Metal Working Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433281 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Metal Working Market Size

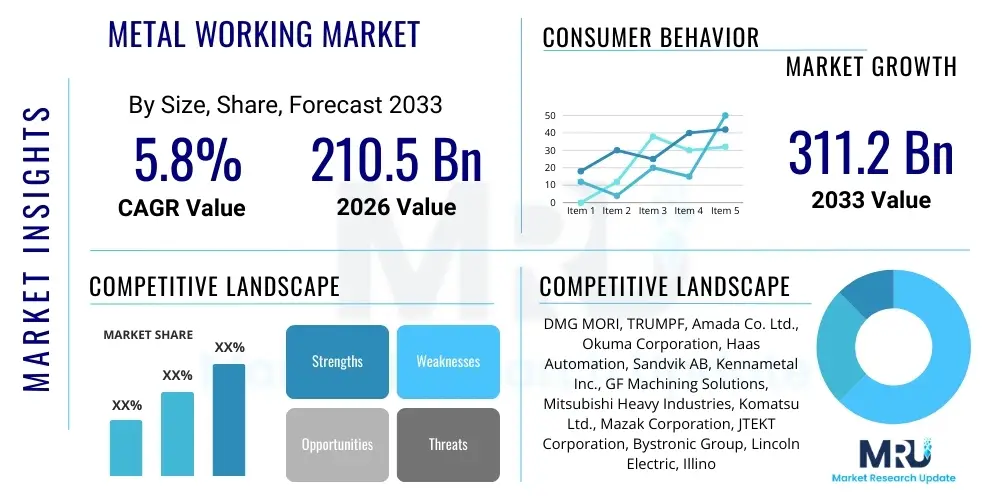

The Metal Working Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 210.5 Billion in 2026 and is projected to reach USD 311.2 Billion by the end of the forecast period in 2033.

Metal Working Market introduction

The Metal Working Market encompasses a vast array of industrial processes dedicated to the shaping, fabricating, and assembly of metal components, critical for almost every major manufacturing sector globally. These processes include material removal (cutting, drilling, milling), deformation (forming, bending, stamping), and consolidation (joining, welding, brazing). The fundamental product description involves transforming raw metal materials, such as sheets, billets, or castings, into finished parts that meet strict geometric tolerances and performance specifications. Major applications span high-precision components for aerospace engines, structural elements for infrastructure and construction, chassis components for the automotive industry, and specialized tooling for energy production facilities. The market is defined by continuous innovation in machinery and automation to improve efficiency and material utilization.

The core benefits derived from advanced metal working include enhanced material strength, superior surface finish, improved product longevity, and precise dimensional accuracy, which are non-negotiable requirements in mission-critical applications. Technological advancements, particularly in Computer Numerical Control (CNC) machinery and additive manufacturing techniques, are expanding the capabilities of the sector, allowing for the creation of complex geometries previously unattainable. This evolution ensures that metal working remains the backbone of modern industrial production, supplying crucial components across the entire supply chain from consumer goods to heavy industrial equipment.

Key driving factors accelerating market expansion include the rapid industrialization in developing economies, leading to increased demand for infrastructure and machinery, and the sustained growth of the electric vehicle (EV) sector, which requires specialized lightweight metal alloys and fabrication techniques. Furthermore, the robust global aerospace and defense spending necessitates constant high-precision metal component manufacturing, fueling investment in advanced machinery and automation solutions. The shift toward Industry 4.0 paradigms, emphasizing smart factories and integrated production systems, provides a strong impetus for the adoption of sophisticated metal working technologies.

Metal Working Market Executive Summary

The Metal Working Market demonstrates robust expansion driven by significant shifts in global business trends, including the accelerated adoption of smart manufacturing protocols and the imperative for supply chain resilience following recent geopolitical and logistical disruptions. Business trends indicate a strong move towards vertical integration among key players and substantial investment in automation technologies, particularly multi-axis machining centers and robotic welding systems, to mitigate rising labor costs and ensure consistent quality. Companies are prioritizing sustainable manufacturing practices, leading to increased demand for dry machining and minimum quantity lubrication (MQL) techniques, alongside high-efficiency machinery designed for reduced energy consumption. This focus on efficiency and sustainability is shaping procurement decisions across all major end-use sectors, including automotive and heavy machinery.

Regionally, the market dynamics are characterized by intense growth in the Asia Pacific (APAC) region, primarily led by massive industrial bases in China, India, and Southeast Asian nations which are rapidly expanding their domestic manufacturing capacity across automotive and electronics sectors. North America and Europe maintain dominance in high-value, precision-intensive segments such as aerospace and medical device manufacturing, acting as early adopters of advanced technologies like hybrid machining and specialized tool coatings. Regulatory environments focused on emission standards and safety mandates in developed regions further drive demand for sophisticated, lightweight metal components, sustaining steady growth despite mature industrial landscapes. Latin America and the Middle East and Africa (MEA) are emerging as crucial markets due to significant infrastructure development and expanding oil and gas industry requirements, creating niche opportunities for specialized heavy-duty fabrication.

Segment trends reveal a significant surge in the Forming segment, driven by the need for high-volume, cost-effective component creation, particularly stamping operations in the automotive sector for complex body parts. Concurrently, the Cutting segment, including high-speed milling and laser cutting, continues to witness innovation spurred by the demand for processing difficult-to-machine superalloys used in aerospace and energy applications. The end-use segment shows the automotive industry as the largest consumer, transitioning towards lightweighting materials (aluminum and high-strength steels) to improve fuel efficiency and battery range in EVs. Furthermore, the increasing complexity of modern manufacturing necessitates highly specialized tooling and consumables, bolstering growth in the ancillary services and tooling segments, emphasizing precision and durability.

AI Impact Analysis on Metal Working Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Metal Working Market center around optimization of production parameters, the role of machine learning in predictive maintenance (PdM) for Computer Numerical Control (CNC) machines, and the automation of intricate quality control (QC) tasks. Users often question how AI can manage tool wear prediction precisely, minimize scrap rates, and dynamically adjust cutting speeds and feed rates in real-time to optimize material removal rates without compromising surface integrity. There is also strong interest in using AI algorithms to analyze large datasets generated by shop floor sensors (the Industrial Internet of Things or IIoT) to identify operational bottlenecks and enhance overall equipment effectiveness (OEE). The key themes emerging from user analysis are the need for actionable intelligence to reduce downtime, the desire for higher manufacturing autonomy, and skepticism regarding the initial investment cost versus the guaranteed return on investment (ROI) in retrofitting older machines.

The incorporation of AI facilitates a paradigm shift from reactive to proactive manufacturing environments, fundamentally transforming how metal working operations are planned and executed. AI algorithms are increasingly employed in process simulation and optimization, enabling manufacturers to model complex machining operations digitally before execution, thereby significantly reducing physical prototyping and setup times. For instance, in additive manufacturing, AI optimizes powder bed fusion parameters to eliminate defects, ensuring metallurgical soundness. This capability directly addresses the crucial user concern regarding reducing high-cost waste associated with premium materials like titanium and specialized alloys. Furthermore, AI-driven scheduling software utilizes real-time capacity and order input to create highly efficient, dynamic production schedules that adapt instantaneously to unexpected machine failures or material shortages, bolstering supply chain responsiveness.

Beyond optimization, AI is revolutionizing human-machine interaction and safety on the shop floor. Collaborative robots (cobots) integrated with AI vision systems are now capable of performing precision tasks like grinding, polishing, and quality inspection with minimal human supervision, ensuring consistent results often exceeding human capabilities, particularly in repetitive or hazardous environments. This technological integration not only enhances throughput and product quality but also enables specialized workers to focus on higher-level strategic tasks, such as process innovation and complex problem-solving. As data infrastructure matures within manufacturing facilities, the predictive power of AI models will become the central determinant of competitive advantage, enabling personalized and optimized processes for highly diverse product mixes, moving the industry closer to genuine mass customization.

- AI-driven Predictive Maintenance (PdM) reduces unplanned machine downtime by monitoring acoustic, vibration, and thermal signatures of CNC equipment.

- Real-time process optimization adjusts machining parameters (feed, speed, depth of cut) using reinforcement learning to maximize throughput and tool life.

- AI vision systems automate quality control and defect detection, rapidly inspecting complex surface finishes and geometric tolerances with superior accuracy.

- Generative Design algorithms, informed by AI, optimize part geometry for reduced material usage and enhanced structural performance (lightweighting).

- Automated scheduling and workload balancing across a fleet of machines improves overall shop floor efficiency and reduces order lead times.

- Enhanced cybersecurity measures are being integrated using AI models to detect and neutralize threats targeting highly automated manufacturing systems.

DRO & Impact Forces Of Metal Working Market

The Metal Working Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the fundamental Impact Forces guiding its trajectory. The primary Drivers revolve around technological advancements, specifically the widespread adoption of multi-axis CNC machines and the integration of automation, which enhance production precision and speed. The burgeoning global demand from the automotive sector, driven by the transition to electric vehicles requiring precise battery casings and lightweight body structures, acts as a major market accelerator. Additionally, stringent quality standards in industries like aerospace and medical devices mandate investment in high-end metal working solutions, perpetually pushing the envelope of technological capability and process control. These drivers collectively ensure a continuous influx of capital expenditure into modernizing production capabilities worldwide, sustaining market momentum.

Conversely, significant Restraints present barriers to unfettered growth, most notably the high initial capital expenditure required for acquiring advanced CNC machinery and implementing integrated smart factory solutions. Small and medium-sized enterprises (SMEs) often find this investment prohibitive, leading to a productivity gap. Furthermore, a persistent shortage of skilled labor capable of programming, operating, and maintaining highly sophisticated metal working equipment, combined with the increasing complexity of materials (superalloys, composites), limits operational scale and efficiency. Regulatory compliance costs related to environmental protection and worker safety, particularly in advanced economies, also impose financial burdens, sometimes leading manufacturers to seek lower-cost manufacturing hubs abroad.

Despite these challenges, substantial Opportunities exist, particularly the proliferation of Additive Manufacturing (AM) technologies, often referred to as 3D printing, which is complementing traditional subtractive processes by allowing for design freedom and rapid prototyping, especially in tooling and specialized low-volume parts. The shift towards sustainable manufacturing, incorporating techniques such as resource-efficient machining and recycling programs, offers significant potential for market differentiation and compliance advantages. The expansion of industrial activity in emerging markets, coupled with government initiatives promoting domestic manufacturing capability, presents untapped potential for equipment suppliers and service providers. The combined Impact Forces underscore a market structure where innovation, efficiency, and skilled talent acquisition are critical determinants of competitive success, requiring continuous strategic investment.

Segmentation Analysis

The Metal Working Market is comprehensively segmented based on the fundamental process type employed, the end-use industry utilizing the fabricated components, and the geographical region governing demand and supply dynamics. This segmentation provides a granular view of market activity, revealing specific growth pockets and technological preferences. The Process Type segmentation categorizes the market into distinct methodologies—Cutting, Forming, Joining, and Surface Treatment—reflecting the core mechanical and chemical operations involved in transforming metal. The End-Use Industry segment dissects consumption patterns across vital sectors such as automotive, aerospace & defense, construction, electronics, and energy, each characterized by unique material requirements and tolerance standards, dictating the necessary machinery and consumable usage.

The dominance of the Cutting segment, including milling, turning, and grinding, highlights the perpetual need for high-precision material removal, essential for manufacturing complex engine parts, molds, and surgical instruments. However, the Forming segment, encompassing stamping, forging, and bending, is rapidly expanding due to the cost-efficiency of high-volume production for standardized parts, particularly in mass-market applications like automotive body panels and consumer appliances. Segmentation by material often reveals the technological intensity of the market, with dedicated solutions required for ferrous metals (steel, cast iron) versus non-ferrous alloys (aluminum, titanium, nickel-based superalloys), influencing tool material choices and machine rigidity requirements. Understanding these interdependencies is crucial for market participants looking to tailor their product offerings effectively.

Geographical segmentation reveals that manufacturing maturity directly correlates with technology adoption. Developed regions emphasize sophisticated automation and customized tooling, whereas developing regions prioritize capacity expansion and the adoption of foundational machinery. The nuanced requirements of each end-use sector—for example, the zero-defect mandate in aerospace versus the high-throughput requirements in general machinery—ensure specialized tooling and consumable markets remain highly fragmented yet profitable. Overall, the segmentation matrix allows stakeholders to precisely identify areas for strategic market entry, product specialization, and competitive positioning within the diverse landscape of global metal fabrication.

- Process Type:

- Cutting (Milling, Turning, Drilling, Grinding, Sawing, CNC Machining)

- Forming (Stamping, Forging, Extrusion, Casting, Bending, Shearing)

- Joining (Welding, Brazing, Soldering, Fastening, Adhesive Bonding)

- Surface Treatment and Finishing (Plating, Coating, Polishing, Heat Treatment)

- End-Use Industry:

- Automotive (Including EV Manufacturing)

- Aerospace & Defense

- Construction & Infrastructure

- General Manufacturing & Heavy Machinery

- Energy (Oil & Gas, Power Generation)

- Electronics & Electrical Equipment

- Medical Devices & Instrumentation

- Material Type:

- Ferrous Metals (Steel, Cast Iron)

- Non-Ferrous Metals (Aluminum, Copper, Titanium, Nickel Alloys)

- Regional Outlook:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Metal Working Market

The Value Chain for the Metal Working Market begins with upstream activities focused on raw material sourcing and primary production. This upstream segment is dominated by major mining companies and primary metal producers (steel mills, aluminum smelters) that process ores into standardized shapes like sheets, bars, and ingots. Quality and purity of the raw materials are critical, directly influencing the efficiency and final product integrity in subsequent metal working steps. Suppliers of advanced machinery, including vendors of CNC machines, lasers, and welding equipment, also form a crucial upstream component, providing the technological infrastructure necessary for processing the materials. Innovation in machine tool design and component reliability are key competitive factors in this stage, heavily impacting the operational costs of manufacturers downstream.

The midstream segment involves the core metal working processes executed by fabricators and job shops. These businesses utilize the machinery and raw materials to perform cutting, forming, and joining operations, transforming primary shapes into semi-finished or finished components. Distribution channels play a critical role here, ranging from highly specialized direct sales models for large, custom machinery to indirect sales through distributors and technical representatives for standard tooling and consumables (e.g., cutting fluids, abrasives, electrodes). The effectiveness of the supply chain logistics, ensuring timely delivery of tooling and spare parts, is paramount for minimizing production bottlenecks and maximizing uptime on the factory floor. Digital platforms are increasingly used to streamline procurement and inventory management across this complex network.

Downstream activities center on delivering the finished metal components to the end-user industries, such as automotive OEMs, aerospace contractors, and construction firms. Direct distribution is common for highly customized or high-volume orders requiring specific logistical handling or immediate technical support, ensuring seamless integration into the customer's assembly line. Indirect distribution channels often involve specialized industrial distributors or third-party logistics (3PL) providers for standard components and maintenance, repair, and overhaul (MRO) supplies. The value chain concludes with post-sales services, including maintenance contracts for machinery, technical application support for complex processes, and recycling or scrap management services, ensuring the entire lifecycle of the metal product and associated manufacturing equipment is supported and optimized for longevity and sustainability.

Metal Working Market Potential Customers

The Metal Working Market serves a broad spectrum of industries, with potential customers defined primarily by their intense reliance on precisely fabricated metal components for their core operations. The most significant segment of end-users are original equipment manufacturers (OEMs) within the Automotive Industry, which consistently requires massive volumes of accurately stamped, cast, and machined parts for powertrain, chassis, and body construction. The rapid transition towards electric vehicles (EVs) is creating a new class of specialized customers focused on lightweighting solutions, demanding high-precision machining of aluminum alloys for battery enclosures and structural components. These buyers prioritize volume capacity, strict quality certifications, and cost-effective production methods to meet tight mass-market schedules and performance requirements.

Another high-value customer base resides in the Aerospace and Defense sector, which demands extremely stringent quality control, traceability, and the use of exotic materials such as titanium, inconel, and nickel superalloys. These buyers, including aircraft manufacturers and military contractors, are characterized by low-volume, high-mix production orders, often requiring specialized, multi-axis machining capabilities and complex inspection procedures (NDT). Their purchasing decisions are driven by reliability, compliance with regulatory bodies (FAA, EASA), and established reputation, making long-term strategic partnerships crucial. The energy sector, covering oil and gas infrastructure, renewable energy systems (wind turbines), and power generation, also represents a significant customer base requiring large, heavy-duty fabricated structures and corrosion-resistant machined parts for continuous operation in harsh environments.

The vast network of job shops and contract manufacturers forms an indirect yet vital customer segment. These entities act as crucial intermediaries, outsourcing complex metal working tasks for various small and large OEMs across consumer electronics, medical device manufacturing, and general industrial machinery. Medical device manufacturers represent a highly lucrative, albeit smaller volume, customer group, needing ultra-high precision, micro-machining capabilities for intricate surgical tools and implants using biocompatible materials. For all potential customers, the ultimate buying criteria increasingly hinge on the metal working supplier’s ability to integrate digitally, offering seamless data exchange (e.g., design files, real-time tracking) and demonstrating capabilities in sustainable and resource-efficient manufacturing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 210.5 Billion |

| Market Forecast in 2033 | USD 311.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DMG MORI, TRUMPF, Amada Co. Ltd., Okuma Corporation, Haas Automation, Sandvik AB, Kennametal Inc., GF Machining Solutions, Mitsubishi Heavy Industries, Komatsu Ltd., Mazak Corporation, JTEKT Corporation, Bystronic Group, Lincoln Electric, Illinois Tool Works (ITW), Flow International Corporation, Hypertherm, Schuler Group, Atlas Copco, 3M Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Working Market Key Technology Landscape

The technological landscape of the Metal Working Market is characterized by a rapid evolution toward intelligent, interconnected, and highly automated systems, central to the Industry 4.0 framework. Key technologies include advanced Computer Numerical Control (CNC) machining centers, particularly 5-axis and 9-axis systems, which enable complex, high-precision geometries to be manufactured in a single setup, minimizing handling errors and setup times. High-speed machining (HSM) techniques, coupled with specialized tool coatings (e.g., ceramic, diamond-like carbon), are essential for processing high-performance materials like titanium and nickel-based superalloys efficiently while maximizing tool life. Furthermore, sophisticated software solutions, including Computer-Aided Manufacturing (CAM) and Digital Twin technology, are becoming standard, optimizing tool paths and simulating the entire machining process before actual production begins, significantly reducing waste and production iterations.

In the forming and joining segments, the technological focus lies on improving structural integrity and reducing cycle times. Advanced forming processes such as hydroforming and incremental sheet forming are utilized to create complex, lightweight structures, crucial for modern vehicle designs. Welding technologies have seen major advancements with the increased adoption of robotic welding cells, which incorporate sophisticated sensors and vision systems to ensure precise and repeatable weld beads, particularly in laser and friction stir welding applications. Fiber laser technology has revolutionized cutting and joining operations, offering unmatched speed, energy efficiency, and quality for thin to medium-thickness materials, largely replacing traditional CO2 laser systems in many applications. These integrated systems require robust data acquisition capabilities to monitor performance and maintain certifications.

Looking forward, the integration of Additive Manufacturing (AM), or 3D printing, is perhaps the most transformative technological shift. While not a direct replacement for traditional metal working, metal AM (including powder bed fusion and directed energy deposition) serves as a complementary technology, particularly for rapid prototyping, complex tooling, and low-volume production of highly customized parts. Hybrid machines, combining both additive and subtractive capabilities in one platform, are emerging, offering manufacturers the flexibility to repair, build, and finish complex parts simultaneously. This technological convergence, supported by the Industrial Internet of Things (IIoT) sensors providing shop-floor data in real-time, is fundamentally driving efficiency, pushing the boundaries of material performance, and enabling lights-out manufacturing operations across the globe, defining the modern, competitive metal working facility.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, propelled by heavy investment in manufacturing capacity in China, India, and Southeast Asia. The region benefits from massive consumer electronics, automotive, and general machinery production bases. Governments in countries like China and South Korea actively support the modernization of metal working sectors through initiatives promoting automation and domestic technology development, sustaining high demand for CNC machine tools and forming equipment, often sourced both regionally and internationally.

- North America: North America maintains a strong position in high-precision, high-value segments, primarily aerospace, medical devices, and specialized defense manufacturing. Demand is characterized by the need for advanced 5-axis machining, automated quality assurance systems, and specialized tooling for superalloys. The push for reshoring manufacturing capabilities and significant capital expenditure in the EV supply chain are key drivers, demanding state-of-the-art automation and digital integration capabilities to maintain a competitive edge against global rivals.

- Europe: Europe is a highly mature market, distinguished by technological leadership in machine tool innovation and strict adherence to environmental and worker safety standards. Germany, Italy, and Switzerland are pivotal centers for manufacturing sophisticated machinery and high-end automotive components. The market focuses heavily on process efficiency, sustainable manufacturing practices (MQL, dry machining), and the robust adoption of Industry 4.0 technologies, utilizing sophisticated software for process optimization and integrated supply chain management.

- Latin America: This region demonstrates moderate growth, primarily tied to the automotive assembly sector in Brazil and Mexico, and significant infrastructure and mining activities. The market often seeks cost-effective, durable machinery, with gradual adoption of automation compared to developed regions. Demand fluctuations are often influenced by local economic stability and government policies regarding foreign investment in the industrial sector.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in large-scale infrastructure projects, expansion of the oil and gas sector (requiring heavy-duty fabrication and corrosion-resistant components), and increasing defense spending. The region relies heavily on imported high-tech machinery and specialized services, focusing on establishing localized maintenance and service centers to support major industrial ventures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Working Market.- DMG MORI

- TRUMPF

- Amada Co. Ltd.

- Okuma Corporation

- Haas Automation

- Sandvik AB

- Kennametal Inc.

- GF Machining Solutions

- Mitsubishi Heavy Industries

- Komatsu Ltd.

- Mazak Corporation

- JTEKT Corporation

- Bystronic Group

- Lincoln Electric

- Illinois Tool Works (ITW)

- Flow International Corporation

- Hypertherm

- Schuler Group

- Atlas Copco

- 3M Manufacturing

- Sodick Co., Ltd.

- Makino Inc.

- EMAG Group

- FANUC Corporation

Frequently Asked Questions

Analyze common user questions about the Metal Working market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the global Metal Working Market?

The global Metal Working Market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, reaching an estimated value of USD 311.2 Billion by the end of the forecast period, driven largely by automation and electric vehicle manufacturing requirements.

Which technology is most significantly impacting efficiency in high-precision metal fabrication?

Advanced 5-axis Computer Numerical Control (CNC) machining centers and integrated fiber laser cutting technologies are most significantly impacting efficiency, enabling rapid production of complex geometries with superior accuracy and minimal material waste, crucial for aerospace and medical applications.

How does the shift to electric vehicles (EVs) affect metal working demand?

The EV transition is fueling demand for specialized metal working processes focused on lightweighting, particularly the high-precision machining and forming of aluminum and high-strength steel alloys necessary for structural battery enclosures and lightweight body frames to maximize vehicle range and performance.

What are the primary restraints challenging market growth in developed economies?

Key restraints include the extremely high initial capital investment required for adopting state-of-the-art smart factory and CNC technology, coupled with a persistent and critical shortage of skilled labor proficient in operating and maintaining these increasingly complex and digitally integrated manufacturing systems.

Which segment holds the largest share of the Metal Working Market by process type?

The Cutting segment, encompassing milling, turning, and grinding, currently holds the largest market share due to its foundational necessity in virtually all manufacturing activities requiring material removal to achieve final dimensional tolerances and specialized component fabrication across all major end-use industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Metal Working Equipment Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chlorinated Paraffin Market Size Report By Type (CP-42, CP-52, CP-70), By Application (PVC, Metal Working Oil, Paint, Polymeric Material, Sealant, Mastics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Metal Working Fluids Market Size Report By Type (Metal Removal Fluids, Metal Treating Fluids, Metal Forming Fluids, Metal Protecting Fluids), By Application (Automotive Industry, General Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hexanoic Acid Market Statistics 2025 Analysis By Application (Flavoring and Perfuming Agent, Metal Working Fluid, Daily Chemicals), By Type (0.98, 0.99), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Isononanoic Acid Market Statistics 2025 Analysis By Application (Coating and paint, Cosmetics and personal care, Metal working fluids, Lubricant, Plasticizer), By Type (Below 95%min, Above 95%min), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager