DC-DC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427999 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

DC-DC Converter Market Size

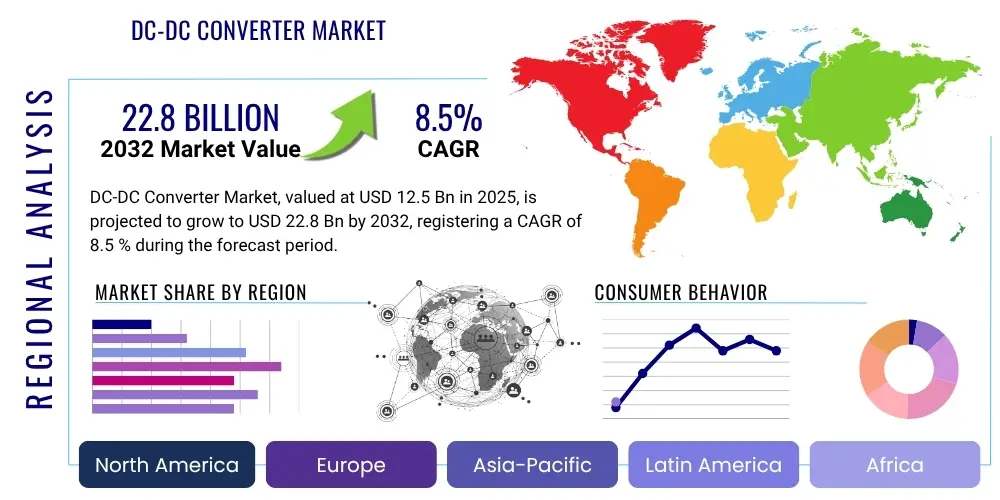

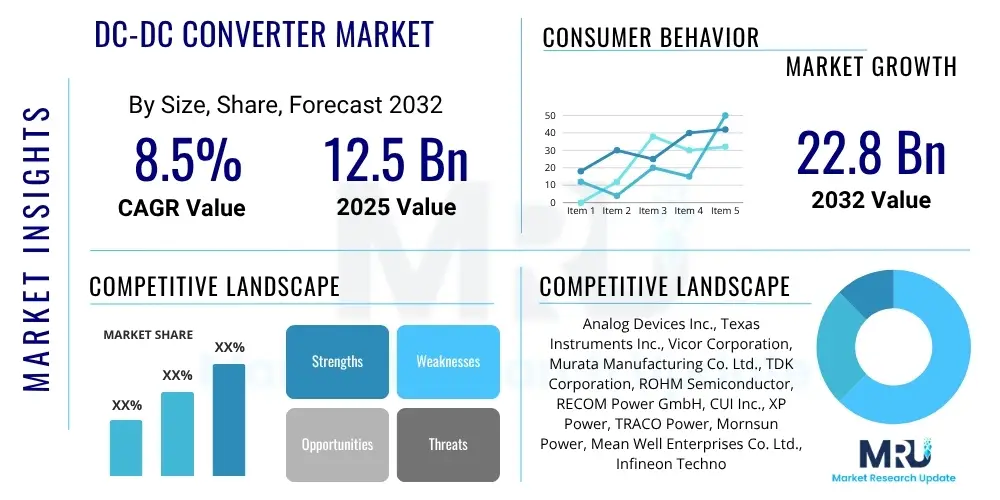

The DC-DC Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 22.8 Billion by the end of the forecast period in 2032.

DC-DC Converter Market introduction

The DC-DC converter market is a critical segment within the broader power electronics industry, specializing in devices that transform one direct current (DC) voltage level to another. These converters are indispensable in virtually every electronic system, facilitating the efficient and reliable delivery of power from a source to a load. Their fundamental role involves regulating and conditioning power, ensuring that sensitive electronic components receive the precise voltage and current required for optimal operation, thereby preventing damage and maximizing performance. The increasing complexity and diversity of electronic devices across various sectors have consistently driven the demand for more advanced and efficient DC-DC conversion solutions.

The product range encompasses various topologies, including isolated converters such as flyback, forward, and full-bridge, which provide galvanic isolation between input and output, and non-isolated converters like buck, boost, and buck-boost, which offer simpler designs and higher efficiency for specific voltage conversion needs. Major applications span a vast array of industries, from consumer electronics like smartphones and laptops to demanding sectors such as automotive, industrial automation, telecommunications, medical devices, and renewable energy systems. In automotive applications, they are vital for electric vehicle battery management and auxiliary systems, while in industrial settings, they power sensors, actuators, and control systems requiring robust and stable power supplies.

The primary benefits of DC-DC converters include enhanced energy efficiency, which is crucial for prolonging battery life in portable devices and reducing overall power consumption in larger systems, leading to significant operational cost savings. They also provide voltage stabilization, ensuring consistent performance regardless of fluctuations in the input power source, and enable miniaturization of electronic devices by offering compact power solutions. Key driving factors propelling market growth include the global push towards electrification, particularly in the automotive sector with the proliferation of electric and hybrid vehicles; the accelerating adoption of renewable energy sources such as solar and wind power, which require efficient power conditioning; the rapid expansion of IoT devices and smart infrastructure; and the continuous demand for smaller, more powerful, and energy-efficient electronic devices across all end-user segments.

DC-DC Converter Market Executive Summary

The DC-DC Converter Market is experiencing dynamic growth, characterized by significant business trends focused on innovation, consolidation, and strategic partnerships. Companies are heavily investing in research and development to introduce next-generation converter technologies, notably those incorporating wide bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC). These materials are instrumental in achieving higher power densities, greater efficiency, and smaller form factors, addressing the critical needs of evolving applications. Furthermore, there is a clear trend towards modular and integrated power solutions, simplifying design processes for OEMs and reducing time-to-market. The competitive landscape is also seeing mergers and acquisitions as market players seek to expand their technological portfolios, market share, and geographic reach, enhancing their capabilities to cater to diverse and demanding application requirements.

Regionally, the market exhibits varied growth trajectories and demand patterns. The Asia Pacific (APAC) region continues to dominate the DC-DC converter market, primarily driven by its robust manufacturing base for consumer electronics, automotive components, and telecommunications equipment, alongside rapid industrialization and significant investments in renewable energy infrastructure. North America is a hub for innovation, particularly in high-power applications for data centers, electric vehicles, and aerospace and defense sectors, with a strong emphasis on advanced power management solutions. Europe demonstrates steady growth, fueled by stringent energy efficiency regulations, the growth of industrial automation, and expanding renewable energy installations, fostering demand for high-performance and reliable converters. Latin America, the Middle East, and Africa are emerging markets, showing increasing adoption driven by infrastructure development, rising industrial activity, and growing demand for telecommunications and renewable energy solutions, offering new avenues for market expansion.

In terms of segmentation trends, the automotive sector stands out as a primary growth driver, with the escalating production of electric and hybrid vehicles necessitating advanced DC-DC converters for battery management systems, infotainment, and various auxiliary functions. The industrial segment is also witnessing substantial expansion, propelled by the increasing automation of manufacturing processes, the deployment of robotics, and the need for robust power solutions in harsh environments. Simultaneously, the telecommunications sector continues its strong demand for DC-DC converters to support the rollout of 5G infrastructure and data centers, emphasizing high efficiency and power density. While consumer electronics remain a significant market, growth here is steadier, driven by continuous innovation in portable devices requiring ever smaller and more efficient power solutions. The medical and renewable energy sectors are showing accelerated adoption, demanding highly reliable and efficient converters for critical applications and grid integration, respectively.

AI Impact Analysis on DC-DC Converter Market

The integration of Artificial Intelligence (AI) is poised to significantly transform the DC-DC Converter market, addressing user questions centered on optimizing design, enhancing performance, and improving reliability. Common inquiries revolve around how AI can facilitate more efficient power management, enable predictive maintenance for critical converter applications, and support the increasingly complex power demands of AI-driven hardware itself. Users are keenly interested in leveraging AI to move beyond traditional design limitations, seeking solutions that offer greater adaptability, intelligence, and robustness in diverse operating conditions. The collective expectation is that AI will usher in a new era of smart power conversion, where systems can self-optimize, anticipate failures, and seamlessly integrate into intelligent grids and autonomous systems, fundamentally altering how power is delivered and managed.

AI's influence extends across the entire lifecycle of DC-DC converters, from initial design and simulation to real-time operation and maintenance. In the design phase, AI algorithms can rapidly explore vast design spaces, optimizing topologies, component selection, and control strategies for specific performance metrics such as efficiency, power density, and thermal management, far surpassing human capabilities. This leads to faster development cycles and the creation of highly specialized converters tailored for nuanced application requirements. During operation, AI-powered control systems can dynamically adjust converter parameters in response to varying load conditions, input voltage fluctuations, and ambient temperatures, maintaining peak efficiency and stability, which is crucial for critical applications like data centers and electric vehicles. Moreover, AI enables predictive analytics by processing operational data to identify potential anomalies and anticipate component failures, shifting from reactive repairs to proactive maintenance schedules.

The impact of AI also directly addresses the burgeoning demand for power solutions within AI hardware itself, such as specialized processors for machine learning and neural networks that require highly stable and precise power delivery. AI-driven power management units can intelligently allocate power, optimize voltage rails, and manage thermal loads for these high-performance computing systems, ensuring their sustained operation and longevity. Furthermore, AI contributes to the development of self-diagnosing and self-healing power systems, where converters can detect faults, isolate issues, and even reconfigure themselves to maintain functionality. This enhances the overall resilience and reliability of power infrastructure, making it more robust against unforeseen operational challenges and contributing to a paradigm shift towards truly intelligent and autonomous power management. This symbiotic relationship, where AI optimizes converters and converters power AI, signifies a profound and lasting transformation.

- AI-driven design optimization for higher efficiency, reduced size, and lower cost through advanced simulation and material selection.

- Predictive maintenance capabilities, enabling early detection of potential failures and proactive servicing for enhanced system reliability and uptime.

- Enhanced power management for AI accelerators and data centers, providing precise, stable, and dynamic power delivery for high-performance computing.

- Adaptive control algorithms that allow converters to dynamically adjust operating parameters for optimal performance under varying load and environmental conditions.

- Integration into smart grids and energy harvesting systems, facilitating intelligent power distribution and maximizing energy utilization.

- Advanced fault detection and isolation in complex power systems, minimizing downtime and improving system resilience.

- Automation of testing and quality control processes, leading to faster validation and higher manufacturing consistency.

- Improved thermal management strategies through AI modeling and real-time adjustment, preventing overheating and extending component lifespan.

- Development of next-generation intelligent power modules that incorporate onboard AI for autonomous operation and self-optimization.

- Optimization of energy conversion in renewable energy systems, improving the efficiency of solar inverters and wind turbine converters.

- Personalized power delivery in consumer electronics, adapting to user behavior for extended battery life and improved device performance.

- Real-time anomaly detection in industrial automation and robotic systems, ensuring consistent and safe operation.

- Enhanced cybersecurity for power management units, as AI can monitor for unusual patterns indicative of malicious activity.

DRO & Impact Forces Of DC-DC Converter Market

The DC-DC Converter Market is significantly influenced by a robust set of drivers, primarily centered around the global imperatives for energy efficiency, miniaturization, and advanced technological integration. The rapid electrification of the automotive industry, particularly the surge in demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), acts as a powerful catalyst, as these vehicles extensively rely on high-performance DC-DC converters for battery management, charging systems, and various onboard electronics. Concurrently, the increasing worldwide adoption of renewable energy sources such as solar photovoltaics and wind power necessitates efficient DC-DC converters for maximum power point tracking (MPPT) and seamless grid integration. The pervasive expansion of the Internet of Things (IoT) ecosystem, coupled with the miniaturization trend in consumer electronics and portable devices, further fuels market growth by demanding compact, highly efficient, and reliable power solutions. Additionally, the growing focus on reducing energy consumption across industrial and commercial sectors, driven by environmental regulations and economic benefits, mandates the deployment of advanced DC-DC converters that can deliver superior power conversion efficiency.

Despite the strong growth drivers, the DC-DC converter market faces notable restraints that can impede its expansion. One significant challenge is the high cost associated with advanced materials like Gallium Nitride (GaN) and Silicon Carbide (SiC), which, while offering superior performance in terms of efficiency and power density, come with a premium price tag that can deter widespread adoption in cost-sensitive applications. The inherent design complexity of high-frequency and high-power density converters also poses a restraint, requiring specialized engineering expertise and extensive R&D investments, which can be a barrier for smaller players. Furthermore, effectively managing thermal dissipation in increasingly compact and high-power devices remains a critical technical hurdle, as inadequate thermal management can lead to reduced reliability and shorter operational lifespans. The intensely competitive market landscape, characterized by numerous established players and emerging innovators, also contributes to pricing pressures and limits profit margins for manufacturers, compelling continuous innovation to maintain market relevance.

The market is also ripe with opportunities stemming from emerging technological frontiers and expanding application areas. The global rollout of 5G infrastructure presents a substantial opportunity, as telecom equipment for 5G networks requires highly efficient and compact power solutions to support increased data rates and network density. The escalating demand for high-performance computing, particularly for Artificial Intelligence (AI) and Machine Learning (ML) hardware in data centers, opens avenues for advanced DC-DC converters capable of precise and dynamic power delivery to power-hungry processors. Moreover, the growth in medical device technology, including portable and implantable devices, necessitates ultra-compact, highly reliable, and low-noise power conversion solutions. The ongoing development of smart cities and sophisticated aerospace and defense systems also represents significant opportunities, demanding robust and resilient power management. The overarching impact forces influencing this market include rapid technological advancements, evolving regulatory standards emphasizing energy efficiency, and the fluctuating dynamics of global supply chains, which dictate material availability and production costs. Geopolitical stability and trade policies also exert an influence on market access and international collaborations, shaping the strategic decisions of market players.

Segmentation Analysis

The DC-DC converter market is comprehensively segmented to provide a detailed understanding of its diverse landscape, categorizing products and applications based on various technical and end-user parameters. This segmentation helps in analyzing market trends, identifying growth opportunities, and understanding the specific requirements of different industry verticals. The primary modes of segmentation include product type, which differentiates between isolated and non-isolated converters; output power, categorizing devices based on their power handling capabilities from low to high; input and output voltage levels, addressing the specific voltage conversion needs; application, detailing the various industries where these converters are deployed; and end-user, focusing on the ultimate consumers or sectors utilizing these products. This granular approach allows for a precise evaluation of market dynamics within each niche, reflecting the varied technological demands and market maturity across different segments, thereby offering a holistic view of the market's structure and potential growth areas.

- By Product Type:

- Isolated Converters:

- Flyback Converter

- Forward Converter

- Push-Pull Converter

- Half-Bridge Converter

- Full-Bridge Converter

- Non-Isolated Converters:

- Buck Converter

- Boost Converter

- Buck-Boost Converter

- SEPIC Converter (Single-Ended Primary Inductor Converter)

- Cuk Converter

- Isolated Converters:

- By Output Power:

- Low Power (Up to 75 W)

- Medium Power (75 W to 500 W)

- High Power (Above 500 W)

- By Input Voltage:

- Low Input Voltage (Less than 36 V)

- Medium Input Voltage (36 V to 75 V)

- High Input Voltage (Above 75 V)

- By Output Voltage:

- Low Output Voltage (Less than 12 V)

- Medium Output Voltage (12 V to 48 V)

- High Output Voltage (Above 48 V)

- By Application:

- Consumer Electronics (Smartphones, Laptops, Wearables, Tablets)

- Automotive (Electric Vehicles, Hybrid Electric Vehicles, ADAS, Infotainment)

- Industrial (Automation, Robotics, Power Tools, LED Lighting)

- Telecommunications (5G Infrastructure, Base Stations, Networking Equipment)

- Medical (Portable Medical Devices, Diagnostic Equipment, Implantable Devices)

- Renewable Energy (Solar Inverters, Wind Power Systems, Energy Storage)

- Aerospace & Defense (Avionics, Satellite Systems, Military Equipment)

- Data Centers & Cloud Computing (Servers, Networking, Storage)

- By End-User:

- Automotive Sector

- Industrial Sector

- Telecommunications Sector

- Healthcare Sector

- IT & Consumer Electronics Sector

- Energy & Power Sector

- Military & Government Sector

Value Chain Analysis For DC-DC Converter Market

The value chain for the DC-DC converter market begins with the upstream segment, which is crucial for the fundamental components and materials required for converter manufacturing. This stage involves suppliers of semiconductor materials, including silicon, Gallium Nitride (GaN), and Silicon Carbide (SiC), which are vital for power switches and rectifiers. Additionally, suppliers of magnetic materials, such as ferrites and amorphous metals, are critical for inductors and transformers, which are core components of many converter topologies. Passive component manufacturers providing capacitors, resistors, and printed circuit boards (PCBs) also form an integral part of the upstream supply. Innovation in these foundational materials and components directly impacts the efficiency, size, and cost-effectiveness of the final DC-DC converter products, driving the entire value chain toward advancements in power density and performance.

Moving further along the value chain, the manufacturing and assembly phase is where these raw materials and components are integrated into finished DC-DC converters. This stage involves the design, fabrication, and testing of complex power management integrated circuits (PMICs) and discrete converter modules. Original Equipment Manufacturers (OEMs) and specialized power electronics companies conduct extensive research and development to create highly efficient and robust converter designs tailored for specific applications. The downstream segment of the value chain focuses on the distribution and end-use of these converters. This includes system integrators who incorporate DC-DC converters into larger electronic systems, distributors who manage the supply chain to various end-users, and the vast array of original equipment manufacturers (OEMs) across industries like automotive, consumer electronics, industrial, and telecommunications who integrate these converters into their final products. The effectiveness of the downstream segment relies heavily on efficient logistics, technical support, and the ability to meet diverse customer specifications.

The distribution channel for DC-DC converters encompasses both direct and indirect sales approaches, each playing a strategic role in market penetration. Direct distribution typically involves manufacturers selling directly to large-volume OEMs or strategic partners, fostering closer collaboration, customization, and technical support. This approach is often preferred for high-value, specialized, or custom-designed converters. Indirect distribution, on the other hand, involves a network of third-party distributors, wholesalers, and online marketplaces that cater to a broader customer base, including small to medium-sized enterprises (SMEs) and individual design engineers. These channels provide greater market reach, inventory management, and localized support. The choice of distribution strategy often depends on the product's complexity, target market, required level of technical assistance, and the desired speed of market penetration. The efficiency of these distribution channels is paramount in ensuring that DC-DC converters reach their intended end-users effectively and competitively, supporting the continuous demand across diverse global industries.

DC-DC Converter Market Potential Customers

The DC-DC converter market caters to a diverse and expanding base of potential customers, primarily comprising end-users and buyers from various industrial sectors. Automotive OEMs stand as a significant customer segment, particularly with the escalating production of electric vehicles (EVs) and hybrid electric vehicles (HEVs), autonomous driving systems (ADAS), and advanced infotainment units. These manufacturers require highly reliable, efficient, and robust DC-DC converters for battery management systems, auxiliary power supplies, and critical safety features. As vehicles become more electrified and technologically sophisticated, the demand for specialized converters that can withstand harsh automotive environments and meet stringent power requirements continues to grow, making this sector a cornerstone for market expansion and innovation in converter technology.

Beyond automotive, the industrial automation sector represents a vast segment of potential customers, including manufacturers of robotics, control systems, factory automation equipment, and various industrial machinery. These end-users demand DC-DC converters that offer high efficiency, robust performance, and long operational lifespans to power sensors, actuators, programmable logic controllers (PLCs), and motor drives in demanding operational environments. The telecommunications industry, driven by the global deployment of 5G networks and the continuous expansion of data centers, is another key customer base. Telecom equipment providers and data center operators require high-density, highly efficient, and reliable DC-DC converters for base stations, networking equipment, servers, and storage systems, where power consumption and thermal management are critical considerations for operational costs and performance.

Furthermore, the IT & consumer electronics sector remains a consistent and high-volume buyer, with manufacturers of smartphones, laptops, tablets, wearable devices, and home appliances constantly seeking smaller, more efficient, and cost-effective DC-DC converters to extend battery life, reduce device form factors, and enhance overall user experience. The healthcare sector, encompassing manufacturers of portable medical devices, diagnostic equipment, and implantable electronics, also constitutes a vital customer segment, prioritizing extreme reliability, compact size, and low power consumption for critical patient care applications. Lastly, the energy and power sector, including developers of solar and wind power systems, energy storage solutions, and smart grid infrastructure, relies heavily on efficient DC-DC converters for power conditioning, voltage regulation, and grid integration. These diverse end-users collectively underscore the pervasive importance of DC-DC converter technology across modern industries, driving continuous demand and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2032 | USD 22.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices Inc., Texas Instruments Inc., Vicor Corporation, Murata Manufacturing Co. Ltd., TDK Corporation, ROHM Semiconductor, RECOM Power GmbH, CUI Inc., XP Power, TRACO Power, Mornsun Power, Mean Well Enterprises Co. Ltd., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, NXP Semiconductors N.V., Microchip Technology Inc., Bourns Inc., Delta Electronics Inc., Artesyn Embedded Power (Advanced Energy Industries Inc.) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DC-DC Converter Market Key Technology Landscape

The DC-DC converter market is undergoing a significant technological transformation, largely driven by the adoption of wide bandgap (WBG) semiconductors, particularly Gallium Nitride (GaN) and Silicon Carbide (SiC). These advanced materials are revolutionizing power electronics by enabling devices to operate at much higher switching frequencies, higher voltages, and elevated temperatures compared to traditional silicon-based components. The inherent advantages of GaN and SiC, such as lower switching losses, higher electron mobility, and superior thermal conductivity, allow for the design of DC-DC converters that are dramatically more efficient, smaller in size, and lighter in weight. This shift is critical for applications demanding high power density and reduced energy consumption, suchcompassing electric vehicles, 5G telecom infrastructure, and data center power supplies, where space and energy efficiency are paramount. The continuous innovation in WBG fabrication processes and device structures is further driving their integration across a broader range of converter topologies and power levels, solidifying their position as a cornerstone of next-generation power conversion technology.

Another pivotal technological advancement in the DC-DC converter market is the increasing sophistication of digital control techniques. Traditionally, analog control loops have been the standard, but digital controllers offer unparalleled flexibility, precision, and the ability to implement complex algorithms for adaptive power management. Digital control allows for real-time monitoring of various operational parameters, enabling dynamic adjustments to optimize efficiency across varying load conditions, input voltage fluctuations, and temperature changes. This capability is crucial for achieving peak performance in complex power systems and for facilitating features like predictive maintenance and fault diagnosis. Furthermore, digital control enables advanced communication interfaces, allowing DC-DC converters to integrate seamlessly into intelligent power management networks and smart grids. The development of highly integrated digital power management ICs (PMICs) that combine control, sensing, and protection functionalities into a single chip is enhancing the overall reliability and functionality of modern DC-DC converter solutions.

The market is also witnessing the rapid evolution of modular and reconfigurable converter designs, alongside the development of integrated power modules (IPMs). Modular designs facilitate easier scaling, maintenance, and customization, allowing manufacturers to quickly adapt to diverse application requirements with standardized building blocks. This approach reduces development time and costs while improving system flexibility. Integrated Power Modules, on the other hand, consolidate multiple power components (e.g., switches, drivers, control circuitry) into a single package, leading to significantly higher power density, reduced parasitic inductances, and improved thermal performance. These IPMs are becoming increasingly vital for ultra-compact applications and high-power density systems where board space is at a premium. Complementing these hardware advancements are innovative circuit topologies, such as resonant converters, which offer very high efficiency at high switching frequencies, and advanced packaging techniques that further minimize device footprints and enhance thermal dissipation. These combined technological thrusts are collectively pushing the boundaries of what is possible in DC-DC power conversion, driving the industry towards more intelligent, efficient, and compact power solutions for an increasingly electrified and interconnected world.

Regional Highlights

- North America: This region is a significant market driven by substantial investments in electric vehicle (EV) infrastructure, advanced data centers for cloud computing and AI, and the aerospace and defense sector. Strong research and development capabilities, coupled with stringent energy efficiency regulations, foster innovation in high-power and high-efficiency DC-DC converters. The presence of leading technology companies and a robust industrial base further stimulates demand for cutting-edge power management solutions, particularly for specialized applications and smart grid integration.

- Europe: Europe represents a mature and technologically advanced market for DC-DC converters, propelled by a strong focus on industrial automation, renewable energy integration, and electric mobility initiatives. Stringent environmental policies and energy efficiency standards mandated by the European Union drive the adoption of high-efficiency converters. Countries like Germany, France, and the UK are key contributors, with robust manufacturing sectors and significant investments in smart factories and sustainable energy systems, creating consistent demand for reliable and high-performance power solutions.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market for DC-DC converters globally. This dominance is attributed to its massive manufacturing base for consumer electronics, rapid automotive electrification, and extensive telecommunications infrastructure development, including the widespread rollout of 5G networks. Countries such as China, Japan, South Korea, and India are leading the charge, with surging demand for power solutions across diverse applications, from portable devices to industrial equipment and renewable energy projects. Favorable government policies and increasing disposable incomes also contribute to the expansive market growth.

- Latin America: The market in Latin America is characterized by steady growth, driven by increasing industrialization, infrastructure development, and growing adoption of telecommunications services. Countries like Brazil and Mexico are witnessing expanding manufacturing capabilities and investments in renewable energy, creating a rising demand for DC-DC converters. While still developing compared to other regions, the emphasis on modernizing industrial processes and improving energy efficiency presents significant opportunities for market expansion and technology adoption in various sectors.

- Middle East and Africa (MEA): This region is an emerging market for DC-DC converters, primarily influenced by significant investments in renewable energy projects, particularly solar power, and the ongoing expansion of telecommunications networks. Rapid urbanization and economic diversification initiatives, especially in Gulf Cooperation Council (GCC) countries, are fostering demand for advanced power management solutions in infrastructure, oil and gas, and smart city developments. The need for reliable power in remote areas and harsh environments also drives the adoption of robust DC-DC converter technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DC-DC Converter Market.- Analog Devices Inc.

- Texas Instruments Inc.

- Vicor Corporation

- Murata Manufacturing Co. Ltd.

- TDK Corporation

- ROHM Semiconductor

- RECOM Power GmbH

- CUI Inc.

- XP Power

- TRACO Power

- Mornsun Power

- Mean Well Enterprises Co. Ltd.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Microchip Technology Inc.

- Bourns Inc.

- Delta Electronics Inc.

- Artesyn Embedded Power (Advanced Energy Industries Inc.)

Frequently Asked Questions

What is a DC-DC converter and its primary function?

A DC-DC converter is an electronic circuit that converts a source of direct current (DC) from one voltage level to another, typically a different voltage level. Its primary function is to efficiently regulate and condition power, ensuring that electronic components receive the precise and stable voltage required for optimal operation, which is critical for preventing damage and maximizing performance across various applications.

What are the main types of DC-DC converters?

The main types of DC-DC converters are broadly categorized into isolated and non-isolated. Non-isolated converters include buck (step-down), boost (step-up), and buck-boost converters, offering high efficiency and simplicity. Isolated converters, such as flyback, forward, and full-bridge, provide galvanic isolation between input and output, enhancing safety and noise suppression, particularly crucial in medical or high-power industrial applications.

Which industries are the major consumers of DC-DC converters?

Major consumers of DC-DC converters include the automotive industry (especially electric vehicles), consumer electronics (smartphones, laptops), industrial automation (robotics, control systems), telecommunications (5G infrastructure, data centers), and renewable energy (solar inverters, energy storage). These sectors rely on converters for efficient power management, voltage regulation, and miniaturization of electronic systems, driving significant market demand.

How does AI influence the DC-DC converter market?

AI significantly influences the DC-DC converter market by enabling smarter design optimization, predictive maintenance, and adaptive power management. AI algorithms can enhance converter efficiency, reduce size, and improve reliability through advanced simulations. Furthermore, AI-powered control systems allow for dynamic adjustments to operating parameters in real-time, optimizing performance and extending component lifespan in critical applications.

What are the key technological advancements driving market growth?

Key technological advancements driving market growth include the widespread adoption of wide bandgap (WBG) semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) for higher efficiency and power density. Other advancements include sophisticated digital control techniques for adaptive power management, modular and integrated power module designs for scalability and compactness, and innovative circuit topologies for enhanced performance, collectively pushing the boundaries of power conversion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fuel Cell DC-DC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft DC-DC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Space DC-DC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Isolated DC-DC Converter Market Statistics 2025 Analysis By Application (Industrial & Automation, Consumer electronics, Medical), By Type (Flyback, Forward), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager