Overhead Conductor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430847 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Overhead Conductor Market Size

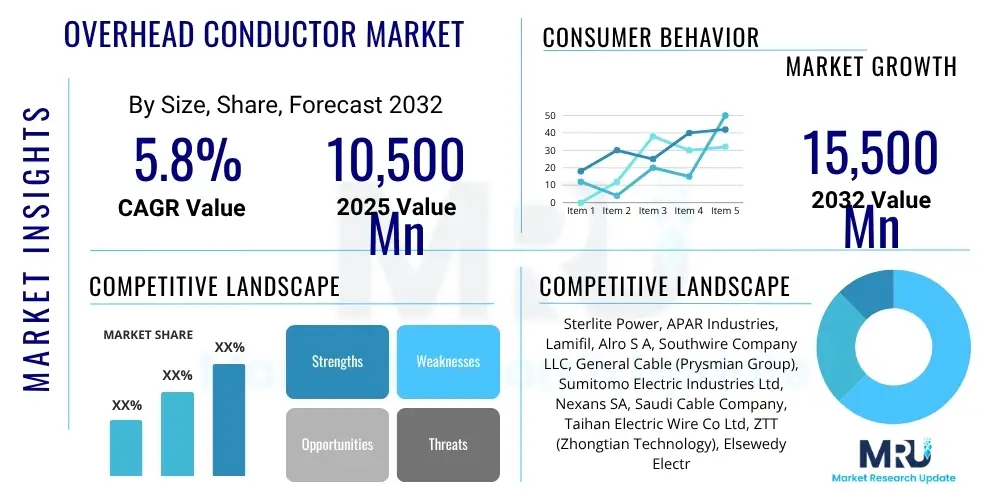

The Overhead Conductor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 10.5 billion in 2025 and is projected to reach USD 15.5 billion by the end of the forecast period in 2032.

Overhead Conductor Market introduction

The Overhead Conductor Market is fundamental to the global energy infrastructure, facilitating the efficient transmission and distribution of electrical power from generation sources to end-users. These essential components of power grids are typically made from aluminum or copper alloys, often reinforced with steel, and are designed to withstand various environmental conditions while minimizing energy losses. Their widespread application spans across high-voltage transmission lines, medium-voltage distribution networks, and low-voltage service drops, serving urban, rural, and industrial areas alike.

Overhead conductors offer numerous benefits, including their cost-effectiveness in initial deployment compared to underground cabling, ease of maintenance, and relative simplicity in fault detection and repair. Major applications include inter-regional power transfer, local grid supply, electrification of remote communities, and specialized industrial power connections. The market's growth is predominantly driven by increasing global electricity demand, rapid urbanization, industrial expansion, and significant investments in grid modernization and renewable energy integration, which necessitate robust and efficient transmission infrastructure.

The product types vary significantly, ranging from all aluminum conductors (AAC) and all aluminum alloy conductors (AAAC) to aluminum conductor steel reinforced (ACSR) and high-temperature low-sag (HTLS) conductors. Each type is selected based on specific requirements related to current carrying capacity, mechanical strength, sag performance, and environmental resilience. The ongoing transition towards smart grids and sustainable energy sources further propels innovation in conductor technology, emphasizing efficiency, durability, and smart monitoring capabilities.

Overhead Conductor Market Executive Summary

The Overhead Conductor Market is experiencing robust growth, primarily fueled by the accelerating global demand for electricity, extensive grid expansion initiatives, and the imperative for modernizing aging power infrastructure worldwide. Business trends indicate a strong focus on sustainable and high-performance conductors, with increasing adoption of advanced materials and designs to enhance efficiency and reliability. The integration of renewable energy sources into national grids also presents a significant growth opportunity, requiring new transmission lines and upgrades to existing ones to handle intermittent power flows efficiently.

Regional trends reveal Asia Pacific as the leading and fastest-growing market, driven by rapid industrialization, urbanization, and ambitious electrification programs in countries like China and India. North America and Europe are concentrating on grid modernization, smart grid deployment, and replacing outdated infrastructure with more resilient and higher capacity conductors. Latin America, the Middle East, and Africa are witnessing steady growth, propelled by expanding access to electricity and investments in energy infrastructure development to support economic growth.

Segmentation trends highlight the dominance of ACSR conductors due to their favorable strength-to-weight ratio and cost-effectiveness, particularly in long-distance transmission. However, there is a growing shift towards advanced conductors such as HTLS and composite core conductors, especially in regions requiring higher current carrying capacity and reduced sag for existing corridor upgrades. The transmission segment continues to hold the largest market share, with distribution also showing substantial growth as countries invest in last-mile connectivity and improving grid resilience against outages. The emphasis on smart conductors capable of real-time monitoring is also gaining traction across all segments.

AI Impact Analysis on Overhead Conductor Market

Users are increasingly curious about how Artificial Intelligence (AI) can revolutionize the overhead conductor market, focusing on enhancing grid reliability, enabling predictive maintenance, and optimizing operational efficiencies. Key themes include leveraging AI for real-time monitoring and fault detection, designing more resilient conductors, and managing complex power transmission networks more intelligently. There is a strong expectation that AI will lead to significant improvements in energy distribution, minimize downtime, and contribute to the development of a smarter, more adaptive grid infrastructure.

- AI-powered predictive maintenance identifies potential conductor failures before they occur, reducing outages and maintenance costs.

- Optimized grid management and load balancing through AI algorithms improve efficiency and reduce transmission losses.

- AI assists in the design and material selection for new conductors, leading to higher performance and durability.

- Real-time monitoring of conductor health and environmental conditions using AI-driven analytics enhances operational safety.

- Automated fault detection and localization capabilities enabled by AI significantly speed up repair times and restore power faster.

- AI contributes to better asset management and inventory optimization for conductor components within utility companies.

- Enhanced integration of renewable energy sources by AI managing fluctuating power inputs and grid stability.

- AI can analyze vast datasets from sensors on conductors to identify trends and inform strategic infrastructure investments.

DRO & Impact Forces Of Overhead Conductor Market

The Overhead Conductor Market is influenced by a complex interplay of drivers, restraints, opportunities, and various impact forces that shape its trajectory. Significant drivers include the relentless increase in global electricity consumption, primarily due to population growth, industrialization, and digitalization. Furthermore, substantial government investments in smart grid initiatives and the expansion of transmission and distribution networks, particularly in developing economies, are key catalysts. The worldwide push for renewable energy integration, such as solar and wind power, necessitates robust and efficient conductor infrastructure to connect these new generation sources to the grid, further boosting demand.

However, the market also faces considerable restraints. High initial capital expenditure required for installing or upgrading transmission lines, coupled with complex regulatory frameworks and stringent environmental clearances, can slow down project execution. The volatility of raw material prices, especially for aluminum and copper, directly impacts manufacturing costs and profitability. Additionally, the increasing preference for underground cabling in densely populated urban areas, driven by aesthetic and safety concerns, poses a challenge to the growth of overhead conductor installations in specific geographies. Ageing infrastructure in developed nations also requires significant investment, which can be a restraint if funding is insufficient.

Opportunities for growth lie in the continuous technological advancements leading to the development of high-performance and innovative conductors, such as high-temperature low-sag (HTLS) conductors and composite core conductors, which offer superior efficiency and capacity. The burgeoning market for smart conductors equipped with sensors for real-time monitoring and fault detection presents a lucrative avenue for market players. Moreover, significant potential exists in emerging markets of Asia Pacific, Latin America, and Africa, where electrification rates are still lower and substantial investments in new infrastructure are underway. The ongoing global trend of grid modernization and digitalization also creates demand for advanced, resilient, and communication-enabled conductors. Impact forces include evolving environmental regulations, rapid technological shifts in grid management, geopolitical stability affecting infrastructure investments, and macroeconomic factors influencing industrial output and energy demand.

Segmentation Analysis

The Overhead Conductor Market is comprehensively segmented based on various attributes to provide a detailed understanding of its dynamics and growth prospects across different categories. These segmentations enable stakeholders to identify key growth areas, understand competitive landscapes, and formulate targeted strategies. The market is typically analyzed by conductor type, voltage level, application area, and material composition, each presenting unique demand patterns and technological requirements. This granular view helps in assessing the adoption rates of different conductor technologies and their suitability for specific grid scenarios.

- By Type:

- All Aluminum Conductor (AAC)

- All Aluminum Alloy Conductor (AAAC)

- Aluminum Conductor Steel Reinforced (ACSR)

- Aluminum Conductor Alloy Reinforced (ACAR)

- High-Temperature Low-Sag (HTLS) Conductors

- Overhead Ground Wire (OHGW) / Optical Ground Wire (OPGW)

- Composite Core Conductors (ACCC, ACCR)

- Others (e.g., Copper Conductors)

- By Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

- Extra-High Voltage (EHV)

- Ultra-High Voltage (UHV)

- By Application:

- Power Transmission

- Power Distribution

- Railways and Metros

- Industrial and Commercial

- Renewable Energy Integration

- By Material:

- Aluminum

- Aluminum Alloy

- Steel

- Copper

- Composite Materials

- By End-User:

- Electric Utilities

- Industrial

- Residential

- Commercial

Value Chain Analysis For Overhead Conductor Market

The value chain for the Overhead Conductor Market encompasses a series of sequential activities, starting from raw material extraction and processing, through manufacturing, distribution, and finally, installation and maintenance by end-users. Upstream analysis involves key suppliers of raw materials such as aluminum ingots, aluminum alloys, steel, copper, and composite fibers. These suppliers play a critical role in determining the cost, quality, and availability of primary inputs, with global commodity prices significantly impacting the overall production cost of conductors. Manufacturers often engage in long-term contracts or vertical integration to secure stable supplies and mitigate price volatility.

In the midstream, conductor manufacturers process these raw materials into various types of overhead conductors, including AAC, AAAC, ACSR, and HTLS, employing specialized machinery and manufacturing processes like stranding, drawing, and heat treatment. This stage involves significant technological investment in research and development to produce high-performance, efficient, and durable conductors. Downstream activities primarily involve the distribution and sales of these finished products to a diverse customer base. Distribution channels can be direct, where large utility companies procure conductors directly from manufacturers for major transmission projects, or indirect, involving a network of distributors, wholesalers, and contractors who supply to smaller utilities, industrial clients, and local electrification projects.

The distribution network is crucial for market penetration, ensuring products reach various geographical locations and customer segments efficiently. Direct channels offer manufacturers greater control over sales and customer relationships, often preferred for large-scale, complex projects requiring specialized technical support. Indirect channels, on the other hand, provide broader market access and cater to the diverse needs of smaller purchasers and maintenance contractors. Installation, commissioning, and subsequent maintenance services provided by utility companies or specialized contractors complete the value chain, ensuring the long-term operational efficiency and reliability of the overhead conductor infrastructure. This comprehensive value chain highlights the interconnectedness of various stakeholders and the critical role of each stage in delivering electrical power effectively to consumers.

Overhead Conductor Market Potential Customers

The primary end-users and buyers in the Overhead Conductor Market are entities responsible for the generation, transmission, and distribution of electricity, as well as those requiring large-scale power infrastructure. Electric utilities, encompassing both public and private sector companies, represent the largest customer segment. These utilities continuously invest in expanding and maintaining their transmission and distribution networks to meet growing electricity demand, integrate new power sources, and replace aging infrastructure. Their needs range from high-voltage transmission lines for long-distance power transfer to medium and low-voltage conductors for local distribution and last-mile connectivity.

Beyond traditional utilities, industrial consumers with high power requirements, such as manufacturing plants, mining operations, and large commercial complexes, often purchase conductors for their internal power distribution systems or for direct grid connections. Infrastructure development projects, including those for railways, metro systems, and smart cities, also serve as significant customers, requiring robust and reliable overhead conductors for traction power and urban electrification. Furthermore, contractors specializing in power infrastructure development and electrification projects act as intermediaries, purchasing conductors for installation on behalf of various clients, ensuring adherence to project specifications and regulatory standards. The increasing focus on renewable energy projects, such as solar farms and wind power installations, also drives demand for conductors to connect these facilities to the main grid, expanding the customer base to renewable energy developers and operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10,500 Million |

| Market Forecast in 2032 | USD 15,500 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sterlite Power, APAR Industries, Lamifil, Alro S A, Southwire Company LLC, General Cable (Prysmian Group), Sumitomo Electric Industries Ltd, Nexans SA, Saudi Cable Company, Taihan Electric Wire Co Ltd, ZTT (Zhongtian Technology), Elsewedy Electric, NKT A/S, Polycab India Ltd, KEI Industries Ltd, Universal Cables Ltd, Gupta Power Infrastructure Ltd, CTC Global Corporation, Midal Cables, Oman Cables Industry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Overhead Conductor Market Key Technology Landscape

The Overhead Conductor Market is characterized by continuous technological advancements aimed at improving efficiency, capacity, and resilience of power transmission and distribution networks. A significant technological trend is the development and adoption of High-Temperature Low-Sag (HTLS) conductors. These conductors, including Aluminum Conductor Composite Core (ACCC) and Aluminum Conductor Composite Reinforced (ACCR) types, utilize advanced materials like carbon fiber composite cores instead of traditional steel. This innovation allows them to operate at higher temperatures without excessive sag, significantly increasing current carrying capacity within existing corridor constraints and reducing energy losses, making them ideal for grid modernization and upgrades.

Another crucial area of innovation is the integration of "smart" capabilities into overhead conductors. This involves embedding fiber optic cables within ground wires to create Optical Ground Wire (OPGW) conductors, which serve dual purposes of lightning protection and high-speed data transmission for grid monitoring and communication. Beyond OPGW, research is progressing on conductors with integrated sensors for real-time monitoring of temperature, current, sag, and even ice accumulation. These smart conductors enable predictive maintenance, faster fault detection, and more efficient grid management, contributing significantly to grid reliability and resilience in the era of smart grids.

Furthermore, advancements in materials science are leading to the development of new alloys and composite materials that offer improved corrosion resistance, lighter weight, and enhanced mechanical strength. Specialized coatings are also being developed to protect conductors from environmental degradation, thereby extending their lifespan and reducing maintenance frequency. Manufacturing technologies are also evolving, with greater emphasis on precision engineering and automated production processes to ensure consistent quality and optimize production costs. These technological developments collectively aim to enhance the performance, sustainability, and economic viability of overhead conductors in meeting the evolving demands of the global energy sector.

Regional Highlights

- North America: The market here is driven by grid modernization initiatives, replacement of aging infrastructure, and increasing investment in smart grid technologies. There is a strong emphasis on enhancing grid reliability and integrating renewable energy sources, leading to demand for high-performance and HTLS conductors. Countries like the United States and Canada are making significant investments in upgrading their transmission and distribution networks.

- Europe: European countries are focused on achieving ambitious climate neutrality targets, driving investments in renewable energy and the associated transmission infrastructure. Strict environmental regulations and the need for greater energy efficiency are propelling the adoption of advanced conductor technologies. Grid interconnections and cross-border power exchanges also contribute to market growth.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to rapid urbanization, industrialization, and massive electrification projects, particularly in developing economies like China, India, and Southeast Asian countries. Surging electricity demand, coupled with significant infrastructure development spending, makes this region a crucial growth engine for the overhead conductor market. The region also sees extensive adoption of both traditional and advanced conductors for new grid expansions.

- Latin America: This region is characterized by ongoing investments in expanding access to electricity, modernizing existing grids, and developing renewable energy projects, especially hydro and solar power. Brazil, Mexico, and Argentina are key markets, witnessing demand for overhead conductors to connect new power generation facilities and extend distribution networks to underserved areas.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth driven by population expansion, industrial diversification, and ambitious national development visions that prioritize electrification. Gulf Cooperation Council (GCC) countries are investing heavily in new power plants and transmission networks, while several African nations are focusing on increasing electricity access and improving grid stability, leading to a steady demand for overhead conductors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Overhead Conductor Market.- Sterlite Power

- APAR Industries

- Lamifil

- Alro S A

- Southwire Company LLC

- General Cable Prysmian Group

- Sumitomo Electric Industries Ltd

- Nexans SA

- Saudi Cable Company

- Taihan Electric Wire Co Ltd

- ZTT Zhongtian Technology

- Elsewedy Electric

- NKT A/S

- Polycab India Ltd

- KEI Industries Ltd

- Universal Cables Ltd

- Gupta Power Infrastructure Ltd

- CTC Global Corporation

- Midal Cables

- Oman Cables Industry

Frequently Asked Questions

Analyze common user questions about the Overhead Conductor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of overhead conductors used in power transmission?

The most common types include All Aluminum Conductors (AAC) for low and medium voltages, All Aluminum Alloy Conductors (AAAC) for better strength, and Aluminum Conductor Steel Reinforced (ACSR) for high-voltage transmission due to its high strength-to-weight ratio. High-Temperature Low-Sag (HTLS) conductors are also gaining traction for capacity upgrades.

How do weather conditions impact the performance and lifespan of overhead conductors?

Weather conditions significantly affect conductors. High temperatures cause sag, reducing ground clearance. Ice and wind loading can lead to mechanical stress and potential damage or collapse. Corrosion from humidity and pollutants also degrades conductor materials over time, reducing lifespan and increasing resistance.

What is a "smart conductor" and how does it benefit grid operations?

A smart conductor is an overhead conductor equipped with integrated sensors and communication capabilities, often via fiber optics (e.g., OPGW). It provides real-time data on temperature, sag, current, and other parameters, enabling predictive maintenance, faster fault detection, dynamic line rating, and improved grid stability and efficiency.

What are the key drivers for the growth of the overhead conductor market?

Key drivers include increasing global electricity demand, massive investments in grid modernization and expansion projects, the integration of renewable energy sources into the grid, and rapid urbanization and industrialization, particularly in emerging economies. Infrastructure development initiatives also play a significant role.

What environmental concerns are associated with overhead power lines and how are they addressed?

Environmental concerns include visual impact, land acquisition for corridors, electromagnetic fields (EMF), and potential bird collisions. These are addressed through aesthetic design improvements, optimizing routes to minimize impact, adhering to EMF safety guidelines, and installing bird flight diversions or insulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager