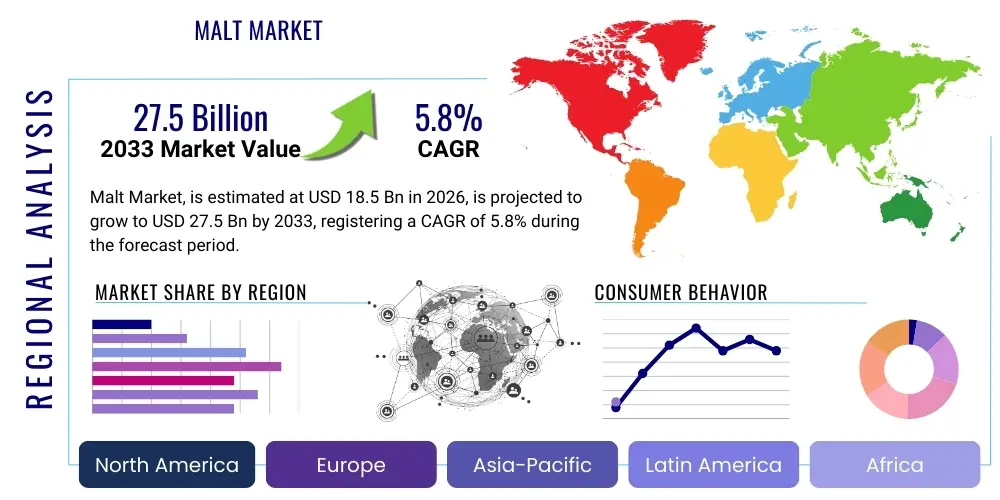

Malt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437309 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Malt Market Size

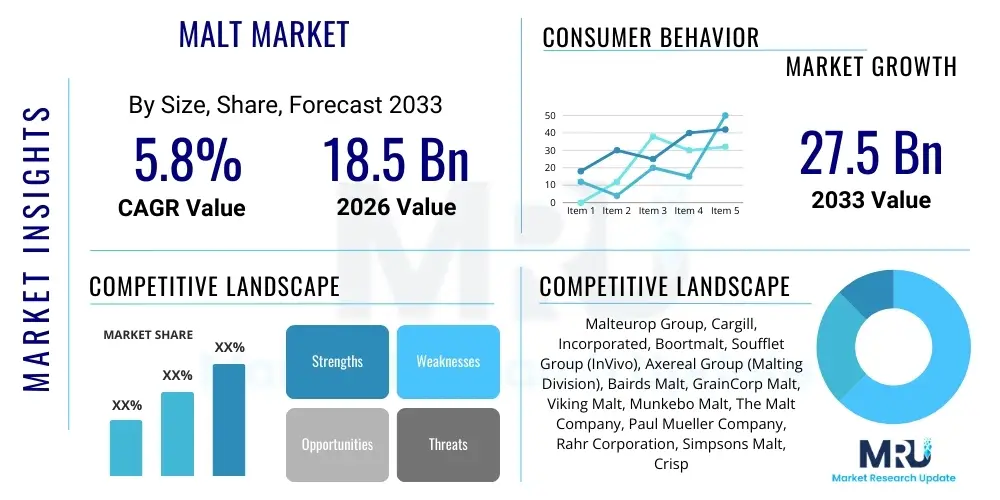

The Malt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating global demand for alcoholic beverages, particularly craft beer and premium spirits, coupled with the increasing use of malt-based ingredients in the processed food and non-alcoholic beverage industries. The shift towards natural sweeteners and flavor enhancers further solidifies the market's robust expansion outlook, requiring continuous innovation in malting processes and sourcing specialized grains.

Malt Market introduction

The Malt Market encompasses the production and distribution of germinated cereal grains, primarily barley, that have been dried in a process known as malting, which halts the germination process but retains enzymes critical for converting starches into sugars. Malt serves as a foundational ingredient across several industrial sectors. Its primary product description involves its use as a natural source of fermentable sugars, flavor, and color, essential for brewing beer and distilling whiskey. Major applications extend beyond alcoholic beverages, including the production of malt extracts utilized in confectionery, baked goods, breakfast cereals, baby foods, and pharmaceuticals. The inherent benefits of malt include improved flavor profiles, enhanced nutritional content, and acting as a natural preservative and coloring agent. Key driving factors propelling market growth include the globalization of craft brewing, rising consumer preference for natural ingredients over artificial additives, and significant technological advancements in modern malting methods that improve yield, consistency, and sustainability of production, ensuring high-quality specialized malts are available for niche applications.

Malt Market Executive Summary

The Malt Market is characterized by dynamic business trends driven by consolidation among large global malting companies seeking supply chain efficiencies, alongside the emergence of numerous independent specialty maltsters catering to artisanal producers. A major business trend involves increasing vertical integration, especially by multinational brewing conglomerates aiming to secure consistent, high-quality malt supply and control input costs. Regionally, Asia Pacific is dominating market expansion, fueled by increasing per capita consumption of beer in emerging economies like China and India, alongside the rapid expansion of the food processing industry. European and North American markets, while mature, are experiencing significant segmentation trends driven by the premiumization of products, notably the rise of specialty malts such as dark, crystal, and smoked malts, which are crucial for flavor differentiation in high-end spirits and craft beers. Segment trends also highlight the increasing adoption of wheat and rye malt for specific non-traditional brewing styles and the growing utilization of malt extract as a clean-label ingredient replacing artificial sweeteners in functional foods and beverages, indicating a strong pivot toward health and wellness applications within the overall market structure.

AI Impact Analysis on Malt Market

User queries regarding the impact of Artificial Intelligence (AI) on the Malt Market frequently center on themes of operational efficiency, supply chain resilience, and quality control optimization. Key concerns involve how AI can predict crop yields and quality variability based on climate data, automate complex steeping and kilning processes, and ultimately reduce waste and energy consumption in capital-intensive malting plants. Users express expectations that AI-driven predictive maintenance will significantly lower downtime, while machine learning algorithms will be used to analyze large datasets of barley varietals and malting parameters to achieve highly specific and replicable flavor profiles required by specialized customers. The consensus is that AI will transform malting from a traditional process reliant on expert judgment into a highly standardized, data-driven manufacturing operation, addressing core market demands for consistency, traceability, and sustainability.

- AI optimizes barley sourcing by predicting yield, protein content, and starch quality based on historical and real-time environmental data.

- Machine learning algorithms fine-tune complex malting parameters (steeping time, temperature, moisture levels) to maximize enzyme development and achieve precise specifications.

- Predictive maintenance systems utilize sensor data within kilns and processing machinery to minimize unexpected equipment failures and maintain operational continuity.

- AI-powered quality control enhances defect detection and ensures lot-to-lot consistency by analyzing visual and chemical characteristics of the finished malt faster than manual methods.

- Demand forecasting models leverage AI to optimize inventory management and reduce storage costs, aligning production schedules precisely with volatile customer orders.

- Integration of blockchain with AI ensures end-to-end traceability of the malt supply chain, enhancing transparency for consumers and regulators regarding origin and processing standards.

- AI assists in developing sustainable malting practices by modeling energy consumption patterns and identifying opportunities for water and heat recovery across the plant lifecycle.

DRO & Impact Forces Of Malt Market

The Malt Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming potent Impact Forces. Key drivers include the robust expansion of the craft beer and premium spirits industries globally, which consistently demands higher volumes of diverse specialty malts. Additionally, increasing consumer awareness regarding natural ingredients fuels the demand for malt extracts as substitutes for artificial colors and sweeteners in the food and beverage sectors. However, the market faces critical restraints, notably the high volatility and susceptibility of barley, wheat, and rye crops to adverse weather conditions and climate change, leading to unpredictable raw material prices and supply instability. Furthermore, the capital-intensive nature of building and operating large-scale malting facilities poses a high barrier to entry for new players. Opportunities abound in emerging markets, specifically in Asia and Latin America, where disposable incomes are rising, driving higher consumption of malt-derived products. There is also a substantial opportunity in developing functional malts with enhanced nutritional profiles, targeting the burgeoning health and wellness market, alongside implementing advanced sustainable agricultural and processing technologies. The major impact forces thus center on raw material supply security, regulatory pressures related to food safety and sustainable sourcing, and the rapid innovation cycle dictated by consumer preference shifts toward premium, specialty, and health-focused beverages and food items.

Segmentation Analysis

The Malt Market is intricately segmented based on Type, Application, and Source, allowing producers to cater to highly specialized industrial requirements. Segmentation by Type distinguishes between standard base malts, which form the bulk of beer and spirit recipes, and specialty malts, such as crystal, roasted, carapils, and smoked malts, which impart unique color, flavor, and aroma characteristics. Application segmentation is crucial, differentiating between the dominant use in brewing (beer production) and distilling (whiskey, vodka, gin), and the significant, though smaller, food and non-alcoholic beverage industry segments. Furthermore, the market is differentiated by Source, primarily barley, but also wheat, rye, and specialty grains like oats and rice, reflecting geographical availability and specific end-product needs. This structured segmentation is vital for both supply chain planning and strategic market penetration, enabling targeted product development and pricing strategies across diverse industrial landscapes.

- By Type:

- Base Malt (e.g., Pale Malt, Pilsner Malt)

- Specialty Malt (e.g., Crystal Malt, Roasted Malt, Chocolate Malt, Black Malt, Smoked Malt)

- By Source:

- Barley Malt

- Wheat Malt

- Rye Malt

- Other Grains (e.g., Sorghum, Oat, Rice)

- By Application:

- Brewing (Craft Beer, Commercial Beer)

- Distilling (Whiskey, Vodka, Gin)

- Food and Beverages (Malt Beverages, Baked Goods, Confectionery, Breakfast Cereals)

- Pharmaceutical and Nutraceutical

Value Chain Analysis For Malt Market

The Malt Market value chain is a highly integrated process starting with specialized agricultural sourcing and culminating in global distribution to industrial end-users. The upstream analysis focuses intensely on the selection, procurement, and storage of high-quality malting grains, primarily malting barley, which requires close collaboration between maltsters and contract farmers to ensure specific varietal characteristics, low protein content, and high germination capacity. This stage is critical for maintaining raw material consistency, which directly impacts the quality of the final malt product. Key upstream activities also involve rigorous testing and storage facilities designed to maintain grain viability over extended periods, mitigating supply chain risks associated with annual harvests and climate variability.

Midstream processing involves the energy-intensive malting process itself, encompassing steeping, germination, and kilning. Large malting companies heavily invest in state-of-the-art facilities equipped with advanced process control systems to optimize enzyme development and achieve precise moisture levels and color specifications required by customers. Efficiency and sustainability are major focus areas in the midstream, with substantial efforts directed towards reducing water usage, optimizing heat recovery in the kilning stage, and minimizing waste byproducts. The competitive advantage at this stage often rests on proprietary malting technology and the ability to produce a diverse portfolio of specialty malts with strict adherence to flavor and aroma profiles.

Downstream analysis covers the distribution channel, which is highly diversified. Malt is distributed both directly and indirectly. Direct sales predominate for large industrial customers, such as multinational brewing groups and major distillers, utilizing long-term supply contracts and dedicated logistics. Indirect channels involve a network of specialized malt distributors and brokers who service smaller craft breweries, independent food manufacturers, and homebrew markets, often requiring smaller batch sizes, complex logistics for less-than-truckload shipments, and localized inventory management. Successful downstream operations depend on reliable supply chain logistics, exceptional inventory management, and tailored customer support, especially regarding technical applications and formulation advice for specialty products, ensuring the high-quality malt reaches the end-user efficiently and in optimal condition.

Malt Market Potential Customers

The primary consumers and end-users of malt are large-scale commercial brewing companies, followed closely by the rapidly expanding network of independent and regional craft breweries worldwide. Brewing remains the dominant application, where malt provides the fermentable sugars, body, color, and flavor essential for all types of beer. These customers demand significant volumes of base malt (e.g., Pilsner, Pale) alongside specialized variants for unique flavor creation. Consistency and supply reliability are paramount for brewers, leading them to form long-term purchasing agreements with established maltsters.

The second major consumer segment includes the distilling industry, particularly producers of whiskey, scotch, and malt vodka. Distillers require highly specific types of malt, often heavily peated or roasted, to achieve distinct flavor notes and characteristics that define their premium products. The demand here is often less volume-driven than brewing but requires extremely high quality and purity standards. The growth in premium and single-malt spirits globally ensures this customer segment remains a critical, high-value component of the market, necessitating specialty production capabilities from maltsters.

A growing base of potential customers resides in the food and non-alcoholic beverage sectors, encompassing producers of breakfast cereals, bakery products, confectionery, and functional malt-based drinks. These industrial buyers leverage malt extracts as natural sweeteners, binders, and flavor enhancers, driven by the clean-label trend and the rejection of artificial additives by modern consumers. Furthermore, the pharmaceutical and nutraceutical sectors use malt extracts as fermentation mediums or carriers for vitamins and dietary supplements, highlighting the material’s utility beyond traditional food and beverage applications and pointing toward diverse growth vectors in the wellness market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Malteurop Group, Cargill, Incorporated, Boortmalt, Soufflet Group (InVivo), Axereal Group (Malting Division), Bairds Malt, GrainCorp Malt, Viking Malt, Munkebo Malt, The Malt Company, Paul Mueller Company, Rahr Corporation, Simpsons Malt, Crisp Malting Group, Castle Malting, China Resources Beer (Holdings) Co., Ltd., Heineken N.V., Briess Malt & Ingredients Co., Weyermann Specialty Malts, GlobalMalt GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Malt Market Key Technology Landscape

The technological evolution within the Malt Market is focused heavily on optimizing efficiency, improving quality consistency, and enhancing sustainability across the malting process. Modern malting facilities increasingly utilize fully automated computer control systems to meticulously manage parameters during steeping, germination, and kilning. These systems integrate advanced sensor technology, including infrared moisture analyzers and real-time enzyme monitoring, ensuring that environmental variables are precisely managed to maximize starch conversion and enzyme activity. This precise control allows maltsters to rapidly switch production between standard base malts and highly specialized, low-volume malts without significant downtime, enhancing operational flexibility and responsiveness to dynamic customer requirements.

Another significant technological focus lies in kiln and energy management. Energy consumption, primarily for heating the kiln, represents a major operational cost and environmental concern. Innovative technologies such as heat recovery exchangers, highly efficient burners, and sophisticated recirculation air systems are being widely adopted to drastically reduce natural gas and electricity consumption per ton of malt produced. Furthermore, research and development are concentrated on novel steeping methods that reduce water usage and the implementation of fluidized bed dryers, which offer faster, more uniform drying compared to traditional compartment kilns, thereby improving product throughput and reducing the risk of quality variance often associated with uneven drying cycles.

The integration of advanced analytics and digital solutions, including AI and machine learning, is rapidly defining the future technology landscape. These tools are applied to predictive modeling of grain characteristics based on genetics and environmental inputs, optimizing storage conditions, and refining final product quality assurance. Traceability technologies, particularly blockchain, are becoming crucial for transparency, allowing end-users to verify the origin and processing history of their malt, which is increasingly demanded by consumers focused on ingredient integrity and ethical sourcing. This push towards digitization not only ensures superior quality control but also establishes a resilient, transparent, and sustainable supply chain for premium malt products.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region in the global Malt Market. This expansion is driven primarily by the rising middle-class population, increased disposable income, and the rapid westernization of dietary and consumption habits, leading to booming beer consumption, particularly in China, India, and Southeast Asian nations. The region is also witnessing significant investment in local malting facilities and brewing operations by multinational companies aiming to localize production and mitigate supply chain complexity. Government initiatives supporting domestic grain production further bolster local market development.

- Europe: Europe maintains its status as the largest and most established market, serving as the historical epicenter for both brewing and malting excellence. The market here is characterized by extremely high consumption of traditional alcoholic beverages and a mature, sophisticated craft beer segment that drives substantial demand for premium and heritage malts. Technological advancements in malting processes and stringent sustainability regulations regarding water and energy usage are key regional trends, pushing European maltsters toward high efficiency and environmental stewardship. The UK, Germany, and Belgium remain central hubs for production and innovation.

- North America: The North American market, dominated by the United States and Canada, is highly dynamic, largely fueled by the relentless growth and diversification of the craft brewing industry. Craft brewers demand an unparalleled variety of base and specialty malts, often seeking unique, locally sourced grain profiles. Innovation is focused on niche malts (e.g., floor-malted, single-origin malts) and the development of malts derived from non-barley sources like corn and rice for specific regional tastes and brewing applications. Supply chain resilience, given climatic challenges in grain belts, is a core strategic focus for regional players.

- Latin America: The market in Latin America is marked by steady growth, primarily led by Brazil and Mexico, both major beer-producing and consuming nations. Demand is heavily concentrated on standard pilsner-style base malts to support mass-market lager production. However, the emerging craft beer scenes in countries like Argentina and Chile are creating new, albeit smaller, pockets of demand for specialty malts, signaling future market diversification. Economic instability and dependency on grain imports pose specific challenges in this region.

- Middle East and Africa (MEA): The MEA region is the smallest but exhibits potential for growth, mainly through non-alcoholic applications such as malt beverages, extracts used in food production, and institutional applications. While alcohol consumption is restricted in many parts of the Middle East, the high demand for malt-based non-alcoholic beers and beverages, especially in Gulf Cooperation Council (GCC) countries, drives import volumes. The African market, notably South Africa and Nigeria, shows expanding indigenous brewing operations, contributing to rising local demand for malt.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Malt Market.- Malteurop Group

- Cargill, Incorporated

- Boortmalt

- Soufflet Group (InVivo)

- Axereal Group (Malting Division)

- Bairds Malt

- GrainCorp Malt

- Viking Malt

- Munkebo Malt

- The Malt Company

- Paul Mueller Company

- Rahr Corporation

- Simpsons Malt

- Crisp Malting Group

- Castle Malting

- China Resources Beer (Holdings) Co., Ltd.

- Heineken N.V. (Through integrated supply)

- Briess Malt & Ingredients Co.

- Weyermann Specialty Malts

- GlobalMalt GmbH & Co. KG

- Malteries Franco-Belges

- Groupe Warcoing

- Muntons Plc

- Barrett Burston Malting Co. Pty Ltd

- Hefele GmbH & Co. KG

- Malt Products Corporation

- RyeSense, LLC

- Admiral Maltings

- Rye Malt Co.

- Colorado Malting Company

Frequently Asked Questions

Analyze common user questions about the Malt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the specialty malt segment?

The primary driver is the accelerating global demand from the craft brewing and distilling industries. These sectors require specialty malts (such as crystal, roasted, or smoked varieties) to achieve unique flavor profiles, color, and aroma differentiation in premium, high-value beverages, moving away from mass-produced standard lagers.

How does raw material volatility affect the profitability of maltsters?

Raw material volatility, especially concerning the quality and price of malting barley, significantly impacts profitability. Adverse weather events often lead to reduced crop yields or diminished quality, forcing maltsters to pay premium prices or invest heavily in specialized processing techniques to meet consistency standards, directly squeezing operating margins.

Which region holds the largest market share in the Malt Market and why?

Europe currently holds the largest market share due to its established, mature brewing and distilling sectors, high per capita consumption of alcoholic beverages, and the presence of major global malting conglomerates and sophisticated traditional malting technologies. High demand for both base and premium specialty malts solidifies its dominance.

Beyond brewing and distilling, what are the emerging applications for malt?

Emerging applications focus on the food and nutraceutical industries, where malt extracts are increasingly used as clean-label, natural ingredients. This includes using malt as a natural sweetener, flavor enhancer, and colorant in breakfast cereals, energy bars, baby food, and functional health beverages, capitalizing on the consumer trend toward natural additives.

What role does sustainability play in modern malt production?

Sustainability is a core focus, driven by consumer expectations and regulatory pressure. Maltsters are implementing technologies for efficient water management, heat recovery in kilning, and sourcing sustainably grown grains. Traceability via digital solutions like blockchain also ensures ethical and environmentally sound sourcing practices are maintained throughout the supply chain.

What is the difference between base malt and specialty malt in terms of function?

Base malt is the foundation of most recipes, providing the majority of the fermentable sugars and enzymes necessary for the mashing process. Specialty malts, in contrast, are used in smaller quantities primarily to contribute specific, non-fermentable characteristics like deep color, residual sweetness, complex flavors (e.g., caramel, chocolate), and enhanced body to the final product.

How does technological advancement impact malt consistency and quality?

Technological advancements, such as automated moisture sensors, precise temperature control systems, and AI-driven process modeling, minimize human error and environmental variability during malting. This leads directly to superior, highly consistent malt quality batch after batch, meeting the rigorous standards required by industrial brewers and distillers.

Which grain source is most dominant in the global Malt Market?

Barley remains the overwhelmingly dominant grain source in the global Malt Market. This is due to its favorable combination of high starch content, low protein levels, and the presence of ideal enzyme packages required for efficient conversion into fermentable sugars during the brewing and distilling processes.

What challenges does the Malt Market face concerning climate change?

Climate change poses severe challenges, primarily through increased frequency of extreme weather events (droughts or heavy rains) that significantly affect the yield and quality of malting grains. This unpredictability necessitates diversified sourcing strategies and enhanced supply chain risk management to ensure continuous, high-quality material flow.

How is the craft distilling movement influencing demand for specialty rye malt?

The craft distilling movement is significantly boosting demand for specialty rye malt, particularly in North America. Rye malt imparts spicy, distinct flavor notes essential for creating premium, small-batch rye whiskeys and specific styles of craft gin, diversifying the market away from traditional barley dominance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Single Malt Scotch Whisky Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Single Malt Whisky Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Syrup Market Size Report By Type (Chocolate Syrup, Maple Syrup, High-fructose Corn Syrup, Rice Syrup, Malt Syrup, Tapioca Syrup, Honey, Fruit Syrup, Other Types), By Application (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Speciality Malt Market Size Report By Type (Roasted Malt, Caramelized Malts), By Application (Ales, Lagers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hemostatic Forceps Market Size Report By Type (Halstead Mosquito Hemostatic Forceps, Kelly and Crile Hemostatic Forceps, Rochester-Carmalt Hemostatic Forceps), By Application (Surgical, Dissection, Dental, Laparoscopic, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager