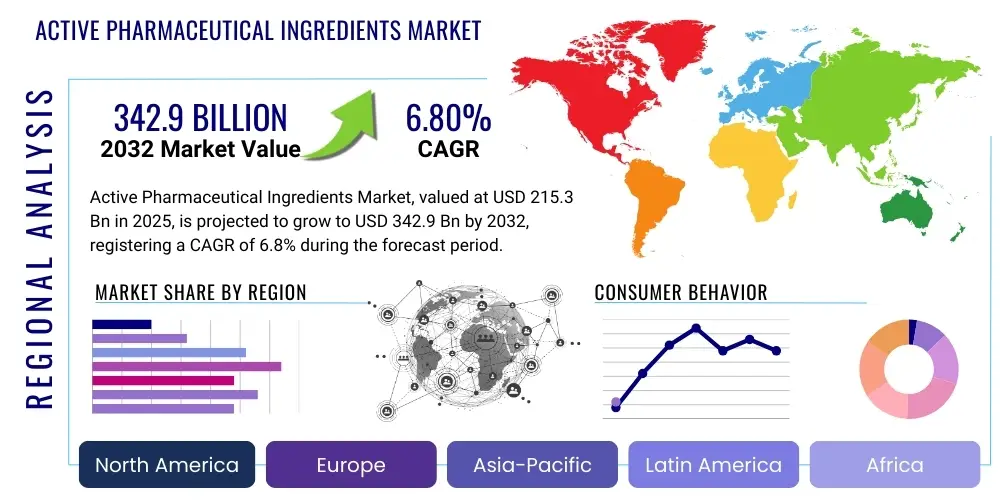

Active Pharmaceutical Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427713 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Active Pharmaceutical Ingredients Market Size

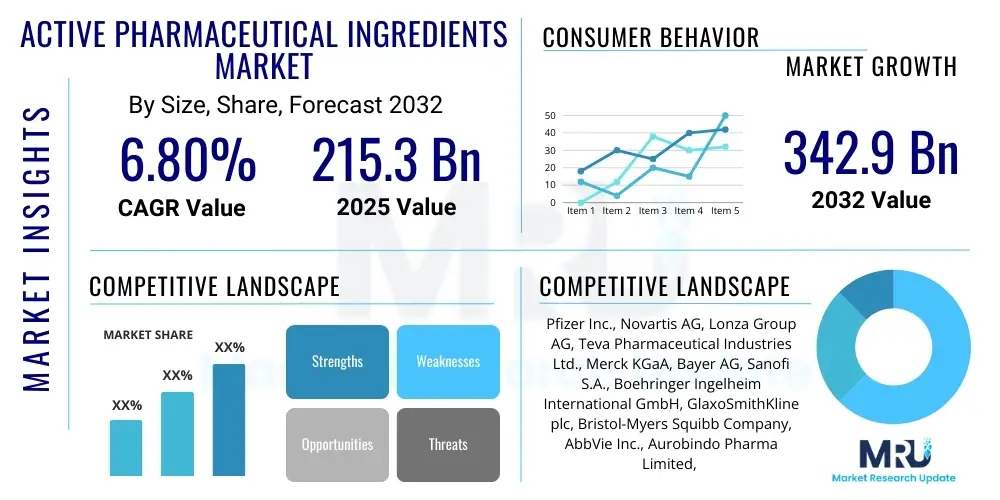

The Active Pharmaceutical Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 215.3 billion in 2025 and is projected to reach USD 342.9 billion by the end of the forecast period in 2032.

Active Pharmaceutical Ingredients Market introduction

The Active Pharmaceutical Ingredients (API) market is a critical component of the global pharmaceutical industry, forming the biologically active core of any drug product. These potent substances are the fundamental components responsible for the therapeutic effects of medications. The market encompasses a vast array of chemical compounds and biotechnologically derived substances, ranging from small molecule synthetic compounds to complex biologics, which are then formulated into finished drug products by pharmaceutical companies.

Major applications for Active Pharmaceutical Ingredients span across diverse therapeutic areas, including oncology, cardiovascular diseases, central nervous system (CNS) disorders, diabetes, respiratory conditions, and infectious diseases. The increasing prevalence of chronic and lifestyle-related diseases worldwide, coupled with an aging global population, drives consistent demand for a wide spectrum of APIs. These ingredients are essential not only for new drug development but also for the manufacturing of generic medications, which aim to provide more affordable treatment options.

Key benefits of a robust API market include ensuring a steady supply of high-quality drug components, fostering innovation in drug discovery, and enabling the production of essential medicines globally. Driving factors for market expansion include the rising demand for both novel and generic drugs, advancements in pharmaceutical manufacturing technologies, the increasing focus on biopharmaceuticals, and a growing emphasis on precision medicine. The intricate regulatory landscape and supply chain complexities remain central to the dynamics of this market.

Active Pharmaceutical Ingredients Market Executive Summary

The Active Pharmaceutical Ingredients market is experiencing significant transformation, driven by evolving business trends, pronounced regional shifts, and distinct segment growth patterns. Business trends highlight a pronounced move towards outsourcing API manufacturing to Contract Development and Manufacturing Organizations (CDMOs), spurred by the need for cost efficiency, specialized expertise, and reduced time-to-market. Furthermore, there is a growing emphasis on sustainable manufacturing practices, green chemistry, and the adoption of advanced process technologies to improve yield and reduce environmental impact, reflecting broader industry and regulatory pressures. Collaboration between pharmaceutical companies and API manufacturers is also increasing to ensure supply chain resilience and innovation.

Regional trends indicate that Asia-Pacific continues its dominance as a key manufacturing hub for APIs, particularly China and India, due to cost advantages, readily available skilled labor, and established infrastructure. However, North America and Europe remain crucial for advanced research, development, and the production of high-value, complex APIs, including biologics, driven by strong innovation ecosystems and stringent regulatory frameworks. Emerging markets in Latin America and Africa are showing growth potential, fueled by improving healthcare infrastructure and increasing access to medicines, albeit starting from a smaller base. These regions are also becoming more attractive for local manufacturing to reduce import reliance and enhance regional supply security.

Segment trends reveal a robust growth in the biopharmaceutical sector, with biologics and high-potency active pharmaceutical ingredients (HPAPIs) witnessing substantial demand, driven by advancements in biotechnology and targeted therapies. Synthetic APIs continue to hold a large market share, essential for generic drug production. The increasing complexity of drug molecules is pushing the demand for specialized API synthesis services. Furthermore, there is a distinct trend towards sterile and highly pure APIs, especially for injectables and advanced therapies, necessitating advanced manufacturing and quality control capabilities across all segments.

AI Impact Analysis on Active Pharmaceutical Ingredients Market

Common user questions regarding AIs impact on the Active Pharmaceutical Ingredients market often revolve around its potential to accelerate drug discovery, optimize manufacturing processes, reduce costs, and enhance quality control. Users are keen to understand how AI can streamline the traditionally time-consuming and expensive API development cycle, from initial compound identification to large-scale production. Concerns frequently touch upon data security, the need for specialized AI expertise, and the integration challenges within existing pharmaceutical infrastructure. Expectations are high for AI to revolutionize the precision and efficiency of API synthesis and analysis, ultimately leading to faster access to novel and more effective treatments.

AIs influence on the API market is multifaceted, offering unprecedented capabilities for innovation and operational enhancement. It is poised to transform drug design by predicting molecular properties, identifying promising lead compounds, and optimizing synthetic pathways with greater accuracy and speed than traditional methods. In the realm of manufacturing, AI can predict process deviations, optimize reaction conditions, and improve yield, thereby reducing waste and increasing efficiency. This predictive power extends to quality control, where AI algorithms can analyze vast datasets from various analytical techniques to detect impurities or inconsistencies early, ensuring higher product purity and compliance with stringent regulatory standards. The integration of AI tools promises a paradigm shift towards smarter, more agile, and more cost-effective API production.

- AI accelerates novel API discovery and design through advanced molecular modeling and predictive analytics.

- Optimizes API synthetic pathways and manufacturing processes, enhancing efficiency and yield.

- Improves quality control and purity analysis by detecting subtle deviations in real-time.

- Reduces research and development costs by minimizing trial-and-error experimentation.

- Facilitates supply chain management through demand forecasting and risk assessment.

- Enables personalized medicine by aiding in the development of highly specific APIs.

DRO & Impact Forces Of Active Pharmaceutical Ingredients Market

The Active Pharmaceutical Ingredients market is shaped by a confluence of powerful drivers, notable restraints, and significant opportunities, all influenced by overarching impact forces. Key drivers include the escalating global burden of chronic diseases such as cancer, diabetes, and cardiovascular conditions, which necessitate a continuous supply of therapeutic agents. Furthermore, the growing demand for generic drugs globally, driven by patent expirations and the push for affordable healthcare, significantly fuels the production of established APIs. The rapid advancements in biotechnology, leading to the development of complex biologics and biosimilars, also represent a substantial growth engine for specialized API segments. Finally, increasing healthcare expenditure and improving access to medical treatments in emerging economies contribute to market expansion.

Despite robust growth, the market faces several restraints. Stringent regulatory frameworks imposed by bodies like the FDA, EMA, and others, coupled with complex intellectual property rights issues, often create significant barriers to entry and increase development costs. The high capital investment required for establishing and maintaining state-of-the-art manufacturing facilities, particularly for high-potency or sterile APIs, presents a financial hurdle. Moreover, the increasing complexity of chemical synthesis for novel drug molecules and the inherent challenges in managing a globalized, yet sometimes fragmented, supply chain, pose continuous operational challenges for manufacturers. Environmental regulations and the need for sustainable practices also add layers of complexity and cost.

Opportunities within the API market are plentiful, particularly in the realm of technological innovation and strategic partnerships. The adoption of advanced manufacturing technologies, such as continuous manufacturing, flow chemistry, and green chemistry principles, offers avenues for improved efficiency, reduced waste, and cost savings. The rising trend of outsourcing API manufacturing to Contract Development and Manufacturing Organizations (CDMOs) provides opportunities for specialized players to leverage their expertise and capacity. Furthermore, the burgeoning demand for high-potency active pharmaceutical ingredients (HPAPIs) and biopharmaceuticals presents lucrative niches for companies capable of handling their complex production requirements. Strategic expansion into underserved emerging markets also represents a significant growth pathway.

Segmentation Analysis

The Active Pharmaceutical Ingredients market is broadly segmented based on various attributes including type, manufacturing process, application, and end-user, each offering distinct insights into market dynamics and growth potential. This detailed segmentation allows for a granular understanding of the diverse landscape, highlighting areas of high growth and specific technological requirements. Analyzing these segments helps in identifying niche markets, competitive landscapes, and strategic entry points for various stakeholders involved in the pharmaceutical value chain. Each segment plays a crucial role in delivering the necessary components for a wide range of therapeutic solutions globally.

- By Type:

- Synthetic APIs (Small Molecules)

- Biotech APIs (Large Molecules)

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Insulin

- Other Biotech APIs

- By Manufacturer Type:

- Captive (In-house) APIs

- Merchant (Outsourced) APIs

- By Application:

- Oncology

- Cardiovascular Diseases

- Neurology

- Orthopedic

- Pain Management

- Respiratory Diseases

- Diabetes

- Infectious Diseases

- Others

- By Therapeutic Area:

- Branded APIs

- Generic APIs

Active Pharmaceutical Ingredients Market Value Chain Analysis

The Active Pharmaceutical Ingredients markets value chain is a complex ecosystem, beginning with the sourcing of raw materials and culminating in the distribution of APIs to drug formulators. Upstream activities involve the procurement of basic chemicals, solvents, and other precursors from various chemical suppliers. This stage is critical as the quality and cost of raw materials directly impact the final API. Research and development also form a significant upstream component, involving drug discovery, process development, and optimization of synthetic routes, often requiring extensive capital and scientific expertise. Ensuring reliable and high-quality raw material supply chains is paramount for API manufacturers to maintain production consistency and cost efficiency.

Midstream activities primarily encompass the actual manufacturing of APIs, which can involve complex chemical synthesis, fermentation, or biotechnological processes. This stage includes several sub-processes such as reaction, purification, isolation, and drying, all conducted under stringent Good Manufacturing Practice (GMP) guidelines to ensure product quality and safety. Quality control and analytical testing are integrated throughout the manufacturing process to verify the purity, potency, and identity of the API. The choice between in-house production (captive) and outsourcing to Contract Manufacturing Organizations (CMOs) significantly impacts this stage, driven by factors like cost, capacity, and specialized technological requirements.

Downstream analysis focuses on the distribution and ultimate consumption of APIs. Once manufactured and rigorously tested, APIs are packaged and transported to pharmaceutical companies, which then formulate them into finished dosage forms like tablets, capsules, or injectables. The distribution channel includes both direct sales from API manufacturers to pharmaceutical companies and indirect channels involving distributors or wholesalers who bridge the gap between producers and smaller formulators. The efficiency and reliability of these distribution networks are crucial for timely drug production and market supply. Regulatory compliance, logistics, and inventory management are key considerations throughout this final stage of the API value chain.

Active Pharmaceutical Ingredients Market Potential Customers

Potential customers for Active Pharmaceutical Ingredients are primarily entities within the pharmaceutical and biotechnology sectors that require these active substances for the manufacturing of finished drug products. The largest segment of end-users consists of established pharmaceutical companies, encompassing both innovator drug manufacturers and generic drug producers. Innovator companies require high-quality, often novel, APIs for their patented drug formulations, while generic manufacturers extensively utilize off-patent APIs to produce cost-effective alternatives. These customers prioritize API suppliers who can guarantee consistent quality, supply reliability, and adherence to global regulatory standards.

Another significant customer segment includes biotechnology companies, which primarily seek advanced biotech APIs such as monoclonal antibodies, recombinant proteins, and vaccines. These companies often require highly specialized manufacturing capabilities and expertise in complex biological processes, leading them to partner with API manufacturers possessing advanced biotechnological platforms. The increasing pipeline of biologics and biosimilars further expands this customer base, driving demand for innovative and high-purity biological APIs. These customers often engage in long-term strategic partnerships with API providers to secure dedicated manufacturing capacity and specialized technical support for their highly sensitive products.

Furthermore, Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs) also represent crucial potential customers within the API market. CDMOs often procure APIs as part of their integrated services to pharmaceutical and biotech clients, handling everything from process development to commercial manufacturing of finished drug products. CROs may require specific APIs for their preclinical and clinical trial activities. This segment values suppliers who can offer flexibility, speed, and comprehensive support services, aligning with their project-based requirements. The overarching need for regulatory compliance and efficient supply chain management remains a universal priority across all potential customer types.

Active Pharmaceutical Ingredients Market Key Technology Landscape

The Active Pharmaceutical Ingredients market is underpinned by a rapidly evolving technological landscape, continuously driven by the imperative for enhanced efficiency, improved safety, and reduced environmental impact. One of the most significant technological advancements is continuous manufacturing, which contrasts with traditional batch processing. This approach allows for uninterrupted production, leading to higher throughput, smaller facility footprints, and improved quality control through real-time monitoring and automation. Continuous manufacturing not only optimizes operational costs but also provides greater flexibility and scalability, making it particularly attractive for high-volume API production and reducing lead times.

Another crucial area of innovation is the adoption of green chemistry principles and technologies. This includes the development of more environmentally friendly synthetic routes, the use of benign solvents, and the reduction of waste generation. Technologies such as biocatalysis, which utilizes enzymes for highly selective chemical transformations, and flow chemistry, which enables reactions in small, continuously flowing streams, significantly contribute to sustainable API production. These advancements not only align with global environmental regulations but also offer economic benefits through reduced raw material consumption and waste treatment costs, enhancing the overall sustainability profile of API manufacturing.

Moreover, the integration of advanced analytical techniques and digitalization is profoundly impacting the API technology landscape. Process Analytical Technology (PAT) allows for real-time monitoring and control of critical process parameters, ensuring consistent product quality and reducing the need for extensive end-product testing. Data analytics, machine learning, and artificial intelligence are increasingly being employed for process optimization, predictive maintenance, and drug design, enabling more efficient and intelligent manufacturing. The push towards Industry 4.0 in pharmaceutical manufacturing is fostering a highly interconnected and automated environment, leading to greater precision, faster development cycles, and enhanced compliance in API production.

Regional Highlights

- North America: This region holds a significant share in the API market, driven by robust R&D activities, the presence of major pharmaceutical and biotechnology companies, and strong government support for drug innovation. Stringent regulatory frameworks ensure high-quality standards. The increasing adoption of advanced manufacturing technologies like continuous manufacturing is also a key factor.

- Europe: Europe represents another key market, characterized by a well-established pharmaceutical industry, high healthcare expenditure, and a strong focus on specialty and high-potency APIs. Countries like Germany, Switzerland, and Ireland are known for advanced manufacturing capabilities and a skilled workforce. Regulatory harmonization efforts within the EU also facilitate market access.

- Asia-Pacific: This region is projected to exhibit the highest growth rate, primarily driven by India and China, which are global hubs for generic API manufacturing due to cost-effectiveness, large production capacities, and a skilled labor pool. Growing healthcare awareness, increasing disposable incomes, and improving healthcare infrastructure in countries like Japan and South Korea further fuel demand for APIs across various therapeutic areas.

- Latin America: The market in Latin America is witnessing steady growth, propelled by expanding healthcare access, increasing government investments in healthcare infrastructure, and a growing patient population. Brazil and Mexico are key markets, focusing on both domestic production and imports to meet rising demand for essential medicines.

- Middle East & Africa: This region is an emerging market for APIs, with growth driven by efforts to diversify economies, increase healthcare spending, and reduce reliance on imported medicines. Initiatives to establish local pharmaceutical manufacturing capabilities are gaining traction, although the market still heavily depends on imports for complex APIs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Pharmaceutical Ingredients Market.- Pfizer Inc.

- Novartis AG

- Lonza Group AG

- Teva Pharmaceutical Industries Ltd.

- Merck KGaA

- Bayer AG

- Sanofi S.A.

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline plc

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Aurobindo Pharma Limited

- Dr. Reddys Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Divis Laboratories Limited

- Lupin Limited

- Cipla Ltd.

- Albemarle Corporation

- Catalent, Inc.

- WuXi AppTec Inc.

Frequently Asked Questions

What is an Active Pharmaceutical Ingredient (API)?

An Active Pharmaceutical Ingredient (API) is the substance in a drug that is biologically active and responsible for the therapeutic effects of the medication. It is the core component of any drug formulation.

What factors are driving the growth of the API market?

Key drivers include the rising prevalence of chronic diseases, increasing demand for generic drugs, growth in the biopharmaceutical sector, and advancements in pharmaceutical manufacturing technologies.

How is AI impacting API development and manufacturing?

AI is transforming API development by accelerating drug discovery, optimizing synthetic pathways, improving manufacturing efficiency, and enhancing quality control processes through predictive analytics and real-time monitoring.

What are the primary challenges faced by API manufacturers?

Challenges include stringent regulatory requirements, high capital investment for advanced facilities, complexities in chemical synthesis for novel molecules, and managing a globalized, yet often fragmented, supply chain.

Which regions are leading in API production and consumption?

Asia-Pacific, particularly China and India, dominates API manufacturing due to cost advantages, while North America and Europe lead in innovation, R&D, and consumption of high-value, complex APIs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Penicillin Active Pharmaceutical Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Contract Manufacturing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Active Pharmaceutical Ingredients (API) Manufacturing, Finished Dosage Formulation (FDF) Development & Manufacturing, Secondary Packaging), By Application (Big Pharma, Small & Mid-size Pharma, Generic Pharmaceutical Companies, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- High Potency Active Pharmaceutical Ingredients (Hpapi) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Synthetic, Biotech), By Application (Oncology, Hormonal, Glaucoma, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- High Performance Active Pharmaceutical Ingredients (Hpapi) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Synthetic Ingredients, Biological Ingredients, Others), By Application (Oncology, Glaucoma, Anti-diabetic), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager