Inspection Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428170 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Inspection Robots Market Size

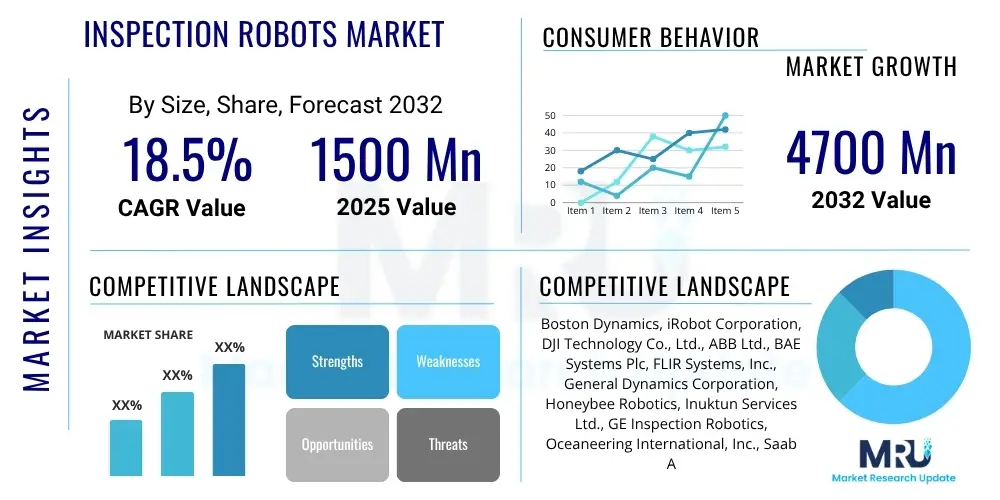

The Inspection Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 1500 million in 2025 and is projected to reach USD 4700 million by the end of the forecast period in 2032.

Inspection Robots Market introduction

Inspection robots are sophisticated autonomous or semi-autonomous robotic systems engineered to execute monitoring, examination, and data collection tasks in diverse environments. These settings often include hazardous, remote, or difficult-to-access locations where human presence poses significant risks or is impractical. The product category encompasses a wide array of robotic platforms, prominently including Unmanned Aerial Vehicles (UAVs) or drones, Unmanned Ground Vehicles (UGVs) such as crawlers and wheeled robots, Remotely Operated Vehicles (ROVs), and Autonomous Underwater Vehicles (AUVs). Each type is tailored with specific designs and functionalities to optimize performance in its intended operational domain, ranging from aerial surveillance of extensive infrastructure to precise internal inspections of pipelines and subsea assets.

Equipped with an advanced suite of sensors, including high-resolution cameras, thermal imagers, ultrasonic and LiDAR sensors, gas detectors, and non-destructive testing (NDT) capabilities, inspection robots are capable of gathering highly detailed and accurate data. Their major applications span across critical industries such such as oil and gas, power generation, manufacturing, aerospace and defense, and public infrastructure, where they are deployed for structural integrity monitoring, leak detection, environmental surveillance, and proactive asset management. The compelling benefits of adopting these systems include significantly enhanced safety for personnel by minimizing exposure to dangerous conditions, substantial improvements in operational efficiency through faster and more consistent inspections, superior data accuracy, and considerable reductions in long-term operational costs. This market expansion is primarily driven by an increasing global imperative for industrial automation, the enforcement of more stringent safety and environmental regulations, and continuous breakthroughs in robotics, artificial intelligence, and sensor fusion technologies.

Inspection Robots Market Executive Summary

The Inspection Robots Market is currently experiencing a period of robust expansion, propelled by converging technological advancements and an intensified global focus on industrial safety, operational efficiency, and stringent regulatory compliance. Business trends within the sector indicate a significant shift towards the adoption of Robotics-as-a-Service (RaaS) models, which offer enterprises greater flexibility, reduced upfront capital investment, and simplified maintenance, thereby accelerating market penetration across various industries. This evolving service model democratizes access to advanced robotic capabilities, particularly benefiting small and medium-sized enterprises (SMEs) that may lack the resources for outright purchase and extensive in-house technical expertise. Furthermore, there is an increasing demand for integrated solutions that combine inspection robots with broader digital ecosystems, such as IoT platforms and digital twin technologies, enabling comprehensive, real-time asset monitoring and predictive analytics capabilities that transform raw data into actionable insights for strategic decision-making and operational optimization.

Regional trends reveal distinct patterns of market maturity and growth potential. North America and Europe currently lead the market, characterized by their early adoption of advanced robotics, substantial investments in research and development, and a strong regulatory environment that mandates high safety and environmental standards. These regions are at the forefront of deploying sophisticated autonomous inspection solutions in critical sectors like oil and gas, aerospace, and advanced manufacturing. Conversely, the Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market, driven by its accelerated pace of industrialization, massive ongoing infrastructure development projects, and a burgeoning awareness regarding the critical importance of industrial safety and asset integrity. Within market segments, significant technological advancements are noted across various robot types; Unmanned Aerial Vehicles (UAVs) are benefiting from extended battery life and enhanced payload capacities for broader aerial inspection tasks, while Unmanned Ground Vehicles (UGVs) are evolving with improved navigation and manipulation capabilities for hazardous confined space assessments. Moreover, the software and services components are increasingly gaining prominence, providing advanced data analytics, AI-powered defect detection, and seamless integration with existing enterprise resource planning (ERP) systems, thereby creating more intelligent and value-added inspection solutions.

AI Impact Analysis on Inspection Robots Market

User questions regarding the impact of Artificial Intelligence (AI) on the Inspection Robots Market frequently revolve around the enhancement of autonomous capabilities, the precision of data interpretation, and the overall efficiency gains. Users are particularly interested in understanding how AI contributes to superior accuracy in anomaly detection, accelerates decision-making processes, and enables robots to navigate and operate independently in highly complex and dynamic industrial environments. Key themes also include AI's role in transforming raw sensor data into actionable insights, facilitating predictive maintenance strategies, and minimizing human intervention during inspection tasks. While expectations are high for AI to significantly reduce false positives and streamline workflows, common concerns include the reliability and robustness of AI algorithms in safety-critical applications, the cybersecurity implications of advanced autonomous systems, and the technical expertise required for effective AI integration and ongoing management within operational frameworks.

- Enhanced autonomous navigation and path planning in intricate, dynamic industrial settings.

- Real-time anomaly detection and precise classification of defects using advanced computer vision and deep learning.

- Predictive maintenance capabilities by analyzing vast datasets to anticipate equipment failures.

- Optimized data processing and fusion from multiple heterogeneous sensor inputs for comprehensive analysis.

- Improved decision-making and adaptive behavior, allowing robots to respond intelligently to unforeseen environmental changes.

- Reduced necessity for human oversight during routine and repetitive inspection missions.

- Automated report generation and extraction of actionable insights from collected inspection data.

- Development of self-learning algorithms that continuously improve inspection accuracy and efficiency over time.

- Enabling human-robot collaboration and intuitive control interfaces for complex tasks.

DRO & Impact Forces Of Inspection Robots Market

The Inspection Robots Market is experiencing robust growth driven by several potent forces. Paramount among these is the escalating demand for enhanced industrial safety across hazardous sectors such as oil and gas, nuclear power, and chemical processing, where inspection robots significantly mitigate human exposure to dangerous conditions. Coupled with this is the continuous imperative for greater operational efficiency, as industries strive to minimize downtime, optimize asset utilization, and reduce maintenance costs through frequent, precise, and repeatable inspections. Furthermore, stringent regulatory frameworks and compliance requirements across various geographies compel industries to adopt advanced inspection technologies to ensure asset integrity, environmental protection, and public safety. Lastly, rapid and sustained technological advancements in robotics, artificial intelligence, machine learning, advanced sensor systems, and connectivity solutions are making inspection robots increasingly sophisticated, reliable, and cost-effective, expanding their capabilities and applicability across a broader range of industrial use cases.

Despite the compelling drivers, several significant restraints pose challenges to the widespread adoption and accelerated growth of the inspection robots market. A primary impediment is the high initial capital investment required for acquiring and deploying advanced robotic systems, which can be a substantial barrier, particularly for small and medium-sized enterprises (SMEs) with limited budgets. The technical complexities associated with the integration, operation, and maintenance of these sophisticated robots often necessitate specialized expertise, which may not be readily available in-house, leading to additional training or outsourcing costs. Furthermore, limitations such as restricted battery life for prolonged operations, challenges in accurate navigation and communication within GPS-denied or electromagnetically noisy environments, and inherent cybersecurity vulnerabilities of interconnected autonomous systems present ongoing technical hurdles that require continuous innovation and robust solutions. Regulatory hurdles regarding autonomous operations in public spaces and concerns about job displacement also contribute to cautious market adoption.

However, substantial opportunities continue to emerge and shape the future trajectory of the Inspection Robots Market. The increasing proliferation of Robotics-as-a-Service (RaaS) models offers a compelling solution to overcome the high upfront investment barrier, enabling more businesses to access advanced inspection capabilities through subscription-based services. The burgeoning industrial development and infrastructure projects in emerging economies, particularly across the Asia Pacific and Latin America regions, present vast untapped markets for inspection robot deployment. Moreover, ongoing technological breakthroughs in miniaturization, advanced materials, energy storage solutions, and seamless integration with other transformative technologies like IoT, 5G networks, and digital twin platforms promise to unlock new applications and enhance robot capabilities. The development of highly specialized robots for niche applications, coupled with sophisticated data analytics platforms that transform raw inspection data into actionable intelligence, will further expand market potential and drive sustained innovation and adoption.

Segmentation Analysis

The Inspection Robots Market is comprehensively segmented to provide a detailed and nuanced understanding of its intricate structure, enabling precise analysis of market dynamics, competitive landscapes, and specific growth opportunities. This detailed segmentation allows stakeholders to effectively categorize and evaluate the market based on several critical dimensions, including the distinct types of robotic platforms utilized, the constituent components that form these advanced systems, the diverse end-user industries that deploy these solutions, and the specific applications for which they are designed. Each segment and its sub-segments present unique technological requirements, market drivers, regulatory considerations, and competitive dynamics, collectively offering a holistic view of the market's current state and future trajectory. Such granular analysis is indispensable for strategic planning, targeted product development, and achieving successful market penetration within the rapidly evolving and technologically advanced inspection robotics ecosystem.

- By Type:

- Unmanned Aerial Vehicles (UAVs)/Drones (Fixed-wing, Rotary-wing, Hybrid)

- Unmanned Ground Vehicles (UGVs) (Wheeled, Tracked/Crawler, Legged)

- Remotely Operated Vehicles (ROVs)

- Autonomous Underwater Vehicles (AUVs)

- Climbing Robots

- Pipe Inspection Robots

- Others (e.g., snake robots, robotic arms for confined spaces)

- By Component:

- Hardware

- Sensors (Ultrasonic, Thermal, LiDAR, Hyperspectral, Gas Detectors, Visual/IR Cameras)

- Cameras (HD, 4K, Zoom, Thermal, 3D)

- Navigation & Positioning Systems (GPS, INS, SLAM, Odometry)

- Actuators & Motors

- Batteries & Power Management Systems

- Communication Modules (Wi-Fi, 4G/5G, Satellite)

- Robotic Arms & Manipulators

- Processors & Controllers

- Frame & Chassis

- Software

- Control & Navigation Software

- Data Acquisition & Processing Software

- Image & Video Analysis Software

- AI/ML Algorithms (for Anomaly Detection, Object Recognition)

- Reporting & Analytics Software

- Fleet Management Software

- Cloud & Edge Computing Platforms

- Services

- Maintenance & Support

- Integration & Deployment

- Training & Consulting

- Robotics-as-a-Service (RaaS)

- Data Analytics & Reporting Services

- Hardware

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Power & Energy (Nuclear Power Plants, Thermal Power Plants, Wind Farms, Solar Farms, Transmission & Distribution Lines)

- Manufacturing (Automotive, Aerospace, Electronics, Heavy Machinery)

- Aerospace & Defense (Aircraft Inspection, Military Surveillance, Infrastructure Monitoring)

- Public Infrastructure (Bridges, Roads, Railways, Dams, Tunnels, Buildings)

- Chemical & Petrochemical

- Mining & Construction (Structural Integrity, Site Survey, Equipment Inspection)

- Healthcare & Pharmaceutical (Facility Inspection, Equipment Monitoring)

- Logistics & Warehousing (Inventory Monitoring, Facility Safety)

- Maritime & Shipping (Hull Inspection, Cargo Hold Inspection)

- Agriculture (Crop Health Monitoring, Infrastructure Inspection)

- Telecommunications

- Water & Wastewater Treatment

- Others

- By Application:

- Remote Visual Inspection (RVI)

- Non-Destructive Testing (NDT) (Ultrasonic, Eddy Current, Magnetic Particle, Radiographic)

- Environmental Monitoring (Air Quality, Water Quality, Leak Detection)

- Pipeline & Tank Inspection (Internal, External)

- Structural Integrity Monitoring (Bridges, Buildings, Offshore Platforms)

- Security & Surveillance

- Asset Management

- Predictive Maintenance

- Leak Detection & Gas Detection

- Exploration & Mapping

- Quality Control & Assurance

- Disaster Response & Assessment

- Inventory Management

Value Chain Analysis For Inspection Robots Market

The value chain for the Inspection Robots Market commences with the upstream segment, which is primarily dedicated to fundamental research and development alongside the meticulous sourcing and supply of critical components. This foundational stage involves key players specializing in the design and manufacturing of advanced sensory technologies, including high-resolution cameras, thermal imagers, LiDAR systems, ultrasonic sensors, and gas detectors, which are indispensable for data acquisition. It also encompasses suppliers of robust navigation and positioning systems, powerful actuators, energy-efficient motors, long-duration batteries, communication modules, and specialized materials engineered for durability and resilience in harsh operating environments. The innovation and quality embedded at this upstream stage are crucial, as they directly influence the performance, reliability, and ultimate cost-effectiveness of the final inspection robot products, forming the technological bedrock upon which the entire market is built.

Progressing downstream, the value chain encompasses the robot manufacturers themselves, along with system integrators and specialized software developers. This segment is responsible for the intricate process of assembling the diverse components into fully functional inspection robots and developing the sophisticated software platforms that enable their autonomous operation, data processing, and intelligent analysis. This stage requires advanced engineering expertise to ensure seamless hardware-software integration, often incorporating cutting-edge artificial intelligence and machine learning algorithms for capabilities such as real-time anomaly detection, predictive analytics, and autonomous decision-making. Following the manufacturing and integration processes, the distribution channel becomes paramount. Major robot manufacturers often engage in direct sales, establishing relationships with large industrial clients requiring bespoke solutions. Concurrently, third-party distributors, value-added resellers (VARs), and service providers play a vital role in broadening market reach, often offering localized support, customization services, and maintenance. The emergence of Robotics-as-a-Service (RaaS) providers represents a rapidly growing indirect distribution model, allowing end-users to access advanced robotic capabilities on a subscription basis, thereby circumventing the significant upfront capital expenditure associated with purchasing and maintaining the robots.

The final and equally critical stage of the value chain involves the end-users and the comprehensive suite of services that support the deployment, operation, and ongoing optimization of inspection robots. End-users span a vast array of industries, including oil and gas, power and energy, manufacturing, infrastructure, and defense, all leveraging these robots for their specific inspection requirements. The essential supporting services include professional installation, routine maintenance, timely repairs, critical software updates, and comprehensive training programs for operators and technical personnel. A continuous and effective feedback loop from end-users to manufacturers and software developers is absolutely vital for driving continuous product improvement, fostering innovation, and ensuring that future robotic solutions precisely address evolving industrial needs and challenges. The entire value chain is characterized by a high degree of specialized expertise, intricate interdependencies, and collaborative efforts across multiple disciplines to deliver high-value inspection solutions.

Inspection Robots Market Potential Customers

Potential customers for inspection robots are diverse, primarily comprising enterprises and governmental organizations across industries that necessitate rigorous monitoring, maintenance, and safety protocols for their assets and operations. Leading this customer base are organizations within the oil and gas sector, including exploration, production, pipeline, and refinery operators, who require robots for comprehensive inspection of critical infrastructure such as pipelines, storage tanks, offshore platforms, and subsea equipment to prevent leaks, ensure structural integrity, and maintain regulatory compliance in highly hazardous environments. Similarly, companies in the power and energy sector, encompassing nuclear, thermal, hydro, wind, and solar power plants, as well as electricity transmission and distribution companies, represent significant buyers. They deploy inspection robots to monitor power lines, turbine blades, solar panels, and reactor vessels, aiming to enhance reliability, minimize downtime, and ensure safe energy generation and delivery.

Beyond traditional heavy industries, the manufacturing sector, particularly in automotive, aerospace, and electronics, constitutes a rapidly growing segment of potential customers. These manufacturers leverage inspection robots for automated quality control, precise defect detection on assembly lines, and condition monitoring of complex machinery, ensuring product excellence and continuous production flow. Public infrastructure authorities and governmental agencies responsible for managing vast networks of bridges, roads, railways, dams, tunnels, and public buildings are increasingly adopting robotics for proactive structural integrity assessments, identifying wear and tear, and facilitating timely repairs. This adoption significantly contributes to public safety and extends the lifespan of critical national assets by providing data-driven insights into maintenance requirements.

Emerging customer segments include the mining and construction industries, where inspection robots are utilized for topographical mapping, geological surveys, monitoring excavation sites for safety, and assessing the structural health of temporary and permanent structures in challenging conditions. The chemical and petrochemical industries heavily invest in these robots for inspecting processing plants, detecting hazardous gas leaks, and ensuring the integrity of containment vessels in highly volatile environments. Furthermore, defense and security organizations employ inspection robots for surveillance, reconnaissance, explosive ordnance disposal, and hazardous material detection. Logistics and warehousing companies are also integrating robots for automated inventory management and facility safety inspections. These varied end-users are united by their common goal of enhancing safety, improving operational efficiency, and achieving data-driven decision-making through the deployment of advanced inspection robotics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1500 million |

| Market Forecast in 2032 | USD 4700 million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Dynamics, iRobot Corporation, DJI Technology Co., Ltd., ABB Ltd., BAE Systems Plc, FLIR Systems, Inc., General Dynamics Corporation, Honeybee Robotics, Inuktun Services Ltd., GE Inspection Robotics, Oceaneering International, Inc., Saab AB, Schlumberger Limited, SuperDroid Robots Inc., TerraRobotics Inc., ECA Group, AIBOT (by Percepto), Sarcos Technology and Robotics Corporation, Wingtra AG, Skydio Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inspection Robots Market Key Technology Landscape

The Inspection Robots Market is profoundly shaped by a rapidly evolving and interconnected technological landscape, with continuous innovation serving as the primary catalyst for expanding capabilities and market penetration. At the core of these advancements are Artificial Intelligence (AI) and Machine Learning (ML), which empower robots with sophisticated cognitive functions. These include real-time anomaly detection, advanced pattern recognition, predictive analytics for equipment failures, and autonomous decision-making in complex and dynamic environments. Computer vision systems, often leveraging deep learning algorithms, are integral, enabling robots to interpret visual data with unprecedented accuracy, identify defects, assess conditions, and perform precise measurements, effectively transforming raw imagery into actionable intelligence for asset managers.

Another pivotal technological area is sensor fusion, where data from multiple disparate sensor types are combined and intelligently processed to generate a more comprehensive and accurate understanding of the inspection environment. This involves integrating inputs from LiDAR, ultrasonic, thermal, hyperspectral, and conventional high-resolution cameras, as well as gas and chemical detectors. This multi-modal data processing significantly enhances the robot's perception, measurement precision, and ability to detect subtle flaws or environmental hazards that might be missed by single-sensor systems, which is crucial for applications like structural integrity monitoring and leak detection. Concurrently, significant strides in navigation and localization systems, such as advanced GPS, Inertial Measurement Units (IMUs), and Simultaneous Localization and Mapping (SLAM) algorithms, ensure that robots can operate reliably and precisely even in challenging, GPS-denied, or electromagnetically noisy industrial settings, guaranteeing accurate data collection and safe operation.

Connectivity and integration technologies are also revolutionizing the operational paradigms of inspection robots. The advent of 5G networks provides ultra-low latency, high-bandwidth communication, enabling seamless real-time data transfer and remote control of robots over vast geographical distances, which is critical for complex industrial operations. The Internet of Things (IoT) facilitates the integration of robot-collected data with broader industrial systems, feeding into digital twin models for holistic asset management and predictive maintenance strategies. Furthermore, Robotics-as-a-Service (RaaS) models, increasingly supported by robust cloud computing infrastructure, are democratizing access to advanced inspection capabilities. These service-oriented offerings provide scalable, flexible, and cost-efficient solutions by abstracting the complexities of robot ownership and maintenance, thereby driving broader market adoption and continuous innovation across diverse industrial applications.

Regional Highlights

- North America: Dominates the market with early adoption of advanced robotics, substantial investments in R&D, and stringent regulatory frameworks in industries like oil & gas, aerospace, and critical infrastructure. High demand for autonomous and AI-powered inspection solutions is a key driver.

- Europe: A significant market characterized by strong industrial automation, rigorous environmental and safety standards, and robust government support for robotics innovation. Countries such as Germany, the UK, and France are pivotal, leveraging inspection robots in manufacturing, energy, and infrastructure sectors.

- Asia Pacific (APAC): Positioned as the fastest-growing region, fueled by rapid industrialization, extensive ongoing infrastructure development, and a rising awareness regarding industrial safety and asset integrity. China, Japan, India, and South Korea are major contributors to both production and consumption of inspection robots.

- Latin America: An emerging market experiencing increased investments in oil & gas, mining, and public infrastructure projects. This growth stimulates the demand for inspection robots to enhance operational safety, efficiency, and compliance in burgeoning industrial landscapes.

- Middle East & Africa (MEA): Demonstrates substantial growth potential, driven by significant investments in the oil & gas sector, large-scale petrochemical developments, and ambitious infrastructure mega-projects. The region focuses on adopting advanced digital transformation and inspection technologies for critical asset management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inspection Robots Market.- Boston Dynamics

- iRobot Corporation

- DJI Technology Co., Ltd.

- ABB Ltd.

- BAE Systems Plc

- FLIR Systems, Inc.

- General Dynamics Corporation

- Honeybee Robotics

- Inuktun Services Ltd.

- GE Inspection Robotics

- Oceaneering International, Inc.

- Saab AB

- Schlumberger Limited

- SuperDroid Robots Inc.

- TerraRobotics Inc.

- ECA Group

- AIBOT (by Percepto)

- Sarcos Technology and Robotics Corporation

- Wingtra AG

- Skydio Inc.

Frequently Asked Questions

Analyze common user questions about the Inspection Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are inspection robots and what is their primary function?

Inspection robots are autonomous or semi-autonomous robotic systems equipped with advanced sensors to perform critical monitoring, examination, and data collection tasks in hazardous, remote, or hard-to-reach environments, primarily to enhance safety and operational efficiency.

Which industries are the primary beneficiaries of inspection robots?

Key industries benefiting from inspection robots include oil & gas, power & energy, manufacturing, aerospace & defense, public infrastructure, chemical & petrochemical, and mining & construction, leveraging them for asset integrity, safety, and predictive maintenance.

How does Artificial Intelligence (AI) significantly enhance the capabilities of inspection robots?

AI empowers inspection robots with advanced functionalities such as autonomous navigation, real-time anomaly detection, predictive maintenance, intelligent data analysis, and adaptive decision-making, leading to more accurate, efficient, and reliable inspection processes.

What are the main challenges hindering the growth and widespread adoption of inspection robots?

Major challenges include high initial capital investment costs, the requirement for specialized technical expertise for deployment and maintenance, limitations in battery life for prolonged operations, complex navigation in varied environments, and potential cybersecurity risks.

What is the future outlook and key growth drivers for the inspection robots market?

The market is poised for strong growth, driven by continuous technological advancements (AI, 5G, IoT), increasing adoption of Robotics-as-a-Service (RaaS) models, expanding applications in emerging economies, and the growing global emphasis on industrial safety and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager