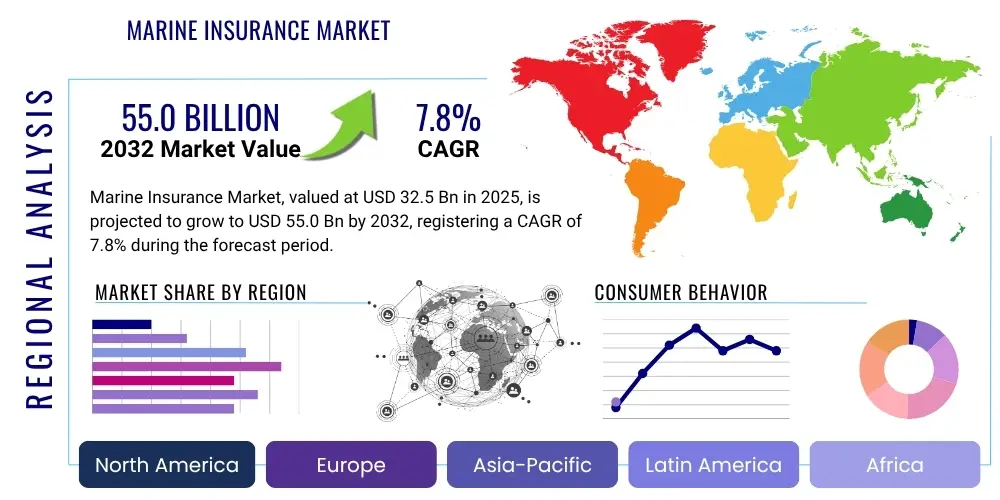

Marine Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430965 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Marine Insurance Market Size

The Marine Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $32.5 billion in 2025 and is projected to reach $55.0 billion by the end of the forecast period in 2032.

Marine Insurance Market introduction

Marine insurance constitutes a critical component of global commerce, offering protection against financial losses arising from perils associated with maritime transportation. This specialized form of insurance covers loss or damage to ships (hull and machinery), cargo, offshore platforms, and the liabilities of shipowners or operators. It is fundamental to mitigating risks across the intricate supply chains that underpin international trade, safeguarding investments made in goods, vessels, and infrastructure.

The product encompasses a broad spectrum of coverage options, including Hull & Machinery insurance for vessels, Cargo insurance for goods in transit, Protection & Indemnity (P&I) insurance for third-party liabilities, and offshore energy insurance for oil and gas installations. These policies are tailored to address the unique and often complex risks inherent in marine operations, ranging from natural disasters and piracy to navigational errors and mechanical breakdowns. The demand for marine insurance is inextricably linked to the volume and value of global trade, as well as the increasing complexity of logistics and the regulatory environment.

Major applications of marine insurance span across various sectors such as international shipping, oil and gas exploration, commercial fishing, and pleasure craft operations. Benefits include financial security for businesses, facilitating trade by making risk manageable, and enabling investment in maritime assets. The market is primarily driven by the continuous expansion of global trade, the escalating value of goods transported by sea, heightened awareness of marine risks, and advancements in maritime technology and logistics that necessitate comprehensive coverage.

Marine Insurance Market Executive Summary

The Marine Insurance Market is currently experiencing a dynamic phase driven by a confluence of global business trends. Persistent growth in international trade volumes, particularly from emerging economies, fuels demand for robust cargo and hull insurance solutions. Furthermore, increasing geopolitical uncertainties, coupled with the rising frequency and severity of climate-related maritime incidents, underscore the critical need for comprehensive risk management. Insurers are responding by developing more sophisticated policies, often integrating advanced data analytics and risk modeling to accurately assess and price these evolving threats. Digitalization initiatives across the maritime industry are also compelling insurers to enhance their digital capabilities, streamline operations, and improve customer engagement.

Regional trends indicate significant shifts in market growth and focus. Asia Pacific is emerging as a dominant force, propelled by rapid industrialization, burgeoning trade routes, and substantial investments in port infrastructure and shipbuilding, particularly in countries like China, India, and Singapore. Europe, while a mature market, continues to be a global hub for marine insurance expertise and underwriting capacity, with the London market playing a pivotal role. North America demonstrates steady demand, heavily influenced by its robust energy sector and complex regulatory landscape. Latin America and the Middle East & Africa regions are also exhibiting growth, albeit from a smaller base, driven by commodity exports and strategic waterway importance.

Segmentation trends highlight particular areas of expansion. The cargo insurance segment is witnessing strong growth due to the escalating value and volume of goods transported globally, alongside increasing supply chain vulnerabilities. Hull and machinery insurance remains a foundational segment, adapting to larger, more technologically advanced, and higher-value vessels. Protection & Indemnity (P&I) clubs continue to play a crucial role in managing third-party liabilities, evolving to cover new risks such as cyber liabilities and pollution. The offshore energy segment is also poised for steady growth, driven by continued investments in exploration and production, necessitating specialized and high-value coverage for complex offshore assets and operations.

AI Impact Analysis on Marine Insurance Market

User inquiries regarding the impact of Artificial Intelligence on the Marine Insurance Market frequently center on how AI can revolutionize risk assessment, claims processing, and underwriting. Common themes include expectations of greater efficiency, accuracy, and fraud detection capabilities, alongside concerns about job displacement, data privacy, and the ethical implications of algorithmic decision-making. Stakeholders are particularly interested in AI's potential to analyze vast datasets for predictive insights, allowing for more dynamic pricing and personalized policy offerings, while also questioning the reliability and transparency of AI models in complex maritime scenarios where human judgment has traditionally been paramount.

The integration of AI technologies promises to significantly transform various facets of the marine insurance landscape. By leveraging machine learning algorithms, insurers can process and analyze immense volumes of data from diverse sources, including satellite imagery, weather patterns, vessel telemetry, historical claims, and port congestion data. This enables more precise risk modeling, moving from static underwriting to dynamic, real-time risk evaluation. Predictive analytics can forecast potential incidents, allowing for proactive risk mitigation strategies and potentially reducing the frequency and severity of claims.

Moreover, AI-powered solutions are poised to streamline claims management processes, reducing turnaround times and operational costs. Natural Language Processing (NLP) can assist in the automated review of claim documents and policy wordings, while computer vision can expedite damage assessments through image and video analysis. This increased efficiency not only benefits insurers through cost savings but also improves customer satisfaction by providing faster and more transparent claims settlements. The adoption of AI is not without challenges, including the need for high-quality data, robust cybersecurity measures, and regulatory frameworks to ensure fair and ethical application.

- Enhanced risk assessment through predictive analytics, analyzing real-time data from vessels and environmental conditions.

- Automated claims processing, utilizing AI to review documentation, verify incidents, and expedite settlements.

- Improved fraud detection by identifying suspicious patterns and anomalies in claims data that might escape human review.

- Personalized underwriting and dynamic pricing models based on granular risk profiles of individual vessels, routes, and cargo.

- Development of smart contracts using blockchain and AI for automated policy execution and claims payouts.

- Optimized resource allocation for adjusters and surveyors, directing human expertise to the most complex cases.

- Better accumulation control and portfolio management by understanding systemic risks across entire insured fleets or cargo types.

DRO & Impact Forces Of Marine Insurance Market

The Marine Insurance Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the relentless expansion of global seaborne trade, which directly correlates with the demand for cargo and hull insurance. Coupled with this, the increasing value of cargo and the growing fleet of specialized, high-value vessels elevate the financial exposure, necessitating comprehensive insurance coverage. Geopolitical tensions, evolving regulatory landscapes (e.g., environmental regulations, IMO 2020), and the undeniable impacts of climate change leading to more frequent and severe weather events also act as significant drivers, compelling stakeholders to seek robust insurance solutions against diverse and intensifying perils.

However, the market also faces notable restraints. Intense competition among insurers often leads to pricing pressures and reduced profitability, making it challenging for smaller players to thrive. The inherent complexity of marine risks, requiring highly specialized underwriting expertise, and the global nature of claims management can pose operational hurdles. Economic slowdowns and trade protectionist policies can dampen global trade volumes, thereby negatively impacting demand for marine insurance. Furthermore, the high capital requirements for underwriting substantial marine risks and the cyclical nature of the insurance market, often influenced by catastrophe losses, can create volatility.

Opportunities for growth are abundant within this evolving landscape. The emergence of new risks, such as cyber threats targeting maritime systems and the increasing use of autonomous vessels, creates demand for novel and specialized insurance products. Technological advancements, including the adoption of IoT, big data analytics, and blockchain in the maritime sector, offer avenues for insurers to innovate in risk assessment, policy administration, and claims processing. Expansion into untapped or underserved emerging markets, particularly in rapidly industrializing regions with growing trade infrastructure, presents significant growth potential. Furthermore, the rising awareness of environmental liabilities and the need for sustainable shipping practices can drive demand for tailored environmental pollution liability coverage.

Segmentation Analysis

The Marine Insurance Market is broadly segmented based on various criteria, including the type of coverage, the end-user, and the distribution channel. These segmentations provide a granular view of the market's structure, allowing for a detailed understanding of demand dynamics and competitive landscapes within specific niches. Each segment addresses distinct needs and risk profiles within the maritime industry, contributing to the overall market's diversity and resilience. Understanding these segments is crucial for insurers to tailor their offerings, optimize their underwriting strategies, and target specific customer groups effectively.

- By Type:

- Hull and Machinery (H&M): Covers damage to the vessel itself, including the ship's structure, machinery, and equipment.

- Cargo Insurance: Protects goods from loss or damage during transit, whether by sea, air, or land.

- Protection & Indemnity (P&I) Insurance: Covers third-party liabilities such as pollution, bodily injury, collision, and wreck removal.

- Offshore Energy Insurance: Specialized coverage for offshore oil and gas exploration, production platforms, and related infrastructure.

- Marine Liability (excluding P&I): Covers other liabilities not covered by P&I, such as port operator liabilities.

- Yacht/Pleasure Craft Insurance: Tailored coverage for recreational boats and yachts.

- By End-User:

- Shipowners: Operators of commercial vessels, including tankers, container ships, bulk carriers, and cruise lines.

- Cargo Owners: Importers, exporters, manufacturers, and retailers who own goods being transported.

- Logistics Providers & Freight Forwarders: Companies managing the transportation and storage of goods.

- Offshore Energy Companies: Firms involved in exploration, drilling, and production of oil and gas at sea.

- Port Authorities & Terminal Operators: Entities responsible for managing port operations and infrastructure.

- Other Stakeholders: Including shipbuilders, marine contractors, and recreational boat owners.

- By Distribution Channel:

- Direct Sales: Insurers sell policies directly to clients.

- Brokers & Agents: Intermediaries who facilitate policy sales between insurers and clients, offering expertise and market access.

- P&I Clubs: Mutual insurance associations owned by their shipowner members, providing P&I coverage.

- Digital Platforms & Online Channels: Growing segment leveraging technology for policy issuance and management.

Value Chain Analysis For Marine Insurance Market

The value chain of the Marine Insurance Market is complex, involving numerous interconnected stages and stakeholders, each adding value to the final insurance product. It begins with upstream activities focused on data collection, risk assessment, and policy development. This phase involves specialist consultants providing risk management advice, maritime classification societies ensuring vessel standards, and technology providers offering data analytics tools, satellite tracking, and IoT solutions. Access to accurate and real-time information regarding vessel movements, cargo conditions, and environmental factors is paramount for effective underwriting and pricing decisions. Reinsurance companies also play a critical upstream role by absorbing and diversifying large risks, thereby increasing the underwriting capacity of primary insurers.

The core of the value chain involves the primary insurance providers and underwriters who assess specific risks, determine premiums, and issue policies. This stage requires deep expertise in maritime law, shipping operations, and international trade. Distribution channels then connect these insurance products with potential customers. This includes direct sales teams within large insurance corporations, independent marine insurance brokers who act as intermediaries, and specialized P&I clubs that operate on a mutual basis to provide liability coverage. Brokers and agents are crucial for market access, providing advice to clients, negotiating terms, and managing relationships, especially for complex or bespoke insurance requirements. Their role is particularly significant in navigating the specialized London and European markets.

Downstream activities primarily involve claims management, loss adjustment, and legal support once an insured event occurs. Claims adjusters investigate incidents, assess damages, and facilitate settlements, often engaging salvage operators for recovery efforts. Legal firms specializing in maritime law provide essential services for dispute resolution and subrogation. The efficiency and fairness of the claims process are vital for customer satisfaction and the insurer's reputation. Furthermore, ongoing policy servicing, renewals, and client relationship management form a continuous feedback loop, influencing product development and risk mitigation strategies for future policies. The entire value chain relies heavily on robust communication and data exchange among all participants to ensure smooth and effective operation.

Marine Insurance Market Potential Customers

The Marine Insurance Market serves a diverse array of end-users and buyers, each with unique operational needs and risk exposures requiring tailored insurance solutions. At the forefront are shipowners and operators, who constitute a foundational customer base. This group includes owners of commercial vessels such as container ships, oil tankers, bulk carriers, cruise liners, and fishing fleets. Their primary concern is protecting their substantial investments in vessels (Hull & Machinery insurance) and mitigating significant third-party liabilities arising from accidents, pollution, or crew-related incidents (Protection & Indemnity insurance). The sheer scale and value of global shipping assets make this a consistently high-demand segment.

Another critical segment comprises cargo owners, which encompasses a vast range of businesses involved in international trade, from large multinational corporations importing raw materials or exporting finished goods, to small and medium-sized enterprises moving specialized products. These customers seek protection for their goods against loss or damage during transit across various modes of transport, predominantly sea. Freight forwarders and logistics companies, while often not direct owners of cargo, act as crucial intermediaries and frequently purchase marine cargo insurance on behalf of their clients or as part of their comprehensive service offerings, bundling insurance with transportation solutions to provide an integrated package to shippers.

Beyond traditional shipping, the market also caters to specialized sectors. Offshore energy companies, involved in oil and gas exploration and production, require extensive and high-value coverage for their platforms, drilling rigs, subsea equipment, and associated liabilities. Port authorities and terminal operators are potential customers for liability insurance protecting against damages arising from their operations. Furthermore, the growing segment of yacht and pleasure craft owners also represents a significant customer group, seeking specialized policies for their recreational vessels. The increasing complexity of global supply chains and maritime operations ensures a continuous and evolving demand from these diverse customer bases, each striving to manage the inherent risks of marine activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $32.5 billion |

| Market Forecast in 2032 | $55.0 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA, Allianz, Zurich Insurance Group, Liberty Mutual Insurance, Marsh & McLennan Companies, Aon plc, Gard AS, Skuld, UK P&I Club, Steamship Mutual, Britannia P&I, Chubb Limited, The Standard Club, Tokio Marine Holdings Inc., Generali, Munich Re, Swiss Re, Hannover Re, Beazley Group, W.R. Berkley Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Insurance Market Key Technology Landscape

The Marine Insurance Market is undergoing a significant technological transformation, with the adoption of advanced solutions playing a pivotal role in enhancing efficiency, accuracy, and risk management capabilities. Internet of Things (IoT) sensors are increasingly deployed on vessels and within cargo containers, providing real-time data on location, speed, temperature, humidity, and operational status. This granular data allows insurers to monitor risks proactively, assess conditions during transit, and potentially offer dynamic pricing based on actual exposure. Furthermore, telematics solutions, similar to those in automotive insurance, are gathering comprehensive data on vessel performance and crew behavior, enabling more precise underwriting and predictive maintenance insights.

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of this technological evolution, driving improvements in various aspects of marine insurance. AI algorithms are used for sophisticated risk modeling, analyzing vast datasets of historical claims, weather patterns, geopolitical incidents, and market trends to predict potential losses with greater accuracy. This enables insurers to develop more refined underwriting strategies and identify emerging risks before they become widespread. Machine learning also powers automated claims processing systems, using Natural Language Processing (NLP) to analyze documentation and computer vision for damage assessment, significantly reducing processing times and administrative costs while simultaneously improving fraud detection capabilities.

Blockchain technology is also gaining traction, offering potential for increased transparency, security, and efficiency across the marine insurance value chain. Smart contracts, built on blockchain platforms, can automate policy issuance, premium payments, and claims settlements based on predefined conditions, thereby reducing manual intervention and disputes. Additionally, digital platforms and advanced data analytics tools are becoming indispensable for insurers to manage vast amounts of information, create interactive dashboards, and generate actionable insights. These technologies collectively enable a shift towards a more data-driven, customer-centric, and resilient marine insurance market, fostering innovation in product development and service delivery while navigating complex global maritime challenges.

Regional Highlights

- North America: A mature market characterized by stringent regulatory environments and a strong focus on specialized coverages, particularly for offshore energy and large commercial fleets. The region benefits from significant trade flows through its major ports and the presence of sophisticated risk management practices.

- Europe: Dominates the global marine insurance landscape, largely due to the influence of the London market which serves as a global hub for underwriting expertise and capacity. European P&I clubs are central to liability coverage, and the region leads in developing innovative solutions for complex risks and sustainable shipping initiatives.

- Asia Pacific (APAC): The fastest-growing region, driven by its booming manufacturing base, expanding global trade routes, and massive investments in port infrastructure and shipbuilding, especially in China, Japan, South Korea, and Singapore. The region's increasing maritime activity generates substantial demand for cargo, hull, and P&I insurance.

- Latin America: An emerging market with significant growth potential, fueled by commodity exports, infrastructure development, and increasing maritime trade volumes. The region is seeing greater adoption of formal insurance practices as its economies integrate further into global supply chains, though it faces unique challenges related to political stability and natural disaster risks.

- Middle East and Africa (MEA): Benefits from its strategic geographical location, including the Suez Canal, and substantial oil and gas exports. The region's marine insurance market is expanding with increased port developments and trade liberalization, particularly in the Arabian Gulf and key African trade hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Insurance Market.- AXA

- Allianz

- Zurich Insurance Group

- Liberty Mutual Insurance

- Marsh & McLennan Companies

- Aon plc

- Gard AS

- Skuld

- UK P&I Club

- Steamship Mutual

- Britannia P&I

- Chubb Limited

- The Standard Club

- Tokio Marine Holdings Inc.

- Generali

- Munich Re

- Swiss Re

- Hannover Re

- Beazley Group

- W.R. Berkley Corporation

Frequently Asked Questions

What is marine insurance and why is it important for global trade?

Marine insurance is a specialized type of insurance that protects against loss or damage to ships, cargo, terminals, and any transport property moving between points of origin and destination. It is crucial for global trade as it mitigates financial risks for businesses involved in international shipping, ensuring continuity and stability in complex supply chains by covering perils such as natural disasters, piracy, accidents, and liabilities.

What are the main types of marine insurance coverage available?

The primary types of marine insurance include Hull and Machinery (H&M) insurance, which covers damage to the vessel itself; Cargo insurance, which protects goods during transit; and Protection & Indemnity (P&I) insurance, covering third-party liabilities like pollution, bodily injury, and collision. Other specialized coverages include Offshore Energy insurance and Yacht/Pleasure Craft insurance, tailored for specific marine assets and operations.

How is AI impacting risk assessment in marine insurance?

AI is revolutionizing marine insurance risk assessment by enabling insurers to analyze vast amounts of data from IoT sensors, satellite tracking, and historical claims using machine learning algorithms. This allows for more accurate predictive modeling of potential incidents, dynamic pricing based on real-time conditions, and identification of emerging risk patterns, leading to more precise underwriting and proactive risk mitigation strategies.

What are the key drivers of growth in the Marine Insurance Market?

Key drivers of growth include the continuous expansion of global seaborne trade, increasing values of cargo and vessels, heightened awareness of diverse marine risks such as climate change impacts and geopolitical tensions, and the ongoing demand for sophisticated risk management solutions. Technological advancements in maritime logistics also necessitate evolving insurance products.

Which regions are expected to lead the growth in the Marine Insurance Market?

Asia Pacific is anticipated to be the fastest-growing region in the Marine Insurance Market, driven by its robust manufacturing sector, expanding global trade routes, and significant investments in port infrastructure and shipbuilding. While Europe remains a mature hub for expertise, the dynamic growth in Asian economies presents substantial opportunities for market expansion and innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Marine Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Marine Insurance Market Size Report By Type (Offshore/Energy, Marine Liability, Transport/Cargo, Hull), By Application (Cargo Owners, Ship Owners, Government, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Inland Marine Insurance Market Statistics 2025 Analysis By Application (Food Industry, Construction Industry, Transport Industry, Others), By Type (Free from Particular Average, with Particular Average, All Risk, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager