Physical Security Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429054 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Physical Security Market Size

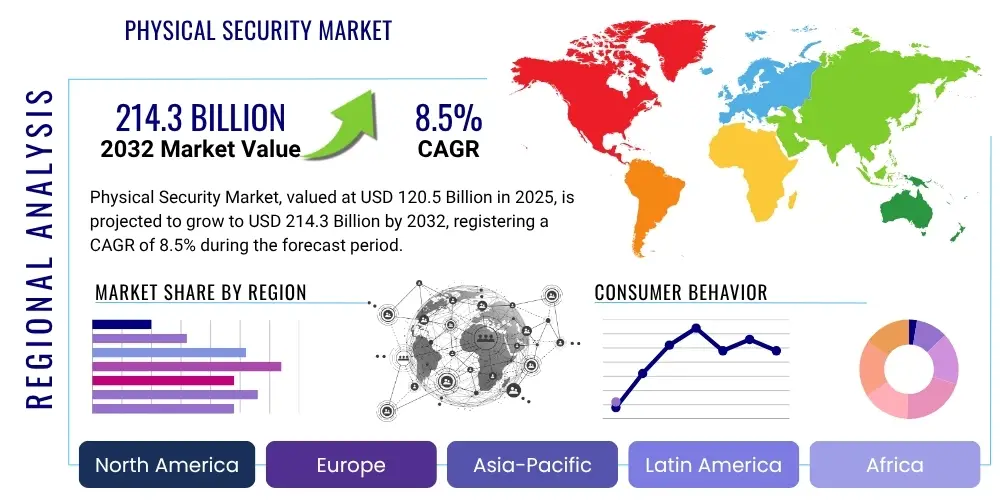

The Physical Security Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at $120.5 Billion in 2025 and is projected to reach $214.3 Billion by the end of the forecast period in 2032.

Physical Security Market introduction

The Physical Security Market encompasses a comprehensive suite of solutions and services designed to protect assets, personnel, and properties from physical threats. This includes measures such as access control systems, video surveillance, intrusion detection, and various other integrated security components. The primary objective is to deter, detect, and respond to unauthorized access, theft, vandalism, and other malicious activities, ensuring a safe and secure environment for various entities.

Key products within this market range from advanced IP cameras, biometric scanners, and smart locks to sophisticated security management software and perimeter protection solutions. These technologies are extensively applied across a diverse array of sectors, including commercial enterprises, residential complexes, government facilities, critical infrastructure, industrial sites, retail spaces, and educational institutions. The market's growth is predominantly driven by escalating global security concerns, increased adoption of smart technologies, stringent regulatory mandates for safety, and the imperative to safeguard valuable assets and human lives against evolving threats. Benefits extend beyond mere protection, offering operational efficiencies, improved incident response times, and comprehensive situational awareness.

Physical Security Market Executive Summary

The Physical Security Market is experiencing robust growth, propelled by escalating security threats and significant technological advancements. Business trends indicate a strong shift towards integrated security solutions, cloud-based services, and the incorporation of artificial intelligence and Internet of Things (IoT) capabilities for enhanced threat detection, predictive analytics, and automated response mechanisms. There is a growing demand for subscription-based Security-as-a-Service (SaaS) models, offering flexibility and cost-effectiveness for end-users, alongside a notable emphasis on cybersecurity integration to protect physical security infrastructure from digital vulnerabilities.

Regionally, the market exhibits varied growth patterns. North America and Europe represent mature markets characterized by high adoption rates of advanced security technologies and stringent regulatory compliance, driving innovation and upgrades. The Asia Pacific region is poised for significant expansion, fueled by rapid urbanization, smart city initiatives, infrastructure development, and increasing investments in security systems across commercial and public sectors. Latin America and the Middle East & Africa are also witnessing substantial growth, driven by economic development, rising security awareness, and the need for modernizing existing security infrastructures.

Segment-wise, video surveillance and access control systems continue to dominate, with a strong trend towards IP-based solutions, high-definition cameras, and biometric authentication for improved identification and monitoring. Intrusion detection systems are evolving with advanced sensor technologies and real-time alerts. The services segment, including installation, maintenance, and system integration, is expanding rapidly as organizations seek comprehensive, turnkey security solutions and ongoing support to manage complex physical security ecosystems effectively.

AI Impact Analysis on Physical Security Market

User inquiries concerning AI's influence on the physical security market frequently revolve around its potential to revolutionize threat detection, improve operational efficiency, and address the limitations of human surveillance. Common questions include how AI can enhance video analytics, its role in predictive security, the implications for privacy, and the challenges of integration. Users are keen to understand the practical applications of AI in real-world security scenarios, from autonomous monitoring to intelligent access control, while also expressing concerns about data accuracy, ethical considerations, and the potential for job displacement.

The key themes emerging from this analysis underscore a strong expectation for AI to transform reactive security into proactive and preventive measures. Users anticipate significant improvements in the speed and accuracy of threat identification, reduced false alarms, and more efficient resource allocation. There is also considerable interest in AI's capacity to integrate disparate security systems and analyze vast amounts of data to uncover subtle patterns of suspicious activity. However, privacy implications and the need for robust ethical guidelines and transparent AI models remain significant concerns, highlighting a desire for solutions that balance enhanced security with individual rights.

- Enhanced video analytics for real-time anomaly detection and object recognition.

- Predictive security capabilities for anticipating potential threats and incidents.

- Automated incident response through integration with other security systems.

- Reduced false alarms by intelligently distinguishing between genuine threats and benign events.

- Improved operational efficiency and reduced human resource reliance for continuous monitoring.

- Facial recognition and biometric authentication for advanced access control.

- Behavioral analytics to identify unusual patterns in crowds or individuals.

- Integration with IoT devices to create smarter, interconnected security ecosystems.

- Challenges in data privacy and ethical implications of widespread surveillance.

- Demand for robust cybersecurity measures to protect AI-powered systems.

DRO & Impact Forces Of Physical Security Market

The Physical Security Market is primarily driven by a confluence of factors including the escalating global security concerns stemming from terrorism, organized crime, and geopolitical instabilities, which compel organizations and governments to invest heavily in advanced protective measures. Furthermore, the rapid pace of technological innovation, particularly in areas like artificial intelligence, IoT, and advanced analytics, is continuously enhancing the capabilities and effectiveness of physical security systems, making them more appealing to a broader range of end-users. The increasing regulatory pressure and compliance requirements across various industries also mandate the adoption of robust security infrastructures, thereby stimulating market growth. Additionally, the proliferation of smart city initiatives and the development of intelligent infrastructure are creating significant demand for integrated and interconnected physical security solutions.

However, the market faces several restraints, including the significant initial capital investment required for deploying sophisticated physical security systems, which can be a deterrent for small and medium-sized enterprises (SMEs) and budget-constrained public entities. Concerns surrounding data privacy, particularly with the widespread adoption of video surveillance and biometric technologies, pose ethical and legal challenges, sometimes leading to public resistance or stringent regulatory hurdles that complicate deployment. The complexity of integrating disparate security technologies from various vendors into a cohesive system also presents a technical and operational challenge for many organizations. Moreover, the shortage of skilled professionals capable of designing, installing, and maintaining advanced physical security solutions can impede market expansion.

Despite these restraints, substantial opportunities exist within the market. The growing demand for cloud-based security solutions, offering scalability, remote management, and reduced on-premise infrastructure costs, presents a significant avenue for growth, especially through Security-as-a-Service (SaaS) models. The increasing focus on cybersecurity for physical security systems, driven by the rise of cyber-physical attacks, opens new opportunities for integrated solutions that secure both digital and physical perimeters. Emerging markets in developing economies, characterized by rapid urbanization and infrastructure development, offer untapped potential for adopting modern security technologies. Furthermore, the integration of physical security with broader enterprise risk management strategies and building management systems provides an opportunity for holistic operational efficiency and enhanced safety protocols.

Segmentation Analysis

The Physical Security Market is extensively segmented to reflect the diverse range of solutions, technologies, and applications serving various end-user requirements. This segmentation allows for a granular understanding of market dynamics, identifying specific growth areas, competitive landscapes, and technological shifts within each category. The primary segments include components, systems, services, and end-users, each with several sub-segments that detail the specific offerings and their respective market penetration.

The component segment focuses on the hardware, software, and services that constitute a physical security solution. System segmentation delves into the specific types of security functionalities provided, such as access control or video surveillance. Services cover the entire lifecycle, from initial consultation to ongoing maintenance. End-user segmentation highlights the diverse industries and entities that leverage physical security solutions, each with unique needs and compliance requirements. This comprehensive breakdown aids in strategic planning and targeted market development.

- By Component

- Hardware

- Cameras

- Sensors

- Controllers

- Locks

- Biometric Devices

- Servers

- Storage Devices

- Software

- Video Management Software (VMS)

- Access Control Software (ACS)

- Intrusion Detection Software

- Physical Security Information Management (PSIM)

- Security Analytics Software

- Services

- Installation and Integration

- Maintenance and Support

- Managed Security Services

- Consulting and Design

- Risk Assessment

- Hardware

- By System

- Access Control Systems

- Biometric Systems

- Card-based Systems

- Keypad Systems

- Intercom Systems

- Cloud-based Access Control

- Video Surveillance Systems

- IP Cameras

- Analog Cameras

- Video Recorders (DVRs, NVRs)

- Video Analytics

- Thermal Cameras

- Intrusion Detection Systems

- Perimeter Security Systems

- Motion Sensors

- Contact Sensors

- Glass Break Detectors

- Alarm Systems

- Fire & Life Safety Systems

- Fire Alarms

- Sprinkler Systems

- Emergency Lighting

- Smoke Detectors

- Perimeter Security Systems

- Fences and Gates

- Intrusion Detection Fences

- Radar Systems

- Ground Sensors

- Access Control Systems

- By End-User

- Commercial

- Retail

- Hospitality

- Office Buildings

- Data Centers

- Industrial

- Manufacturing

- Energy & Power

- Oil & Gas

- Mining

- Government & Defense

- Military Bases

- Government Buildings

- Border Security

- Law Enforcement

- Residential

- Single-Family Homes

- Multi-Family Dwellings

- Gated Communities

- Transportation

- Airports

- Seaports

- Railways

- Roadways

- Education

- Schools

- Universities

- Healthcare

- Hospitals

- Clinics

- Pharmaceutical Facilities

- Banking & Financial Services (BFSI)

- Commercial

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Physical Security Market

The value chain for the Physical Security Market begins with upstream activities focused on the research, development, and manufacturing of core components and technologies. This involves suppliers of critical hardware elements such as cameras, sensors, biometric modules, access control panels, and server infrastructure. Additionally, software developers play a crucial role in creating video management systems, access control software, analytics platforms, and Physical Security Information Management (PSIM) solutions. These upstream players are essential for innovation and providing the foundational building blocks of modern security systems, constantly pushing the boundaries of technology to offer more efficient and intelligent solutions.

Midstream activities involve system integrators and distributors who consolidate various components and software into comprehensive, tailored security solutions for end-users. Distributors manage logistics and provide channels to market, while system integrators offer specialized expertise in designing, installing, and configuring complex security architectures. They are pivotal in ensuring interoperability between different systems and customizing solutions to meet specific client needs, often providing a single point of contact for project management and deployment. This stage adds significant value by transforming disparate technologies into functional, integrated security ecosystems.

Downstream analysis centers on the end-users and the various distribution channels through which physical security products and services reach them. Direct channels involve manufacturers selling and implementing solutions directly to large enterprises or government entities, often for highly customized projects. Indirect channels include a network of value-added resellers (VARs), integrators, dealers, and managed security service providers (MSSPs) who deliver solutions to a broader customer base, including SMEs and residential markets. These downstream activities also encompass ongoing maintenance, technical support, and monitoring services, ensuring the continuous effective operation of security systems and maximizing their lifecycle value for the end-customers.

Physical Security Market Potential Customers

The Physical Security Market caters to a wide array of potential customers across virtually every sector, driven by the universal need to protect assets, personnel, and information from various threats. Enterprises, regardless of their size or industry, constitute a significant portion of the customer base, seeking to secure their premises, intellectual property, and employees. This includes large corporations, small and medium-sized businesses (SMBs), and multinational organizations that require scalable and robust security infrastructures to manage diverse operational environments. Their demands range from basic surveillance and access control to advanced integrated systems with real-time analytics and remote monitoring capabilities.

Government and public sector entities represent another critical customer segment, including federal, state, and local government agencies, defense organizations, law enforcement bodies, and critical infrastructure operators. These customers require highly resilient and often classified security solutions to protect sensitive data, critical national assets, public spaces, and to ensure citizen safety. Their procurement processes are often complex, driven by stringent regulatory compliance and national security imperatives. The demand from this sector is consistently high due as governments continuously upgrade their security postures against evolving threats.

Furthermore, residential customers, educational institutions, healthcare facilities, and the transportation sector also form substantial segments of the market. Residential users seek peace of mind through home security systems, smart alarms, and video doorbells. Educational institutions focus on campus safety and student protection. Healthcare providers prioritize securing patient data, sensitive equipment, and preventing unauthorized access to restricted areas. The transportation sector, encompassing airports, seaports, and public transit, requires sophisticated surveillance and access control to manage large crowds, secure terminals, and prevent illicit activities, making these diverse end-users pivotal for the continuous growth and innovation within the physical security market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $120.5 Billion |

| Market Forecast in 2032 | $214.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hikvision, Dahua Technology, ASSA ABLOY, Bosch Security Systems, Axis Communications, Hanwha Vision, Johnson Controls, Honeywell International, Siemens, Genetec, Pelco (Motorola Solutions), Cisco Systems, Panasonic, LenelS2 (Carrier Global), IDEMIA, Verkada, Avigilon (Motorola Solutions), dormakaba, Gallagher, Zhejiang Uniview Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Physical Security Market Key Technology Landscape

The Physical Security Market is undergoing a significant technological transformation, driven by innovations aimed at enhancing efficiency, accuracy, and proactive threat response. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, powering advanced video analytics for facial recognition, object detection, behavioral anomaly detection, and predictive surveillance. These AI-driven capabilities enable systems to learn normal patterns and flag deviations automatically, significantly reducing the burden on human operators and minimizing false alarms. AI also plays a crucial role in intelligent access control, enabling touchless authentication and dynamic access privileges based on real-time threat assessments.

The Internet of Things (IoT) is another pivotal technology, facilitating the creation of interconnected security ecosystems. IoT sensors, smart cameras, and networked access control devices can communicate seamlessly, collecting vast amounts of data that can be analyzed for deeper insights. This integration allows for comprehensive situational awareness and coordinated responses across various security components. Cloud computing is rapidly gaining traction, offering scalable, flexible, and cost-effective solutions for data storage, remote management, and Security-as-a-Service (SaaS) offerings. Cloud-based platforms enable remote monitoring, centralized control of distributed sites, and provide enhanced cybersecurity against evolving digital threats.

Furthermore, biometrics continue to evolve with advanced techniques like multimodal authentication, vein pattern recognition, and behavioral biometrics, offering more secure and convenient access control solutions. High-resolution IP-based cameras and thermal imaging technologies provide superior image clarity and performance in challenging environments, complementing video analytics. Cybersecurity is also becoming an integral part of physical security, as systems become increasingly networked and susceptible to cyberattacks, necessitating robust encryption, secure protocols, and threat intelligence to protect critical infrastructure from both physical and digital intrusions. Drone technology is emerging for perimeter surveillance and rapid incident assessment, further augmenting the capabilities of traditional security measures.

Regional Highlights

- North America: This region is a mature and leading market for physical security, characterized by high technological adoption, significant investments in advanced security solutions, and a strong presence of key market players. The demand is largely driven by stringent regulatory frameworks, concerns over public safety, and the protection of critical infrastructure. Innovation in AI-powered analytics, cloud-based services, and integrated platforms is particularly strong here.

- Europe: The European market is robust, with a focus on data privacy regulations (like GDPR) influencing the deployment of surveillance and biometric technologies. Growth is propelled by modernization of existing security systems, smart city initiatives, and the need for enhanced security in commercial, governmental, and transportation sectors. Germany, the UK, and France are key contributors, emphasizing integrated solutions and managed security services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid urbanization, increasing infrastructure development, and a surge in smart city projects across countries like China, India, Japan, and South Korea. Rising disposable incomes, increasing security awareness, and government initiatives for public safety are driving substantial investments in video surveillance, access control, and other physical security components.

- Latin America: This region experiences steady growth, primarily driven by increasing security threats, economic development, and foreign investments. Countries like Brazil, Mexico, and Argentina are investing in modernizing their security infrastructure, particularly in commercial and residential sectors. The adoption of advanced surveillance and access control systems is gaining momentum, though market penetration remains lower than in developed regions.

- Middle East & Africa (MEA): The MEA market is witnessing significant growth fueled by substantial investments in infrastructure, smart city development (especially in the UAE and Saudi Arabia), and heightened security concerns. Government spending on defense and public safety, coupled with the expansion of commercial and industrial sectors, is creating a strong demand for sophisticated physical security solutions, including advanced perimeter security and integrated surveillance systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Physical Security Market.- Hikvision

- Dahua Technology

- ASSA ABLOY

- Bosch Security Systems

- Axis Communications

- Hanwha Vision (formerly Hanwha Techwin)

- Johnson Controls

- Honeywell International

- Siemens

- Genetec

- Pelco (Motorola Solutions)

- Cisco Systems

- Panasonic

- LenelS2 (Carrier Global)

- IDEMIA

- Verkada

- Avigilon (Motorola Solutions)

- dormakaba

- Gallagher

- Zhejiang Uniview Technologies

Frequently Asked Questions

What is physical security and why is it important?

Physical security refers to measures designed to protect physical assets, people, and property from unauthorized access, damage, or theft. It is crucial for safeguarding valuable resources, ensuring business continuity, meeting regulatory compliance, and protecting personnel from various threats, thereby maintaining a safe and secure environment.

How is AI transforming the physical security market?

AI is revolutionizing physical security by enabling advanced capabilities such as predictive analytics, real-time anomaly detection, intelligent video surveillance (e.g., facial recognition, object tracking), and automated incident response. It enhances efficiency, reduces false alarms, and provides proactive threat intelligence, shifting security from reactive to preventive.

What are the main components of a comprehensive physical security system?

A comprehensive physical security system typically includes video surveillance (cameras, VMS), access control (biometrics, card readers, locks), intrusion detection (sensors, alarms), and increasingly, integration software (PSIM) to manage and correlate data from these disparate systems for a unified security posture.

What are the major challenges in implementing physical security solutions?

Key challenges include high upfront investment costs, complexities in integrating diverse technologies from multiple vendors, concerns regarding data privacy and regulatory compliance (e.g., GDPR), and the shortage of skilled professionals required for deployment and ongoing management of advanced security systems.

Which industries are the largest adopters of physical security solutions?

Major adopters include commercial enterprises (retail, corporate offices, data centers), government and defense organizations, critical infrastructure (energy, utilities, transportation), and increasingly, the healthcare, education, and residential sectors. Each industry has unique security requirements driving specific solution adoptions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Physical Security Information Management (PSIM) Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Physical Security Information Management (PSIM) Market Size Report By Type (PSIM+, PSIM), By Application (Critical Infrastructure, Commercial, First Responders, Military, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Situation Awareness Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Command & Control System, Fire & Flood Alarm System, Radio Frequency Identification (RFID), Radar, Chemical Biological Radiological and Nuclear (CBRN) Systems, Sonar, Physical Security Information Management (PSIM), others), By Application (Military and Defense, Healthcare, Aerospace, Marine security, Automotive, Mining and oil & gas, Industrial, Cyber security, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Visitor Management Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Provisioning Software, Physical Security Information Management, Physical Identity and Access Management), By Application (Critical Infrastructure Protection, Public Safety & Security, Energy Security, Port Security, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager