Artificial Lift System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429459 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Artificial Lift System Market Size

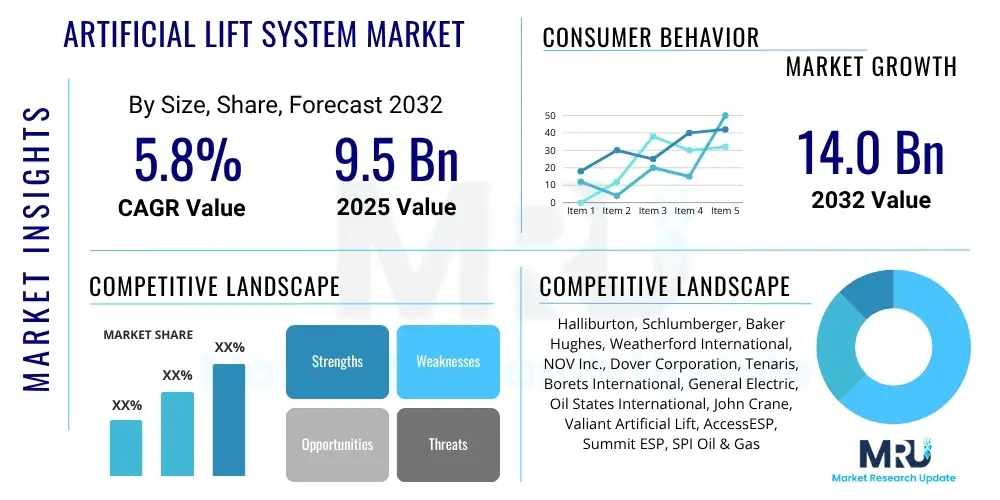

The Artificial Lift System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 9.5 billion in 2025 and is projected to reach USD 14.0 billion by the end of the forecast period in 2032.

Artificial Lift System Market introduction

The Artificial Lift System Market encompasses technologies and services designed to enhance the flow of hydrocarbons from oil and gas wells to the surface when natural reservoir pressure is insufficient. These systems are critical for maintaining production rates, particularly in mature oilfields where reservoir pressure has declined and in unconventional plays requiring significant assistance to bring fluids to the surface. Artificial lift methods overcome hydrostatic pressure and friction within the wellbore, enabling economic recovery of oil and gas that would otherwise remain untapped. The market is characterized by a diverse range of technologies, each suited to specific well conditions, fluid properties, and operational objectives.

Products within this market include Electrical Submersible Pumps (ESPs), Rod Pumps (also known as sucker rod pumps or beam pumps), Gas Lift systems, Progressive Cavity Pumps (PCPs), Hydraulic Piston Pumps (HPP), and Plunger Lift systems. Major applications span both onshore and offshore exploration and production (E&P) activities, from conventional vertical wells to complex horizontal and deviated wells. These systems are indispensable across the entire lifecycle of an oil or gas well, moving beyond initial production to optimize recovery during later stages and extend the productive life of assets. The selection of an appropriate artificial lift method depends heavily on factors such as well depth, production rate, fluid viscosity, gas-oil ratio, and the presence of solids or corrosive elements.

The primary benefits of artificial lift systems include significantly increased oil and gas production rates, extended economic life of wells, optimized energy consumption through advanced control mechanisms, and improved operational efficiency. Driving factors for market growth include the global demand for energy, the natural decline in reservoir pressure across an aging portfolio of oil and gas fields, and the increasing development of unconventional resources that inherently require artificial lift from the outset. Additionally, technological advancements in system reliability, automation, and real-time monitoring are further propelling market expansion, as operators seek more efficient and cost-effective solutions to maximize recovery.

Artificial Lift System Market Executive Summary

The Artificial Lift System Market is currently experiencing robust growth driven by persistent global energy demand and the increasing reliance on mature oilfields and challenging unconventional resources. Key business trends indicate a strong focus on digitalization, automation, and the integration of advanced analytics to optimize system performance, reduce downtime, and lower operational expenditures. Companies are investing in research and development to create more durable, energy-efficient, and intelligent artificial lift solutions capable of operating in harsh downhole environments. The competitive landscape is characterized by a mix of established oilfield service giants and specialized technology providers, all vying to offer integrated solutions that address complex production challenges. Consolidation and strategic partnerships are also becoming prevalent as firms seek to expand their service portfolios and geographic reach, enhancing their market position in a dynamic energy sector.

Regional trends highlight North America as a dominant market, primarily due to extensive shale oil and gas production activities and the optimization of mature fields across the region. The Middle East and Africa are witnessing significant growth, spurred by new discoveries, large-scale field development projects, and national oil companies' efforts to maximize recovery from vast conventional reserves. Asia Pacific is also emerging as a high-growth region, driven by increasing energy consumption, governmental initiatives to boost domestic production in countries like China and India, and the development of challenging offshore and onshore assets. Latin America continues to offer substantial opportunities, particularly in deepwater offshore plays and unconventional basins, demanding highly robust and efficient artificial lift technologies capable of handling diverse fluid conditions and pressures.

Segment-wise, Electrical Submersible Pumps (ESPs) and Gas Lift systems continue to hold substantial market shares due to their versatility, efficiency, and application across a wide range of well types and production scenarios. ESPs are favored for high-volume wells, while Gas Lift is preferred in high gas-oil ratio wells or those prone to sand production. Rod pumps remain a foundational technology, particularly for conventional, low-volume wells and marginal fields where their simplicity and cost-effectiveness are advantageous. The market is also seeing increased demand for Progressive Cavity Pumps (PCPs) in wells producing viscous fluids or heavy oil. Future growth is expected to be fueled by the adoption of hybrid systems, remote monitoring capabilities, and predictive maintenance technologies across all artificial lift segments, as operators prioritize operational uptime and cost efficiency.

AI Impact Analysis on Artificial Lift System Market

Common user questions regarding AI's impact on the Artificial Lift System Market frequently center on how these advanced technologies can enhance operational efficiency, reduce costly downtime, and optimize production rates. Users are keenly interested in predictive maintenance capabilities, real-time system optimization, and the integration of autonomous controls. Concerns often arise regarding the data infrastructure required, the cybersecurity implications of connected systems, and the need for specialized personnel capable of deploying and managing AI solutions. Expectations are high for AI to deliver substantial improvements in equipment reliability, energy consumption, and overall well profitability through smarter decision-making and proactive problem solving across the entire artificial lift lifecycle, from installation to end-of-life optimization.

- Predictive maintenance for anticipating and preventing equipment failures, extending operational lifespan.

- Real-time optimization of lift system performance based on dynamic well conditions and reservoir behavior.

- Automated anomaly detection in production data, flagging potential issues before they escalate.

- Enhanced data analytics and visualization for deeper insights into well performance and operational efficiency.

- Reduced operational costs through optimized energy usage, fewer interventions, and improved resource allocation.

- Increased hydrocarbon recovery by continuously adjusting lift parameters to maximize fluid flow.

- Development of autonomous control systems for self-adjusting artificial lift operations.

- Improved safety by minimizing human exposure to hazardous operational environments through remote monitoring.

DRO & Impact Forces Of Artificial Lift System Market

The Artificial Lift System Market is predominantly driven by the pervasive challenge of natural reservoir pressure depletion in mature oil and gas fields globally. As wells age, their natural flow diminishes, necessitating artificial assistance to sustain economic production levels. Concurrently, the increasing global demand for energy, particularly from burgeoning economies, compels E&P companies to maximize recovery from existing assets and explore new, often more challenging, reservoirs. The expansion of unconventional resource development, such as shale oil and gas, which inherently requires artificial lift from the outset, further amplifies market demand. Additionally, continuous technological advancements, especially in automation, digitalization, and material science, are enhancing the efficiency, reliability, and cost-effectiveness of artificial lift systems, making them more attractive to operators.

However, several restraints temper this growth. Volatile crude oil and natural gas prices significantly impact E&P spending, leading to deferred investments in new projects or optimization efforts, including artificial lift system upgrades. The high initial capital expenditure associated with installing advanced artificial lift systems, particularly in complex offshore or deep well environments, can be a barrier for smaller operators or in periods of low commodity prices. Furthermore, the global shift towards renewable energy sources and increasingly stringent environmental regulations, aimed at reducing carbon emissions and minimizing the environmental footprint of oil and gas operations, can restrict new exploration activities and place additional compliance burdens on existing ones, impacting the overall market trajectory.

Opportunities for market players lie in several key areas. The development of more sustainable and energy-efficient artificial lift solutions, including those powered by renewable energy or designed for lower carbon footprints, presents a significant growth avenue in an environmentally conscious world. Integrating artificial intelligence (AI) and machine learning (ML) for predictive analytics, real-time optimization, and autonomous operations offers immense potential for improving system performance and reducing operational costs. Expanding into frontier exploration areas and unconventional plays that require specialized and robust artificial lift technologies also represents a substantial opportunity. Moreover, providing comprehensive lifecycle services, from installation and commissioning to maintenance and decommissioning, allows companies to capture greater value throughout the asset's lifespan.

Impact forces on the market are multifaceted. Fluctuations in crude oil and gas prices directly influence the profitability of E&P projects and, consequently, investment decisions in artificial lift technologies. Technological innovation cycles drive demand for newer, more efficient systems, while older technologies face obsolescence. Geopolitical stability and government policies regarding energy production, taxation, and environmental regulations can profoundly affect E&P activities and market dynamics. The increasing focus on environmental, social, and governance (ESG) factors is pushing companies to adopt more responsible and sustainable operational practices, which in turn influences the design and deployment of artificial lift systems. Supply chain disruptions, often exacerbated by global events or trade policies, can also impact manufacturing costs and system availability, affecting market growth.

Segmentation Analysis

The Artificial Lift System Market is comprehensively segmented to provide a detailed understanding of its diverse components, operational mechanisms, and application areas. This granular segmentation allows for precise market analysis, enabling stakeholders to identify key growth drivers, niche opportunities, and competitive dynamics across various categories. The market is primarily bifurcated by product type, which distinguishes between the core technologies employed, and further broken down by mechanism, application, component, and well type, each offering unique insights into market trends and adoption patterns. This multi-dimensional approach to segmentation highlights the specialized nature of artificial lift solutions, tailored to specific production challenges and reservoir characteristics across the global oil and gas landscape.

- By Type:

- Electrical Submersible Pumps (ESPs)

- Rod Pumps (Beam Pumps, Sucker Rod Pumps)

- Gas Lift

- Progressive Cavity Pumps (PCPs)

- Hydraulic Piston Pumps (HPP)

- Plunger Lift

- Other Artificial Lift Systems (e.g., Jet Pumps, Hybrids)

- By Mechanism:

- Pump-Assisted Lift

- Gas-Assisted Lift

- By Application:

- Onshore

- Offshore (Shallow Water, Deepwater, Ultra-Deepwater)

- By Component:

- Pumps

- Motors

- Drives (Variable Speed Drives)

- Sensors and Monitoring Equipment

- Controllers and Automation Systems

- Power Cables and Surface Equipment

- Others (e.g., Tubing, Rods, Packers)

- By Well Type:

- Vertical Wells

- Horizontal Wells

- Deviated Wells

Value Chain Analysis For Artificial Lift System Market

The value chain for the Artificial Lift System Market commences with upstream activities involving extensive research and development (R&D) and the sourcing of specialized raw materials. This initial phase focuses on innovative design, engineering, and manufacturing of critical components such as pumps, motors, seals, and control systems. Key raw material suppliers provide high-grade metals, advanced polymers, and electronic components, which are then processed and assembled by artificial lift system manufacturers. Upstream also includes the rigorous testing and certification of equipment to ensure durability, reliability, and performance in harsh downhole environments. This stage is crucial for developing robust and efficient technologies that can withstand extreme temperatures, pressures, and corrosive fluids, forming the foundation of the entire system.

Midstream activities in the value chain involve the integration of various components into complete artificial lift packages, along with sophisticated logistics and distribution networks. Manufacturers work closely with oilfield service providers and E&P companies to tailor solutions to specific well characteristics and operational requirements. This involves custom assembly, packaging, and transportation of bulky and specialized equipment to remote onshore sites or complex offshore platforms. Efficient inventory management and supply chain optimization are paramount at this stage to minimize lead times and ensure timely delivery, preventing costly delays in drilling and production schedules. Effective coordination between manufacturers, logistics providers, and end-users is essential for seamless execution and deployment.

Downstream activities encompass the critical phases of installation, commissioning, operation, and ongoing maintenance and optimization of artificial lift systems. Oilfield service companies, often working in conjunction with or as part of the system manufacturers, deploy specialized field crews and equipment for the precise installation of these complex systems. Post-installation, comprehensive commissioning ensures that the systems are operating optimally and integrated with the overall production infrastructure. Continuous monitoring, preventive maintenance, and predictive diagnostics using advanced sensors and data analytics are integral to maximizing system uptime and performance throughout the well's lifespan. Distribution channels are primarily direct, through the sales and service networks of major artificial lift providers, offering direct technical support and customized solutions. Indirect channels involve third-party distributors or local agents who facilitate market access in specific regions or for smaller operators, providing specialized expertise and localized support. This comprehensive downstream support is vital for ensuring the long-term efficiency and economic viability of artificial lift investments.

Artificial Lift System Market Potential Customers

The primary potential customers and end-users of artificial lift systems are exploration and production (E&P) companies operating across the global oil and gas sector. This broad category includes major international oil companies (IOCs) such as ExxonMobil, Shell, BP, and Chevron, which manage vast portfolios of both mature and newly developed fields worldwide. National oil companies (NOCs) like Saudi Aramco, ADNOC, Petrobras, and Pemex also represent significant customer segments, given their responsibility for managing national hydrocarbon reserves and maximizing production from extensive domestic assets. These large entities require advanced, high-performance artificial lift solutions for deepwater, unconventional, and high-volume conventional wells, emphasizing reliability, efficiency, and advanced monitoring capabilities.

In addition to these large-scale operators, independent oil and gas companies constitute a substantial portion of the customer base. These firms often focus on specific geological basins, unconventional plays, or optimizing production from smaller, marginal fields. For independent operators, cost-effectiveness, ease of installation, and robust, low-maintenance systems are frequently key purchasing criteria. Their diverse operational scales and financial capacities mean they seek a range of artificial lift technologies, from simple beam pumps for conventional wells to more sophisticated ESPs or gas lift systems for challenging reservoirs, balancing initial investment with long-term operational efficiency and production uplift. Therefore, providers must offer flexible solutions that cater to varying technical and economic requirements across this wide spectrum of E&P clients.

Beyond traditional E&P companies, other entities within the oil and gas value chain also act as indirect or direct customers. Drilling contractors and well service companies often integrate artificial lift system procurement and installation into their comprehensive service offerings for E&P operators. These service providers act as intermediaries, selecting and deploying appropriate artificial lift technologies as part of larger contracts, ensuring seamless project execution. Furthermore, companies specializing in enhanced oil recovery (EOR) projects or field rejuvenation programs frequently require advanced artificial lift solutions to maximize hydrocarbon extraction, representing another crucial segment. The decision-making process for these customers is influenced by a complex interplay of well economics, operational expenditure reduction targets, environmental compliance, and the ability of the artificial lift system to reliably deliver sustained production rates over extended periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 14.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Halliburton, Schlumberger, Baker Hughes, Weatherford International, NOV Inc., Dover Corporation, Tenaris, Borets International, General Electric, Oil States International, John Crane, Valiant Artificial Lift, AccessESP, Summit ESP, SPI Oil & Gas, Pro-Rod Inc., Global Energy Services (GES), Petrofac, Centrilift, National Oilwell Varco (NOV) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Lift System Market Key Technology Landscape

The Artificial Lift System Market is characterized by a rapidly evolving technology landscape focused on enhancing efficiency, reliability, and automation across diverse operational environments. Key technological advancements include the widespread adoption of variable speed drives (VSDs) for Electrical Submersible Pumps (ESPs), which allow for precise control over pump speed and flow rates, significantly improving energy efficiency and extending equipment life. Furthermore, robust material science and advanced metallurgy are crucial for developing downhole components that can withstand increasingly harsh wellbore conditions, including high temperatures, extreme pressures, and corrosive fluids, thereby minimizing failures and reducing intervention costs. The integration of advanced sensor technology for real-time data acquisition is also foundational, providing operators with continuous insights into downhole pressure, temperature, flow rates, and vibration, enabling proactive adjustments and performance optimization.

Recent innovations are heavily centered on the digitalization of artificial lift operations. The Internet of Things (IoT) is increasingly being leveraged to connect artificial lift systems with remote monitoring and control platforms, allowing for operations to be managed from centralized control rooms, often thousands of miles away. This connectivity facilitates predictive maintenance through sophisticated machine learning algorithms that analyze sensor data to anticipate equipment failures, enabling proactive interventions rather than reactive repairs, thus significantly reducing downtime. The development of intelligent well systems incorporates autonomous control capabilities, allowing artificial lift systems to self-adjust parameters in response to changing reservoir conditions, further optimizing production and minimizing human intervention requirements, enhancing both efficiency and safety in remote or challenging locations.

Beyond individual system improvements, the industry is also exploring hybrid artificial lift solutions that combine the advantages of multiple technologies to address complex well challenges more effectively. For instance, combining plunger lift with gas lift can enhance efficiency in certain gas-condensate wells. Furthermore, the emphasis on developing environmentally friendly solutions is driving innovation in power generation for remote sites, including solar and wind power integration for artificial lift systems, reducing reliance on conventional power sources and lowering the carbon footprint of operations. These technological strides collectively aim to reduce the total cost of ownership, maximize hydrocarbon recovery, and ensure sustainable operations in an increasingly complex and environmentally conscious energy landscape.

Regional Highlights

- North America: This region holds a dominant market share in the artificial lift system market, primarily driven by the extensive development of unconventional oil and gas resources, particularly in shale formations across the United States and Canada. The region also boasts a significant number of mature oilfields requiring artificial lift to maintain production, coupled with high levels of technological adoption and robust infrastructure for R&D and manufacturing.

- Europe: The European market is characterized by efforts to optimize production from mature fields, especially in the North Sea. Strict environmental regulations and a focus on operational efficiency and emission reduction drive the demand for highly efficient, low-impact artificial lift technologies, including those integrated with digital solutions for enhanced performance and reduced energy consumption.

- Asia Pacific (APAC): Asia Pacific is projected to be one of the fastest-growing regions, fueled by rising energy demand from rapidly industrializing economies like China, India, and Indonesia. Investments in new exploration activities, both onshore and offshore, alongside the rejuvenation of existing wells and a focus on domestic energy security, are significant growth factors for artificial lift system adoption in the region.

- Latin America: This region presents substantial growth opportunities, particularly due to large offshore discoveries in Brazil and extensive unconventional and conventional reserves in countries such as Argentina, Mexico, and Venezuela. The demand is high for robust and versatile artificial lift solutions capable of handling deepwater conditions, heavy oil, and complex reservoir characteristics inherent to the region's hydrocarbon assets.

- Middle East and Africa (MEA): The MEA region is a crucial market due to its vast conventional oil and gas reserves, a large number of mature fields requiring advanced recovery techniques, and ongoing significant capital investments in new field developments. National oil companies in the Middle East and emerging markets in Africa are consistently investing in artificial lift technologies to maximize production and extend the life of their prolific fields.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Lift System Market.- Halliburton

- Schlumberger

- Baker Hughes, a GE company

- Weatherford International

- NOV Inc.

- Dover Corporation

- Tenaris

- Borets International

- General Electric

- Oil States International

- John Crane

- Valiant Artificial Lift

- AccessESP

- Summit ESP

- SPI Oil & Gas

- Pro-Rod Inc.

- Global Energy Services (GES)

- Petrofac

- Centrilift

- National Oilwell Varco (NOV)

Frequently Asked Questions

Analyze common user questions about the Artificial Lift System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an artificial lift system in oil and gas production?

An artificial lift system is a mechanical or gas-assisted method used in oil and gas wells to overcome insufficient natural reservoir pressure, enabling the efficient flow of hydrocarbons from the wellbore to the surface for extraction and processing.

Why are artificial lift systems crucial for oil and gas operators?

Artificial lift systems are crucial because they extend the economic life of wells, maximize hydrocarbon recovery, and maintain consistent production rates, especially in mature fields or challenging unconventional reservoirs where natural flow is no longer sustainable or sufficient.

What are the primary types of artificial lift technologies?

The main types include Electrical Submersible Pumps (ESPs), Rod Pumps (sucker rod pumps), Gas Lift systems, Progressive Cavity Pumps (PCPs), Hydraulic Piston Pumps, and Plunger Lift, each suited for specific well conditions and fluid properties.

How does artificial intelligence (AI) impact the artificial lift market?

AI impacts the artificial lift market by enabling predictive maintenance to prevent failures, optimizing pump performance in real-time, automating system controls, and providing advanced data analytics for enhanced efficiency, reduced operational costs, and improved production uptime.

What key factors drive the growth of the artificial lift system market?

The market's growth is primarily driven by the depletion of natural reservoir pressure, increasing global energy demand, the expansion of unconventional oil and gas resource development, and continuous technological advancements aimed at improving system efficiency and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager