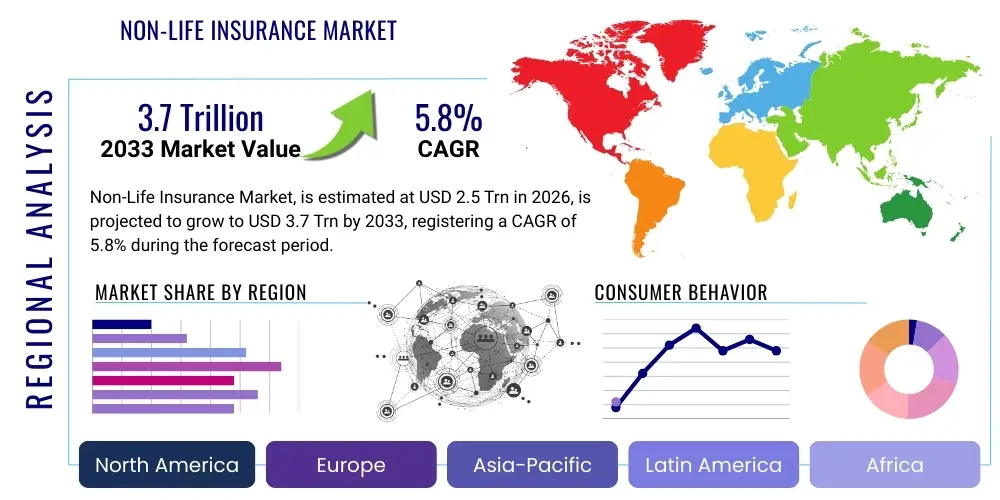

Non-Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439023 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Non-Life Insurance Market Size

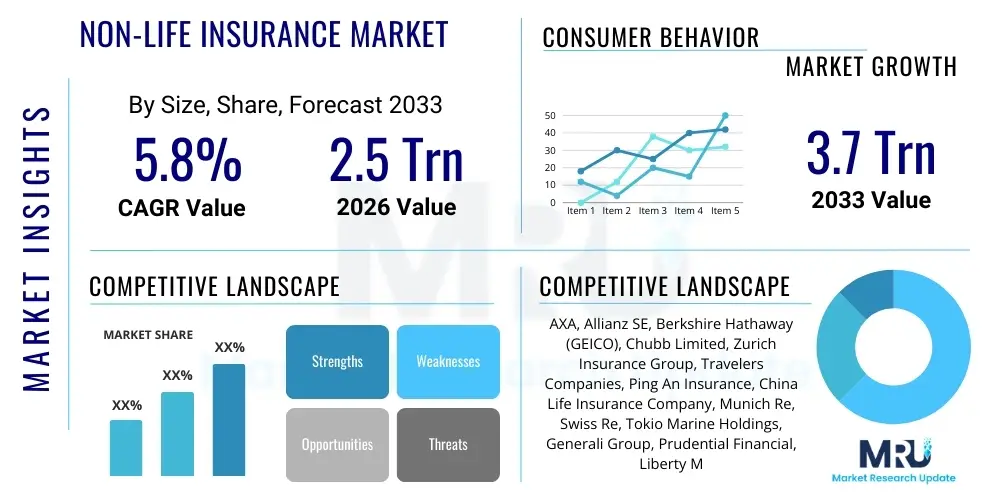

The Non-Life Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Trillion in 2026 and is projected to reach USD 3.7 Trillion by the end of the forecast period in 2033.

Non-Life Insurance Market introduction

The Non-Life Insurance Market, often referred to as Property and Casualty (P&C) insurance, encompasses a wide range of products designed to protect individuals and businesses against financial losses arising from specific risks other than life and health events. Key product categories include motor insurance, property insurance, liability insurance, marine insurance, and professional indemnity. The core function of non-life insurance is risk transfer and pooling, ensuring that policyholders are compensated following unforeseen events such as natural disasters, accidents, or theft. This market segment is crucial for economic stability, providing a safety net that facilitates investment and business continuity by mitigating catastrophic financial exposures.

Major applications of non-life insurance span across nearly every sector of the economy. Personal lines primarily focus on protecting individual assets, such as homeowners insurance, renters insurance, and comprehensive vehicle coverage. Commercial lines, conversely, address the complex risk profiles of businesses, offering products like commercial property coverage, general liability, workers' compensation, and specialized coverages such as cyber risk insurance. The increasing sophistication of global supply chains and the rising frequency of climate--related events are driving a higher demand for tailored, comprehensive non-life insurance solutions that extend beyond standard offerings.

The primary benefits driving market expansion include stringent regulatory requirements mandating certain types of coverage (e.g., motor insurance and professional liability), increasing global wealth resulting in higher asset protection needs, and enhanced consumer awareness regarding financial risk management. Furthermore, technological advancements, particularly in telematics and remote sensing, are enabling insurers to offer more accurate risk pricing and personalized policies, thereby improving profitability and consumer engagement. Geopolitical stability and robust economic growth in emerging economies are also significant driving factors, fostering greater insurance penetration in previously underserved regions, further solidifying the market's trajectory.

Non-Life Insurance Market Executive Summary

The Non-Life Insurance Market is characterized by robust business trends centered on digitalization, data analytics adoption, and consolidation. Insurers are heavily investing in straight-through processing (STP) and automation to reduce operational costs and enhance claims processing efficiency, directly impacting profit margins. Furthermore, the convergence of insurance and technology (InsurTech) is introducing new competitive dynamics, challenging traditional business models by offering innovative distribution channels and hyper-personalized risk assessment tools. Resilience planning, particularly concerning climate change risks, has become a core strategic pillar, necessitating sophisticated catastrophe modeling capabilities and portfolio rebalancing away from highly exposed geographies.

Regionally, the market exhibits high disparity in maturity and growth rates. North America and Europe maintain dominance, characterized by highly regulated, mature markets focusing on specialized, high-value commercial lines and advanced digital infrastructure. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid urbanization, expanding middle-class populations, and government initiatives promoting compulsory insurance schemes. Latin America and the Middle East & Africa (MEA) are also emerging as crucial growth frontiers, driven by infrastructure projects, increased foreign direct investment, and a lower current penetration rate, indicating significant untapped potential for standard P&C products.

Segment trends highlight a strong shift toward usage-based insurance (UBI) in the motor sector, facilitated by IoT and telematics, moving away from traditional demographic-based pricing. The property segment is grappling with escalating reinsurance costs due to climate volatility, pushing insurers to emphasize risk mitigation services alongside standard policies. Cyber insurance is the fastest-growing segment in commercial lines, reflecting the pervasive threat of digital breaches and the increasing regulatory requirements for data protection. Specialty insurance lines, covering risks like political violence, space launches, and environmental liability, are experiencing high demand due to increasing global complexity and interconnected risk exposure.

AI Impact Analysis on Non-Life Insurance Market

Common user questions regarding AI's impact on the Non-Life Insurance Market frequently revolve around job displacement, data privacy implications, accuracy of automated underwriting, and the potential for bias in AI-driven claims decisions. Users are primarily concerned about how AI will fundamentally change the role of agents and adjusters, whether machine learning models can accurately assess complex, novel risks (like advanced cyber threats), and how the integration of deep learning tools will affect the transparency and fairness of pricing structures. Key expectations include personalized premium calculations, instantaneous claim adjudication, and proactive risk warning systems that prevent losses rather than just compensating them after the fact.

The analysis indicates that AI is not merely an efficiency tool but a transformative force reshaping the entire non-life insurance value chain. AI algorithms, particularly natural language processing (NLP) and computer vision, are revolutionizing customer interactions via chatbots and analyzing property damage images in real-time, drastically reducing response times. Predictive analytics, powered by machine learning, is moving risk assessment from reactive to predictive, allowing insurers to anticipate policy cancellations, detect fraudulent activities more accurately, and model complex catastrophic events with higher precision than traditional actuarial methods. This shift fundamentally alters the competitive landscape, rewarding firms that can effectively leverage unstructured data.

However, the implementation of AI introduces significant governance challenges. The industry must navigate regulatory scrutiny concerning algorithmic transparency and bias mitigation, ensuring that AI models do not unintentionally discriminate based on protected characteristics. The sheer volume of data required to train effective AI models necessitates robust cybersecurity measures and strict adherence to global data protection frameworks like GDPR. Ultimately, AI adoption is transitioning the role of human professionals from transactional processors to strategic analysts and relationship managers, focusing expertise on complex cases and high-touch customer service interactions where emotional intelligence remains irreplaceable.

- Automated Underwriting and Risk Scoring: AI utilizes diverse data sources (e.g., satellite imagery, telematics) for instant, granular risk assessment.

- Enhanced Fraud Detection: Machine learning models analyze claims patterns and metadata in real-time to flag suspicious activities, reducing indemnity leakage.

- Streamlined Claims Processing: NLP and Computer Vision accelerate First Notice of Loss (FNOL) and damage assessment, enabling rapid claim settlement.

- Personalized Product Development: AI identifies micro-segments and behavioral patterns, facilitating the creation of hyper-customized policies, such as Usage-Based Insurance (UBI).

- Operational Efficiency: Robotics Process Automation (RPA) and intelligent automation handle repetitive tasks, lowering administrative costs dramatically.

- Chatbots and Virtual Assistants: AI-driven customer service tools provide 24/7 support for policy inquiries and basic transaction processing.

DRO & Impact Forces Of Non-Life Insurance Market

The Non-Life Insurance Market is propelled by several strong economic and regulatory drivers, while simultaneously being constrained by mounting catastrophic risk exposures and slow technological integration in legacy systems. The overarching opportunity lies in leveraging emerging technologies like IoT and blockchain to create new products and optimize operational workflows. These forces collectively shape the market's evolution, demanding high adaptability from carriers to maintain profitability in an increasingly volatile environment. The inherent characteristics of the insurance business model—namely the long tail of liabilities and the reliance on investment returns—further amplify the impact of macroeconomic and geopolitical instability on pricing and capital requirements.

Key drivers include the global increase in private and corporate asset valuation, stringent governmental mandates for liability and property insurance, and the expansion of insurable exposures linked to digitalization (e.g., cyber risk). Conversely, the primary restraints center on climate change, which increases the frequency and severity of large-scale catastrophic losses, making reliable pricing difficult and escalating reinsurance costs. Furthermore, consumer trust issues stemming from complex policy language and slow claims settlements, coupled with intense regulatory oversight requiring large compliance investments, act as significant inhibitors to rapid market expansion. The shortage of specialized talent, particularly in data science and risk modeling, also limits the pace of technological transformation within many traditional carriers.

Significant opportunities exist in underserved middle-market commercial segments, the burgeoning micro-insurance sector in developing economies, and the integration of loss prevention services (risk mitigation consulting) alongside standard policies, transforming the insurer relationship from payer to partner. InsurTech partnerships offer a pathway for incumbents to rapidly adopt cutting-edge technologies without massive internal R&D expenditures. The impact forces are driving carriers towards greater financial resilience, necessitating enhanced capital reserves and more sophisticated reinsurance strategies. Furthermore, the competitive impact force from non-traditional players, such as large technology firms entering the distribution space, compels incumbents to prioritize digital transformation and customer experience excellence to retain market share.

Segmentation Analysis

The Non-Life Insurance market is segmented primarily by Type of Insurance, End-User, Distribution Channel, and Geographic Region, providing a detailed view of consumer behavior and growth pockets across the global landscape. Segmentation by Type reveals the dominance of motor insurance, although commercial property and specialty lines are exhibiting faster growth due to industrialization and complex risk accumulation. Analyzing the market through the End-User lens highlights the distinction between Personal Lines (driven by individual wealth and compulsory insurance) and Commercial Lines (driven by industrial activity and regulatory compliance).

The evolution of distribution channels is critical to market strategy, with direct-to-consumer digital channels gaining significant traction, challenging the traditional dominance of agents and brokers. This shift is particularly pronounced in standardized, high-frequency products like motor and simple travel insurance, where price comparison and speed of issuance are paramount. However, complex commercial risks still heavily rely on the expertise and advisory capacity provided by independent brokers and specialized wholesale intermediaries, reflecting the requirement for deep industry knowledge in structuring complex risk transfer agreements.

Strategic growth depends heavily on mastering segmentation nuances, particularly the rise of parametric insurance products within the specialty segment. Parametric solutions, which pay out based on defined triggers (e.g., specific wind speed or earthquake magnitude) rather than actual loss assessment, are being rapidly adopted in agriculture, catastrophe coverage, and emerging markets, providing speed and transparency. This adaptability across different product categories and delivery mechanisms underscores the market's maturity and its response to evolving societal and economic risks.

- By Type of Insurance:

- Motor Vehicle Insurance

- Property Insurance (Residential and Commercial)

- Liability Insurance (General, Professional, Directors & Officers)

- Marine, Aviation, and Transit (MAT) Insurance

- Health (Non-Life Component) & Accident Insurance

- Specialty Insurance (Cyber, Political Risk, Environmental Liability)

- By End-User:

- Individuals/Households (Personal Lines)

- Commercial Entities (SMEs and Large Enterprises)

- By Distribution Channel:

- Agencies and Brokers (Independent and Captive)

- Bancassurance

- Direct Sales (Online/Digital Platforms and Company Websites)

- Other Channels (Aggregators, Affinity Groups)

Value Chain Analysis For Non-Life Insurance Market

The Non-Life Insurance value chain begins with upstream activities focused heavily on product design, actuarial modeling, and reinsurance placement. Actuarial science forms the bedrock, utilizing historical data and advanced analytics to define risk appetite and calculate appropriate premiums. Upstream suppliers are predominantly data providers, software vendors specializing in core system management (policy administration and billing), and catastrophe modeling firms. Reinsurers act as essential upstream partners, absorbing large or systemic risks that individual carriers cannot retain, thereby stabilizing the market and determining the capital efficiency of primary insurers.

Midstream activities encompass policy issuance, distribution, sales, and ongoing customer management. Distribution is complex, involving agents (captive or independent), brokers, and direct digital channels. Efficiency at this stage is increasingly reliant on seamless integration of Customer Relationship Management (CRM) systems and automated underwriting platforms to minimize acquisition costs. Downstream activities are dominated by the claims management process, which includes claims reporting (First Notice of Loss), investigation, adjustment, and settlement. This stage is critical for customer satisfaction and profitability, as inefficient claims handling can lead to significant leakage and reputational damage.

Distribution channels are broadly categorized into direct and indirect methods. Direct channels involve the insurer selling policies directly to the policyholder, typically via company websites, mobile applications, or call centers, allowing for greater control over pricing and customer data. Indirect distribution, leveraging agents and brokers, remains crucial, particularly for complex commercial risks requiring personalized consultation and risk engineering. The increasing sophistication of digital aggregators is blurring the lines between these traditional methods, as these platforms efficiently connect consumers with multiple carrier offerings, effectively commoditizing standardized products and driving price competition across the market.

Non-Life Insurance Market Potential Customers

The potential customer base for the Non-Life Insurance Market is exceptionally broad, spanning nearly every entity that owns assets, faces legal liabilities, or requires protection against specific perils. For Personal Lines, the primary buyers are households and individual consumers requiring protection for their homes, vehicles, personal possessions, and financial well-being against unforeseen accidents. Key purchasing behaviors are influenced by mandatory insurance requirements (e.g., vehicle registration), disposable income levels, homeownership rates, and life stage changes such as purchasing a first home or acquiring new valuable assets, demanding frequent policy adjustments.

In the Commercial Lines segment, the customer base is segmented by size (SMEs vs. Large Enterprises) and industry vertical. Small and Medium-sized Enterprises (SMEs) often seek bundled products covering general liability, commercial property, and business interruption, driven primarily by cost efficiency and ease of management. Large multinational corporations, conversely, require highly customized, complex specialty coverages, including political risk insurance, directors and officers (D&O) liability, and sophisticated global cyber policies, driven by regulatory compliance and complex international operational footprints. Industries such as construction, energy, healthcare, and technology represent high-value buyers due to their specialized and high-risk operational profiles.

A rapidly growing segment of potential customers includes specialized entities seeking coverage for non-traditional or emerging risks. This includes technology companies requiring intellectual property (IP) insurance, climate-vulnerable communities demanding parametric catastrophe coverage, and financial institutions necessitating credit and surety guarantees. The increasing interconnectedness of global commerce means that potential buyers are no longer confined to specific geographic regions; rather, they require policies that provide seamless coverage across multiple jurisdictions, making carriers with extensive international networks highly attractive to large corporate buyers and global financial intermediaries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Trillion |

| Market Forecast in 2033 | USD 3.7 Trillion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA, Allianz SE, Berkshire Hathaway (GEICO), Chubb Limited, Zurich Insurance Group, Travelers Companies, Ping An Insurance, China Life Insurance Company, Munich Re, Swiss Re, Tokio Marine Holdings, Generali Group, Prudential Financial, Liberty Mutual Insurance, State Farm, Allstate Corporation, AIG, MetLife, Nippon Life Insurance, Hannover Re. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Life Insurance Market Key Technology Landscape

The technological landscape of the Non-Life Insurance Market is undergoing rapid modernization, primarily driven by the need to manage massive data volumes, enhance customer experience, and reduce exposure to catastrophic losses. Central to this transformation is the adoption of Cloud Computing, which provides scalable infrastructure for handling peak demand periods (such as immediately following a catastrophic event) and facilitates the rapid deployment of new analytical tools. Core system modernization, moving away from legacy mainframe systems to modular, API-driven platforms, is essential for enabling seamless integration with InsurTech solutions and external data sources, thereby speeding up product time-to-market.

Advanced data analytics and Artificial Intelligence (AI) are perhaps the most influential technologies. Machine learning algorithms are now routinely employed in advanced risk modeling, detecting subtle patterns indicative of fraud, and optimizing pricing in real-time based on granular behavioral data collected via Internet of Things (IoT) devices. Telematics, specifically, is foundational for usage-based insurance (UBI) in the motor segment, collecting data on driving behavior to personalize premiums. In property insurance, satellite imagery and drone technology are providing rapid, post-disaster assessments and facilitating pre-loss risk mitigation analysis, drastically improving claims response efficiency and reducing field investigation costs.

Furthermore, Distributed Ledger Technology (DLT), specifically blockchain, is being piloted to streamline complex processes such as reinsurance contract management and subrogation claims, offering an immutable and transparent ledger for multi-party transactions. This reduces administrative friction and enhances trust among carriers, reinsurers, and intermediaries. The convergence of these technologies—AI, IoT, and Cloud infrastructure—is creating a highly efficient ecosystem that supports hyper-personalization, immediate service delivery, and fundamentally shifts the industry focus from indemnity payout to proactive risk prevention and mitigation.

Regional Highlights

- North America (U.S. and Canada): Characterized by a mature, highly competitive market with strong penetration in both personal and commercial lines. Dominance is maintained by robust commercial P&C segments, heavy investment in cyber insurance solutions, and the early adoption of AI for claims automation and catastrophe modeling. The U.S. remains the largest single market globally, with regulatory complexity driving demand for sophisticated risk management services.

- Europe (Germany, U.K., France): A fragmented market dominated by regional giants and specialized carriers. Growth is driven by mandatory insurance requirements (e.g., liability and workers' compensation) and stringent regulatory frameworks like GDPR, necessitating investment in robust compliance solutions. The U.K. is a hub for specialty lines, including marine and aviation, and has seen rapid adoption of direct digital sales channels.

- Asia Pacific (APAC) (China, India, Japan, Australia): The fastest-growing regional market, fueled by urbanization, infrastructure development, and increasing disposable incomes, which translates into higher demand for motor and property coverage. China and India represent immense untapped potential due to low historical penetration rates. Growth strategies here are focused on mobile-first distribution and partnerships with local telecommunication firms to reach mass market segments.

- Latin America (Brazil, Mexico): Exhibits moderate growth, highly influenced by macroeconomic stability and inflation levels. Key growth drivers include rising motor vehicle ownership and government efforts to enforce stronger infrastructure and liability insurance mandates. The market is increasingly adopting micro-insurance models to serve lower-income populations effectively.

- Middle East and Africa (MEA): A region with highly varied penetration levels. The GCC countries (Middle East) are characterized by significant infrastructure projects and high-value energy risks, driving demand for specialty commercial insurance and reinsurance. Growth in Africa is concentrated in South Africa and emerging markets like Nigeria and Kenya, focusing on standard motor and agricultural insurance, often utilizing mobile technology for policy administration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Life Insurance Market.- AXA

- Allianz SE

- Berkshire Hathaway (GEICO)

- Chubb Limited

- Zurich Insurance Group

- The Travelers Companies Inc.

- Ping An Insurance (Group) Company of China, Ltd.

- China Life Insurance Company Limited

- Munich Re

- Swiss Re

- Tokio Marine Holdings, Inc.

- Generali Group

- Liberty Mutual Insurance

- State Farm

- Allstate Corporation

- AIG (American International Group)

- Nippon Life Insurance Company (Non-Life Subsidiaries)

- Hannover Re

- Sompo Holdings, Inc.

- Progressive Corporation

Frequently Asked Questions

Analyze common user questions about the Non-Life Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Non-Life Insurance Market?

Market growth is primarily driven by stricter regulatory mandates requiring insurance for property and liability, increasing global urbanization leading to higher asset values requiring protection, and the rapid expansion of emerging risks such as cyber threats and climate change volatility, which necessitate complex risk transfer solutions.

How is digital transformation impacting the profitability of P&C insurers?

Digital transformation significantly enhances profitability by reducing operating expenses through automation (RPA and AI), improving risk selection via advanced analytics and telematics, and lowering loss ratios through superior fraud detection. Digital channels also reduce customer acquisition costs compared to traditional agency models.

Which segment holds the highest growth potential in the Non-Life Insurance Market?

The Cyber Insurance and Specialty Lines segment currently exhibits the highest growth potential, driven by the escalating frequency and cost of data breaches, increasing corporate reliance on digital infrastructure, and regulatory requirements demanding robust risk mitigation and liability coverage for technology-related failures globally.

What role does the Internet of Things (IoT) play in contemporary Non-Life Insurance products?

IoT devices, including telematics in vehicles and smart sensors in homes and commercial properties, enable the collection of real-time behavioral and environmental data. This data is critical for Usage-Based Insurance (UBI) pricing, proactive risk assessment, loss prevention services, and expediting accurate claim verification.

What are the main risks associated with underwriting property insurance today?

The main underwriting risks are centered on climate change-related perils, including the increased frequency and severity of wildfires, floods, and hurricanes. This volatility leads to difficulties in accurate catastrophe modeling, necessitates higher capital reserves, and results in escalating premium rates and reinsurance costs in high-risk zones.

The Non-Life Insurance Market continues its transformation trajectory, shifting from a focus purely on indemnification toward a holistic model centered on risk management and prevention. This evolution is structurally supported by major technological shifts, including the deployment of sophisticated AI systems across underwriting and claims functions. The market size expansion, projected at a robust 5.8% CAGR, is sustainable, anchored by increasing global awareness of financial risk management and regulatory requirements mandating coverage across various economic activities. Regional dynamics clearly illustrate that while mature markets focus on specialty innovation and efficiency gains, emerging markets in APAC and Latin America drive volume growth through basic coverage expansion. Future market leaders will be defined by their ability to seamlessly integrate InsurTech capabilities, manage climate-related underwriting volatility, and execute personalized customer engagement strategies across digital distribution channels. The sustained convergence of insurance, technology, and advanced data science is rapidly redefining competitive advantages, necessitating continuous portfolio reevaluation and strategic capital allocation toward high-growth, high-tech segments.

Within the operational framework, the efficiency gains realized through automation, particularly in policy administration and routine claims handling, are crucial for maintaining solvency margins amidst increasing loss severity. Companies that effectively leverage predictive modeling not only enhance profitability by selecting superior risks but also improve customer lifetime value by offering proactive mitigation advice. The reliance on the global reinsurance market remains paramount, especially as primary carriers grapple with aggregating exposures from non-traditional perils, notably cyber and political instability risks. This interdependence reinforces the need for transparent data sharing and standardized risk transfer mechanisms, underscoring the potential utility of blockchain in complex B2B transactions. Overall, the market remains fundamentally strong, adapting resiliently to global economic shifts and utilizing technological innovation as a central pillar for long-term sustainable growth and risk capital optimization.

Geopolitical tensions and regulatory shifts, particularly concerning data localization and cross-border underwriting, introduce layers of complexity that carriers must navigate with precision. The drive for Environmental, Social, and Governance (ESG) compliance is also exerting pressure, requiring insurers to integrate climate-risk assessments into their investment portfolios and underwriting criteria, influencing both their asset and liability sides. The Non-Life insurance industry's capacity to absorb these societal changes while maintaining financial stability determines its enduring role as a key facilitator of global commerce and individual financial security. Strategic foresight regarding emerging technological risks and demographic changes will be essential for capitalizing on the projected USD 3.7 Trillion market opportunity by 2033.

The analysis of the Non-Life Insurance Value Chain clearly demonstrates a critical dependency on external technology vendors for core system modernization and advanced data acquisition, marking a definitive shift from proprietary, in-house IT development toward flexible, vendor-managed, cloud-based solutions. This transition is essential for achieving the scalability required to process billions of data points generated by IoT devices and customer interactions. Furthermore, the downstream claims process is increasingly reliant on external service providers for legal, repair, and medical review services, making vendor management efficiency a crucial determinant of customer satisfaction and claims accuracy. The optimal operational model involves a hybrid approach, where high-touch advisory services (brokers/agents) are retained for complex commercial lines, while automated, direct digital channels handle high-volume, standardized personal lines, thereby optimizing the cost-to-serve ratio across the diverse product portfolio.

The concentration of potential customers within specific geographic and industry clusters means that localized marketing and product specialization are key to market penetration. For example, focusing resources on rapidly industrializing corridors in Southeast Asia or targeting the renewable energy sector globally requires specialized underwriting talent and distinct product offerings that deviate significantly from standard motor or residential policies. The market's structural resilience is continuously tested by the accumulation of catastrophic risks, reinforcing the necessity for highly diversified global portfolios. As technology democratizes access to insurance products, customer expectations regarding speed, transparency, and fairness will continue to rise, compelling carriers to continuously refine their operational processes and distribution strategies to maintain a competitive edge in a technologically augmented market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Life & Non-Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Brokers in Non-Life Insurance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Independent Agent, Special Agent, General Agent), By Application (Property Loss, Liability Insurance, Credit Guarantee Insurance), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager