Oil Insulated Switchgear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430292 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Oil Insulated Switchgear Market Size

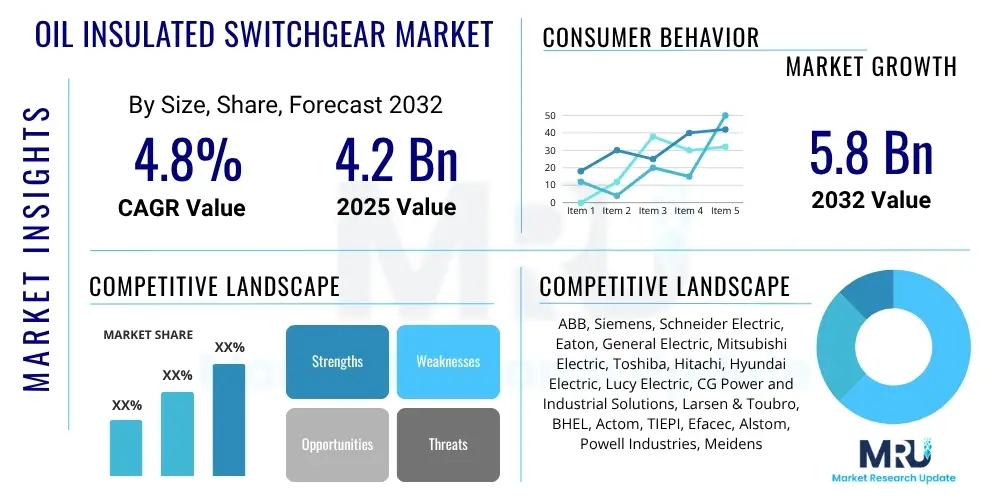

The Oil Insulated Switchgear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at $4.2 Billion in 2025 and is projected to reach $5.8 Billion by the end of the forecast period in 2032.

Oil Insulated Switchgear Market introduction

The Oil Insulated Switchgear Market encompasses electrical equipment used to control, protect, and isolate electrical circuits, utilizing insulating oil as a dielectric medium for arc extinction and insulation. This traditional technology has been a cornerstone of power grids globally, offering robust performance in a variety of challenging environments, particularly in high-voltage applications and areas prone to extreme weather conditions. The primary product in this market includes oil circuit breakers, oil-filled disconnectors, and oil-immersed transformers, integrated into substations and industrial facilities.

Major applications for oil insulated switchgear span across power generation, transmission, and distribution utilities, as well as heavy industries such as manufacturing, mining, and oil and gas. These systems are critical for ensuring grid stability, preventing equipment damage, and facilitating maintenance without widespread outages. The inherent benefits of oil insulation include its high dielectric strength, excellent heat dissipation properties, and proven reliability over decades of use. These characteristics contribute to the longevity and stable operation of power infrastructure, especially in remote or demanding locations where alternative technologies might face more complex logistical or operational challenges.

Driving factors for the continued demand for oil insulated switchgear, despite the emergence of newer technologies, include the extensive existing installed base requiring maintenance and replacement, the ongoing expansion of power grids in developing economies, and the cost-effectiveness for certain voltage levels and applications. While environmental concerns and advancements in gas-insulated and air-insulated switchgear present challenges, the proven robustness and relatively lower initial capital expenditure for specific legacy system upgrades continue to support market activity. The focus remains on improving operational efficiency, enhancing safety, and extending the lifespan of these vital components within the energy infrastructure.

Oil Insulated Switchgear Market Executive Summary

The Oil Insulated Switchgear Market is experiencing a period of strategic evolution, marked by a balance between the enduring demand for reliable, cost-effective traditional solutions and the increasing push towards environmentally sustainable and technologically advanced alternatives. Business trends indicate a strong emphasis on modernization and retrofitting existing infrastructure, particularly in mature economies where a substantial installed base of oil-filled equipment requires life-extension solutions or targeted replacements. Manufacturers are focusing on R&D to enhance the safety, efficiency, and environmental performance of new oil-insulated designs, while also diversifying their portfolios to include Gas Insulated Switchgear (GIS) and Air Insulated Switchgear (AIS) to meet diverse client needs and evolving regulatory landscapes. This dual approach allows companies to capitalize on traditional market segments while adapting to future industry shifts.

Regional trends reveal varied market dynamics. Developing economies, particularly in Asia Pacific and parts of Africa, are witnessing significant grid expansion and industrialization, driving demand for both new installations and robust, proven switchgear solutions, including oil-insulated types, due to their lower initial cost and reliable performance in harsh conditions. Conversely, North America and Europe are primarily focused on replacing aging infrastructure, upgrading existing substations, and integrating renewable energy sources into the grid, which often involves a transition towards more compact and environmentally friendly switchgear. However, even in these regions, oil-insulated switchgear continues to be relevant for specific applications where its characteristics offer distinct advantages or where budget constraints prioritize established technology. The Middle East and Latin America also present growth opportunities through grid modernization initiatives and industrial development, balancing new installations with maintenance of existing assets.

Segmentation trends highlight the continued dominance of medium and high-voltage applications within the utility sector, encompassing power generation, transmission, and distribution. Industrial end-users, especially in heavy manufacturing, mining, and oil and gas, also represent a significant segment due to their stringent reliability requirements and often challenging operating environments. There is a growing inclination towards smart oil-insulated switchgear solutions that incorporate digital monitoring and control capabilities, enhancing operational intelligence and predictive maintenance, even as the core insulation technology remains oil-based. This integration of smart features aims to bridge the gap between traditional robust hardware and modern grid management demands, optimizing asset performance and extending operational lifespans effectively.

AI Impact Analysis on Oil Insulated Switchgear Market

User inquiries regarding AI's impact on the Oil Insulated Switchgear market primarily revolve around how artificial intelligence can enhance the operational efficiency, predictive maintenance capabilities, and overall lifespan of these traditional assets, rather than a fundamental change in their insulation technology. Common questions explore the integration of AI for fault detection, anomaly identification, and optimized maintenance schedules, aiming to minimize downtime and reduce operational costs. Users are keen to understand if AI can make oil-insulated switchgear "smarter" and more competitive against newer, often digitally native, alternatives. There's also curiosity about AI's role in optimizing the manufacturing process and supply chain for these components, as well as its potential to manage the risks associated with aging infrastructure. The prevailing expectation is that AI will augment, not replace, the core functionality of oil-insulated switchgear by providing advanced analytical capabilities and operational insights.

- AI enables predictive maintenance by analyzing operational data, identifying potential failures before they occur, and reducing unplanned outages.

- Optimized asset management through AI-driven insights allows for better resource allocation, extending the lifespan of existing oil-insulated switchgear.

- Enhanced fault detection and diagnosis using AI algorithms improves response times and minimizes damage during electrical disturbances.

- AI contributes to smart grid integration by facilitating data exchange and control, making traditional switchgear compatible with modern energy management systems.

- Improved operational efficiency through AI-powered monitoring and control systems reduces energy losses and optimizes power flow.

- AI can assist in risk assessment and safety management by analyzing operational parameters and environmental conditions, mitigating potential hazards.

- Supply chain optimization and manufacturing process improvements are achievable with AI, leading to more efficient production and delivery of components.

DRO & Impact Forces Of Oil Insulated Switchgear Market

The Oil Insulated Switchgear Market is shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A significant driver is the continuous expansion and modernization of electrical grids globally, particularly in emerging economies that require robust and cost-effective power infrastructure. The reliability and proven track record of oil-insulated switchgear in harsh conditions and high-voltage applications also contribute to its sustained demand. Furthermore, the substantial installed base of legacy oil-insulated equipment necessitates ongoing maintenance, upgrades, and replacements, creating a steady aftermarket. Industrial sectors, such as manufacturing, mining, and oil and gas, continue to rely on these systems for their resilience and performance. The relatively lower initial capital expenditure compared to some advanced alternatives can also be a driving factor for budget-conscious projects.

However, several restraints impede the market's growth. Environmental concerns surrounding the potential for oil spills, fire hazards, and the end-of-life disposal of insulating oil are significant drawbacks. Stricter environmental regulations globally are pushing utilities and industries towards greener alternatives, such as SF6-free gas-insulated switchgear or vacuum circuit breakers. The maintenance requirements for oil-insulated switchgear are generally higher and more complex than for some modern alternatives, contributing to higher operational costs over the equipment's lifespan. Additionally, the increasing competition from technologically advanced and more compact gas-insulated switchgear (GIS) and air-insulated switchgear (AIS) solutions, which offer benefits like reduced footprint and lower maintenance, poses a considerable challenge to the oil-insulated segment.

Despite these restraints, opportunities exist for market players. The massive aging infrastructure in developed economies presents a significant opportunity for retrofit and replacement projects where oil-insulated switchgear might be the most compatible and cost-effective solution for existing layouts. Developing regions, with their rapid industrialization and urbanization, offer avenues for new installations. Innovation in enhancing the safety, monitoring, and environmental performance of oil-insulated designs, such as biodegradable oils or advanced condition monitoring systems, can carve out niche opportunities. Impact forces such as global energy policy shifts towards renewable integration, increasing demand for reliable power, and ongoing research into sustainable insulation materials will continue to influence market dynamics. Geopolitical stability and economic growth directly impact infrastructure investment, further shaping the market trajectory for oil insulated switchgear.

Segmentation Analysis

The Oil Insulated Switchgear Market is comprehensively segmented based on various technical and application-specific parameters, allowing for a detailed understanding of market dynamics across different operational environments and end-user needs. These segmentations provide crucial insights into how market demand is distributed and where growth opportunities are most prevalent. The primary segments typically include distinctions by voltage level, which directly correlates with the scale and application of the switchgear, by insulation type (though primarily oil-insulated, variations within oil types or hybrid systems exist), and by end-user industry, reflecting the diverse applications from utility grids to heavy industrial operations. Further segmentation by installation type, such as indoor or outdoor, also provides context for environmental and space considerations.

- By Voltage Level:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV – 36 kV)

- High Voltage (Above 36 kV)

- By Application:

- Power Generation

- Power Transmission

- Power Distribution

- Industrial

- Commercial

- By End User:

- Utilities

- Oil and Gas

- Mining

- Manufacturing and Process Industries

- Railways and Transportation

- Data Centers

- Infrastructure and Construction

- By Component:

- Circuit Breakers

- Disconnectors

- Load Break Switches

- Fuses

- Relays

- Control Panels

- By Installation:

- Indoor

- Outdoor

Value Chain Analysis For Oil Insulated Switchgear Market

The value chain for the Oil Insulated Switchgear Market begins with upstream activities involving the sourcing and processing of raw materials. This includes critical components such as high-grade steel and aluminum for enclosures, copper for conductors, specialized insulating oils, porcelain or polymer insulators, and various electrical components like contacts, springs, and operating mechanisms. Key suppliers in this stage are manufacturers of metals, chemical companies providing dielectric oils, and specialized component producers. The quality and availability of these raw materials directly impact the cost and performance of the final switchgear product. Efficiency in sourcing and managing these upstream inputs is crucial for maintaining competitive pricing and production timelines within the industry.

Midstream activities involve the manufacturing, assembly, and testing of the oil insulated switchgear. This stage encompasses design engineering, fabrication of parts, assembly of circuit breakers, disconnectors, and associated control panels, followed by rigorous quality control and testing processes to ensure compliance with international standards and operational safety. Manufacturers leverage specialized facilities and skilled labor for these intricate assembly processes. Downstream activities focus on distribution, installation, commissioning, and after-sales services. Distribution channels can be direct, where manufacturers sell directly to large utilities or industrial clients, or indirect, involving a network of distributors, system integrators, and contractors who handle sales, installation, and local support. The effectiveness of the distribution network is critical for market penetration and timely project execution.

Direct distribution channels are often preferred for large-scale, high-voltage projects where direct manufacturer engagement ensures technical expertise and tailored solutions. This allows for close collaboration between the client and the manufacturer, ensuring that specific project requirements and technical specifications are met. Indirect channels, on the other hand, are essential for reaching a broader customer base, particularly for medium and low-voltage applications, and for providing localized support and maintenance services. After-sales services, including maintenance, spare parts supply, and retrofitting services, constitute a significant portion of the value chain, extending the product lifecycle and building long-term customer relationships. The service aspect is particularly vital for oil-insulated switchgear due to its traditional nature and the need for regular inspections and oil quality management.

Oil Insulated Switchgear Market Potential Customers

Potential customers for Oil Insulated Switchgear primarily comprise entities involved in the generation, transmission, and distribution of electricity, alongside various heavy industries that require robust and reliable power control and protection. The utility sector stands as the largest end-user segment, encompassing national and regional power grid operators, state-owned electricity boards, and private utility companies. These organizations purchase oil-insulated switchgear for their substations, power plants, and distribution networks to manage high-voltage power flows, ensure grid stability, and protect critical assets from overloads and short circuits. Their procurement decisions are often influenced by factors such as equipment lifespan, maintenance costs, initial investment, and adherence to established operational standards.

Beyond utilities, a significant portion of demand originates from industrial end-users, particularly those with heavy power consumption and demanding operational environments. This includes the mining industry, where switchgear must withstand harsh conditions and provide uninterrupted power for excavation and processing. The oil and gas sector also relies on these systems for managing power in refineries, drilling platforms, and pipelines, often in remote and challenging locations. Heavy manufacturing industries, such as metals, chemicals, and cement, utilize oil-insulated switchgear for controlling large machinery and ensuring the reliable operation of their production lines. These industrial clients prioritize equipment durability, safety features, and the ability to operate continuously under specific load requirements, making oil-insulated solutions a viable option for certain applications.

Furthermore, entities involved in large-scale infrastructure development, such as railway networks, ports, and large commercial complexes, also represent potential customers. For instance, railway electrification projects require robust switchgear for traction power supply, where reliability and proven technology are paramount. Although newer technologies are emerging, the established performance, cost-effectiveness for specific applications, and the need for seamless integration with existing infrastructure mean that oil-insulated switchgear continues to be procured for both new installations and, more frequently, for the replacement and refurbishment of existing power systems. The decision-making process for these customers is a careful balance between upfront costs, long-term operational efficiency, maintenance considerations, and compliance with evolving environmental and safety regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.2 Billion |

| Market Forecast in 2032 | $5.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Schneider Electric, Eaton, General Electric, Mitsubishi Electric, Toshiba, Hitachi, Hyundai Electric, Lucy Electric, CG Power and Industrial Solutions, Larsen & Toubro, BHEL, Actom, TIEPI, Efacec, Alstom, Powell Industries, Meidensha, Jiangsu Dagong Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oil Insulated Switchgear Market Key Technology Landscape

The technology landscape for the Oil Insulated Switchgear market, while traditionally mature, continues to see incremental innovations focused on enhancing performance, safety, and environmental compliance. The core technology involves the use of dielectric mineral oil or, increasingly, synthetic or natural ester oils as an insulating and arc-quenching medium within circuit breakers, load break switches, and disconnectors. Advancements are primarily directed towards improving the properties of these insulating fluids, such as better thermal stability, higher dielectric strength, and reduced environmental impact, including the use of biodegradable and less flammable alternatives. Efforts are also concentrated on optimizing the design of arc chambers and contact systems to achieve more efficient and faster arc interruption, thereby improving the overall reliability and operational speed of the switchgear.

Furthermore, the integration of advanced monitoring and control technologies represents a significant evolution in the traditional oil-insulated switchgear domain. This includes the adoption of digital sensors for real-time monitoring of critical parameters such as oil temperature, pressure, moisture content, and partial discharge. These sensors feed data into sophisticated monitoring units, often equipped with communication interfaces for remote diagnostics and control. The objective is to enable predictive maintenance strategies, reduce the need for manual inspections, and provide early warnings of potential issues, thereby extending asset life and minimizing unscheduled downtime. This integration aligns oil-insulated switchgear with the broader trend of digitalization within smart grids, allowing it to function more intelligently within modern power infrastructure.

Materials science plays a vital role in the technological evolution, with research into improved contact materials for reduced wear and enhanced conductivity, as well as the development of more durable and lightweight structural components. Safety enhancements, such as improved pressure relief mechanisms and explosion-proof designs, are also continuously being refined to address historical concerns associated with oil-filled equipment. While the fundamental principles of oil insulation remain constant, these technological refinements ensure that oil-insulated switchgear remains a viable and competitive option for specific applications, especially where robust, proven technology is prioritized over the compact footprint and advanced features of newer alternatives. The ongoing focus is on balancing traditional reliability with modern demands for efficiency, intelligence, and environmental responsibility.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to rapid industrialization, urbanization, and significant investments in grid infrastructure expansion and upgrades, particularly in countries like China, India, and Southeast Asian nations. The demand for reliable and cost-effective power solutions drives the adoption of oil-insulated switchgear.

- Europe: Characterized by a focus on replacing aging infrastructure and modernizing existing grids. While there's a strong push towards greener technologies, the substantial installed base of oil-insulated switchgear necessitates ongoing maintenance, retrofits, and targeted replacements, particularly in Eastern European countries.

- North America: Exhibits a mature market with a primary emphasis on grid reliability and the replacement of outdated equipment. Strict environmental regulations encourage a shift towards SF6-free or other advanced solutions, but oil-insulated switchgear still holds relevance for specific legacy system upgrades and cost-effective solutions in certain regions.

- Latin America: Witnessing steady growth driven by increasing electricity demand, infrastructure development, and industrial expansion. Countries like Brazil and Mexico are investing in power generation and transmission projects, contributing to the demand for various types of switchgear, including oil-insulated.

- Middle East & Africa (MEA): Poised for significant growth due to extensive infrastructure development projects, rising energy demand, and investments in industrial and commercial sectors. The region often prioritizes robust and proven technologies, making oil-insulated switchgear a relevant choice for new installations and grid expansion in many countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oil Insulated Switchgear Market.- ABB

- Siemens

- Schneider Electric

- Eaton

- General Electric

- Mitsubishi Electric

- Toshiba

- Hitachi

- Hyundai Electric

- Lucy Electric

- CG Power and Industrial Solutions

- Larsen & Toubro

- BHEL (Bharat Heavy Electricals Limited)

- Actom

- TIEPI (Transformer & Electric Power Industry Co.)

- Efacec

- Alstom

- Powell Industries

- Meidensha Corporation

- Jiangsu Dagong Electric Co., Ltd.

Frequently Asked Questions

What is oil insulated switchgear and how does it function?

Oil insulated switchgear refers to electrical apparatus that uses insulating oil as the dielectric medium to quench arcs during circuit interruption and to provide insulation for live parts. It functions by submerging circuit breakers, disconnectors, and other components in oil, which effectively cools and extinguishes the electric arc generated when contacts open, thus protecting the electrical system.

What are the primary benefits of using oil insulated switchgear?

The primary benefits include high dielectric strength, excellent heat dissipation capabilities, proven reliability over decades of use, and a relatively lower initial capital cost for certain applications. These systems are robust and perform well in demanding environmental conditions, making them suitable for traditional grid infrastructure.

What are the main drawbacks or environmental concerns associated with oil insulated switchgear?

The main drawbacks include potential environmental hazards from oil spills or leaks, higher maintenance requirements compared to modern alternatives, and fire risks associated with flammable insulating oil. There are also disposal challenges for used oil and equipment at the end of its lifecycle, leading to a push for greener alternatives.

How is AI impacting the maintenance and operation of oil insulated switchgear?

AI is primarily impacting oil insulated switchgear by enabling advanced predictive maintenance, optimizing asset management through data analysis, and enhancing fault detection. This allows for early identification of potential issues, reduced downtime, and more efficient operational planning, extending the lifespan of existing equipment without altering the core insulation technology.

Which regions are driving the demand for oil insulated switchgear?

Asia Pacific is currently the leading region for oil insulated switchgear demand due to rapid industrialization and extensive grid expansion projects. Other regions like Latin America, the Middle East, and Africa are also showing significant growth as they invest in developing their power infrastructure and industrial capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Voltage Oil Insulated Switchgear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Utility Scale Oil Insulated Switchgear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager