Flavors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430151 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Flavors Market Size

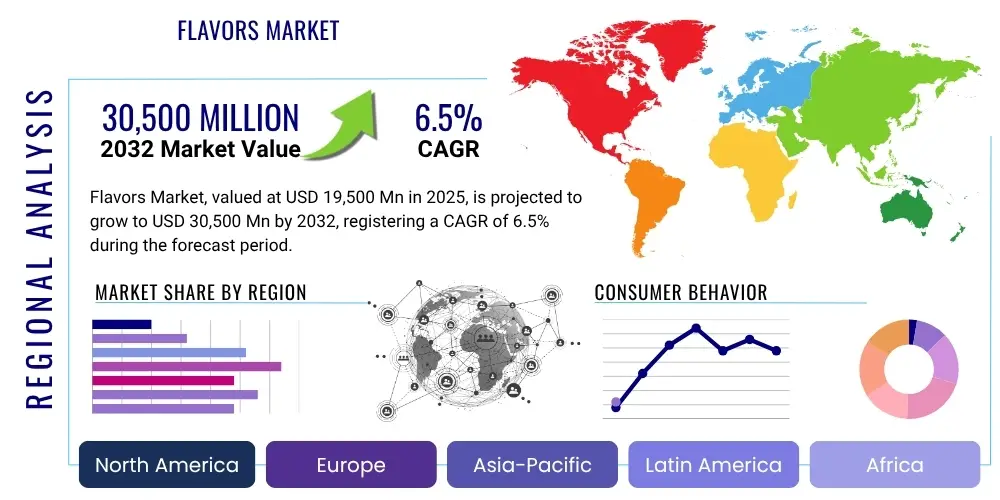

The Flavors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 19,500 Million in 2025 and is projected to reach USD 30,500 Million by the end of the forecast period in 2032.

Flavors Market introduction

The global flavors market is a cornerstone of the modern food and beverage industry, encompassing a vast array of compounds and preparations designed to impart, enhance, or modify the taste and aroma of products. Flavors are not merely additives but sophisticated formulations crafted by expert perfumers and chemists, crucial for consumer acceptance and brand differentiation in a highly competitive landscape. They serve to create desirable sensory experiences, mask undesirable natural notes in ingredients, and ensure consistent taste profiles across mass-produced goods. The complexity involved in flavor creation often draws from an intricate understanding of chemistry, biology, and consumer psychology, allowing for the development of both classic and novel taste sensations that cater to a perpetually evolving global palate. This market is further diversified by the distinction between natural flavors, derived directly from plant or animal sources through physical, enzymatic, or microbiological processes, and artificial flavors, which are synthesized to mimic natural compounds or create entirely new profiles, offering versatility and cost-effectiveness to manufacturers.

The applications for these sophisticated flavor profiles are extensive and continue to expand beyond traditional food and beverage categories. In the food sector, flavors are indispensable in beverages such as soft drinks, juices, and alcoholic beverages; dairy products including yogurts, ice creams, and cheeses; confectionery items like chocolates and candies; bakery goods such as breads, cakes, and cookies; and the vast savory and snacks segment, encompassing soups, sauces, ready meals, and extruded snacks. Beyond culinary uses, flavors play a critical role in the pharmaceutical industry, where they are employed to improve the palatability of medicines, particularly for pediatric and elderly patients, thereby enhancing compliance. Similarly, in the cosmetics and personal care sectors, specific flavor compounds contribute to the aromatic appeal of products like toothpastes, mouthwashes, and lip balms, influencing consumer perception of freshness and efficacy. The market benefits significantly from robust driving factors, including the pervasive trend of urbanization and the consequent demand for convenient, ready-to-eat meals, escalating disposable incomes globally which enable consumers to seek out premium and novel food experiences, and the persistent desire for healthier and more authentic natural ingredients, which propels innovation towards clean label flavor solutions.

Furthermore, the global shift towards plant-based diets and functional foods represents a substantial growth impetus, requiring innovative flavor solutions to make alternative protein sources and health-enhancing ingredients palatable and enjoyable. Manufacturers are under constant pressure to develop flavors that are heat-stable, pH-stable, and compatible with complex food matrices, ensuring that the desired taste profile is maintained throughout processing, storage, and consumption. The rise of e-commerce and global supply chains also facilitates broader market access for unique ingredients and flavor profiles, contributing to a more diverse and globally interconnected flavor industry. Ultimately, the market is characterized by a relentless pursuit of sensory excellence, driven by technological advancements and a deep understanding of consumer preferences, making flavors a critical determinant of product success across multiple consumer goods industries.

Flavors Market Executive Summary

The flavors market is currently experiencing dynamic growth, propelled by several interconnected business, regional, and segment-specific trends that are reshaping its trajectory. From a business perspective, the industry is marked by significant investments in research and development aimed at creating sustainable, natural, and clean label flavor solutions, driven by a global consumer shift towards healthier and environmentally conscious choices. Consolidation through strategic mergers and acquisitions remains a prevalent strategy, allowing major players to expand their technological capabilities, broaden their product portfolios, and enhance their geographical footprint. There is also an intensified focus on customization and co-creation with food and beverage manufacturers, moving beyond off-the-shelf offerings to develop bespoke flavor profiles that align precisely with unique product concepts and brand identities. Digital transformation, including advanced analytics and supply chain optimization, is gaining traction, streamlining operations and improving responsiveness to market demands. This trend highlights the industry’s commitment to not only meeting but anticipating consumer desires, fostering a culture of continuous innovation.

Geographically, the Asia Pacific (APAC) region stands out as the primary growth engine for the flavors market, driven by its rapidly expanding population, increasing urbanization rates, and a burgeoning middle class with higher disposable incomes. This demographic shift is fueling a substantial demand for processed foods, convenience meals, and diverse culinary experiences, leading to significant investment in flavor innovation tailored to regional tastes. North America and Europe, while representing more mature markets, continue to be pivotal for premium and specialty flavors, with a strong emphasis on health and wellness trends, plant-based alternatives, and sophisticated sensory science. These regions are at the forefront of adopting advanced technologies in flavor discovery and delivery. Latin America is also demonstrating robust growth, influenced by evolving consumer lifestyles and an increasing appreciation for both international and localized flavor profiles, while the Middle East and Africa regions present emerging opportunities as their food processing industries develop and consumer spending power rises, indicating a globally distributed yet regionally nuanced growth pattern for the flavors sector.

Segmentation trends within the flavors market underscore a pronounced shift towards natural flavors, driven by growing consumer skepticism towards artificial ingredients and a preference for authenticity and transparency in food labeling. This has spurred significant innovation in natural extracts, essences, and aroma chemicals. The beverage segment, encompassing everything from carbonated soft drinks to functional waters and alcoholic beverages, consistently holds a substantial market share, owing to frequent product launches and consumer demand for refreshing and novel drink experiences. Similarly, the savory and snacks segment continues its upward trajectory, benefiting from the global trend of on-the-go consumption and the desire for complex, palatable taste profiles in convenient formats. The dairy and confectionery segments also remain crucial, with ongoing innovation in indulgent yet healthier options. Overall, the market reflects a complex interplay of global trends and localized preferences, necessitating agile product development and strategic market positioning for sustained success.

AI Impact Analysis on Flavors Market

User queries regarding the impact of Artificial Intelligence (AI) on the flavors market frequently highlight a strong interest in how this technology can revolutionize the traditional approaches to flavor creation and application. Common questions often explore AI's capability to predict emerging consumer taste preferences with greater accuracy, thereby significantly reducing the guesswork in product development. Users are keen to understand how AI algorithms can analyze vast datasets of sensory information, chemical structures, and market trends to generate novel flavor combinations that human intuition might overlook, potentially accelerating the innovation cycle. Furthermore, there is considerable curiosity about AI's role in optimizing the consistency and efficiency of flavor production, ensuring quality control from raw material sourcing to final product integration. Discussions also touch upon the potential for AI to personalize flavor experiences, tailoring products to individual dietary needs or preferences, and the associated ethical considerations regarding data privacy and intellectual property. The prevailing themes underscore an expectation for AI to usher in an era of hyper-personalized, rapidly innovated, and scientifically validated flavor solutions, transforming both the art and science of taste creation.

- Predictive Analytics for Consumer Trends: AI models analyze social media data, sales figures, and demographic information to forecast upcoming taste preferences and ingredient trends, enabling flavor companies to proactively develop relevant solutions.

- Accelerated Flavor Discovery and Design: AI algorithms rapidly screen and identify potential flavor molecules from vast chemical libraries, suggesting novel combinations and optimizing existing formulations for specific sensory attributes and stability requirements, significantly shortening R&D cycles.

- Enhanced Quality Control and Consistency: AI-driven sensors and analytical tools monitor flavor production processes in real-time, detecting deviations in chemical composition or sensory profiles, thereby ensuring batch-to-batch consistency and superior product quality.

- Optimization of Supply Chain and Sourcing: AI supports more efficient management of raw material procurement by predicting demand, optimizing inventory levels, and identifying sustainable sourcing options, mitigating risks associated with supply volatility.

- Personalized Flavor Experiences: AI can enable the creation of customized flavor profiles based on individual consumer data, dietary restrictions, health goals, and geographic preferences, paving the way for hyper-personalized food and beverage products.

- Simulation and Virtual Prototyping: AI-powered simulations allow flavor chemists to test and evaluate new formulations virtually, predicting their performance in different food matrices and under various processing conditions before costly physical prototypes are developed.

- Regulatory Compliance and Risk Assessment: AI systems can quickly analyze vast regulatory databases to ensure new flavor formulations comply with global and regional standards, identifying potential safety or labeling issues early in the development process.

- Improved Sensory Evaluation: AI augments traditional human sensory panels by processing and interpreting complex sensory data from electronic noses and tongues, providing objective and quantifiable insights into flavor characteristics and consumer perception.

DRO & Impact Forces Of Flavors Market

The flavors market is intricately shaped by a comprehensive set of driving forces that propel its expansion, alongside significant restraints that pose challenges, and numerous opportunities that dictate its future direction. A primary driver is the accelerating global demand for processed and convenience foods, spurred by increasingly busy consumer lifestyles and urbanization. These food products inherently rely on sophisticated flavor systems to deliver consistent taste, extended shelf life, and attractive sensory profiles, thereby making flavors indispensable components in their formulation. Additionally, rising disposable incomes in emerging economies empower consumers to seek out a wider variety of premium and novel food experiences, including exotic and authentic regional flavors. The burgeoning consumer health consciousness globally further drives demand for natural, clean label, and healthier food and beverage options, compelling flavor manufacturers to invest heavily in naturally derived solutions that are free from artificial ingredients and perceived as more wholesome, thereby fostering market growth and innovation.

Despite robust growth drivers, the flavors market faces considerable restraints that impact its stability and profitability. One of the most significant challenges is the volatility in the prices and availability of key raw materials, particularly natural extracts, essential oils, and agricultural commodities. Fluctuations in supply due to climate change, geopolitical issues, and crop failures can lead to unpredictable pricing, directly affecting production costs and profit margins for flavor manufacturers. Furthermore, the global flavors industry operates under a complex and often stringent regulatory landscape, with different food safety and labeling standards in various countries and regions. Navigating these diverse regulations requires substantial investment in research, testing, and compliance, which can be a significant barrier to market entry and product innovation, particularly for smaller companies. Public health concerns, sometimes based on misinformation, regarding the safety of artificial flavors and certain ingredients also occasionally influence consumer perception and purchasing behavior, creating pressure for manufacturers to reformulate or emphasize natural alternatives, irrespective of scientific evidence of safety.

Concurrently, the flavors market is rich with promising opportunities that are poised to fuel future growth and innovation. The rapid economic development and expanding food and beverage industries in emerging markets across Asia Pacific, Latin America, and Africa present vast untapped potential for flavor companies seeking new consumer bases and manufacturing partnerships. The escalating global trend towards plant-based diets and veganism, coupled with the increasing popularity of functional foods and nutraceuticals, opens up new avenues for developing specialized flavors that can mask the off-notes of plant proteins or enhance the palatability of health-benefiting ingredients without compromising taste. Moreover, advancements in biotechnology, precision fermentation, and sustainable sourcing practices offer innovative solutions for producing natural and clean label flavors more efficiently and responsibly. The ongoing development of novel flavor delivery systems, such as advanced encapsulation technologies, also provides opportunities to enhance flavor stability, extend shelf life, and create unique sensory release profiles, catering to sophisticated product requirements and enhancing consumer experience in diverse food and beverage applications.

Segmentation Analysis

The global flavors market is meticulously segmented across various dimensions, providing a granular view of its intricate structure and diverse consumer needs. This comprehensive segmentation is critical for market players to effectively analyze trends, identify lucrative opportunities, and tailor their product offerings to specific industrial applications and consumer preferences. By dissecting the market based on criteria such as type, form, application, and origin, stakeholders can gain profound insights into demand patterns, competitive dynamics, and the technological advancements influencing each sub-segment. This analytical approach supports strategic decision-making, enabling companies to optimize their R&D investments, marketing strategies, and distribution networks to capture maximum market share and maintain a competitive edge in the rapidly evolving global flavor industry, which is continuously adapting to shifting culinary trends and health consciousness.

Understanding these distinct segments is essential for targeted innovation and market penetration. For instance, the distinction between natural and artificial flavors drives different sourcing, production, and marketing strategies, reflecting consumer demand for authenticity versus cost-effectiveness and versatility. Similarly, the form in which flavors are delivered—liquid, powder, paste, or emulsion—dictates their suitability for various manufacturing processes and end-product matrices, impacting stability and ease of integration. The wide array of applications, ranging from beverages and dairy to pharmaceuticals and animal feed, highlights the pervasive and multi-faceted role of flavors across industrial sectors, each with its unique technical requirements and taste preferences. Furthermore, the origin of flavors, whether botanical, animal-derived, or synthetic, informs regulatory compliance, supply chain considerations, and consumer perception, underscores the complexity and breadth of the flavors market.

- By Type: This segmentation distinguishes flavors based on their source and manufacturing process, significantly influencing consumer perception and regulatory classification.

- Natural Flavors: Derived from natural sources such as plants, animals, or microorganisms through physical, enzymatic, or microbiological processes, ensuring authenticity and appealing to clean label preferences.

- Artificial (Synthetic) Flavors: Chemically synthesized compounds designed to mimic natural flavor profiles or create novel tastes, offering greater consistency, stability, and often cost-effectiveness.

- By Form: This categorizes flavors based on their physical state, which impacts their application, stability, and ease of handling in different manufacturing environments.

- Liquid: Typically oil-soluble or water-soluble, offering ease of dispersion and common in beverages, confectionery, and dairy.

- Powder: Often spray-dried or encapsulated, providing extended shelf life, stability, and precise dosage, prevalent in dry mixes, bakery, and savory snacks.

- Paste: Concentrated forms offering intense flavor, used in confectionery fillings and specialized bakery applications.

- Emulsion: Flavor oils dispersed in a water base, offering stability and turbidity, commonly used in beverages.

- By Application: This is a crucial segmentation reflecting the diverse end-use industries where flavors are incorporated to enhance product appeal and consumer satisfaction.

- Beverages: Including carbonated soft drinks, juices, functional drinks, alcoholic beverages, and dairy-based beverages, requiring heat-stable and water-soluble flavors.

- Dairy Products: Such as yogurts, ice creams, flavored milk, and cheeses, demanding flavors that complement dairy matrices and withstand pasteurization.

- Confectionery: Encompassing chocolates, candies, gums, and other sweet treats, where flavor intensity, longevity, and texture compatibility are key.

- Bakery Products: For breads, cakes, cookies, pastries, and biscuits, requiring flavors that can endure high baking temperatures and provide a pleasant aroma.

- Savory & Snacks: Including soups, sauces, dressings, processed meats, instant meals, and extruded snacks, emphasizing umami, spicy, and authentic ethnic profiles.

- Pharmaceuticals: Flavors used to mask bitter notes in medications, especially for pediatric and geriatric formulations, improving palatability and patient compliance.

- Animal Feed: Enhancing the appeal and palatability of animal diets to ensure adequate consumption and nutritional intake for livestock and pets.

- Nutraceuticals: Flavors integrated into health supplements, functional foods, and dietary products to improve their sensory acceptance without compromising efficacy.

- By Origin: This classification refers to the primary source material from which the flavor compounds are derived.

- Botanical: Flavors extracted from plants, including fruits, vegetables, herbs, spices, and floral sources.

- Animal: Flavors derived from animal products or by-products, such as dairy or meat extracts.

- Synthetic: Flavors produced through chemical synthesis, which may replicate natural compounds or create novel ones.

Value Chain Analysis For Flavors Market

The value chain for the flavors market is a complex ecosystem spanning from raw material acquisition to end-product integration, involving a series of specialized activities that add value at each stage. The upstream segment of this value chain is primarily concerned with the sourcing and initial processing of a vast array of raw materials. For natural flavors, this involves extensive agricultural practices, including the cultivation, harvesting, and initial extraction of botanical ingredients such as fruits, vegetables, herbs, spices, and essential oils. The quality, sustainability, and ethical sourcing of these natural raw materials are increasingly critical, influencing both the final flavor profile and consumer perception. For artificial flavors, the upstream stage includes the procurement of various chemical precursors and intermediates from the petrochemical or chemical industries, which are then synthesized to create specific flavor compounds. This foundational stage is vital, as the purity, availability, and cost of these raw materials directly impact the subsequent manufacturing processes and the market competitiveness of flavor houses.

Moving downstream, these raw materials are transformed by flavor houses—the core of the industry—into finished flavor formulations. This intricate process involves significant investment in research and development, where flavor chemists, perfumers, and sensory scientists employ advanced analytical techniques such as gas chromatography-mass spectrometry (GC-MS) and high-performance liquid chromatography (HPLC) to identify and characterize aroma compounds. They then meticulously blend these components, often using proprietary technologies and deep expertise, to create stable, effective, and unique flavor profiles that meet specific customer requirements for taste, aroma, color stability, and suitability within various food matrices. Rigorous quality control, sensory evaluation panels, and application testing are integral to this stage, ensuring that the flavors perform as expected in the final product. Innovation in flavor delivery systems, such as encapsulation technologies, also plays a crucial role here, enhancing the stability, longevity, and controlled release of flavors.

The distribution of these finished flavors to end-user industries represents a critical link in the value chain, encompassing both direct and indirect channels. Large flavor manufacturers often engage in direct sales to major food and beverage corporations, forming long-term partnerships and offering bespoke solutions. This direct channel facilitates close collaboration on product development and ensures efficient supply chain management. Conversely, indirect distribution channels involve sales through specialized distributors, agents, and brokers who serve a broader base of small to medium-sized food and beverage producers, as well as pharmaceutical, cosmetic, and animal feed manufacturers. These intermediaries provide vital logistical support, warehousing, and often technical assistance, ensuring wider market penetration and accessibility for smaller clients who may not have the capacity for direct procurement. The ultimate downstream segment involves the integration of these flavors into a vast array of consumer products, where their success is measured by consumer acceptance, repeat purchases, and overall brand loyalty, completing the cycle of value creation from raw ingredient to final sensory experience.

Flavors Market Potential Customers

The flavors market serves a diverse and expansive customer base, predominantly comprising industries that prioritize sensory appeal and consumer experience to drive product demand and brand loyalty. At the forefront are food and beverage manufacturers, representing the largest segment of potential buyers. This extensive category includes major players across various sub-sectors such as dairy producers (for yogurts, ice creams, flavored milks), confectionery companies (for chocolates, candies, gums), bakery enterprises (for breads, cakes, cookies), beverage companies (for soft drinks, juices, alcoholic beverages), and manufacturers of savory products and snacks (for soups, sauces, ready meals, processed meats). These customers continuously seek innovative flavor solutions to differentiate their offerings, cater to evolving consumer preferences for novel and authentic tastes, and maintain consistency across product lines, making flavors a critical component of their product development and marketing strategies. The fierce competition within these sectors drives a perpetual need for flavor innovation and customization.

Beyond the core food and beverage industry, the pharmaceutical sector emerges as a significant potential customer, where flavors play a crucial role in improving patient compliance. Many active pharmaceutical ingredients (APIs) possess unpleasant, bitter, or metallic tastes, which can deter patients, particularly children and the elderly, from taking their medication. Flavor manufacturers develop specialized masking flavors and palatability enhancers that effectively neutralize these undesirable notes, making medicines more agreeable to consume. This application is vital for ensuring therapeutic adherence and enhancing overall patient care. Similarly, the cosmetic and personal care industries represent a growing customer segment, utilizing flavors primarily for their aromatic attributes. Products like toothpastes, mouthwashes, lip balms, and even certain skincare items incorporate flavors to create pleasant sensory experiences, contributing to consumer perception of freshness, cleanliness, and efficacy, which can significantly influence purchasing decisions in a competitive beauty market.

Furthermore, the animal feed industry is an increasingly important and expanding customer for flavor products. Flavors are incorporated into animal diets to enhance palatability, thereby encouraging consumption and ensuring adequate nutrient intake for livestock, poultry, and pets. This is particularly crucial in situations where feed ingredients might be less appealing or when dealing with young or recovering animals. By improving feed intake, flavors contribute to animal health, growth, and overall productivity, making them a valuable additive for feed manufacturers. Lastly, the rapidly growing nutraceutical and dietary supplement industries are significant potential customers. As consumers become more health-conscious, there is a rising demand for functional foods and supplements. Flavors are indispensable here to make health-benefiting ingredients, which can often have undesirable tastes, more palatable and enjoyable, balancing nutritional efficacy with sensory appeal and ensuring consumer acceptance of wellness products. The broad applicability of flavors across these diverse industries underscores their fundamental role in enhancing product quality and consumer satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19,500 Million |

| Market Forecast in 2032 | USD 30,500 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Givaudan SA, Firmenich International SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Kerry Group plc, Sensient Technologies Corporation, Takasago International Corporation, MANE SA, Robertet SA, WILD Flavors & Specialty Ingredients (ADM), Synergy Flavors, Inc., Bell Flavors & Fragrances, Inc., Döhler GmbH, Tate & Lyle PLC, Carmi Flavor & Fragrance Co., Inc., Comax Manufacturing Corporation, Flavorchem Corporation, Treatt PLC, Ottens Flavors, Kalsec Inc., Prinova Group LLC, FONA International Inc., T. Hasegawa Co., Ltd., Wiberg GmbH, Prova SAS, IFF Lucas Meyer Cosmetics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flavors Market Key Technology Landscape

The flavors market is undergoing a significant transformation driven by continuous advancements in scientific and engineering technologies, aimed at meeting the complex demands for innovative, stable, and sustainable taste solutions. One of the most critical technological areas is encapsulation, which involves surrounding flavor compounds with a protective matrix material. This technology, including microencapsulation and nanoencapsulation, plays a pivotal role in protecting volatile flavor molecules from degradation caused by heat, light, oxygen, and moisture, thereby extending shelf life and preserving flavor intensity throughout product processing and storage. Encapsulation also enables controlled release mechanisms, allowing flavors to be delivered at specific stages of consumption or product preparation, thereby enhancing the overall sensory experience and improving product functionality in diverse applications ranging from beverages to bakery items.

Biotechnology and precision fermentation are rapidly emerging as foundational technologies for developing natural and clean label flavors. These methods utilize microorganisms, such as bacteria, yeast, or fungi, to produce specific flavor compounds through controlled fermentation processes. This approach offers a sustainable and efficient alternative to traditional extraction methods for rare or costly natural ingredients, reducing reliance on agricultural land and mitigating environmental impact. Biotechnology also facilitates the creation of "nature-identical" flavors that are chemically identical to their natural counterparts but produced synthetically, offering consistency and cost advantages while often appealing to consumers seeking natural-sounding ingredients. Furthermore, advanced analytical techniques, including Gas Chromatography-Mass Spectrometry (GC-MS), High-Performance Liquid Chromatography (HPLC), and Nuclear Magnetic Resonance (NMR) spectroscopy, are indispensable for the precise identification, quantification, and quality control of flavor components, ensuring consistency, safety, and regulatory compliance across all flavor formulations.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing the flavor creation process, moving it from an art to a more data-driven science. AI algorithms can analyze vast datasets of chemical compositions, sensory evaluations, consumer preferences, and market trends to predict successful flavor combinations, identify gaps in the market, and even design entirely novel flavor molecules. This significantly accelerates the R&D cycle, reduces costs associated with trial-and-error, and leads to more targeted product development. Alongside AI, sophisticated sensory analysis tools, such as electronic noses and tongues, are being employed to objectively measure and quantify aroma and taste profiles. These instruments provide invaluable data that complements traditional human sensory panels, offering a consistent and reproducible method for evaluating flavor characteristics, predicting consumer acceptance, and optimizing flavor formulations for superior sensory performance across a wide array of food and beverage applications.

Regional Highlights

- North America: This region represents a highly mature and innovative flavors market, characterized by sophisticated consumer demands and a strong emphasis on health and wellness. Key drivers include the prevalent clean label trend, robust demand for natural and organic flavors, and the increasing popularity of plant-based and functional food products. The market benefits from substantial investments in R&D, leading to advancements in flavor delivery systems and the introduction of complex, premium flavor profiles. The United States and Canada are pivotal markets, showcasing a strong inclination towards customized and authentic regional American and global flavors, alongside a keen interest in sustainable sourcing practices and transparent ingredient declarations.

- Europe: The European flavors market is shaped by stringent regulatory frameworks concerning food additives and a deeply ingrained consumer preference for natural, authentic, and sustainably sourced ingredients. Innovation in Europe is often driven by the clean label movement, pushing manufacturers towards natural extracts, botanicals, and traditional flavor profiles. The region exhibits high demand for savory flavors in ready meals and snacks, as well as classic fruit and sweet flavors in confectionery and dairy. Countries like Germany, France, and the UK are major contributors, with a growing focus on organic and ethically produced flavors, reflecting a heightened environmental consciousness among consumers and industry players alike.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, the APAC region is propelled by rapid urbanization, significant population growth, and a burgeoning middle class with increasing disposable incomes. This demographic shift is fueling an unprecedented demand for processed foods, convenience beverages, and a diverse range of culinary experiences, from traditional ethnic flavors to globally inspired tastes. Countries such as China, India, Japan, and Australia are key contributors, demonstrating strong growth in savory, spicy, and fruit-based flavors across all application segments. The market is also seeing substantial investment in localized product development, catering to specific regional palates and traditional food preferences.

- Latin America: This region presents an emerging and dynamic market with considerable growth potential. Factors contributing to this growth include increasing disposable incomes, evolving consumer lifestyles, and a gradual shift towards westernized diets, alongside a strong appreciation for local and tropical fruit flavors. Brazil and Mexico are leading markets within Latin America, characterized by a rising demand for convenience foods, soft drinks, and dairy products. Flavor innovation here focuses on creating unique taste experiences that blend traditional local ingredients with modern culinary trends, while also addressing growing health and wellness concerns with natural and reduced-sugar flavor options.

- Middle East and Africa (MEA): The MEA region is a developing market for flavors, experiencing steady growth driven by population expansion, increasing tourism, and the modernization of the food processing and hospitality sectors. The Gulf Cooperation Council (GCC) countries are at the forefront of this growth, with rising disposable incomes and a growing appetite for both international and unique regional flavors in confectionery, beverages, and savory dishes. The market is also influenced by specific cultural and religious dietary requirements, such as halal certification, which flavor manufacturers must adhere to. Investment in improving supply chains and expanding local manufacturing capabilities is expected to further bolster market development in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flavors Market.- Givaudan SA

- Firmenich International SA

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Kerry Group plc

- Sensient Technologies Corporation

- Takasago International Corporation

- MANE SA

- Robertet SA

- WILD Flavors & Specialty Ingredients (ADM)

- Synergy Flavors, Inc.

- Bell Flavors & Fragrances, Inc.

- Döhler GmbH

- Tate & Lyle PLC

- Carmi Flavor & Fragrance Co., Inc.

- Comax Manufacturing Corporation

- Flavorchem Corporation

- Treatt PLC

- Ottens Flavors

- Kalsec Inc.

- Prinova Group LLC

- FONA International Inc.

- T. Hasegawa Co., Ltd.

- Wiberg GmbH

- Prova SAS

- IFF Lucas Meyer Cosmetics

Frequently Asked Questions

What are the primary factors driving growth in the global flavors market?

The global flavors market is primarily driven by increasing demand for processed and convenience foods due to rapid urbanization and busy lifestyles. Additionally, rising disposable incomes, evolving consumer preferences for diverse, novel, and authentic taste experiences, and a strong global trend towards natural and clean label ingredients significantly contribute to market expansion.

How do natural and artificial flavors differ in market application?

Natural flavors are derived from natural sources and are increasingly sought after by consumers for clean label products, often at a higher cost. Artificial flavors are chemically synthesized, offering greater stability, consistency, and cost-effectiveness, making them versatile for a wide range of applications where cost or specific sensory profiles are critical.

Which geographical regions are key to the flavors market, and what are their unique characteristics?

Asia Pacific is the fastest-growing region due to urbanization and rising incomes. North America and Europe are mature markets focused on natural, clean label, and functional flavors with strong R&D. Latin America and MEA are emerging markets driven by evolving diets and expanding food processing industries, with a growing appreciation for local and international tastes.

What role does technology, particularly AI, play in modern flavor development?

Technology, including AI and machine learning, is transforming flavor development by enabling predictive analytics for consumer trends, accelerating the discovery of new flavor combinations, optimizing formulations for stability and consistency, and enhancing quality control. Advanced techniques like encapsulation further improve flavor delivery and shelf life.

What are the significant challenges faced by the flavors industry?

The flavors industry faces challenges such as the volatility of raw material prices, which impacts production costs. Stringent and diverse global regulatory frameworks require significant investment in compliance. Additionally, health concerns associated with certain ingredients and high research and development costs for innovative solutions pose ongoing hurdles for market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food Flavors and Additives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oil Soluble Flavors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Flavors & Fragrances Market Size Report By Type (Natural, Essential Oils, Orange Essential Oils, Corn mint Essential Oils, Eucalyptus Essential Oils, Pepper Mint Essential Oils, Lemon Essential Oils, Citronella Essential Oils, Patchouli Essential Oils, Clove Essential Oils, Ylang Ylang/Canaga Essential Oils, Lavender Essential Oils, Oleoresins, Paprika Oleoresins, Black Pepper Oleoresins, Turmeric Oleoresins, Ginger Oleoresins, Others, Aroma Chemical, Esters, Alcohol, Aldehydes, Phenol, Terpenes, Others), By Application (Flavors, Confectionery, Convenience Food, Bakery Food, Dairy Food, Beverages, Animal Feed, Others, Fragrances, Fine Fragrances, Cosmetics & Toiletries, Soaps & Detergents, Aromatherapy, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Flavors Market Size Report By Type (Natural, Essential Oil, Natural Essence, Others, Synthetic, Artificial flavors, Nature-identical flavor), By Application (Beverages, Alcoholic beverages, Hot non-alcoholic beverages, Cold non-alcoholic beverages, RTD Coffee, RTD Juices, Others, Alcoholic free beverages, Dairy, Cheese, Dairy drinks, Flavored milk, Yoghurt Drinks, Others, Dairy food, Nutrition and health, Weight Management, Infant and Baby Nutrition, Maternal health, Sports Nutrition, Sports protein, RTD, Powder, Bars, Sports non-protein, BCAAs, Energy drink, Hydration gels, Others, Others, Savory, Bakery, Snacks, Soups, sauces and dressings, Others, Sweet goods, Bakery sweet, Confections, Desserts, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Chiral Chemicals Market Size Report By Type (Traditional Separation Method, Asymmetric Preparation Method, Biological Separation Method), By Application (Pharmaceutical, Agrochemical, Flavors and Fragrances, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager