MCU Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431492 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

MCU Market Size

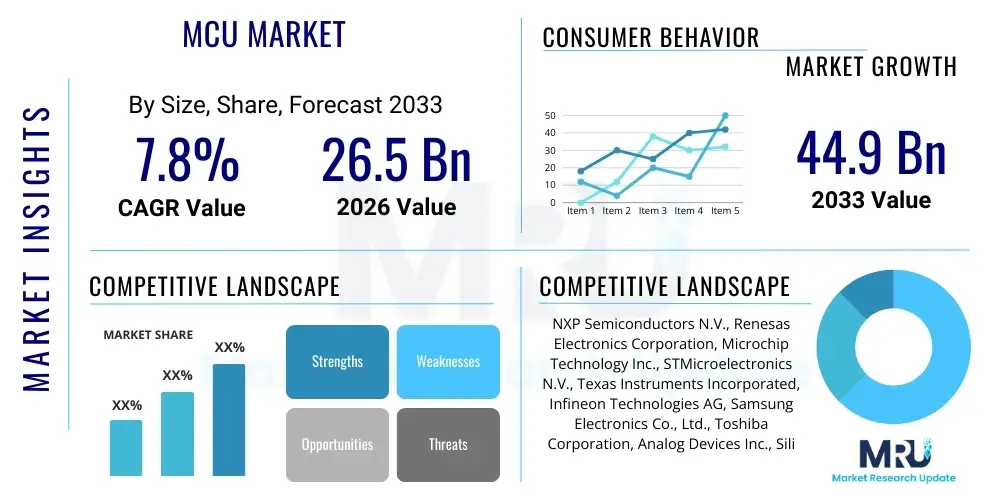

The MCU Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 26.5 Billion in 2026 and is projected to reach USD 44.9 Billion by the end of the forecast period in 2033.

MCU Market introduction

The Microcontroller Unit (MCU) market encompasses the global ecosystem involved in the design, manufacturing, and distribution of specialized integrated circuits that function as small, dedicated computers within embedded systems. These single-chip solutions consolidate a processor core (CPU), volatile and non-volatile memory (RAM, Flash), and programmable input/output (I/O) peripherals onto a single substrate. The fundamental product description centers on highly integrated, cost-effective silicon designed for real-time control and monitoring, distinguishing them from more general-purpose microprocessors (MPUs) through optimized power consumption profiles and deterministic operational behavior crucial for time-sensitive tasks. The market's robust trajectory is intrinsically linked to the pervasive digitalization of infrastructure, consumer goods, and industrial processes globally, where every connected or automated function relies on these foundational computing blocks. The value derived from MCUs stems from their ability to enable local intelligence, manage power resources efficiently, and facilitate communication interfaces, thereby significantly reducing system complexity and overall Bill of Materials (BOM) for Original Equipment Manufacturers (OEMs).

Major applications for MCUs are widespread and critically important across nearly every industrial vertical. In the automotive industry, MCUs serve as the processing backbone for Electronic Control Units (ECUs), managing everything from sophisticated engine timing and transmission control to body electronics, passive safety systems (airbags), and the increasingly complex modules required for Advanced Driver-Assistance Systems (ADAS). Industrial applications utilize MCUs for precision robotics control, complex programmable logic controllers (PLCs), motor drives, and advanced human-machine interfaces (HMIs), forming the essential components of Industry 4.0 infrastructure. The immense market growth driver, however, is the explosion of the Internet of Things (IoT), where billions of smart sensors, gateways, and connected edge devices require energy-efficient processing capabilities for data collection, local inference, and wireless communication protocols like Wi-Fi, Bluetooth Low Energy (BLE), and Zigbee. These diverse application requirements mandate a highly segmented product portfolio from manufacturers, ranging from ultra-low power 8-bit devices to high-performance 32-bit units incorporating dedicated digital signal processing (DSP) or artificial intelligence (AI) acceleration capabilities.

The core benefits realized through the deployment of modern MCUs include significant energy savings, crucial for battery-operated devices; enhanced reliability through integrated hardware redundancy and safety features necessary for mission-critical systems; and accelerated time-to-market for electronic products owing to comprehensive software ecosystems and development tools provided by vendors. Driving factors underpinning the sustained market expansion involve regulatory mandates pushing for increased vehicle safety (e.g., mandatory ADAS features), global initiatives toward energy efficiency (e.g., smart grid and smart metering), and the continuous consumer demand for increasingly sophisticated and interconnected smart devices. Furthermore, the strategic shift among semiconductor manufacturers towards integrating more peripherals—such as high-resolution analog-to-digital converters (ADCs), dedicated memory controllers, and secure cryptographic engines—on the single chip further enhances the MCU's value proposition by reducing external component count and improving system integration efficiency, thereby maintaining its centrality in the modern electronic landscape.

MCU Market Executive Summary

The global Microcontroller Unit market is experiencing dynamic growth defined by a profound architectural migration and strategic realignment within the semiconductor supply chain. Key business trends indicate a definitive preference for 32-bit architectures, overwhelmingly based on the ARM Cortex-M family, which now accounts for the majority of new design wins across high-growth sectors like automotive and industrial IoT. Manufacturers are strategically pivoting their investment focus towards software ecosystems and comprehensive development toolchains, recognizing that ease of use and rapid application development are critical differentiators beyond pure silicon specifications. Consolidations and mergers continue to reshape the competitive landscape, as major players seek to integrate specialized IP, particularly in areas like advanced security, specialized radio frequency (RF) technology, and proprietary AI acceleration to offer highly differentiated System-on-Chip (SoC) solutions. Supply chain resilience, following the global component shortage period, remains a top priority, leading to strategic investments in regionalized manufacturing capacity and dual-sourcing strategies to mitigate future geopolitical or logistical risks, fundamentally changing procurement dynamics.

Regional trends reveal the continued dominance of the Asia Pacific (APAC) region, which acts as the epicenter for both high-volume manufacturing of consumer electronics and the rapid deployment of industrial and smart city infrastructure. Countries like China, Taiwan, and South Korea leverage their established foundry capabilities and large domestic markets to sustain high growth rates, especially within the IoT and low-to-mid-range industrial segments. Contrastingly, North America and Europe, while consuming smaller volumes compared to APAC, represent high-value markets focused on mission-critical and high-reliability applications. European demand is heavily biased towards automotive safety and high-end industrial automation (e.g., advanced robotics), strictly adhering to ISO 26262 functional safety standards. North American market strength lies in aerospace, medical technology, and advanced AI edge computing, prioritizing high-security features, certified performance, and long product life cycles, driving innovation in advanced process nodes and security IP integration necessary for governmental and proprietary applications.

Segment trends underscore the phenomenal trajectory of the connected MCU sub-segment, driven by the requirement for ubiquitous communication capabilities in the age of ubiquitous connectivity. The integration of certified connectivity standards—including Cat-M1/NB-IoT cellular connectivity alongside standard Wi-Fi and BLE—is crucial for penetrating emerging IoT verticals that demand continuous data exchange. Within the application segments, Automotive remains the most stringent and rapidly evolving area, fueled by the complex requirements of Battery Management Systems (BMS) in Electric Vehicles (EVs) and the computational needs of centralized domain controllers in next-generation vehicle architectures. Furthermore, the industrial segment is witnessing significant growth, specifically in predictive maintenance and autonomous industrial vehicles, which demand rugged, high-performance 32-bit MCUs capable of executing complex fieldbus protocols and running embedded real-time operating systems (RTOS) necessary for deterministic control, reinforcing the structural shift away from simpler 8-bit devices toward advanced computing platforms across the entire industrial ecosystem.

AI Impact Analysis on MCU Market

Analysis of user queries regarding AI’s influence on the MCU market consistently points toward concerns over computational feasibility, power efficiency constraints, and the strategic positioning of MCUs relative to high-end accelerators like GPUs. Users are keen to understand how traditional, resource-constrained MCUs can effectively execute Machine Learning (ML) inference models necessary for advanced features such as local voice control, anomaly detection, and basic image recognition without drastically increasing power consumption or cost. The primary expectation is that AI integration must adhere to the core MCU value proposition: ultra-low power, small form factor, and affordability. Consequently, the key themes summarize the need for highly optimized, hardware-software co-designed solutions—often involving techniques like model quantization (e.g., INT8) and efficient memory management—to democratize AI inference capabilities down to the billions of edge nodes where real-time, local decision-making offers the greatest systemic advantage.

The realization of Edge AI on MCUs dictates a fundamental evolution in chip architecture. Standard Von Neumann architectures struggle with the massive parallel processing demands of neural networks. Therefore, MCU manufacturers are actively integrating specialized hardware components, typically referred to as Neural Processing Units (NPUs) or highly optimized Digital Signal Processors (DSPs), directly alongside the main Cortex-M core. These accelerators are specifically designed to handle matrix multiplication and convolution operations—the computational bottlenecks of deep learning—with unparalleled energy efficiency, measured in inferences per Joule. This architectural enhancement allows a device to perform complex tasks, such as filtering sensor data to determine operational status or recognizing specific voice commands, instantaneously without network latency, offering immense performance benefits in remote, battery-powered deployments where continuous cloud connection is infeasible or prohibitively expensive due to data usage and power drain.

Beyond hardware, the impact of AI necessitates a significant investment in the software ecosystem to ensure accessibility for the mass market of embedded developers. Vendors must provide comprehensive ML frameworks, often tailored versions of popular open-source tools like TensorFlow Lite for Microcontrollers (TFLite Micro) or proprietary toolchains that facilitate model training, compression, optimization, and seamless deployment onto their specific MCU hardware. This end-to-end enablement is critical, as the complexity of developing efficient ML models for constrained environments can be a major barrier to adoption. The continuous push for greater power efficiency means that future MCU designs will tightly integrate processing units with memory structures, minimizing data movement and leveraging advanced sleep modes, ensuring that the AI capabilities are deployed in a manner that preserves the MCU's core identity as a leader in ultra-low power embedded computing, thereby unlocking entirely new categories of intelligent, battery-powered edge devices.

- MCUs are increasingly integrating dedicated hardware accelerators (NPUs, DSPs, or optimized fixed-function blocks) for efficient neural network inference at the edge.

- Enables ultra-low latency decision-making and real-time control in embedded systems without relying on continuous cloud connectivity, critical for robotic and safety systems.

- Drives demand for high-end 32-bit and increasingly complex heterogenous RISC-V architectures capable of handling sophisticated, compressed machine learning models.

- Facilitates advanced applications such as sophisticated sensor fusion, local voice processing (keyword spotting), anomaly detection in industrial equipment, and low-resolution computer vision in constrained environments.

- Requires the provisioning of sophisticated, power-aware software toolchains and model optimization frameworks (e.g., pruning, quantization, efficient memory mapping) suitable for limited memory and power budgets.

- Significantly increases the requirement for enhanced security features to protect both the proprietary intellectual property embedded in ML models and the sensitive data processed locally on the device.

- Leads to accelerated differentiation among competing MCU products, with AI capabilities becoming a critical benchmark for high-performance and premium device categories, driving higher average selling prices (ASPs).

DRO & Impact Forces Of MCU Market

The dynamics of the MCU market are governed by robust drivers, persistent restraints, and significant opportunities that collectively shape its growth trajectory. The most compelling driver is the exponential growth of the Internet of Things (IoT), necessitating billions of low-cost, connected microcontrollers for ubiquitous sensing and control, particularly in industrial automation (IIoT), smart cities, and consumer appliances. Parallel to this, the automotive sector’s rapid pivot toward electrification (EVs) and autonomous driving heavily leverages high-performance, functionally safe MCUs for Battery Management Systems (BMS), centralized domain controllers, and sophisticated ADAS modules. Furthermore, the architectural shift towards 32-bit platforms, offering superior performance per watt compared to older 8-bit devices, enables the integration of complex software stacks, further accelerating their adoption across nearly all high-growth segments, thereby acting as a critical technological accelerator for market expansion.

Despite these powerful growth factors, the market faces significant restraints that dampen immediate expansion potential and increase complexity. The ongoing volatility and vulnerability within the global semiconductor supply chain—stemming from geopolitical tensions, natural disasters, and the sheer capital intensity required for foundry expansion—continues to pose risks, leading to unpredictable lead times and increased component costs for OEMs. Another major restraint is the escalating complexity of embedded software development; as MCUs integrate more peripherals, security features, and networking stacks, the required expertise and development time increase, demanding highly specialized engineering resources, which can be a bottleneck for smaller design houses. Moreover, the inherent risk of cybersecurity breaches in billions of connected edge devices necessitates increasingly complex and expensive hardware security measures, adding to the cost of goods sold and placing pressure on margins, especially in the highly price-competitive consumer segment.

However, the market is rich with strategic opportunities poised to drive long-term structural transformation. The most disruptive opportunity is the maturation and adoption of the open-source RISC-V Instruction Set Architecture (ISA), which allows companies unparalleled flexibility to customize the MCU core for specific application requirements (e.g., highly optimized vector processing for AI or enhanced security features). This freedom reduces dependency on proprietary licensing models, potentially lowering barriers to entry and fostering specialized innovation. Additional long-term opportunities arise from the global push toward Industry 4.0, requiring robust, deterministic MCUs capable of handling time-sensitive networking (TSN) for real-time control in factory environments. Furthermore, the advancement in ultra-low power technologies and energy harvesting techniques opens up massive potential for 'fit-and-forget' sensor nodes that operate perpetually without battery replacement, creating entirely new segments in environmental monitoring and infrastructure management, sustaining market evolution through profound energy efficiency gains.

Segmentation Analysis

The analysis of the MCU market is effectively executed through multiple layers of segmentation, predominantly defined by architectural complexity, end-use application, integrated connectivity features, and underlying memory technology. This structural categorization allows for a precise understanding of demand drivers and competitive dynamics within specific niches. The transition observed within the architectural segmentation—from legacy 8-bit devices used in simple appliances toward the overwhelming preference for 32-bit MCUs—is indicative of the market's trajectory towards performance and complexity. The 32-bit category, powered mainly by ARM Cortex-M cores, dominates revenue and growth, as it provides the necessary computational horsepower, addressable memory space, and peripheral richness required for advanced tasks such as running full TCP/IP stacks, implementing graphical user interfaces, and supporting modern security protocols, essential for contemporary embedded systems.

Application segmentation serves as a crucial lens for market evaluation, as the performance, reliability, and certification requirements vary dramatically across sectors. The Automotive segment demands MCUs compliant with strict functional safety standards (ISO 26262), extended temperature ranges, and guaranteed long-term supply, often justifying higher average selling prices (ASPs). Conversely, the Consumer Electronics segment prioritizes cost optimization, integration (e.g., on-chip RF), and low-power standby modes suitable for battery operation in wearables and smart home devices. The industrial sector mandates robust fault tolerance and support for deterministic communication protocols, differentiating their needs from the volume-driven consumer market. This divergence necessitates that manufacturers maintain highly tailored product lines, often involving specialized packaging and dedicated certification efforts for each high-reliability sector.

Furthermore, the connectivity segmentation highlights the rapid technological evolution transforming MCUs into foundational elements of the connected world. 'Connected MCUs,' featuring integrated wireless technologies like Wi-Fi, Bluetooth LE, and LoRaWAN, are the fastest-growing subsegment, reflecting the ubiquity of IoT deployment. This integration reduces complexity for OEMs and improves power management for the communication module. Conversely, 'Standard MCUs,' typically relying on wired interfaces (like Ethernet, CAN, or UART), retain importance in traditional industrial control and certain legacy systems where wireless communication is either prohibited due to security concerns or unnecessary. The strategic integration of RF front-ends and sophisticated antenna matching on-chip is a key competitive battleground within the connected MCU space, where manufacturers strive for optimal wireless performance and minimal external component requirements.

- By Architecture:

- 8-bit Microcontrollers (Highly cost-sensitive, basic control)

- 16-bit Microcontrollers (Mid-range control, historical applications)

- 32-bit Microcontrollers (Dominant Segment: High performance, IoT, Automotive, AI)

- By Application:

- Automotive (Body Electronics, Powertrain, ADAS, Infotainment, BMS)

- Industrial (Automation, Control Systems, Robotics, Smart Metering, HMI)

- Consumer Electronics (Smart Appliances, Wearables, Gaming, Entertainment)

- Medical Devices (Diagnostics, Monitoring Equipment, Implantables)

- Communication & Computing (Networking Equipment, Servers, Peripherals)

- By Connectivity:

- Standard MCUs (Wired Interfaces: CAN, LIN, Ethernet)

- Connected MCUs (Integrated Wireless: Wi-Fi, BLE, LoRa, NB-IoT/Cellular)

- By Memory Type:

- Flash-Based MCU (Non-volatile, field re-programmable)

- ROM-Based MCU (Mask programmed, cost-effective for extremely high volume)

- EEPROM-Based MCU (Used for data logging and configuration storage)

- By Fabrication Process:

- CMOS Technology

- Bipolar Technology

Value Chain Analysis For MCU Market

The MCU market value chain begins with highly specialized Upstream Analysis, centered on Intellectual Property (IP) development and silicon fabrication prerequisites. This initial stage involves foundational design houses, such as ARM, which license proprietary CPU cores, or contributors to open-source ISAs like RISC-V. Raw materials procurement, primarily ultra-high-purity silicon wafers and specialized chemical dopants, are sourced globally from a limited number of specialized suppliers. The subsequent fabrication process is highly capital-intensive, executed primarily by leading foundries (pure-play or integrated device manufacturers—IDMs) in cleanroom environments, utilizing advanced photolithography to create the intricate circuits. Efficiency at the upstream level dictates the power profile, gate density, and overall cost of the silicon, placing significant strategic importance on controlling or securing access to leading-edge process nodes (e.g., 40nm, 28nm, and below), which are crucial for high-performance and power-efficient 32-bit MCUs targeting complex Edge AI applications.

The Midstream phase involves the core activities of chip manufacturing, including packaging, assembly, and rigorous testing. Once the wafers are fabricated, they undergo sophisticated testing to ensure functional compliance, followed by cutting and packaging into various form factors, ranging from tiny chip-scale packages (CSPs) for wearables to robust quad flat packages (QFPs) for industrial use. Quality control is paramount, especially for automotive and medical-grade devices, which require extensive traceability and compliance with zero-defect standards. The distribution channel then takes over, facilitating the movement of finished MCUs to end-users. Direct distribution is favored for large Original Equipment Manufacturers (OEMs), particularly those in the automotive or high-volume industrial sectors, where manufacturers can offer customized inventory management, long-term supply agreements, and dedicated technical application support, forming deep, strategic partnerships based on specific roadmap requirements.

Conversely, Indirect distribution relies on global and regional specialized electronic component distributors (e.g., catalog distributors and franchised distributors) who manage complex logistics, inventory stocking, and often provide the first line of technical support and small-volume sales to small-to-midsize enterprises (SMEs), hobbyists, and technology startups focused on rapid prototyping and niche IoT solutions. This indirect network is vital for market penetration, especially across fragmented regional markets and the vast, diverse ecosystem of IoT developers, providing essential availability and accessibility. Downstream Analysis focuses on the final integration and deployment, where OEMs embed the MCU into their final products. The success of the MCU in the downstream market is increasingly determined not just by the hardware specifications, but by the comprehensiveness of the accompanying software ecosystem, including free integrated development environments (IDEs), expansive middleware libraries, real-time operating system (RTOS) support, and robust debugging tools, which significantly influence the customer's overall development cost and speed to market.

MCU Market Potential Customers

Potential customers for Microcontroller Units span the entire spectrum of electronic manufacturing, encompassing virtually every industry that requires real-time digital control, sensor interfacing, and embedded intelligence. The largest group of buyers are Original Equipment Manufacturers (OEMs) specializing in mass-produced items where cost and energy efficiency are critical, such as manufacturers of smart home devices, consumer wearables (e.g., fitness trackers, smartwatches), and basic handheld tools. These customers typically prioritize low-cost, high-volume 8-bit and 16-bit solutions for simpler tasks, though increasingly require 32-bit MCUs with integrated wireless stacks for connectivity. These buyers are intensely focused on maximizing cost-efficiency and minimizing power consumption, driving demand for high-volume, highly integrated, and often standardized 8-bit and lower-end 32-bit MCUs with integrated memory and peripherals, utilizing mass market distribution channels to secure competitive pricing and guaranteed stock availability necessary for massive production runs.

A second crucial customer segment is the Automotive and Industrial sector, characterized by highly stringent requirements regarding operational temperature range, functional safety certifications (like ASIL-D), extended lifecycle support, and resistance to harsh operating environments. Automotive Tier 1 suppliers purchase massive volumes of specialized, high-reliability MCUs for critical applications such as braking systems (ABS/ESC), engine management, and battery management systems (BMS) in electric vehicles. Similarly, industrial automation firms, including those developing PLC systems, robotics, and complex sensor networks for Industry 4.0, demand high-performance 32-bit MCUs with robust connectivity protocols (e.g., Ethernet/IP, Profinet) and guaranteed long-term availability, prioritizing reliability, longevity, and adherence to stringent industry standards above pure cost considerations.

Finally, the burgeoning segment of specialized design houses, system integrators, and smaller technology startups focusing on niche IoT applications form a critical customer base, relying heavily on distributors for access to product, technical documentation, and rapid prototyping tools. Customers in the medical technology sector also represent a high-value niche, requiring MCUs certified for use in critical care equipment (e.g., patient monitoring, infusion pumps), where reliability, security, and low power consumption are paramount. These diverse customer needs drive innovation in MCU architectures, pushing manufacturers to offer highly specialized product families tailored to specific market requirements regarding performance, security, and longevity. These buyers often require access to the newest architectural designs, sophisticated developer kits, and robust technical support for complex integration challenges, frequently procuring components through specialized distributors who provide value-added services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 Billion |

| Market Forecast in 2033 | USD 44.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NXP Semiconductors N.V., Renesas Electronics Corporation, Microchip Technology Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Infineon Technologies AG, Samsung Electronics Co., Ltd., Toshiba Corporation, Analog Devices Inc., Silicon Labs, GigaDevice Semiconductor Inc., Espressif Systems, Holtek Semiconductor, Nordic Semiconductor ASA, Ceva, Inc., MediaTek Inc., Lattice Semiconductor Corporation, ROHM Co., Ltd., Zilog, Inc., Maxim Integrated (now Analog Devices) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MCU Market Key Technology Landscape

The MCU technological landscape is defined by continuous pursuit of higher integration, superior energy efficiency, and accelerated computational capability for edge processing. The established dominance of 32-bit architecture, primarily based on the licensed ARM Cortex-M family, dictates the performance benchmark for modern embedded systems, supporting complex RTOS and multi-tasking environments. However, the most disruptive trend is the rise of open-source Instruction Set Architectures, specifically RISC-V, which offers unparalleled architectural freedom, allowing designers to precisely tailor the core and peripheral set to highly specific application needs (e.g., optimizing for proprietary security implementations or specialized AI workload offloading). This shift is accelerating innovation by lowering IP licensing barriers, particularly benefiting startups and companies seeking domain-specific specialization in high-volume, cost-sensitive IoT markets where unique design parameters offer significant competitive advantage over standardized platforms.

High levels of system integration, transitioning MCUs toward highly specialized System-on-Chips (SoCs), remains a cornerstone of current technological development. Modern MCUs frequently incorporate dedicated analog components, sophisticated power management circuits (PMICs), and highly reliable non-volatile memory technologies (like embedded Flash or advanced emerging memories like MRAM/ReRAM) onto a single silicon die. Crucially, the integration of certified wireless communication stacks—such as Thread, Matter, and various cellular IoT protocols (NB-IoT/LTE-M)—significantly reduces the external component count and simplifies RF design for OEMs, directly addressing the market demand for smaller, more power-efficient connected devices. Furthermore, the specialized integration of AI accelerators, often optimized for low-precision mathematics (INT8/INT4), is defining the cutting edge, enabling computationally intensive ML models to run locally within strict power budgets. Fabrication technology, moving toward advanced process nodes (e.g., 22nm, 16nm) especially for high-end automotive and AI-enabled MCUs, is essential for achieving the necessary density and low leakage current required to sustain complex computations in battery-powered, fan-less environments, pushing the boundaries of edge device performance.

The third major technological focus centers on hardening the MCU against operational failure and external threats. Functional safety technology, aligned with ISO 26262 for automotive applications, involves implementing hardware redundancies, self-test capabilities, and error correction codes (ECC) on memory critical to system operation, ensuring predictable performance under fault conditions. Concurrently, cybersecurity enhancements are now mandatory, including the integration of hardware root-of-trust, physical unclonable functions (PUFs) for unique device identity generation, and dedicated cryptographic engines (AES, SHA) to ensure secure boot, over-the-air (OTA) update verification, and protection of sensitive firmware and data. These combined advancements in safety, security, and AI define the roadmap for next-generation MCUs, transforming them into intelligent, resilient, and highly secure foundational platforms for the digital future, requiring substantial R&D investment in advanced packaging techniques and heterogenous computing architectures.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share both in terms of manufacturing volume and application consumption. Fueled by robust growth in consumer electronics production (smartphones, home appliances) in China and South Korea, coupled with massive investments in industrial automation and automotive assembly across Southeast Asia and India. APAC is the fastest-growing region, driven heavily by low-cost, high-volume IoT deployments and governmental support for domestic semiconductor production.

- North America: Characterized by high-value, high-performance applications, particularly in defense, aerospace, advanced medical devices, and sophisticated data center infrastructure management. Demand is focused on MCUs offering stringent security features, functional safety compliance, and cutting-edge Edge AI processing capabilities, often requiring components tailored to high-reliability, long-lifecycle military or industrial specifications.

- Europe: A mature market defined by strong demand from the automotive sector, especially Germany and France, driven by strict mandates for vehicle safety (ADAS) and the transition to electric powertrains. Europe prioritizes compliance with functional safety standards (ISO 26262) and supports robust industrial automation infrastructure (Industry 4.0), seeking MCUs with integrated Time-Sensitive Networking (TSN) capabilities for factory environments.

- Latin America (LATAM): Exhibits steady growth driven by the modernization of infrastructure, smart grid deployment, and the burgeoning local automotive industry. Market penetration is moderate, focusing primarily on cost-effective solutions for consumer and general industrial applications, with recent investments supporting local semiconductor packaging and testing facilities to enhance supply chain proximity.

- Middle East and Africa (MEA): Emerging market primarily driven by large-scale government investments in smart city projects, utility metering, and oil & gas infrastructure modernization. Demand is highly localized and often focused on robust, secure MCUs suitable for challenging environmental conditions, often procured via global system integrators managing regional smart infrastructure rollouts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MCU Market.- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Microchip Technology Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Infineon Technologies AG

- Samsung Electronics Co., Ltd.

- Toshiba Corporation

- Analog Devices Inc.

- Silicon Labs

- GigaDevice Semiconductor Inc.

- Espressif Systems

- Holtek Semiconductor

- Nordic Semiconductor ASA

- Ceva, Inc.

- Maxim Integrated (now Analog Devices)

- Cypress Semiconductor (now Infineon)

- MediaTek Inc.

- Lattice Semiconductor Corporation

- ROHM Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the MCU market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the 32-bit MCU segment?

The shift towards 32-bit MCUs is primarily driven by the increasing complexity of modern embedded applications, particularly in IoT and automotive sectors, which necessitate higher processing power, larger addressable memory, and the capability to efficiently run sophisticated operating systems, networking stacks, and data-intensive Edge AI algorithms necessary for real-time decision-making.

How is the adoption of the RISC-V architecture impacting established MCU vendors?

RISC-V is introducing significant competitive pressure by offering an open-source Instruction Set Architecture, enabling unparalleled customization and reducing IP licensing costs. This forces established vendors relying on proprietary architectures (like ARM) to innovate faster, particularly in terms of specialized hardware integration, energy efficiency, and ecosystem support, to justify their premium offerings against highly tailored RISC-V solutions.

What are the key security requirements for MCUs used in critical applications like automotive systems?

Critical automotive and industrial MCUs require robust, hardware-enforced security features, including a hardware root-of-trust, secure boot mechanisms, integrated physical unclonable functions (PUFs), and cryptographic accelerators. These features are essential to ensure code integrity, prevent unauthorized firmware updates, protect intellectual property, and comply with functional safety and cybersecurity standards such as ISO 26262.

Which geographical region holds the largest market share for MCU consumption and production?

Asia Pacific (APAC) holds the dominant market share globally, driven by its concentration of high-volume manufacturing centers for consumer electronics and its vast industrial base. The region is both the primary global production hub for MCUs and the largest consumer, fueled by rapid expansion in mass-market IoT devices, smart city development, and large-scale industrial modernization initiatives.

What role does Edge AI play in the future evolution of microcontroller technology?

Edge AI integration is defining the future of MCUs by mandating the inclusion of specialized hardware accelerators (NPUs/DSPs) optimized for machine learning inference. This enables devices to perform complex processing—such as local sensor fusion and predictive maintenance algorithms—in real-time, ultra-low power scenarios without constant cloud connectivity, thereby unlocking new capabilities for billions of intelligent, battery-powered edge nodes.

How do functional safety standards (e.g., ISO 26262) influence MCU design?

Functional safety standards heavily influence MCU design by requiring hardware-level redundancy, self-testing mechanisms, comprehensive error correction codes (ECC) on critical memory paths, and rigorous fault detection capabilities. Designing for compliance with standards like ISO 26262 (up to ASIL-D) increases the complexity and cost of the MCU but is mandatory for adoption in safety-critical automotive, aerospace, and medical applications, where failure can result in system harm or loss of life.

What is the primary technical challenge associated with developing ultra-low power MCUs?

The primary technical challenge is minimizing leakage current (static power consumption) while maintaining sufficient computational capability for burst processing. This requires sophisticated power management integrated circuits (PMICs) on-chip, optimized clock gating, and the use of specialized low-power fabrication process nodes (FD-SOI) to ensure the device can spend maximum time in deep sleep modes while retaining the necessary memory state and peripheral readiness for instantaneous wake-up and computation.

In the industrial segment, why is Time-Sensitive Networking (TSN) important for MCUs?

Time-Sensitive Networking (TSN) is crucial because it guarantees deterministic, low-latency communication over standard Ethernet networks, which is non-negotiable for real-time industrial control systems, robotics, and synchronized factory automation under Industry 4.0. MCUs supporting TSN integrate specialized Ethernet PHYs and sophisticated media access control (MAC) layers to ensure strict adherence to precise timing requirements necessary for safety and productivity.

How does the shift to electric vehicles (EVs) specifically affect MCU demand?

The EV shift dramatically increases the demand for high-performance, high-reliability MCUs, particularly for Battery Management Systems (BMS), high-voltage DC/DC converters, and centralized vehicle control units. These applications require MCUs with high levels of integration, robust thermal performance, and compliance with the highest functional safety standards to manage complex power delivery and ensure passenger safety and battery longevity.

What is the distinction between a microcontroller (MCU) and a microprocessor (MPU)?

An MCU is a highly integrated, single-chip system containing the CPU, memory, and peripherals, designed for specific, deterministic control tasks, prioritizing low power and low cost. An MPU is typically a higher-performance CPU core requiring external memory and peripherals, designed for general-purpose computing, high throughput, and running complex operating systems, usually at the expense of higher power consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager