Liquor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432152 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Liquor Market Size

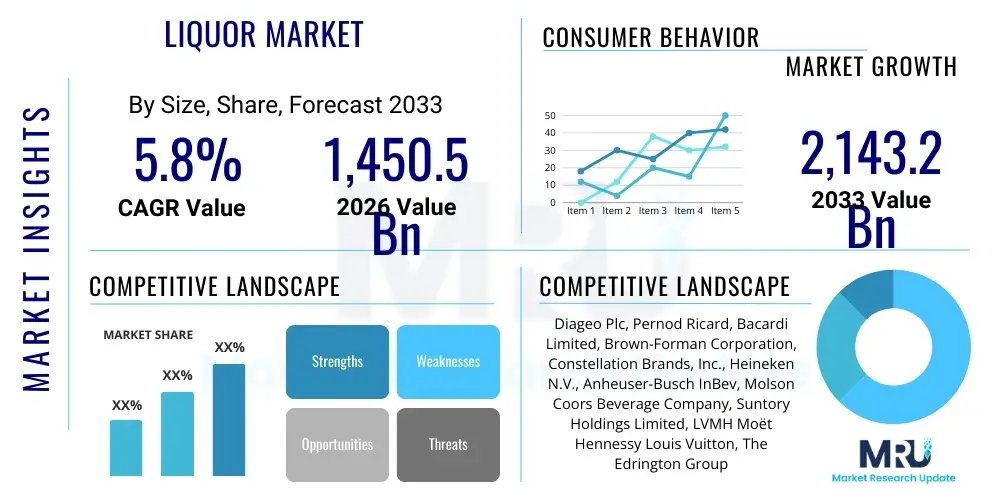

The Liquor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is primarily fueled by accelerated premiumization trends globally, where consumers are shifting from mass-market products to high-quality, craft, and specialty spirits. Furthermore, the expansion of e-commerce platforms and digital distribution channels has significantly broadened market reach, particularly appealing to younger, digitally native consumers seeking convenience and variety. The market dynamics are also heavily influenced by demographic changes, including the rising disposable incomes in emerging economies, particularly across Asia Pacific, which drives higher consumption frequencies and experimentation with diverse liquor categories such as premium whiskies and international wines. Regulatory harmonization and easing of trade tariffs in key trading blocs further support this expansion by facilitating cross-border sales and ingredient sourcing.

The market is estimated at $1,450.5 Billion USD in 2026, driven by sustained demand in established segments like beer and vodka, combined with explosive growth in niche categories such as ready-to-drink (RTD) cocktails and ultra-premium tequila. This valuation reflects a recovering on-trade sector (bars, restaurants, hotels) rebounding from previous disruptions, alongside continued resilience in the off-trade sector (retail stores, liquor shops). The shift in consumer preference towards 'better for you' options, including low-alcohol or no-alcohol alternatives, while a challenge to traditional volume, simultaneously introduces new, high-margin product lines that contribute positively to the overall market valuation. Strategic investments by multinational conglomerates in acquiring regional craft distilleries also contribute to the market's value by integrating successful premium brands into global distribution networks, capitalizing on local authenticity and established consumer bases.

The global liquor market is projected to reach $2,143.2 Billion USD by the end of the forecast period in 2033. This forecast is predicated on continued innovation in flavor profiles, sustainable packaging initiatives, and effective digital marketing strategies targeting specific consumer segments. Key growth areas include China and India, where urbanization and Western cultural assimilation are rapidly increasing demand for international spirits. Additionally, advancements in supply chain resilience, supported by technology adoption such as blockchain for provenance tracking, are expected to enhance consumer trust and justify premium pricing, thereby increasing the total attainable market value. The persistent trend of home consumption, even post-pandemic, supported by sophisticated delivery networks and curated at-home cocktail experiences, provides a stable underpinning for the forecasted high-value market expansion.

Liquor Market introduction

The global liquor market encompasses the production, distribution, and sale of alcoholic beverages, ranging from low-alcohol content beverages like beer and cider to high-proof distilled spirits such as whiskey, rum, vodka, gin, and specialized categories like liqueurs and ready-to-drink (RTD) cocktails. This industry is highly fragmented yet dominated at the top tier by a few multinational corporations that control vast portfolios across multiple product categories. The market’s primary function is to serve consumer demand for social, recreational, and cultural consumption occasions. Products are defined by their base raw materials (grains, fruits, sugarcane, agave), fermentation and distillation processes, aging techniques, and regional provenance, all of which significantly influence flavor profile and market positioning. Major applications extend across both on-trade environments—including restaurants, bars, and hotels—and off-trade locations such as retail grocery stores, specialized liquor outlets, and the rapidly growing digital commerce sector. The overall market is a sophisticated blend of tradition, stringent regulation, and cutting-edge marketing.

The core benefits derived from the liquor market include significant economic contributions through excise taxes, employment generation across agriculture, manufacturing, logistics, and hospitality sectors, and the role these products play in social rituals and cultural identity worldwide. Economically, the industry is a major revenue generator for governments globally, often providing substantial fiscal backing. For consumers, the benefits are primarily experiential, offering variety, luxury, and social connectivity. Driving factors for market growth are multifaceted and include rising levels of global disposable income, which allows consumers to trade up to premium and super-premium brands; accelerated urbanization, especially in Asia and Africa, which shifts consumption habits towards commercially produced beverages; and sophisticated global marketing campaigns that introduce new consumption occasions and product types, such as the sustained interest in craft brewing and artisanal distillation. Moreover, demographic shifts, including a younger, more adventurous consumer base, are pushing manufacturers towards innovative flavors and sustainable production methods.

A significant aspect influencing the market landscape is the duality of growth drivers and associated societal responsibilities. While factors like the resurgence of cocktail culture, the globalization of regional specialties (e.g., Mezcal, Japanese Whisky), and the convenience provided by digital distribution propel sales, the industry also faces considerable restraints related to public health concerns, strict government regulations on advertising and sales, and increasing societal focus on responsible consumption. Consequently, market participants are heavily investing in responsible drinking initiatives and developing low-alcohol and non-alcoholic alternatives to mitigate regulatory risks and align with evolving consumer wellness trends. The perpetual push for innovation, particularly in product customization and environmentally sound operations, remains a foundational pillar for navigating the complex regulatory and societal framework of the global liquor industry.

Liquor Market Executive Summary

The global liquor market is experiencing a pivotal period defined by strategic business trends focusing on premiumization, digital transformation, and sustainable sourcing. Business trends indicate that multinational beverage conglomerates are actively consolidating the market through strategic mergers and acquisitions (M&A), targeting regional craft and specialized spirit producers to quickly integrate high-growth niche brands into their global portfolios. This consolidation aims to capture the higher margins associated with premium products and diversify risk across a wider product spectrum, mitigating volatility in any single category. Furthermore, significant capital is being deployed into enhancing supply chain resilience, utilizing advanced logistics and predictive analytics to manage complex global sourcing networks, particularly in categories reliant on time-sensitive or climate-vulnerable agricultural inputs like grapes (for wine) and agave. Digital engagement, encompassing direct-to-consumer (D2C) channels and personalized digital marketing, has become non-negotiable for competitive differentiation, driving strong growth in e-commerce channels which offer greater consumer personalization and convenience.

Regional trends reveal significant divergences in market maturity and growth dynamics. North America and Europe remain high-value, mature markets characterized by sustained demand for super-premium segments, with a noticeable shift towards low-alcohol/no-alcohol (LoNo) options and experimentation in innovative spirit categories like high-end American Single Malt Whiskey and craft gins. The key growth engine for global volume and future value, however, resides in the Asia Pacific (APAC) region, specifically in high-density markets like China and India, where a burgeoning middle class and rapid urbanization drive massive increases in consumption of imported spirits and international beer brands. Latin America is showcasing strong growth fueled by regional specialties, particularly Tequila and Mezcal, which are gaining significant international appeal. Conversely, the Middle East and Africa (MEA) market remains complex, dominated by specific regional consumption patterns and highly variable regulatory landscapes, though increasing tourism and expatriate populations in key hubs drive niche demand for premium Western brands.

Segment trends emphasize the rapid ascent of specialty spirits and the structural evolution of distribution channels. Among product types, RTD cocktails and High-End Tequila/Mezcal are the fastest-growing segments, capturing consumer demand for convenience, novelty, and premium mixers. Whiskey, particularly the single malt and Japanese varieties, maintains its position as a high-value anchor, supported by robust connoisseur interest and collectability. Beer continues to dominate in volume but faces margin pressure, compelling major brewers to invest heavily in craft beer subsidiaries and LoNo alternatives. In distribution, the off-trade channel, particularly e-commerce, has gained permanent market share following global mobility restrictions, necessitating extensive investment in digital inventory management, localized delivery solutions, and engaging online experiences. The on-trade sector is focused on delivering unique, high-quality experiences, driving demand for innovative bar tools, specialized cocktails, and curated beverage menus that justify higher experiential pricing.

AI Impact Analysis on Liquor Market

Common user questions regarding AI's impact on the liquor market frequently revolve around how artificial intelligence can optimize the often traditional and complex supply chain, enhance personalized consumer experiences, and potentially influence the artistic aspects of distillation and flavor creation. Users are keen to understand if AI can accurately predict fluctuating demand across various regions and seasons, manage perishable inventories (like wine), and automate logistics, thereby reducing costs and waste. A recurring theme is the expectation that AI will radically alter customer relationship management (CRM) and targeted marketing, allowing brands to move beyond broad demographic targeting to hyper-personalized promotions based on granular purchasing behavior and psychographic data. Concerns often center on data privacy regarding detailed consumption patterns and the potential for AI-driven automation to impact employment in traditional roles, such as sales forecasting and entry-level sommelier services. Overall, users anticipate that AI will be a core enabler of efficiency, hyper-personalization, and data-driven product innovation within the next five years.

Based on this analysis, the key themes summarizing AI’s influence include optimization, personalization, and predictive innovation. AI algorithms are already being deployed to analyze massive datasets related to point-of-sale information, social media sentiment, and macroeconomic indicators, providing distilleries and retailers with unprecedented accuracy in demand forecasting. This capability minimizes stock-outs of popular premium items while preventing overstocking of slow-moving inventory, optimizing working capital significantly. Furthermore, AI is central to customizing the customer journey, powering recommendation engines on e-commerce platforms that suggest pairings, cocktail recipes, or personalized promotions based on past purchases and browsing history, dramatically boosting conversion rates and fostering brand loyalty. In product development, sophisticated machine learning models are beginning to assist master blenders by analyzing chemical profiles and consumer preference scores to guide the creation of novel flavor combinations and consistent product quality across large production batches, thereby accelerating the innovation cycle.

The strategic deployment of AI extends deeply into operational efficiency and market responsiveness. In logistics, AI optimizes routing for last-mile delivery of alcoholic beverages, adhering to strict age verification and local regulatory compliance in real time. For large producers, maintenance systems for complex distillation equipment are becoming predictive, utilizing AI to analyze operational data and flag potential mechanical failures before they occur, drastically reducing downtime and ensuring product consistency. Moreover, brands are leveraging natural language processing (NLP) to analyze unstructured consumer feedback from reviews and social media, providing real-time insights into flavor preferences, packaging perceptions, and emerging trends, allowing for rapid strategic adjustments in marketing and product rollout. This data-driven approach shifts the industry from reactive marketing to proactive, anticipatory product development and supply chain management.

- AI-driven demand forecasting optimizes inventory levels for seasonal and regional shifts, particularly critical for high-value aged spirits.

- Personalized marketing and recommendation engines, powered by machine learning, significantly increase e-commerce conversion rates and customer lifetime value.

- AI enhances quality control and accelerates new product development by analyzing chemical compositions and predicting optimal blending ratios.

- Predictive maintenance for production machinery reduces operational downtime and ensures consistency in distillation and brewing processes.

- Blockchain integration, often managed by AI, provides enhanced provenance tracking and anti-counterfeiting measures for premium and collectible bottles.

- AI systems automate regulatory compliance checks during the digital sales process, ensuring adherence to age verification and local alcohol laws.

- Natural Language Processing (NLP) provides real-time analysis of consumer sentiment from social media and online reviews, informing strategic decisions.

DRO & Impact Forces Of Liquor Market

The dynamics of the global liquor market are determined by a powerful interplay between structural Drivers (D), constraining Restraints (R), emergent Opportunities (O), and external Impact Forces. The primary drivers include the aforementioned global premiumization trend, which elevates the average value per transaction, and rapid demographic shifts, particularly the growth of the young adult consumer base in high-growth economies. These drivers are fundamentally economic and sociological, rooted in increasing discretionary spending power and the associated lifestyle changes that favor international, high-status brands. However, these forces are counterbalanced by significant restraints, most notably the stringent global regulatory framework encompassing high excise taxes, strict advertising bans, and age restrictions, which create substantial barriers to entry and operational complexity for market players. Furthermore, a growing global emphasis on health and wellness, manifested in reduced overall alcohol consumption and preference for Low/No-Alcohol (LoNo) options, directly challenges the volume growth of traditional alcoholic categories, forcing producers to innovate aggressively or risk stagnation. The balance between economic ambition and regulatory prudence defines the operational environment.

Opportunities in the market center around innovation, technology adoption, and expansion into untapped distribution channels. The proliferation of e-commerce and direct-to-consumer (D2C) sales models represents a significant opportunity for brands to bypass traditional distribution layers, enhance margins, and capture consumer data directly. Parallel opportunities exist in flavor innovation, catering to the experimental palates of Millennials and Gen Z through specialized spirits like craft vodka, flavored whiskies, and complex RTD cocktails, which offer convenience without sacrificing quality. Furthermore, the global trend towards sustainability and ethical sourcing provides a critical competitive advantage; companies that invest in environmentally friendly distillation processes, waste reduction, and transparent sourcing are better positioned to attract conscious consumers and secure favorable regulatory treatment. The successful integration of blockchain for supply chain transparency, ensuring product authenticity for premium collectors, also represents a major, technologically driven opportunity for value creation and brand trust.

Impact forces acting upon the market are generally macro-environmental and external to industry control, often dictating immediate market conditions and long-term strategic planning. Global economic volatility and inflationary pressures significantly impact the liquor market by influencing consumer discretionary spending; during downturns, consumers tend to shift to lower-priced categories, slowing premiumization. Geopolitical tensions and trade wars directly affect cross-border trade, tariffs on imported raw materials (e.g., barley, corks), and the stability of established distribution routes, creating cost unpredictability. Additionally, public health crises, climate change affecting agricultural yields (wine grapes, grains), and shifts in consumer confidence due to regulatory announcements (e.g., minimum pricing legislation) are powerful external forces that require dynamic adaptation. The synergistic interaction of these forces—where premiumization (Driver) meets health consciousness (Restraint), mediated by digital commerce (Opportunity)—shapes the profitability and future structure of the global liquor industry.

Segmentation Analysis

Segmentation analysis of the global liquor market is crucial for understanding the nuanced dynamics that drive consumer choice, price sensitivity, and regional variance. The market is primarily segmented across three core dimensions: product type, distribution channel, and geographic region. Product type segmentation distinguishes between fermented beverages (e.g., beer, wine) and distilled spirits (e.g., whiskey, vodka, rum). Within spirits, further sub-segmentation occurs based on base ingredients, aging techniques, and regional origins, which directly dictate the price point, perceived quality, and target consumer demographic. For instance, the whiskey segment is heavily subdivided into Scotch, Bourbon, Irish, Japanese, and American Single Malt, each catering to distinct consumer profiles and investment preferences. Analyzing these segments helps companies allocate R&D and marketing spend effectively, focusing resources on the fastest-growing categories like premium tequila and RTDs, while managing mature, high-volume segments like mainstream beer.

The distribution channel segmentation is perhaps the most dynamic area, differentiating between On-Trade (consumption in bars, restaurants, hotels, catering) and Off-Trade (consumption purchased from retail for home use). The recent acceleration of e-commerce has introduced a highly disruptive third channel, often overlapping with off-trade but requiring specialized logistical and regulatory compliance expertise. Understanding the shifts in channel dominance is essential; the revival of the On-Trade sector is indicative of recovering social spending and experiential consumption, while the permanence of a strong e-commerce channel reflects the consumer demand for convenience and personalized delivery. Strategic focus is now shifting towards omnichannel integration, ensuring a seamless brand experience whether the consumer is purchasing a product in a physical store, ordering a cocktail at a bar, or completing a transaction online. This complexity necessitates granular data analysis to optimize pricing and promotional strategies across various consumer touchpoints.

Finally, geographic segmentation highlights the critical differences in regulatory environments, cultural consumption norms, and economic capacity. While North America drives high value due to established premium markets and strong cocktail culture, Asia Pacific dominates volume growth and future value creation due to sheer population size and increasing middle-class affluence. Emerging markets require tailored product strategies focusing on locally relevant ingredients and pricing tiers, contrasting sharply with the mature European markets, where emphasis is often placed on heritage, provenance, and sustainable production credentials. Successful market participants employ localized segmentation strategies that respect cultural sensitivities and navigate diverse tax structures and legal restrictions on alcohol advertising and sale, ensuring compliance while maximizing market penetration across varied global landscapes.

- By Product Type:

- Whiskey (Scotch, Irish, Bourbon, Japanese, Canadian)

- Vodka (Standard, Premium, Flavored)

- Rum (White, Dark, Gold, Spiced)

- Gin (London Dry, Plymouth, Old Tom, Contemporary)

- Tequila and Mezcal (Blanco, Reposado, Añejo, Ultra-Premium)

- Brandy (Cognac, Armagnac, Pisco)

- Wine (Still Wine, Sparkling Wine, Fortified Wine)

- Beer (Lager, Ale, Stout, Craft Beer, Low-Alcohol/No-Alcohol Beer)

- Ready-to-Drink (RTD) Cocktails and Hard Seltzers

- By Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels, Cafes)

- Off-Trade (Retail Stores, Supermarkets, Liquor Stores)

- E-commerce (Online Retailers, D2C Platforms)

- By Packaging:

- Glass Bottles

- Cans

- Kegs

- Pouches/Cartons

Value Chain Analysis For Liquor Market

The liquor market value chain begins with highly specialized upstream activities, primarily involving the cultivation, harvesting, and processing of raw agricultural inputs such as grains (barley, rye, corn), fruits (grapes, apples), sugarcane, and agave. The quality and consistency of these raw materials are paramount, significantly influencing the final product's flavor profile, and often require specialized sourcing agreements, particularly for heritage brands that rely on specific regional inputs (e.g., Scotch whisky relies on Scottish barley). This upstream segment includes malting operations, fermentation processes, and initial distillation phases. Key challenges here involve managing climate volatility, ensuring sustainable farming practices, and navigating volatile commodity pricing. Due to the nature of aged spirits, the upstream phase also includes long-term storage and maturation management, which ties up significant capital over extended periods, necessitating robust financial planning and risk management.

The core midstream segment involves large-scale manufacturing processes, including blending, bottling, packaging, and quality assurance. This stage focuses on achieving product consistency, adhering to stringent quality standards, and complying with diverse international labeling requirements. Packaging components—glass bottles, closures, and labeling—represent significant cost centers and are increasingly influenced by sustainability demands, driving innovation towards lighter, recycled, or alternative packaging formats. Following bottling, the distribution channel becomes critical. This downstream flow is highly complex, moving products from centralized manufacturing hubs through various layers: national importers, specialized wholesalers, regional distributors, and finally to the end points. Direct and indirect distribution methods coexist; indirect channels rely on established third-party distributors who handle logistics, local regulatory compliance, and sales to retailers, providing broad market access. Direct channels (D2C via e-commerce or brand-owned stores) offer higher margins and direct consumer data but require significant investment in specialized logistics capable of handling age-restricted products.

The final stage involves the retail and consumption points, categorized into On-Trade and Off-Trade. On-Trade distribution involves supplying bars and restaurants, where margins are often higher due to the experiential value added at the point of consumption, requiring strong trade marketing and relationship management. Off-Trade, encompassing supermarkets and specialized liquor stores, focuses on volume and price competitiveness. E-commerce acts as a hybrid, streamlining the purchase process and often serving as a primary channel in regions with restrictive trade laws. The entire value chain is characterized by strict governmental oversight regarding taxation, movement, and sales. Therefore, successful market participation requires not only efficient operations but also deep expertise in managing regulatory complexity across all jurisdictions, ensuring that every step, from seed to sale, is fully traceable and compliant.

Liquor Market Potential Customers

The potential customer base for the global liquor market is exceptionally broad, spanning various demographic and psychographic segments, but can be broadly categorized into individual consumers and institutional buyers. Individual consumers represent the vast majority of volume and are segmented based on age, income, lifestyle, and consumption preference. The most critical segments include high-disposable-income consumers who drive the premium and ultra-premium categories, exhibiting brand loyalty and a focus on provenance and exclusivity (e.g., collectors of limited-edition whiskies or high-vintage wines). Another pivotal segment is the young adult population (Millennials and Gen Z), who are characterized by experimental purchasing habits, high engagement with digital marketing, and a preference for novelty, convenience (RTDs), and ethically sourced products. This segment is highly responsive to innovative packaging and targeted social media campaigns, driving growth in flavored spirits and customized cocktail solutions. Understanding the nuanced shift in this segment towards conscious consumption, including LoNo options, is paramount for future product strategy.

Institutional buyers primarily fall under the HORECA (Hotels, Restaurants, and Cafes) sector, which constitutes the essential On-Trade distribution channel. These buyers prioritize product consistency, reliable supply chains, bulk pricing, and brand reputation, as their beverage offerings directly influence their operational profitability and customer experience. A key subset within this institutional segment includes corporate catering services, airlines, cruise lines, and large-scale event organizers, all requiring specialized volumes, packaging, and logistical coordination. For premium brands, the ability to secure placements in high-end, trend-setting bars and five-star hotels serves as a crucial marketing vehicle, establishing brand prestige and driving consumer pull-through in the off-trade segment. Supplying the institutional market requires dedicated sales teams focused on inventory management, beverage program consultation, and compliance with high volume purchasing contracts.

Beyond traditional consumers and institutional buyers, niche segments represent significant growth potential. These include the burgeoning tourism market, where local distilleries and breweries attract experiential buyers seeking authentic regional products, and the sophisticated collector market, where certain high-value, aged spirits are purchased as alternative investment assets rather than for immediate consumption. Furthermore, the expansion of global duty-free and travel retail channels caters specifically to international travelers seeking exclusive, often oversized, limited-edition products. The strategic focus across all potential customer segments must increasingly incorporate digital engagement, personalized loyalty programs, and transparent communication regarding sourcing and production ethics, aligning product offerings with the global consumer movement towards wellness, authenticity, and conscious indulgence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,450.5 Billion USD |

| Market Forecast in 2033 | $2,143.2 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo Plc, Pernod Ricard, Bacardi Limited, Brown-Forman Corporation, Constellation Brands, Inc., Heineken N.V., Anheuser-Busch InBev, Molson Coors Beverage Company, Suntory Holdings Limited, LVMH Moët Hennessy Louis Vuitton, The Edrington Group, Rémy Cointreau, Asahi Group Holdings, Ltd., Campari Group, Treasury Wine Estates, Vina Concha y Toro S.A., United Spirits Limited, Thai Beverage Public Company Limited, Patron Spirits International AG, Whyte & Mackay. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquor Market Key Technology Landscape

The liquor market, traditionally rooted in long-established artisanal practices, is increasingly leveraging advanced technology across the production, logistics, and consumer engagement spectrums. In the production phase, sophisticated analytical instruments are essential for modernizing quality control, ensuring precise monitoring of fermentation temperatures, pH levels, and alcohol content throughout the brewing and distillation processes. Advanced computer-controlled distillation columns allow master distillers to achieve unprecedented accuracy in separating ethanol and congeners, leading to highly consistent and repeatable spirit profiles, crucial for large-scale operations maintaining global brand standards. Furthermore, the adoption of specialized Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES) tailored for the beverage industry ensures seamless integration between raw material tracking, production scheduling, packaging lines, and inventory management, significantly improving overall operational throughput and reducing waste across the manufacturing footprint.

In the supply chain and consumer trust domain, blockchain technology is emerging as a disruptive force, particularly for high-value and collectible spirits. Blockchain ledgers provide an immutable record of a bottle's journey—from the moment of distillation and barrel assignment to bottling, transportation, and final sale—providing verifiable provenance information that combats counterfeiting, a persistent threat to luxury brands. Concurrently, the growth of e-commerce has necessitated substantial investment in logistics technologies, including AI-driven route optimization for rapid delivery and specialized age-verification software integrated directly into delivery protocols to comply with strict regional laws. The use of Near Field Communication (NFC) and Quick Response (QR) codes embedded in smart packaging enables brands to engage directly with consumers post-purchase, offering digital content, customized cocktail recipes, or personalized brand stories, effectively turning the product packaging into an interactive marketing channel.

Consumer engagement and marketing strategies are now intrinsically linked to advanced data analytics and Customer Relationship Management (CRM) tools. Major players utilize big data processing capabilities to analyze millions of consumer interactions, purchase histories, and digital footprints, allowing for the segmentation of markets down to individual preference levels. This data is leveraged to create hyper-personalized advertising campaigns, optimize pricing dynamically based on localized competition and demand signals, and guide product innovation (e.g., identifying trending flavor profiles for RTDs). The future technology landscape will be defined by the integration of these digital tools with core physical production assets, creating 'smart distilleries' that operate autonomously, minimize environmental impact, and respond instantaneously to complex global market demands, transitioning the industry from traditional manufacturing to a data-driven ecosystem focused on resilience and hyper-efficiency.

Regional Highlights

The global liquor market demonstrates highly heterogeneous growth patterns, with market maturity and consumption dynamics varying significantly across major geographic regions. North America (NA), driven primarily by the United States and Canada, represents a mature, high-value market characterized by robust consumer spending on premium and super-premium spirits, particularly high-end bourbon, tequila, and craft beer. This region is at the forefront of the cocktail culture revival and the rapid expansion of the LoNo (low/no-alcohol) segment, indicating a consumer focus on quality and moderate consumption. Distribution is complex, involving strict state-level regulatory schemes (the three-tier system in the US) that necessitate high logistical compliance and strategic distribution partnerships. Key growth drivers include the continued premiumization of brown spirits and the surging popularity of ready-to-drink beverages, appealing to convenience-seeking urban populations.

Europe stands as a stronghold for traditional consumption patterns, dominated by wine, beer, and classic spirits like Scotch whisky and Cognac, benefiting from strong heritage and protected geographical indication (PGI) status which supports premium pricing. Western Europe is seeing dynamic shifts towards sustainability, organic certifications, and local craft products, pushing smaller distillers into the mainstream. Eastern Europe, while generally focused on traditional high-volume spirits like vodka, shows growing aspirations for Western premium brands driven by increasing wealth. Regulatory bodies, especially the European Union, significantly influence trade and labeling standards, placing a high administrative burden on market participants but also ensuring high product quality standards. The key trend here is the balancing act between preserving heritage categories and innovating to meet the rising demand for healthier and sustainable beverage options.

Asia Pacific (APAC) is universally recognized as the engine for future volume and value growth. This region encompasses massive markets like China and India, where urbanization, the rise of a vast middle class, and the adoption of Western consumption habits are driving astronomical demand, especially for imported spirits (whisky, brandy) and international beer brands. While localized spirits (e.g., Baijiu in China, Soju in Korea) still dominate volume, the premium segment is expanding rapidly, often viewed as a symbol of status and business formality. Japan remains a sophisticated high-value market known for its exceptional whisky and highly selective consumption. Challenges in APAC include complex and fragmented distribution systems, high import tariffs, and variable regulation across different countries, requiring market players to tailor products and entry strategies rigorously to local consumer preferences and governmental mandates.

Latin America is characterized by robust growth in indigenous spirits, particularly Tequila and Mezcal from Mexico, which have successfully transitioned from regional staples to globally trending premium categories. Brazil, as the largest economy, dominates regional consumption, favoring beer and Cachaça. The region faces economic volatility and infrastructural challenges, which can complicate sophisticated logistics and premium product distribution. The market here is highly price-sensitive, yet cultural celebratory consumption remains high. Finally, the Middle East and Africa (MEA) present a dual market scenario: heavily restricted markets in many Middle Eastern nations contrast with high-growth, young-population markets in key African nations like South Africa and Nigeria. Growth in MEA is largely concentrated in cosmopolitan hubs and tourist centers, driven by expatriate populations and international tourism, sustaining demand for global luxury brands despite local restrictions.

- North America: High penetration of premium spirits; leading global market for craft beer and RTDs; complex three-tier distribution system in the US; focus on low-sugar and wellness-oriented beverages.

- Europe: Strong heritage for wine and whisky; highly regulated market focused on environmental sustainability and provenance; significant growth in LoNo beer and localized craft spirits.

- Asia Pacific (APAC): Highest volume growth potential fueled by urbanization in China and India; increasing demand for imported luxury spirits (especially Scotch and Cognac); dynamic e-commerce adoption; preference for status-symbol brands.

- Latin America: Dominance of indigenous spirits (Tequila, Cachaça); large beer market; significant price sensitivity; growth driven by rising tourism and increasing global appeal of regional specialties.

- Middle East and Africa (MEA): Highly variable regulatory environment; growth focused on tourism and expatriate communities in hub cities (e.g., UAE, South Africa); emerging market for international premium brands among young, urban African consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquor Market.- Diageo Plc

- Pernod Ricard

- Bacardi Limited

- Brown-Forman Corporation

- Constellation Brands, Inc.

- Heineken N.V.

- Anheuser-Busch InBev

- Molson Coors Beverage Company

- Suntory Holdings Limited

- LVMH Moët Hennessy Louis Vuitton

- The Edrington Group

- Rémy Cointreau

- Asahi Group Holdings, Ltd.

- Campari Group

- Treasury Wine Estates

- Vina Concha y Toro S.A.

- United Spirits Limited

- Thai Beverage Public Company Limited

- Patron Spirits International AG (Subsidiary of Bacardi)

- Whyte & Mackay

Frequently Asked Questions

Analyze common user questions about the Liquor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the premiumization trend in the liquor market globally?

The premiumization trend is primarily driven by rising global disposable incomes, particularly in emerging economies, alongside a cultural shift where consumers prioritize quality, authenticity, and brand heritage over sheer volume. This is often associated with the 'less but better' philosophy, supported by increased consumer interest in craft production, specialized ingredients, and unique flavor profiles.

How significant is the e-commerce channel for liquor sales in the forecast period?

E-commerce is projected to be one of the fastest-growing distribution channels, significantly expanding its market share globally. Its significance lies in providing unprecedented convenience, enabling direct-to-consumer (D2C) sales for specialty brands, and offering platforms for personalized marketing and product curation, especially in regions with favorable regulatory environments.

Which liquor segment is experiencing the fastest growth currently?

The Ready-to-Drink (RTD) cocktails and hard seltzer segments are currently experiencing the fastest volumetric and value growth. This rapid expansion is fueled by consumer demand for convenience, variety, and lower-calorie options, attracting younger demographics who appreciate immediate consumption without the need for complex mixing or preparation.

What major regulatory challenges face international liquor producers?

International producers face major challenges including high and varied excise taxes across jurisdictions, complex local licensing requirements for sales and distribution, and stringent regulations governing advertising, age verification, and health warnings. Navigating these highly fragmented regulatory landscapes requires constant compliance monitoring and localized market strategies.

What is the impact of low/no-alcohol (LoNo) beverages on the traditional liquor industry?

LoNo beverages are impacting the traditional market by challenging volume sales, particularly in the beer segment. However, they simultaneously present a major opportunity for brands to diversify portfolios, address consumer wellness trends, and attract consumers seeking moderated consumption, effectively capturing new, high-margin revenue streams within the broader beverage market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Kaoliang Liquor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Alcoholic Beverage Market Size Report By Type (Beer, Beer Type, Ale, Lager, Hybrid, Distilled Spirits, Distilled Spirits, Rum, Whiskey, Vodka, Others, Wine, Wine, Sparkling Wine, Fortified Wine, Others, Others), By Application (Convenience Stores, On Premises, Liquor Stores, Grocery Shops, Internet Retailing, Supermarkets), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Liquor Market Size Report By Type (Thick-flavor, Sauce-flavor, Light-flavor, Other), By Application (Family Dinner, Friends Gathering, Business Entertainment, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Liquor Bottle Cap Market Statistics 2025 Analysis By Application (SMEs, Large Enterprises), By Type (Continuous Thread Designs, Flip Top, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Product Packaging Design Market Statistics 2025 Analysis By Application (Large Companies, SMEs), By Type (Food & Beverage Packaging Design, Cosmetics Packaging Design, Liquor & Tobacco Packaging Design), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager