Protective Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430509 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Protective Packaging Market Size

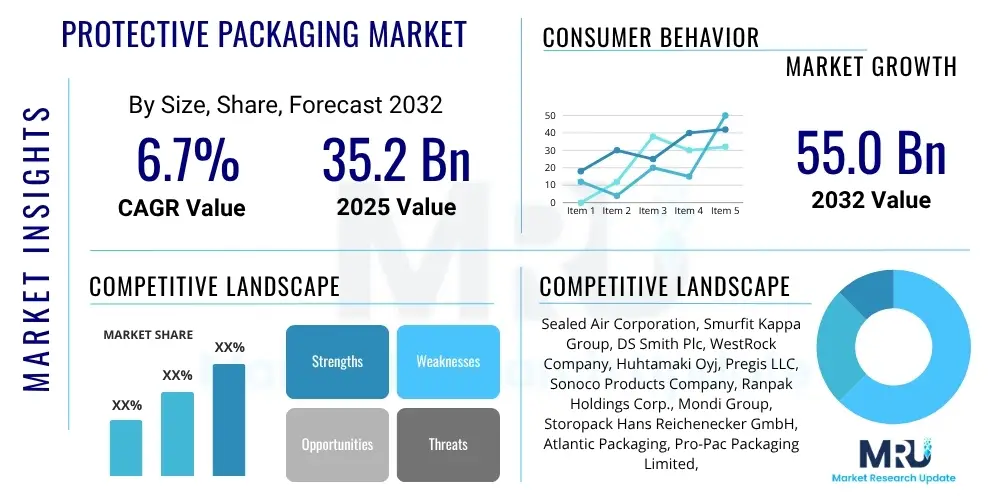

The Protective Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at $35.2 Billion in 2025 and is projected to reach $55.0 Billion by the end of the forecast period in 2032.

Protective Packaging Market introduction

The protective packaging market encompasses a wide array of materials and systems designed to safeguard products during storage, transportation, and handling. This crucial industry segment focuses on preventing damage from physical shocks, vibrations, temperature fluctuations, and contamination, thereby ensuring product integrity and reducing economic losses associated with spoilage, breakage, or returns. Protective packaging solutions are vital across numerous sectors, from high-value electronics to delicate food items and robust industrial equipment.

Key products within this market include cushioning materials such as bubble wrap, foam inserts, and air pillows, alongside void fill solutions like packing peanuts and paper void fill, and blocking and bracing systems utilizing various forms of rigid or flexible barriers. These solutions are predominantly utilized in critical applications across the burgeoning e-commerce sector, the intricate supply chains of the electronics and automotive industries, and the stringent requirements of the food and beverage and healthcare industries. The primary benefits derived from effective protective packaging include enhanced product safety, reduced transit damage, improved customer satisfaction, and optimized logistics costs. Furthermore, it plays a significant role in brand reputation and compliance with industry standards. The market's growth is predominantly propelled by the relentless expansion of global e-commerce, the escalating demand for consumer electronics, and increasing awareness regarding the importance of sustainable and efficient packaging solutions.

Driving factors extend beyond just e-commerce, encompassing the globalization of supply chains that necessitate robust protection for products traveling long distances, the increasing value of goods being transported, and a heightened focus on reducing product damage to minimize waste and improve customer experience. Innovations in material science, particularly the development of lightweight, high-performance, and environmentally friendly alternatives, are also significant contributors to market evolution. The protective packaging industry is continuously adapting to meet diverse application requirements while balancing cost-effectiveness and ecological considerations, making it a dynamic and essential component of modern commerce.

Protective Packaging Market Executive Summary

The protective packaging market is experiencing robust growth driven by significant shifts in global business, regional economic dynamics, and evolving consumer preferences, all contributing to an increased demand for secure and efficient product protection. Business trends highlight a strong focus on automation in packaging processes, the integration of smart packaging technologies for enhanced traceability and monitoring, and a substantial push towards lightweighting and the circular economy. These trends are reshaping operational efficiencies and material choices across the supply chain, emphasizing both cost-effectiveness and environmental stewardship. The continuous expansion of e-commerce remains a primary catalyst, necessitating innovative and durable packaging solutions capable of withstanding the rigors of direct-to-consumer shipping.

Regionally, Asia Pacific stands out as the dominant and fastest-growing market, fueled by its immense manufacturing capabilities, burgeoning middle class, and rapid adoption of online retail. North America and Europe, while mature, are characterized by high rates of innovation in sustainable materials and advanced packaging technologies, alongside stringent regulatory frameworks driving eco-friendly practices. Latin America, the Middle East, and Africa are identified as emerging markets, presenting substantial growth opportunities as industrialization and e-commerce penetration deepen. Each region exhibits unique demands influenced by local consumption patterns, regulatory pressures, and logistical infrastructures. The market's diverse geographical spread underscores the universal need for protective solutions tailored to specific economic and environmental contexts.

Segment-wise, the market is witnessing a pronounced shift towards sustainable and flexible protective packaging solutions. Material segments are seeing increased adoption of paper-based and biodegradable options in response to environmental concerns, while plastics continue to hold a significant share due to their versatility and protective qualities, albeit with a growing emphasis on recycled content. The e-commerce end-use industry segment is experiencing unparalleled growth, driving demand for cushioning, void fill, and surface protection products. Innovations in foam and air-based protective solutions are also prominent, offering superior product protection with optimized material usage. This comprehensive market overview underlines the dynamic nature of protective packaging, poised for continued expansion and transformation in response to global economic shifts and technological advancements.

AI Impact Analysis on Protective Packaging Market

Common user questions regarding AI's impact on the Protective Packaging Market frequently revolve around how artificial intelligence can optimize packaging design for specific products, predict demand fluctuations to streamline inventory, automate packaging operations to reduce labor costs and increase efficiency, and enhance sustainability efforts through material optimization. Users are keen to understand if AI can significantly improve damage prevention, personalize packaging experiences, or offer real-time insights into supply chain performance. There is also interest in AI's role in quality control, defect detection, and ensuring compliance with various industry standards. Essentially, users expect AI to bring unprecedented levels of precision, foresight, and automation to the protective packaging lifecycle, addressing challenges related to cost, speed, and environmental footprint.

- Optimized Packaging Design: AI algorithms analyze product dimensions, fragility, and transit conditions to recommend optimal packaging structures and materials, minimizing material usage while maximizing protection.

- Predictive Analytics for Demand: AI-driven insights forecast demand for specific protective packaging types, enabling manufacturers and distributors to optimize inventory levels and production schedules, reducing waste and stockouts.

- Automated Packaging Lines: AI powers robotic systems for picking, packing, and sealing, enhancing speed, accuracy, and consistency in packaging operations, particularly for complex or varied product lines.

- Enhanced Quality Control: Machine vision systems augmented with AI detect defects in packaging materials or errors in the packing process in real-time, ensuring high-quality output and reducing costly reworks.

- Supply Chain Optimization: AI analyzes logistics data to identify routes and conditions that minimize damage risks, suggesting resilient packaging strategies and improving overall supply chain efficiency and reliability.

- Sustainability Enhancement: AI assists in identifying and recommending sustainable material alternatives, optimizing material thickness, and predicting the environmental impact of various packaging choices.

- Personalized Packaging Solutions: AI can enable customization at scale, allowing for protective packaging tailored to individual product or shipment requirements, improving customer experience and brand perception.

DRO & Impact Forces Of Protective Packaging Market

The protective packaging market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, all influenced by various impact forces that dictate its growth trajectory and evolutionary path. The primary drivers include the exponential growth of the e-commerce industry, which necessitates robust and efficient packaging to ensure product integrity during numerous transit points and last-mile delivery. Additionally, the increasing demand for consumer electronics, automotive components, and delicate medical devices, all requiring specialized protection against shock, vibration, and contamination, further fuels market expansion. The growing global supply chain complexities also mandate advanced protective solutions to mitigate risks associated with long-distance transportation and diverse environmental conditions. A heightened focus on reducing product damage and returns, which directly impacts brand reputation and operational costs, acts as a strong impetus for adopting high-quality protective packaging.

However, the market faces significant restraints that could impede its growth. Fluctuations in raw material prices, particularly for petrochemical-derived plastics and pulp, introduce cost volatility for manufacturers, affecting profitability and pricing strategies. Environmental concerns regarding plastic waste and the push for a circular economy pose challenges, prompting stricter regulations and consumer preference shifts towards sustainable alternatives. This necessitates substantial investment in research and development for eco-friendly materials and manufacturing processes. Furthermore, the high initial capital investment required for advanced automated packaging machinery and innovative material technologies can be a barrier for smaller players, hindering widespread adoption of cutting-edge solutions. The complexity of designing packaging for a diverse range of products with varying fragility and specifications also presents a continuous challenge, requiring ongoing innovation and customization.

Amidst these challenges, numerous opportunities are emerging that promise substantial growth. The development and increasing adoption of sustainable protective packaging solutions, including biodegradable materials, recycled content, and reusable designs, represent a significant avenue for innovation and market differentiation. The rise of smart packaging technologies, incorporating RFID, IoT sensors, and QR codes, offers opportunities for enhanced traceability, real-time monitoring of product conditions, and improved supply chain efficiency, adding significant value beyond mere physical protection. Emerging economies, with their rapidly expanding industrial bases and burgeoning e-commerce sectors, present untapped markets for protective packaging manufacturers. Furthermore, the increasing demand for customized packaging solutions tailored to specific product geometries and brand aesthetics provides avenues for specialized manufacturers. The ongoing technological advancements in material science and manufacturing processes continue to create new possibilities for lighter, stronger, and more cost-effective protective packaging. These opportunities, when strategically leveraged, can propel the market forward, transforming challenges into growth drivers.

Segmentation Analysis

The protective packaging market is comprehensively segmented based on various critical attributes, including material, type, function, and end-use industry, providing a detailed view of its diverse landscape and market dynamics. This granular segmentation allows for a deeper understanding of specific product applications, material preferences, and industry-specific demands, highlighting growth areas and strategic opportunities. Each segment reflects unique technological advancements, regulatory impacts, and consumer preferences that influence market trends and competitive strategies. The market's structure is a testament to the wide array of solutions required to protect a vast range of products in diverse logistical environments.

- By Material

- Plastic (Polyethylene, Polypropylene, Polystyrene, Polyvinyl Chloride, Others)

- Paper & Paperboard (Corrugated, Paperboard)

- Foams (Polyurethane, Polyethylene, Polystyrene, Others)

- Others (Biodegradable Materials, Wood, Metal)

- By Type

- Flexible (Bubble Wrap, Air Pillows, Protective Films)

- Rigid (Boxes, Crates, Containers)

- Foam (Foam-in-Place, Foam Sheets, Foam Inserts)

- By Function

- Cushioning

- Void Fill

- Blocking & Bracing

- Insulation

- Surface Protection

- By End-use Industry

- E-commerce

- Electronics

- Automotive

- Food & Beverage

- Industrial (Machinery, Heavy Equipment)

- Healthcare & Pharmaceuticals

- Consumer Goods

- Others

Value Chain Analysis For Protective Packaging Market

The value chain for the protective packaging market is a complex network involving multiple stages, from raw material sourcing to final product delivery and disposal, each adding value to the end product. At the upstream end, the chain begins with the procurement of essential raw materials such as polymers (polyethylene, polypropylene, polystyrene) derived from petrochemicals, paper pulp from sustainable forests or recycled sources, and various additives and chemicals that provide specific properties like flame retardancy or biodegradability. Key players in this stage include chemical companies, forestry operations, and recycled material processors. The quality and availability of these raw materials directly impact the cost, performance, and environmental footprint of the final protective packaging solutions, necessitating robust supply chain management and strategic partnerships with suppliers to ensure consistency and competitive pricing.

Moving downstream, these raw materials are transformed by converters and manufacturers into various forms of protective packaging, including bubble wrap, foam sheets, air pillows, corrugated boxes, and custom molded inserts. This stage involves sophisticated manufacturing processes such as extrusion, molding, fabrication, and lamination, requiring significant technological investment and expertise. These converted products are then distributed through a combination of direct and indirect channels. Direct distribution involves manufacturers selling directly to large-scale end-users like major e-commerce retailers, automotive manufacturers, or pharmaceutical companies, often involving customized solutions and dedicated sales teams. Indirect distribution, on the other hand, relies on a network of wholesalers, distributors, and third-party logistics (3PL) providers who cater to a broader range of smaller and medium-sized enterprises, offering a diverse portfolio of standard protective packaging products and value-added services such as inventory management and just-in-time delivery. The efficiency of these distribution channels is crucial for timely product delivery and market penetration.

The final stage of the value chain involves the end-users who integrate protective packaging into their product shipment and storage operations. These end-users span a wide range of industries, including e-commerce, electronics, automotive, food and beverage, healthcare, and industrial goods. Their specific needs drive demand for particular types of protective packaging, influencing product innovation and customization. Post-consumption, the value chain extends to waste management, recycling, and disposal, highlighting the growing importance of circular economy principles. As regulatory pressures and consumer demand for sustainable packaging intensify, efforts to integrate recycled content, design for recyclability, and promote reusable packaging solutions are becoming critical, influencing decisions across the entire value chain. Collaboration among all stakeholders, from raw material suppliers to end-users and recycling facilities, is essential to optimize the value chain for both economic and environmental performance, ensuring a sustainable future for the protective packaging industry.

Protective Packaging Market Potential Customers

Potential customers for the protective packaging market represent a diverse array of industries and businesses globally, united by the fundamental need to safeguard their products from damage during transit and storage. The burgeoning e-commerce sector stands as a paramount customer segment, with online retailers and logistics providers continuously requiring robust and efficient packaging solutions to protect a vast range of goods, from electronics and apparel to groceries, delivered directly to consumers. These entities prioritize packaging that offers superior cushioning, void fill capabilities, and ease of assembly, often seeking lightweight and sustainable options to manage shipping costs and environmental impact. The rapid expansion of direct-to-consumer models across various industries further amplifies this demand, making e-commerce a central pillar of the protective packaging market's growth.

Beyond e-commerce, the electronics industry constitutes another significant customer base, demanding specialized protective packaging for delicate and high-value components such as semiconductors, smartphones, laptops, and consumer appliances. This segment often requires anti-static properties, precise fit, and shock absorption to prevent damage from electrostatic discharge and physical impact. Similarly, the automotive industry relies heavily on protective packaging for components ranging from small, intricate parts to large body panels and engines, ensuring they reach assembly lines and dealerships without blemishes. The food and beverage industry also generates substantial demand, particularly for packaging that offers insulation, maintains freshness, and prevents contamination, especially for perishable goods and temperature-sensitive products. Healthcare and pharmaceuticals, another critical sector, require sterile and highly protective packaging for medical devices, diagnostic equipment, and drugs, where product integrity and patient safety are paramount. These industries necessitate solutions that comply with stringent health and safety regulations, often involving specialized materials and designs.

Furthermore, a broad spectrum of industrial and consumer goods manufacturers are key end-users. Industrial companies producing machinery, heavy equipment, and construction materials require heavy-duty blocking and bracing solutions, along with robust surface protection, to withstand severe handling conditions. The consumer goods sector, encompassing everything from personal care products to home furnishings, seeks packaging that balances protection with aesthetic appeal and brand presentation. In essence, any business involved in manufacturing, shipping, or distributing physical goods is a potential customer for protective packaging, with specific requirements varying based on product fragility, value, shipping methods, and industry regulations. This widespread utility underscores the foundational importance of protective packaging across the global economy, cementing its role as an indispensable component of modern commerce.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $35.2 Billion |

| Market Forecast in 2032 | $55.0 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sealed Air Corporation, Smurfit Kappa Group, DS Smith Plc, WestRock Company, Huhtamaki Oyj, Pregis LLC, Sonoco Products Company, Ranpak Holdings Corp., Mondi Group, Storopack Hans Reichenecker GmbH, Atlantic Packaging, Pro-Pac Packaging Limited, Crown Holdings Inc., Berry Global (RPC Group Plc), Amcor plc, BillerudKorsnäs AB, Pactiv Evergreen Inc., International Paper Company, Indevco Group, UFP Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Protective Packaging Market Key Technology Landscape

The protective packaging market is continually evolving, driven by advancements in material science, manufacturing processes, and digital integration, leading to a dynamic key technology landscape. Innovations in materials focus heavily on sustainability, with significant developments in biodegradable polymers, compostable films, and high-recycled content papers and plastics. These new materials aim to offer equivalent or superior protective qualities while minimizing environmental impact, addressing both regulatory pressures and growing consumer demand for eco-friendly solutions. Furthermore, advancements in multi-layer and barrier technologies are enhancing the protection capabilities of flexible packaging, extending shelf life and safeguarding sensitive products against moisture, oxygen, and contaminants, which is particularly crucial for food and pharmaceutical applications. The pursuit of lighter yet stronger materials also remains a key technological trend, reducing shipping weights and associated costs without compromising product safety.

In terms of manufacturing processes, automation and robotics are transforming packaging lines, enabling greater efficiency, precision, and customization. Robotic arms equipped with advanced sensors and AI-driven vision systems are increasingly used for intricate packing tasks, void filling, and precise placement of cushioning materials, reducing labor costs and minimizing human error. Foam-in-place (FIP) systems continue to advance, offering on-demand custom cushioning that perfectly molds to products, eliminating the need for pre-formed inserts and reducing material waste. Air cushioning technology is also seeing improvements, with more efficient machines and durable film compositions producing air pillows and bubble wrap that offer excellent protection with minimal material. Furthermore, digital printing technologies are enabling greater flexibility and customization in packaging design, allowing for short runs and personalized branding directly on protective packaging components.

The integration of smart packaging technologies represents a cutting-edge frontier in the protective packaging market, moving beyond passive protection to active monitoring and data collection. This includes the incorporation of IoT sensors, RFID tags, QR codes, and Near Field Communication (NFC) chips directly into packaging materials. These technologies provide real-time data on temperature, humidity, shock events, and location, offering unprecedented visibility into the supply chain. Such data is invaluable for products requiring strict environmental controls, like pharmaceuticals or certain electronics, allowing for immediate intervention in case of deviations. Smart packaging also enables enhanced product traceability, anti-counterfeiting measures, and improved consumer engagement through interactive experiences. The convergence of these material, process, and digital technologies is shaping a future where protective packaging is not just a shield but an intelligent component of the entire product lifecycle, offering advanced protection, efficiency, and sustainability.

Regional Highlights

- North America: Characterized by a mature e-commerce market and a strong focus on advanced manufacturing and logistics. The region is a hub for innovation in protective packaging, with a growing demand for sustainable and smart packaging solutions. High adoption rates of automated packaging technologies and premium protective materials due to stringent product safety standards. The United States and Canada are leading contributors due to large industrial bases and sophisticated retail infrastructure.

- Europe: Driven by robust environmental regulations and a strong emphasis on the circular economy. European countries are pioneers in developing and adopting eco-friendly protective packaging materials such as recycled content, biodegradable plastics, and paper-based solutions. The region's automotive, pharmaceutical, and food and beverage industries are significant consumers. Germany, the UK, and France are key markets, prioritizing sustainability and efficiency.

- Asia Pacific (APAC): The largest and fastest-growing market for protective packaging, fueled by rapid industrialization, burgeoning manufacturing sectors, and an explosion in e-commerce penetration. Countries like China, India, Japan, and South Korea are major contributors, with increasing disposable incomes leading to higher consumption of electronics and packaged goods. The region offers immense growth opportunities due to its vast population and expanding logistics infrastructure, although cost-effectiveness remains a critical factor.

- Latin America: An emerging market showing significant growth potential, driven by increasing foreign investment, expanding manufacturing capabilities, and a developing e-commerce landscape. Brazil and Mexico are leading the way, with rising demand for protective packaging in the food and beverage, automotive, and retail sectors. Focus on basic protective solutions, but with a growing awareness for more advanced and sustainable options.

- Middle East and Africa (MEA): This region is experiencing steady growth, particularly in the GCC countries due to infrastructure development and diversification away from oil economies. Increased industrial activity and a nascent but growing e-commerce sector are driving demand. Significant opportunities exist in food packaging, healthcare, and logistics, with a gradual shift towards more sophisticated protective solutions as economies mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Protective Packaging Market.- Sealed Air Corporation

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- Huhtamaki Oyj

- Pregis LLC

- Sonoco Products Company

- Ranpak Holdings Corp.

- Mondi Group

- Storopack Hans Reichenecker GmbH

- Atlantic Packaging

- Pro-Pac Packaging Limited

- Crown Holdings Inc.

- Berry Global (RPC Group Plc)

- Amcor plc

- BillerudKorsnäs AB

- Pactiv Evergreen Inc.

- International Paper Company

- Indevco Group

- UFP Technologies Inc.

Frequently Asked Questions

What is protective packaging?

Protective packaging safeguards products from damage during storage, handling, and transportation by providing cushioning, void fill, blocking, bracing, and insulation, ensuring product integrity and reducing losses.

What are the main types of protective packaging materials?

Common materials include plastics (like polyethylene, polypropylene, polystyrene), paper and paperboard (corrugated, molded pulp), and foams (polyurethane, polyethylene), alongside sustainable options like biodegradable films.

Which industries are the largest consumers of protective packaging?

The e-commerce, electronics, automotive, food and beverage, and healthcare industries are the primary consumers, each requiring specialized protective solutions to meet specific product and logistical demands.

How is AI impacting the protective packaging market?

AI is revolutionizing the market by optimizing packaging design, enabling predictive demand forecasting, automating packaging operations, enhancing quality control, and improving supply chain efficiency, often with a focus on sustainability.

What are the key drivers for growth in the protective packaging market?

The market's growth is predominantly driven by the surging global e-commerce sector, increasing demand for consumer electronics, expansion of the automotive industry, and a heightened focus on product safety and damage reduction across various sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- ESD Protective Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flexible Protective Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Plastic Protective Packaging Market Statistics 2025 Analysis By Application (Food and Beverage, Construction, Pharmaceutical, Electronics, Consumer Product, Other), By Type (PP, PVC, LDPE, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Protective Packaging Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Rigid, Flexible, Foam), By Application (Food & beverage, Health care, Industrial goods, Automotive, Household appliances, Consumer electronics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager