Benzoic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427179 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Benzoic Acid Market Size

The Benzoic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by the end of the forecast period in 2032. This growth trajectory is underpinned by consistent demand across diverse industrial applications, particularly within the food and beverage sector as a crucial preservative, and in the chemical industry for the synthesis of various derivatives. The market expansion reflects a global trend towards enhanced food safety standards, increased consumption of processed foods, and the continuous innovation in material sciences where benzoic acid serves as a fundamental building block.

Benzoic Acid Market introduction

Benzoic acid, chemically represented as C6H5COOH, is a fundamental aromatic carboxylic acid renowned for its versatile industrial applications and natural occurrence in numerous plants such as cranberries, prunes, and cinnamon. Its widespread use stems from its effective antimicrobial properties, making it an indispensable compound in various sectors. Historically, its synthesis and application have evolved significantly, transitioning from traditional extraction methods to highly efficient industrial production processes, primarily through the liquid-phase oxidation of toluene. This chemical is typically presented as a white, crystalline solid with a characteristic, slightly pungent odor, and is sparingly soluble in water but more readily soluble in organic solvents. Its molecular structure provides a stable platform for a range of chemical reactions, underpinning its utility as a key intermediate.

The primary applications of benzoic acid span across the food and beverage industry, pharmaceuticals, personal care products, and chemical manufacturing. As a food preservative, it is widely recognized by its E-numbers (E210, E211, E212, E213) for benzoic acid and its salts, effectively inhibiting the growth of yeasts, molds, and some bacteria, particularly in acidic foods and drinks like fruit juices, soft drinks, pickled vegetables, and sauces. Its efficacy in preventing spoilage extends the shelf life of products, thereby reducing waste and ensuring consumer safety. Beyond preservation, benzoic acid acts as a crucial chemical intermediate in the production of various esters, plasticizers (like phthalates, though benzoic acid derived plasticizers are becoming more prevalent due to regulatory shifts), and benzoyl chloride, which further contribute to diverse downstream products including dyes, resins, and perfumes.

The market for benzoic acid is significantly driven by several key factors. The escalating global demand for packaged and processed foods, propelled by urbanization and changing dietary habits, directly fuels the need for effective preservatives. Simultaneously, stringent food safety regulations imposed by various governments and international bodies mandate the use of approved antimicrobial agents, benefiting benzoic acid’s market position. Furthermore, the growth of the pharmaceutical industry, where benzoic acid and its derivatives are utilized in topical medications for fungal skin infections, and the expanding personal care sector incorporating it into cosmetics and toiletries, contribute substantially to market growth. The increasing adoption of benzoic acid as a precursor in the production of engineering plastics and synthetic fibers also underscores its growing industrial importance, offering a broad spectrum of benefits from antimicrobial efficacy to chemical versatility.

Benzoic Acid Market Executive Summary

The Benzoic Acid Market is currently experiencing robust growth, primarily propelled by its extensive utility as a preservative in the food and beverage industry and its crucial role as a chemical intermediate. Business trends indicate a strong focus on optimizing production processes, driven by rising raw material costs and the need for greater efficiency. Manufacturers are increasingly investing in advanced catalytic technologies and sustainable production methods to enhance yield and reduce environmental impact. Strategic collaborations and partnerships between raw material suppliers and benzoic acid producers are becoming more prevalent, aimed at securing supply chains and fostering innovation in product development. Furthermore, there is a discernible shift towards the development and adoption of bio-based benzoic acid alternatives, driven by increasing consumer preference for natural ingredients and tightening environmental regulations, which presents both opportunities and challenges for established players.

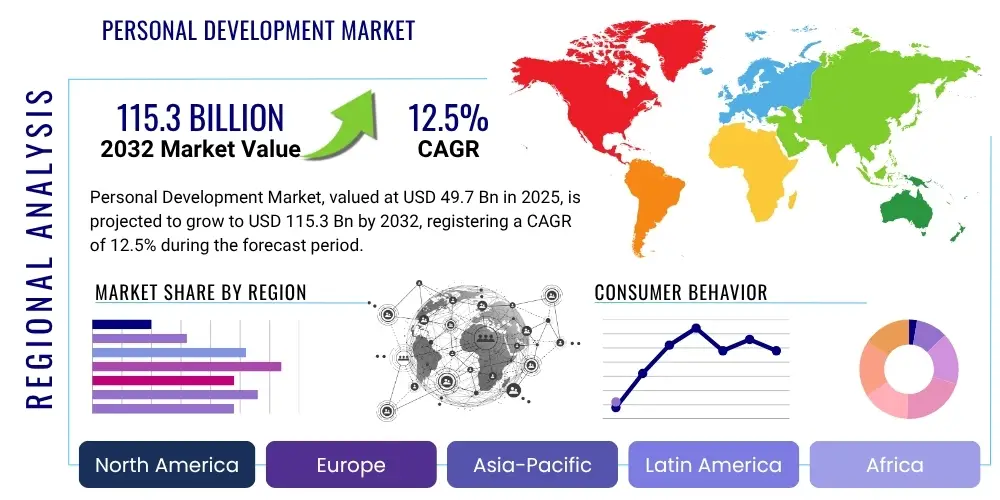

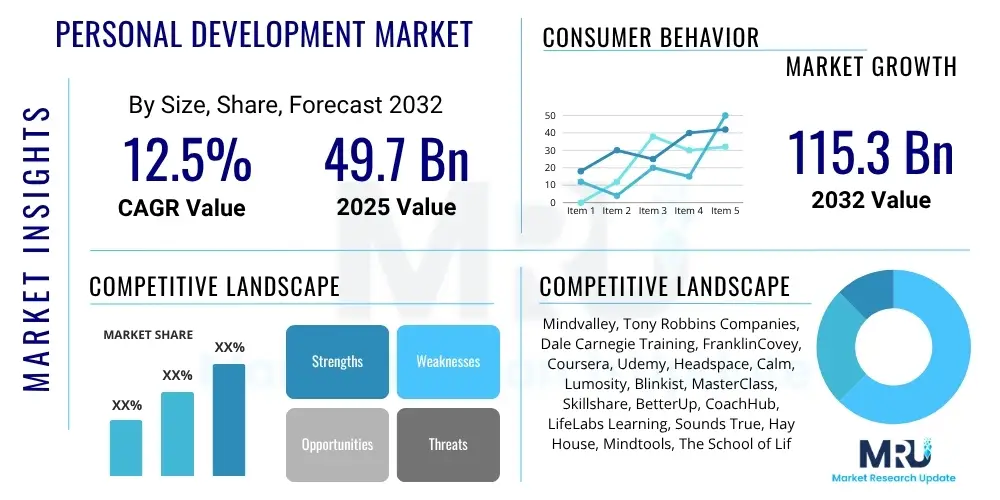

Regional dynamics play a significant role in shaping the benzoic acid market landscape. Asia-Pacific, particularly emerging economies like China and India, dominates the market share due to rapid industrialization, burgeoning food processing sectors, and increasing pharmaceutical manufacturing activities. The regions large consumer base and growing disposable incomes are driving demand for packaged foods, directly translating into higher consumption of benzoic acid. North America and Europe represent mature markets characterized by stable demand, stringent regulatory frameworks concerning food additives and chemical safety, and a strong emphasis on high-quality and high-purity grades for pharmaceutical and personal care applications. These regions are also at the forefront of adopting sustainable practices and developing advanced production technologies, influencing global market standards and innovation. Emerging markets in Latin America and the Middle East & Africa are showing promising growth, fueled by urbanization, improving economic conditions, and expanding manufacturing capabilities, though they are often reliant on imports.

Segmentation trends within the benzoic acid market highlight the continued dominance of the food and beverage segment, which accounts for the largest share due to its indispensable preservative function. However, the chemical intermediate segment is experiencing substantial growth, particularly in the production of plasticizers for PVC, alkyd resins, and various esters used in fragrances and dyes. The pharmaceutical segment also demonstrates steady growth, driven by the expanding healthcare industry and the application of benzoic acid derivatives in medicinal formulations. Purity level segmentation shows increasing demand for higher purity grades for sensitive applications in pharmaceuticals and specialized chemical synthesis, reflecting a broader industry trend towards quality and application-specific product customization. These segment-specific trends collectively underscore the diversified demand drivers and the multifaceted nature of the benzoic acid market, where various end-use industries contribute to its overall resilience and expansion.

AI Impact Analysis on Benzoic Acid Market

The influence of Artificial Intelligence (AI) on the benzoic acid market is poised to be transformative, fundamentally reshaping various facets from raw material procurement to end-product distribution. Common user inquiries often revolve around AI’s capacity to optimize complex chemical synthesis processes, enhance supply chain resilience, and accelerate the discovery of novel applications or more sustainable production routes. Users are particularly keen to understand how AI algorithms can predict market demand fluctuations more accurately, thereby reducing inventory costs and minimizing waste. Furthermore, there is significant interest in AIs role in improving quality control and ensuring regulatory compliance, especially given the stringent standards in the food and pharmaceutical industries where benzoic acid is widely utilized. The overarching expectation is that AI will drive efficiency, cost reduction, and innovation across the entire value chain, making production more agile and responsive to market dynamics.

AIs impact extends significantly to the operational efficiency of benzoic acid manufacturing. Through advanced predictive analytics, AI can optimize reaction conditions, monitor equipment health to prevent costly downtimes, and manage energy consumption more effectively, leading to substantial reductions in operational expenditures. Machine learning models can analyze vast datasets from production lines, identifying subtle patterns and correlations that human analysis might miss, thereby enabling continuous process improvement and higher yields. This level of optimization is crucial in an industry where margins can be tight and the consistency of product quality is paramount. The ability to predict potential bottlenecks or quality deviations before they occur allows manufacturers to implement proactive measures, ensuring a more stable and efficient production flow.

- AI-driven process optimization enhances production efficiency and yield.

- Predictive maintenance for manufacturing equipment reduces downtime and operational costs.

- AI-powered supply chain management improves raw material sourcing and logistics.

- Accelerated R&D through AI simulations for new formulations and applications.

- Enhanced quality control and defect detection using computer vision and machine learning.

- Improved market intelligence and demand forecasting for strategic planning.

- Development of sustainable production methods, including bio-catalysis, with AI guidance.

DRO & Impact Forces Of Benzoic Acid Market

The Benzoic Acid Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside various impact forces that shape its trajectory. A significant driver is the continuously expanding global food and beverage industry, where benzoic acid and its derivatives are indispensable as preservatives. The rising demand for processed and packaged foods, driven by urbanization and changing consumer lifestyles, directly translates into increased consumption of benzoic acid to ensure product safety and extend shelf life. Concurrently, the growth of the pharmaceutical and personal care sectors further bolsters demand, as benzoic acid is utilized in a range of topical medications, cosmetics, and toiletries for its antimicrobial properties. Furthermore, its role as a crucial chemical intermediate in the production of various industrial chemicals, including plasticizers for PVC, alkyd resins, and dyes, contributes substantially to its market expansion, linking its demand to the broader chemical manufacturing sectors growth.

Despite these strong drivers, the benzoic acid market faces several notable restraints. The most prominent restraint is the volatility in the prices of key raw materials, particularly toluene, which is the primary feedstock for industrial benzoic acid production. Fluctuations in crude oil prices directly impact toluene costs, leading to unpredictable production expenses and potential profit margin erosions for manufacturers. Another significant challenge arises from stringent regulatory frameworks and public perception regarding synthetic food additives. While benzoic acid is generally recognized as safe (GRAS) by regulatory bodies, increasing consumer preference for "clean label" products and natural preservatives can pose a threat, prompting research into alternative solutions. Moreover, intense competition from other preservative agents, both synthetic and natural, such as sorbates, propionates, and parabens, constantly pressures benzoic acid manufacturers to maintain competitive pricing and demonstrate superior efficacy.

However, substantial opportunities exist within the market that could mitigate these restraints and propel future growth. The escalating demand for bio-based benzoic acid, derived from renewable resources, presents a significant avenue for innovation and market differentiation, aligning with global sustainability goals and consumer preferences for natural products. Advancements in biotechnology and green chemistry offer the potential for more environmentally friendly and cost-effective production methods, reducing reliance on petrochemical feedstocks. Furthermore, the expansion into emerging economies, particularly in Asia-Pacific, Latin America, and Africa, where industrialization and food processing sectors are rapidly growing, provides fertile ground for market penetration and increased sales. Technological innovations aimed at improving the efficiency and purity of benzoic acid production, alongside the discovery of new applications in advanced materials and niche chemical synthesis, also represent promising opportunities for market players to capture value and diversify their portfolios. The evolving regulatory landscape, while a restraint in some aspects, also presents opportunities for manufacturers who can adapt quickly and develop products that meet increasingly stringent safety and environmental standards, thereby gaining a competitive edge.

Segmentation Analysis

The Benzoic Acid Market is comprehensively segmented to reflect the diverse applications and end-use requirements of this versatile chemical compound. This segmentation typically categorizes the market based on application, purity level, and end-use industry, providing a granular view of demand drivers and market dynamics across various sectors. The application segment delineates its primary uses, ranging from its well-known role as a preservative to its critical function as a chemical intermediate. Purity level segmentation highlights the different grades of benzoic acid, each tailored to specific industrial, food, or pharmaceutical standards. The end-use industry segment focuses on the ultimate sectors consuming benzoic acid, offering insights into the broader industrial landscape influencing its demand and consumption patterns. Understanding these segments is crucial for market participants to identify key growth areas, customize product offerings, and devise targeted marketing and distribution strategies, ensuring alignment with specific industry needs and regulatory requirements.

- By Application:

- Food & Beverage Preservative: Used in carbonated drinks, fruit juices, jams, pickles, and sauces to inhibit microbial growth.

- Chemical Intermediate: Essential in the production of plasticizers (e.g., benzoate esters), alkyd resins, benzoyl chloride, and phenol.

- Pharmaceuticals: Incorporated in topical antifungal preparations, as a solubilizer, and in certain cough syrups.

- Personal Care & Cosmetics: Employed as a preservative in lotions, creams, shampoos, and oral care products.

- Others: Includes applications in agricultural chemicals, dyes, and as a corrosion inhibitor.

- By Purity Level:

- Technical Grade: Used primarily in industrial applications where high purity is not strictly essential.

- Food Grade: Meets specific purity standards for use as a food additive and preservative.

- Pharmaceutical Grade: Adheres to stringent pharmacopoeial standards for medicinal applications.

- By End-Use Industry:

- Food & Beverage Industry: Largest consumer, driven by processed food and drink production.

- Chemical Industry: Utilizes benzoic acid for synthesizing various derivatives and polymers.

- Healthcare Industry: Incorporates benzoic acid in drug formulations and medical products.

- Cosmetics & Personal Care Industry: Uses it as a preservative and fragrance component.

- Plastics Industry: Employs benzoic acid derivatives as plasticizers and polymerization inhibitors.

- Agriculture Industry: Niche applications in fungicides and herbicides.

Benzoic Acid Market Value Chain Analysis

The value chain for the Benzoic Acid Market is intricate, beginning with the sourcing of raw materials and extending through several stages of manufacturing, distribution, and consumption by end-use industries. The upstream segment primarily involves the procurement of key feedstocks, with toluene being the predominant raw material, typically sourced from petrochemical refineries. Other essential inputs include oxygen, often obtained through air separation, and various catalysts crucial for the oxidation process. The efficiency and cost-effectiveness of this upstream supply directly influence the overall production cost of benzoic acid. Suppliers of these raw materials, therefore, hold significant influence over the markets pricing dynamics and operational stability. Managing relationships with these suppliers and securing long-term contracts are critical for manufacturers to ensure a consistent and cost-effective supply, mitigating risks associated with price volatility and availability.

The core of the value chain lies in the manufacturing and processing stage, where toluene undergoes liquid-phase oxidation to produce benzoic acid. This stage involves complex chemical engineering processes, often requiring substantial capital investment in plant infrastructure and specialized equipment. Key players in this segment focus on optimizing reaction conditions, enhancing catalyst efficiency, and implementing advanced purification techniques to achieve the desired purity levels, particularly for food and pharmaceutical grades. Technological advancements aimed at improving yield, reducing energy consumption, and minimizing waste are central to competitive advantage. After synthesis, the benzoic acid is processed into various forms—flakes, granules, or powder—depending on the end-use application, and is then packaged for distribution to different markets.

The downstream analysis of the benzoic acid market value chain encompasses its distribution and sales channels, leading to its ultimate consumption by a diverse range of end-use industries. Distribution channels can be broadly categorized into direct and indirect sales. Direct sales involve manufacturers selling directly to large-scale industrial customers, such as major food processing companies, pharmaceutical giants, or large chemical producers, often through long-term supply agreements. This approach allows for closer customer relationships, tailored supply solutions, and potentially higher profit margins. Indirect sales, conversely, involve leveraging a network of distributors, agents, and traders who specialize in serving smaller manufacturers or niche markets. These intermediaries provide logistical support, local market expertise, and warehousing facilities, effectively extending the reach of benzoic acid producers to a broader customer base. The choice between direct and indirect channels often depends on market size, customer segment, geographical reach, and the strategic objectives of the benzoic acid manufacturer, with many adopting a hybrid approach to maximize market penetration and efficiency. The end-users, including the food & beverage, pharmaceutical, personal care, and chemical industries, then integrate benzoic acid into their final products, marking the completion of its journey through the value chain.

Benzoic Acid Market Potential Customers

The potential customers for benzoic acid are incredibly diverse, reflecting the compounds multifaceted applications across various industries. Foremost among these are the vast number of food and beverage manufacturers, who rely heavily on benzoic acid and its salts (sodium benzoate, potassium benzoate) as crucial preservatives. Companies producing carbonated soft drinks, fruit juices, jams, jellies, pickles, sauces, and various processed foods represent a substantial and consistent demand base. Their need for effective antimicrobial agents to extend shelf life, maintain product integrity, and ensure consumer safety positions them as primary buyers. The continuous growth of the global processed food industry, driven by urbanization and convenience-seeking consumers, ensures a robust and expanding customer segment within this sector. These manufacturers often purchase benzoic acid in large volumes, necessitating reliable supply chains and consistent product quality.

Beyond the food sector, pharmaceutical companies constitute another significant customer segment. Benzoic acid and its derivatives are incorporated into various medicinal formulations, particularly in topical preparations for fungal skin infections and as a component in certain cough syrups and antiseptic solutions. The stringent regulatory requirements and high-purity standards demanded by the pharmaceutical industry mean that suppliers must adhere to pharmacopoeial specifications. Similarly, manufacturers within the personal care and cosmetics industry are important buyers, utilizing benzoic acid as a preservative in a wide array of products, including lotions, creams, shampoos, conditioners, and oral hygiene products, to prevent microbial contamination and enhance product stability. The brand reputation and consumer trust in these industries are highly dependent on the safety and efficacy of ingredients, making consistent quality paramount for benzoic acid suppliers.

Furthermore, the broader chemical industry represents a critical segment of potential customers, leveraging benzoic acid as a versatile chemical intermediate. Companies involved in the production of plasticizers, such as benzoate esters, which are used to enhance the flexibility and durability of PVC and other polymers, are major consumers. Manufacturers of alkyd resins, essential components in paints, coatings, and varnishes, also depend on benzoic acid. Additionally, the compound is a precursor for the synthesis of benzoyl chloride, a key reagent in organic synthesis for producing peroxides, dyes, and other fine chemicals. Niche applications extend to the agricultural sector, where it is used in certain fungicides, and in the manufacturing of specialty chemicals. Each of these industrial buyers presents unique requirements in terms of volume, purity, and technical support, demanding a tailored approach from benzoic acid suppliers to meet their specific operational and product development needs effectively.

Benzoic Acid Market Key Technology Landscape

The key technology landscape for the Benzoic Acid Market is dominated by established industrial processes, primarily centered on the efficient synthesis of the compound from petrochemical feedstocks, while simultaneously witnessing emerging innovations in green chemistry and biotechnology. The most prevalent industrial method for benzoic acid production is the liquid-phase oxidation of toluene. This process involves the reaction of toluene with air or oxygen, typically in the presence of a cobalt or manganese salt catalyst, under elevated temperature and pressure. The technological maturity of this method, coupled with its cost-effectiveness and scalability, makes it the cornerstone of global benzoic acid production. Manufacturers continuously invest in optimizing these processes through improvements in reactor design, catalyst formulations, and separation techniques to maximize yield, enhance purity, and reduce energy consumption. These technological refinements aim to achieve higher conversion rates and lower operational costs, maintaining competitiveness in a price-sensitive market.

Beyond the conventional toluene oxidation, advancements in catalytic processes and purification technologies are continuously being developed to address specific market demands and regulatory pressures. For instance, research is focused on developing more selective and robust catalysts that can operate under milder conditions, leading to reduced energy input and fewer by-products. Innovations in purification, such as advanced crystallization techniques, membrane separation, and ion exchange, are crucial for achieving the high purity levels required for pharmaceutical and food-grade benzoic acid. These technologies ensure that the final product meets stringent quality standards and is free from impurities that could impact its efficacy or safety. Furthermore, process intensification strategies, which aim to make chemical processes smaller, safer, more energy-efficient, and capable of higher throughput, are being explored to further optimize benzoic acid manufacturing operations, reducing both capital and operating expenses.

An emerging and increasingly significant aspect of the technology landscape is the exploration and development of bio-based and sustainable production methods. With growing environmental consciousness and the push for renewable resources, research into bio-catalysis and fermentation routes for benzoic acid synthesis is gaining momentum. This involves using microorganisms or enzymes to convert renewable feedstocks, such as glucose or lignin-derived compounds, into benzoic acid. While these technologies are currently in various stages of development and often face challenges in terms of scalability and cost-competitiveness compared to conventional methods, they represent a long-term opportunity for a more sustainable production pathway. As consumer preferences shift towards natural ingredients and regulatory frameworks become more stringent regarding petrochemical reliance, these green chemistry approaches are expected to play an increasingly vital role, driving future technological innovation and market differentiation within the benzoic acid industry. The ability to integrate these novel technologies with existing infrastructure or develop entirely new green production facilities will be a key competitive differentiator for future market leaders.

Regional Highlights

- Asia-Pacific: This region stands as the largest and fastest-growing market for benzoic acid, driven primarily by rapid industrialization, burgeoning population growth, and increasing disposable incomes. Countries like China and India are at the forefront, witnessing substantial expansion in their food and beverage processing, pharmaceutical manufacturing, and chemical industries. The rising demand for packaged foods, coupled with less stringent environmental regulations compared to Western markets, has fueled the establishment of numerous benzoic acid production facilities and a high consumption rate. Continuous economic growth and foreign investments further solidify Asia-Pacifics dominant position.

- North America: A mature market characterized by stable demand for benzoic acid, largely attributable to its well-established food processing, pharmaceutical, and personal care sectors. Stringent food safety regulations imposed by bodies like the FDA ensure consistent demand for high-quality, approved preservatives. The region also emphasizes advanced manufacturing technologies and sustainable practices, leading to a focus on efficient production and premium-grade benzoic acid, particularly for medicinal and high-end cosmetic applications.

- Europe: This region holds a significant market share, driven by a strong focus on innovation, high-quality standards, and sustainable production within its chemical, pharmaceutical, and food industries. European regulations, such as those from the European Food Safety Authority (EFSA), are among the most rigorous globally, ensuring that benzoic acid used in food applications adheres to strict purity and safety criteria. There is a growing trend towards bio-based alternatives and green chemistry approaches in the production of benzoic acid and its derivatives.

- South America: An emerging market for benzoic acid, experiencing steady growth due to urbanization, expanding food and beverage industries, and increasing investments in chemical manufacturing, particularly in countries like Brazil and Argentina. While still reliant on imports for a significant portion of its benzoic acid supply, local production capabilities are gradually developing to meet growing domestic demand. Economic stability and regional trade agreements are key factors influencing market expansion.

- Middle East & Africa (MEA): This developing market is witnessing increasing demand for benzoic acid, primarily fueled by investments in the food processing, personal care, and pharmaceutical sectors. Economic diversification initiatives in the Gulf Cooperation Council (GCC) countries and improving infrastructure across various African nations are contributing to market growth. However, the region remains largely dependent on imports, with local manufacturing capabilities still in nascent stages, offering future growth opportunities for international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benzoic Acid Market.- Emerald Kalama Chemical (A LANXESS Company)

- Novaphene

- Puyang Guangming Chemicals Co. Ltd.

- Shandong Xinhua Pharmaceutical Co. Ltd.

- Tengzhou Tenglong Chemical Co. Ltd.

- Wuxi Dongbang Chemical Science and Technology Co. Ltd.

- Huantai Jinhe Chemical Co. Ltd.

- Shandong Shouguang Luqing Chemical Co. Ltd.

- Tianjin Dongda Chemical Co. Ltd.

- Gujarat Alkalies and Chemicals Limited (GACL)

- Changzhou Xiaqing Chemical Co. Ltd.

- Foodchem International Corporation

Frequently Asked Questions

What is benzoic acid primarily used for?

Benzoic acid is primarily used as a food preservative to inhibit the growth of mold, yeast, and bacteria, extending the shelf life of various products like soft drinks, fruit juices, and pickled foods. It also serves as a crucial chemical intermediate in manufacturing plasticizers, pharmaceuticals, and personal care products.

Is benzoic acid safe as a food additive?

Yes, benzoic acid and its salts are generally recognized as safe (GRAS) by major food safety authorities, including the FDA and EFSA, when used within approved limits. Its safety is well-established through extensive research and long-term use as an antimicrobial agent in food and beverages.

What are the main raw materials for benzoic acid production?

The primary raw material for industrial benzoic acid production is toluene, which is derived from petrochemical processes. Oxygen (from air) and specific metal salt catalysts, typically cobalt or manganese salts, are also essential inputs for the liquid-phase oxidation reaction.

Which region dominates the benzoic acid market?

Asia-Pacific currently dominates the benzoic acid market. This leadership is driven by rapid industrialization, significant growth in the food and beverage sector, expanding chemical industries, and increasing consumer demand for processed goods in countries like China and India.

What are the emerging trends in the benzoic acid market?

Emerging trends include the increasing demand for bio-based benzoic acid from renewable sources, advancements in sustainable and green chemistry production methods, and the growing adoption of AI and automation for process optimization, supply chain management, and quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dichlorobenzoic Acid Isomers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- P-hydroxybenzoic Acid Market Size Report By Type (Industrial Grade, LCP Grade), By Application (Cosmetics, Pharmaceutical, Liquid Crystal Polymer, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- 2-Chloro-5-iodobenzoic Acid Market Statistics 2025 Analysis By Application (Laboratory Research and Development, Chemical Synthesis, Pharmaceutical Synthesis), By Type (0.97, >97.0%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Benzoic Acid (CAS 65-85-0) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Food Grade Benzoic Acid, Pharma Grade Benzoic Acid, Industrial Grade Benzoic Acid), By Application (Personal Care & Cosmetics, Food & Beverages, Pharmaceuticals, Plastics, Paints, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager