Marine Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439680 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Marine Insurance Market Size

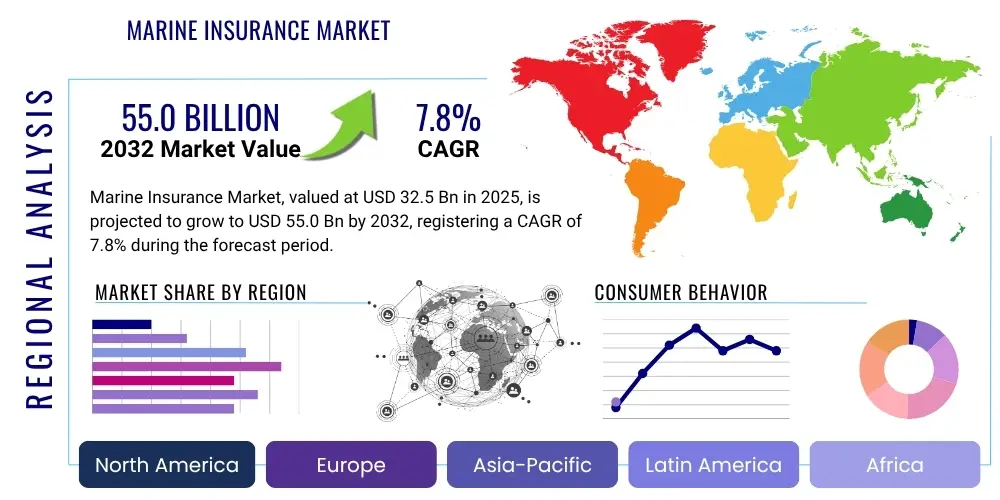

The Marine Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 31.5 Billion in 2026 and is projected to reach USD 49.8 Billion by the end of the forecast period in 2033.

Marine Insurance Market introduction

The Marine Insurance Market serves as a critical financial safeguard for entities engaged in maritime trade and operations worldwide. This specialized form of insurance provides coverage against losses or damages to vessels, cargo, terminals, and any transport by which property is transferred, acquired, or held between the point of origin and the final destination. Its primary purpose is to mitigate the vast financial risks associated with the unpredictable nature of sea travel, including perils like piracy, natural disasters, accidents, and general average sacrifices. The market encompasses a broad spectrum of products, from hull and machinery insurance protecting the vessel itself, to cargo insurance covering goods in transit, and Protection and Indemnity (P&I) insurance addressing third-party liabilities such as pollution or crew injury. It is an indispensable component of the global supply chain, enabling seamless international commerce.

The product description for marine insurance is inherently complex due to the diverse range of risks and assets it covers. Hull and Machinery (H&M) policies typically insure the physical structure of ships, their engines, and equipment against damage, loss, or total destruction. Cargo insurance provides financial protection for goods being transported by sea, air, or land, from the moment they leave the seller's warehouse until they reach the buyer's premises, covering perils like theft, damage, or loss. Protection and Indemnity (P&I) insurance, often provided by mutual clubs, covers a shipowner's third-party liabilities, including crew injury, passenger claims, cargo damage, collision liability, and pollution. Offshore energy insurance further extends coverage to specialized vessels, drilling rigs, and platforms involved in oil and gas exploration and production, addressing unique operational and environmental risks. These tailored offerings underscore the market's adaptability and essential role in various maritime sectors.

The major applications of marine insurance span across all facets of the maritime industry. Shipping companies rely heavily on H&M and P&I insurance to protect their assets and manage liabilities, ensuring operational continuity even in the face of significant incidents. Logistics firms, importers, and exporters utilize cargo insurance to safeguard the value of goods as they move through complex global supply chains, providing confidence and stability in international trade transactions. Beyond commercial shipping, marine insurance also finds application in leisure boating, cruise lines, fishing fleets, and the burgeoning offshore renewable energy sector, each requiring specific risk transfer solutions. The benefits are profound, including vital financial protection against catastrophic losses, compliance with international conventions and contractual obligations, and the facilitation of global trade by making risk manageable and predictable. Driving factors for market growth include the steady expansion of global trade volumes, increasing geopolitical instability affecting shipping routes, heightened awareness of environmental liabilities, and technological advancements that both introduce new risks (e.g., cyber) and offer new avenues for risk mitigation (e.g., IoT data analytics).

Marine Insurance Market Executive Summary

The Marine Insurance Market is currently navigating a period of dynamic transformation, characterized by significant business, regional, and segment-specific trends. Globally, the industry is witnessing a strong drive towards digitalization, with insurers leveraging advanced analytics, artificial intelligence, and blockchain to enhance underwriting precision, streamline claims processing, and detect fraud more effectively. Sustainability considerations are also becoming paramount, influencing policy design and risk assessment, particularly with the increasing emphasis on greener shipping practices and environmental liabilities. Consolidation among insurers and brokers, alongside the entry of new technology-driven players, is reshaping the competitive landscape, pushing incumbents to innovate and optimize their operational efficiencies. The interplay of these macro trends defines the strategic priorities for market participants, focusing on resilience, adaptability, and technological integration to maintain relevance and profitability.

Regionally, the market exhibits diverse growth patterns and evolving risk profiles. Asia-Pacific continues to emerge as a primary growth engine, driven by the rapid expansion of trade volumes, infrastructure development in key economies like China, India, and Southeast Asia, and the increasing modernization of their shipping fleets. North America and Europe, while mature markets, are experiencing growth through specialization, technological adoption, and a focus on complex risks such as cyber threats and offshore energy. These regions are also leading in the development of sophisticated regulatory frameworks and innovative insurance products. Conversely, emerging markets in Latin America and the Middle East & Africa present significant untapped potential, albeit with unique challenges related to political stability, regulatory harmonization, and market penetration. Understanding these regional nuances is crucial for insurers seeking to optimize their market entry strategies and product offerings.

Segment-wise, the market is experiencing differential growth and evolving risk landscapes across its core components. The cargo insurance segment is expanding robustly, directly correlated with the uptick in global merchandise trade and the increasing value and complexity of goods being transported. Hull and Machinery (H&M) insurance faces challenges from overcapacity in some shipping sectors but benefits from the increasing size and technological sophistication of modern vessels, which demand higher coverage limits and specialized underwriting. Protection and Indemnity (P&I) clubs are adapting to new regulatory pressures, particularly concerning environmental protection and crew welfare, alongside managing the financial volatility inherent in mutual insurance models. The offshore energy segment is experiencing renewed interest, driven by both traditional oil and gas activities and the accelerated development of offshore wind farms, which require bespoke and highly specialized insurance solutions to cover construction, operation, and environmental risks. These segment trends highlight a dynamic market where adaptation to specific industry needs and regulatory changes is key to sustained growth.

AI Impact Analysis on Marine Insurance Market

The integration of Artificial Intelligence (AI) into the Marine Insurance Market is fundamentally transforming how risks are assessed, policies are underwritten, and claims are managed. Common user questions often revolve around how AI can provide more accurate risk models, enhance operational efficiency, and mitigate emerging threats like cyber risks. Users are keen to understand AI's capability to process vast datasets from telematics, satellite imagery, and weather patterns to predict potential incidents, thereby moving from reactive claims handling to proactive risk prevention. There's significant interest in AI's role in automating routine tasks, freeing up human underwriters for more complex decision-making, and its potential to personalize insurance offerings based on real-time data. Concerns frequently surface regarding data privacy, the ethical implications of algorithmic bias in underwriting, the explainability of AI decisions, and the potential impact on human employment within the industry. Expectations are high for AI to deliver greater transparency, fairness, and speed in all marine insurance processes, ultimately leading to more competitive premiums and improved customer satisfaction.

AI's influence extends across the entire marine insurance value chain, from initial risk assessment to post-claim analysis. In underwriting, AI algorithms can analyze historical claim data, vessel specifications, crew records, and real-time environmental factors to provide highly accurate risk scores, enabling insurers to set more precise premiums and identify high-risk exposures. This data-driven approach moves beyond traditional actuarial tables, incorporating dynamic variables that reflect current operating conditions and historical performance, leading to more granular and fair pricing. Furthermore, AI can identify patterns and correlations that human underwriters might overlook, allowing for a more comprehensive understanding of complex risk profiles associated with specific shipping routes, cargo types, or vessel classes. The ability of AI to continuously learn and adapt from new data ensures that risk models remain current and responsive to the evolving maritime landscape, encompassing everything from geopolitical tensions impacting shipping lanes to the effects of climate change on weather patterns.

In claims management, AI is proving revolutionary by accelerating the process, reducing fraud, and enhancing customer experience. Machine learning models can swiftly process and analyze claims documents, cross-referencing information with policy terms and external data sources to validate claims quickly and accurately. This automation significantly reduces the time taken to process claims, leading to faster payouts and higher satisfaction for the insured. Beyond efficiency, AI plays a crucial role in fraud detection by identifying unusual patterns, inconsistencies, and anomalies in claims data that might indicate fraudulent activity, thereby protecting insurers from significant financial losses. Chatbots and natural language processing (NLP) powered virtual assistants are also being deployed to handle initial claims inquiries, answer frequently asked questions, and guide policyholders through the claims submission process, offering 24/7 support and improving accessibility. The predictive capabilities of AI can also be leveraged post-claim to analyze root causes, identify recurring issues, and inform future risk mitigation strategies, creating a feedback loop that continuously improves underwriting accuracy and operational resilience.

- Enhanced risk assessment and predictive analytics through real-time data analysis (telematics, satellite, IoT).

- Automated underwriting processes, leading to faster policy issuance and personalized premiums.

- Improved claims management efficiency and accelerated fraud detection.

- Development of parametric insurance solutions triggered by predefined events using AI-monitored data.

- Personalized customer experiences and proactive risk alerts through AI-powered platforms.

- New product development, such as cyber insurance for maritime operations, leveraging AI for threat intelligence.

- Optimization of capital allocation and reinsurance strategies with AI-driven insights.

DRO & Impact Forces Of Marine Insurance Market

The Marine Insurance Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its trajectory. Key drivers propelling market growth include the steady expansion of global trade and maritime traffic, which directly correlates with the demand for cargo and hull insurance. The increasing sophistication and value of modern vessels, alongside the escalating size and complexity of global supply chains, necessitate comprehensive and high-value insurance solutions. Furthermore, heightened geopolitical tensions and the growing frequency and intensity of extreme weather events attributed to climate change introduce greater uncertainties and risks for maritime operations, thereby increasing the reliance on robust marine insurance coverage. Regulatory frameworks, such as those governing environmental liabilities (e.g., pollution), also mandate specific insurance provisions, acting as a non-negotiable driver for the market. Technological advancements, including the adoption of IoT, big data analytics, and AI, are transforming risk management capabilities and product innovation, further stimulating market development.

Despite these growth drivers, the market faces significant restraints that temper its expansion and profitability. The inherently volatile claims experience, often characterized by infrequent but high-severity losses (e.g., major vessel casualties, large cargo losses, or widespread pollution incidents), can lead to considerable financial strain on insurers and impact premium stability. Intense competition within the fragmented marine insurance market often leads to downward pressure on premiums, eroding underwriting margins. The lack of universal standardization across policies and legal jurisdictions can create complexities and ambiguities in coverage, leading to disputes and delays. Economic slowdowns, trade protectionism, and disruptions to global supply chains (such as those experienced during pandemics or major geopolitical conflicts) can reduce maritime trade volumes, directly impacting premium income. Additionally, emerging risks like sophisticated cyber threats targeting maritime infrastructure and vessels, coupled with evolving regulatory landscapes, pose significant challenges for insurers to adequately assess, price, and cover.

Opportunities within the Marine Insurance Market are abundant, allowing for strategic growth and innovation. The expansion into emerging economies, particularly in Asia-Pacific and parts of Africa, presents significant untapped potential as these regions increase their participation in global trade and develop their maritime infrastructure. The demand for specialized coverage for new and evolving risks, such as autonomous vessels, offshore renewable energy projects (e.g., wind farms), and sophisticated cyber perils, offers avenues for product differentiation and premium growth. The ongoing digital transformation within the industry, including the adoption of AI, blockchain, and advanced analytics, provides opportunities for operational efficiency, enhanced risk modeling, and the creation of innovative insurance solutions like parametric insurance. Furthermore, strategic partnerships between traditional insurers, technology providers, and logistics firms can unlock new distribution channels and create integrated risk management offerings, catering to the holistic needs of the modern maritime industry. These opportunities underscore a dynamic market poised for strategic evolution and growth through innovation and adaptation.

Segmentation Analysis

The Marine Insurance Market is segmented across various critical dimensions to provide a detailed understanding of its structure, operational dynamics, and growth trajectories. These segments include, but are not limited to, the Type of Insurance, the End-User/Application, and the Distribution Channel. Analyzing these segments helps stakeholders, from insurers and brokers to policymakers and shipping companies, to identify specific market niches, understand demand patterns, and develop tailored strategies. For instance, understanding the differential growth rates and risk appetites within Hull and Machinery versus Cargo insurance allows for targeted product development and resource allocation. Similarly, segmenting by end-user, such as shipowners versus cargo owners, reveals distinct needs and purchasing behaviors, which are crucial for effective marketing and client engagement. The overall segmentation approach is fundamental to dissecting the complex marine insurance ecosystem and projecting its future evolution.

- By Type:

- Hull and Machinery (H&M) Insurance

- Cargo Insurance

- Protection and Indemnity (P&I) Insurance

- Offshore Energy Insurance

- Marine Liability Insurance (excluding P&I)

- Pleasure Craft/Yacht Insurance

- By Application/End-User:

- Shipowners

- Cargo Owners (Importers/Exporters)

- Freight Forwarders & Logistics Companies

- Offshore Operators (Oil & Gas, Renewable Energy)

- Port & Terminal Operators

- Marine Contractors

- Leisure Boaters

- By Distribution Channel:

- Brokers & Agents

- Direct Sales

- Bancassurance

- Online/Digital Platforms

- By Coverage:

- All Risks

- Named Perils

- By Geographic Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Marine Insurance Market

The value chain of the Marine Insurance Market is a complex ecosystem involving various specialized entities that contribute to the creation, delivery, and ongoing service of marine insurance products. At the upstream end, the chain is supported by critical data providers, technology vendors, and reinsurance companies. Data providers supply essential information on weather patterns, geopolitical risks, vessel movements, and historical claims, which are crucial for accurate risk assessment and underwriting. Technology vendors offer solutions ranging from telematics and IoT devices for real-time monitoring to advanced analytics platforms and AI tools that enhance predictive capabilities and operational efficiency. Reinsurers play a pivotal role by absorbing a portion of the risk from primary insurers, thereby enabling them to underwrite larger and more complex policies, stabilize their financial performance, and manage capital requirements effectively. These upstream participants are foundational, providing the tools and capacity that empower primary insurers to operate.

The midstream of the value chain is dominated by marine insurance carriers (underwriters) and brokers/agents, who act as intermediaries between insurers and end-users. Insurance carriers assess risks, design policies, and manage claims, bearing the ultimate financial responsibility for covered losses. They invest heavily in actuarial science, risk management expertise, and claims adjustment capabilities. Brokers and agents are crucial distribution channels, providing expert advice to clients, helping them navigate complex policy options, and facilitating the placement of risks with appropriate insurers. They represent the interests of the insured, negotiating terms and conditions, and often assisting with claims submissions. The choice between direct and indirect distribution channels significantly impacts the market reach and customer engagement strategies of insurers; while direct sales allow for greater control and potentially lower acquisition costs, indirect channels leverage the established networks and specialized expertise of brokers and agents to reach a broader and more diverse client base.

Downstream in the value chain are the ultimate beneficiaries and supporting services, including the insured clients (shipowners, cargo owners, offshore operators), claims adjusters, and legal services. Insured clients are the demand side of the market, seeking protection against maritime perils. Claims adjusters, often independent experts, play a critical role in investigating incidents, assessing damages, and quantifying losses, ensuring fair and accurate settlement of claims. Legal services are frequently engaged, particularly in complex or disputed claims, to interpret policy wordings, advise on liabilities, and represent parties in litigation or arbitration. This downstream segment highlights the service-oriented nature of marine insurance, where effective claims handling and dispute resolution are paramount to customer satisfaction and the market's overall reputation. The efficiency and effectiveness of interactions across the entire value chain are critical for maintaining a healthy and resilient marine insurance market.

Marine Insurance Market Potential Customers

The potential customers for the Marine Insurance Market are diverse and encompass virtually any entity involved in the transportation of goods or people by sea, or in maritime operations. At the core, these include commercial shipping companies that own and operate various types of vessels, from massive container ships and bulk carriers to oil tankers and specialized research vessels. These shipowners require comprehensive coverage for their physical assets (hull and machinery) and extensive third-party liabilities (P&I), which can range from collision damage and environmental pollution to crew injuries and cargo claims. Without adequate marine insurance, the financial risks associated with owning and operating a fleet would be prohibitive, making it an indispensable part of their operational framework and a significant expenditure.

Beyond vessel owners, cargo owners represent a vast segment of potential customers. This includes importers and exporters of all sizes, from multinational corporations dealing in high-value manufactured goods to small businesses shipping raw materials. These entities rely on cargo insurance to protect their goods from loss or damage during transit across oceans, covering risks such as theft, fire, sinking, or improper handling. Freight forwarders and logistics companies, who manage the complex movement of goods across multiple modes of transport, also frequently purchase marine insurance either on behalf of their clients or to cover their own liabilities arising from their role in the supply chain. Their reliance on marine insurance ensures the continuity of trade and provides financial security against the myriad risks inherent in global logistics operations, underscoring its pivotal role in facilitating international commerce.

Other significant potential customers include offshore operators involved in the oil and gas industry, as well as the rapidly growing offshore renewable energy sector (e.g., wind farms). These companies require highly specialized marine insurance products to cover their drilling rigs, production platforms, support vessels, subsea equipment, and the substantial environmental liabilities associated with their operations. Furthermore, port and terminal operators seek marine liability coverage for risks associated with vessel handling, cargo storage, and infrastructure damage. Marine contractors involved in shipbuilding, repair, or underwater construction also require tailored policies. Lastly, a substantial segment of leisure boaters and yacht owners purchase marine insurance to protect their recreational vessels and cover personal liabilities. This broad spectrum of end-users highlights the pervasive need for marine insurance across the entire maritime ecosystem, driven by the inherent risks of marine activities and the critical importance of financial protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 31.5 Billion |

| Market Forecast in 2033 | USD 49.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz Global Corporate & Specialty (AGCS), AXA XL, Chubb Limited, Travelers Companies Inc., AIG, Zurich Insurance Group, Liberty Mutual Insurance, The Standard Club, North P&I Club, Gard AS, Britannia P&I, UK P&I Club, West of England P&I Club, Skuld, QBE Insurance Group, XL Catlin (part of AXA XL), Tokio Marine Holdings, Markel Corporation, Falvey Cargo Underwriting, The Steamship Mutual P&I Club |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Insurance Market Key Technology Landscape

The marine insurance market is undergoing a significant technological transformation, driven by the imperative to enhance risk assessment accuracy, streamline operations, and develop innovative products. At the forefront of this evolution are advancements in data collection and analysis. Internet of Things (IoT) sensors deployed on vessels, cargo containers, and offshore platforms generate vast amounts of real-time data on parameters such as location, speed, engine performance, temperature, and environmental conditions. This granular data, combined with satellite imagery and telematics, provides insurers with unprecedented visibility into maritime operations. Leveraging big data analytics, marine insurers can process these complex datasets to identify trends, predict potential incidents, and gain a more comprehensive understanding of individual and aggregate risk exposures. This move towards data-driven insights marks a significant departure from traditional underwriting methods, enabling more precise risk profiling and dynamic pricing models, moving beyond historical data to predictive foresight.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal in interpreting these massive datasets and automating critical processes. AI algorithms can identify subtle patterns indicative of increased risk, such as deviations from optimal routes or unusual equipment performance, allowing for proactive interventions. In claims management, AI-powered systems can analyze claim documents, accident reports, and external data sources to expedite processing, verify authenticity, and detect fraudulent activities with higher accuracy and speed than manual methods. Natural Language Processing (NLP) further enhances this by extracting key information from unstructured text data, such as incident reports and communications. Robotic Process Automation (RPA) is also being adopted to automate repetitive administrative tasks, such as data entry, policy administration, and initial claims intake, thereby increasing operational efficiency and allowing human capital to focus on more complex, value-added activities that require expert judgment and client interaction.

Beyond data analytics and automation, blockchain technology is emerging as a critical enabler for enhanced transparency, security, and efficiency within the marine insurance ecosystem. By providing an immutable and distributed ledger, blockchain can streamline processes such as policy issuance, premium payments, and claims settlement, reducing administrative overhead and disputes. Smart contracts, built on blockchain, can automatically trigger payouts when predefined conditions (e.g., specific weather events, vessel arrival) are met, leading to faster and more reliable claims processing, particularly for parametric insurance products. Furthermore, advancements in cloud computing provide the scalable infrastructure necessary to host these data-intensive technologies and support global operations. The integration of these technologies—from IoT data capture and AI-driven analytics to blockchain-enabled smart contracts—is creating a more agile, transparent, and resilient marine insurance landscape, paving the way for new business models and an improved customer experience rooted in real-time, actionable insights.

Regional Highlights

- Asia Pacific: The Asia Pacific region stands as the fastest-growing market for marine insurance, primarily driven by robust economic expansion, increasing trade volumes, and significant investments in maritime infrastructure across countries like China, India, Japan, Singapore, and South Korea. This region is home to some of the world's busiest ports and largest shipping fleets, leading to a substantial demand for both cargo and hull & machinery insurance. The Belt and Road Initiative (BRI) by China further fuels maritime trade and related insurance needs. Emerging economies in Southeast Asia are also contributing significantly, modernizing their ports and expanding their shipping capabilities. While growth is strong, the region also faces unique challenges such as dense shipping lanes, geopolitical tensions in certain areas, and varying regulatory environments, which create complex risk landscapes for insurers.

- Europe: Europe represents a mature yet highly sophisticated marine insurance market, characterized by established insurance hubs like London, which is a global center for marine underwriting and reinsurance. Countries such as the UK, Germany, Norway, and Greece (with its vast ship-owning community) are major contributors. The European market benefits from a strong regulatory framework, high levels of specialization, and a focus on complex risks, including offshore energy (particularly offshore wind farms), cruise line liabilities, and advanced maritime technologies. While growth rates may be lower than in Asia Pacific, the market maintains high premium values due to the complexity and value of insured assets and liabilities. Regulatory changes, such as those related to environmental protection and cyber security, continue to shape product development and risk assessment in the region.

- North America: The North American marine insurance market is robust and highly diversified, with significant demand stemming from its extensive coastlines, major port operations, and substantial cross-border trade with Asia and Europe. The United States and Canada are key players, with a strong focus on sophisticated risk management solutions for large commercial fleets, cargo operations, and specialized offshore sectors such as oil & gas in the Gulf of Mexico. The region also experiences significant demand for pleasure craft insurance due to a large recreational boating community. Technological adoption, particularly in data analytics and telematics, is a defining characteristic, helping insurers manage risks more effectively, including those related to hurricane activity and cyber threats to port infrastructure and shipping networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Insurance Market.- Allianz Global Corporate & Specialty (AGCS)

- AXA XL

- Chubb Limited

- Travelers Companies Inc.

- AIG

- Zurich Insurance Group

- Liberty Mutual Insurance

- The Standard Club

- North P&I Club

- Gard AS

- Britannia P&I

- UK P&I Club

- West of England P&I Club

- Skuld

- QBE Insurance Group

- XL Catlin (part of AXA XL)

- Tokio Marine Holdings

- Markel Corporation

- Falvey Cargo Underwriting

- The Steamship Mutual P&I Club

Frequently Asked Questions

Analyze common user questions about the Marine Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Marine Insurance and why is it important?

Marine insurance provides financial protection against loss or damage to ships, cargo, terminals, and any other property involved in maritime transportation. It is crucial because it mitigates the substantial financial risks associated with sea travel, including accidents, natural disasters, piracy, and liabilities, ensuring the stability and continuity of global trade and maritime operations.

What types of coverage does Marine Insurance typically offer?

Typical marine insurance coverage includes Hull and Machinery (H&M) insurance for the vessel itself, Cargo insurance for goods in transit, and Protection and Indemnity (P&I) insurance for third-party liabilities like crew injury, pollution, or cargo claims. Specialized policies also cover offshore energy assets, marine liabilities, and pleasure crafts, tailored to specific maritime risks.

How is AI impacting the Marine Insurance market?

AI is transforming marine insurance by enhancing risk assessment through predictive analytics of real-time data (IoT, telematics, satellite), automating underwriting for faster policy issuance, and improving claims management efficiency with accelerated fraud detection. It enables more personalized premiums and the development of innovative products like parametric insurance, leading to a more efficient and responsive market.

What are the key drivers for growth in the Marine Insurance market?

Key drivers include the continuous expansion of global trade and maritime traffic, which increases demand for coverage. Rising geopolitical tensions, the escalating impacts of climate change, and the increasing value and technological sophistication of vessels and cargo also necessitate more robust insurance solutions. Furthermore, advancements in technology like IoT and AI enhance risk management capabilities, fueling market innovation.

What are the main challenges facing the Marine Insurance industry?

The main challenges include a volatile claims experience marked by high-severity losses, intense competition leading to premium pressure, and the complexity of managing emerging risks such as cyber threats, autonomous vessel liabilities, and evolving environmental regulations. Economic slowdowns and lack of standardization across jurisdictions also pose significant operational and financial hurdles for insurers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Marine Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Marine Insurance Market Size Report By Type (Offshore/Energy, Marine Liability, Transport/Cargo, Hull), By Application (Cargo Owners, Ship Owners, Government, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Inland Marine Insurance Market Statistics 2025 Analysis By Application (Food Industry, Construction Industry, Transport Industry, Others), By Type (Free from Particular Average, with Particular Average, All Risk, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager