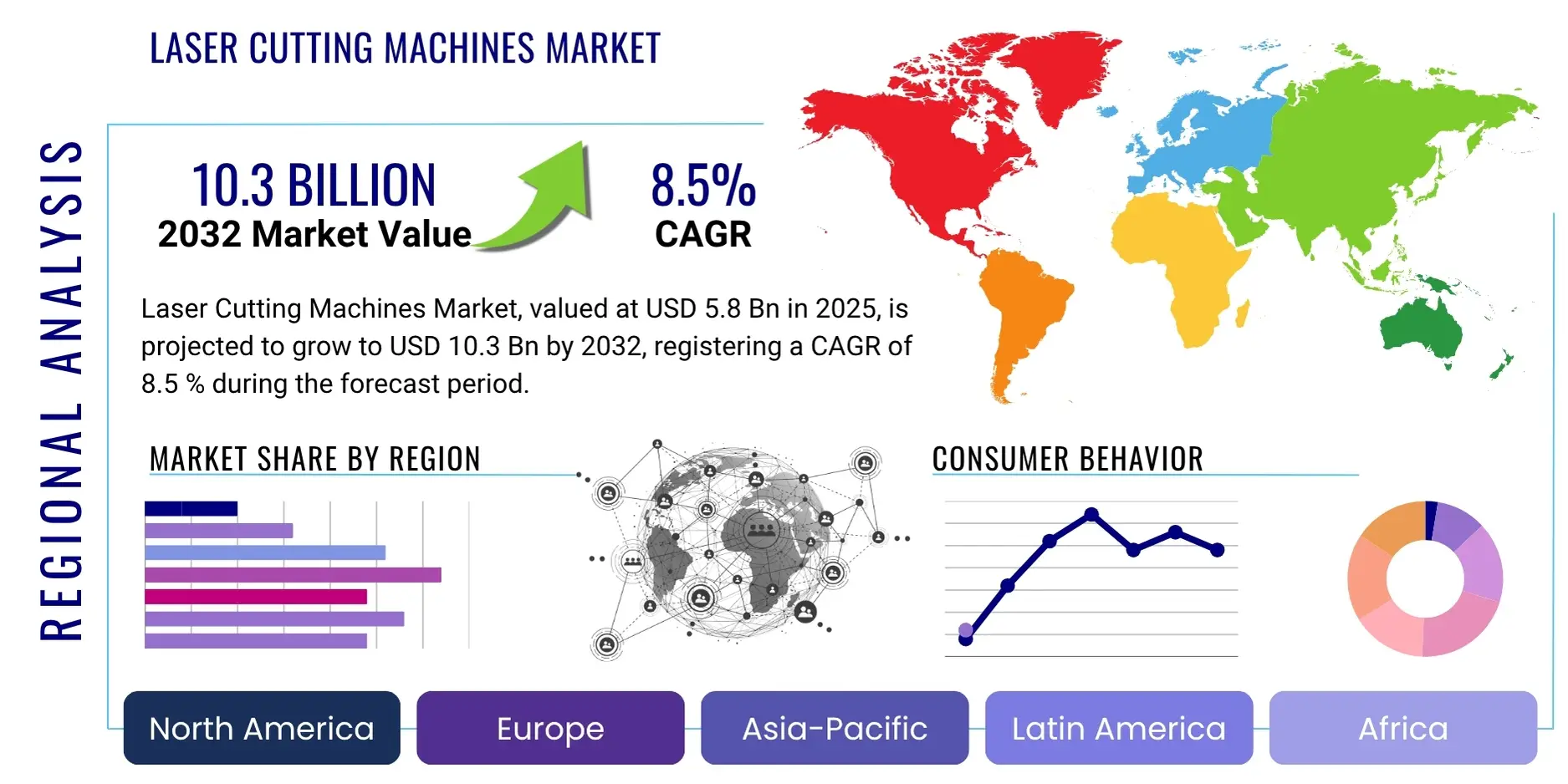

Laser Cutting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428296 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Laser Cutting Machines Market Size

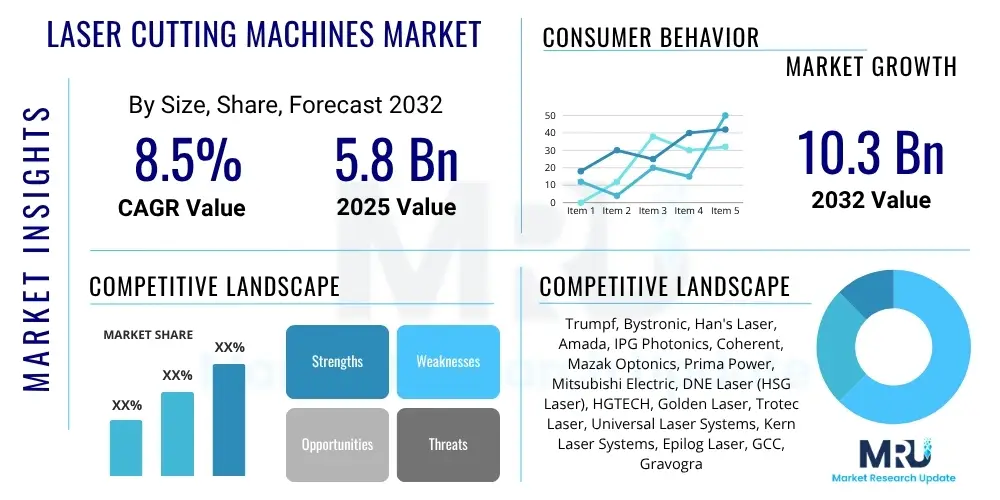

The Laser Cutting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2032.

Laser Cutting Machines Market introduction

The global laser cutting machines market is a technologically advanced and rapidly evolving sector within the industrial manufacturing landscape, playing a crucial role in modern material processing. These sophisticated machines harness the power of a highly concentrated laser beam to precisely cut, engrave, or mark a vast array of materials, ranging from various metals and alloys to plastics, composites, wood, and textiles. Their fundamental principle involves focusing a high-energy laser onto the workpiece, causing localized melting, burning, or vaporization, which is often assisted by a coaxial jet of gas to remove molten material and achieve a clean, narrow cut. This non-contact process minimizes material distortion, provides exceptional edge quality, and allows for intricate geometries and complex designs that are challenging or impossible with conventional cutting methods.

The product description of modern laser cutting machines encompasses a variety of laser sources, prominently including fiber lasers, CO2 lasers, and disk lasers, each offering distinct advantages depending on the application and material type. Fiber lasers, for instance, are highly efficient for cutting reflective metals with superior speed, while CO2 lasers excel in processing non-metallic materials. Major applications for these machines are pervasive across nearly all industrial sectors. In the automotive industry, they are indispensable for manufacturing lightweight vehicle components, chassis, and intricate engine parts, contributing to fuel efficiency and advanced vehicle designs. Aerospace and defense sectors rely on them for cutting high-strength alloys and composite materials used in aircraft structures and sophisticated military equipment, demanding the utmost precision and reliability.

The benefits of adopting laser cutting technology are manifold and significant, acting as primary driving factors for market expansion. These include unparalleled accuracy and repeatability, leading to reduced material waste and improved product quality. The high processing speeds significantly boost production efficiency and throughput, thereby lowering per-unit manufacturing costs. Furthermore, the inherent versatility of laser cutters allows manufacturers to handle diverse materials and switch between different jobs with minimal setup time, offering operational flexibility. The integration with Computer Numerical Control (CNC) systems enables a high degree of automation, reducing the need for manual intervention and improving worker safety. These compelling benefits, coupled with ongoing technological advancements that enhance power, efficiency, and intelligence of laser systems, are poised to further accelerate the market's growth trajectory and solidify its position as a cornerstone of advanced manufacturing globally.

Laser Cutting Machines Market Executive Summary

The Laser Cutting Machines Market is currently experiencing robust growth, primarily propelled by the escalating global demand for precision manufacturing, enhanced automation, and the pervasive adoption of Industry 4.0 paradigms across diverse industrial sectors. A key business trend observable is the pronounced shift towards high-power fiber laser technology, which offers superior energy efficiency, reduced maintenance requirements, and the capability to process a wider spectrum of materials, including highly reflective metals, with unparalleled speed and accuracy. Manufacturers are increasingly focusing on developing integrated solutions that combine laser cutting with robotic automation, artificial intelligence, and sophisticated software for design and process optimization. This integration facilitates seamless workflow, reduces operational complexities, and significantly improves overall productivity, thereby acting as a critical differentiator in a competitive market landscape. Strategic alliances, mergers, and acquisitions are also prominent, as companies seek to consolidate market share, expand their technological portfolios, and penetrate new geographical markets.

From a regional perspective, Asia Pacific continues to assert its dominance and is projected to be the fastest-growing market throughout the forecast period. This remarkable growth is underpinned by rapid industrialization, substantial investments in advanced manufacturing infrastructure, and the flourishing automotive, electronics, and general fabrication industries in economic powerhouses such as China, India, Japan, and South Korea. North America and Europe, while representing mature markets, maintain significant market shares, driven by a sustained emphasis on high-value, high-precision applications, robust research and development activities in next-generation laser technologies, and stringent quality standards across their well-established manufacturing bases. Emerging economies in Latin America, particularly Brazil and Mexico, and the Middle East and Africa, are demonstrating promising growth, stimulated by industrial diversification initiatives, increasing foreign direct investment in manufacturing capabilities, and a rising awareness of the benefits of advanced production technologies.

Segmentation trends within the market underscore the continued ascendancy of fiber laser cutting machines, which now account for the largest market share, a direct consequence of their operational efficiencies, versatility, and cost-effectiveness over traditional CO2 lasers in numerous applications. The demand for high-power laser systems (exceeding 3kW) is notably increasing, driven by heavy-duty industrial requirements for processing thicker materials and achieving higher throughput. Conversely, lower-power systems continue to cater effectively to specialized applications, intricate detailing, and the needs of small and medium-sized enterprises (SMEs) requiring cost-efficient solutions. The automotive industry consistently remains the largest end-user segment due to its high-volume production needs, though rapid expansion is also being observed in the aerospace and defense sectors, as well as the burgeoning electronics and semiconductor manufacturing, all demanding the utmost precision and reliability from laser cutting solutions.

AI Impact Analysis on Laser Cutting Machines Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to fundamentally transform the laser cutting machines market, ushering in an era of unprecedented operational efficiency, predictive intelligence, and advanced process optimization. Users frequently pose questions regarding AI's capability to intelligently manage cutting parameters, such as laser power, cutting speed, focal position, and assist gas pressure, to automatically adapt to varying material properties and thicknesses, thereby minimizing waste and maximizing cut quality. There is significant anticipation for AI to autonomously detect and correct imperfections during the cutting process, reducing human intervention and ensuring consistent output quality. Furthermore, the potential for AI-driven systems to provide real-time performance analytics, offer prescriptive maintenance recommendations, and streamline job scheduling resonates strongly with manufacturers aiming to achieve lights-out manufacturing and significantly reduce operational expenditure.

Key themes emerging from market inquiries and discussions highlight the expectation of self-optimizing machines that can learn from vast datasets of cutting operations, identify optimal strategies, and proactively adjust to dynamic manufacturing environments. This includes AI algorithms that can analyze sensor data to predict potential machine failures before they occur, enabling timely maintenance and preventing costly downtime. Another crucial aspect is AI's role in personalizing and customizing manufacturing workflows, allowing for rapid iteration of designs and efficient production of bespoke parts without extensive manual reprogramming. While concerns exist regarding the complexity of initial AI integration, data security, and the necessity for upskilling the workforce, the overarching sentiment is one of eagerness to embrace AI for its transformative potential to enhance productivity, reduce operational costs, and elevate the overall precision and flexibility of laser cutting processes.

Ultimately, AI is viewed as a pivotal enabler for achieving true smart factory environments, where laser cutting machines can communicate seamlessly with other production units, share data, and collectively optimize the entire manufacturing chain. This connectivity, facilitated by AI, promises to enhance supply chain resilience, enable more agile responses to market fluctuations, and empower manufacturers to innovate faster. The ability of AI to interpret complex data patterns, automate decision-making, and continuously learn from operational experiences will not only improve the performance of individual laser cutting machines but also drive systemic improvements across the entire material processing industry, setting new benchmarks for efficiency, accuracy, and sustainable production practices.

- Enhanced predictive maintenance and real-time fault detection, drastically reducing unplanned downtime.

- Automated optimization of complex cutting parameters for superior cut quality, speed, and material utilization.

- AI-powered vision systems for precise material recognition, positioning, and defect detection.

- Dynamic adjustment of laser power and speed based on real-time sensor feedback and material variations.

- Intelligent nesting algorithms to maximize material yield and minimize scrap, integrating seamlessly with CAD/CAM.

- Self-correcting capabilities to adapt to minor deviations in material properties or machine performance.

- Personalized and adaptive cutting strategies for unique or custom job requirements, improving flexibility.

- Integration into broader smart factory ecosystems, enabling data exchange and collaborative optimization.

- Reduced reliance on highly skilled operators through intuitive, AI-driven process automation and guidance.

- Advanced simulation and digital twin technologies for virtual testing and process validation, accelerating R&D.

- Energy consumption optimization through intelligent scheduling and power management.

DRO & Impact Forces Of Laser Cutting Machines Market

The Laser Cutting Machines Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively dictate its growth trajectory and competitive landscape. A prominent driver is the accelerating global demand for high-precision, high-speed, and non-contact material processing across a multitude of industrial sectors. Industries such as automotive, aerospace, electronics, and medical devices increasingly require intricate designs and stringent quality standards for their components, for which laser cutting offers unparalleled accuracy and clean edges. Furthermore, the relentless pace of technological advancements, particularly in the development of more powerful, energy-efficient, and intelligent fiber lasers, continues to enhance machine capabilities and expand their application scope, thereby fueling market expansion. The growing imperative for automation and the widespread adoption of Industry 4.0 principles in manufacturing facilities worldwide also serve as a crucial driver, as laser cutting machines seamlessly integrate into smart factories to boost productivity, reduce labor costs, and optimize operational efficiency.

Despite these compelling drivers, the market faces several notable restraints that can impede its growth potential. The most significant barrier is the substantial initial capital investment required for acquiring high-end laser cutting machines, which can be prohibitive for small and medium-sized enterprises (SMEs) with limited financial resources. This high upfront cost also includes associated expenses for installation, specialized infrastructure, and advanced software. Moreover, the technical complexity involved in operating, programming, and maintaining these sophisticated machines necessitates a highly skilled workforce, which can be scarce and expensive to train, adding to operational overheads. Intense competition from well-established alternative cutting technologies, such as plasma cutting, waterjet cutting, and mechanical stamping, which may offer lower initial costs or specialized capabilities for certain applications, also presents a challenge. Economic downturns and geopolitical uncertainties can further dampen industrial spending and investment in new capital equipment, impacting market demand.

However, amidst these challenges, numerous opportunities exist that are poised to drive future market development and innovation. The burgeoning manufacturing sectors in emerging economies across Asia Pacific (e.g., Vietnam, Indonesia) and Latin America present vast untapped market potential, driven by rapid industrialization, urbanization, and increasing foreign direct investment. The growing trend towards customization, on-demand manufacturing, and rapid prototyping across industries creates a strong demand for flexible and agile laser cutting solutions. Significant opportunities also lie in the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) for predictive maintenance, remote diagnostics, process optimization, and enhanced automation, which promise to unlock new levels of efficiency and intelligence. Furthermore, the development of more affordable and user-friendly laser systems, coupled with innovative leasing and financing models, could help overcome the high initial investment restraint, making advanced laser cutting technology accessible to a broader customer base, including a wider range of SMEs and specialized workshops. The increasing focus on sustainable manufacturing practices also opens avenues for laser cutting solutions that offer higher energy efficiency and reduced material waste.

Segmentation Analysis

The Laser Cutting Machines Market is meticulously segmented across various crucial dimensions, offering a detailed and multi-faceted understanding of its internal dynamics and external market forces. This granular approach to segmentation is essential for market participants to identify lucrative niches, formulate effective product development strategies, and tailor their marketing efforts to specific customer needs. The segmentation by machine type vividly illustrates the ongoing technological evolution within the industry, where each laser source offers unique capabilities tailored to different material properties and application requirements. Understanding these distinctions is critical for manufacturers in optimizing their product portfolios and for end-users in making informed purchasing decisions that align with their production goals and material processing demands.

Further segmentations by process type and power output provide additional layers of insight into the market's technical demands. The differentiation in cutting processes—fusion, flame, and sublimation cutting—reflects varying approaches to material removal based on the material's thermal properties and desired edge finish, influencing precision and speed. Power output classifications, from low to high power, directly correlate with a machine's ability to cut different material thicknesses and handle diverse production volumes, from intricate micro-cutting to heavy-duty industrial fabrication. These technical distinctions are pivotal in assessing the competitive landscape and identifying opportunities for innovation, such as developing ultra-high-power fiber lasers or specialized low-power systems for niche applications, thereby catering to a broader spectrum of industrial requirements.

The segmentation by application industry and end-user type highlights the pervasive utility of laser cutting technology across the global manufacturing economy. Analyzing demand from sectors such as automotive, aerospace, electronics, and medical devices reveals key growth drivers and specific technological requirements. For instance, the automotive sector demands high-speed, automated systems for mass production, while aerospace requires extreme precision for critical components. The distinction between large enterprises and SMEs as end-users underscores different purchasing power, scalability needs, and service expectations, influencing pricing strategies and product configurations. A comprehensive segmentation analysis thus enables a holistic view of the market, empowering stakeholders to identify emerging trends, address unmet needs, and position themselves strategically for sustainable growth within this dynamic industry.

- By Type

- Fiber Laser Cutting Machines: Dominate the market due to high efficiency, speed, and ability to cut reflective metals.

- CO2 Laser Cutting Machines: Preferred for non-metallic materials like wood, plastics, and acrylics.

- Disk Laser Cutting Machines: Offer robust performance and high power, suitable for thick materials.

- Others (e.g., Excimer Laser, Diode Laser): Used for specialized applications requiring specific wavelengths or low heat input.

- By Process

- Fusion Cutting: Uses an inert gas (e.g., Nitrogen) to blow molten material, resulting in smooth, dross-free edges.

- Flame Cutting (Oxidative Cutting): Uses oxygen as an assist gas, where the oxygen reacts with the molten metal to create an exothermic reaction, suitable for thick ferrous metals.

- Sublimation Cutting: Material converts directly from solid to gas, producing very fine and precise cuts, ideal for delicate materials.

- By Power

- Low Power (<1kW): Typically used for engraving, marking, and cutting thin, delicate materials or for educational/hobbyist purposes.

- Medium Power (1kW-3kW): Versatile for a range of materials and thicknesses, suitable for job shops and small to medium-sized manufacturing.

- High Power (>3kW): Designed for heavy industrial applications, cutting thick metal plates at high speeds, and large-scale production.

- By Application

- Automotive: Manufacturing chassis, body parts, interior components, and specialized parts for electric vehicles.

- Aerospace & Defense: Cutting high-strength alloys and composites for aircraft structures, engine components, and defense equipment.

- Electronics & Semiconductor: Precision cutting of circuit boards, display components, and micro-parts with minimal heat effect.

- Industrial Machinery: Fabrication of heavy equipment parts, industrial tools, and machinery components.

- Medical Devices: Producing intricate and sterile surgical instruments, implants, and diagnostic equipment.

- Others (e.g., Jewellery, Art & Decoration, Consumer Goods, Signage): Includes custom fabrication, decorative elements, and consumer product manufacturing.

- By End-User

- Large Enterprises: Typically adopt high-volume, automated, and integrated laser cutting systems for mass production.

- Small and Medium-sized Enterprises (SMEs): Focus on versatile, cost-effective machines for custom jobs, prototyping, and flexible manufacturing.

Value Chain Analysis For Laser Cutting Machines Market

The value chain for the Laser Cutting Machines Market is a complex and interconnected network of activities, commencing with the conceptualization and research & development phases, extending through material sourcing and component manufacturing, ultimately culminating in distribution, sales, installation, and comprehensive after-sales services. The upstream segment is critical and involves the procurement of highly specialized raw materials and the production of precision components that form the core of a laser cutting system. This includes advanced optical components such as lenses, mirrors, and beam delivery systems, high-power laser sources (e.g., fiber laser modules, CO2 gas tubes, solid-state crystals), sophisticated motion control systems, durable machine frames, and integrated electronic control units. Key suppliers in this phase are often global leaders in photonics, optics, and industrial electronics, whose technological expertise and quality standards directly impact the performance, reliability, and lifespan of the final laser cutting machine. Strategic partnerships and long-term contracts with these specialized upstream component providers are essential for manufacturers to maintain a competitive edge and ensure a stable supply chain for cutting-edge technology.

Moving further along the value chain, the core manufacturing and assembly processes take center stage, where various components are integrated into a complete, functional laser cutting system. This phase involves precision engineering, software development for machine control (CNC systems), and rigorous quality testing. Manufacturers invest heavily in research and development to innovate new laser technologies, improve machine design, enhance user interfaces, and develop proprietary cutting software that optimizes performance for diverse materials and applications. Following manufacturing, the distribution channel plays a pivotal role in market penetration and customer reach. Distribution models can be either direct, where manufacturers sell and service their machines directly to large industrial clients, allowing for greater control over customer relationships and technical support, or indirect, involving a network of authorized distributors, resellers, and agents who provide localized sales, marketing, and first-line technical support in various geographical regions. The choice of distribution strategy often depends on market maturity, customer segment, and the manufacturer's global footprint, balancing reach with control.

The downstream activities of the value chain are centered on customer engagement and long-term support, which are crucial for building brand loyalty and ensuring operational longevity of the machines. This includes installation and commissioning services, thorough operator training programs, and comprehensive after-sales support covering maintenance, repairs, spare parts supply, and software updates. Effective and responsive customer service is a significant differentiator in this capital equipment market, as machine downtime can lead to substantial production losses for end-users. Additionally, the value chain incorporates marketing and sales activities, often involving industry trade shows, digital marketing, and solution-based selling to educate potential customers about the benefits and return on investment of laser cutting technology. The entire value chain is constantly evolving with technological advancements and market demands, emphasizing the importance of integrated supply chain management, customer-centric strategies, and continuous innovation to sustain competitiveness and profitability in the dynamic Laser Cutting Machines Market.

Laser Cutting Machines Market Potential Customers

The expansive utility and precision capabilities of laser cutting machines attract a broad and diverse range of potential customers across virtually every manufacturing sector globally, all seeking advanced solutions for material processing. At the forefront are manufacturers engaged in metal fabrication, where laser technology offers unparalleled accuracy, speed, and flexibility for cutting various types of metals and alloys, including stainless steel, carbon steel, aluminum, brass, and copper, used in everything from structural components to custom parts. This category encompasses large-scale industrial players in automotive and aerospace, requiring high-volume, automated production lines, as well as specialized job shops and small to medium-sized enterprises (SMEs) focused on bespoke metalwork, prototyping, and intricate component manufacturing for diverse clients. The automotive industry, for example, heavily relies on laser cutting for producing lightweight vehicle bodies, intricate chassis parts, and complex exhaust systems, driven by increasing demands for fuel efficiency and advanced vehicle designs.

Beyond traditional metalworking, the aerospace and defense sectors constitute a critical customer segment, leveraging laser cutting for fabricating high-strength, lightweight components from advanced materials and superalloys, which are essential for aircraft structures, engine parts, and sophisticated military equipment. The demand for extreme precision and minimal material stress in these applications makes laser cutting an indispensable tool. Similarly, the electronics and semiconductor industry represents a significant customer base, employing laser cutting for processing delicate circuit boards, display components, and micro-precision parts where thermal distortion must be rigorously controlled. The medical device manufacturing sector also heavily invests in laser cutting technology due to its ability to produce intricate, sterile, and highly precise surgical instruments, implants, and diagnostic equipment, meeting stringent regulatory standards and ensuring patient safety.

Furthermore, the market extends to a variety of other industrial and commercial applications. General industrial machinery manufacturers utilize laser cutting for producing heavy equipment parts, industrial tools, and various components for manufacturing lines. Construction industries benefit from precise metal profiling for structural elements and architectural designs. Even creative industries, such as jewellery manufacturing, art and decoration, and consumer goods production, increasingly adopt laser cutting for intricate designs, rapid prototyping, and efficient batch production of customized items. The burgeoning trend of personalized products and on-demand manufacturing further expands the potential customer pool, as businesses across all sizes seek agile and efficient production technologies that can quickly adapt to changing market demands and facilitate product innovation. This widespread applicability underscores the essential role laser cutting machines play in enabling advanced, efficient, and versatile manufacturing across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 10.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trumpf, Bystronic, Han's Laser, Amada, IPG Photonics, Coherent, Mazak Optonics, Prima Power, Mitsubishi Electric, DNE Laser (HSG Laser), HGTECH, Golden Laser, Trotec Laser, Universal Laser Systems, Kern Laser Systems, Epilog Laser, GCC, Gravograph, ESAB, Cincinnati Inc., LVD Company, Messer Cutting Systems, Lincoln Electric (Burny Kaliburn), Koike Aronson, Kjellberg Finsterwalde, Hypertherm, GSI Group, Sumitomo Heavy Industries, Komatsu, Alpha Laser GmbH, DMG Mori AG |

| Regions Covered | North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (MEA) (UAE, Saudi Arabia, South Africa, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Cutting Machines Market Key Technology Landscape

The technology landscape of the Laser Cutting Machines Market is an incredibly dynamic and innovative domain, continually pushing the boundaries of material processing capabilities through advancements in laser sources, control systems, and integration with smart manufacturing paradigms. Fiber laser technology, in particular, remains the undisputed frontrunner, consistently dominating market share due to its remarkable efficiency, superior beam quality, high reliability, and significantly lower maintenance requirements compared to older CO2 laser systems. Recent breakthroughs in fiber laser sources include the development of ultra-high-power outputs, reaching tens of kilowatts, enabling faster cutting of exceptionally thick metals with unprecedented precision. Furthermore, continuous improvements in beam delivery systems, such as adaptive optics and programmable beam shaping technologies, allow for dynamic manipulation of the laser spot size and intensity profile, optimizing cutting performance for diverse materials and complex geometries, thereby minimizing heat-affected zones and improving edge quality.

Beyond the core laser resonator, the market is profoundly shaped by the sophisticated integration of advanced control and automation technologies. Modern laser cutting machines are almost universally equipped with highly advanced Computer Numerical Control (CNC) systems that provide multi-axis control, enabling complex 2D and 3D cutting operations with micron-level precision and high repeatability. These CNC systems are increasingly complemented by advanced sensor technologies, including vision systems for precise part alignment and anomaly detection, and in-process monitoring sensors that gather real-time data on cutting parameters, material behavior, and machine health. This continuous data feedback loop allows for dynamic parameter adjustments, enabling machines to self-optimize and maintain consistent performance. The adoption of robust automation solutions, such as automated material loading and unloading systems, robotic part removal and sorting, and integrated storage towers, is transforming laser cutting into a fully autonomous and lights-out capable production cell, significantly boosting throughput, enhancing operator safety, and reducing labor costs.

The future of the laser cutting machines market's technological landscape is undeniably intertwined with the pervasive adoption of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). These disruptive technologies are enabling machines to move beyond mere automation to truly intelligent operation. AI algorithms are being developed for predictive maintenance, analyzing sensor data to anticipate potential component failures and schedule preventative interventions, thereby maximizing machine uptime. Furthermore, AI-driven software can autonomously optimize nesting patterns for maximum material utilization, learn optimal cutting parameters for new materials or designs, and even perform real-time quality inspection and defect correction. The IoT facilitates seamless connectivity, allowing machines to communicate with each other, central manufacturing execution systems (MES), and cloud-based platforms for remote monitoring, diagnostics, and overall factory optimization. This convergence of advanced laser physics, precision mechanics, and intelligent software solutions is creating highly adaptive, efficient, and versatile laser cutting systems, capable of meeting the increasingly demanding requirements of modern manufacturing and contributing significantly to the vision of smart factories and Industry 4.0.

Regional Highlights

- Asia Pacific (APAC): This region stands as the dominant force in the global laser cutting machines market, and is projected to exhibit the fastest growth throughout the forecast period. The growth is primarily fueled by rapid industrialization, extensive government support for advanced manufacturing initiatives (e.g., "Made in China 2025," "Make in India"), and the presence of vast manufacturing bases in countries like China, India, Japan, and South Korea across automotive, electronics, general fabrication, and heavy machinery sectors. Increasing foreign direct investment and rising disposable incomes also contribute to the expansion of manufacturing capabilities demanding precision cutting.

- Europe: A mature yet highly significant market, Europe is characterized by a strong emphasis on technological innovation, high adoption rates of advanced manufacturing techniques, and stringent quality standards. Countries such as Germany, Italy, and France are at the forefront, driven by robust automotive, aerospace, industrial machinery, and precision engineering sectors. The region benefits from substantial R&D investments and a well-established industrial infrastructure focused on high-value production and automation.

- North America: This region maintains a substantial market share, primarily fueled by continuous technological advancements, significant investments in automation and smart factory initiatives, and strong demand from critical sectors like aerospace & defense, heavy machinery, and customized fabrication, particularly in the United States and Canada. The region's focus on high-performance manufacturing and rapid prototyping further boosts the adoption of advanced laser cutting solutions.

- Latin America: Representing an emerging and promising market, Latin America is experiencing growth due to ongoing industrialization, increasing foreign investments in manufacturing, and rising demand from its burgeoning automotive, construction, and general fabrication sectors. Countries like Brazil and Mexico are leading this regional expansion, driven by efforts to modernize their industrial infrastructures and enhance production capabilities.

- Middle East and Africa (MEA): This region is a developing market with significant growth potential, stemming from governmental diversification initiatives aimed at reducing reliance on oil and gas, alongside substantial investments in infrastructure development and the establishment of nascent manufacturing industries. Countries like the UAE, Saudi Arabia, and South Africa are key players, gradually adopting advanced manufacturing technologies to build robust industrial ecosystems and drive economic growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Cutting Machines Market.- Trumpf

- Bystronic

- Han's Laser

- Amada

- IPG Photonics

- Coherent

- Mazak Optonics

- Prima Power

- Mitsubishi Electric

- DNE Laser (HSG Laser)

- HGTECH

- Golden Laser

- Trotec Laser

- Universal Laser Systems

- Kern Laser Systems

- Epilog Laser

- GCC

- Gravograph

- ESAB

- Cincinnati Inc.

- LVD Company

- Messer Cutting Systems

- Lincoln Electric (Burny Kaliburn)

- Koike Aronson

- Kjellberg Finsterwalde

- Hypertherm

- GSI Group

- Sumitomo Heavy Industries

- Komatsu

- Alpha Laser GmbH

- DMG Mori AG

Frequently Asked Questions

What is a laser cutting machine and what are its core functionalities?

A laser cutting machine is an advanced industrial tool that harnesses a high-power, focused laser beam to precisely cut, engrave, or mark materials. Its core functionality involves generating a concentrated beam of light from a laser resonator (such as fiber or CO2), directing it through a series of optics, and focusing it onto the workpiece. This intense energy melts, burns, or vaporizes the material along a programmed path, often assisted by an inert gas to expel molten material, resulting in exceptionally clean, narrow, and accurate cuts. This non-contact process minimizes material distortion and provides superior edge quality for intricate designs.

What are the key advantages of employing laser cutting technology over traditional fabrication methods?

The key advantages of laser cutting technology over conventional methods like plasma, waterjet, or mechanical stamping are numerous. It offers unparalleled precision and accuracy, allowing for the creation of intricate and complex geometries with minimal kerf width. The non-contact nature of the process reduces tool wear and eliminates mechanical stress on the material, leading to minimal heat-affected zones and superior surface finishes without the need for secondary processing. Furthermore, laser cutting provides high processing speeds, reduced material waste through optimized nesting, and the versatility to cut a wide array of materials with quick changeovers, significantly boosting productivity and cost-efficiency in manufacturing operations.

Which major industries are the primary consumers and beneficiaries of laser cutting machines?

Laser cutting machines are indispensable across a wide spectrum of major industries globally. The automotive sector is a significant consumer, utilizing laser cutting for producing lightweight vehicle components, intricate chassis parts, and advanced structural elements to meet evolving design and fuel efficiency demands. The aerospace and defense industries rely heavily on this technology for cutting high-strength alloys and advanced composites for critical aircraft structures and sophisticated military equipment, demanding extreme precision. Other primary beneficiaries include electronics and semiconductor manufacturing for micro-precision components, industrial machinery for heavy equipment fabrication, and the medical device sector for sterile, intricate surgical tools and implants. Its adaptability also extends to signage, jewelry, and custom fabrication.

What types of materials can be effectively processed by different laser cutting machine technologies?

Laser cutting machines offer remarkable versatility in material processing, though capabilities vary by laser type. Fiber laser machines are highly effective for cutting a wide range of metals, including stainless steel, carbon steel, aluminum, brass, copper, and other reflective alloys, often at high speeds and thicknesses. CO2 laser machines excel in processing non-metallic materials such as wood, acrylic, plastics, paper, fabrics, leather, glass, and some ceramics, producing clean cuts and intricate details. Disk lasers, a type of solid-state laser, also offer high power and beam quality suitable for thick metals. The choice of laser technology depends on the material composition, thickness, and desired cut quality.

How is Artificial Intelligence (AI) influencing and shaping the future trajectory of the laser cutting market?

Artificial Intelligence (AI) is profoundly influencing the laser cutting market by ushering in a new era of smart manufacturing. AI-driven systems are enabling advanced capabilities such as predictive maintenance, anticipating potential machine failures to minimize downtime. They facilitate real-time optimization of cutting parameters, automatically adjusting laser power, speed, and gas pressure based on sensor data and material variations for superior quality and efficiency. AI also enhances quality control through automated defect detection, optimizes material nesting for waste reduction, and supports autonomous operation within integrated smart factory environments. This integration of AI is leading to higher productivity, reduced operational costs, and more adaptive and intelligent laser cutting solutions for future manufacturing needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fiber Laser Cutting Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fiber Laser Cutting Machines Market Statistics 2025 Analysis By Application (General Machinery Processing, Automotive, Home Appliance, Aerospace and Marine), By Type (2D Laser Cutting Machine, 3D Laser Cutting Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- 2D Laser Cutting Machines Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (СО2 Lаѕеr Сuttіng Масhіnе, Fіbеr Lаѕеr Сuttіng Масhіnе), By Application (Gеnеrаl Масhіnеrу Рrосеѕѕіng, Аutоmоtіvе Іnduѕtrу, Ноmе Аррlіаnсе, Аеrоѕрасе аnd Ѕhір Вuіldіng, Оthеrѕ), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager