Flue Gas Desulfurization System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427182 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Flue Gas Desulfurization System Market Size

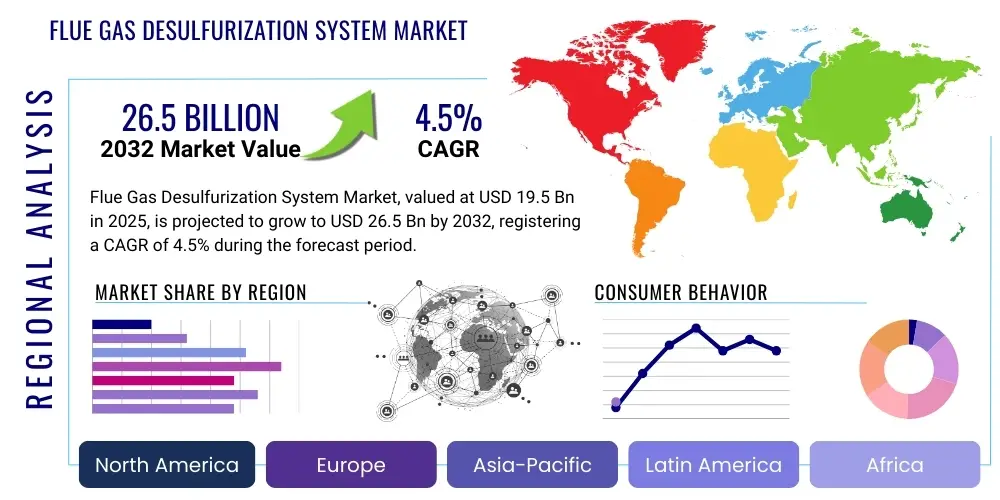

The Flue Gas Desulfurization System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032. The market is estimated at USD 19.5 Billion in 2025 and is projected to reach USD 26.5 Billion by the end of the forecast period in 2032.

Flue Gas Desulfurization System Market introduction

The Flue Gas Desulfurization (FGD) system market is a critical component of environmental protection strategies globally, primarily focused on mitigating the emission of sulfur dioxide (SO2) from industrial and power generation facilities. These systems are designed to remove SO2, a major air pollutant responsible for acid rain, respiratory issues, and environmental degradation, from exhaust gases before they are released into the atmosphere. The product spectrum encompasses various technologies, including wet, dry, and semi-dry scrubbers, each tailored to specific industrial requirements and emission standards.

Major applications for FGD systems are predominantly found in coal-fired power plants, which are significant sources of SO2 emissions, along with industrial boilers, refineries, cement plants, and metallurgical facilities. The primary benefits derived from the implementation of FGD systems include compliance with stringent environmental regulations, improved public health outcomes, protection of ecosystems from acid rain, and enhanced operational efficiency of industrial plants by preventing acid corrosion. These systems are indispensable for industries aiming to achieve environmental sustainability and adhere to international accords.

The markets growth is predominantly driven by escalating global concerns regarding air quality and the subsequent imposition of stricter environmental protection policies and emission reduction targets by governments worldwide. Furthermore, rapid industrialization, particularly in emerging economies, coupled with increasing electricity demand and the continued reliance on fossil fuels for energy generation, necessitates the widespread adoption of advanced SO2 control technologies. The ongoing modernization and retrofitting of existing industrial infrastructure also contribute significantly to the demand for efficient FGD solutions.

Flue Gas Desulfurization System Market Executive Summary

The Flue Gas Desulfurization System market is experiencing dynamic shifts, characterized by evolving business trends, distinct regional growth patterns, and technological advancements across various segments. Business trends indicate a strong emphasis on smart FGD systems integrated with IoT and AI for enhanced efficiency and predictive maintenance, alongside a growing consolidation among key players through strategic partnerships and mergers to offer comprehensive environmental solutions. There is also an increasing focus on lifecycle cost reduction and the development of more compact, modular systems, particularly for smaller industrial applications, reflecting a move towards more adaptable and cost-effective solutions for diverse operational scales.

Regionally, Asia-Pacific remains the dominant and fastest-growing market, primarily fueled by rapid industrial expansion, escalating energy demand, and increasingly stringent environmental regulations in countries like China and India. North America and Europe, while mature, continue to invest in upgrading existing FGD infrastructure to meet evolving emission standards and adopt advanced, more efficient technologies. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth as they industrialize and adopt environmental compliance measures, albeit at a slower pace due to varying regulatory landscapes and investment capabilities.

Segmentation trends reveal that wet FGD systems, particularly limestone-based, continue to hold the largest market share due to their high SO2 removal efficiency and proven track record in large-scale power generation. However, dry and semi-dry FGD systems are gaining traction for specific industrial applications requiring lower capital expenditure, less water usage, and simpler waste management, especially in regions facing water scarcity or smaller industrial facilities. The market is also witnessing a shift towards multi-pollutant control systems, integrating SO2 removal with NOx and particulate matter control, driven by comprehensive air quality regulations. This holistic approach to pollution control highlights the industrys response to broader environmental challenges.

AI Impact Analysis on Flue Gas Desulfurization System Market

User inquiries concerning AIs influence on Flue Gas Desulfurization systems frequently revolve around optimization, efficiency gains, and cost reduction. Key themes include how AI can enhance the performance of existing FGD units, enable predictive maintenance to minimize downtime, reduce operational expenses through smarter resource management, and provide real-time insights for regulatory compliance. Users are keen to understand the practical applications of AI in monitoring complex processes, optimizing reagent consumption, and forecasting equipment failures, ultimately expecting a significant leap in environmental control effectiveness and economic viability for industrial operators. The underlying expectation is that AI will transform FGD systems from reactive maintenance models to proactive, highly optimized, and self-regulating environmental control assets.

- Predictive maintenance for critical components, reducing unscheduled downtime.

- Real-time process optimization through intelligent control algorithms, improving SO2 removal efficiency.

- Optimized reagent consumption (e.g., limestone, lime) leading to significant cost savings.

- Enhanced energy management and reduced parasitic load of FGD operations.

- Automated fault detection and diagnosis, streamlining troubleshooting and repairs.

- Improved data analytics for regulatory reporting and environmental compliance.

- Adaptive control to respond to varying flue gas conditions and load changes.

- Support for workforce by providing actionable insights and reducing manual intervention.

DRO & Impact Forces Of Flue Gas Desulfurization System Market

The Flue Gas Desulfurization System market is profoundly shaped by a confluence of drivers, restraints, and opportunities, all influenced by various impact forces. Key drivers include increasingly stringent environmental regulations imposing stricter limits on sulfur dioxide emissions globally, rapid industrialization and urbanization in developing nations leading to higher energy demand and subsequent pollutant output, and growing public awareness regarding air pollutions adverse health effects. Additionally, the need for retrofitting aging power plants and industrial facilities with advanced environmental control technologies further fuels market expansion. These drivers collectively create a compelling demand for effective SO2 abatement solutions across diverse industrial sectors.

However, the market also faces significant restraints. High capital investment required for installing new FGD systems or upgrading existing ones, coupled with substantial operational and maintenance costs associated with reagents, energy consumption, and waste disposal, can deter potential adopters, especially smaller enterprises. The increasing shift towards renewable energy sources for power generation, while environmentally beneficial, poses a long-term threat to the market for FGD systems by reducing the reliance on fossil-fuel-fired power plants. Furthermore, the technical complexity and space requirements for some FGD technologies can be challenging for facilities with limited footprints or specific operational constraints.

Opportunities for growth lie in the ongoing development of more efficient, cost-effective, and compact FGD technologies, including hybrid systems and modular designs, that can cater to a broader range of industrial applications and scales. The integration of advanced analytics, artificial intelligence, and IoT for predictive maintenance and process optimization presents a significant avenue for enhancing system performance and reducing operational expenditure. Emerging economies with burgeoning industrial sectors and evolving environmental policies represent untapped markets with substantial growth potential. The impact forces, such as the bargaining power of buyers driven by the need for cost-effective compliance, the bargaining power of suppliers influenced by the availability of specialized reagents and components, and the threat of new entrants by niche technology providers, continually shape the competitive landscape and drive innovation within the FGD market.

Segmentation Analysis

The Flue Gas Desulfurization System market is extensively segmented based on technology type, end-use industry, and reagent type, allowing for a detailed analysis of market dynamics and tailored solutions. Each segment exhibits distinct growth trajectories and technological preferences, reflecting the diverse operational requirements and regulatory landscapes across various industrial applications. Understanding these segmentations is crucial for stakeholders to identify lucrative opportunities, develop targeted strategies, and innovate in response to specific market demands.

- By Type: Wet FGD Systems, Dry FGD Systems, Semi-Dry FGD Systems

- By End-Use Industry: Power Generation, Chemical Manufacturing, Cement Industry, Iron & Steel Industry, Other Industrial Applications

- By Reagent: Limestone, Lime, Sodium Hydroxide, Seawater, Other Reagents

Flue Gas Desulfurization System Market Value Chain Analysis

The Flue Gas Desulfurization System markets value chain commences with the upstream analysis, encompassing raw material and component suppliers. This segment includes providers of core reagents such as limestone, lime, and sodium hydroxide, crucial for the SO2 absorption process. It also involves manufacturers of specialized components like spray nozzles, pumps, fans, absorbers, heat exchangers, and instrumentation, as well as suppliers of construction materials for system fabrication. The efficiency and cost-effectiveness of these upstream inputs directly influence the overall system cost and performance, highlighting the importance of robust supply chain management and supplier relationships.

Moving downstream, the value chain extends to the end-users, primarily large industrial facilities and power plants that implement these systems for emission control. This segment includes the engineering, procurement, and construction (EPC) firms responsible for the design, installation, and commissioning of FGD systems. Post-installation, the downstream activities also involve ongoing operation and maintenance services, including spare parts supply, technical support, and performance optimization, which are critical for the long-term effectiveness and compliance of the installed systems. Service providers offering these after-sales supports form an integral part of ensuring the longevity and efficiency of FGD units.

Distribution channels for FGD systems are typically direct, involving direct sales from manufacturers to large industrial clients or through specialized EPC contractors who manage the entire project lifecycle from design to handover. Indirect channels may include consultants and integrators who advise clients on appropriate technologies and integrate various components into a complete solution. The complexity and high capital expenditure associated with FGD systems often necessitate a direct, consultative sales approach, emphasizing technical expertise and customized solutions over off-the-shelf product distribution. Both direct and indirect channels play a role in reaching diverse clients, with direct sales being predominant for large-scale projects.

Flue Gas Desulfurization System Market Potential Customers

The primary potential customers for Flue Gas Desulfurization Systems are industrial entities that generate significant sulfur dioxide emissions as a byproduct of their operational processes. Foremost among these are coal-fired power plants, which remain a dominant segment due to their substantial reliance on sulfur-containing fuels and the strict environmental mandates governing their emissions. These power generation facilities continually seek to comply with national and international air quality standards, making FGD systems an essential investment for their continued operation and environmental stewardship.

Beyond the power sector, a diverse range of heavy industries represents significant end-users. This includes the cement manufacturing industry, where the combustion of raw materials and fuels can release considerable SO2; the iron and steel industry, particularly in processes like sintering and coking; and various chemical processing plants that utilize sulfur-containing feedstocks or produce sulfurous waste gases. Oil and gas refineries also stand as crucial customers, needing to control SO2 emissions from fluid catalytic cracking units and other combustion sources.

Additionally, other industrial applications such as glass manufacturing, pulp and paper production, and certain mining and metallurgical operations also constitute a portion of the potential customer base. Any facility engaged in large-scale combustion or industrial processes involving sulfur where environmental regulations dictate SO2 emission limits becomes a prospective buyer of FGD technologies. The demand is often driven by a combination of regulatory compliance, corporate social responsibility initiatives, and the desire to enhance operational sustainability.

Flue Gas Desulfurization System Market Key Technology Landscape

The technological landscape of the Flue Gas Desulfurization System market is characterized by a blend of established and emerging innovations aimed at enhancing efficiency, reducing operational costs, and improving environmental performance. Wet scrubbing, particularly the wet limestone-gypsum process, remains the most widely adopted and highly efficient technology, especially for large-scale power plants, due to its proven capability to achieve high SO2 removal rates and produce a marketable byproduct in the form of gypsum. Variations include seawater FGD systems used in coastal areas, leveraging the natural alkalinity of seawater to absorb SO2.

Complementing wet systems, dry and semi-dry scrubbing technologies offer alternatives with specific advantages. Dry FGD systems, often utilizing spray dryer absorbers or circulating dry scrubbers with lime as a reagent, are favored for their lower water consumption, simpler waste handling in dry form, and reduced capital investment, making them suitable for smaller industrial applications or regions with water scarcity. Semi-dry systems strike a balance, offering good removal efficiency with less water usage than wet systems and easier waste management compared to fully dry processes, making them versatile for various industrial scales.

Emerging technologies and trends further advance the market, including the integration of advanced sensors, real-time analytics, and artificial intelligence for predictive maintenance, optimized reagent injection, and adaptive process control. Modular FGD systems are gaining traction for easier installation and scalability, while hybrid systems combining the benefits of different technologies are also being developed. Research into novel sorbents, advanced catalysts, and multi-pollutant control systems, which simultaneously remove SO2, NOx, and particulate matter, signifies a continuous drive towards more comprehensive and sustainable air pollution control solutions, pushing the boundaries of traditional FGD capabilities.

Regional Highlights

- Asia Pacific: This region dominates the FGD market, propelled by rapid industrialization, increasing energy demand primarily met by coal-fired power plants, and escalating environmental concerns leading to stricter emission regulations in countries like China, India, and Southeast Asian nations. Significant investments in new power generation capacity and retrofitting of existing industrial infrastructure underscore its market leadership.

- North America: A mature market characterized by stringent air quality standards and a strong emphasis on upgrading existing FGD systems with more efficient and advanced technologies. The U.S. and Canada are focused on optimizing operational costs, integrating smart technologies, and ensuring compliance for their aging industrial and power generation facilities, even as natural gas displaces some coal-fired capacity.

- Europe: Driven by ambitious climate targets and comprehensive environmental directives from the European Union, the European market is marked by continuous advancements in FGD technology and a focus on multi-pollutant control. Countries such as Germany and the UK are prominent, with an emphasis on achieving high removal efficiencies and exploring carbon capture integration alongside SO2 abatement.

- Latin America: This region is experiencing steady growth, fueled by industrial development, particularly in Brazil and Mexico. The adoption of FGD systems is gradually increasing due to growing awareness of environmental protection and the implementation of local emission control regulations, albeit at a slower pace compared to developed regions.

- Middle East & Africa: An emerging market for FGD systems, driven by ongoing industrial expansion, the construction of new power plants, and a gradual tightening of environmental regulations. Countries rich in fossil fuel resources are beginning to invest in air pollution control technologies to meet international standards and address local environmental impacts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flue Gas Desulfurization System Market.- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Hitachi Power Systems, Ltd.

- General Electric Company

- Ducon Environmental Systems, Inc.

- Hamon & Cie International SA

- Siemens AG

- Doosan Lentjes GmbH

- Thermax Limited

- KC Cottrell Co., Ltd.

- Marsulex Environmental Technologies (MET)

- Croll-Reynolds Company Inc.

- Valmet Corporation

- General Electric Steam Power

- Fuji Electric Co., Ltd.

- John Wood Group PLC

Frequently Asked Questions

What is a Flue Gas Desulfurization System?

A Flue Gas Desulfurization (FGD) system is an environmental control technology designed to remove sulfur dioxide (SO2) from the exhaust flue gases of fossil fuel power plants and other industrial facilities before they are released into the atmosphere, mitigating air pollution.

What are the main types of FGD systems?

The main types of FGD systems are Wet FGD, Dry FGD, and Semi-Dry FGD. Wet systems use a liquid absorbent slurry, dry systems inject a dry sorbent into the flue gas, and semi-dry systems use a finely atomized sorbent slurry.

Why are FGD systems important?

FGD systems are crucial for reducing SO2 emissions, which are major contributors to acid rain, respiratory diseases, and environmental damage. They help industries comply with stringent air quality regulations and improve public health and ecological well-being.

What industries primarily use FGD systems?

FGD systems are primarily used in the power generation industry (especially coal-fired power plants), cement manufacturing, iron and steel production, chemical processing, and oil and gas refining, where significant SO2 emissions are produced.

How does AI impact the efficiency of FGD systems?

AI impacts FGD systems by enabling predictive maintenance, optimizing reagent consumption in real-time, improving energy efficiency, and automating fault detection. This leads to higher SO2 removal rates, reduced operational costs, and increased system reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager