Lidar Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433977 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Lidar Technology Market Size

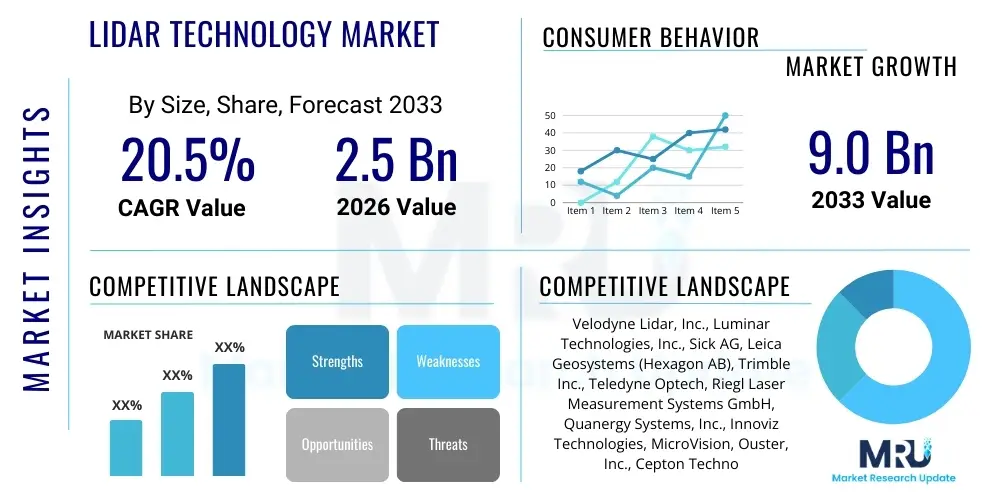

The Lidar Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $9.0 Billion by the end of the forecast period in 2033.

Lidar Technology Market introduction

The Lidar (Light Detection and Ranging) Technology Market encompasses sophisticated sensing systems that utilize pulsed laser light to measure distances to the Earth's surface or objects. This technology generates highly accurate, three-dimensional spatial data, forming detailed point clouds essential for perception systems across numerous industries. Lidar systems typically consist of a laser, a scanner, and a highly sensitive receiver, operating on the principle of measuring the time-of-flight (ToF) of the emitted light pulses. The adoption of Lidar is fundamentally changing how environments are mapped, perceived, and navigated, moving beyond traditional two-dimensional imaging to provide robust depth information critical for automation.

Lidar technology is characterized by its high angular resolution, long-range detection capabilities, and immunity to ambient light conditions, making it superior to traditional radar and standard camera systems in specific scenarios. Major applications span from creating high-definition maps for civil engineering and urban planning to enabling advanced driver assistance systems (ADAS) and full autonomy in vehicles. The benefits derived from Lidar implementation include enhanced safety through superior collision avoidance, increased operational efficiency in logistics and industrial automation, and the provision of precise geological and environmental data collection necessary for climate modeling and resource management. Miniaturization and cost reduction of Lidar units, particularly solid-state variants, are driving their integration into consumer electronics and robotics.

Key driving factors accelerating market growth include the explosive demand from the automotive sector for realizing Level 3, 4, and 5 autonomous driving capabilities, where Lidar acts as the crucial redundant sensor providing validated geometric data. Furthermore, the rising need for high-fidelity 3D mapping and surveying in infrastructure projects and construction is propelling uptake in the Geographic Information System (GIS) sector. Regulatory pressures emphasizing safety standards in transportation and the increasing deployment of unmanned aerial vehicles (UAVs) equipped with Lidar for rapid data acquisition further solidify the market's trajectory, establishing Lidar as a foundational technology for the next generation of spatial intelligence.

Lidar Technology Market Executive Summary

The Lidar Technology Market is witnessing robust expansion, primarily fueled by the accelerating transition towards autonomous mobility and the critical need for precise 3D spatial data across industrial verticals. Business trends indicate a strong shift from traditional mechanical Lidar units, which are bulky and expensive, toward compact, durable, and mass-producible solid-state Lidar architectures, including MEMS and Flash Lidar, enabling integration into consumer-grade devices and mainstream automotive models. Significant venture capital investment and strategic partnerships between specialized Lidar manufacturers and Tier 1 automotive suppliers are reshaping the competitive landscape, focusing on achieving cost parity and performance optimization suitable for harsh operational environments. Supply chain refinement, particularly concerning laser sources and optical components, remains a crucial area of focus for market participants aiming to scale production volumes.

Segment trends highlight the dominance of the automotive sector in terms of revenue growth, although the surveying and mapping segment continues to represent a stable foundational market. Within technology types, the solid-state segment is projected to exhibit the highest CAGR, driven by its promise of reliability and lower maintenance requirements compared to mechanical scanning systems. Furthermore, software and data processing services, which turn raw point cloud data into actionable intelligence, are growing faster than hardware sales, reflecting the market's maturation toward comprehensive solution delivery. The deployment of hybrid Lidar solutions combining different sensor modalities is also emerging as a dominant strategy to ensure robustness against various environmental challenges, such as fog and heavy rain.

Geographically, North America and Europe currently hold significant market shares due to early adoption in advanced R&D for autonomous vehicles and extensive infrastructure development using terrestrial Lidar systems. However, the Asia Pacific (APAC) region is forecasted to be the fastest-growing market, largely attributable to massive investments in smart city infrastructure, rapid industrial automation in countries like China and South Korea, and supportive governmental policies promoting electric and autonomous vehicles. The competitive intensity is escalating globally, requiring companies to rapidly innovate on integration methods, improve angular resolution, and reduce power consumption to secure long-term OEM contracts and penetrate high-volume consumer markets successfully.

AI Impact Analysis on Lidar Technology Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lidar Technology Market primarily revolve around data processing efficiency, sensor fusion integration, and the enablement of high-level autonomy. Users frequently ask how AI can overcome the limitations of raw Lidar data—specifically the massive data volumes generated and the difficulty in interpreting unstructured point clouds in real-time. Key concerns center on whether AI algorithms can reliably classify objects, predict behaviors, and handle complex occlusions and clutter, which are vital for safety-critical applications like autonomous driving. The expectation is that AI, particularly through deep learning networks, will transform Lidar from merely a distance measurement device into a complex perception system, allowing vehicles and robots to understand their environment contextually rather than just geometrically.

The synergy between Lidar hardware and AI software is fundamentally redefining market value. AI-powered algorithms are essential for processing the high-density point cloud data generated by modern Lidar sensors, enabling real-time object detection, tracking, and environmental semantic segmentation. This integration elevates Lidar from a passive sensor to an active intelligence contributor, drastically improving the accuracy and reliability of autonomous systems operating under various conditions. Furthermore, AI facilitates effective sensor fusion—combining Lidar data with information from cameras and radar—to create a unified, redundant, and highly reliable perception model, which is critical for meeting stringent safety standards in the automotive industry. The development of specialized neural networks optimized for spatial data handling (e.g., PointNet and VoxelNet architectures) is a major focus area for Lidar software providers.

Moreover, AI contributes significantly to the optimization of Lidar hardware itself. Machine learning techniques are increasingly utilized during the design phase to optimize scanning patterns, minimize data redundancy, and improve the Signal-to-Noise Ratio (SNR) in low-visibility situations. Predictive maintenance enabled by AI allows Lidar systems to monitor their own performance and alert operators to potential failures, thereby reducing downtime, especially in industrial or remote mapping applications. The deployment of edge AI processing capabilities directly onto Lidar units or integrated control modules is becoming standard practice, ensuring minimal latency and rapid decision-making crucial for high-speed automated processes, profoundly accelerating the market's utility and adoption rates beyond traditional mapping.

- AI enhances real-time point cloud classification and semantic segmentation.

- Deep learning algorithms enable advanced object tracking and behavior prediction necessary for L4/L5 autonomy.

- AI facilitates robust sensor fusion, combining Lidar data with camera and radar inputs for redundancy.

- Machine learning optimizes Lidar scanning parameters and minimizes data volume transmission requirements.

- Edge AI processing ensures low-latency decision-making in safety-critical applications.

- AI-driven calibration and diagnostic tools improve sensor reliability and operational lifespan.

DRO & Impact Forces Of Lidar Technology Market

The Lidar Technology Market is shaped by a confluence of powerful drivers and restrictive challenges, mediated by significant emerging opportunities. The primary driver is the global pursuit of fully autonomous mobility, where Lidar is mandated as a crucial component for ensuring spatial accuracy and safety. Alongside this, the increasing demand for high-resolution 3D data in infrastructure management, environmental monitoring, and urban planning significantly contributes to market buoyancy. Conversely, the market faces significant restraints, chiefly the high initial cost of integration, especially for mechanical systems, and the inherent performance degradation of certain Lidar types (particularly those operating at 905 nm) when faced with severe adverse weather conditions like dense fog or heavy snowfall, demanding robust perception stack solutions.

Impact forces acting on the Lidar market include the intense competitive pressure leading to rapid price erosion, which acts as both a driver for adoption and a restraint on profit margins for established players. Technological innovation, particularly the successful maturation and mass production of solid-state Lidar, represents a major opportunity, promising the affordability and durability required for widespread consumer market penetration. Geopolitical factors, such as trade restrictions on key components and regional investment disparities in smart infrastructure, also exert substantial influence on supply chain stability and regional growth patterns. The convergence of Lidar with specialized photogrammetry and synthetic aperture radar (SAR) systems further broadens the scope of applications, particularly in defense and aerial surveillance, adding new revenue streams and diversifying end-user dependency.

Opportunities for market expansion are abundant, centered around the application of Lidar in robotics and industrial automation (e.g., smart warehouses and logistics), consumer electronics (smartphones and AR/VR devices), and specialized defense applications. The integration of high-performance Lidar with low-cost processors and AI frameworks opens up vast new vertical markets previously inaccessible due to cost constraints. Regulatory developments, such as specific standards for high-definition mapping and autonomous vehicle testing protocols in various jurisdictions, will dictate the pace and direction of technological deployment, requiring continuous adaptation from market incumbents to secure regulatory compliance and first-mover advantages in new geographies.

Segmentation Analysis

The Lidar Technology Market is comprehensively segmented based on component, technology type, deployment platform, application, and end-user vertical, reflecting the diverse utility of the technology across industrial and consumer landscapes. Component segmentation is vital, distinguishing between the hardware elements (lasers, detectors, optics, scanning mirrors), the proprietary software required for processing and interpreting the vast point cloud data, and the professional services associated with deployment, calibration, and data analysis. The technological differentiation between mechanical, solid-state (MEMS, Flash), and hybrid Lidar is crucial as it dictates cost, ruggedness, and suitability for mass production, with solid-state being the future direction for high-volume applications like automotive.

Application-based segmentation clearly illustrates the primary revenue drivers, dominated by autonomous vehicles (both passenger and commercial), followed closely by high-precision surveying and mapping for geographic information systems (GIS). Emerging segments include advanced robotics for warehouse logistics and specific industrial quality control applications. Furthermore, the segmentation by deployment platform—categorizing systems as airborne (drones, aircraft), ground-based (terrestrial scanners, vehicle-mounted), or space-based (satellite systems)—highlights the variance in operational requirements, ranging from short-range high-frequency measurements to large-scale infrastructure mapping. Understanding these segments is key for market participants to tailor product specifications and investment strategies effectively.

- Component: Hardware (Laser, Receiver, Scanner, Optics), Software (Point Cloud Processing, Sensor Fusion), Services (Integration, Maintenance, Data Analytics)

- Type: Mechanical Lidar (Rotating), Solid-State Lidar (MEMS Lidar, Flash Lidar, Optical Phased Array Lidar), Hybrid Lidar

- Deployment: Airborne Lidar (UAV/Drone, Aircraft), Ground-Based Lidar (Mobile Mapping, Static Terrestrial Scanning), Space-Based Lidar (Satellite)

- Application: Autonomous Vehicles (L2+ to L5), Advanced Driver Assistance Systems (ADAS), Mapping and Surveying (GIS, Topography), Robotics and Automation, Security and Surveillance, Mining and Geology, Agriculture and Forestry

- Vertical: Automotive, Aerospace & Defense, Civil Engineering and Infrastructure, Consumer Electronics, Industrial Automation, Oil & Gas

Value Chain Analysis For Lidar Technology Market

The Lidar Technology Market value chain is complex and involves several specialized stages, starting with upstream component manufacturing, moving through system integration, and culminating in downstream deployment and data services. Upstream analysis focuses on the supply of highly specialized materials and components, including high-power semiconductor lasers (e.g., 905 nm and 1550 nm sources), photodetectors (SPAD, APD arrays), high-precision optics, and microelectromechanical systems (MEMS) mirrors or optical phased arrays. The supply chain for 1550 nm components, which offer eye-safety benefits at higher power, involves a fewer number of specialized suppliers, leading to potential bottlenecks and higher costs. Strategic sourcing and vertical integration capabilities in this stage are critical for maintaining competitive pricing and controlling intellectual property related to core components.

Midstream activities involve the design, assembly, calibration, and mass manufacturing of the integrated Lidar unit, often performed by specialized Lidar companies (e.g., Velodyne, Luminar) or Tier 1 automotive suppliers (e.g., Bosch, Continental). This stage requires significant R&D investment, particularly in areas like packaging, thermal management, and ensuring sensor ruggedness. The distribution channel analysis shows a dual approach: direct sales dominate high-value, specialized markets (like surveying and aerospace), where close technical support is necessary. Conversely, indirect channels, involving partnerships with system integrators, automotive OEMs, and large Tier 1 suppliers, are predominant for high-volume markets like autonomous vehicles and industrial robotics, facilitating large-scale integration and reducing time-to-market.

Downstream analysis focuses on the utilization and monetization of the Lidar data. This includes the development of sophisticated software for processing raw point clouds, performing sensor fusion, and providing analytics services. Direct customers (e.g., vehicle manufacturers, military organizations) purchase integrated units and manage the data internally, while indirect customers often rely on third-party service providers (e.g., mapping firms, construction companies) that utilize Lidar-equipped devices to deliver detailed mapping and surveying reports. The value is increasingly shifting towards the software and service layer, driven by the need to derive actionable insights from massive datasets, cementing the importance of AI and cloud computing infrastructure in the final stage of the value chain.

Lidar Technology Market Potential Customers

The Lidar Technology Market targets a diverse group of end-users and institutional buyers whose operational efficiency and safety depend on precise 3D spatial awareness. The most prominent end-users are automotive Original Equipment Manufacturers (OEMs) and Tier 1 suppliers, who utilize Lidar for integrating Level 3, 4, and 5 autonomous capabilities into passenger vehicles, robotaxis, and commercial trucking fleets. These buyers demand high reliability, durability, and a low cost structure suitable for mass production, making solid-state Lidar solutions the preferred choice. Furthermore, research institutions and technology developers focused on AI and robotics represent a consistent customer base, often requiring advanced, flexible Lidar units for experimentation and prototype development.

Beyond the automotive sector, substantial potential lies within the surveying, mapping, and infrastructure vertical. Civil engineering firms, government agencies (e.g., Departments of Transportation, geological surveys), and construction companies are key buyers of ground-based and airborne Lidar systems. They leverage the technology for creating high-definition digital twins of infrastructure, monitoring land deformation, optimizing road design, and managing forestry resources. These industrial buyers prioritize accuracy, range, and the ability to operate in challenging environments, often preferring higher-cost, high-performance mechanical or high-resolution hybrid systems tailored for detailed mapping campaigns.

Emerging potential customers include players in industrial automation and logistics, such as warehouse operators and factory owners, who use Lidar for precise navigation of autonomous mobile robots (AMRs) and for safety curtain and collision avoidance systems in high-throughput environments. The defense and security sector also remains a vital end-user, deploying Lidar for surveillance, target acquisition, and complex terrain mapping for mission planning. Finally, the growing market for AR/VR devices and consumer electronics, where miniaturized Lidar modules enhance depth perception for mobile devices and head-mounted displays, signifies a future high-volume customer segment focused primarily on cost-effective, high-integration components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $9.0 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Velodyne Lidar, Inc., Luminar Technologies, Inc., Sick AG, Leica Geosystems (Hexagon AB), Trimble Inc., Teledyne Optech, Riegl Laser Measurement Systems GmbH, Quanergy Systems, Inc., Innoviz Technologies, MicroVision, Ouster, Inc., Cepton Technologies, Valeo, Continental AG, Bosch GmbH, XenomatiX, Hesai Technology, AEye, RoboSense, 3D perception |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lidar Technology Market Key Technology Landscape

The Lidar Technology Market is characterized by intense technological evolution, shifting rapidly from bulky, rotating mechanical systems to advanced solid-state and micro-electro-mechanical systems (MEMS) architectures. Mechanical Lidar, while offering 360-degree coverage and established reliability, is increasingly being superseded due to its high cost, complex moving parts, and limited longevity in mass-market applications. The shift towards solid-state Lidar is a defining trend, utilizing technologies like Flash Lidar, which illuminates an entire scene simultaneously without moving parts, offering superior durability, ruggedness, and significantly lower manufacturing costs essential for automotive integration. Another critical technology is the development of MEMS-based Lidar, which uses microscopic mirrors to steer the laser beam, achieving a balance between field-of-view flexibility and reduced physical size.

A key technological differentiator influencing market competition is the operational wavelength. Systems using 905 nanometers (nm) are cost-effective and utilize standard silicon detectors but have limitations in eye safety at high power, restricting range. In contrast, Lidar systems operating at 1550 nm use specialized InGaAs detectors and are inherently eye-safe at higher laser power, allowing for longer range and superior performance, crucial for high-speed autonomous applications like long-haul trucking. However, 1550 nm systems face challenges related to the higher cost of InGaAs components. Current research is heavily focused on improving detector sensitivity, developing highly efficient laser sources (VCSELs), and integrating these systems onto silicon photonics platforms for ultimate miniaturization and cost reduction.

Furthermore, advancements in signal processing and perception software are integral to the technological landscape. Frequency Modulated Continuous Wave (FMCW) Lidar represents a significant emerging technology, offering velocity measurement (Doppler information) simultaneously with range, providing superior immunity to interference from other Lidar sensors and ambient sunlight. This technique utilizes coherent detection, which is complex but yields richer data outputs. Alongside hardware innovation, the optimization of data compression techniques and the deployment of purpose-built ASICs (Application-Specific Integrated Circuits) for real-time point cloud processing are vital for ensuring low-latency operation, which is non-negotiable for safety-critical autonomous systems, driving significant R&D spending across the industry.

Regional Highlights

The global Lidar Technology Market exhibits pronounced regional variations in adoption rates, technological focus, and market maturity, largely driven by regulatory environments and local industrial investment priorities. North America currently dominates the market, primarily due to the early and aggressive deployment of autonomous vehicle testing programs in the United States and Canada, coupled with high R&D spending in Silicon Valley and strong government investment in infrastructure mapping (GIS) and defense applications. The region benefits from a dense presence of Lidar startups, advanced technology research institutions, and major automotive Tier 1 suppliers, which accelerates innovation and commercialization, especially for solid-state solutions.

Europe represents a mature and highly strategic market, driven by stringent environmental monitoring regulations and major investments in smart cities and precision agriculture. Countries like Germany, France, and the UK are leaders in automotive manufacturing and are heavily focused on Lidar integration for ADAS and self-driving trucks. European Union directives supporting high-precision mapping and the need for robust industrial automation solutions in manufacturing and logistics further cement the region's strong market position. There is a strong emphasis on developing 1550 nm Lidar systems to ensure safety and long-range performance essential for high-speed European road networks.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid growth is spearheaded by China, Japan, and South Korea, fueled by vast state investments in new energy vehicles (NEVs), smart infrastructure development, and mass adoption of industrial robotics. China, in particular, is aggressively promoting its domestic Lidar manufacturers, leading to significant competitive pricing advantages and accelerated deployment in robotaxis and consumer vehicles. Favorable regulatory support for large-scale drone mapping projects in agriculture and construction across India and Southeast Asia further contributes to the explosive demand for cost-effective, high-performance Lidar solutions in this region.

- North America: Market leader driven by autonomous vehicle R&D, strong startup ecosystem, and high defense/GIS spending. Focus on solid-state and 1550 nm technologies.

- Europe: Mature market characterized by robust automotive R&D, stringent safety standards, and high adoption in industrial automation and precision mapping. Strong focus on safety and high performance.

- Asia Pacific (APAC): Fastest-growing region, propelled by massive government investment in NEVs, smart cities (especially China), and rapid industrial automation adoption across manufacturing hubs. Price competitiveness is key.

- Latin America (LATAM): Emerging market with growing adoption in mining, geology, and large-scale infrastructure surveying, often utilizing airborne Lidar for remote area mapping.

- Middle East and Africa (MEA): Growth centered on massive smart city projects (e.g., NEOM in Saudi Arabia) and oil and gas infrastructure monitoring, demanding high-durability ground-based Lidar systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lidar Technology Market.- Velodyne Lidar, Inc.

- Luminar Technologies, Inc.

- Sick AG

- Leica Geosystems (Hexagon AB)

- Trimble Inc.

- Teledyne Optech

- Riegl Laser Measurement Systems GmbH

- Quanergy Systems, Inc.

- Innoviz Technologies

- MicroVision

- Ouster, Inc.

- Cepton Technologies

- Valeo

- Continental AG

- Bosch GmbH

- XenomatiX

- Hesai Technology

- AEye

- RoboSense

- 3D perception

Frequently Asked Questions

Analyze common user questions about the Lidar Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Lidar Technology Market?

The primary factor driving market growth is the global acceleration of autonomous vehicle development (Level 3, 4, and 5). Lidar is recognized as the essential sensor technology for providing redundant, high-accuracy 3D perception data critical for safety and navigation in complex environments.

What is the key difference between mechanical Lidar and solid-state Lidar?

Mechanical Lidar uses rotating parts to achieve a 360-degree field of view but is typically expensive and less durable. Solid-state Lidar (such as MEMS or Flash Lidar) uses no moving parts, leading to significantly lower production costs, enhanced durability, miniaturization, and faster integration into consumer and automotive applications.

How does the operating wavelength (905 nm versus 1550 nm) impact Lidar performance?

905 nm Lidar is cost-effective but limited in range due to eye-safety restrictions. 1550 nm Lidar is eye-safe at higher power, allowing for longer range and superior performance in high-speed applications, though it utilizes more expensive detectors (InGaAs).

Which industry vertical is expected to be the largest consumer of Lidar technology by 2033?

The Automotive vertical (including passenger vehicles, robotaxis, and commercial trucks) is expected to remain the largest consumer of Lidar technology, driven by massive production volumes and the irreversible shift toward autonomous and enhanced safety features (ADAS).

What challenges does the Lidar market face regarding adverse weather conditions?

Lidar performance can degrade significantly in adverse conditions like heavy fog, rain, or snow due to laser scattering. Manufacturers address this by increasing power, implementing advanced filtering algorithms (often AI-driven), and utilizing sensor fusion with radar, which performs better in poor weather.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager