Neodymium Iron Boron Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438378 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Neodymium Iron Boron Market Size

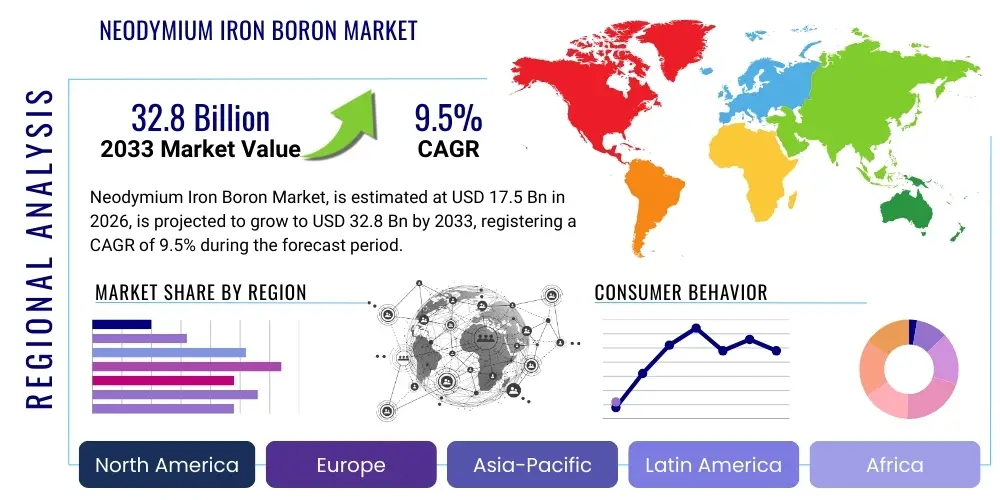

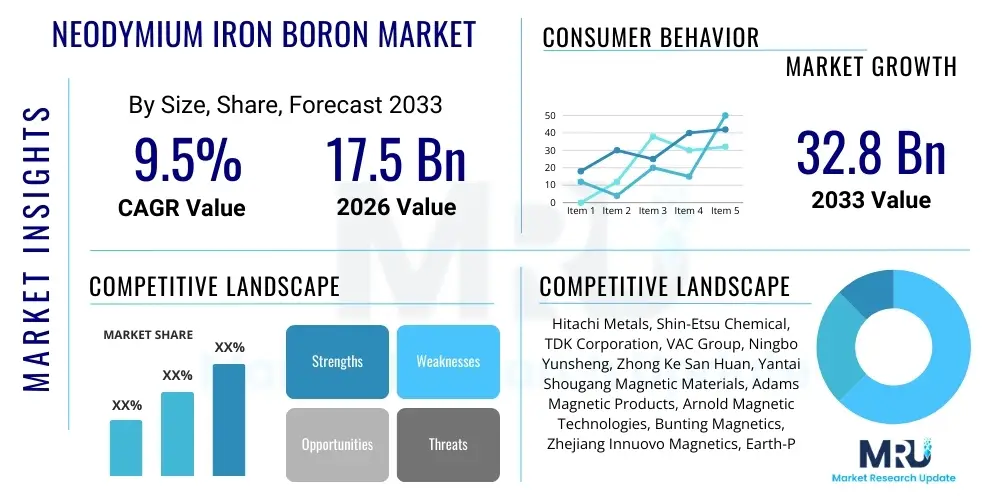

The Neodymium Iron Boron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 32.8 Billion by the end of the forecast period in 2033.

Neodymium Iron Boron Market introduction

The Neodymium Iron Boron (NdFeB) Market encompasses the production, distribution, and consumption of one of the most powerful types of permanent magnets available globally. These magnets, composed primarily of neodymium, iron, and boron, exhibit exceptional magnetic strength, high coercivity, and maximum energy product, making them indispensable components across numerous high-technology sectors. Their superior magnetic performance, often categorized by high remanence and inherent resistance to demagnetization, allows for the design of smaller, lighter, and more efficient electronic and mechanical systems compared to traditional ferrite or Alnico magnets. The foundational application of NdFeB magnets lies in devices requiring strong magnetic fields in confined spaces, fundamentally driving efficiency improvements in energy conversion technologies and precision movement systems.

Major applications for NdFeB magnets span the automotive industry, particularly in electric and hybrid vehicles (EVs/HEVs), where they are vital for traction motors and various sensors; the renewable energy sector, integral to the generators of modern large-scale wind turbines; and the consumer electronics market, powering devices such as hard disk drives, smartphones, and high-fidelity audio equipment. Furthermore, industrial automation utilizes these magnets extensively in servomotors, robotics, and precise motion control systems, capitalizing on their reliability and power density. The core benefit derived from NdFeB magnets is their unmatched ability to facilitate miniaturization while simultaneously increasing the operational efficiency and power output of end-user devices, contributing significantly to global energy transition goals and technological advancement.

The market growth is intrinsically linked to macro-economic trends such as the global push toward electrification, the accelerating adoption of electric mobility solutions, and the increasing investment in renewable energy infrastructure, specifically offshore and onshore wind power generation. Driving factors also include rapid technological advancements in magnet manufacturing processes, such as grain boundary diffusion (GBD) techniques, which enhance thermal stability and reduce the reliance on scarce heavy rare earth elements like dysprosium (Dy) and terbium (Tb). These innovations not only stabilize supply chains but also expand the applicability of NdFeB magnets into high-temperature environments previously dominated by other materials, thereby solidifying their market dominance in high-performance permanent magnet applications.

Neodymium Iron Boron Market Executive Summary

The Neodymium Iron Boron (NdFeB) market is experiencing robust expansion driven primarily by global decarbonization initiatives and the ensuing boom in Electric Vehicle (EV) production and renewable energy capacity installation. Business trends indicate a strategic shift among major magnet manufacturers toward optimizing supply chain resilience, particularly concerning the sourcing and processing of rare earth elements, often involving vertical integration or long-term procurement agreements to mitigate price volatility and geopolitical risks associated with raw material supply. Furthermore, there is a pronounced investment trend in developing advanced manufacturing techniques, such such as hot pressing and powder metallurgy improvements, aimed at creating high-grade magnets with superior temperature tolerance and reduced reliance on critical heavy rare earths, thereby addressing key performance and sustainability challenges faced by high-demand sectors like automotive and wind power.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, maintains undisputed dominance in both the production and consumption of NdFeB magnets, owing to its established rare earth processing capabilities and the massive domestic demand from its thriving electronics and burgeoning EV industries. Europe and North America are focusing heavily on establishing regional rare earth processing and magnet manufacturing facilities to enhance supply chain security and reduce dependence on Asian sources, fostering niche growth in specialized, high-specification magnet segments utilized in defense and high-precision industrial applications. Latin America and the Middle East and Africa (MEA) are emerging as growth markets, primarily driven by investments in localized renewable energy projects and nascent electrification programs, though they currently remain net importers of finished NdFeB products.

Segment trends highlight the sintered NdFeB segment as the primary revenue generator due to its superior magnetic properties essential for high-power applications like EV motors and wind generators, despite the bonded NdFeB segment showing rapid growth in miniaturized electronics and small motor applications due to its complex shape molding capabilities. Application-wise, the Automotive segment, specifically the electric propulsion system components, is projected to register the highest Compound Annual Growth Rate (CAGR), reflecting the irreversible global transition from internal combustion engines. Simultaneously, the Wind Energy segment continues its significant uptake, especially with the trend toward larger, multi-megawatt offshore turbines requiring vast quantities of high-energy-density NdFeB magnets, cementing the magnet's critical role in the global energy transition.

AI Impact Analysis on Neodymium Iron Boron Market

User inquiries regarding AI's impact on the NdFeB market frequently center on three critical areas: optimization of the rare earth supply chain, enhancement of magnet manufacturing efficiency, and development of new material formulations. Users are concerned about how AI and machine learning (ML) algorithms can predict and mitigate the volatile pricing and supply risks inherent in rare earth sourcing, and how these technologies can accelerate the discovery of magnet alloys with better thermal stability and less reliance on heavy rare earths. Furthermore, questions address the practical application of AI in streamlining complex manufacturing steps, such as sintering temperature control, powder mixing uniformity, and quality assurance processes, to reduce defects and minimize energy consumption during production, ultimately driving down the cost of high-performance magnets.

- AI algorithms optimize rare earth mining and extraction processes by analyzing geological data and predicting optimal resource yields, thereby improving efficiency and reducing waste.

- Machine learning is utilized in predictive maintenance of NdFeB manufacturing equipment, minimizing downtime and ensuring consistent, high-quality output during sintering and bonding.

- Generative AI models accelerate R&D by simulating millions of potential material compositions, identifying novel, lower-cost, or higher-performance NdFeB substitutes or optimizing existing formulations to reduce Dy/Tb content.

- Advanced analytics enhance supply chain resilience by providing real-time forecasting of rare earth element prices and demand fluctuations, enabling proactive inventory and procurement management.

- AI-powered visual inspection systems increase quality control accuracy in magnet finishing and testing, rapidly identifying micro-defects invisible to traditional methods.

- Optimization software driven by AI manages complex production scheduling in magnet factories, ensuring maximum throughput and energy efficiency, particularly in highly customized order environments.

- AI supports the development of advanced recycling technologies for end-of-life NdFeB magnets by optimizing sorting and separation processes, thereby creating a circular economy pathway.

DRO & Impact Forces Of Neodymium Iron Boron Market

The dynamics of the Neodymium Iron Boron market are shaped by a complex interplay of robust drivers rooted in global electrification, significant restraints primarily stemming from resource scarcity and geopolitical tensions, and compelling opportunities driven by technological advancement and sustainability mandates. The primary driving force is the global surge in demand for high-efficiency electric motors and generators, fueled by ambitious targets for electric vehicle adoption and massive investments in renewable energy infrastructure, particularly wind power. Simultaneously, the market is constrained by the inherent dependence on rare earth elements, whose supply chain is geographically concentrated, leading to substantial price volatility and geopolitical risk. These forces dictate strategic investment decisions, pushing manufacturers towards securing stable supply lines and developing substitution technologies, thereby profoundly impacting market growth trajectory and competitive dynamics.

The impact forces influencing the NdFeB market are highly concentrated on external regulatory environments and internal material innovation. Regulatory mandates globally encouraging energy efficiency and penalizing carbon emissions act as potent accelerants for NdFeB adoption in applications like high-efficiency industrial motors and HVAC systems. Conversely, the high cost of specialized processing equipment and the energy-intensive nature of sintering remain significant internal barriers to entry for new market participants. Opportunities emerge prominently through continuous R&D focused on heavy rare earth reduction techniques, such such as grain boundary diffusion methods, which not only mitigate supply risk but also enhance the thermal stability of the magnets, expanding their use in high-operating-temperature automotive applications.

Furthermore, the market benefits immensely from the growing push toward miniaturization in consumer electronics and robotics, where NdFeB’s unparalleled power density is critical for shrinking device size without compromising performance. However, manufacturers must constantly navigate the intellectual property landscape, as key patents surrounding the formulation and manufacturing processes remain tightly held by established market leaders. The overarching impact force is the necessity for supply chain diversification and circular economy practices; the successful development of economically viable rare earth magnet recycling infrastructure represents a major opportunity to stabilize the long-term cost structure and reduce environmental impacts associated with raw material extraction.

- Drivers: Accelerated global transition to Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs).

- Drivers: Robust global installation rate of high-power wind turbines requiring high magnetic energy products.

- Drivers: Increasing demand for miniaturized, high-efficiency motors in robotics, industrial automation, and consumer electronics.

- Restraints: Volatility and geographic concentration of the rare earth element supply chain (Neodymium, Dysprosium).

- Restraints: High capital expenditure and operational costs associated with advanced sintering and processing technologies.

- Restraints: Susceptibility to corrosion and demagnetization at high temperatures without adequate protective coatings or heavy rare earth additives.

- Opportunities: Technological advancements (e.g., Grain Boundary Diffusion) reducing reliance on expensive and volatile heavy rare earths (Dysprosium, Terbium).

- Opportunities: Development and scaling of economically viable recycling technologies for end-of-life NdFeB magnets (e.g., Hydrogen Processing of Magnet Scrap - HPMS).

- Opportunities: Expansion into high-growth, specialized fields such as high-temperature aerospace components and advanced medical imaging devices.

- Impact Forces (Positive): Stringent government regulations promoting energy efficiency standards across industrial and consumer sectors.

- Impact Forces (Negative): Geopolitical tensions and trade barriers affecting the cross-border movement of rare earth raw materials and processed magnet components.

Segmentation Analysis

The Neodymium Iron Boron market is primarily segmented based on product type, application, and geography, reflecting the varied technological requirements and end-use demands across different industries. Segmentation by type differentiates between Sintered NdFeB and Bonded NdFeB magnets. Sintered magnets, which represent the majority of the market value, offer superior magnetic properties and are crucial for high-power applications requiring maximum energy density, such as EV traction motors and wind turbine generators. Bonded magnets, conversely, are formed by mixing NdFeB powder with a polymer binder, allowing for complex shaping and better dimensional precision, making them ideal for small, intricate components in consumer electronics and sensors, where magnetic strength requirements are less stringent than in heavy machinery.

Analyzing the market by application reveals a clear hierarchy of demand, with the Automotive sector, particularly the electric vehicle sub-segment, emerging as the largest and fastest-growing consumer due to the critical need for lightweight, high-performance motors. Following closely are the Industrial Automation and Consumer Electronics sectors, which rely on NdFeB magnets for efficient motors, actuators, and sensors. The Wind Energy segment, while generating massive per-unit demand, is characterized by large, long-term projects, contributing significantly to volume, particularly in regions investing heavily in offshore capacity. Understanding these application segments is vital for manufacturers planning production capacity and tailoring magnet grades, as performance specifications regarding coercivity, temperature tolerance, and corrosion resistance vary significantly between, for instance, a smartphone speaker and an EV motor.

Geographically, market segmentation underscores the critical role of the Asia Pacific region, which dictates global supply and manufacturing trends. The ongoing industrial policies in North America and Europe, aiming for self-sufficiency in critical materials, are carving out distinct, specialized market spaces focused on high-quality, traceable, and sustainably sourced magnets for high-security and high-reliability applications. This geographical segmentation analysis helps stakeholders identify bottlenecks in the supply chain, understand regulatory divergence, and strategically position production facilities closer to high-growth consumption centers, balancing cost-efficiency with supply chain resilience and security mandates.

- By Product Type:

- Sintered Neodymium Iron Boron Magnets

- Bonded Neodymium Iron Boron Magnets

- By Application:

- Automotive (EV/HEV Motors, Sensors, Steering Systems)

- Wind Energy (Direct Drive and Geared Generators)

- Consumer Electronics (HDD, Speakers, Headphones, Smartphones)

- Industrial Automation (Servo Motors, Robotics, Actuators)

- Medical Devices (MRI Systems, Drug Delivery Systems)

- Others (Aerospace & Defense, HVAC, Appliances)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, Rest of MEA)

Value Chain Analysis For Neodymium Iron Boron Market

The Neodymium Iron Boron value chain is highly complex, beginning with the upstream analysis involving the mining and separation of rare earth ores, primarily light rare earth elements (LREEs) such as Neodymium (Nd) and Praseodymium (Pr), and, crucially, the heavy rare earth elements (HREEs) like Dysprosium (Dy) and Terbium (Tb), which are added to enhance coercivity and thermal stability. This upstream segment is characterized by high geopolitical concentration and environmental concerns related to extraction and chemical separation processes, making it the highest risk area of the chain. Following extraction, rare earth oxides are converted into metals and then alloyed with iron and boron to create the precursor alloys necessary for magnet manufacturing. Control over this alloy production phase is a key strategic advantage, as the purity and homogeneity of the alloy directly determine the final magnetic performance and consistency of the finished product.

The midstream section constitutes the core magnet manufacturing process, predominantly involving powder metallurgy for sintered magnets, which includes milling, pressing, sintering (heating under vacuum), and subsequent machining, surface treatment (coating for corrosion resistance), and magnetization. The distribution channel analysis highlights a dual structure: direct and indirect sales. Direct distribution is common for high-volume, strategic buyers (such as large automotive OEMs or wind turbine manufacturers) who require custom specifications, rigorous quality assurance, and long-term contracts. This allows manufacturers to maintain tight control over product performance and intellectual property. Indirect distribution involves specialized distributors and magnet suppliers catering to smaller volume users, prototype development, and standardized applications across diversified industrial sectors, providing flexibility and inventory management services.

The downstream analysis focuses on the integration of NdFeB magnets into final products by End-User/Buyers. This stage includes complex motor assembly, sensor integration, and system testing across applications such as Electric Vehicle traction systems, precision robotics, and specialized medical imaging equipment. The value generated downstream is substantial, as the superior efficiency provided by NdFeB magnets translates directly into enhanced product performance, energy savings, and competitive advantages for the OEM. The robustness of the entire value chain is critical; disruptions at the upstream rare earth supply level can severely impact the downstream production schedules and technological progress of high-growth sectors globally.

Neodymium Iron Boron Market Potential Customers

Potential customers for Neodymium Iron Boron magnets are broadly categorized as Original Equipment Manufacturers (OEMs) operating within sectors demanding high-efficiency and high-power-density components. The dominant consumer base resides in the electric mobility sector, encompassing major automotive manufacturers and tier-one suppliers specializing in Electric Vehicle (EV) drive systems, including traction motors, battery management sensors, and auxiliary motors (e.g., electronic power steering and braking systems). These buyers prioritize magnet grade consistency, thermal stability (especially N, M, H, SH, UH, EH grades), and long-term supply agreements to support high-volume vehicle production targets, making supplier qualification extremely rigorous and demanding adherence to stringent automotive quality standards (e.g., IATF 16949).

Another significant customer segment includes large-scale industrial and energy infrastructure companies, particularly developers and manufacturers of wind turbine generators (both direct-drive and geared systems), where NdFeB magnets are essential for maximizing power output and reliability in harsh operating environments. Furthermore, key players in the industrial automation and robotics sector constitute high-value customers, requiring specialized magnets for precision servo motors and actuators necessary for high-speed, accurate manufacturing processes. The demand here is often for highly complex shapes and precise magnetic tolerance, enabling miniaturization and increased speed in robotic joints and assembly line equipment.

Finally, the consumer electronics industry, including manufacturers of hard disk drives (HDD), professional audio equipment, and high-end smartphones, remains a constant, high-volume consumer, particularly for bonded NdFeB magnets and smaller sintered variants used in voice coil motors and high-fidelity speakers. In the medical field, major potential customers are manufacturers of advanced medical imaging equipment, such as Magnetic Resonance Imaging (MRI) systems, where powerful, stable magnetic fields are non-negotiable for diagnostic accuracy. These diverse end-user segments collectively drive market specifications, demanding continuous innovation in coating technologies, magnetic performance, and material sustainability/traceability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 32.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Shin-Etsu Chemical, TDK Corporation, VAC Group, Ningbo Yunsheng, Zhong Ke San Huan, Yantai Shougang Magnetic Materials, Adams Magnetic Products, Arnold Magnetic Technologies, Bunting Magnetics, Zhejiang Innuovo Magnetics, Earth-Panda Advanced Magnetic Materials, Beijing Zhong Ke San Huan Hi-Tech, Chengdu Galaxy Magnets, Daido Steel, Electron Energy Corporation, Lynas Rare Earths, Showa Denko, Mitsubishi Steel, Jiangsu Tianhe Magnetic Material. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neodymium Iron Boron Market Key Technology Landscape

The Neodymium Iron Boron market's technology landscape is highly dynamic, driven by the imperative to maximize energy product (BHmax) while simultaneously minimizing the use of expensive and high-risk heavy rare earth elements (HREEs) like Dysprosium (Dy) and Terbium (Tb), which are crucial for achieving high coercivity and thermal stability. The central technology innovation driving current market performance is the Grain Boundary Diffusion (GBD) process, sometimes referred to as 'Dysprosium-free' or 'low-Dy' technology. GBD involves diffusing HREE-rich alloys into the grain boundaries of the pre-sintered magnet block. This method concentrates the HREEs precisely where they are needed to inhibit demagnetization, achieving required coercivity with up to 50% less HREE usage compared to traditional alloying methods. This innovation significantly lowers material cost, reduces supply chain risk, and broadens the operational temperature range for NdFeB magnets, making them more suitable for demanding EV and industrial applications.

Beyond GBD, advancements in powder metallurgy and sintering techniques are continually optimizing material microstructure. Hot deformation/hot pressing technology is gaining traction, particularly in the production of high-performance bonded magnets, allowing for highly anisotropic magnetic properties in bonded structures—a significant step up from traditional isotropic bonded magnets. Furthermore, the development of advanced protective coatings is crucial. NdFeB magnets are highly susceptible to corrosion, which diminishes their magnetic performance. Zinc, Nickel-Copper-Nickel (Ni-Cu-Ni), and specialized epoxy coatings are standard, but recent innovations focus on anti-corrosion barrier layers applied through Physical Vapor Deposition (PVD) or specialized proprietary multi-layer systems, ensuring long-term reliability in humid or high-temperature environments typical of maritime wind turbines or automotive under-hood components.

Another area of intense technological focus is the establishment of viable recycling pathways. Given the strategic importance and finite nature of rare earth elements, technologies like Hydrogen Processing of Magnet Scrap (HPMS) are being refined. HPMS allows for the selective absorption of hydrogen by the NdFeB material, causing it to disintegrate into fine powder which can then be directly reused or reprocessed, offering a more sustainable and economically sound method for reclaiming materials from end-of-life products such as computer hard drives and EV motors. These technologies collectively underscore a shift toward both high performance and circular economy principles within the NdFeB manufacturing ecosystem, ensuring that future growth is supported by diversified and responsible material sourcing.

Regional Highlights

The regional dynamics of the Neodymium Iron Boron market are heavily stratified, dictated by disparities in rare earth resources, manufacturing capacity, and demand concentration across major consuming sectors. The Asia Pacific (APAC) region is the undisputed global hub, controlling the overwhelming majority of the value chain, from rare earth mining and separation to final magnet fabrication. China, specifically, dominates global supply, benefiting from vast domestic rare earth resources and mature processing infrastructure, catering to both domestic demand—driven by the world's largest EV market and massive electronics manufacturing base—and international export requirements. Japan and South Korea also hold significant market relevance, focusing on high-specification, high-quality magnets for their advanced automotive and consumer electronics industries, maintaining technological leadership in certain complex magnet manufacturing processes like hot pressing.

Europe and North America represent high-growth consumption markets, characterized by ambitious electrification targets and substantial investment in large-scale renewable energy projects. While these regions possess significant downstream demand (Automotive, Aerospace, Defense), they are currently net importers of finished NdFeB magnets. Strategic focus in these regions is increasingly placed on building resilient, local supply chains through initiatives that fund domestic rare earth refining and magnet manufacturing. This includes developing alternative, non-Chinese supply routes for raw materials and emphasizing advanced magnet grades suitable for harsh environments (e.g., wind turbine generators in the North Sea or specialized military applications), aiming to reduce supply chain fragility and comply with national security requirements.

Latin America and the Middle East and Africa (MEA) currently account for a smaller share but exhibit high potential growth rates, particularly linked to infrastructure development and localized green energy initiatives. In the MEA region, investments in smart grid technology and utility-scale solar and wind projects are beginning to drive demand for NdFeB magnets in specialized generators and industrial motors. Growth in Latin America is tied to nascent but expanding EV adoption and industrial modernization projects. However, market penetration in these regions often relies on international suppliers and distributors, highlighting opportunities for market entry and localized assembly operations focused on regional specific needs.

- Asia Pacific (APAC): Dominates global production and consumption; driven by China's control over rare earth supply and its massive EV manufacturing sector; strong focus on R&D for cost-efficient, high-performance magnets.

- North America: Significant downstream demand, particularly in high-reliability automotive and defense sectors; strategic emphasis on securing localized, traceable supply chains (e.g., US initiatives to fund domestic rare earth processing).

- Europe: High demand from major European automotive OEMs transitioning to EV platforms and expansive offshore wind energy installations; prioritizing R&D into heavy rare earth substitution technologies to meet sustainability goals.

- Japan: A key technological leader in magnet innovation, focusing on high-coercivity, high-temperature grades for premium automotive and industrial applications.

- India: Emerging market with increasing industrial automation and governmental push for electric mobility (FAME II scheme), driving future domestic consumption growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neodymium Iron Boron Market.- Hitachi Metals, Ltd.

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- VAC Group (Vacuumschmelze GmbH & Co. KG)

- Ningbo Yunsheng Co., Ltd.

- Zhong Ke San Huan High-Tech Co., Ltd.

- Yantai Shougang Magnetic Materials Inc.

- Adams Magnetic Products Co.

- Arnold Magnetic Technologies Corporation

- Bunting Magnetics Co.

- Zhejiang Innuovo Magnetics Co., Ltd.

- Earth-Panda Advanced Magnetic Materials Co., Ltd.

- Beijing Zhong Ke San Huan Hi-Tech Co., Ltd.

- Chengdu Galaxy Magnets Co., Ltd.

- Daido Steel Co., Ltd.

- Electron Energy Corporation

- Lynas Rare Earths Ltd. (Upstream Supplier)

- Showa Denko Materials Co., Ltd.

- Mitsubishi Steel Mfg. Co., Ltd.

- Jiangsu Tianhe Magnetic Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Neodymium Iron Boron market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary applications drive the current demand for Neodymium Iron Boron magnets?

The primary demand drivers are Electric Vehicle (EV) traction motors and high-power generators used in large-scale wind turbines, both requiring the high energy product and power density characteristic of sintered NdFeB magnets for optimal efficiency and miniaturization.

How is the NdFeB market addressing the volatility of rare earth element supply?

The market addresses supply volatility through technological innovation, primarily the Grain Boundary Diffusion (GBD) technique, which significantly reduces the necessary content of high-cost heavy rare earths like Dysprosium, and through strategic investment in geographically diversified rare earth processing and recycling infrastructure.

What is the key difference between Sintered and Bonded Neodymium Iron Boron magnets?

Sintered NdFeB magnets are stronger, offering the highest magnetic performance suitable for large motors and generators, while Bonded NdFeB magnets are weaker but allow for complex, net-shape molding, making them preferred for intricate sensors and small electronic components.

Which geographical region holds the most significant influence over the global NdFeB supply chain?

The Asia Pacific region, particularly China, holds the most significant influence, as it controls the majority of global rare earth mining, refining, and specialized NdFeB magnet manufacturing capacity, dictating pricing and supply conditions worldwide.

What are the main technological restraints hindering broader application of NdFeB magnets?

The main restraints include the inherent susceptibility of NdFeB magnets to corrosion and demagnetization at high operating temperatures, necessitating expensive protective coatings and the addition of heavy rare earth elements to maintain performance stability in severe environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager