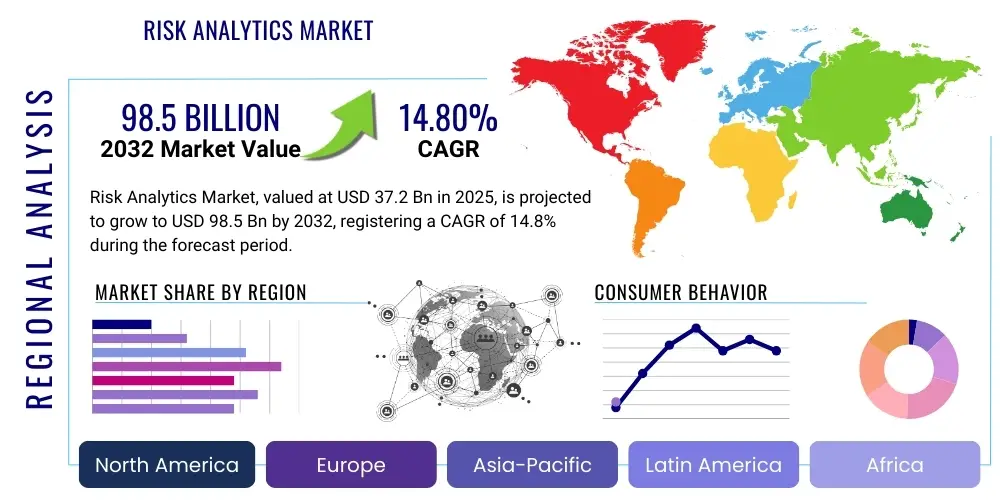

Risk Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427626 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Risk Analytics Market Size

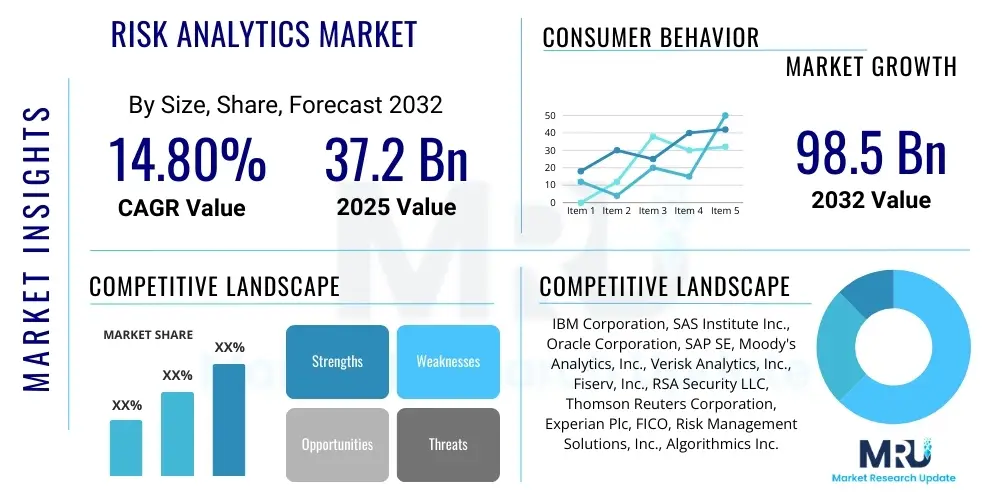

The Risk Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2025 and 2032. The market is estimated at USD 37.2 billion in 2025 and is projected to reach USD 98.5 billion by the end of the forecast period in 2032. This substantial growth is primarily driven by the increasing complexity of global business operations, the proliferation of digital data, and the ever-evolving regulatory landscape that mandates robust risk management frameworks across various industries. Enterprises are increasingly investing in sophisticated risk analytics solutions to gain predictive insights, enhance decision-making, and ensure business continuity amidst dynamic market conditions.

Risk Analytics Market introduction

The Risk Analytics Market encompasses a range of solutions and services designed to identify, assess, monitor, and mitigate various risks faced by organizations. These solutions leverage advanced statistical methods, data mining, artificial intelligence, and machine learning algorithms to process vast amounts of structured and unstructured data, providing actionable insights into potential threats and opportunities. Risk analytics is crucial for improving strategic planning, optimizing resource allocation, and maintaining regulatory compliance, thereby enhancing overall organizational resilience and competitive advantage. The product description primarily includes integrated software platforms, predictive modeling tools, data visualization dashboards, and specialized consulting services that cater to diverse risk types such as financial, operational, credit, market, and cybersecurity risks.

Major applications of risk analytics span across critical sectors including banking, financial services, and insurance (BFSI), healthcare, retail, manufacturing, and government. In the BFSI sector, it is indispensable for fraud detection, credit scoring, market risk assessment, and regulatory reporting (e.g., Basel III, Solvency II). Benefits derived from adopting risk analytics include enhanced decision-making capabilities, improved regulatory compliance, early detection of fraudulent activities, optimized capital allocation, and significant operational efficiency gains. The market is propelled by key driving factors such as the accelerating pace of digital transformation, the exponential growth in data volumes, the increasing sophistication of cyber threats, and the stringent global regulatory frameworks that demand proactive and comprehensive risk management strategies.

Risk Analytics Market Executive Summary

The Risk Analytics Market is currently experiencing a period of significant expansion, characterized by several prominent business trends. Organizations are increasingly shifting towards cloud-based risk analytics solutions, driven by their scalability, flexibility, and cost-effectiveness, which facilitates broader adoption across enterprises of all sizes. There is a growing integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into risk analytics platforms, enabling more accurate predictive modeling, real-time risk assessment, and automated anomaly detection. Furthermore, a heightened focus on enterprise-wide risk management (ERM) is compelling businesses to adopt integrated solutions that provide a holistic view of risks across different departments and operational silos, moving beyond siloed risk assessments to comprehensive, unified strategies.

Regional trends indicate North America as the dominant market, propelled by early adoption of advanced technologies, a robust regulatory environment, and the presence of major market players. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by rapid digitalization, economic expansion, and increasing awareness of risk management in emerging economies. European markets are also seeing substantial growth, primarily due to stringent data privacy regulations (e.g., GDPR) and robust financial sector oversight, driving demand for compliance-focused risk analytics. Segment trends highlight strong demand from the financial services sector for credit and market risk analytics, while operational risk and cybersecurity risk analytics are witnessing accelerated adoption across diverse industries as organizations grapple with complex digital threats and operational disruptions. The convergence of these trends points towards a dynamic and evolving market landscape.

AI Impact Analysis on Risk Analytics Market

Users frequently inquire about how Artificial Intelligence (AI) profoundly reshapes risk analytics, with common questions revolving around its ability to enhance predictive capabilities, automate complex processes, and identify obscure risk patterns that human analysis might miss. There is considerable interest in how AI helps manage the explosion of data, its role in real-time risk monitoring, and its potential to personalize risk assessments. Conversely, users also express concerns regarding the explainability and transparency of AI models ("black box" issues), the potential for algorithmic bias in decision-making, and the ethical implications of relying on AI for critical risk evaluations. The general expectation is that AI will act as a powerful augmentative tool, significantly enhancing the efficiency and accuracy of risk management, rather than completely replacing human expertise, thereby creating a collaborative human-AI ecosystem for superior risk intelligence.

AIs influence on the Risk Analytics Market is transformative, enabling a paradigm shift from reactive to proactive risk management. It empowers organizations to move beyond traditional rule-based systems to dynamic, self-learning models that can adapt to new data and evolving risk landscapes. The application of AI and Machine Learning facilitates the processing and analysis of vast, heterogeneous datasets, including unstructured data from social media, news feeds, and communication logs, providing a richer context for risk assessment. While AI offers immense potential for accuracy and speed, its integration necessitates careful consideration of data governance, model validation, and the development of robust frameworks to ensure ethical and transparent deployment, addressing concerns around bias, fairness, and accountability in algorithmic decision-making.

- Enhanced Predictive Accuracy: AI algorithms can analyze historical data and identify complex, non-linear patterns, leading to more precise forecasts for credit defaults, market volatility, and fraudulent activities.

- Real-time Risk Monitoring: Machine learning models enable continuous, automated monitoring of transactions, behaviors, and market events, allowing for instantaneous detection and response to emerging risks.

- Automated Anomaly Detection: AI excels at identifying unusual data points or patterns that deviate significantly from the norm, crucial for uncovering new forms of fraud, cyberattacks, or operational irregularities.

- Improved Fraud Detection: By learning from vast datasets of legitimate and fraudulent activities, AI can identify sophisticated fraud schemes with higher accuracy and fewer false positives.

- Personalized Risk Profiles: AI allows for the creation of highly individualized risk assessments for customers, portfolios, or assets, optimizing decision-making in areas like loan approvals, insurance underwriting, and investment strategies.

- Operational Efficiency Gains: Automation of routine risk assessment tasks, data collection, and report generation frees up human analysts to focus on strategic insights and complex problem-solving.

- Challenges in Model Explainability: The complexity of some AI models, particularly deep learning, can make it difficult to understand how decisions are reached, posing challenges for regulatory compliance and audit trails.

- High Data Quality Requirements: The effectiveness of AI in risk analytics is heavily dependent on the quality, quantity, and diversity of training data; biased or incomplete data can lead to flawed risk assessments.

DRO & Impact Forces Of Risk Analytics Market

The Risk Analytics Market is propelled by several potent drivers, chief among them being the exponential growth in digital data across all sectors, necessitating sophisticated tools to extract actionable risk insights. The increasing stringency and complexity of global regulatory frameworks, such as GDPR, Basel III, and CCAR, mandate robust and transparent risk management practices, compelling organizations to invest in advanced analytics for compliance. Furthermore, the escalating frequency and sophistication of cyber threats and financial fraud schemes across all industries underscore the critical need for predictive and proactive risk analytics solutions. The pervasive drive for digital transformation and operational efficiency also acts as a significant catalyst, as businesses seek to leverage analytics to optimize decision-making, streamline processes, and enhance competitive advantage in dynamic markets.

Despite these strong drivers, the market faces notable restraints. High implementation and maintenance costs associated with advanced risk analytics platforms can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). Data privacy and security concerns, especially in light of strict regulations and rising data breaches, create hesitation in sharing and processing sensitive information, impacting the adoption of cloud-based solutions. A persistent shortage of skilled professionals with expertise in both data science and risk management further impedes effective deployment and utilization of these complex systems. Additionally, the inherent complexity of integrating disparate data sources and legacy IT systems with new analytics platforms often leads to lengthy implementation cycles and operational challenges, contributing to resistance to change within organizations.

Opportunities for growth in the risk analytics market are abundant, particularly with the continued advancements in Artificial Intelligence (AI) and Machine Learning (ML), which promise to revolutionize predictive capabilities and automate risk assessment processes further. The expanding adoption of cloud-based solutions offers scalability, reduced infrastructure costs, and greater accessibility for a broader range of enterprises. There is also a substantial opportunity in developing customized and industry-specific risk analytics solutions that cater to the unique challenges of emerging verticals like healthcare, retail, and energy, moving beyond the traditional stronghold of financial services. The rising demand for real-time analytics and prescriptive analytics, which not only predict but also recommend optimal actions, represents a significant avenue for innovation and market expansion, enabling businesses to proactively manage evolving and emerging risks.

Segmentation Analysis

The Risk Analytics Market is meticulously segmented to provide a granular understanding of its diverse components and application areas. This segmentation helps in identifying specific growth pockets and understanding market dynamics across different parameters. The market is primarily broken down by component, distinguishing between the software platforms that perform the analytical tasks and the services that support their implementation, customization, and ongoing operation. Furthermore, deployment models, organization sizes, the varied industry verticals, and the specific types of risks being managed all contribute to a comprehensive view of the markets structure and its addressable sub-markets. Each segment holds unique opportunities and challenges, influencing vendor strategies and investment decisions.

Understanding these segmentations is critical for market participants, allowing them to tailor their offerings to specific customer needs and market demands. For instance, cloud-based deployment is gaining traction due to its flexibility and scalability, particularly among SMEs, while large enterprises might still prefer on-premise solutions for enhanced control and data sovereignty. The demand for various risk types, such as financial, operational, or cybersecurity risk analytics, varies significantly across different industry verticals, reflecting their unique operational landscapes and regulatory requirements. This multi-dimensional segmentation provides a robust framework for strategic planning, competitive analysis, and identifying lucrative growth areas within the broader risk analytics ecosystem.

- By Component

- Software: Comprises various standalone and integrated platforms, applications, and tools for risk data management, modeling, visualization, and reporting.

- Services: Includes professional services such as consulting, implementation, training, support, and managed services that assist organizations in deploying and optimizing risk analytics solutions.

- By Deployment Model

- On-Premise: Solutions deployed and managed within an organizations own infrastructure, offering greater control and data security, often preferred by large enterprises with stringent compliance needs.

- Cloud-Based: Solutions hosted and delivered over the internet, providing scalability, flexibility, reduced infrastructure costs, and easier accessibility, increasingly popular among SMEs.

- By Organization Size

- Large Enterprises: Organizations with extensive operations and complex risk profiles, requiring comprehensive and customized risk analytics suites.

- Small and Medium-sized Enterprises (SMEs): Businesses seeking scalable, cost-effective, and often cloud-based solutions to manage their more contained, yet significant, risk exposures.

- By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI): The largest consumer, using risk analytics for credit risk, market risk, operational risk, fraud detection, and regulatory compliance.

- Healthcare: Employing risk analytics for patient safety, fraud detection in claims, regulatory compliance (e.g., HIPAA), and operational efficiency.

- Retail and E-commerce: Leveraging analytics for fraud prevention, supply chain risk management, customer credit assessment, and inventory optimization.

- Manufacturing: Utilizing risk analytics for supply chain disruptions, operational risks, quality control, and predictive maintenance.

- Government and Public Sector: Applying risk analytics for fraud prevention in social programs, public safety, cybersecurity, and financial management.

- Energy and Utilities: Implementing risk analytics for operational safety, commodity price risk, regulatory compliance, and infrastructure protection.

- Others: Includes sectors like telecommunications, transportation, and media, where risk analytics addresses specific industry challenges.

- By Risk Type

- Strategic Risk: Analyzing risks related to business strategy, competitive landscape, and long-term organizational objectives.

- Operational Risk: Assessing risks from failed internal processes, people, systems, or external events, including cybersecurity and business continuity.

- Financial Risk: Encompassing credit risk, market risk, and liquidity risk, crucial for financial institutions to manage capital and investments.

- Credit Risk: Evaluating the likelihood of a borrower defaulting on debt obligations.

- Market Risk: Measuring the risk of losses in positions arising from movements in market prices.

- Liquidity Risk: Assessing the risk that an entity will be unable to meet its short-term debt obligations.

- Cyber Risk: Analyzing threats related to data breaches, cyberattacks, and information security vulnerabilities.

- Compliance Risk: Managing risks associated with non-adherence to laws, regulations, internal policies, and ethical standards.

- Reputational Risk: Evaluating potential damage to an organizations brand and public image.

Risk Analytics Market Value Chain Analysis

The value chain of the Risk Analytics Market begins with upstream activities focused on foundational technologies and data infrastructure. This segment involves critical players like raw data providers (e.g., credit bureaus, market data vendors), technology developers specializing in AI, Machine Learning, and big data platforms, as well as cloud infrastructure providers. These upstream components are essential for collecting, processing, and storing the vast amounts of data that fuel risk analytics solutions. Furthermore, academic research institutions and specialized software development firms contribute to the innovation and advancement of analytical algorithms and predictive models, forming the intellectual bedrock upon which the entire market operates, ensuring that the analytical tools remain cutting-edge and effective.

Moving downstream, the value chain encompasses the development, integration, and distribution of actual risk analytics solutions to end-users. This stage involves software vendors who build the analytics platforms, system integrators who customize and deploy these solutions into client environments, and consulting firms that provide expert advice on risk management strategies and regulatory compliance. The distribution channels play a pivotal role, with direct sales models often employed for large enterprise clients requiring bespoke solutions and extensive support. Indirect channels, including reseller partnerships, value-added resellers (VARs), and cloud marketplaces, are crucial for broader market penetration, especially for targeting small and medium-sized enterprises and delivering integrated solutions that bundle software with complementary services. The interaction between direct and indirect channels optimizes market reach and caters to diverse customer preferences for purchasing and implementation, balancing specialized service with wide accessibility.

Risk Analytics Market Potential Customers

The potential customers for risk analytics solutions are diverse, spanning a wide array of industries that face significant exposure to various forms of financial, operational, strategic, and cyber risks. Financial institutions, including commercial banks, investment banks, asset management firms, and insurance companies, represent the largest and most mature segment of buyers. These organizations rely heavily on risk analytics for critical functions such as credit scoring, market risk assessment, liquidity management, fraud detection, and ensuring compliance with complex global financial regulations. The inherent nature of their business models, which involves managing vast sums of money and high stakes, makes robust risk analytics indispensable for maintaining stability and profitability.

Beyond the financial sector, a growing number of enterprises in other verticals are rapidly adopting risk analytics to navigate their unique challenges. Healthcare organizations utilize these solutions for managing patient safety risks, detecting insurance fraud, and ensuring regulatory adherence (e.g., HIPAA). Retail and e-commerce companies leverage risk analytics to prevent payment fraud, manage supply chain disruptions, and assess customer creditworthiness. Manufacturing firms employ risk analytics for operational resilience, supply chain optimization, and predictive maintenance to mitigate equipment failure. Government agencies also serve as significant end-users, applying risk analytics for public sector fraud detection, cybersecurity defense, and ensuring the efficient allocation of public funds. This expanding landscape of applications across diverse sectors underscores the universal utility and increasing demand for sophisticated risk management capabilities.

Risk Analytics Market Key Technology Landscape

The Risk Analytics Market is characterized by a rapidly evolving technological landscape, driven by the need for more accurate, real-time, and predictive insights into complex risk scenarios. At its core, the market extensively utilizes Big Data Analytics, which provides the capability to process and analyze massive volumes of structured and unstructured data from disparate sources, forming the foundation for comprehensive risk assessment. Complementing this, Cloud Computing technologies offer the necessary scalability, flexibility, and cost-effectiveness for storing, processing, and deploying these analytics solutions, enabling wider adoption across various organizational sizes and geographic locations. The shift to cloud-native architectures facilitates agile development and continuous innovation in risk analytics platforms.

Central to the advancements in risk analytics are Artificial Intelligence (AI) and Machine Learning (ML). These technologies power predictive analytics, enabling algorithms to learn from historical data, identify intricate patterns, and forecast future risk events with remarkable accuracy. Specific techniques include deep learning for anomaly detection, natural language processing (NLP) for analyzing unstructured text (e.g., regulatory documents, news feeds), and sophisticated regression models for credit scoring. Prescriptive Analytics, an extension of predictive capabilities, further empowers organizations by not only forecasting risks but also recommending optimal actions to mitigate them. Data Visualization tools are also crucial, translating complex analytical outputs into intuitive dashboards and reports, making insights accessible and actionable for decision-makers. Emerging technologies like Blockchain are also being explored for enhancing data integrity, transparency, and security in certain risk management applications, particularly in areas like supply chain finance and regulatory reporting, promising a future of verifiable and immutable risk data.

Regional Highlights

- North America: This region holds the largest market share, driven by a high adoption rate of advanced technologies, the presence of major risk analytics vendors, and a stringent regulatory environment, particularly in the financial services sector. The United States and Canada are at the forefront of innovation, with significant investments in AI and cloud-based risk solutions across BFSI, healthcare, and government sectors. The market here benefits from a strong emphasis on data-driven decision-making and a mature technological infrastructure, fostering continuous growth and innovation in risk management practices.

- Europe: The European market for risk analytics is characterized by robust regulatory frameworks such as GDPR (General Data Protection Regulation) and specific financial directives like Basel IV and Solvency II, which compel organizations to invest heavily in compliance and operational risk solutions. Countries like the UK, Germany, and France are leading the adoption, focusing on data privacy, cybersecurity, and enterprise-wide risk management. The region shows a strong demand for integrated platforms that can handle complex regulatory reporting and provide transparent risk insights, ensuring accountability and data governance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid digital transformation, increasing financial inclusion, and a burgeoning number of startups and SMEs. Countries like China, India, Japan, and Australia are experiencing significant growth in their BFSI, retail, and manufacturing sectors, leading to a rising need for sophisticated risk analytics to manage credit risk, fraud, and supply chain disruptions. Government initiatives to promote digital economies and smart cities further accelerate the adoption of risk management technologies across various public and private enterprises.

- Latin America (LATAM): The Latin American market is emerging, driven by increasing digitalization, expanding financial services sectors, and growing awareness of cybersecurity threats. Countries such as Brazil and Mexico are seeing investments in risk analytics to combat fraud, enhance credit assessment, and improve regulatory compliance, particularly in their developing financial systems. While adoption is slower compared to North America or Europe, the region presents substantial untapped potential as economic stability improves and digital infrastructure expands, fostering a greater need for robust risk management tools.

- Middle East & Africa (MEA): The MEA region is witnessing steady growth, primarily influenced by ambitious government-led digital transformation agendas, diversification of economies away from oil, and increasing foreign direct investments. Countries like the UAE, Saudi Arabia, and South Africa are investing in risk analytics for their banking, energy, and government sectors to manage operational risks, improve cybersecurity, and ensure compliance with evolving international standards. The regions focus on building resilient financial and operational infrastructures is a key driver for market expansion, particularly with the adoption of cloud-based solutions tailored to specific regional challenges and regulatory landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Risk Analytics Market.- IBM Corporation

- SAS Institute Inc.

- Oracle Corporation

- SAP SE

- Moodys Analytics, Inc.

- Verisk Analytics, Inc.

- Fiserv, Inc.

- RSA Security LLC (Dell Technologies)

- Thomson Reuters Corporation

- Experian Plc

- FICO (Fair Isaac Corporation)

- Risk Management Solutions, Inc. (RMS)

- Algorithmics Inc. (IBM)

- Palantir Technologies Inc.

- Accenture Plc

Frequently Asked Questions

What is Risk Analytics and why is it important for businesses?

Risk Analytics refers to the process of using advanced statistical methods, data mining, and artificial intelligence to identify, assess, monitor, and mitigate various risks an organization faces. It is crucial because it enables businesses to make informed decisions, comply with regulations, detect fraud, optimize capital allocation, and enhance operational efficiency, ultimately safeguarding assets and ensuring business continuity in a complex and volatile environment.

How does AI impact the Risk Analytics Market?

AI significantly impacts risk analytics by enhancing predictive accuracy through advanced pattern recognition in vast datasets, enabling real-time risk monitoring, and automating anomaly detection for fraud and cyber threats. While it boosts efficiency and insight, it also introduces challenges related to model explainability, data quality requirements, and potential algorithmic bias, necessitating careful implementation and ethical considerations.

What are the primary types of risks addressed by Risk Analytics?

Risk analytics addresses a wide array of risk types, including financial risks (credit risk, market risk, liquidity risk), operational risks (process failures, human error, system failures, cybersecurity), strategic risks (business strategy, competitive landscape), and compliance risks (regulatory adherence). It also covers emerging areas like reputational risk and environmental risk, providing a holistic view of potential threats to an organization.

What are the main drivers for the growth of the Risk Analytics Market?

Key drivers for market growth include the exponential increase in digital data, the escalating complexity and frequency of cyber threats and financial fraud, increasingly stringent global regulatory mandates, and the pervasive need for digital transformation to improve operational efficiency. Organizations are also driven by the desire to gain predictive insights and enhance decision-making in dynamic market conditions.

What challenges do organizations face when implementing Risk Analytics solutions?

Organizations face several challenges, including high implementation and maintenance costs, concerns over data privacy and security, and a scarcity of skilled professionals with expertise in both data science and risk management. Additionally, difficulties in integrating new analytics platforms with existing legacy IT systems and overcoming internal resistance to change often pose significant hurdles to successful deployment and adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager