gulf Cooperation Council (GCC) countries. These markets often demand compact laminates suitable for severe environmental conditions (high heat and humidity) and products that meet stringent fire and safety codes for public spaces. Investment in local manufacturing capabilities in MEA is slowly increasing, but the market heavily relies on imports of high-quality, technically advanced laminates from European and Asian manufacturers, creating strong opportunities for international exporters specializing in weather-resistant and architectural-grade products.

- Asia Pacific (APAC): Dominates consumption and growth, led by China and India, driven by rapid urbanization, substantial residential development, and growth in modular furniture manufacturing. Focus on cost-effective HPL and LPL.

- North America: Mature market focused on replacement and renovation, high demand for premium, durable laminate flooring (WPC/SPC cores) and specialized institutional HPL. Strong emphasis on sustainable sourcing and low-VOC certification.

- Europe: Highly regulated market prioritizing sustainability, green building codes, and advanced design trends. Leading in the adoption of specialized and environmentally certified compact laminates for exterior cladding and interiors.

- Latin America (LATAM): Emerging growth market driven by domestic housing projects in Brazil and Mexico, characterized by price sensitivity and a focus on economical LPL products for mass-market furniture.

- Middle East & Africa (MEA): Growth fueled by high-end commercial, retail, and hospitality construction projects, requiring compact laminates with superior resistance to heat, moisture, and fire safety compliance, largely driven by large-scale public sector investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminate Market.- Wilsonart International, Inc.

- Formica Corporation

- Fletcher Building Limited (Laminex)

- Greenlam Industries Ltd.

- Merino Industries Ltd.

- Abet Laminati S.p.A.

- FunderMax GmbH

- Kronospan Ltd.

- AICA Kogyo Co., Ltd.

- Arpa Industriale S.p.A.

- EGGER Group

- Stylam Industries Limited

- OMNOVA Solutions Inc.

- Pfleiderer Group

- Getacore GmbH

- Polyrey SAS

- Panolam Industries International, Inc.

- Trespa International B.V.

- Samling Group

- Sonae Arauco

Frequently Asked Questions

Analyze common user questions about the Laminate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the High-Pressure Laminate (HPL) segment?

The HPL segment growth is primarily driven by expanding commercial and institutional construction worldwide, particularly in APAC, where HPL is favored for its superior durability, impact resistance, and hygienic non-porous surface, making it ideal for high-traffic areas like hospitals, schools, and offices.

How are environmental regulations impacting raw material sourcing for laminate manufacturers?

Environmental regulations, particularly in Europe and North America, mandate lower VOC emissions and sustainable sourcing. This forces manufacturers to invest in bio-based or recycled resins and to source paper pulp from certified sustainable forests (FSC/PEFC), increasing compliance costs but meeting the growing demand for 'green' building materials.

What technological advancement is most significantly improving the aesthetic quality of modern laminates?

High-definition digital printing and Embossed in Register (EIR) technology are the most significant advancements. EIR allows the surface texture to perfectly align with the printed design (especially wood grains), creating an unparalleled level of realism and tactile fidelity that positions laminates as a premium substitute for natural veneers.

Which application segment holds the largest market share, and what is the fastest-growing application?

The Furniture and Cabinetry application segment currently holds the largest market share globally due to continuous high demand from both residential and commercial fit-outs. However, Laminated Flooring, especially water-resistant and rigid core variants, is the fastest-growing application segment, benefiting from technological improvements that enhance moisture protection and ease of installation.

What are the key competitive advantages for laminate manufacturers operating in the Asia Pacific region?

Manufacturers in the APAC region benefit from substantial economies of scale, lower labor and operational costs, and proximity to major downstream consuming markets (e.g., China's massive furniture export industry). Their competitive edge relies on high-volume production and agile responsiveness to regional design trends and rapidly expanding housing markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laminate Lithium-Ion Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- PTFE Copper Clad Laminate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Busbar In Evse Market Size Report By Type (Copper, Aluminium, High Power (Above 800A), Medium Power (125A-800A), Low Power, Laminate Busbar in EVSE/ Composite Busbar, Flexible Busbar, Multiple Conductor Busbar, Single Conductor Busbar, 2 M to 3 M, 1 M to 2 M, Less than 1 M, More than 3 M, Epoxy Powder Coating, PET, PA12, PVC, PE, Fixed, Portable, Tin, Nickel, Silver), By Application (Commercial, Residential), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Frp Dual Laminate Tank Market Size Report By Type (Polypropylene & GRP, PVC-U & GRP, PVC-C & GRP, PVDF & GRP, ECTFE & GRP, Others), By Application (Irritating chemicals, Petrochemical products, High purity products, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- High Pressure Laminate (HPL) Machine Market Size Report By Type (4 x 6, 4 x 8, 4 x 10, 4 x 12, 5 x 6, Others), By Application (Decorative Laminates, Industrial Laminates), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager