Lutein and Lutein Esters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440260 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Lutein and Lutein Esters Market Size

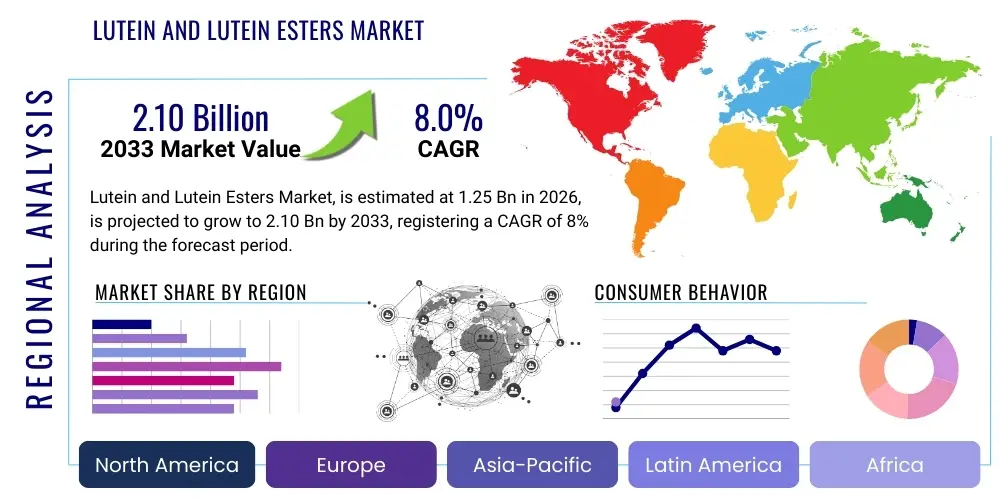

The Lutein and Lutein Esters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.0% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.10 Billion by the end of the forecast period in 2033.

Lutein and Lutein Esters Market introduction

The Lutein and Lutein Esters Market is a dynamic and expanding sector within the global nutraceutical and functional ingredient industries, driven by a heightened global focus on preventive healthcare and natural solutions. Lutein and its esterified form are natural carotenoids, primarily sourced from marigold flowers (Tagetes erecta L.), revered for their potent antioxidant properties. These compounds are pivotal for human health, particularly renowned for their role in ocular health by protecting the macula from oxidative stress and harmful blue light, thereby reducing the risk of age-related macular degeneration (AMD) and cataracts. Beyond vision care, increasing research highlights their benefits for skin health, cognitive function, and cardiovascular well-being, positioning them as multifaceted ingredients in various consumer products.

The core of this market lies in its versatility and efficacy, translating into a broad spectrum of major applications across diverse industries. In the dietary supplement segment, lutein and lutein esters are foundational ingredients in eye health formulas, multivitamin complexes, and standalone supplements targeting specific health concerns. The functional foods and beverages sector is rapidly integrating these carotenoids into products like fortified yogurts, dairy alternatives, juices, and specialized snack bars, appealing to health-conscious consumers seeking added nutritional value. Furthermore, their vibrant yellow-orange pigmentation and antioxidant profile make them valuable in animal feed, particularly for poultry to enhance yolk color, and in the cosmetics industry for anti-aging formulations and skin protection products, providing natural colorants and photoprotective benefits.

Several compelling factors are propelling the market's robust growth. A significant driver is the global aging population, which inherently leads to a higher incidence of age-related eye conditions, consequently increasing the demand for prophylactic and therapeutic nutritional interventions. Concurrent with this demographic shift is a burgeoning consumer awareness regarding the importance of proactive health management and the preference for natural, plant-derived ingredients over synthetic alternatives. Scientific advancements and a growing body of clinical evidence continually validate the health benefits of lutein and lutein esters, reinforcing their credibility and fostering trust among consumers and manufacturers alike. The clean label trend, emphasizing transparency and natural origins, further aligns with the intrinsic properties of these carotenoids, solidifying their market position as premium, health-enhancing ingredients.

Lutein and Lutein Esters Market Executive Summary

The Lutein and Lutein Esters Market is currently experiencing robust growth, primarily fueled by evolving business trends centered on innovation, strategic partnerships, and sustainability. Key players are investing heavily in research and development to enhance bioavailability, improve stability, and discover novel applications beyond traditional eye health. This includes exploring new delivery formats such as gummies, softgels, and functional beverages that cater to diverse consumer preferences and lifestyles. Furthermore, strategic collaborations between ingredient suppliers and finished product manufacturers are becoming increasingly prevalent, enabling companies to leverage specialized expertise and expand their market reach, while ensuring a consistent and high-quality supply chain. The emphasis on sustainable sourcing of marigold flowers, alongside ethical production practices, is also a critical business trend, driven by both corporate social responsibility and growing consumer demand for environmentally conscious products.

Regional trends significantly influence the market's trajectory, with distinct growth patterns and consumption preferences observed across different geographies. North America and Europe represent mature markets characterized by high consumer awareness, strong regulatory frameworks, and a well-established nutraceutical industry. In these regions, demand is primarily driven by an aging population and a strong inclination towards premium, research-backed health supplements. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, propelled by rapidly increasing disposable incomes, a burgeoning middle class, and a greater awareness of preventive health, particularly in populous countries like China and India. Latin America and the Middle East & Africa (MEA) are nascent but promising markets, where improving healthcare infrastructure and growing health consciousness are gradually creating new opportunities for market expansion, albeit from a lower base.

Segmentation trends reveal a clear hierarchy in terms of market contribution and growth potential. The dietary supplements segment continues to dominate the market share, primarily due to the widespread adoption of lutein in eye health formulations and general wellness products. Within this segment, innovative product forms and targeted health solutions are driving sustained growth. However, the functional foods and beverages segment is exhibiting the highest growth rate, as consumers increasingly seek health benefits integrated into their daily diets rather than solely relying on pills. This trend is leading to the fortification of a wide range of food products, from dairy to baked goods. The animal feed and cosmetics segments, while smaller, are also experiencing steady expansion, reflecting the versatile applications of lutein and lutein esters in enhancing animal health and improving the efficacy and natural appeal of personal care products, diversifying the overall market landscape.

AI Impact Analysis on Lutein and Lutein Esters Market

The advent of artificial intelligence (AI) is poised to exert a transformative influence across the entire value chain of the Lutein and Lutein Esters Market. User questions frequently revolve around how AI can enhance the efficiency of raw material sourcing, optimize extraction and purification processes, streamline research and development for novel formulations, and provide deeper insights into consumer preferences and market dynamics. There is significant anticipation regarding AI's potential to revolutionize personalized nutrition by tailoring lutein intake recommendations based on individual genetic profiles and health data, leading to more efficacious and targeted product offerings. Users are also keen to understand how AI can improve supply chain transparency, predict demand fluctuations, and ensure stringent quality control throughout the production lifecycle, addressing concerns about product consistency and authenticity in a competitive market.

- Enhanced Research and Development: AI algorithms can analyze vast datasets of scientific literature, clinical trials, and molecular structures to identify new lutein derivatives, optimize formulations for enhanced bioavailability, and accelerate the discovery of novel health benefits or synergies with other compounds, significantly reducing R&D timelines and costs.

- Optimized Cultivation and Extraction: Precision agriculture techniques powered by AI can monitor marigold growth conditions (soil moisture, nutrients, light) in real-time, predicting optimal harvest times and maximizing lutein yield. AI can also refine extraction processes by optimizing parameters such as solvent ratios, temperature, and pressure, leading to higher purity and efficiency.

- Predictive Analytics for Supply Chain: AI-driven predictive models can analyze historical sales data, seasonal trends, and external factors (e.g., weather patterns affecting marigold crops) to forecast demand fluctuations and potential supply chain disruptions. This enables proactive inventory management, reduces waste, and ensures a stable supply of raw materials and finished products, leading to greater market stability.

- Personalized Nutrition and Product Development: AI can leverage consumer genomic data, dietary habits, and health goals to develop highly personalized lutein-containing supplements or functional foods. This allows manufacturers to offer bespoke products that cater to individual needs, improving efficacy and consumer engagement in the personalized nutrition space.

- Quality Control and Traceability: Machine vision systems and AI-powered sensors can monitor production lines for anomalies, ensuring consistent product quality from raw material to finished goods. Blockchain technology, often integrated with AI, can provide immutable records of sourcing, processing, and distribution, enhancing transparency and traceability for consumers and regulatory bodies.

- Market Analysis and Consumer Insights: AI tools can analyze social media sentiment, online reviews, and market research data to identify emerging consumer trends, unmet needs, and competitive landscapes. This allows companies to quickly adapt their product development and marketing strategies, staying ahead in a rapidly evolving market.

- Automated Regulatory Compliance: AI can assist in navigating complex global regulatory landscapes by automatically flagging potential compliance issues in product formulations, labeling, and marketing claims, ensuring products meet diverse regional standards and reducing the risk of regulatory setbacks.

DRO & Impact Forces Of Lutein and Lutein Esters Market

The Lutein and Lutein Esters Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all shaped by significant impact forces. Key drivers include the escalating global prevalence of age-related eye disorders such as AMD and cataracts, necessitating effective nutritional interventions, alongside a rising awareness among consumers about the critical role of carotenoids in maintaining overall health. The growing demand for natural and clean-label ingredients in functional foods, beverages, and supplements further bolsters market growth, as consumers increasingly seek plant-derived solutions for their wellness needs. Moreover, continuous scientific research validating the diverse health benefits of lutein, extending beyond eye health to cognitive function, skin protection, and cardiovascular well-being, expands its application scope and consumer appeal. The increasing elderly population worldwide serves as a fundamental demographic driver, creating a sustained demand for products that support healthy aging.

Despite the strong tailwinds, the market faces several significant restraints that could impede its growth trajectory. High production costs associated with the cultivation of marigold flowers, which are the primary source of natural lutein, and the complex extraction processes involved, contribute to higher end-product pricing, potentially limiting affordability and market penetration in price-sensitive regions. The seasonal and climate-dependent nature of marigold cultivation introduces supply chain vulnerabilities, leading to potential raw material shortages and price volatility. Furthermore, stringent regulatory requirements in various regions for novel food ingredients and health claims necessitate substantial investments in clinical trials and approvals, posing challenges for new product introductions. Competition from synthetic carotenoids, which can be produced at a lower cost, and alternative eye health ingredients, also presents a competitive pressure that the natural lutein market must navigate strategically.

However, these challenges are balanced by numerous opportunities that promise to unlock new avenues for market expansion. The vast potential in emerging economies, particularly in Asia Pacific and Latin America, where economic growth, improving healthcare infrastructure, and rising health consciousness are creating new consumer bases, represents a significant growth frontier. Innovations in delivery systems, such as microencapsulation and nanoemulsions, are enhancing the bioavailability and stability of lutein, leading to more effective and user-friendly products. The integration of lutein into personalized nutrition platforms, where recommendations are tailored to individual genetic and lifestyle data, offers a premium market segment with high growth potential. Moreover, the exploration of new application areas, including clinical nutrition for specific disease states, and the development of sustainable and ethically sourced supply chains, will not only enhance market appeal but also contribute to long-term market resilience and growth. These opportunities, when strategically leveraged, can overcome existing restraints and propel the market forward.

Segmentation Analysis

The Lutein and Lutein Esters Market is comprehensively segmented to provide a granular understanding of its diverse components, aiding in targeted strategic planning and market analysis. These segmentations allow for a detailed examination of product types, sources, forms, and end-use applications, reflecting the varied landscape of production, distribution, and consumption. Understanding these distinct categories is crucial for identifying growth hotspots, competitive dynamics, and evolving consumer preferences across different market verticals.

- By Product Type:

- Lutein (Free Lutein)

- Lutein Esters

- By Source:

- Marigold Flower

- Algae

- Synthetic

- Others (e.g., leafy greens, fruits)

- By Application:

- Dietary Supplements

- Functional Foods and Beverages

- Animal Feed

- Cosmetics & Personal Care

- Pharmaceuticals

- By Form:

- Oil Suspension

- Powder

- Beadlet

- Emulsion

- Softgel/Capsule

- By End-Use Industry:

- Nutraceuticals

- Food & Beverage

- Animal Nutrition

- Personal Care & Cosmetics

- Pharmaceuticals

- By Purity/Concentration:

- Standard Grade

- High Purity Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Lutein and Lutein Esters Market

The value chain for the Lutein and Lutein Esters Market is a complex and interconnected network, beginning with the upstream supply of raw materials and extending through various processing stages to final distribution and end-user consumption. The upstream analysis primarily focuses on the cultivation of marigold flowers, which are the predominant natural source of lutein. This segment involves farmers cultivating specific marigold varieties optimized for lutein content, requiring specialized agricultural practices, careful crop management, and efficient harvesting techniques. Following cultivation, primary processors extract lutein or lutein esters from the marigold oleoresin. This extraction is a critical step, often involving sophisticated solvent extraction, supercritical fluid extraction, or enzymatic methods to yield a purified ingredient. The efficiency and quality at this initial stage directly impact the cost-effectiveness and final purity of the lutein products, forming the foundation of the entire value chain.

Moving further downstream, the extracted lutein and lutein esters are then supplied to ingredient manufacturers and formulators. These entities transform the raw carotenoid into various market-ready forms such as oil suspensions, powders, beadlets, or emulsions, often incorporating advanced technologies like microencapsulation to enhance stability, bioavailability, and ease of application in different product matrices. These processed ingredients are then sold to a diverse range of finished product manufacturers in industries such as nutraceuticals, functional foods and beverages, animal feed, and cosmetics. These manufacturers integrate lutein into their final products, which are subsequently packaged, branded, and prepared for consumer markets. The value added at each stage, from basic processing to sophisticated formulation, significantly contributes to the overall market value and product differentiation.

The distribution channels for Lutein and Lutein Esters are multi-faceted, encompassing both direct and indirect sales strategies to reach a global customer base. Direct distribution involves ingredient suppliers selling directly to large-scale manufacturers who require bulk quantities for their production lines, facilitating closer relationships and customized solutions. Indirect channels are more varied and include specialized distributors who handle a portfolio of nutraceutical ingredients, often providing technical support and logistical services to a wider array of smaller and medium-sized manufacturers. Additionally, finished lutein-containing products reach end-users through traditional retail channels such as pharmacies, health food stores, and supermarkets, as well as modern e-commerce platforms. The increasing prominence of online sales has expanded market reach and consumer accessibility, while direct-to-consumer models adopted by some brands further streamline the distribution process. The optimization of these distribution networks is crucial for efficient market penetration and ensuring product availability across diverse geographic and demographic segments.

Lutein and Lutein Esters Market Potential Customers

The Lutein and Lutein Esters Market serves a broad spectrum of potential customers, primarily comprising businesses across various end-use industries that integrate these vital carotenoids into their product offerings. The largest segment of buyers consists of nutraceutical manufacturers who formulate dietary supplements targeting specific health concerns, predominantly eye health, but increasingly also cognitive function, skin health, and overall wellness. These manufacturers range from large multinational pharmaceutical companies with extensive research and development capabilities to specialized supplement brands focusing on natural ingredients. Their demand is driven by consumer awareness of preventive health, the rising incidence of age-related diseases, and a strong preference for science-backed, natural health solutions. These customers prioritize high-purity, stable, and bioavailable forms of lutein to ensure product efficacy and consumer trust.

Another significant customer base lies within the functional food and beverage industry. Food and beverage companies are increasingly seeking to fortify their products with health-enhancing ingredients to cater to a health-conscious consumer demographic looking for added benefits beyond basic nutrition. This includes manufacturers of dairy products (yogurts, fortified milk), juices, snack bars, cereals, and even baked goods. For these buyers, lutein offers the dual advantage of health benefits and natural pigmentation, aligning with clean label trends. The challenge for these customers often involves ensuring the stability of lutein under various processing conditions and maintaining its sensory profile within food matrices, driving demand for innovative, stable formulations like microencapsulated powders or emulsions.

Beyond human consumption, the animal nutrition sector represents a robust and growing customer segment. Poultry feed manufacturers are key buyers, utilizing lutein and lutein esters to enhance the yolk color of eggs, which is a desirable quality indicator for consumers. Aquaculture industries also use lutein as a natural pigment for fish and crustaceans. Furthermore, the cosmetics and personal care industry is an emerging customer segment, with manufacturers incorporating lutein into anti-aging creams, sunscreens, and other skincare products due to its antioxidant and photoprotective properties. These diverse customer groups underscore the versatility of lutein and lutein esters, driving continuous innovation in product development and application across multiple commercial sectors. Each segment has unique requirements regarding product form, concentration, and regulatory compliance, necessitating tailored offerings from lutein suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.10 Billion |

| Growth Rate | 8.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kemin Industries, BASF SE, DSM, Chr. Hansen Holding A/S, Naturex (Givaudan), Allied Biotech Corporation, Zhejiang Medicine Co. Ltd., Lycored Corp., Chenguang Biotech Group Co. Ltd., Barentz International, Kalsec Inc., OmniActive Health Technologies, Indena S.p.A., Fuji Chemical Industry Co., Ltd., Novus International Inc., EID Parry (India) Limited, Vidya Herbs Pvt. Ltd., Diana Food (Symrise AG), Cyanotech Corporation, DDW The Color House |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lutein and Lutein Esters Market Key Technology Landscape

The technological landscape of the Lutein and Lutein Esters Market is characterized by continuous advancements aimed at improving extraction efficiency, enhancing product stability, increasing bioavailability, and broadening application possibilities. At the core are sophisticated extraction technologies, which are crucial for isolating lutein and lutein esters from raw materials, primarily marigold flowers. Traditional solvent extraction methods are being refined for greater efficiency and reduced environmental impact, often employing food-grade solvents to meet stringent regulatory standards. Supercritical carbon dioxide (CO2) extraction has emerged as a preferred method due to its ability to yield high-purity, solvent-free extracts, offering a cleaner and more environmentally friendly alternative that preserves the integrity of the delicate carotenoid compounds. Enzymatic extraction techniques are also gaining traction, utilizing specific enzymes to break down plant cell walls and release lutein, often resulting in higher yields and milder processing conditions, which is beneficial for heat-sensitive compounds.

Beyond extraction, significant technological innovation is focused on formulation and delivery systems to overcome challenges related to lutein's poor water solubility, susceptibility to oxidation, and low bioavailability. Microencapsulation technology is widely employed to encapsulate lutein within a protective matrix, such as carbohydrates or proteins, shielding it from light, oxygen, and moisture, thereby extending shelf life and maintaining potency. This also facilitates its incorporation into various food and beverage matrices without compromising sensory attributes. Nanoemulsion and liposomal delivery systems represent more advanced approaches, reducing particle size to nano-scale to significantly enhance dispersion, absorption, and bioavailability in the human body. These technologies are critical for creating highly effective supplements and fortifying functional foods where ingredient stability and absorption are paramount, ensuring that the lutein delivered is optimally utilized by the consumer.

Furthermore, the market benefits from advanced analytical techniques that ensure product quality, purity, and compliance with regulatory standards. High-Performance Liquid Chromatography (HPLC) is the gold standard for quantitative analysis of lutein and its isomers, ensuring accurate concentration and identifying potential impurities. UV-Vis spectrophotometry is also utilized for rapid screening and quality control during production. Traceability technologies, including blockchain, are increasingly being adopted to provide transparent information about the origin, processing, and handling of lutein ingredients throughout the supply chain, addressing consumer demands for authenticity and sustainability. These technological advancements collectively contribute to a more efficient, high-quality, and market-responsive Lutein and Lutein Esters industry, continually pushing the boundaries of what is possible in natural health ingredients.

Regional Highlights

- North America: This region stands as a significant market, characterized by high consumer awareness regarding eye health and the benefits of natural supplements. An aging population, coupled with proactive healthcare spending and a well-established nutraceutical industry, drives consistent demand for lutein and lutein esters, particularly in dietary supplements and functional foods. Stringent regulatory frameworks ensure high-quality products, further bolstering consumer trust.

- Europe: The European market demonstrates steady growth, driven by a strong preference for natural and organic ingredients, a mature health and wellness sector, and an increasing focus on preventive health strategies. Regulatory standards are robust, emphasizing product safety and efficacy, which encourages manufacturers to invest in high-quality, scientifically-backed lutein products. Germany, France, and the UK are key contributors, with rising applications in functional foods and cosmetics.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is propelled by a burgeoning middle class, rising disposable incomes, and a rapidly expanding awareness of health and wellness, particularly in countries like China, India, and Japan. The large aging population and a growing prevalence of lifestyle-related diseases are boosting demand for eye health and general wellness supplements. Furthermore, traditional medicine systems in some countries are increasingly incorporating scientifically validated natural ingredients like lutein, creating substantial market opportunities.

- Latin America: This region represents an emerging market with significant untapped potential. Increasing urbanization, improving healthcare infrastructure, and a gradual rise in health consciousness are contributing to the growth of the nutraceutical sector. Brazil and Mexico are leading the adoption of lutein in dietary supplements and fortified foods, driven by a growing awareness of its health benefits.

- Middle East & Africa (MEA): Currently a nascent market, the MEA region is expected to witness gradual growth as economic development, improving healthcare access, and increasing exposure to global health trends drive demand for functional ingredients. While consumption levels are lower compared to other regions, there is a growing interest in health supplements and natural products, indicating future opportunities for market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lutein and Lutein Esters Market.- Kemin Industries

- BASF SE

- DSM

- Chr. Hansen Holding A/S

- Naturex (Givaudan)

- Allied Biotech Corporation

- Zhejiang Medicine Co. Ltd.

- Lycored Corp.

- Chenguang Biotech Group Co. Ltd.

- Barentz International

- Kalsec Inc.

- OmniActive Health Technologies

- Indena S.p.A.

- Fuji Chemical Industry Co., Ltd.

- Novus International Inc.

- EID Parry (India) Limited

- Vidya Herbs Pvt. Ltd.

- Diana Food (Symrise AG)

- Cyanotech Corporation

- DDW The Color House

Frequently Asked Questions

What is the Lutein and Lutein Esters Market, and what are its primary products?

The Lutein and Lutein Esters Market encompasses the global trade and application of these natural carotenoid pigments, primarily derived from marigold flowers. Lutein is typically available as free lutein, while lutein esters are its more stable, esterified form. Both are widely used as active ingredients in dietary supplements, functional foods, beverages, animal feed, and cosmetics, valued for their antioxidant properties and health benefits, particularly for eye health.

What are the main health benefits associated with Lutein and Lutein Esters?

The primary health benefits of lutein and lutein esters are linked to ocular health, where they accumulate in the macula to protect against harmful blue light and oxidative stress, thereby reducing the risk of age-related macular degeneration (AMD) and cataracts. Emerging research also highlights their role in supporting cognitive function, enhancing skin health through antioxidant protection and hydration, and contributing to cardiovascular well-being by reducing oxidative stress and inflammation.

What are the key drivers propelling the growth of the Lutein and Lutein Esters Market?

Key market drivers include the global aging population, which increases the prevalence of age-related eye conditions, and a heightened consumer awareness of preventive healthcare and the benefits of natural ingredients. Scientific advancements continuously validate new health benefits, expanding application areas. Additionally, the growing demand for functional foods and beverages, along with the clean label trend, significantly boosts market expansion for these natural carotenoids.

Which regions are leading the Lutein and Lutein Esters Market, and what are their dynamics?

North America and Europe are established markets characterized by high consumer awareness and a mature nutraceutical industry, emphasizing premium products. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rising disposable incomes, an increasing elderly population, and growing health consciousness in countries like China and India. Latin America and MEA are nascent markets showing gradual growth potential.

What technological advancements are impacting the production and application of Lutein and Lutein Esters?

Technological advancements are primarily focused on optimizing extraction methods, such as supercritical CO2 and enzymatic extraction, to enhance purity and yield. Innovations in formulation, including microencapsulation and nanoemulsion technologies, improve lutein's stability, solubility, and bioavailability. Advanced analytical techniques like HPLC ensure product quality and regulatory compliance, while traceability solutions enhance supply chain transparency, collectively driving market efficiency and product efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager