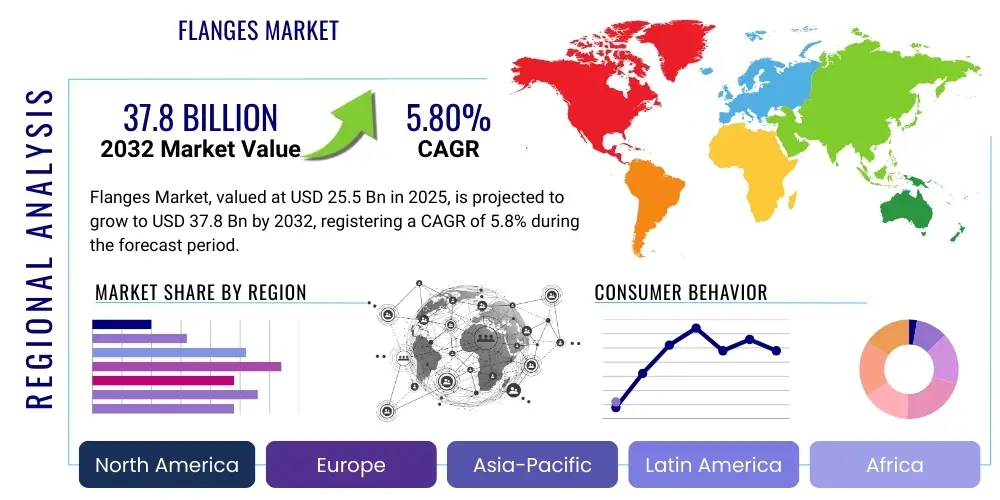

Flanges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427311 | Date : Oct, 2025 | Pages : 239 | Region : Global | Publisher : MRU

Flanges Market Size

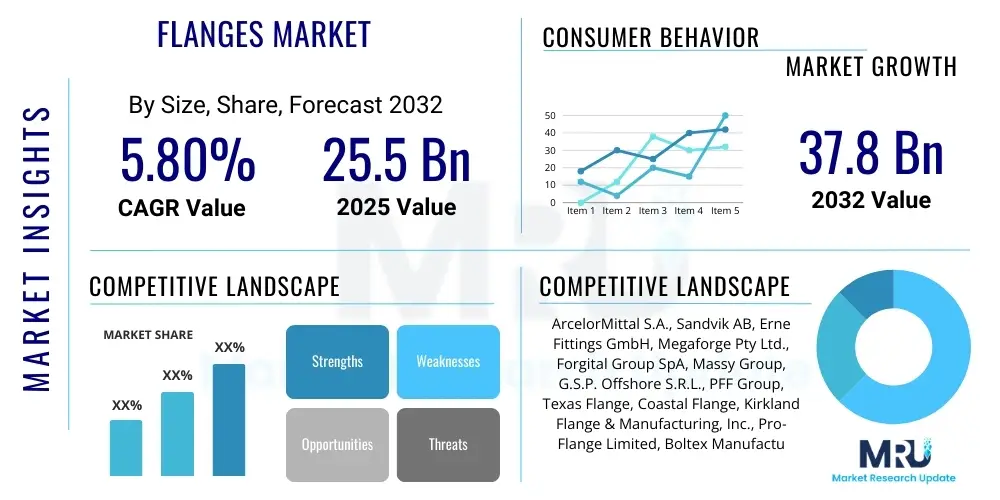

The Flanges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2032.

Flanges Market introduction

The Flanges Market encompasses a diverse range of mechanical components used to connect pipes, valves, pumps, and other equipment, forming a pipeline system. These crucial elements provide an easy method for cleaning, inspection, and modification. They are typically joined by bolting two flanges together with a gasket in between, providing a tight seal. Flanges are integral to the safe and efficient operation of countless industrial processes, offering robust and reliable connections that can withstand high pressures, extreme temperatures, and corrosive environments. The markets stability is driven by the consistent demand for infrastructure development and industrial maintenance across various sectors.

Flanges are primarily categorized by their design (e.g., weld neck, slip-on, blind, threaded, lap joint), material (e.g., carbon steel, stainless steel, alloy steel, non-ferrous alloys), pressure rating, and size. Their applications are widespread, spanning industries such as oil and gas, chemical and petrochemical, water and wastewater treatment, power generation, marine, and construction. The products fundamental benefit lies in its ability to create strong, leak-proof, and easily detachable connections, facilitating system assembly, disassembly, and maintenance. This versatility and essential function underscore their indispensable role in modern industrial infrastructure, providing flexibility in design and operation that welded connections do not offer as readily.

Key driving factors for the flanges market include rapid industrialization and urbanization, particularly in emerging economies, leading to increased demand for energy and water infrastructure. The continuous expansion of the oil and gas sector, including upstream, midstream, and downstream operations, along with significant investments in chemical processing plants, are substantial growth catalysts. Furthermore, the global emphasis on upgrading aging infrastructure and stringent safety regulations regarding leak prevention contribute to sustained demand for high-quality flanges. The adoption of advanced materials and manufacturing techniques also enhances product performance and expands application possibilities, fostering market growth.

Flanges Market Executive Summary

The global Flanges Market is experiencing steady expansion, propelled by robust industrial growth and infrastructure development worldwide. Business trends indicate a shift towards specialized and high-performance flanges capable of operating under extreme conditions, driven by demand from demanding sectors like deep-sea oil exploration, high-temperature chemical processing, and nuclear power generation. There is also a notable trend towards customization and rapid prototyping, enabled by advanced manufacturing techniques, to meet specific project requirements. Furthermore, sustainability considerations are influencing material choices and manufacturing processes, with an increasing focus on corrosion resistance and extended product lifespans to reduce maintenance and replacement cycles. Digitalization is beginning to impact supply chain management and predictive maintenance strategies for flanged systems.

Regional trends highlight significant growth in Asia Pacific, attributed to rapid industrialization, burgeoning energy demands, and extensive infrastructure projects in countries like China and India. North America and Europe maintain substantial market shares due to well-established industrial bases, ongoing investments in critical infrastructure upgrades, and strict regulatory frameworks that mandate high-quality components. The Middle East and Africa region is also emerging as a key growth area, driven by vast oil and gas reserves and associated investment in production, refining, and transportation infrastructure. Latin America shows consistent demand, particularly in its growing mining and petrochemical sectors, reflecting a global interconnectedness in industrial supply chains.

Segmentation trends reveal strong demand for carbon steel and stainless steel flanges due to their versatility and excellent mechanical properties, with alloy steel gaining traction for specialized, high-stress applications. By type, weld neck and slip-on flanges continue to dominate due to their common applications in various pipeline systems. The oil and gas industry remains the largest end-user segment, consistently driving innovation and consumption, followed closely by the chemical and petrochemical, power generation, and water and wastewater treatment sectors. The increasing complexity of industrial processes and the need for enhanced operational safety are propelling the demand for higher-pressure rating flanges and those manufactured to precise international standards, ensuring reliability and interchangeability across global projects.

AI Impact Analysis on Flanges Market

The integration of Artificial intelligence (AI) in the Flanges Market is poised to revolutionize various aspects, from design and manufacturing to supply chain management and predictive maintenance. Users are increasingly questioning how AI can enhance efficiency, reduce costs, and improve the reliability of flanged connections. Key themes emerging from these inquiries include the potential for AI-driven material optimization, intelligent quality control systems that can detect micro-defects, and the application of machine learning in forecasting demand and managing inventory more effectively. There is significant expectation that AI will lead to more robust designs, fewer failures, and a more streamlined production process, ultimately impacting the entire lifecycle of flange products and their integration into complex industrial systems.

Concerns often revolve around the initial investment required for AI infrastructure, the need for skilled personnel to implement and manage AI systems, and data security issues related to proprietary designs and operational parameters. However, the anticipated benefits, such as enhanced product traceability, optimized manufacturing parameters for reduced waste, and the ability to conduct virtual testing of flange performance under various conditions, are driving interest. Users are also exploring how AI can support compliance with stringent industry standards and regulations by providing comprehensive data analysis and reporting capabilities, ensuring that components meet or exceed performance benchmarks. The overarching goal is to leverage AI to move towards an era of smart manufacturing for flanged components.

Expectations for AIs influence in the flanges domain are high, focusing on predictive maintenance for flanged joints, using sensor data and AI algorithms to anticipate potential failures before they occur, thereby minimizing downtime and maximizing operational safety. Furthermore, AI is expected to play a critical role in the design phase, enabling generative design processes that explore optimal flange geometries for specific applications, considering factors like material usage, stress distribution, and fatigue life. This could lead to lighter, stronger, and more cost-effective flange solutions. The potential for AI to integrate seamlessly with existing digital twins of industrial plants also holds significant promise for comprehensive system management and real-time performance monitoring of all flanged connections.

- AI-driven generative design optimizes flange geometry for specific applications, reducing material usage and improving performance.

- Predictive maintenance algorithms analyze sensor data from flanged joints to anticipate leaks or failures, preventing costly downtime.

- Automated quality inspection systems using computer vision detect microscopic defects in flange surfaces and welds with high precision.

- Supply chain optimization through AI forecasting improves inventory management and reduces lead times for flange components.

- AI enhances material selection by simulating performance under various environmental conditions, ensuring optimal material choice for durability.

- Robotics and AI-controlled manufacturing processes increase precision, consistency, and speed in flange production.

- Digital twins of industrial assets integrate AI to monitor real-time flange performance and recommend maintenance actions.

- Data analytics platforms powered by AI provide insights into flange failure modes, informing future design and operational improvements.

DRO & Impact Forces Of Flanges Market

The Flanges Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory and competitive landscape. Key drivers include the robust expansion of the oil and gas industry, both upstream and downstream, necessitating vast networks of pipelines and processing units that rely heavily on flanged connections. Similarly, the rapid growth in the chemical and petrochemical sectors, driven by increasing global demand for plastics, fertilizers, and specialty chemicals, fuels consistent demand for durable and chemically resistant flanges. Furthermore, significant investments in power generation, including conventional and renewable energy projects, along with ongoing upgrades to aging water and wastewater treatment infrastructure, provide foundational demand for various flange types. Urbanization and industrialization in developing economies, leading to new infrastructure projects, serve as strong underlying growth catalysts for the market.

However, the market also faces notable restraints. Fluctuations in raw material prices, particularly for steel and other alloys, can directly impact manufacturing costs and product pricing, potentially affecting market stability and profitability. Stringent environmental regulations and safety standards, while ensuring product quality and operational safety, can also increase compliance costs for manufacturers, posing a challenge for smaller players. The maturity of the market in developed regions, coupled with slower economic growth in some areas, may lead to more moderate growth rates compared to emerging economies. Additionally, the availability of alternative joining technologies, such as advanced welding techniques or specialized pipe coupling systems, presents a competitive pressure, though flanges often remain preferred for their flexibility and ease of maintenance.

Despite these challenges, substantial opportunities exist within the Flanges Market. The burgeoning renewable energy sector, including offshore wind farms and geothermal plants, presents new avenues for specialized flange applications designed for unique operating conditions. The increasing adoption of advanced materials like superalloys and composites for high-performance flanges, addressing extreme temperature, pressure, and corrosive environments, opens up premium market segments. Moreover, the growing focus on infrastructure development in emerging economies, coupled with smart city initiatives, promises sustained long-term demand. Opportunities also lie in the digitalization of manufacturing processes, including Industry 4.0 technologies for enhanced production efficiency and quality control, alongside the development of smart flanges equipped with sensors for real-time monitoring and predictive maintenance, adding significant value proposition for end-users.

Segmentation Analysis

The Flanges Market is extensively segmented to reflect the diverse applications and technical requirements across various industries. This segmentation provides a granular view of market dynamics, allowing for a detailed analysis of demand patterns, technological trends, and competitive positioning within specific niches. Key categories include segmentation by material, type, pressure rating, size, and end-user industry, each playing a crucial role in defining market behavior and growth prospects. Understanding these segments is vital for stakeholders to identify target markets, develop appropriate product strategies, and capitalize on emerging opportunities in this essential industrial component sector.

- By Material:

- Carbon Steel Flanges (e.g., A105, A350 LF2) - Dominant due to cost-effectiveness and good mechanical properties.

- Stainless Steel Flanges (e.g., ASTM A182 F304/304L, F316/316L) - Preferred for corrosion resistance and hygiene requirements.

- Alloy Steel Flanges (e.g., A182 F5, F9, F11, F22) - Used in high-temperature and high-pressure applications.

- Duplex/Super Duplex Steel Flanges - Offering superior corrosion resistance and strength in aggressive environments.

- Non-Ferrous Flanges (e.g., Nickel alloys, Titanium, Copper alloys) - Employed in highly specialized, extreme conditions.

- By Type:

- Weld Neck Flanges - Provides strong connection, suitable for high-pressure and high-temperature applications.

- Slip-On Flanges - Easier to align, lower cost, used in lower pressure applications.

- Blind Flanges - Used to close off the end of a piping system or valve opening.

- Lap Joint Flanges - Used with stub ends, ideal for applications requiring frequent dismantling.

- Threaded Flanges - Screwed onto pipes with external threads, without welding.

- Socket Weld Flanges - Used for small bore, high-pressure piping.

- Orifice Flanges - Used for flow measurement with orifice plates.

- By Pressure Rating (ASME/ANSI):

- Class 150, Class 300, Class 600, Class 900, Class 1500, Class 2500 - Indicating the maximum allowable pressure at given temperatures.

- By Size:

- Small Bore (NPS 1/2 to NPS 2)

- Medium Bore (NPS 2 1/2 to NPS 12)

- Large Bore (NPS 14 and above)

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream) - Largest consumer, driven by exploration, production, and refining.

- Chemical and Petrochemical - Demands corrosion-resistant and high-pressure flanges for processing plants.

- Power Generation (Thermal, Nuclear, Renewable) - Essential for steam, water, and fuel lines.

- Water and Wastewater Treatment - Used in filtration, pumping, and distribution systems.

- Marine - Applications in shipbuilding, offshore platforms, and piping systems.

- Mining - For slurry and process water lines in harsh environments.

- Construction and Infrastructure - General piping and structural connections.

- Food and Beverage - Requires sanitary and corrosion-resistant flanges.

Flanges Market Value Chain Analysis

The Flanges Market value chain is a complex network of activities that transforms raw materials into finished flange products and delivers them to end-users. It begins with the upstream segment, which primarily involves the extraction and processing of raw materials such as iron ore, chromium, nickel, and other alloying elements, followed by their conversion into steel billets, bars, and plates by steel mills and foundries. This initial stage is critical as the quality and cost of these basic materials directly impact the final product. Suppliers in this segment focus on economies of scale, material purity, and consistent supply, acting as foundational providers for flange manufacturers. The stability of raw material pricing and the availability of specialized alloys are significant factors influencing the overall cost structure and lead times in the industry.

Midstream activities involve the actual manufacturing of flanges. This includes forging, casting, machining, heat treatment, and surface finishing. Manufacturers convert raw material forms into specific flange types according to international standards (e.g., ASME, DIN, JIS) and customer specifications. This stage requires significant capital investment in machinery, skilled labor, and adherence to stringent quality control processes. Many manufacturers specialize in particular materials or types of flanges, leveraging expertise in metallurgy and precision engineering. Innovation in manufacturing technologies, such as automation and advanced machining, plays a crucial role in optimizing production efficiency, reducing waste, and improving the dimensional accuracy and surface finish of the final products.

Downstream, the distribution channel connects manufacturers with a diverse range of end-users. This typically involves a mix of direct sales and indirect channels. Direct sales are common for large-scale projects or specialized custom orders where manufacturers engage directly with EPC contractors, major oil and gas companies, or large industrial plants. Indirect channels include distributors, wholesalers, and specialized stockists who maintain inventories of standard flanges, providing localized supply, quick delivery, and technical support to smaller projects and maintenance operations. These distributors often play a vital role in market penetration, especially in regional markets, by offering a wider product range and value-added services such as kitting, assembly, and testing. Effective logistics and inventory management within the distribution network are essential to meet diverse customer demands efficiently and maintain competitive pricing.

Flanges Market Potential Customers

Potential customers for flanges span a broad spectrum of heavy industries, where reliable and maintainable piping and equipment connections are paramount. The primary end-users are entities involved in the construction, operation, and maintenance of industrial facilities that transport fluids or gases. This includes major players in the oil and gas sector, encompassing exploration and production companies, midstream pipeline operators, and downstream refineries and petrochemical plants. These customers require a vast array of flanges designed to withstand extreme pressures, high temperatures, and corrosive substances encountered in drilling, processing, and transportation activities. Their purchasing decisions are heavily influenced by product certification, material integrity, and compliance with international safety and performance standards, as any failure can lead to significant financial losses and environmental hazards.

Beyond the hydrocarbon industry, the chemical and petrochemical manufacturing sectors represent another substantial customer base. These facilities produce a wide range of chemicals, plastics, and synthetic materials, requiring flanges that can resist aggressive chemicals, maintain hermetic seals, and operate reliably under critical process conditions. Similarly, power generation plants, whether coal-fired, gas-fired, nuclear, or renewable (e.g., geothermal, concentrated solar power), are consistent buyers. Flanges are integral to steam lines, cooling water systems, and fuel delivery systems, demanding durability and high-temperature resistance. Utilities involved in water and wastewater treatment also represent a significant segment, purchasing flanges for large-scale piping networks, pumping stations, and treatment facilities, where corrosion resistance and ease of maintenance are critical considerations for long operational lifespans.

Other vital customer segments include the marine industry, comprising shipbuilders and offshore platform operators who require robust, corrosion-resistant flanges for their piping systems. The mining sector utilizes flanges for slurry transport, water management, and processing plants in harsh, abrasive environments. Furthermore, companies engaged in industrial construction and general manufacturing often purchase standard flanges for various utility lines and equipment connections. The purchasing process for these diverse customers typically involves detailed technical specifications, adherence to project timelines, and consideration of total cost of ownership, including initial purchase price, installation costs, and long-term maintenance implications. Reliability, product life, and supplier reputation are often prioritized over marginal cost savings, reflecting the critical nature of these components in industrial operations.

Flanges Market Key Technology Landscape

The Flanges Market benefits significantly from a continuously evolving technology landscape, encompassing advancements in material science, manufacturing processes, and digital integration. In material science, the development of high-strength, corrosion-resistant alloys, such as various grades of duplex and super duplex stainless steels, nickel-based alloys, and titanium, is crucial. These advanced materials enable flanges to perform reliably in increasingly harsh operating conditions, including sour gas environments, high-temperature chemical processes, and deep-sea applications, where conventional carbon steel or standard stainless steel would fail. Researchers are also exploring composite materials and advanced coatings to further enhance properties like wear resistance, anti-fouling, and extended fatigue life, pushing the boundaries of what flanges can endure and expanding their application envelope in specialized industries.

Manufacturing technologies have also seen significant innovation. Precision forging and casting techniques, coupled with advanced CNC machining, ensure tight dimensional tolerances and superior surface finishes, which are critical for achieving leak-proof connections. Automation and robotics are increasingly integrated into the production lines, improving efficiency, reducing labor costs, and enhancing product consistency and quality. Additive manufacturing, or 3D printing, is an emerging technology that holds promise for producing complex or custom flange geometries with reduced lead times and material waste, especially for prototypes or small-batch, highly specialized components. Heat treatment processes, such as quenching and tempering, are meticulously controlled to optimize the metallurgical structure of the flanges, thereby enhancing their mechanical properties and ensuring long-term performance under stress.

Digital technologies, particularly those associated with Industry 4.0, are beginning to transform the flanges sector. This includes the implementation of Internet of Things (IoT) sensors for real-time monitoring of flanged joints in operational environments. These smart flanges can transmit data on pressure, temperature, vibration, and even micro-leaks, enabling predictive maintenance strategies and enhancing operational safety. Digital twin technology is also gaining traction, where virtual models of flanged systems can be simulated and analyzed to predict performance, optimize maintenance schedules, and identify potential failure points before they occur in the physical asset. Furthermore, AI and machine learning algorithms are being employed in quality control, supply chain optimization, and even in the generative design of new flange types, leading to more efficient, reliable, and intelligent flanged solutions that contribute to overall system integrity and plant uptime.

Regional Highlights

- Asia Pacific: The largest and fastest-growing market, driven by extensive infrastructure development, rapid industrialization, and significant investments in the energy sector, particularly in China, India, and Southeast Asian countries. Demand for flanges is consistently high across oil and gas, power generation, and water treatment projects.

- North America: A mature market characterized by substantial demand from the oil and gas industry (shale exploration, pipelines), petrochemicals, and ongoing upgrades to industrial infrastructure. Stringent safety and environmental regulations drive demand for high-quality, certified flanges.

- Europe: Exhibits steady demand, fueled by established industrial sectors, particularly chemical, power generation (including renewables), and water utilities. Focus on advanced materials and energy efficiency also stimulates market for specialized flanges.

- Middle East & Africa: A high-growth region, primarily due to vast oil and gas reserves and significant investments in exploration, production, refining, and export infrastructure. Major construction projects and industrial expansion also contribute to market growth.

- Latin America: Showing consistent growth, propelled by the development of its oil and gas sector (e.g., Brazil, Mexico), mining industry, and increasing investments in water infrastructure and industrial facilities.

- Russia & CIS: Driven by substantial oil and gas production and export activities, as well as investments in pipeline networks and petrochemical facilities. The regions severe climatic conditions often necessitate specialized flange solutions.

- Japan & South Korea: Advanced industrial economies with strong demand from shipbuilding, petrochemicals, power generation, and high-tech manufacturing sectors. Emphasis on precision engineering and high-performance materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flanges Market.- ArcelorMittal S.A.

- Sandvik AB

- Erne Fittings GmbH

- Megaforge Pty Ltd.

- Forgital Group SpA

- Massy Group (Massy Energy)

- G.S.P. Offshore S.R.L.

- PFF Group

- Texas Flange

- Coastal Flange

- Kirkland Flange & Manufacturing, Inc.

- Pro-Flange Limited

- Boltex Manufacturing Co. L.P.

- M.E.G.A. S.p.A.

- Metal Forgings Private Limited

- Viraj Profiles Ltd.

- Outokumpu Oyj

- Penn Stainless Products, Inc.

- AFGlobal Corporation

- Bonney Forge Corporation

Frequently Asked Questions

What is a flange and what is its primary purpose in industrial piping?

A flange is a mechanical component used to connect pipes, valves, pumps, and other equipment to form a piping system. Its primary purpose is to provide an easily detachable and maintainable connection point, allowing for system assembly, disassembly, cleaning, and inspection, while ensuring a secure and leak-proof seal, typically achieved by bolting two flanges together with a gasket.

What are the most common materials used for manufacturing flanges and why?

The most common materials for flanges are carbon steel, stainless steel, and alloy steel. Carbon steel is widely used for its cost-effectiveness and good mechanical properties. Stainless steel is preferred for its excellent corrosion resistance, especially in chemical, food, and marine applications. Alloy steel is chosen for high-temperature, high-pressure, and specialized corrosive environments due to its enhanced strength and material properties.

How do pressure ratings of flanges impact their application?

Flange pressure ratings (e.g., Class 150, 300, 600) indicate the maximum allowable pressure a flange can safely withstand at a specific temperature. Higher pressure ratings correspond to thicker flanges with more robust designs, making them suitable for demanding applications in industries like oil and gas, and power generation, where operational integrity under extreme conditions is critical for safety and efficiency.

What are the key drivers for growth in the global Flanges Market?

Key growth drivers for the Flanges Market include global industrialization and urbanization, significant investments in the oil and gas sector (exploration, production, refining), expansion of chemical and petrochemical industries, and ongoing projects in power generation and water infrastructure. The need for upgrading aging infrastructure and stringent safety regulations also consistently fuels demand for new and replacement flanges.

How is Artificial Intelligence (AI) expected to impact the Flanges Market?

AI is expected to impact the Flanges Market through advancements in generative design for optimized flange geometries, predictive maintenance for flanged joints to prevent failures, automated quality inspection using computer vision, and improved supply chain management. These applications aim to enhance product reliability, reduce manufacturing costs, and increase operational efficiency and safety across the industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Flanges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Carbon Steel Flanges Market Statistics 2025 Analysis By Application (Petrochemical Industry, Pharmaceutical Industry, Food Industry, Aviation and Aerospace Industry, Architectural Decoration Industry, Oil and Gas Industry, Others), By Type (Blind Flange, Weld Neck Flange, Slip-On Flange, Socket Weld Flange, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Alloy Steel Flanges Market Statistics 2025 Analysis By Application (Petrochemical Industry, Pharmaceutical Industry, Food Industry, Aviation and Aerospace Industry, Architectural Decoration Industry, Oil and Gas Industry, Others), By Type (Blind Flange, Weld Neck Flange, Slip-On Flange, Socket Weld Flange, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Stainless Steel Flanges Market Statistics 2025 Analysis By Application (Petrochemical Industry, Food and Pharmaceutical Industry, Architectural Decoration Industry, Others), By Type (Weld Flange, Blind Flange, Slip-On Flange, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Subsea Swivel Joints & Flanges Market Statistics 2025 Analysis By Application (Subsea Tree Connections, Production Manifold Connections, Free Standing Hybrid Risers (FSHR), In-Line T Connections, Pipeline End Termination (PLET) Connections, Pipeline End Manifold (PLEM) Connections, Other), By Type (Subsea Swivel Joints, Subsea Swivel Flanges), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager