Automotive Wheel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430867 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Wheel Market Size

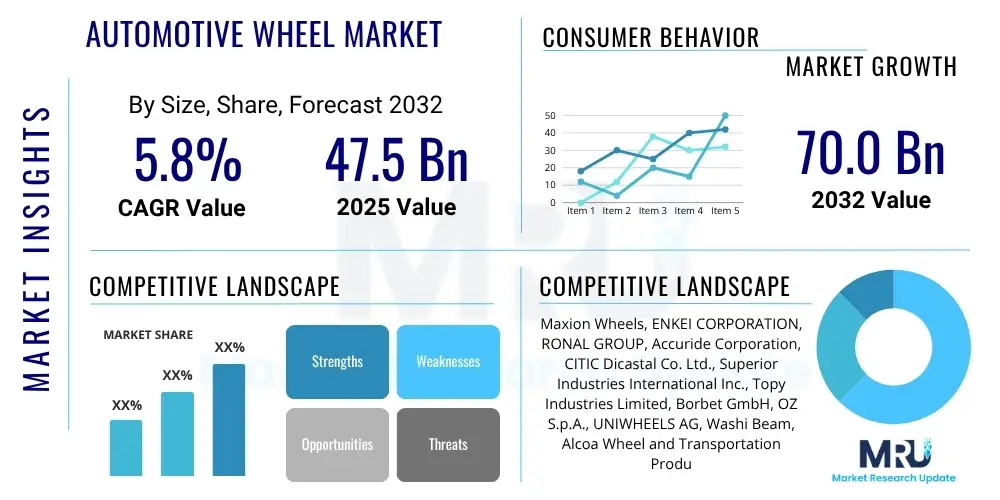

The Automotive Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 47.5 Billion in 2025 and is projected to reach USD 70.0 Billion by the end of the forecast period in 2032.

Automotive Wheel Market introduction

The Automotive Wheel Market encompasses the global production and distribution of wheels used in various vehicle types, from passenger cars to heavy commercial vehicles and motorcycles. Automotive wheels are critical components, serving as the interface between the vehicle and the road, supporting vehicle weight, facilitating steering, braking, and accelerating, and significantly influencing overall vehicle performance, safety, and aesthetics. The product range includes wheels made from diverse materials such as steel, aluminum alloy, magnesium alloy, and advanced composites like carbon fiber, each offering distinct advantages in terms of weight, strength, durability, and cost.

Major applications for automotive wheels span across Original Equipment Manufacturers (OEMs) for new vehicle assembly and the aftermarket for replacement, customization, and performance upgrades. The benefits derived from advanced wheel technologies include improved fuel efficiency through lightweight designs, enhanced handling and braking performance, increased vehicle safety, and significant aesthetic appeal that contributes to vehicle branding and consumer preference. The market is propelled by several key driving factors, including the consistent growth in global vehicle production, increasing demand for lightweight and fuel-efficient vehicles, the rising popularity of electric vehicles, and a strong consumer inclination towards vehicle customization and premium features.

Furthermore, evolving consumer lifestyles, particularly in emerging economies, are leading to higher vehicle ownership rates and a greater emphasis on vehicle appearance and performance. Technological advancements in wheel manufacturing processes, such as flow forming and forging, enable the production of stronger yet lighter wheels, further fueling market expansion. The global shift towards sustainable transportation and electric mobility also plays a pivotal role, as electric vehicles often require specialized wheels designed for optimal aerodynamics and load bearing capacities, presenting new avenues for market growth and innovation.

Automotive Wheel Market Executive Summary

The Automotive Wheel Market is experiencing robust growth driven by a confluence of evolving business trends, distinct regional dynamics, and significant segment shifts. Key business trends include the increasing adoption of lightweight materials to enhance fuel efficiency and reduce emissions, a surge in demand for aesthetic customization, and the continuous innovation in manufacturing processes such as advanced casting and forging techniques. The market is also heavily influenced by the global transition towards electric vehicles, which necessitates specialized wheel designs optimized for battery weight and regenerative braking systems. Sustainability initiatives are pushing manufacturers towards more eco-friendly production methods and recyclable materials, shaping new product development strategies.

Regionally, the Asia Pacific market stands out as the primary growth engine, propelled by high vehicle production volumes, rapid urbanization, and rising disposable incomes, particularly in countries like China and India. North America and Europe, while mature markets, continue to see demand for premium and performance wheels, along with a focus on advanced safety features and stricter regulatory compliance. Emerging markets in Latin America and the Middle East and Africa are witnessing steady growth, supported by infrastructure development and increasing vehicle parc. Each region presents unique challenges and opportunities, influencing localized product offerings and distribution strategies.

Segment-wise, aluminum alloy wheels maintain their dominance due to their superior aesthetics, lighter weight compared to steel, and improved heat dissipation properties. The aftermarket segment is booming, fueled by consumer desires for personalization and performance upgrades, offering significant opportunities for manufacturers of custom and high-performance wheels. The trend towards larger rim sizes across all vehicle categories is also a notable segment trend, impacting design and material choices. Furthermore, the commercial vehicle segment is increasingly focusing on durability and load-bearing capacity, while the passenger car segment prioritizes a balance of aesthetics, performance, and efficiency, dictating distinct research and development priorities for manufacturers.

AI Impact Analysis on Automotive Wheel Market

Common user questions regarding AI's impact on the automotive wheel market primarily revolve around its potential to revolutionize manufacturing efficiency, enhance design capabilities, improve supply chain management, and enable the development of "smart" wheels. Users are keen to understand how AI can optimize production processes, predict maintenance needs, personalize wheel designs, and integrate wheels into the broader ecosystem of connected and autonomous vehicles. There is also significant interest in AI's role in material science innovation for lighter and stronger wheels, and its potential to reduce waste and energy consumption in manufacturing. The overarching themes include increased automation, predictive intelligence, enhanced product customization, and the evolution of wheels as intelligent vehicle components.

- AI-driven generative design accelerates the development of optimized wheel geometries for lightweighting and strength.

- Predictive maintenance algorithms for manufacturing equipment enhance operational efficiency and reduce downtime.

- AI-powered quality control systems detect defects with higher precision, improving product reliability and reducing scrap rates.

- Supply chain optimization using AI analytics predicts demand fluctuations and streamlines logistics for raw materials and finished goods.

- Development of "smart wheels" incorporating AI for real-time tire pressure monitoring, road condition analysis, and adaptive suspension control.

- Personalized wheel design and customization options driven by AI algorithms based on consumer preferences and vehicle specifications.

- Enhanced material discovery and optimization through AI for developing next-generation lightweight and durable wheel composites.

- AI in autonomous vehicles for real-time wheel health monitoring and predictive maintenance alerts.

- Robotics and automation in wheel manufacturing, guided by AI, for increased precision and speed.

- Data analytics from sensor-equipped wheels informs vehicle dynamics and safety system enhancements.

DRO & Impact Forces Of Automotive Wheel Market

The Automotive Wheel Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside broader impact forces that dictate its trajectory. Primary drivers include the robust global growth in vehicle production, especially in emerging economies, coupled with increasing consumer disposable incomes that fuel demand for both new vehicles and aftermarket upgrades. The escalating trend towards lightweighting in vehicles to improve fuel efficiency and reduce emissions, particularly with the proliferation of electric vehicles, strongly favors advanced and lighter wheel materials like aluminum alloys and carbon fiber. Furthermore, the growing consumer preference for aesthetic customization and larger wheel sizes continues to boost demand for premium and designer wheels, especially in the passenger car segment.

Conversely, the market faces several notable restraints. The volatility in raw material prices, particularly for aluminum and steel, directly impacts manufacturing costs and profit margins. Stringent environmental regulations, aimed at reducing the carbon footprint of manufacturing processes and promoting recyclability, impose additional compliance costs on manufacturers. High manufacturing costs associated with advanced materials and sophisticated production techniques for high-performance and specialty wheels can also limit their widespread adoption, especially in cost-sensitive markets. Additionally, global supply chain disruptions, as evidenced by recent geopolitical events and pandemics, can severely impact production schedules and material availability.

However, significant opportunities exist for market expansion and innovation. The rapid growth of the electric vehicle (EV) market presents a substantial opportunity for developing specialized wheels that cater to unique EV requirements, such as improved aerodynamics, noise reduction, and enhanced load-bearing capacity for heavy battery packs. Advancements in material science, including new composites and alloys, offer avenues for developing even lighter and stronger wheels. The aftermarket segment continues to be a fertile ground for growth, driven by consumer desire for personalization and performance enhancements. Moreover, the integration of smart technologies into wheels, such as embedded sensors for real-time data on tire pressure and road conditions, opens up new product categories and value propositions, aligning with the broader trend of connected vehicles and fostering sustainable manufacturing practices.

Segmentation Analysis

The Automotive Wheel Market is comprehensively segmented across various parameters, allowing for a detailed understanding of market dynamics, consumer preferences, and technological advancements. These segmentations provide a granular view of market demand, supply, and competitive landscapes, aiding manufacturers and stakeholders in strategic decision-making. The primary classifications include material type, vehicle type, rim size, end-use, manufacturing process, and distribution channel, each revealing distinct market characteristics and growth trajectories.

- By Material Type

- Aluminum Alloy Wheels: Dominant segment due to lightweight, aesthetics, and performance.

- Steel Wheels: Cost-effective, robust, primarily used in entry-level vehicles and commercial applications.

- Carbon Fiber Wheels: High-performance, ultra-lightweight, premium segment, typically for sports cars and luxury vehicles.

- Magnesium Alloy Wheels: Lighter than aluminum, used in high-performance and racing applications.

- Others: Includes composites and specialized alloys.

- By Vehicle Type

- Passenger Cars: Largest segment, driven by high production volumes and customization trends.

- Commercial Vehicles: Focus on durability, load capacity, and cost-efficiency.

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers: Motorcycles, scooters, and mopeds, with specific design and material requirements.

- Other Vehicles: Agricultural vehicles, off-road vehicles.

- By Rim Size

- 13-15 Inches: Smallest segment, typically for compact cars and economy models.

- 16-18 Inches: Mid-range, common for sedans and smaller SUVs, balancing comfort and aesthetics.

- 19-21 Inches: Premium segment, popular in larger SUVs, luxury cars, and sports vehicles.

- Above 21 Inches: High-end luxury and performance vehicles, increasing in popularity.

- By End-Use

- Original Equipment Manufacturer (OEM): Wheels supplied directly to vehicle assembly lines for new vehicles.

- Aftermarket: Wheels sold for replacement, customization, or performance upgrades post-vehicle purchase.

- By Manufacturing Process

- Cast Wheels: Most common, cost-effective, but heavier.

- Forged Wheels: Stronger, lighter, more expensive, used in high-performance applications.

- Flow Formed Wheels: Hybrid process, lighter and stronger than cast, less expensive than forged.

- Others: Includes processes like spin forging and additive manufacturing.

- By Distribution Channel

- Direct Sales to OEMs

- Aftermarket Retailers (Tire Shops, Automotive Parts Stores)

- Online Sales Channels

Value Chain Analysis For Automotive Wheel Market

The value chain for the automotive wheel market is an intricate network involving several stages, from raw material sourcing to the final distribution to end-users, highlighting the complex interdependencies within the industry. It begins with upstream analysis, focusing on the procurement of essential raw materials like aluminum ingots, steel coils, and carbon fiber resins, which are supplied by global mining companies, metal refiners, and chemical producers. These raw materials undergo initial processing before being supplied to wheel manufacturers. Key suppliers also include those providing specialized coatings, paints, and manufacturing equipment, all crucial for the production process.

The manufacturing stage involves various processes such as casting, forging, and flow forming, where raw materials are transformed into finished wheels. This segment includes major wheel manufacturers that invest heavily in research and development for new materials, designs, and production technologies. After manufacturing, wheels move to the downstream segment, primarily through two distinct distribution channels: direct sales to Original Equipment Manufacturers (OEMs) and sales to the aftermarket. Direct sales involve shipping wheels directly to automotive assembly plants worldwide, often under long-term supply contracts, where they are fitted onto new vehicles.

The indirect channel caters to the aftermarket, encompassing a broader network of distributors, wholesalers, retail tire and automotive parts stores, and online platforms. These channels provide replacement wheels, performance upgrades, and customization options directly to vehicle owners, repair shops, and automotive enthusiasts. Effective logistics and supply chain management are critical across both direct and indirect channels to ensure timely delivery, manage inventory, and respond to fluctuating market demands. The value chain also extends to after-sales services, including wheel balancing, alignment, and repair, often provided by tire shops and automotive service centers, completing the lifecycle of the automotive wheel within the market.

Automotive Wheel Market Potential Customers

The Automotive Wheel Market caters to a diverse range of potential customers, each with distinct requirements, purchasing behaviors, and motivations. The largest segment of end-users comprises Original Equipment Manufacturers (OEMs), which are the global automotive manufacturers such as Ford, General Motors, Toyota, Volkswagen, and BMW. These customers procure wheels in large volumes directly from manufacturers to integrate into their new vehicle assembly lines. Their purchasing decisions are primarily driven by factors such as cost-efficiency, consistent quality, adherence to strict performance and safety standards, supply chain reliability, and the ability to meet design specifications that align with their vehicle models and brand image.

Another significant customer segment includes individual vehicle owners who participate in the aftermarket. These buyers seek wheels for various reasons, including replacing damaged or worn-out wheels, upgrading to enhance vehicle performance, or customizing their vehicles for aesthetic appeal and personalization. This segment is highly influenced by trends, brand reputation, price, and the availability of diverse designs and materials. Aftermarket customers often purchase through retail tire shops, specialized automotive parts stores, and increasingly, through online e-commerce platforms, demonstrating a growing preference for convenience and broader selection.

Beyond individual consumers, fleet operators, including rental car companies, logistics firms, and public transport agencies, represent a crucial customer base. Their purchasing criteria prioritize durability, cost-effectiveness, and reliability to ensure minimal downtime and operational efficiency for their vehicle fleets. Furthermore, automotive enthusiasts and professional motorsport teams form a niche but significant customer group, demanding high-performance, lightweight, and often custom-engineered wheels that can withstand extreme conditions and deliver superior handling characteristics. This segment typically invests in premium materials like carbon fiber and forged alloys, valuing cutting-edge technology and performance above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 47.5 Billion |

| Market Forecast in 2032 | USD 70.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maxion Wheels, ENKEI CORPORATION, RONAL GROUP, Accuride Corporation, CITIC Dicastal Co. Ltd., Superior Industries International Inc., Topy Industries Limited, Borbet GmbH, OZ S.p.A., UNIWHEELS AG, Washi Beam, Alcoa Wheel and Transportation Products, Baoding Lizhong Wheel Co. Ltd., Rays Wheels Co. Ltd., Wheel Pros, American Racing Wheels, BBS Japan Co. Ltd., Fuchsfelge GmbH, MHT Luxury Wheels, Bravat |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Wheel Market Key Technology Landscape

The automotive wheel market is continually evolving with significant advancements in manufacturing technologies and material science, aiming to enhance performance, safety, and efficiency while reducing environmental impact. Key technologies are focused on achieving lighter weight without compromising strength and durability, improving aerodynamic properties, and integrating smart functionalities. Lightweighting technologies, such as advanced casting, flow forming, and forging, are paramount, allowing manufacturers to create wheels that reduce unsprung mass, thereby improving vehicle handling, fuel economy, and reducing emissions. These processes enable the creation of complex geometries and thinner cross-sections while maintaining structural integrity, which is critical for modern vehicle demands, especially in the context of electric vehicles where range optimization is crucial.

Material innovation is another cornerstone of the technology landscape. While aluminum alloy wheels dominate, there is increasing research and development into advanced composites like carbon fiber and magnesium alloys. Carbon fiber wheels offer superior strength-to-weight ratios, significantly reducing weight, though at a higher cost, primarily targeting premium and high-performance vehicle segments. Similarly, new generations of magnesium alloys are being explored for their excellent lightweight properties and damping capabilities. Furthermore, surface treatment and coating technologies are advancing to improve wheel durability, corrosion resistance, and aesthetic appeal, offering a wider range of finishes and protection against environmental elements and road hazards.

Beyond material and manufacturing processes, the integration of smart technologies is emerging as a significant trend. This includes the development of wheels with embedded sensors for real-time monitoring of tire pressure, temperature, and even road conditions. These "smart wheels" can transmit data to the vehicle's onboard systems, enhancing safety features like active braking and stability control, and providing predictive maintenance alerts. Aerodynamic wheel designs are also gaining traction, particularly in electric vehicles, where minimizing drag is crucial for extending battery range. Additive manufacturing, or 3D printing, is also being explored for rapid prototyping and producing highly customized or complex wheel components, signaling a future where personalization and innovative designs could become more accessible.

Regional Highlights

- North America: A mature market characterized by high demand for larger rim sizes, performance wheels, and aftermarket customization. The region is witnessing a steady shift towards lightweight aluminum alloys and a growing interest in sustainable manufacturing practices. The presence of major automotive manufacturers and a strong consumer base for SUVs and trucks drive consistent demand.

- Europe: This region emphasizes lightweighting and advanced materials driven by stringent emissions regulations and a preference for premium vehicles. Germany, France, and the UK are key markets, with a focus on high-performance wheels for luxury and sports car segments. The increasing adoption of electric vehicles further fuels demand for aerodynamic and specialized wheel designs.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily fueled by robust vehicle production in China, India, Japan, and South Korea. Rapid urbanization, rising disposable incomes, and increasing vehicle ownership contribute significantly to market expansion. The region is a hub for both OEM and aftermarket demand, with a rising inclination towards aluminum wheels.

- Latin America: An emerging market experiencing gradual growth, supported by increasing vehicle sales and economic recovery. Brazil and Mexico are leading countries, demonstrating rising demand for both steel and aluminum wheels, influenced by affordability and growing vehicle parc. Infrastructure development also plays a role in driving commercial vehicle wheel demand.

- Middle East and Africa (MEA): This region shows promising growth, driven by infrastructure investments, increasing automotive sales, and a growing luxury vehicle segment, particularly in the UAE and Saudi Arabia. Demand for robust wheels suitable for diverse terrain and high temperatures is prevalent, alongside a growing interest in aesthetic upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Wheel Market.- Maxion Wheels

- ENKEI CORPORATION

- RONAL GROUP

- Accuride Corporation

- CITIC Dicastal Co. Ltd.

- Superior Industries International Inc.

- Topy Industries Limited

- Borbet GmbH

- OZ S.p.A.

- UNIWHEELS AG

- Washi Beam

- Alcoa Wheel and Transportation Products

- Baoding Lizhong Wheel Co. Ltd.

- Rays Wheels Co. Ltd.

- Wheel Pros

- American Racing Wheels

- BBS Japan Co. Ltd.

- Fuchsfelge GmbH

- MHT Luxury Wheels

- Bravat

Frequently Asked Questions

What are the primary growth drivers for the Automotive Wheel Market?

The Automotive Wheel Market is primarily driven by increasing global vehicle production, rising disposable incomes leading to higher vehicle ownership, and a growing consumer demand for lightweight and aesthetically appealing wheels. The rapid expansion of the electric vehicle market and technological advancements in manufacturing processes also significantly contribute to market growth.

Which material type dominates the Automotive Wheel Market?

Aluminum alloy wheels currently dominate the Automotive Wheel Market. Their popularity stems from their excellent balance of lightweight properties, attractive aesthetics, good heat dissipation, and improved performance compared to traditional steel wheels. They are widely adopted across various vehicle segments, from passenger cars to luxury and performance vehicles.

How do electric vehicles (EVs) impact the Automotive Wheel Market?

Electric vehicles significantly impact the Automotive Wheel Market by driving demand for specialized wheel designs that enhance aerodynamics, reduce overall vehicle weight for extended range, and accommodate the heavier battery packs. EVs also promote innovation in quieter wheel structures and sustainable material usage.

Which region holds the largest share in the Automotive Wheel Market?

The Asia Pacific (APAC) region holds the largest market share in the Automotive Wheel Market. This dominance is attributed to high vehicle production volumes, rapid industrialization, increasing urbanization, and a growing middle class with rising disposable incomes across countries like China, India, and Japan.

What are the key technological advancements in automotive wheels?

Key technological advancements in automotive wheels include lightweighting techniques such as flow forming and forging, development of advanced materials like carbon fiber and magnesium alloys, integration of smart sensors for real-time monitoring, and aerodynamic designs. Additive manufacturing is also emerging for prototyping and custom wheel production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Wheel Balancing Weight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Wheel Weight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Hub Bearing (Automotive Wheel Bearing) Market Size Report By Type (Gen. 1 Bearing, Gen. 2 Bearing, Gen. 3 Bearing, Other Bearing), By Application (Passenger Vehicle, Commercial Vehicle), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automotive Wheel Bearing Aftersales Market Statistics 2025 Analysis By Application (Passenger Car, Commercial Car), By Type (Ball Bearing, Precision Ball Bearing, Roller Bearing, Tapered Roller Bearing), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Automotive Wheel Hubs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Steel Wheel Hub, Alloy Wheel Hub, Other), By Application (Passenger Cars, Commercial Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager