Gas Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429907 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Gas Detector Market Size

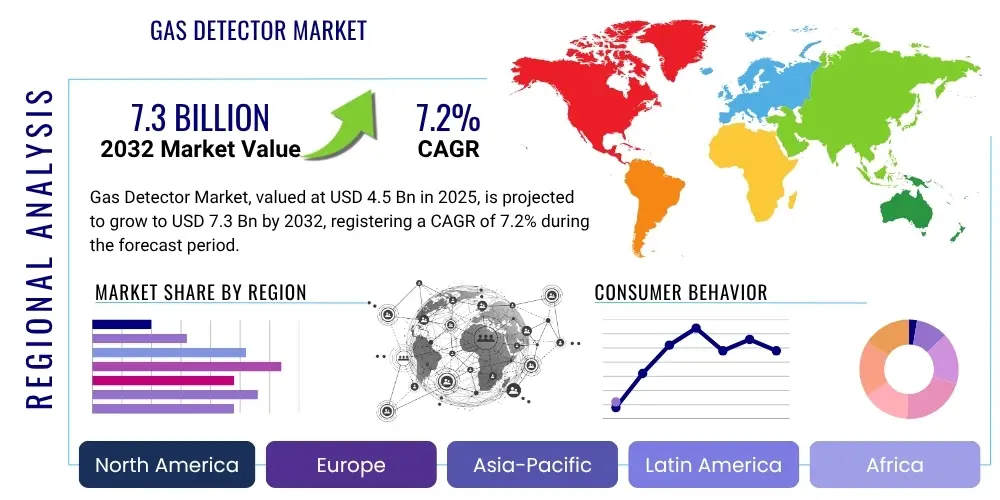

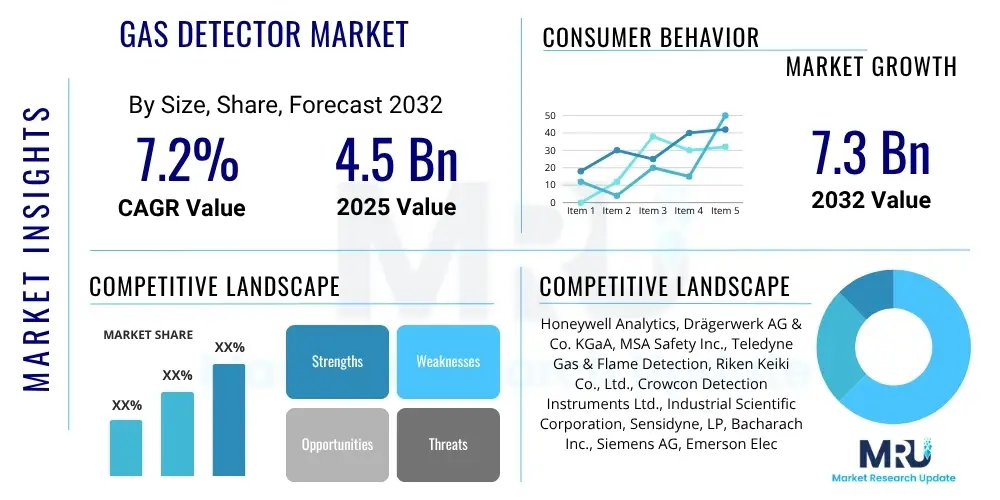

The Gas Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at $4.5 Billion in 2025 and is projected to reach $7.3 Billion by the end of the forecast period in 2032.

Gas Detector Market introduction

The Gas Detector Market encompasses a wide range of devices designed to identify the presence of various gases within an area, often as part of a safety system. These sophisticated instruments play a critical role in safeguarding lives and assets by alerting personnel to potential hazards such as toxic gases, combustible gases, and oxygen depletion. The primary function of a gas detector is to measure the concentration of specific gases in the ambient atmosphere and provide an alarm when levels exceed predefined safety thresholds, enabling timely evacuation or mitigation measures.

Products within this market range from portable, handheld devices used for personal protection or spot-checking, to fixed systems integrated into industrial control environments for continuous monitoring across large facilities. These detectors utilize various sensing technologies, including electrochemical, catalytic bead, infrared, photoionization, and semiconductor sensors, each suited for detecting different types of gases and operating under specific environmental conditions. Advances in sensor technology have led to increased accuracy, faster response times, and enhanced durability, contributing significantly to their reliability in critical applications.

Major applications for gas detectors span numerous industries, including oil and gas, chemical processing, manufacturing, mining, utilities, wastewater treatment, commercial buildings, and even residential settings. The benefits of deploying these systems are paramount, primarily focusing on preventing accidents, protecting worker health, ensuring regulatory compliance, and minimizing potential environmental damage or costly operational disruptions. Key driving factors for market growth include stringent industrial safety regulations, increasing industrialization and infrastructure development globally, heightened awareness of workplace safety, and continuous technological advancements improving detector capabilities and connectivity.

Gas Detector Market Executive Summary

The Gas Detector Market is experiencing robust growth, driven by an accelerating focus on industrial safety, environmental protection, and stringent regulatory frameworks across various sectors. Current business trends indicate a significant shift towards smart, connected gas detection systems, integrating technologies such as the Internet of Things (IoT) for real-time monitoring, data analytics, and remote accessibility. Manufacturers are increasingly focusing on developing highly accurate, durable, and user-friendly devices that can withstand harsh industrial environments while offering enhanced connectivity and reduced false alarm rates. Digitalization and automation are key themes, transforming how gas detection systems are deployed, maintained, and how their data is leveraged for predictive safety insights.

Regional trends reveal a dynamic landscape, with Asia Pacific emerging as a dominant growth region due to rapid industrialization, increasing investments in manufacturing and infrastructure, and the adoption of stricter safety norms, particularly in countries like China and India. North America and Europe, while more mature markets, continue to demonstrate stable demand, primarily driven by regulatory updates, the replacement of aging infrastructure, and a strong emphasis on advanced technological integration, including AI and cloud-based solutions. Latin America, the Middle East, and Africa are also showing promising growth, fueled by expanding oil and gas exploration activities, mining operations, and developing industrial bases, alongside a growing awareness of occupational safety standards.

Segmentation trends highlight a strong demand for both fixed and portable gas detectors, each serving distinct operational needs. Portable detectors are essential for personal safety and confined space entry, while fixed systems provide continuous area monitoring in critical infrastructure. Technology-wise, infrared and electrochemical sensors remain prevalent due to their reliability and specificity, with catalytic bead sensors dominating combustible gas detection. The end-user segments, such as oil and gas, chemicals, and utilities, are consistently the largest consumers, but there is also expanding adoption in commercial and public buildings, wastewater treatment, and even residential applications, indicating diversification in market demand and application scope. The trend towards multi-gas detectors is also notable, offering comprehensive protection in a single device.

AI Impact Analysis on Gas Detector Market

Common user questions regarding AI's impact on the Gas Detector Market often revolve around how artificial intelligence can enhance detection accuracy, reduce false positives, enable predictive maintenance, and facilitate more intelligent safety protocols. Users are keen to understand if AI can move beyond simple threshold alarms to contextualize gas presence, anticipate potential leaks based on operational patterns, and provide more sophisticated decision support. There are also expectations around AI's role in integrating gas detection data with other safety systems, optimizing response mechanisms, and improving the overall efficiency and reliability of safety operations, while also considering the associated costs and complexities of implementing such advanced solutions.

- AI significantly enhances the precision and reliability of gas detection by analyzing complex environmental data patterns, thereby differentiating actual threats from nuisance alarms caused by environmental interference or sensor degradation.

- Predictive maintenance capabilities are boosted by AI, allowing systems to monitor sensor health, predict potential failures, and schedule maintenance proactively, thus reducing downtime and ensuring continuous operational safety.

- Advanced data analytics, powered by AI algorithms, enables comprehensive analysis of historical gas concentration data, environmental factors, and operational parameters to identify trends, pinpoint risk areas, and optimize sensor placement for maximum coverage.

- AI integration facilitates the development of smart response protocols, where automated systems can initiate specific safety measures, such as ventilation activation or system shutdowns, based on the severity and context of detected gas leaks.

- Integration with IoT platforms and smart building management systems becomes seamless with AI, allowing for a unified safety ecosystem that provides a holistic view of environmental hazards and enables centralized control and monitoring.

- The development of autonomous monitoring and robotic inspection systems equipped with AI-powered gas detectors is gaining traction, particularly for dangerous or inaccessible environments, enhancing worker safety by removing human presence from hazardous zones.

- AI-driven sensor fusion techniques can combine data from multiple sensor types and environmental inputs, leading to a more robust and accurate assessment of gas hazards, especially in scenarios involving mixed gas environments.

- Enhanced decision support systems leverage AI to provide real-time recommendations to personnel, guiding them through emergency procedures and improving situational awareness during critical incidents.

- AI contributes to optimized energy consumption for fixed systems by intelligently managing sensor sampling rates and communication frequencies based on perceived risk levels and operational requirements.

- Training and calibration processes for gas detectors can be streamlined using AI, which can analyze performance data to recommend optimal calibration schedules and even suggest self-calibration routines for certain sensor types.

DRO & Impact Forces Of Gas Detector Market

The Gas Detector Market is significantly shaped by a confluence of driving forces, inherent restraints, promising opportunities, and overarching impact forces that dictate its trajectory and evolution. Drivers predominantly include stringent global safety regulations, the escalating industrial safety concerns across hazardous sectors, and the continuous expansion of manufacturing and infrastructure projects, particularly in emerging economies. These factors compel industries to invest in advanced detection technologies to protect personnel and assets. Restraints, conversely, encompass the high initial investment costs associated with sophisticated gas detection systems, the technical complexities involved in system installation and maintenance, and the challenge of false alarms, which can lead to operational inefficiencies and skepticism regarding system reliability. Addressing these limitations is crucial for broader market penetration.

Opportunities within the market are abundant, primarily centered on the integration of cutting-edge technologies like the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, which promise enhanced connectivity, predictive analytics, and remote monitoring capabilities. The growing demand for wireless and portable gas detectors, especially for personal safety and confined space entry, also presents significant avenues for growth. Furthermore, the expansion into new application areas such as smart cities, environmental monitoring, and healthcare facilities offers diversified revenue streams. Manufacturers are increasingly focusing on developing multi-gas detectors and systems that are easier to integrate and manage, providing comprehensive solutions to complex safety challenges and appealing to a wider customer base seeking integrated safety platforms.

Impact forces acting on the Gas Detector Market include rapid technological advancements, which consistently push the boundaries of sensor accuracy, response time, and device durability, making older technologies obsolete faster. Environmental and health and safety regulatory bodies exert immense pressure, mandating compliance and driving the adoption of more effective detection solutions, thereby directly influencing market demand and product development. Global industrial growth, particularly in regions undergoing significant manufacturing expansion, fuels the demand for safety equipment, including gas detectors. Additionally, the increasing global awareness regarding industrial accidents and their profound human and economic costs serves as a powerful motivator for industries to proactively invest in superior gas detection technologies, solidifying the market's importance in the broader safety ecosystem and necessitating continuous innovation.

- Drivers:

- Increasingly stringent industrial safety regulations and compliance mandates globally across various sectors like oil and gas, chemicals, mining, and manufacturing.

- Growing awareness and emphasis on occupational health and safety standards to protect workers from hazardous gas exposures and ensure safe working environments.

- Rapid industrialization and infrastructural development, especially in emerging economies, leading to the establishment of new industrial facilities requiring comprehensive gas detection solutions.

- Rising demand for real-time monitoring and advanced safety systems to prevent industrial accidents, explosions, and fatalities caused by toxic or combustible gases.

- Technological advancements in sensor capabilities, including enhanced accuracy, faster response times, increased durability, and improved selectivity for various gases.

- Expansion of the oil and gas industry, with increased exploration, production, and processing activities in challenging environments demanding robust gas detection.

- Growth in the chemical and petrochemical industries where handling of hazardous chemicals necessitates constant vigilance against gas leaks.

- Restraints:

- High initial investment costs associated with the procurement and installation of sophisticated, multi-point, or integrated gas detection systems, especially for smaller enterprises.

- Technical complexities involved in the calibration, maintenance, and integration of advanced gas detection systems, requiring specialized training and expertise.

- Prevalence of false alarms, which can lead to operational disruptions, unnecessary evacuations, and reduced trust in the reliability of the detection systems over time.

- Limited battery life for portable and wireless gas detectors, requiring frequent recharging or battery replacement, impacting continuous monitoring in remote locations.

- Lack of standardized regulatory frameworks across all regions, creating inconsistencies in safety requirements and product specifications for manufacturers and users.

- Perception of high operational costs related to regular calibration, sensor replacement, and software updates for advanced systems.

- Competition from lower-cost, less advanced detection solutions in price-sensitive markets, potentially hindering the adoption of premium, high-tech systems.

- Opportunity:

- Integration of Internet of Things (IoT) technology for enhanced connectivity, remote monitoring, and real-time data analytics, offering proactive safety management.

- Development and adoption of artificial intelligence (AI) and machine learning (ML) for predictive maintenance, false alarm reduction, and intelligent decision-making in gas detection.

- Increasing demand for wireless gas detection systems that offer flexibility, ease of installation, and cost-effectiveness in diverse industrial and commercial settings.

- Expansion into emerging applications such as smart city infrastructure, environmental monitoring, home safety, and healthcare facilities.

- Focus on developing multi-gas detectors that can simultaneously monitor several hazardous gases, providing comprehensive protection in a single, compact device.

- Growth in the market for cloud-based safety solutions, enabling centralized data management, reporting, and accessibility for distributed operations.

- Customization of gas detection solutions to meet specific industry requirements and unique environmental challenges, creating niche market segments.

- Retrofitting existing industrial infrastructure with advanced, connected gas detection systems to upgrade safety capabilities without extensive overhauls.

- Impact Forces:

- Technological Innovation: Continuous advancements in sensor technology, wireless communication, and data processing capabilities drive market evolution and product competitiveness.

- Regulatory Pressure: Stricter environmental and occupational safety regulations directly influence demand, product features, and market growth by mandating compliance.

- Industrial Growth: Global expansion of industrial sectors, particularly in manufacturing, energy, and construction, directly correlates with increased demand for safety equipment.

- Economic Conditions: Global economic stability and investment levels in industrial and infrastructure projects impact procurement budgets for safety equipment.

- Environmental Concerns: Growing focus on environmental protection and pollution control drives demand for gas detectors to monitor emissions and prevent environmental hazards.

- Public and Corporate Safety Awareness: Heightened awareness of industrial accidents and their consequences fuels demand for proactive safety measures and advanced detection systems.

- Supply Chain Dynamics: Availability of raw materials, electronic components, and global logistics efficiency affects production costs and market supply.

- Competitive Landscape: Intense competition among manufacturers leads to continuous product innovation, price adjustments, and strategic partnerships.

Segmentation Analysis

The Gas Detector Market is intricately segmented based on various critical parameters, providing a detailed understanding of its diverse applications, technological preferences, and end-user demands. This segmentation allows for a comprehensive analysis of market dynamics, enabling stakeholders to identify lucrative opportunities and tailor strategies to specific niches. The market is primarily categorized by product type, technology, end-user industry, and region, each revealing distinct growth patterns and competitive landscapes. Understanding these segments is vital for manufacturers to align their product development with market needs, for distributors to optimize their sales channels, and for end-users to select the most appropriate detection solutions for their specific safety requirements. The proliferation of different hazardous gases and diverse operating environments necessitates this multi-faceted approach to market analysis, ensuring that specialized needs across industries are effectively addressed by tailored product offerings.

- By Product Type:

- Fixed Gas Detectors: Permanently installed systems for continuous monitoring of specific areas or entire facilities, often integrated with control systems.

- Point Gas Detectors

- Open Path Gas Detectors

- Portable Gas Detectors: Handheld or wearable devices used for personal safety, confined space entry, leak detection, or spot-checking.

- Single Gas Detectors

- Multi-Gas Detectors

- Fixed Gas Detectors: Permanently installed systems for continuous monitoring of specific areas or entire facilities, often integrated with control systems.

- By Technology:

- Electrochemical Gas Detectors: Used for detecting toxic gases and oxygen levels, operating on the principle of a chemical reaction generating an electrical current.

- Catalytic Bead Gas Detectors: Primarily used for detecting combustible gases, where a catalytic reaction causes a change in resistance proportional to gas concentration.

- Infrared (IR) Gas Detectors: Utilized for detecting combustible and carbon dioxide gases by measuring the absorption of infrared radiation by gas molecules.

- Open Path IR Detectors

- Point IR Detectors

- Photoionization Detectors (PIDs): Employed for detecting volatile organic compounds (VOCs) and other toxic gases using ultraviolet light to ionize gas molecules.

- Metal Oxide Semiconductor (MOS) Gas Detectors: Versatile sensors for a broad range of gases, including combustible gases, CO, H2S, and VOCs, reacting to changes in resistance due to gas adsorption.

- Laser-Based Gas Detectors: Highly specific and sensitive detectors using laser absorption spectroscopy for remote detection of specific gases like methane.

- Thermal Conductivity Gas Detectors: Used for high-concentration measurements of gases like hydrogen and helium based on their thermal conductivity properties.

- Holographic Gas Detectors: Emerging technology utilizing holographic gratings for gas sensing.

- By End-User Industry:

- Oil and Gas: Exploration, upstream, midstream, downstream operations, refineries, petrochemical plants, offshore platforms.

- Chemical and Pharmaceutical: Chemical manufacturing, storage, research laboratories, pharmaceutical production.

- Mining: Underground and surface mining operations, coal mines, metal mines, tunnels, and quarries.

- Manufacturing and Industrial: Automotive, electronics, food and beverage, pulp and paper, general manufacturing facilities.

- Utilities: Power generation plants, wastewater treatment facilities, gas distribution networks, renewable energy sites.

- Commercial and Residential: HVAC systems in commercial buildings, hotels, hospitals, shopping malls, home safety.

- Building Automation: Integration with smart building systems for indoor air quality monitoring and safety.

- Environmental Monitoring: Air quality stations, landfill gas monitoring, emission control.

- Emergency Services and HazMat: Fire departments, first responders, hazardous materials teams.

- Government and Military: Defense applications, public safety, critical infrastructure protection.

- By Region:

- North America: United States, Canada, Mexico.

- Europe: Germany, United Kingdom, France, Italy, Spain, Rest of Europe.

- Asia Pacific (APAC): China, India, Japan, South Korea, Australia, Southeast Asia, Rest of APAC.

- Latin America: Brazil, Argentina, Rest of Latin America.

- Middle East and Africa (MEA): GCC Countries (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman), South Africa, Rest of MEA.

Value Chain Analysis For Gas Detector Market

The value chain for the Gas Detector Market is a complex ecosystem, beginning with the upstream supply of raw materials and sophisticated electronic components, progressing through precision manufacturing, and culminating in the intricate distribution and after-sales support networks. Upstream activities involve sourcing specialized chemicals for sensor elements, high-grade metals for housing, and advanced electronic components such as microcontrollers, processors, and communication modules from a global network of suppliers. These components are critical for the functionality, accuracy, and reliability of gas detection devices, and their quality directly impacts the final product's performance. Manufacturers often engage in strategic partnerships with component suppliers to ensure a stable supply of high-quality and innovative parts, which is crucial given the rapid technological evolution in sensor science.

The core of the value chain lies in the manufacturing and assembly phase, where raw materials and components are transformed into finished gas detector products. This stage involves sophisticated processes such as sensor fabrication, circuit board assembly, housing manufacturing, and final product integration. Rigorous quality control, calibration, and testing are paramount at every step to ensure that the detectors meet stringent international safety standards and regulatory compliance requirements, such as ATEX, IECEx, UL, and CSA certifications. Research and development activities are deeply embedded in this stage, driving innovation in sensor technology, improving detection capabilities, extending product lifespan, and enhancing user interface and connectivity features, which are vital for maintaining a competitive edge in a dynamic market.

Downstream activities focus on bringing the gas detectors to the end-users through various distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to large industrial clients or government entities, often with customized solutions and comprehensive service contracts. Indirect channels are more diverse, utilizing a network of distributors, value-added resellers (VARs), system integrators, and independent safety equipment suppliers. These intermediaries play a crucial role in providing local sales support, installation services, calibration, maintenance, and training to a broad base of customers. After-sales services, including technical support, repair, and regular calibration, are vital for customer satisfaction and product lifecycle management, ensuring the continued operational effectiveness and regulatory compliance of gas detection systems throughout their service life.

Gas Detector Market Potential Customers

The potential customer base for gas detectors is remarkably broad and diverse, encompassing a multitude of end-user industries that prioritize safety, environmental compliance, and operational efficiency. Fundamentally, any industry or facility where the presence of hazardous gases – whether toxic, combustible, or asphyxiant – poses a risk to human life, property, or the environment is a prime candidate for gas detection solutions. This includes large-scale industrial complexes that handle volatile chemicals, energy production sites extracting and processing hydrocarbons, and urban infrastructure like wastewater treatment plants. These customers seek reliable, accurate, and often ruggedized solutions capable of continuous monitoring in challenging and often extreme operational conditions, where failure can lead to catastrophic consequences.

Within the industrial segment, the oil and gas industry stands out as a significant consumer, requiring gas detectors for exploration, drilling, production, refining, and transportation to mitigate the risks associated with methane, hydrogen sulfide, and various volatile organic compounds. Similarly, chemical and petrochemical plants necessitate extensive gas detection coverage due to the wide array of hazardous substances they manufacture and process. Mining operations rely heavily on gas detectors to monitor methane, carbon monoxide, and oxygen levels in underground environments, ensuring worker safety and preventing explosions. Furthermore, the manufacturing sector, including automotive, electronics, and food and beverage, increasingly adopts gas detection for processes involving solvents, refrigerants, or fermentation gases, aligning with stringent safety standards and production quality control.

Beyond heavy industry, the market extends to commercial, institutional, and even residential sectors. Commercial buildings, hospitals, hotels, and shopping malls deploy gas detectors for indoor air quality monitoring and to detect leaks from HVAC systems or natural gas lines. Wastewater treatment facilities use them to monitor hydrogen sulfide and methane. Emergency services, including fire departments and HazMat teams, utilize portable detectors for incident response and risk assessment. Additionally, government agencies and military installations require specialized gas detection for security, environmental surveillance, and protection against chemical threats. The growing focus on smart cities and environmental monitoring further broadens the customer base, as gas detectors become integral components of intelligent infrastructure designed to enhance public safety and monitor air pollution levels in urban environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.5 Billion |

| Market Forecast in 2032 | $7.3 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell Analytics, Drägerwerk AG & Co. KGaA, MSA Safety Inc., Teledyne Gas & Flame Detection, Riken Keiki Co., Ltd., Crowcon Detection Instruments Ltd., Industrial Scientific Corporation, Sensidyne, LP, Bacharach Inc., Siemens AG, Emerson Electric Co., Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., GfG Gesellschaft für Gerätebau mbH, Halma plc (Crowcon, Amphenol), 3M Company, Kidde (Carrier Global Corporation), Tyco International (Johnson Controls), BW Technologies by Honeywell, Rae Systems (Honeywell) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Detector Market Key Technology Landscape

The technology landscape of the Gas Detector Market is characterized by a blend of established and emerging innovations, all aimed at enhancing accuracy, reliability, and functionality in diverse operating environments. Traditional sensing technologies such as electrochemical sensors for toxic and oxygen gases, catalytic bead sensors for combustible gases, and infrared (IR) sensors for combustible gases and carbon dioxide, continue to form the backbone of the market due to their proven reliability and robust performance. Electrochemical sensors are prized for their specificity and low power consumption, making them ideal for long-term monitoring. Catalytic bead sensors, while robust, are sensitive to sensor poisons and require oxygen, whereas IR sensors offer immunity to poisons and can operate in anaerobic conditions, providing high accuracy for hydrocarbon detection and CO2.

Beyond these foundational technologies, the market is witnessing significant advancements driven by the need for greater versatility, miniaturization, and improved detection limits. Photoionization Detectors (PIDs) are increasingly vital for detecting a broad range of volatile organic compounds (VOCs) at very low parts per million (ppm) levels, crucial for environmental monitoring and health applications. Metal Oxide Semiconductor (MOS) sensors offer cost-effectiveness and broad gas detection capabilities, although with less specificity than other types. Emerging technologies include miniaturized Micro-Electro-Mechanical Systems (MEMS) sensors, which promise smaller, more power-efficient devices with rapid response times and integration capabilities for next-generation portable and IoT-enabled detectors. Laser-based detection, particularly Tunable Diode Laser Absorption Spectroscopy (TDLAS), is gaining traction for highly specific and sensitive remote detection of specific gases like methane and ammonia, offering significant advantages in applications such as pipeline monitoring and flare stack surveillance.

The most transformative aspect of the current technology landscape is the pervasive integration of digital technologies, including the Internet of Things (IoT), artificial intelligence (AI), and advanced wireless communication protocols. IoT connectivity allows gas detectors to transmit real-time data to centralized monitoring systems, enabling remote surveillance, data logging, and predictive analytics. AI and machine learning algorithms are being applied to interpret complex sensor data, reduce false alarms, diagnose sensor health, and even predict potential gas leak scenarios based on operational parameters and historical trends. Wireless technologies, such as Wi-Fi, Bluetooth, Zigbee, and LoRaWAN, facilitate flexible deployment and reduce installation costs, particularly in challenging industrial environments. This digital convergence is creating smart, interconnected safety ecosystems that offer unprecedented levels of safety management, operational efficiency, and data-driven insights, moving gas detection beyond simple alarming to proactive risk mitigation and intelligent decision support.

Regional Highlights

The global Gas Detector Market exhibits significant regional variations in growth, adoption rates, and technological sophistication, influenced by diverse industrial landscapes, regulatory environments, and economic development levels. Each region presents unique market drivers and challenges, shaping the demand for various types of gas detection solutions and fostering distinct competitive dynamics. Understanding these regional specificities is crucial for market players to formulate effective strategies and capitalize on localized growth opportunities, ranging from infrastructure expansion in developing economies to advanced technology adoption in mature markets.

- North America: A mature market characterized by stringent safety regulations, a strong emphasis on occupational safety, and high adoption of advanced gas detection technologies. The region, particularly the United States, drives innovation in IoT-enabled and AI-integrated systems. Demand is robust across the oil and gas, chemical, and general industrial sectors, alongside growing applications in commercial buildings and environmental monitoring.

- Europe: Another highly regulated and mature market with a significant focus on worker safety and environmental protection. Countries like Germany, the UK, and France are key contributors, driven by a strong industrial base and early adoption of advanced sensors. The market is influenced by directives such as ATEX and stringent emission control regulations, promoting high-quality, certified detection solutions and a preference for fixed systems.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, massive infrastructure development, and increasing investments in manufacturing, chemicals, and energy sectors, especially in China, India, and Southeast Asian countries. While cost-effectiveness remains a factor, increasing awareness of workplace safety and evolving regulatory frameworks are driving the adoption of more sophisticated and connected gas detectors.

- Latin America: Showing promising growth due to expanding oil and gas exploration, mining activities, and industrialization in countries like Brazil and Mexico. The market is gradually maturing with a rising focus on international safety standards and the replacement of older equipment, creating demand for both portable and fixed gas detection solutions.

- Middle East and Africa (MEA): Experience substantial growth primarily driven by the colossal oil and gas industry, petrochemical expansions, and significant infrastructure projects. Countries in the GCC region are major investors in advanced safety technologies to protect their critical energy assets. There is a strong demand for robust, high-performance detectors capable of operating in harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Detector Market.- Honeywell Analytics

- Drägerwerk AG & Co. KGaA

- MSA Safety Inc.

- Teledyne Gas & Flame Detection

- Riken Keiki Co., Ltd.

- Crowcon Detection Instruments Ltd.

- Industrial Scientific Corporation

- Sensidyne, LP

- Bacharach Inc.

- Siemens AG

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Thermo Fisher Scientific Inc.

- GfG Gesellschaft für Gerätebau mbH

- Halma plc (including Crowcon, Amphenol)

- 3M Company

- Kidde (Carrier Global Corporation)

- Tyco International (Johnson Controls)

- BW Technologies by Honeywell

- Rae Systems (Honeywell)

Frequently Asked Questions

What is a gas detector and why is it important for industrial safety?

A gas detector is an electronic device designed to detect the presence of various gases within an area, often as part of a comprehensive safety system. Its importance for industrial safety is paramount, as it provides early warning of hazardous gas leaks, such as toxic, combustible, or asphyxiating gases, that could otherwise lead to explosions, fires, serious injuries, or fatalities. By continuously monitoring the atmospheric conditions in industrial environments, gas detectors enable rapid response, evacuation, and mitigation measures, thereby protecting personnel, critical assets, and ensuring compliance with stringent safety regulations. They are fundamental tools for proactive risk management and accident prevention in high-risk sectors.

What are the primary types of gas detection technologies available in the market?

The gas detection market utilizes several primary technologies, each suited for specific gas types and operational conditions. Electrochemical sensors are widely used for detecting toxic gases and oxygen, relying on a chemical reaction to produce an electrical signal. Catalytic bead sensors are effective for combustible gases, functioning by oxidizing the gas on a heated bead. Infrared (IR) sensors detect combustible gases and carbon dioxide by measuring specific wavelength absorption. Photoionization Detectors (PIDs) specialize in volatile organic compounds (VOCs). Additionally, Metal Oxide Semiconductor (MOS) sensors offer broad gas detection, while more advanced laser-based systems provide highly specific and remote detection capabilities. The choice of technology depends on the target gas, required sensitivity, and environmental factors.

How do IoT and AI impact the future of gas detection systems?

The integration of IoT (Internet of Things) and AI (Artificial Intelligence) is revolutionizing gas detection systems by transforming them from isolated alarms into intelligent, interconnected safety networks. IoT enables real-time data transmission from detectors to central monitoring platforms, facilitating remote surveillance, data logging, and immediate alerts to stakeholders. AI, on the other hand, processes this vast amount of data to provide predictive analytics, reduce false alarms by discerning real threats from environmental noise, and optimize maintenance schedules. This fusion allows for proactive safety management, improved decision-making during incidents, and the creation of smarter, more responsive safety ecosystems, ultimately enhancing reliability and operational efficiency in hazardous environments.

Which industries are the largest consumers of gas detectors and why?

The largest consumers of gas detectors are typically industries that operate in environments with a high risk of hazardous gas exposure. The oil and gas sector is a dominant end-user, requiring detectors for exploration, production, refining, and pipeline monitoring due to the presence of flammable hydrocarbons and toxic gases like H2S. Chemical and petrochemical plants are also major consumers, necessitating extensive detection for a wide array of volatile and toxic substances. Mining operations critically depend on gas detectors for methane and CO monitoring in underground shafts. Furthermore, manufacturing, utilities (especially wastewater treatment), and even commercial buildings contribute significantly due to processes involving harmful gases, stringent safety regulations, and the need to protect personnel and assets from potential leaks or accidental releases.

What are the main challenges hindering the growth of the Gas Detector Market?

Despite robust growth, the Gas Detector Market faces several key challenges. One significant restraint is the high initial investment cost associated with advanced, multi-point, or integrated gas detection systems, which can be prohibitive for smaller businesses. Technical complexities related to installation, precise calibration, and ongoing maintenance also pose hurdles, often requiring specialized expertise and adding to operational expenses. The issue of false alarms remains a concern, leading to operational disruptions, reduced trust in the systems, and potential complacency among personnel. Additionally, limitations in battery life for portable devices and a lack of fully harmonized global regulatory standards in some regions can hinder broader market adoption and complicate international trade for manufacturers, necessitating continuous innovation to overcome these barriers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Methane Gas Detector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Methane Gas Detector Market Statistics 2025 Analysis By Application (Petro Chemical, Mining, Utility Service, Construction, Other), By Type (Fixed Methane Gas Detector, Portable Methane Gas Detector), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- HiToxic Gas Detector Market Statistics 2025 Analysis By Application (Petro Chemical, Construction, Mining, Utility Service), By Type (Fixed Gas Detector, Portable Gas Detector), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager