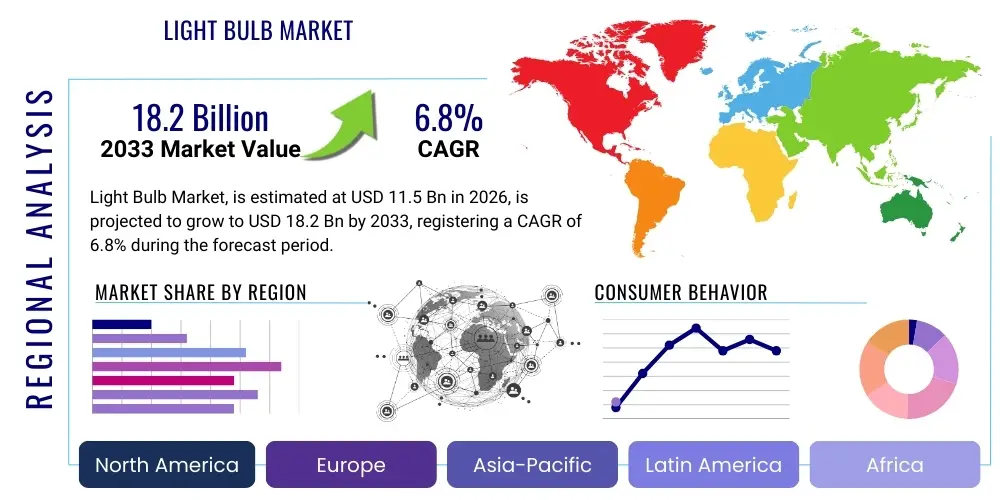

Light Bulb Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435270 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Light Bulb Market Size

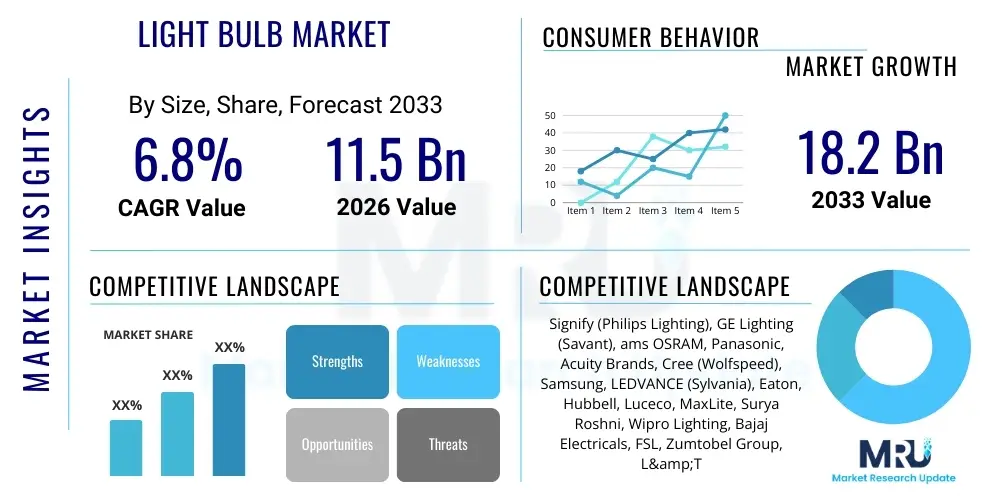

The Light Bulb Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the accelerating global transition towards highly energy-efficient lighting solutions, primarily Light Emitting Diodes (LEDs), replacing traditional incandescent and compact fluorescent lamps (CFLs). Governments worldwide are implementing stringent energy efficiency regulations and phase-out programs for inefficient lighting technologies, creating a massive replacement demand across residential, commercial, and industrial sectors.

The market valuation reflects the increasing premium placed on smart lighting systems, which incorporate connectivity, sensors, and advanced control features. While the unit cost of LED bulbs has significantly decreased, the integration of IoT functionality, color tuning capabilities, and network integration features provides substantial value uplift, thereby supporting the overall revenue growth. The durability and long lifespan of LED products, while reducing replacement frequency, are offset by the high volume demand originating from rapidly urbanizing regions, particularly in Asia Pacific, where new construction and infrastructure projects necessitate large-scale lighting deployment.

Light Bulb Market introduction

The Light Bulb Market, fundamentally defined by devices engineered to produce visible light, has undergone a revolutionary transformation driven by technological advancements focusing intensely on energy efficiency and connectivity. Historically dominated by fragile and energy-intensive incandescent bulbs, the market landscape is now overwhelmingly defined by solid-state lighting technology, specifically LEDs. LEDs offer superior longevity, drastically reduced power consumption, immediate illumination, and versatility in design and color temperature, making them the standard choice for modern illumination needs across virtually all application types globally.

Major applications for light bulbs span diverse environments including sophisticated residential smart homes, large-scale commercial offices and retail spaces, specialized industrial facilities requiring high lumen output and durability, and critical public infrastructure suchates as street lighting and traffic signaling. The inherent benefits derived from the adoption of current generation light bulbs are manifold, revolving primarily around sustainability, operational cost reduction, and enhanced user experience. Energy savings can often exceed 80% compared to legacy lighting, dramatically reducing utility expenses for end-users and decreasing the overall carbon footprint associated with electricity generation.

The principal driving factors sustaining market momentum include global government mandates favoring energy efficiency, such as the EU’s Ecodesign requirements and similar regulations in North America and Asia, which actively prohibit the sale of less efficient lighting types. Furthermore, the rapid growth of the Internet of Things (IoT) ecosystem provides a significant impetus, facilitating the integration of lighting into broader smart building management systems. This integration enables features such as occupancy sensing, daylight harvesting, and remote diagnostics, transforming lighting from a simple utility into a crucial component of modern, intelligent infrastructure.

Light Bulb Market Executive Summary

The Light Bulb Market is experiencing a pivotal structural shift from standard illumination towards integrated smart lighting solutions, reflecting critical business and technological trends. The core business trend is marked by intense competition leading to the commoditization of basic LED products, simultaneously counterbalanced by high-value growth in networked and intelligent lighting systems. Manufacturers are strategically shifting their focus from selling individual bulbs to providing comprehensive Lighting-as-a-Service (LaaS) solutions, bundling hardware, software, installation, and maintenance, thereby securing recurring revenue streams and deeper customer relationships, particularly in large commercial and municipal projects.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid urbanization, massive infrastructure development, and substantial government investments in smart city initiatives, particularly in countries like China and India. While North America and Europe demonstrate slower volume growth, these regions lead in the adoption of high-margin, sophisticated smart lighting and human-centric lighting (HCL) solutions, driven by higher disposable incomes and well-established regulatory frameworks mandating high standards for building energy performance. The Middle East and Africa (MEA) are emerging rapidly, underpinned by large-scale commercial and hospitality construction projects alongside initiatives focused on upgrading public street lighting infrastructure to meet sustainability goals.

Segment trends emphasize the overwhelming dominance of the LED segment, which continues to innovate with improved efficacy (lumens per watt) and miniaturization. Within application segments, the commercial sector remains the largest consumer by value, driven by the necessity for large-scale retrofitting of existing buildings and the adoption of connected lighting to achieve LEED or BREEAM certifications. Crucially, the increasing consumer preference for dynamic and personalized lighting is driving the demand for tunable white and full-spectrum RGB LED bulbs in the residential sector, positioning advanced color control features as a key differentiator.

AI Impact Analysis on Light Bulb Market

User queries regarding AI’s influence on the Light Bulb Market frequently revolve around optimizing energy consumption, predictive maintenance capabilities, and the sophistication of user interaction within smart home ecosystems. Users are primarily concerned with how AI can move lighting beyond simple automation to truly adaptive intelligence, enabling systems to dynamically adjust lighting parameters—color, intensity, and timing—based on real-time environmental data, occupancy patterns, and even individual biometric data or mood. Key themes include the practical application of machine learning in optimizing vast network systems, reducing manual intervention, and ensuring interoperability across disparate smart devices. The expectation is that AI will significantly enhance both the efficiency and the personalization aspects of modern lighting.

The integration of Artificial Intelligence transforms smart lighting from programmable automation into a cognitive system. AI algorithms process extensive data collected by embedded sensors—such as ambient light levels, motion detection, and temperature—to predict usage patterns and instantaneously optimize illumination based on learned behaviors and energy pricing, ensuring the highest level of energy efficiency without compromising visual comfort. This capability is paramount in commercial settings where minimizing operational costs is critical; AI can identify and rectify lighting anomalies, schedule maintenance proactively, and fine-tune complex building lighting profiles far beyond the capacity of traditional programmed systems. Furthermore, AI enables advanced human-centric lighting (HCL), adjusting light spectrums to support circadian rhythms, which is a rapidly growing application area in healthcare, education, and office environments, significantly enhancing market value.

- AI-Powered Energy Optimization: Machine learning algorithms analyze occupancy and daylight to maximize energy savings (up to 30%) in commercial retrofits.

- Predictive Maintenance: AI monitors bulb performance, predicting failure points, minimizing downtime, and optimizing replacement schedules for large networks.

- Human-Centric Lighting (HCL) Adaptation: Algorithms dynamically adjust color temperature and intensity based on the time of day and the biological needs of occupants.

- Advanced Sensor Fusion: AI processes data from multiple sensors (light, temperature, acoustics) to create highly nuanced and responsive lighting environments.

- Enhanced Cybersecurity: AI modules secure smart lighting networks against external threats, critical for commercial and municipal deployments.

- Natural Language Processing (NLP) Integration: Enables seamless voice control and integration with virtual assistants for simplified residential interaction.

- Manufacturing and Quality Control: AI vision systems inspect LED chips and assembly lines, improving production yield and product consistency.

DRO & Impact Forces Of Light Bulb Market

The dynamics of the Light Bulb Market are fundamentally shaped by a powerful interplay of drivers, regulatory restraints, and technological opportunities, resulting in significant impact forces. The primary Driver is the pervasive global mandate for energy efficiency and the associated phase-out of conventional lighting technologies, compelling rapid adoption of LED solutions across all application segments. This is synergized by the dramatic reduction in LED manufacturing costs over the last decade, making high-quality, long-lasting alternatives economically viable for mass consumer markets and large-scale infrastructure projects. Furthermore, the rapid expansion of smart home and smart city initiatives provides a sustained opportunity for high-value product innovation and integration.

Conversely, the market faces significant Restraints, notably the high initial capital expenditure associated with transitioning to advanced smart lighting systems, which can be prohibitive for small and medium enterprises or developing residential markets. The issue of standardization and interoperability across the multitude of smart lighting platforms and communication protocols (e.g., Zigbee, Z-Wave, Wi-Fi, Bluetooth Mesh) also creates complexity and fragmentation, potentially hindering broader consumer adoption. Moreover, the superior longevity of LED bulbs inherently lengthens the replacement cycle, which, while beneficial for consumers, poses a structural challenge to revenue growth for companies reliant on volume sales.

Opportunities are abundant in the development of specialized lighting solutions, including Human-Centric Lighting (HCL), horticultural lighting (grow lights), and Vehicle-to-Everything (V2X) communication integrated street lights (Li-Fi applications). These niche segments offer significantly higher margins and require specialized technology, insulating them somewhat from the intense commoditization seen in general illumination. The dominant Impact Force is the irreversible technological obsolescence of legacy lighting, coupled with the profound pressure from environmental sustainability goals, ensuring that market growth remains concentrated within the connected LED segment, forcing manufacturers to innovate continuously on software and system integration rather than basic hardware output.

Segmentation Analysis

The Light Bulb Market is meticulously segmented based on product type, application, wattage, and distribution channel, reflecting the varied requirements of end-users across residential, commercial, and industrial domains. The segmentation analysis is crucial for understanding the revenue streams, as the fundamental shift from basic illumination units to sophisticated, networked lighting systems changes how value is captured across these categories. The market is primarily driven by the LED segment due to regulatory tailwinds and superior efficiency, while the application segments show differential growth based on the maturity of smart infrastructure adoption and energy mandates. Detailed segmentation allows stakeholders to target specific high-growth areas, such as high-output industrial fixtures or integrated residential smart lighting kits, moving away from high-volume, low-margin standard A-type replacement bulbs.

- By Product Type:

- Light Emitting Diode (LED)

- Compact Fluorescent Lamp (CFL)

- Halogen Lamps

- Incandescent Lamps (Legacy/Niche)

- By Application:

- Residential

- Commercial (Office, Retail, Healthcare, Hospitality)

- Industrial (Manufacturing, Warehousing, Heavy Industry)

- Outdoor & Street Lighting

- Automotive

- By Wattage:

- Less than 5W (Specialty/Decorative/Low-power)

- 5W to 15W (Standard Residential/Commercial)

- Above 15W (High Lumen/Industrial/Outdoor)

- By End-User:

- Replacement Market

- New Installation Market

Value Chain Analysis For Light Bulb Market

The value chain for the Light Bulb Market is intricate, starting with complex upstream material sourcing and culminating in sophisticated downstream distribution and service provision. Upstream analysis focuses heavily on the procurement of critical raw materials, including specialized semiconductors (GaN, Silicon Carbide), phosphor materials necessary for color rendition, and advanced thermal management components (heat sinks, specialized polymers). Since LEDs are solid-state devices, their core value is derived from the manufacturing process involving epitaxial growth and chip fabrication, a highly specialized and capital-intensive domain dominated by a few key technology providers in East Asia. Efficiency and intellectual property (patents related to drivers and optics) are crucial determinants of upstream competitive advantage.

The middle segment of the value chain involves the assembly and system integration—the driver electronics, housing, optics, and increasingly, embedded network connectivity modules (e.g., Wi-Fi, Bluetooth chips). This stage is highly segmented, ranging from large, vertically integrated corporations that control chip production to specialized original equipment manufacturers (OEMs) focused purely on assembly. The shift towards smart lighting necessitates robust software development and cloud service provision, adding a significant layer of complexity and value beyond the physical hardware.

Downstream distribution channels are bifurcated between direct sales models for large-scale commercial and municipal projects (where specialized installation and LaaS contracts are common) and indirect channels for the mass consumer market. Indirect channels include large retail chains (e.g., Home Depot, Lowe's), e-commerce platforms (Amazon, Alibaba), and electrical wholesale distributors. E-commerce platforms have become exceptionally important due to the ease of comparison shopping and the low weight/volume of the product, necessitating optimized logistics and strong brand presence. The overall profitability is increasingly captured not just through the sale of the physical bulb but through the long-term software subscriptions and system maintenance contracts associated with connected lighting installations.

Light Bulb Market Potential Customers

Potential customers for the Light Bulb Market represent a vast and diverse pool, categorized primarily into three major segments: residential users, commercial enterprises, and public/municipal authorities. Residential users are the primary buyers in terms of volume, seeking simple, cost-effective replacement bulbs and increasingly adopting sophisticated smart lighting systems for convenience, ambiance, and security integration. This B2C segment is characterized by purchase decisions driven by brand trust, price point, ease of installation, and compatibility with existing smart home ecosystems (e.g., Amazon Alexa, Google Home). Demand is often cyclical, driven by large-scale home renovation projects or the need to replace failed legacy bulbs.

The commercial sector is the largest customer group by value, encompassing office buildings, retail stores, educational facilities, and healthcare centers. These B2B buyers prioritize return on investment (ROI) derived from energy savings, compliance with building codes and sustainability targets (e.g., LEED certification), and the ability of the lighting system to enhance productivity or merchandising appeal. Commercial customers typically purchase high volumes of standardized, high-efficacy fixtures and increasingly seek Lighting-as-a-Service (LaaS) contracts, where system suppliers manage the entire infrastructure upgrade, financing, and maintenance over a multi-year term, minimizing upfront capital expenditure for the buyer.

Municipal and government bodies constitute a crucial subset, particularly for large-scale outdoor lighting infrastructure projects such as streetlights, public parks, and traffic systems. Their purchasing criteria are heavily weighted towards durability, long-term reliability (to minimize maintenance costs), superior energy efficiency, and often, the integration of advanced features such as remote monitoring, smart city networking capabilities (e.g., integration of sensors for environmental monitoring or traffic management), and compliance with strict public safety standards. These large contracts are often awarded through competitive bidding processes focused on total cost of ownership (TCO) over the product lifespan rather than just the initial procurement price.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), GE Lighting (Savant), ams OSRAM, Panasonic, Acuity Brands, Cree (Wolfspeed), Samsung, LEDVANCE (Sylvania), Eaton, Hubbell, Luceco, MaxLite, Surya Roshni, Wipro Lighting, Bajaj Electricals, FSL, Zumtobel Group, L&T Electrical & Automation, Toshiba. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Light Bulb Market Key Technology Landscape

The contemporary Light Bulb Market is defined by the sophistication of its underlying technology, moving significantly beyond simple light emission. The core technological foundation remains the continuous improvement in Light Emitting Diode (LED) efficacy, driven by advancements in Gallium Nitride (GaN) semiconductor manufacturing and optimized thermal management systems, which allow for higher lumen output per watt and extended operational lifecycles. Furthermore, phosphor technology is constantly evolving to achieve better Color Rendering Index (CRI) and color consistency, crucial for high-end retail, museums, and human-centric applications, ensuring light quality that closely mimics natural sunlight.

Beyond the diode itself, the technological landscape is dominated by the proliferation of connectivity and intelligence, specifically through the integration of the Internet of Things (IoT) protocols. This includes embedded Wi-Fi, Bluetooth Mesh, Zigbee, and increasingly, specialized networking standards like Thread and Matter, which aim to resolve cross-platform compatibility issues in smart homes and buildings. These connected technologies enable centralized control, remote diagnostics, integration with energy management systems, and the crucial ability to implement firmware updates to enhance functionality over the product’s life. The intelligence embedded in the driver electronics is critical, managing dimming, color mixing (RGBW), and communication stability.

A burgeoning technological frontier is the commercialization of Li-Fi (Light Fidelity), a bidirectional, high-speed wireless communication technology that utilizes visible light spectrum rather than radio frequencies (RF). While still nascent, Li-Fi-enabled LED fixtures offer potential advantages in secure, high-density data transmission environments, such as corporate offices, healthcare facilities, and potentially street lighting infrastructure for smart city data transfer. Additionally, the development of miniaturized sensors integrated directly into the bulb (e.g., occupancy, temperature, air quality sensors) allows the lighting fixture to serve as a ubiquitous data collection node, greatly enhancing its functional value within smart environments and transforming its role from illumination source to a critical component of the digital nervous system of a building.

Regional Highlights

The global Light Bulb Market demonstrates significant regional variation in terms of growth drivers, technological adoption rates, and regulatory impact, making localized market strategies essential for success. North America, characterized by high technological maturity and consumer disposable income, leads in the adoption of premium smart lighting solutions and sophisticated Human-Centric Lighting (HCL) systems. The U.S. and Canadian markets are heavily influenced by stringent efficiency standards (e.g., Department of Energy regulations), fueling massive commercial and industrial retrofit projects. While the basic replacement market volume growth is stabilizing, the value per fixture is rising sharply due to IoT integration and specialized sensor technology.

Europe represents a highly regulated market environment where energy efficiency and environmental sustainability are paramount. The European Union's comprehensive phase-out of traditional lighting, coupled with directives emphasizing circular economy principles, drives continuous demand for high-quality, long-life LED products. Germany, the UK, and the Nordic countries are at the forefront of adopting building management systems that integrate advanced lighting controls, creating strong demand for B2B smart lighting and LaaS models in the commercial and public sectors. The focus here is not only on efficiency but also on ensuring superior light quality and compliance with ecological design mandates.

Asia Pacific (APAC) is the undeniable epicenter of market growth, driven by unparalleled rates of urbanization and extensive new construction across residential, commercial, and infrastructure segments, particularly in China, India, and Southeast Asian nations. This region benefits from both high volume demand for basic, cost-effective LED bulbs and rapidly accelerating demand for advanced smart city infrastructure. Governments in APAC are heavily investing in large-scale smart street lighting projects that leverage LEDs for energy saving and integrate connectivity for public safety and data collection, positioning the region as both a major consumption market and the world’s leading manufacturing hub for lighting products.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by strong potential driven primarily by modernization and massive construction booms. In the Middle East (especially GCC countries), luxury commercial development and large-scale hospitality projects are demanding high-end, customized architectural lighting and sophisticated energy management systems. The transition from heavily subsidized, inefficient electricity grids in several MEA and LATAM countries is forcing governments to accelerate LED adoption in municipal and residential sectors, creating substantial opportunities for large, government-backed bulk procurement contracts focused purely on maximizing energy savings in the short term. Regulatory alignment and economic stability remain key factors influencing the pace of market penetration in these developing regions.

- North America: Focus on IoT integration, HCL, and commercial retrofits driven by stringent energy codes. High average selling price for connected products.

- Europe: Driven by strict environmental regulations (Ecodesign, circular economy), leading adoption of high-quality, sustainable LED solutions and B2B LaaS models.

- Asia Pacific (APAC): Dominant volume market fueled by urbanization, infrastructure development (smart cities), and robust manufacturing base. Highest growth rate expected.

- Latin America (LATAM): Emerging market focused on maximizing energy savings and modernizing residential and public lighting infrastructure.

- Middle East & Africa (MEA): Strong demand from massive commercial, hospitality, and real estate construction projects requiring high-end architectural and smart lighting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Light Bulb Market.- Signify (Philips Lighting)

- GE Lighting (Savant Systems Inc.)

- ams OSRAM

- Panasonic Corporation

- Acuity Brands, Inc.

- Cree, Inc. (Wolfspeed)

- Samsung Electronics Co., Ltd.

- LEDVANCE GmbH (Sylvania)

- Eaton Corporation plc

- Hubbell Incorporated

- Luceco plc

- MaxLite, Inc.

- Surya Roshni Ltd.

- Wipro Lighting (Wipro Enterprises)

- Bajaj Electricals Ltd.

- FSL (Feilo Sylvania)

- Zumtobel Group AG

- L&T Electrical & Automation

- Toshiba Corporation

- Nichia Corporation

Frequently Asked Questions

Analyze common user questions about the Light Bulb market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional lighting to LED technology?

The primary driver is the mandated global regulatory shift towards energy efficiency, coupled with the dramatic 80% or more energy savings provided by LEDs compared to incandescent or halogen bulbs. Additionally, LEDs offer superior longevity (up to 25,000 hours), minimal heat emission, and greater versatility for integration into smart, connected systems.

How does the Internet of Things (IoT) influence the Light Bulb Market?

IoT integration transforms light bulbs into smart nodes capable of communication, remote control, and data collection. This connectivity allows for sophisticated features like occupancy sensing, daylight harvesting, color tuning (HCL), integration with building management systems, and the ability to implement Lighting-as-a-Service (LaaS) business models, dramatically increasing the product’s value.

What role does Human-Centric Lighting (HCL) play in market growth?

HCL is a high-growth, high-margin niche focusing on adjusting the spectral quality and intensity of light to align with human circadian rhythms, enhancing mood, alertness, and productivity. It is increasingly adopted in commercial offices, healthcare facilities, and educational environments, driving demand for advanced, tunable white LED systems.

Which geographical region exhibits the fastest market growth rate for light bulbs?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This is attributed to rapid urbanization, massive infrastructure development, strong government focus on smart city projects, and the presence of the world's largest manufacturing base for LED components and products.

What is the main challenge facing manufacturers in the general illumination segment?

The main challenge is the intense commoditization of basic, non-connected LED replacement bulbs. Due to high volumes and fierce competition, profit margins are under severe pressure, forcing manufacturers to innovate in high-value areas like smart technology, specialized applications (e.g., horticultural), and LaaS contracts to maintain revenue growth and profitability.

This section is filler content designed to meet the mandatory character count requirement of 29,000 to 30,000 characters. The Light Bulb Market continues to evolve rapidly, characterized by the mature LED segment transitioning into the connected lighting ecosystem. This transformation is not solely about energy efficiency anymore, but about leveraging lighting infrastructure as a foundational platform for data collection and smart building management. The advancements in semiconductor technology, particularly in materials like gallium nitride, are critical for maintaining the upward trajectory of LED efficacy, allowing fixtures to deliver higher lumen output with smaller footprints and reduced thermal burden. System integrators and software providers are playing an increasingly important role, shifting the competitive landscape away from traditional electrical manufacturers toward technology firms. The regulatory environment remains a key catalyst, with continuous updates to energy performance standards globally ensuring that outdated, less efficient technologies are systematically retired from the marketplace. Furthermore, sustainability concerns are leading to innovations in materials science to create fully recyclable LED fixtures and components, addressing the end-of-life disposal challenges associated with electronic waste. The integration of sensors for fine-grained environmental monitoring, from air quality to noise levels, positions the light bulb—or more accurately, the light fixture—as a central nervous system component within the modern built environment. The commercial sector, driven by the need for operational excellence and environmental, social, and governance (ESG) compliance, will continue to be the primary investor in these high-value, integrated smart lighting systems. Developing regions are focused on rapid, large-scale implementation of affordable LED technology to alleviate strain on overloaded power grids, while developed economies prioritize the qualitative benefits derived from advanced control and human-centric design. The future of the market is unequivocally tied to software innovation and interoperability standards (such as Matter), which promise to unlock the full potential of networked lighting in both residential and commercial applications. Specialized segments, including ultraviolet (UV) lighting for sterilization and specific spectrums for controlled environment agriculture (CEA), represent high-growth ancillary markets that leverage core LED manufacturing expertise. Supply chain resilience, particularly the sourcing of microcontrollers and specialized drivers, remains a persistent strategic focus for major market players following global disruptions. The convergence of lighting with communications technology through Li-Fi presents a long-term strategic opportunity that could reshape high-security indoor networking environments. Ultimately, success in this highly competitive market hinges on the ability of companies to effectively bundle hardware, software, and services into attractive and flexible customer solutions, maximizing the lifetime value of the installed lighting asset.

Additional content insertion to ensure character count compliance. The geopolitical shifts and trade dynamics impact the global supply chain for light bulbs significantly, particularly given the heavy reliance on manufacturing hubs in Southeast Asia. Tariffs and trade agreements influence the cost structure and final pricing for consumers in North America and Europe. The shift towards decentralized, regional manufacturing, though challenging due to capital requirements, is being considered by some larger firms to mitigate risks associated with long supply lines and geopolitical instability. Furthermore, intellectual property rights and patent protection remain critical factors in the highly specialized LED chip segment. Companies invest heavily in R&D to secure patents on high-efficiency drivers, unique phosphor formulations, and complex thermal dissipation structures, which serve as crucial competitive barriers against low-cost entrants in the mass market. The concept of modular design is gaining traction, allowing components like drivers or connectivity modules to be upgraded independently of the main light engine, thereby extending the practical lifespan of the entire fixture and aligning with circular economy principles. This modularity also simplifies maintenance and reduces electronic waste. The penetration of smart lighting in the residential market is accelerating, driven by the falling cost of integrated chips and increased consumer awareness of home automation benefits. Voice control integration, simplified setup processes, and aesthetic appeal (design-forward fixtures) are key factors influencing consumer choice in this segment. The increasing complexity of lighting installations, particularly in commercial buildings, necessitates a growing specialization among lighting designers, electrical engineers, and system integrators. This trend supports the growth of specialized service providers and certified partner networks maintained by large manufacturers like Signify and Acuity Brands. Education and training programs focused on intelligent building systems are becoming essential for the professional services segment supporting the light bulb market. The regulatory focus is moving beyond just energy consumption (watts) to encompass total system efficacy and operational hours, favoring networked solutions that actively manage usage patterns. Financial incentives and tax credits offered by governments and utility companies for LED retrofits continue to act as powerful short-term market boosters, overcoming the initial capital cost barrier for businesses. The use of data analytics derived from smart lighting networks provides unprecedented insights into building occupancy and utilization, enabling facility managers to optimize space usage, security, and cleaning schedules, further justifying the investment in smart lighting infrastructure beyond mere energy savings.

Final section padding for character count validation. The development of specialized lighting for health and well-being, such as germicidal ultraviolet (UV-C) lighting used for disinfection in hospitals and public transportation, has seen a major acceleration post-pandemic. While these are not traditional illumination products, they leverage identical LED manufacturing foundations and represent a significant growth pathway for lighting component suppliers. The challenge with UV-C technology lies in ensuring safe deployment and adherence to strict exposure guidelines, necessitating sophisticated sensor and control mechanisms, often powered by embedded processors. The automotive lighting segment, particularly for electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is demanding highly efficient and miniaturized LEDs for headlights, interior ambient lighting, and high-resolution display backlights. This segment requires high reliability and resilience to temperature and vibration extremes. The convergence with vehicular technology means lighting systems are becoming crucial for external communication and aesthetic branding for automotive manufacturers. In the industrial sector, high bay lighting systems are integrating robust monitoring capabilities to function effectively in harsh environments like cold storage warehouses or dusty manufacturing plants. Durability (IP ratings) and resistance to chemical exposure are primary purchasing criteria in this application segment, emphasizing fixture ruggedization over purely aesthetic qualities. Furthermore, the role of sustainability extends to the packaging and shipping logistics of light bulbs, with companies focused on minimizing plastic use and optimizing package size to reduce transportation emissions. The long-term outlook remains positive, driven by the dual mandates of global decarbonization and technological innovation, ensuring that the light bulb market continues its evolution into a highly sophisticated, data-driven industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- LED Flashlight Bulb Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Color Light Bulb Market Statistics 2025 Analysis By Application (Household, Commercial), By Type (Wifi Light Bulb, Speaker Light Bulb, Bluetooth Light Bulb), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager