Laser Welding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427897 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Laser Welding Machine Market Size

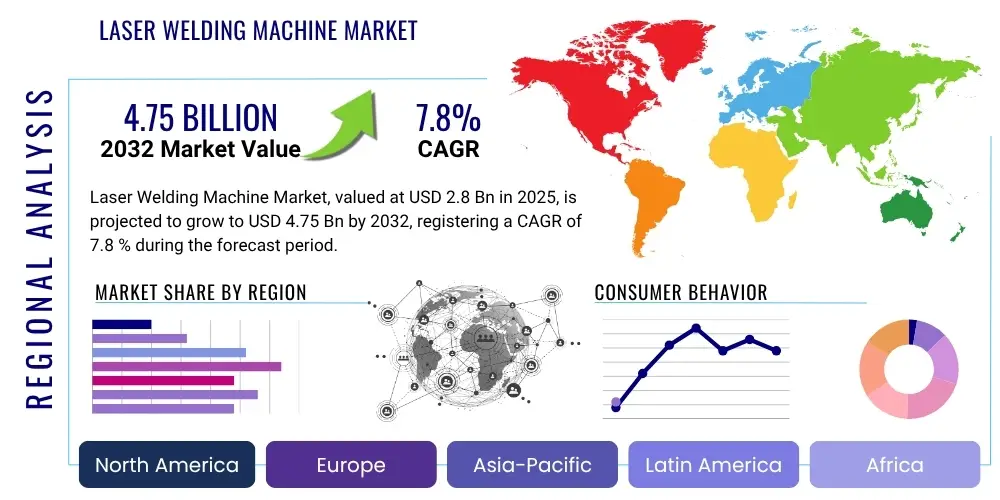

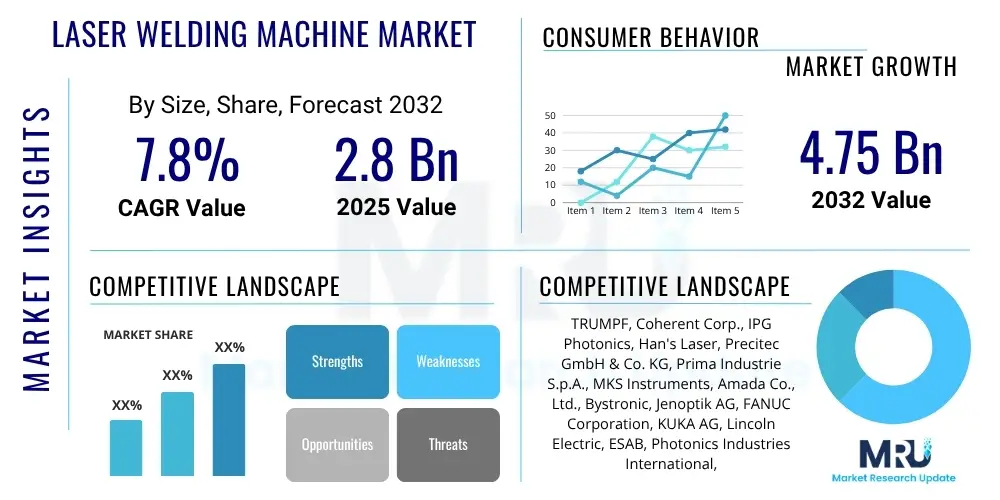

The Laser Welding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 2.8 Billion in 2025 and is projected to reach USD 4.75 Billion by the end of the forecast period in 2032.

Laser Welding Machine Market introduction

Laser welding machines represent a pinnacle of modern manufacturing technology, leveraging concentrated laser beams to join materials with unparalleled precision and minimal heat input. This advanced welding process has revolutionized various industries by offering superior weld quality, increased speed, and the ability to work with a diverse range of materials, including dissimilar metals and highly reflective alloys. The fundamental principle involves converting electrical energy into a high-intensity laser beam that melts and fuses material surfaces, creating strong, narrow, and deep welds. The market encompasses various types of laser sources, each optimized for specific applications and material characteristics, driving its widespread adoption across high-tech sectors.

The widespread utility of laser welding machines spans across critical industrial applications, including the automotive sector for lightweighting components and battery pack manufacturing, the medical device industry for fabricating intricate surgical instruments and implants, and the electronics segment for micro-welding delicate components. Aerospace and defense industries also heavily rely on laser welding for high-integrity joints in critical structures, demanding processes that ensure both structural integrity and minimal material deformation. The technology's ability to create hermetic seals makes it crucial for sensitive electronic packaging and medical implants, where contamination prevention is paramount. Furthermore, its application extends to jewelry manufacturing for intricate designs and general fabrication for high-volume, precision joining tasks, underscoring its versatility across a broad economic spectrum.

Key benefits driving this adoption include exceptional welding speeds that boost productivity, minimal distortion due to localized heat input, and the capability to produce aesthetically superior welds without extensive post-processing. Furthermore, the inherent automation compatibility of laser welding systems facilitates seamless integration into Industry 4.0 environments, enhancing overall manufacturing efficiency, consistency, and reducing reliance on manual labor for repetitive or hazardous tasks. The burgeoning demand for electric vehicles (EVs) is a significant catalyst, as laser welding is indispensable for assembling battery cells, modules, and packs, as well as lightweight structural components required for extended range and performance. Concurrently, the increasing emphasis on automation and robotic integration in manufacturing across developed and developing economies is fueling market expansion, as laser welding systems are inherently suited for automated production lines that prioritize high throughput and repeatable quality.

Laser Welding Machine Market Executive Summary

The Laser Welding Machine Market is undergoing transformative growth, primarily driven by evolving business trends towards enhanced automation, precision manufacturing, and the integration of advanced digital technologies. Manufacturers are increasingly investing in automated laser welding solutions to improve production efficiency, reduce labor costs, and achieve higher weld quality standards across diverse industries. The shift towards lightweight materials in sectors like automotive and aerospace, coupled with the miniaturization of electronic components, further necessitates the adoption of highly precise and controllable laser welding techniques. This trend is amplified by the ongoing global push for Industry 4.0 initiatives, where connectivity and smart manufacturing are paramount, positioning laser welding as a foundational technology for future-ready factories.

Regionally, the Asia Pacific (APAC) market continues to dominate the laser welding machine landscape, propelled by robust manufacturing bases in China, Japan, South Korea, and India, which are global hubs for automotive, electronics, and general industrial production. This region benefits from significant governmental support for industrial modernization and a large pool of skilled labor, alongside growing domestic demand for technologically advanced products. North America and Europe also demonstrate substantial market presence, characterized by high adoption rates in research-intensive sectors like aerospace, medical devices, and advanced automotive manufacturing, focusing on innovation and high-value applications. Emerging economies in Latin America, the Middle East, and Africa are showing promising growth, driven by increasing industrialization and investment in modern manufacturing infrastructure, albeit from a smaller base.

Segmentation trends within the laser welding machine market highlight the increasing prominence of fiber lasers due to their superior efficiency, beam quality, and lower maintenance requirements, making them a preferred choice across various applications. High-power laser welding systems are witnessing heightened demand, especially for heavy industrial applications and complex component assembly in the automotive and aerospace sectors. Furthermore, the rapid expansion of the electric vehicle (EV) industry is a pivotal segment driver, with specialized laser welding solutions being developed specifically for battery manufacturing, including cell-to-cell, module, and pack welding. This focus on niche, high-growth applications, combined with the general industrial uptake, underscores a dynamic market poised for sustained expansion and technological diversification.

AI Impact Analysis on Laser Welding Machine Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the precision, efficiency, and reliability of laser welding processes, particularly concerning real-time quality control, predictive maintenance, and autonomous operation. Key themes revolve around leveraging AI for defect detection, optimizing welding parameters, integrating robotic systems, and ultimately reducing operational costs while improving overall weld integrity. The market expects AI to provide solutions for complex material joining, adaptive process control, and advanced data analytics to drive smart manufacturing decisions, thus elevating laser welding from a sophisticated tool to an intelligent, self-optimizing system.

- AI-driven vision systems enable real-time defect detection and quality assessment during welding, ensuring immediate corrective actions and reducing post-processing rework.

- Predictive maintenance algorithms analyze operational data from laser welding machines to forecast potential failures, minimizing downtime and extending equipment lifespan.

- Machine learning optimizes welding parameters (power, speed, focal length) based on material properties and desired weld characteristics, leading to superior and consistent weld quality.

- AI-powered robotics enhance flexibility and precision in automated laser welding, allowing for adaptive path planning and handling of complex geometries.

- Integration of AI facilitates autonomous laser welding processes, where systems can independently learn, adapt, and execute welding tasks with minimal human intervention.

- AI supports advanced material characterization and process modeling, enabling the development of welding strategies for novel and challenging materials.

DRO & Impact Forces Of Laser Welding Machine Market

The Laser Welding Machine Market is significantly influenced by a confluence of powerful drivers, persistent restraints, compelling opportunities, and transformative impact forces. A primary driver is the accelerating demand for automation in manufacturing processes across virtually all industrial sectors, propelled by the need for increased efficiency, reduced labor costs, and improved product quality. Laser welding systems, with their inherent precision, speed, and suitability for robotic integration, are ideally positioned to meet these automation requirements. Furthermore, the global push for lightweighting in automotive and aerospace industries, necessitated by fuel efficiency and performance demands, requires advanced joining techniques for dissimilar materials and thin gauges, where laser welding excels. The burgeoning electric vehicle (EV) market stands out as a critical driver, with laser welding being indispensable for the manufacturing of battery packs and associated components, demanding high-integrity, high-speed joining solutions.

Despite robust growth, the market faces notable restraints. The high initial capital investment associated with acquiring advanced laser welding machines and integrating them into existing production lines can be a significant barrier for small and medium-sized enterprises (SMEs). This cost includes not only the laser system itself but also peripheral equipment such as robotics, safety enclosures, and skilled operator training. Another restraint is the requirement for highly skilled labor to operate, program, and maintain these sophisticated machines. A shortage of such specialized personnel can impede wider adoption. Moreover, certain safety concerns related to high-power lasers, including eye and skin exposure risks, necessitate stringent safety protocols and protective equipment, adding to operational complexities and costs. The complexity of welding highly reflective materials, while being addressed by technological advancements, still presents challenges for certain applications.

Opportunities for market expansion are substantial and varied. Emerging economies, particularly those undergoing rapid industrialization and modernization of their manufacturing infrastructure, present vast untapped markets. The increasing adoption of additive manufacturing (3D printing) offers new applications for laser welding in post-processing and hybrid manufacturing scenarios. The continued development of smart factories and Industry 4.0 concepts creates avenues for deeper integration of laser welding systems with real-time monitoring, AI, and data analytics for predictive maintenance and process optimization. Furthermore, advancements in laser technology itself, such as the development of more powerful, energy-efficient, and versatile laser sources (e.g., green lasers for copper, blue lasers for highly reflective materials), coupled with innovative beam shaping and scanning technologies, are continuously expanding the application spectrum of laser welding, opening doors to previously challenging materials and designs. These technological leaps are set to revolutionize material joining in high-growth sectors.

Segmentation Analysis

The Laser Welding Machine Market is broadly segmented based on several key characteristics that reflect the diverse applications and technological variations within the industry. Understanding these segments is crucial for analyzing market dynamics, identifying specific growth opportunities, and tailoring solutions to meet precise industrial demands. The segmentation typically covers aspects such as the type of laser source, the power output of the machine, the specific applications it serves, and the end-use industries that are primary consumers of this technology. Each segment exhibits distinct growth trajectories and competitive landscapes, driven by unique technological advancements and market needs, contributing to the overall market complexity and strategic planning for manufacturers and suppliers.

- By Type:

- Fiber Laser Welding Machine

- CO2 Laser Welding Machine

- Nd:YAG Laser Welding Machine

- Diode Laser Welding Machine

- Other Types (e.g., Disk Lasers, Excimer Lasers)

- By Power:

- Low Power (<500W)

- Medium Power (500W - 3kW)

- High Power (>3kW)

- By Application:

- Spot Welding

- Seam Welding

- Hybrid Welding

- Remote Welding

- Other Applications

- By End-Use Industry:

- Automotive

- Electronics & Semiconductor

- Medical Devices

- Aerospace & Defense

- Jewelry

- Heavy Industry/General Fabrication

- Other Industries (e.g., Renewable Energy, Consumer Goods)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Laser Welding Machine Market

The value chain for the Laser Welding Machine Market is a complex ecosystem involving various stages from raw material sourcing to end-user deployment, highlighting the interconnectedness of specialized suppliers and integrators. At the upstream end, the value chain begins with the manufacturing of core components crucial for laser systems, including laser sources (e.g., diodes, gain media, optics), beam delivery components (mirrors, lenses, fiber optics), power supplies, and control electronics. Specialized companies focus solely on producing these high-precision components, which are then supplied to system integrators. This segment of the value chain is characterized by significant R&D investment and a high degree of technical expertise, as the performance and reliability of the entire welding system depend heavily on the quality and efficiency of these foundational elements, driving innovation in laser physics and material science.

Moving downstream, these components are assembled and integrated by original equipment manufacturers (OEMs) or system integrators into complete laser welding machines. These companies often add proprietary software for process control, robotic arms for automation, vision systems for quality monitoring, and safety enclosures to create turnkey solutions tailored for specific industrial applications. Distribution channels play a critical role in connecting these manufacturers with end-users. Direct sales channels are often employed for large industrial clients requiring custom solutions and extensive post-sales support, facilitating direct communication and technical consultation. Conversely, indirect channels, involving distributors, resellers, and regional agents, are crucial for reaching a broader customer base, especially SMEs, by offering local support, training, and more accessible procurement options, often including bundled service agreements and financing solutions.

The final stage involves the deployment and maintenance of laser welding machines at the end-user facilities. End-users span across diverse industries such as automotive, aerospace, medical devices, electronics, and heavy fabrication, each with unique requirements for welding precision, speed, and material compatibility. The downstream activities also encompass after-sales services, including installation, commissioning, maintenance, spare parts supply, and operator training, which are vital for ensuring optimal performance and longevity of the equipment. Both direct and indirect distribution strategies are critical for effectively reaching and serving these varied end-user segments, with direct channels often providing deeper technical engagement for complex projects and indirect channels offering widespread market penetration. The efficiency and robustness of this entire value chain directly impact the market's growth, technological adoption, and overall customer satisfaction, emphasizing the importance of collaboration and specialization at each stage.

Laser Welding Machine Market Potential Customers

The potential customers for laser welding machines represent a broad and diverse spectrum of industries, all seeking to leverage the unparalleled precision, speed, and material versatility offered by this advanced joining technology. At the forefront are sectors with stringent quality requirements and high-volume production demands, where traditional welding methods often fall short in terms of consistency, heat management, and automation potential. These industries are constantly seeking ways to enhance product quality, reduce manufacturing defects, and accelerate production cycles, making laser welding a critical investment for maintaining competitive advantage and meeting evolving market demands for increasingly complex and high-performance products. The ongoing global technological advancements and the increasing emphasis on manufacturing efficiency further broaden the appeal of these machines across new and established industrial landscapes, highlighting a continuous expansion of the customer base.

The automotive industry stands as a major end-user, particularly with the rapid shift towards electric vehicles (EVs). Manufacturers require laser welding for fabricating battery cells, modules, and packs, as well as for welding lightweight aluminum and high-strength steel components in vehicle body structures to improve fuel efficiency and structural integrity. Similarly, the aerospace and defense sectors are critical customers, utilizing laser welding for high-integrity joints in engine components, airframes, and missile systems, where safety and reliability are paramount and materials can be challenging to weld. The medical device industry relies on laser welding for producing intricate, hermetically sealed surgical instruments, implants, and diagnostic equipment, ensuring biocompatibility and sterility. The electronics and semiconductor industry also heavily invests in laser welding for micro-joining delicate components, producing precise connections without thermal damage to surrounding circuitry, which is crucial for the performance and longevity of electronic devices.

Beyond these high-tech sectors, general fabrication and heavy industries also represent significant potential customer bases, using laser welding for diverse applications ranging from customized machinery components to large structural assemblies where speed, precision, and low distortion are valued. The jewelry sector employs fine laser welding for intricate repairs and designs due to its minimal heat input and localized fusion capability. Furthermore, emerging industries such as renewable energy (e.g., solar panel manufacturing, fuel cell components) and additive manufacturing (for post-processing and hybrid builds) are increasingly recognizing the advantages of laser welding. This wide array of end-users underscores the technology's adaptability and its integral role in modern manufacturing, catering to any sector that prioritizes high-quality, high-speed, and automated material joining solutions for complex and sensitive applications, thereby driving continuous innovation in the field.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2032 | USD 4.75 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TRUMPF, Coherent Corp., IPG Photonics, Han's Laser, Precitec GmbH & Co. KG, Prima Industrie S.p.A., MKS Instruments, Amada Co., Ltd., Bystronic, Jenoptik AG, FANUC Corporation, KUKA AG, Lincoln Electric, ESAB, Photonics Industries International, Nlight, Inc., Mitsubishi Electric, Panasonic Corporation, Laserline GmbH, Miyachi America Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Welding Machine Market Key Technology Landscape

The technological landscape of the Laser Welding Machine Market is characterized by continuous innovation aimed at enhancing efficiency, precision, versatility, and integration capabilities. At the core are the diverse types of laser sources, each evolving to meet specific industrial needs. Fiber lasers have emerged as a dominant technology due to their high beam quality, energy efficiency, compact size, and reliability, making them suitable for a wide range of materials and applications, from fine cutting to deep penetration welding. CO2 lasers, while traditionally used, continue to be refined for specific applications requiring high power and flexibility for thicker materials, particularly in heavy industry. Nd:YAG lasers, still prevalent in certain micro-welding and pulsed applications, are seeing advancements in their pulsed energy delivery for specialized tasks. Diode lasers are gaining traction for their direct energy conversion, efficiency, and compact design, particularly for heat conduction welding and brazing applications.

Beyond the laser sources themselves, significant technological advancements are occurring in beam delivery and control systems. Innovations in beam shaping optics, such as programmable optics and adaptive mirrors, allow for dynamic manipulation of the laser spot shape and energy distribution. This capability enables optimized welding for different material combinations and joint geometries, minimizing distortion and improving weld quality. Remote laser welding, utilizing high-speed scanning mirrors, has revolutionized production lines by allowing welding at significant distances from the laser head, dramatically increasing processing speed and flexibility in highly automated environments, making it ideal for large-scale automotive production. The integration of advanced sensors and real-time monitoring systems is also crucial, providing immediate feedback on process parameters and weld quality, essential for maintaining consistency and preventing defects in critical applications.

Furthermore, the convergence of laser welding with robotics and artificial intelligence (AI) is shaping the future of the market. Robotic integration provides unparalleled dexterity and repeatability, allowing laser welding systems to be deployed in complex, multi-axis applications within automated production lines. Machine vision systems, often coupled with AI algorithms, enable precise part localization, seam tracking, and post-weld inspection, further enhancing automation and quality control. AI and machine learning are increasingly being used to optimize welding parameters adaptively, predict potential failures through sensor data analysis, and facilitate autonomous operation, making the systems smarter and more efficient. These technological synergies are transforming laser welding from a standalone process into an intelligent, networked component of the broader Industry 4.0 manufacturing ecosystem, driving new levels of productivity and enabling the fabrication of next-generation products across all key sectors of the economy.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to its robust manufacturing sector, particularly in countries like China, Japan, South Korea, and India. The region benefits from substantial investments in automation, a thriving automotive and electronics industry, and a large consumer base, driving demand for efficient and high-precision welding solutions. The rapid expansion of EV manufacturing plants in China and India is a major growth catalyst.

- Europe: A significant market characterized by strong adoption in the automotive, aerospace, and medical device industries. Countries like Germany, France, and Italy are at the forefront of technological innovation and smart manufacturing, implementing advanced laser welding systems for high-value applications and precision engineering. Stringent quality standards and a focus on R&D further bolster market growth.

- North America: Exhibits high demand for laser welding machines, driven by advanced manufacturing initiatives, significant investment in R&D, and the strong presence of aerospace, defense, and medical device sectors. The growing emphasis on automation and the reshoring of manufacturing activities are key drivers, along with substantial capital expenditure in next-generation automotive production, including EV components.

- Latin America: An emerging market with growing industrialization, particularly in countries like Brazil and Mexico, which are key automotive manufacturing hubs. Increasing foreign direct investment in manufacturing and the modernization of industrial processes are expected to fuel the adoption of laser welding technology, albeit at a slower pace compared to developed regions.

- Middle East & Africa (MEA): Represents a nascent but growing market, propelled by diversification efforts away from oil-dependent economies and increasing investments in infrastructure, defense, and manufacturing capabilities. The region's industrial growth and adoption of advanced technologies are creating new opportunities for laser welding machines, especially in construction and general fabrication, though market penetration is still relatively low.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Welding Machine Market.- TRUMPF

- Coherent Corp.

- IPG Photonics

- Han's Laser

- Precitec GmbH & Co. KG

- Prima Industrie S.p.A.

- MKS Instruments

- Amada Co., Ltd.

- Bystronic

- Jenoptik AG

- FANUC Corporation

- KUKA AG

- Lincoln Electric

- ESAB

- Photonics Industries International

- Nlight, Inc.

- Mitsubishi Electric

- Panasonic Corporation

- Laserline GmbH

- Miyachi America Corporation

Frequently Asked Questions

Analyze common user questions about the Laser Welding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser welding over traditional welding methods?

Laser welding offers superior precision, faster processing speeds, minimal heat-affected zones leading to less material distortion, high-strength welds, and the ability to join dissimilar materials and delicate components with high repeatability, making it ideal for automated production and critical applications.

Which industries are the biggest adopters of laser welding machines?

The automotive industry, particularly for EV battery manufacturing and lightweighting, along with electronics, medical devices, aerospace and defense, and general fabrication, are the largest end-use industries for laser welding machines due to their demand for high precision and efficiency.

How does AI impact the future of laser welding technology?

AI enhances laser welding by enabling real-time quality control, predictive maintenance, optimal parameter selection, and autonomous operation. It improves precision, reduces defects, minimizes downtime, and integrates systems into smart factory environments, pushing towards self-optimizing manufacturing processes.

What are the main types of laser sources used in welding machines?

The primary laser sources include Fiber Lasers (most popular for their efficiency and beam quality), CO2 Lasers (suited for high power and thicker materials), Nd:YAG Lasers (used for pulsed and micro-welding), and Diode Lasers (known for efficiency and compact design in heat conduction applications).

What are the key challenges hindering the growth of the laser welding machine market?

Key challenges include the high initial capital investment required for laser welding systems, the need for highly skilled operators and maintenance personnel, and specific safety considerations related to high-power laser operation. These factors can act as barriers for smaller businesses and new market entrants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager