Laminated Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433973 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Laminated Steel Market Size

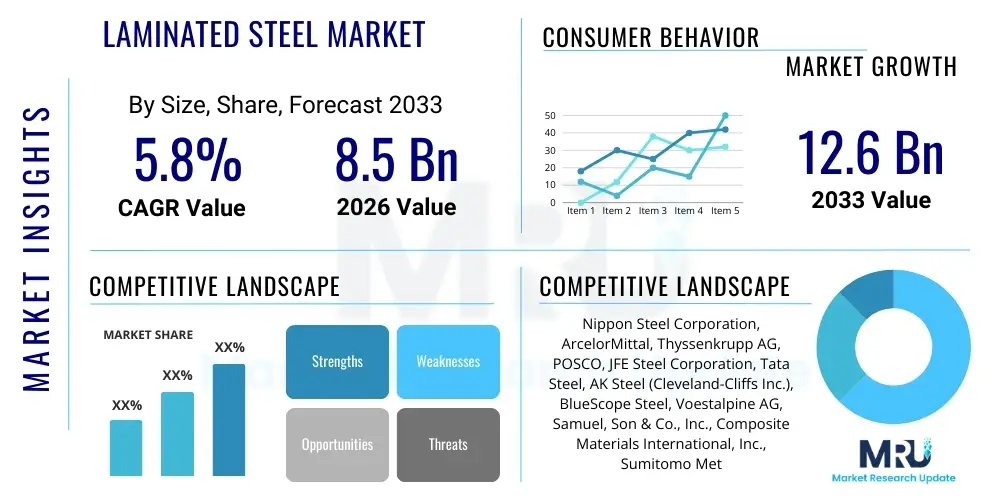

The Laminated Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Laminated Steel Market introduction

Laminated steel, often referred to as clad steel or composite steel, constitutes a specialized class of metallic material manufactured by bonding two or more layers of different metals, or steel layers combined with non-metallic interlayers (such as polymers or specialized adhesives), under extreme heat and pressure. This composite structure is engineered to leverage the superior characteristics of each component, typically resulting in a final product that offers enhanced properties—such as superior corrosion resistance, improved acoustic damping, increased thermal insulation, and exceptional strength-to-weight ratios—compared to monolithic steel. The primary goal of lamination is to achieve multi-functionality tailored to stringent industrial requirements, particularly where weight reduction or noise mitigation is critical.

The applications of laminated steel are expansive and highly diverse, spanning sectors demanding robust performance and longevity. Major application areas include the automotive industry, where it is extensively used for body panels, engine components, and thermal shields to reduce vehicle weight and improve fuel efficiency while ensuring structural integrity and NVH (Noise, Vibration, and Harshness) performance. Furthermore, it is pivotal in the construction sector for roofing and cladding, and significantly utilized in electrical engineering for transformer cores and motor laminations due to its desirable magnetic properties and reduced eddy current losses.

The market is predominantly driven by the accelerating demand for lightweight, energy-efficient, and sustainable materials across major economies. Regulatory pressures related to vehicle emissions and noise pollution necessitate the adoption of advanced materials like laminated steel, which inherently offer superior acoustic and thermal management solutions. Benefits such as extended product lifecycle, reduced maintenance costs, and adaptability to complex forming processes further cement its position as a material of choice in high-specification manufacturing environments. The confluence of technological advancements in bonding techniques and the need for high-performance composites fuels the sustained expansion of this specialized metal segment.

Laminated Steel Market Executive Summary

The global Laminated Steel Market exhibits robust growth, primarily propelled by systemic shifts in industrial design focusing on electrification, lightweighting, and enhanced material durability. Current business trends indicate a strong move towards multi-layer lamination involving high-strength steel grades and advanced polymer interlayers, enabling manufacturers to meet stringent safety standards and efficiency metrics in the automotive and aerospace industries. Consolidation among key players and significant investments in continuous coil coating and bonding lines are reshaping the competitive landscape, emphasizing efficiency gains and customization capabilities, particularly for electromagnetic applications requiring precision lamination.

Regionally, Asia Pacific (APAC) continues to dominate the market in terms of production and consumption volume, underpinned by vast manufacturing hubs in China, India, and South Korea, particularly for automotive and consumer electronics production. North America and Europe, while representing mature markets, demonstrate leadership in adopting high-value, specialized laminated products focused on acoustic insulation and advanced battery enclosures for Electric Vehicles (EVs). These Western regions prioritize innovation in sustainable and recyclable laminated solutions, driving premium market growth, whereas APAC drives volume through rapid industrial expansion and infrastructural projects.

Segment trends reveal that the use of Laminated Steel based on the Type of Layering (e.g., polymer-steel composites) is gaining significant traction over traditional metal-metal cladding, predominantly due to superior acoustic damping properties required in modern vehicle cabins and appliance casings. The application segment sees the Automotive industry maintaining its lead, projected to experience the highest CAGR due to the ongoing global EV transition, necessitating high volumes of specialized laminated steel for thermal management systems and lightweight body structures. Furthermore, the Electrical & Electronics segment is experiencing specialized demand for materials optimizing magnetic performance and energy efficiency in high-frequency devices.

AI Impact Analysis on Laminated Steel Market

Common user questions regarding AI's impact on the Laminated Steel Market frequently center on whether Artificial Intelligence can optimize the complex, multi-variable manufacturing process, predict material performance under stress, and accelerate the development of novel composite structures. Users are keen to understand if AI-driven quality control systems can reduce defects associated with bonding and adhesion, which are critical failure points in lamination. There is also significant curiosity about how AI and Machine Learning (ML) can influence supply chain resilience, forecasting raw material price fluctuations (steel and polymers), and optimizing inventory levels for highly customized laminated coils, moving beyond traditional statistical process control.

AI is profoundly influencing the laminated steel sector by enabling unprecedented levels of manufacturing precision and material innovation. Machine learning algorithms are being integrated into continuous lamination lines to perform real-time analysis of bonding parameters, including pressure, temperature gradients, and adhesive thickness. This allows for immediate process adjustments, significantly reducing material waste and improving the consistency and integrity of the interfacial bond layer, thereby addressing the core technical challenge of composite failure. Furthermore, predictive maintenance powered by AI monitors the health of high-capital lamination equipment, minimizing downtime and maximizing operational throughput.

The deployment of AI-based simulation tools is revolutionizing product development. Generative design techniques, informed by ML models trained on vast datasets of material properties, allow researchers to rapidly model and test thousands of unique combinations of steel grades and polymer thicknesses to achieve specific performance goals, such as target noise reduction frequencies or specific thermal conductivity profiles. This capability accelerates the time-to-market for specialized laminated steel solutions required for advanced applications like fifth-generation automotive battery pack protection and highly sensitive electronics casings, driving customized market growth.

- AI-driven Predictive Quality Control (PQC) minimizes bonding defects and ensures uniform layer integrity.

- Machine Learning optimizes lamination line parameters (temperature, pressure) in real time, increasing throughput efficiency.

- Generative Design algorithms accelerate the creation of novel multi-layer steel composite structures with tailored properties.

- AI enhances supply chain forecasting, predicting volatile raw material costs (steel, specialized polymers) and optimizing procurement.

- Implementation of AI for visual inspection improves defect detection rates far beyond human capability, particularly for subtle interfacial flaws.

- Digital Twin technology, supported by AI, simulates the in-service performance of laminated steel in extreme conditions before physical prototyping.

DRO & Impact Forces Of Laminated Steel Market

The Laminated Steel Market is characterized by a dynamic interplay of potent drivers, structural restraints, and emerging opportunities, which collectively determine its trajectory and competitive intensity. The primary driving force centers on global regulatory mandates emphasizing vehicular lightweighting and noise reduction, particularly the mandatory transition towards Electric Vehicles (EVs), which require high-performance materials for battery safety and superior NVH damping. However, growth is tempered by significant restraints, chiefly the higher initial manufacturing cost and processing complexity associated with composite materials compared to standard monolithic steel sheets, alongside challenges related to achieving perfect, long-term interlayer adhesion, especially when exposed to harsh environmental factors.

Opportunities for expansion are largely concentrated in developing specialized lamination products targeting niche, high-growth applications, such as sophisticated thermal management systems for high-density electronic devices and specialized architectural cladding requiring superior fire resistance combined with aesthetic qualities. Furthermore, the development of sustainable, recyclable bonding agents and the utilization of advanced joining techniques (e.g., laser welding of laminated sheets) present significant avenues for value creation and overcoming current market constraints related to end-of-life recycling challenges. Strategic partnerships between steel producers and polymer chemical suppliers are crucial for capitalizing on these material innovations.

These internal market forces are amplified by external impacts. The market faces a high impact force from evolving material substitution threats, primarily from advanced composites like carbon fiber reinforced plastics (CFRP) and high-performance aluminum alloys, particularly in aerospace and high-end automotive applications where weight savings justify extremely high material costs. Conversely, the rising cost volatility of raw steel and specialized adhesive polymers acts as a constraining impact force, compelling manufacturers to absorb higher input costs or innovate aggressively to improve yield rates. Overall, the market remains moderately dynamic, with innovation in manufacturing technology acting as the critical lever to mitigate cost restraints and capitalize on regulatory drivers.

Segmentation Analysis

The Laminated Steel Market is comprehensively segmented based on the critical characteristics that define product function and manufacturing complexity: Type of Layering, Application, and Manufacturing Technology. Analysis of these segments is vital for stakeholders to identify high-growth niches and tailor their product strategies. Segmentation by Type of Layering (e.g., Metal-Polymer-Metal, Multi-layer Metal) dictates the final physical properties like sound absorption and thermal conductivity, directly influencing suitability for specialized end-uses. The Application segmentation reveals the sector-specific demand patterns, confirming the automotive sector's dominance but also highlighting burgeoning needs in consumer electronics and power generation components.

- By Type of Layering:

- Metal-Polymer-Metal (MPM) Laminated Steel

- Multi-layer Metal Laminated Steel (Clad Steel)

- Other Composite Layers (e.g., Ceramic/Metal Lamination)

- By Manufacturing Technology:

- Continuous Lamination/Roll Bonding

- Explosion Bonding

- Adhesive Bonding/Roll Coating

- Diffusion Bonding

- By Application:

- Automotive (Body Panels, Heat Shields, Fuel Tanks, NVH components)

- Construction (Cladding, Roofing, Architectural Elements)

- Electrical & Electronics (Transformer Laminations, Motor Cores, Capacitor Housings)

- Consumer Appliances (Washing Machine Drums, Refrigerator Panels)

- Industrial Equipment and Machinery

Value Chain Analysis For Laminated Steel Market

The value chain for laminated steel begins with extensive upstream analysis, focusing on the procurement of high-quality raw materials. This stage involves sourcing primary steel (carbon steel, stainless steel, or specialized electrical steel) from major steel mills, coupled with the procurement of highly engineered polymer films or specialized structural adhesives, often supplied by the petrochemical and advanced materials industries. The stability of steel prices and the proprietary nature of high-performance polymer interlayers represent critical leverage points upstream. Strategic supplier relationships ensuring consistent quality and volume are paramount, as the integrity of the final laminated product hinges on the characteristics and consistency of these input materials.

The core midstream activity involves the transformation of these raw inputs into laminated coils or sheets, utilizing sophisticated manufacturing technologies such as continuous roll bonding or specialized adhesive lamination lines. This phase is capital-intensive and requires significant investment in advanced machinery capable of handling high-speed processing, precise tension control, and impeccable cleanliness to ensure optimal adhesion. Key operational metrics include yield rate maximization and minimization of interfacial defects. Successful midstream players differentiate themselves through proprietary lamination process control and the ability to produce highly customized, thin-gauge laminated products meeting tight tolerances for electrical and automotive applications.

The downstream segment encompasses distribution channels, market reach, and end-user engagement. Laminated steel products are typically distributed through a mix of direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and electrical sectors, and through specialized metals service centers that offer cutting, slitting, and just-in-time delivery services. The indirect channel plays a crucial role for smaller fabricators and secondary manufacturers. Efficient logistics and technical support are vital downstream services, as laminated materials often require specialized handling and processing instructions, differentiating high-value suppliers who offer comprehensive technical advisory services to facilitate seamless integration into customer assembly lines.

Laminated Steel Market Potential Customers

The primary end-users and buyers of laminated steel are concentrated in highly engineered sectors where material performance tradeoffs are unacceptable and multi-functional characteristics are mandatory. The largest segment of potential customers resides within the global automotive industry, including major global OEMs (Original Equipment Manufacturers) and Tier 1 suppliers specializing in powertrain components, acoustic packages, and, increasingly, battery pack enclosures for EVs. These customers require materials that simultaneously offer superior crash protection, extreme temperature resistance, lightweighting capabilities, and significant noise reduction to enhance passenger comfort and comply with stringent safety regulations.

A second major cluster of potential buyers is found within the electrical and electronics manufacturing sector, particularly companies involved in the production of high-efficiency transformers, electric motors, generators, and specialized shielding equipment. For these customers, laminated steel, especially electrical steel laminations, is critical for minimizing core losses, improving electromagnetic performance, and ensuring the longevity and energy efficiency of the final device. The demand here is highly sensitive to material purity and geometric precision, often requiring specialized coatings or lamination types to optimize flux density and reduce eddy currents in high-frequency applications.

Furthermore, significant opportunities exist with construction and appliance manufacturers. Construction customers, including architectural firms and large-scale infrastructure developers, utilize laminated steel for external cladding, noise barriers, and specialized structural components where durability and aesthetic appeal must be coupled with insulation and corrosion resistance. Appliance manufacturers are major consumers, utilizing laminated steel (often polymer-steel-polymer) for external casings and internal drums in washing machines and refrigerators, where acoustic damping and resistance to moisture and chemical agents are prioritized features that enhance the perceived quality and operational quietness of the final consumer product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel Corporation, ArcelorMittal, Thyssenkrupp AG, POSCO, JFE Steel Corporation, Tata Steel, AK Steel (Cleveland-Cliffs Inc.), BlueScope Steel, Voestalpine AG, Samuel, Son & Co., Inc., Composite Materials International, Inc., Sumitomo Metal Mining Co., Ltd., Olin Brass (GBC Metals), Clad Metals Inc., Metal Processing Group, Kloeckner Metals, Sandvik Materials Technology, VDM Metals, Hitachi Metals, Ltd., ATI Metals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laminated Steel Market Key Technology Landscape

The manufacturing technology landscape for laminated steel is characterized by a blend of highly established physical bonding methods and increasingly sophisticated chemical bonding techniques, each tailored to achieve specific material properties. Continuous Roll Bonding remains a cornerstone technology, particularly efficient for producing large volumes of multi-layer metallic composites, relying on intense pressure at elevated temperatures to create a metallurgical bond between the layers. Advancements in roll bonding focus on optimizing surface preparation and temperature control to ensure zero-defect interfaces and enable the processing of disparate material combinations, such as high-strength low-alloy (HSLA) steel laminated with corrosion-resistant alloys, thereby enhancing structural performance without sacrificing mass efficiency.

In contrast, Adhesive Bonding, often termed Roll Coating or Continuous Coil Coating, dominates the production of Metal-Polymer-Metal (MPM) laminated steel, which is highly sought after for acoustic damping applications. The key technological evolution here lies in the formulation of the polymer interlayer. Manufacturers are transitioning towards advanced viscoelastic polymers and thermosetting resins that offer superior sheer strength, thermal stability, and, critically, enhanced acoustic performance across a wider frequency spectrum. Precision coating techniques, including proprietary slot die coating and high-speed rotary screen printing, are essential to ensure the polymer layer's uniformity and thickness, which directly impacts the material's sound absorption capabilities and the long-term environmental stability of the laminate.

Emerging technologies focus on hybrid manufacturing processes and localized bonding techniques. Explosion bonding, while historically used for thick plates and specialized industrial equipment, is seeing renewed interest for extremely dissimilar metal combinations where diffusion or roll bonding is infeasible, offering robust, high-integrity bonds. Furthermore, the integration of Non-Destructive Testing (NDT) methodologies, such as advanced ultrasonic testing and pulsed eddy current techniques, into the lamination line is a key technological trend. These NDT systems allow for real-time, non-invasive assessment of bond quality, moving beyond simple visual checks and guaranteeing compliance with the demanding quality assurance standards mandated by the aerospace and EV battery industries. This technological assurance is critical for market acceptance in mission-critical applications.

Regional Highlights

The global Laminated Steel Market exhibits distinct regional dynamics driven by varying industrial maturity, regulatory environments, and prevailing manufacturing capacities. Asia Pacific (APAC) stands as the dominant market both in terms of consumption and production. This dominance is attributed to the presence of large-scale, rapidly expanding automotive manufacturing bases in China, Japan, and South Korea, coupled with extensive electronics production and robust infrastructure development. The sheer volume demand for cost-effective laminated steel in consumer appliances and general construction drives APAC's market size, though there is a concurrent rise in demand for premium, specialized laminates for local EV production lines.

North America and Europe represent mature, high-value markets characterized by stringent regulatory environments, particularly concerning environmental emissions, vehicular safety, and noise pollution (NVH). The demand in these regions is highly focused on sophisticated Metal-Polymer-Metal (MPM) composites used for high-end vehicle cabins and advanced thermal management components for next-generation EVs. European manufacturers, supported by initiatives focused on Circular Economy principles, are also driving innovation in laminated steel solutions that facilitate easier de-lamination and material separation at the end-of-life stage, emphasizing sustainability and recyclability.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets showing significant potential. LATAM's growth is tied to the recovery and expansion of regional automotive production, while MEA's trajectory is strongly influenced by large-scale infrastructure projects and diversification efforts away from oil dependence, driving demand for laminated steel in construction and industrial sectors. While volume consumption remains lower compared to APAC, both regions are experiencing targeted investment in localized manufacturing capabilities to reduce reliance on imported specialized materials, presenting long-term opportunities for global suppliers.

- Asia Pacific (APAC): Market volume leader; driven by massive automotive, electronics, and construction manufacturing; significant investment in EV component production in China and South Korea.

- North America: Focus on high-performance laminates for lightweight automotive structures; strong demand from the aerospace and defense sectors for clad materials; emphasis on technological innovation and quick adoption of NDT monitoring.

- Europe: High adoption of advanced MPM steel for superior NVH characteristics; market growth supported by stringent EU environmental and safety regulations; leading in sustainable and recyclable lamination solutions.

- Latin America: Growth linked to regional automotive sector recovery and domestic infrastructure projects; price sensitivity remains a key factor in material selection.

- Middle East and Africa (MEA): Emerging market primarily driven by infrastructure development (e.g., smart city construction) and localized industrial manufacturing diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laminated Steel Market.- Nippon Steel Corporation

- ArcelorMittal

- Thyssenkrupp AG

- POSCO

- JFE Steel Corporation

- Tata Steel

- AK Steel (Cleveland-Cliffs Inc.)

- BlueScope Steel

- Voestalpine AG

- Samuel, Son & Co., Inc.

- Composite Materials International, Inc.

- Sumitomo Metal Mining Co., Ltd.

- Olin Brass (GBC Metals)

- Clad Metals Inc.

- Metal Processing Group

- Kloeckner Metals

- Sandvik Materials Technology

- VDM Metals

- Hitachi Metals, Ltd.

- ATI Metals

Frequently Asked Questions

Analyze common user questions about the Laminated Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using Metal-Polymer-Metal (MPM) laminated steel over traditional monolithic steel?

The primary benefit of MPM laminated steel is superior acoustic damping and NVH (Noise, Vibration, and Harshness) reduction. The viscoelastic polymer core effectively dissipates kinetic energy, making it essential for lightweight automotive body panels, white goods casings, and industrial equipment where noise mitigation is critical for operational quietness and regulatory compliance.

Which industry accounts for the largest share of laminated steel consumption globally?

The Automotive industry accounts for the largest share of global laminated steel consumption. This is driven by the industry's continuous need for lightweighting to improve fuel economy (in internal combustion engines) and extend range (in electric vehicles), combined with the mandatory requirement for enhanced thermal management and superior acoustic performance in modern vehicle architectures.

How do manufacturing technologies like Roll Bonding and Adhesive Bonding differ in the Laminated Steel Market?

Roll Bonding is a solid-state process utilizing high heat and pressure to create a metallurgical bond between two metallic layers, typically resulting in highly durable clad steel. Adhesive Bonding, conversely, uses a non-metallic polymer or specialized adhesive interlayer, often preferred for creating Metal-Polymer-Metal composites optimized specifically for vibration damping and superior sound absorption.

What are the main challenges hindering the broader adoption of laminated steel?

The main challenges hindering broader adoption include the higher initial material cost compared to conventional steel, the complexity of the specialized manufacturing processes required to ensure perfect interlayer adhesion, and the difficulty in recycling multi-material composites, which necessitates separation or specialized processing at the end of the product lifecycle.

Is the transition to Electric Vehicles (EVs) positively impacting the Laminated Steel Market?

Yes, the transition to EVs is significantly and positively impacting the market. EVs require advanced laminated steel for critical components such as lightweight battery enclosures (for thermal and impact protection) and specialized laminated electrical steel cores to enhance the efficiency and performance of high-frequency electric motors and onboard chargers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laminated Steel Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Laminated Steel Market Statistics 2025 Analysis By Application (Food & Beverages, Chemical industry, Consumer Goods), By Type (Fusion Method Laminated Steel, Bonding Agent Laminated Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laminated Steel Container Market Statistics 2025 Analysis By Application (Food and Beverage Packaging, Aerosol Packaging), By Type (2-piece Cans, 3-piece Cans), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laminated Steel Cans Market Statistics 2025 Analysis By Application (Food and Beverage Packaging, Aerosol Packaging), By Type (2-piece Cans, 3-piece Cans), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laminated Steel for Cans Market Statistics 2025 Analysis By Application (Food and Beverage Packaging, Aerosol Packaging), By Type (PET Laminated Steel, PP Laminated Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager