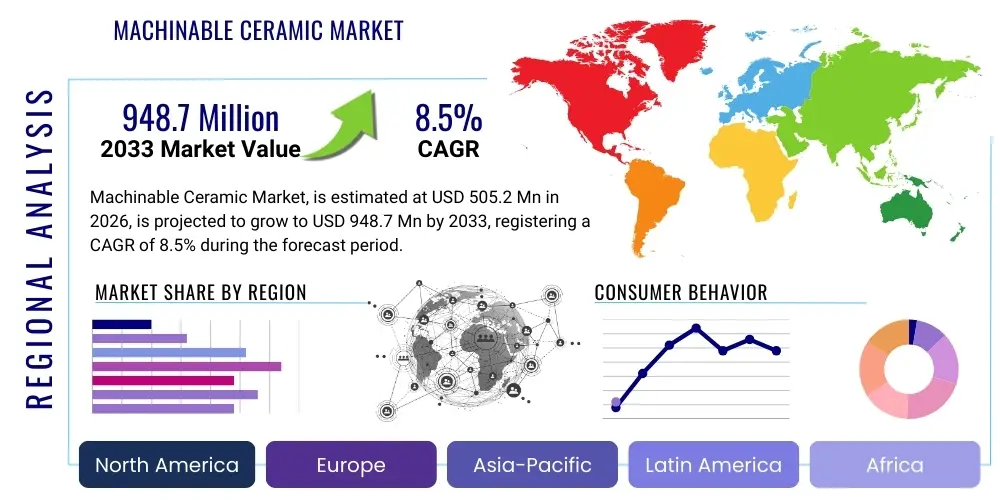

Machinable Ceramic Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433811 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Machinable Ceramic Market Size

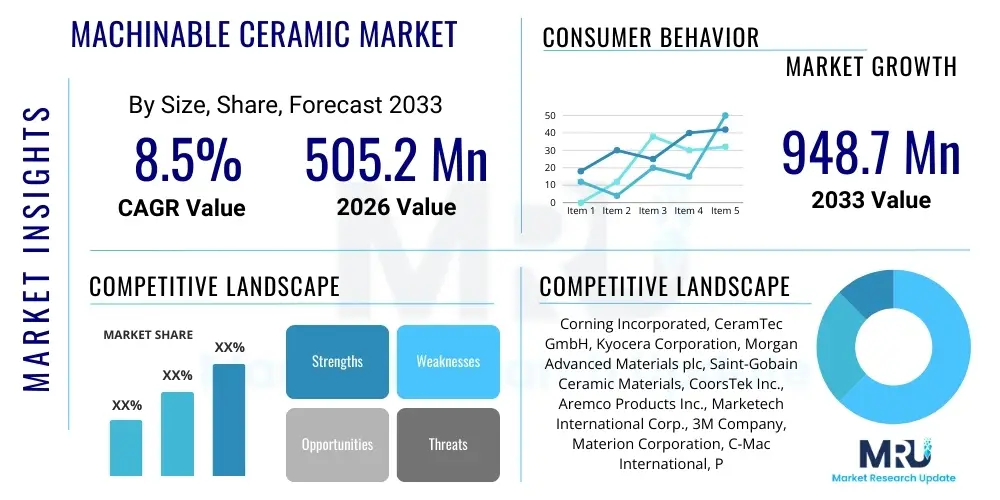

The Machinable Ceramic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 505.2 Million in 2026 and is projected to reach USD 948.7 Million by the end of the forecast period in 2033.

Machinable Ceramic Market introduction

Machinable ceramics represent a specialized class of technical ceramic materials engineered to be processed using conventional metalworking equipment such as standard CNC machines, lathes, and milling tools, contrasting sharply with traditional technical ceramics that typically require expensive diamond grinding post-sintering. These materials, including compositions like Macor (machinable glass-mica), Boron Nitride, and certain types of Aluminum Nitride, offer a unique combination of extreme performance characteristics—high temperature stability, excellent electrical insulation, superior chemical resistance, and dimensional precision—while drastically reducing the fabrication complexity and cost associated with prototyping and producing intricate components. This unique blend of ease of fabrication and high performance is critical in industries where component geometry is complex and performance in extreme operating environments is non-negotiable, particularly within the scientific instrumentation and aerospace sectors.

The primary applications driving the Machinable Ceramic Market span high-tech industries including semiconductor manufacturing, medical device production, aerospace and defense, and complex industrial equipment. In the semiconductor industry, these materials are indispensable for high-purity components like wafer handling fixtures, vacuum chucks, and insulators, where plasma resistance and zero particle contamination are paramount. The medical field utilizes machinable ceramics for prototyping high-precision surgical tools, imaging equipment components, and specialized implantable devices due to their biocompatibility and ability to achieve fine tolerances. The inherent thermal shock resistance and low dielectric constants further position these ceramics as essential materials for next-generation telecommunications infrastructure and advanced sensor technologies, underpinning the market's robust trajectory.

Key benefits driving their adoption include rapid prototyping capabilities, which significantly shorten the design-to-production lifecycle, and their ability to maintain structural integrity and electrical properties under extreme conditions far exceeding the capabilities of high-performance polymers or standard metals. Furthermore, the increasing complexity and miniaturization trends across electronics and photonics necessitate materials that can be precisely machined into micro-scale features without compromising material performance. The market growth is fundamentally propelled by stringent regulatory demands in sectors like aerospace (requiring ultra-reliable, lightweight components) and the continuous technological advancements in areas such as 5G communication and advanced lithography tools that require materials capable of withstanding ultra-high vacuum and intense thermal cycling.

Machinable Ceramic Market Executive Summary

The Machinable Ceramic Market is undergoing rapid expansion, catalyzed by relentless technological progress in high-precision engineering sectors, primarily semiconductors and advanced electronics. Business trends indicate a strategic shift among leading manufacturers toward developing novel composite materials that enhance machinability without sacrificing critical mechanical properties such as flexural strength and hardness, addressing a historical tradeoff challenge. Investment in specialized machining centers optimized for brittle materials is also a defining trend, leading to reduced component lead times and improved surface finish capabilities. Furthermore, key market players are focusing heavily on vertical integration, controlling both the material synthesis and the final high-precision machining services, offering turnkey solutions that are highly attractive to complex end-users like defense contractors and advanced research laboratories.

From a regional perspective, Asia Pacific (APAC) stands out as the dominant growth engine, primarily driven by massive investments in semiconductor fabrication facilities (fabs) and the rapid proliferation of advanced consumer electronics manufacturing bases in countries like China, South Korea, and Taiwan. North America and Europe maintain significant market shares, characterized by strong demand from the aerospace, defense, and high-end scientific instrumentation industries, emphasizing high-value, low-volume specialized components. The regional dynamics also highlight a growing requirement for materials compliant with stringent environmental and regulatory standards, pushing innovation towards non-toxic and energy-efficient ceramic compositions.

Segment trends reveal that the Boron Nitride segment, prized for its excellent thermal management properties, is experiencing accelerated growth, particularly in high-temperature furnace components and electrical insulators used in plasma environments. Concurrently, the application segment focused on Electronics and Semiconductor manufacturing continues to hold the largest market share, driven by the ongoing transition to smaller process nodes and the subsequent demand for highly precise, plasma-resistant chamber components. The emerging trend of using machinable ceramics in additive manufacturing (AM) processes is also gaining momentum, offering unparalleled design freedom for complex geometries previously unattainable through conventional subtractive methods, thereby promising disruption across prototyping and small-batch production lines.

AI Impact Analysis on Machinable Ceramic Market

Common user questions regarding AI's impact on the Machinable Ceramic Market frequently center on how machine learning algorithms can optimize the complex, multi-stage manufacturing process, which involves raw material preparation, sintering, and the subsequent high-precision machining phase. Users are concerned with predictive defect detection, asking if AI can significantly reduce the notoriously high scrap rates associated with ceramic machining, and whether AI-driven design tools can automatically generate optimized geometries that maximize material strength while minimizing stress concentrations during cutting. There is significant interest in using AI for real-time monitoring of CNC machine parameters—such as spindle vibration, cutting tool wear, and temperature fluctuations—to ensure the finished component meets ultra-high tolerance specifications required in fields like optical and lithography equipment. Essentially, users expect AI to transition ceramic manufacturing from an experience-based, iterative process to a data-driven, highly optimized, and predictable operation.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the Machinable Ceramic manufacturing value chain, moving beyond simple automation to sophisticated process optimization and material science innovation. AI models are increasingly deployed to analyze vast datasets derived from sintering furnace parameters, correlating temperature profiles, pressure cycles, and atmosphere compositions with the final material density, porosity, and microstructure. This predictive modeling capability allows manufacturers to significantly reduce the expensive and time-consuming trial-and-error approach typically required to achieve materials with optimal machinability and performance characteristics. Furthermore, generative design algorithms, powered by AI, are exploring novel ceramic component geometries that lightweight structures while enhancing mechanical robustness, particularly relevant for aerospace and defense applications where the strength-to-weight ratio is a critical performance metric.

Within the actual machining stage, AI algorithms analyze sensor data from sophisticated CNC machinery to predict tool life degradation and automatically adjust cutting speeds, feed rates, and depth of cut in real-time to prevent chipping, cracking, or subsurface damage inherent when processing brittle materials. This capability not only boosts operational efficiency by maximizing machine uptime but is crucial for maintaining the sub-micron tolerances demanded by the semiconductor and precision instrumentation sectors. Moreover, AI-driven visual inspection systems, leveraging high-resolution cameras and deep learning, are replacing manual inspection for surface defects and micro-cracks, ensuring 100% quality control throughput, thereby cementing AI as a pivotal technology for enhancing both the efficiency and the quality of machinable ceramic production.

- AI optimizes sintering profiles to achieve desired material microstructure and density, reducing production variability.

- Machine Learning algorithms predict and prevent tool wear and chatter during CNC machining of brittle ceramics, minimizing scrap rates.

- Generative design utilizes AI to create topologically optimized component geometries for improved strength and weight reduction.

- AI-powered defect recognition systems enhance quality control by performing high-speed, accurate surface inspection for micro-cracks and flaws.

- Predictive maintenance schedules for ceramic processing equipment are optimized using ML, increasing operational uptime and efficiency.

DRO & Impact Forces Of Machinable Ceramic Market

The dynamics of the Machinable Ceramic market are defined by a powerful convergence of technological drivers, intrinsic material limitations acting as restraints, and evolving application frontiers presenting substantial opportunities. The primary market driver is the pervasive trend of miniaturization across electronics, necessitating materials that offer high precision machining capabilities coupled with excellent thermal and electrical performance in compact formats, particularly relevant to 5G infrastructure and advanced sensor deployment. However, this market faces substantial restraints, including the inherently high cost of raw materials (such as high-purity Boron Nitride or proprietary glass-mica formulations) and the technical challenge of scaling production while consistently maintaining ultra-high levels of material purity and uniformity. Opportunities emerge strongly from the development of advanced hybrid machinable composites and the adoption of high-resolution ceramic additive manufacturing, which promises to overcome geometric limitations and high material waste associated with subtractive manufacturing.

Key drivers include the burgeoning demand from the semiconductor capital equipment sector, driven by increasing investment in leading-edge fabrication nodes (e.g., 3nm and 2nm), where machinable ceramics are crucial for plasma-etch process components and sensitive vacuum applications. The aerospace and defense sector's perpetual need for lightweight, high-temperature resistant components, particularly in guidance systems and high-power microwave tubes, further fuels demand. Conversely, the market is restrained by the specialized technical expertise required for both material formulation and the subsequent precision machining process. Mismanagement during machining can easily lead to catastrophic component failure, creating high barriers to entry for new market players and increasing operational risk for established manufacturers, thereby necessitating high levels of quality assurance and certification.

The impact forces influencing the market trajectory are multifaceted, encompassing strong regulatory pressure in biomedical applications, mandating biocompatibility and sterilization resilience, alongside the competitive force posed by alternative materials like high-performance engineering plastics (e.g., PEEK) or specialized metals, which might offer lower cost or easier integration in less extreme environments. Opportunities primarily lie in material innovation, specifically the research into transparent machinable ceramics for specialized optical windows and the development of cost-effective, high-volume manufacturing processes for Macor-like materials. Furthermore, geopolitical shifts influencing the global electronics supply chain impact demand, as concentrated manufacturing hubs drive localized demand for specific machinable ceramic types used in high-volume processing equipment, defining where future production capacity will be centered.

Segmentation Analysis

The Machinable Ceramic Market is segmented primarily by Type, Application, and Geography, offering a granular view of market dynamics and specialized demand centers. Segmentation by Type focuses on the specific chemical composition, which dictates performance characteristics such as thermal stability, dielectric strength, and hardness, crucial for selecting the right material for demanding engineering tasks. The application segmentation highlights the key end-use industries—ranging from high-tech manufacturing like semiconductors to specialized fields like medical implants and military guidance systems—providing insight into consumption patterns and regulatory requirements shaping material selection. Understanding these segments is vital for stakeholders to align their product development and market entry strategies with specific industry needs and regulatory frameworks.

- By Type:

- Machinable Glass-Mica (e.g., Macor)

- Boron Nitride (BN)

- Aluminum Nitride (AlN)

- Alumina (Al2O3) Composites

- Silicon Nitride (Si3N4) Composites

- Zirconia (ZrO2) Composites

- By Application:

- Semiconductor Manufacturing Equipment (Wafer chucks, Insulation rings)

- Aerospace and Defense (Insulators, Sensor components, Missile radomes)

- Medical and Biomedical Devices (Surgical tools, X-ray components, Prototyping)

- High-Temperature Furnace Components

- Electrical and Electronic Insulation

- Scientific Instrumentation (Vacuum feedthroughs, Laser fixtures)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Machinable Ceramic Market

The value chain for machinable ceramics is highly specialized, beginning with the sourcing of ultra-high-purity raw materials such as alumina powders, mica minerals, and boron compounds. The upstream segment involves critical material synthesis and purification, where manufacturers must adhere to strict quality control to ensure the homogeneity and low impurity levels necessary for producing high-performance ceramics. This stage is capital-intensive and requires proprietary knowledge to formulate the precursor materials into blanks or pre-sintered components that exhibit the desired combination of excellent performance properties and, crucially, superior machinability. Innovation at the raw material stage, particularly in controlling grain size and binder chemistry, directly impacts the final market price and applicability of the finished product.

The central segment of the value chain involves the material processing and subsequent precision machining. Unlike traditional ceramics, machinable ceramics allow for subtractive shaping using standard tooling, but this still requires high-precision CNC equipment and specialized programming to minimize material stress and waste. Manufacturers offering machining services hold a key competitive edge, as the expertise to machine ceramics accurately to sub-micron tolerances is scarce and highly valuable, especially for complex geometries required in semiconductor and scientific applications. Quality assurance and testing, including non-destructive evaluation (NDE) for internal defects, are integral to this stage before components move into distribution.

The downstream component involves distribution channels, which are typically bifurcated into direct sales for large, specialized orders (e.g., aerospace OEMs or major semiconductor fabs) and indirect channels through specialized technical distributors for smaller batch orders or research institutions. Direct sales ensure deep technical engagement and customization, while distributors provide inventory flexibility and regional access. Potential customers (end-users) are deeply technical experts who value reliability and performance over simple cost, making technical support and comprehensive material certification mandatory components of the distribution strategy. Efficient logistics capable of handling fragile, high-value components are essential for maintaining material integrity until final integration into the end-user application.

Machinable Ceramic Market Potential Customers

The primary customers for machinable ceramics are entities requiring components that must withstand extreme operational conditions—such as high temperatures, aggressive chemical environments, high voltage, or ultra-high vacuum—while demanding highly complex geometries and tight dimensional tolerances. The largest segment of potential customers resides within the Semiconductor Capital Equipment sector, including OEMs that design and manufacture plasma etching systems, deposition tools, and specialized wafer handling equipment. These customers use machinable ceramics for insulators, process chamber components, and structural parts that require exceptional plasma erosion resistance and zero-contamination properties, necessitating a consistent supply of materials like Boron Nitride and specialized glass-micas.

Another crucial customer segment is the Aerospace and Defense industry, specifically contractors and sub-system integrators responsible for radar systems, guidance mechanisms, and high-frequency communication devices. For these customers, the material's low dielectric loss, superior thermal shock resistance, and ability to be manufactured into complex, flight-critical shapes (like microwave windows and high-power vacuum tube insulators) are the key purchasing criteria. They require suppliers to meet extremely high standards of traceability, quality documentation, and often specific military or governmental certifications, making supplier reputation and robust supply chain security paramount concerns.

Furthermore, the medical device and scientific instrumentation sectors represent highly specialized but rapidly growing customer bases. Medical device manufacturers utilize machinable ceramics for prototyping new surgical tools, components in MRI and CT scanners requiring low magnetic susceptibility, and specialized delivery systems that benefit from the material's inertness and biocompatibility. Scientific research institutions, particularly those focusing on particle physics, fusion energy, and advanced optics, are also significant buyers, requiring highly customized components for beamlines, vacuum systems, and laser mounts that demand extreme precision, dimensional stability over temperature ranges, and often single-unit customization, leveraging the material's rapid prototyping advantage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 505.2 Million |

| Market Forecast in 2033 | USD 948.7 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, CeramTec GmbH, Kyocera Corporation, Morgan Advanced Materials plc, Saint-Gobain Ceramic Materials, CoorsTek Inc., Aremco Products Inc., Marketech International Corp., 3M Company, Materion Corporation, C-Mac International, Precision Ceramics USA, HP Technical Ceramics, Sintered Specialties, Elcon International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Machinable Ceramic Market Key Technology Landscape

The technological landscape of the Machinable Ceramic Market is defined by advancements in both material science—focused on enhancing intrinsic properties and machinability—and manufacturing engineering, emphasizing precision and efficiency. A core technological aspect involves the refinement of pre-sintering processes and material formulation, specifically controlling the microstructure, such as the incorporation of mica phases in glass-ceramics (like Macor) or the use of hexagonal structures in Boron Nitride. These controlled microstructures are fundamental as they enable the material to fracture cleanly along controlled planes when subjected to mechanical stress, allowing for chip formation akin to machining metals, rather than unpredictable cracking typical of hard ceramics. Continuous research into advanced binder systems and controlled cooling rates during synthesis is essential for achieving blanks with uniform internal stress distribution, maximizing subsequent machining yield.

In terms of manufacturing technology, the market relies heavily on high-precision Computer Numerical Control (CNC) machining centers, often featuring high-speed spindles and multi-axis capabilities (3-axis, 4-axis, and 5-axis milling). Crucial technological innovations here include the development of specialized tooling materials, such as specific carbide grades or diamond-coated tools optimized for minimizing thermal friction and chipping during dry machining of these brittle materials. Furthermore, sophisticated in-process metrology systems, incorporating laser sensors and non-contact probes, are becoming standard, enabling real-time dimension verification and automatic thermal compensation adjustments, which are essential for achieving the sub-micron tolerances required for optical and semiconductor components.

A significant disruptive technology impacting the landscape is Additive Manufacturing (AM), specifically techniques like stereolithography (SLA) or binder jetting adapted for ceramic slurries. While AM of fully dense technical ceramics remains challenging, the application of AM for creating complex, near-net-shape green bodies of machinable ceramic precursors is gaining traction. This approach reduces the amount of material that needs to be removed via expensive and time-consuming subtractive machining, dramatically lowering waste and fabrication time for intricate geometries. Other key technologies include advanced surface finishing techniques, such as chemically assisted polishing and specialized lapping processes, ensuring the finished components meet stringent surface roughness requirements for high-vacuum and low-friction applications, thus broadening the scope of machinable ceramic use in critical equipment.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Machinable Ceramic market share and is projected to exhibit the highest growth rate during the forecast period. This dominance is primarily driven by the region's position as the global hub for semiconductor manufacturing, particularly in Taiwan, South Korea, China, and Japan. The colossal investments in new fabrication facilities (fabs) and the transition to advanced process nodes (e.g., EUV lithography) generate relentless demand for high-purity, plasma-resistant machinable ceramic components, such as wafer chucks and insulating rings. Additionally, the massive consumer electronics manufacturing sector and the growing presence of high-end medical device assembly operations in the region contribute substantially to the consumption of materials like Boron Nitride and Machinable Glass-Mica for rapid prototyping and mass production.

- North America: North America, particularly the United States, holds a significant market share characterized by high-value, specialized applications in the aerospace, defense, and advanced scientific instrumentation sectors. Demand is heavily concentrated in sophisticated government and defense programs requiring highly certified, high-reliability ceramic components for missile guidance systems, surveillance technology, and satellite communication equipment. The region is also a crucial center for R&D in advanced material science and technology prototyping, driving demand for materials like Macor due to their speed and ease of customization in laboratory settings and small-batch production of unique scientific instruments and vacuum technology.

- Europe: The European market is characterized by a strong presence of precision engineering, industrial machinery, and a high focus on renewable energy technologies. Countries like Germany, Switzerland, and the UK are key consumers, utilizing machinable ceramics in specialized automotive test equipment, high-performance industrial burners, and nuclear research facilities where thermal stability and neutron resistance are mandatory. The stringent quality standards and the prevalence of established industrial giants ensure stable, albeit mature, demand, particularly for high-quality Aluminum Nitride and specialized Alumina composites used in critical thermal management applications.

- Latin America (LATAM) and Middle East & Africa (MEA): While currently representing smaller market segments, these regions are showing gradual growth, primarily tied to investment in infrastructure projects, oil and gas exploration, and nascent medical device manufacturing hubs. In the MEA region, the demand is often linked to high-temperature components required in petrochemical processing and sophisticated defense imports. LATAM demand is spurred by the establishment of research institutions and limited local electronics assembly, requiring machinable ceramics for niche R&D and specialized insulating applications, though reliance on imported finished components remains high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Machinable Ceramic Market.- Corning Incorporated

- CeramTec GmbH

- Kyocera Corporation

- Morgan Advanced Materials plc

- Saint-Gobain Ceramic Materials

- CoorsTek Inc.

- Aremco Products Inc.

- Marketech International Corp.

- 3M Company

- Materion Corporation

- C-Mac International

- Precision Ceramics USA

- HP Technical Ceramics

- Sintered Specialties

- Elcon International

- Technical Ceramics Inc.

- Superior Technical Ceramics

- M&I Materials Ltd.

- Vesuvius plc

- Precision Valve & Automation (PVA)

Frequently Asked Questions

Analyze common user questions about the Machinable Ceramic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of machinable ceramics over traditional technical ceramics?

The primary advantage is the ability to machine components using standard conventional tooling (e.g., CNC milling or turning) without requiring expensive diamond grinding post-sintering. This drastically reduces prototyping time, lowers fabrication costs for complex geometries, and allows for rapid design iteration in critical applications like scientific instrumentation and aerospace R&D.

Which machinable ceramic type is most widely used in the semiconductor industry?

Boron Nitride (BN) and Machinable Glass-Mica (such as Macor) are highly utilized. Boron Nitride is favored for its exceptional thermal conductivity and electrical insulation properties in high-temperature and plasma environments, while Machinable Glass-Mica is often chosen for vacuum components and fixtures due to its zero porosity and excellent dielectric strength.

How is the market influenced by advancements in ceramic additive manufacturing?

Additive Manufacturing (AM) offers a significant opportunity by enabling the production of near-net-shape ceramic green bodies with extremely complex geometries that minimize the required subtractive machining time and material waste. This technology is driving down lead times for high-complexity, low-volume components, expanding the potential applications beyond traditional limits.

What are the key restraint factors limiting the growth of the machinable ceramic market?

Key restraint factors include the high cost of raw, ultra-high-purity precursor materials necessary for optimal performance, the specialized expertise and stringent quality control required during both material synthesis and precision machining, and limitations in mechanical properties (such as lower strength compared to some fully dense, non-machinable technical ceramics).

Which geographical region exhibits the fastest growth in demand for machinable ceramics?

The Asia Pacific (APAC) region, driven primarily by continuous, massive investment in semiconductor manufacturing facilities and the robust electronics supply chain across countries like China, South Korea, and Taiwan, is projected to maintain the fastest growth rate in demand for machinable ceramics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Machinable Ceramic Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Machinable Ceramic Market Statistics 2025 Analysis By Application (Aerospace Industry, Constant & Ultra-high Vacuum Environments, Medical Industry, Welding Nozzles, Semi-conductor Industry), By Type (Fluorophlogopite Glass Ceramic, Non-oxide Ceramic, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager