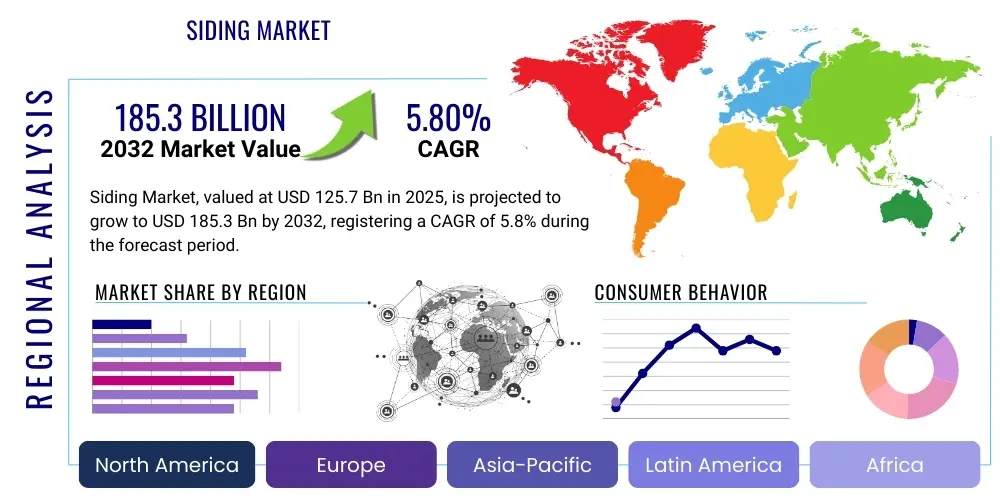

Siding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427809 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Siding Market Size

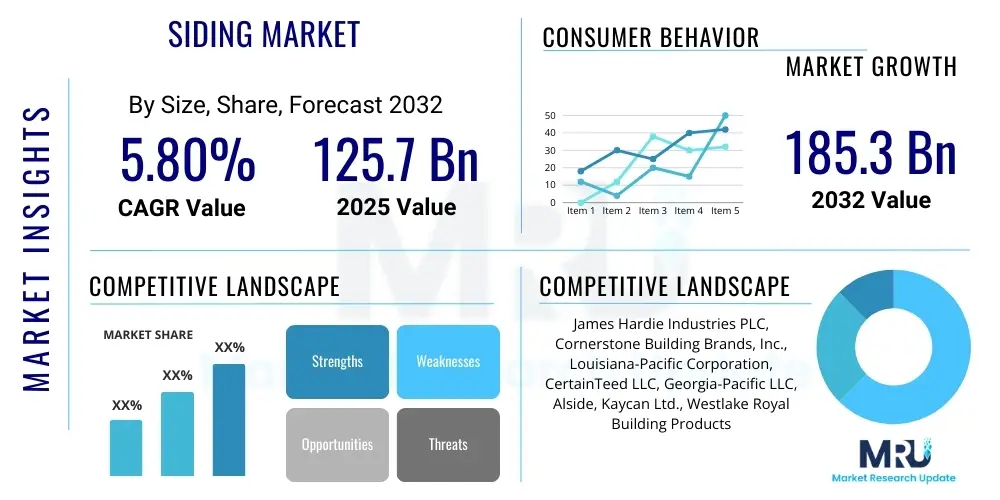

The Siding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 125.7 billion in 2025 and is projected to reach USD 185.3 billion by the end of the forecast period in 2032.

Siding Market introduction

The Siding Market encompasses a diverse range of exterior cladding materials designed to protect structures from environmental elements, enhance aesthetic appeal, and improve energy efficiency. Key product categories include vinyl, fiber cement, wood, metal, stucco, brick, and engineered wood siding. These materials are predominantly applied in residential and commercial construction, covering both new builds and extensive repair and remodeling projects. The markets robust growth is largely propelled by increasing construction activity, a strong emphasis on energy-efficient building solutions, and evolving consumer preferences for durable, low-maintenance, and visually appealing exteriors.

Siding serves as a critical component of a buildings envelope, offering multifaceted benefits beyond mere aesthetics. It provides essential protection against severe weather conditions such as rain, wind, hail, and damaging UV radiation, which significantly impacts the longevity and structural integrity of a building. Furthermore, advanced siding materials often contribute to improved thermal insulation, playing a pivotal role in reducing heating and cooling costs. This aligns with broader energy conservation objectives and stringent building codes, making energy-efficient siding a highly sought-after feature in both new construction and renovation initiatives.

The market is characterized by continuous innovation aimed at enhancing material performance, ease of installation, and environmental sustainability. Driving factors include robust economic growth supporting housing starts and commercial development, a sustained demand for home renovation and upgrades, and a growing consumer awareness of the long-term advantages of high-quality, low-maintenance siding solutions. The industry also benefits from shifts in architectural trends that favor specific textures, colors, and material combinations, fueling demand for a diverse and adaptable product portfolio that caters to a wide range of design preferences and functional requirements.

Siding Market Executive Summary

The Siding Market is experiencing dynamic shifts driven by evolving business trends, significant regional developments, and distinct segment growth patterns. Business trends are largely characterized by a heightened focus on sustainability, with manufacturers investing in eco-friendly materials and production processes. Technological innovations are also leading to more durable, energy-efficient, and aesthetically versatile siding options, including smart siding solutions. Customization and personalization are becoming crucial competitive differentiators, as consumers increasingly seek unique designs and tailored material choices.

Regionally, North America continues to dominate the market due to robust residential construction, a strong repair and remodeling sector, and consumer willingness to invest in home improvements. However, the Asia-Pacific region is emerging as a significant growth hub, propelled by rapid urbanization, substantial infrastructure development, and increasing disposable incomes in countries like China and India. Europe shows steady growth, with a strong emphasis on energy efficiency and sustainable building practices, while Latin America and the Middle East & Africa present nascent opportunities driven by economic development and population expansion.

Segment-wise, fiber cement and vinyl siding maintain substantial market shares due to their cost-effectiveness, durability, and low maintenance requirements. Engineered wood siding is gaining traction, offering the aesthetic appeal of natural wood with enhanced resistance to pests and moisture. The demand for insulated siding products is also on the rise, reflecting the global push for improved building energy performance. Furthermore, the repair and remodeling application segment consistently outperforms new construction in many mature markets, driven by an aging housing stock and a continuous desire for property value enhancement and modernization.

AI Impact Analysis on Siding Market

The integration of Artificial Intelligence (AI) is poised to significantly transform various facets of the Siding Market, from initial design and material selection to manufacturing, supply chain management, and customer engagement. Users frequently inquire about how AI can optimize aesthetic and functional design, predict material performance under diverse conditions, and streamline complex logistical challenges. There is considerable interest in AIs potential to enhance personalized customer experiences, improve installation efficiency through advanced planning, and contribute to more sustainable and cost-effective operations across the entire value chain. The overarching theme of user curiosity revolves around leveraging AI for smarter, more efficient, and more responsive siding solutions.

AIs analytical capabilities offer unprecedented opportunities for predictive modeling in material science. Machine learning algorithms can analyze vast datasets concerning material composition, environmental stress factors, and long-term performance metrics to forecast durability, weather resistance, and insulation properties more accurately. This enables manufacturers to develop advanced siding materials with optimized characteristics, reducing waste in R&D and improving product reliability. Furthermore, AI can simulate various design configurations and material combinations, allowing architects and builders to visualize outcomes and make data-driven decisions that balance aesthetics, performance, and budget.

In terms of operational efficiency, AI can revolutionize supply chain management by predicting demand fluctuations, optimizing inventory levels, and streamlining logistics to ensure timely delivery of materials. This reduces lead times and mitigates the impact of supply chain disruptions, a common challenge in the construction industry. For installers, AI-powered tools and augmented reality applications can assist in precise measurements, error detection, and guided installation processes, enhancing accuracy and reducing labor costs. Ultimately, AI fosters an environment of continuous improvement, enabling the siding market to deliver higher quality products with greater efficiency and responsiveness to evolving market demands.

- Enhanced Design and Visualization: AI tools create realistic 3D renderings and suggest optimal material combinations for aesthetic and functional appeal.

- Predictive Performance Analytics: AI algorithms forecast material durability, weather resistance, and energy efficiency under various conditions.

- Optimized Manufacturing Processes: AI identifies inefficiencies, reduces waste, and improves quality control in production lines.

- Intelligent Supply Chain Management: AI predicts demand, optimizes inventory, and streamlines logistics for timely material delivery.

- Personalized Customer Experience: AI-driven platforms offer tailored product recommendations and interactive design consultations.

- Automated Quality Inspection: AI-powered vision systems detect defects in siding panels with high accuracy during manufacturing.

- Smart Siding Integration: AI facilitates the development of siding with integrated sensors for performance monitoring and predictive maintenance.

DRO & Impact Forces Of Siding Market

The Siding Market is propelled by a robust interplay of drivers, constrained by several significant factors, and presents numerous opportunities for growth and innovation, all influenced by pervasive market forces. Key drivers include accelerating construction activities, particularly in residential and commercial sectors, coupled with a surging demand for renovation and remodeling projects. The increasing emphasis on energy efficiency and sustainable building practices further fuels the adoption of advanced siding materials. Restraints typically involve the volatility of raw material prices, labor shortages impacting installation, and intense competition leading to pricing pressures. Opportunities lie in the development of smart siding technologies, the expansion into emerging markets, and the growing preference for eco-friendly and low-maintenance solutions. These elements collectively shape the market landscape, dictating growth trajectories and competitive dynamics.

Driving forces for the siding market are deeply rooted in demographic and economic trends. Population growth and urbanization, especially in developing regions, necessitate new housing and commercial infrastructure, directly translating into higher demand for exterior cladding. Furthermore, rising disposable incomes in many economies empower homeowners and businesses to invest more in property aesthetics and long-term protection, favoring premium siding products. Regulatory support for green building initiatives and stringent energy codes also plays a pivotal role, compelling builders and property owners to opt for high-performance, insulated siding systems that contribute to reduced carbon footprints and lower operational costs, thereby bolstering market expansion.

Despite these growth catalysts, the market faces persistent challenges. Fluctuations in the cost of raw materials, such as polymers for vinyl siding, cement for fiber cement, or metals, can significantly impact manufacturing costs and consumer pricing, thereby affecting market accessibility and profitability. The construction industry also frequently contends with skilled labor shortages, which can delay projects and increase installation costs, sometimes leading to a preference for easier-to-install materials. Moreover, the siding market operates within a competitive environment, where numerous manufacturers vie for market share, often resulting in aggressive pricing strategies that can compress profit margins and necessitate continuous innovation to maintain a competitive edge and address evolving consumer demands and regulatory landscapes.

Opportunities in the siding market are largely concentrated around technological advancements and sustainability. The emergence of smart siding, integrated with sensors for monitoring temperature, moisture, and structural integrity, offers significant potential for predictive maintenance and enhanced building management. The increasing global awareness regarding environmental impact is driving demand for sustainable and recyclable siding materials, creating a niche for eco-conscious manufacturers. Moreover, untapped potential in emerging economies, characterized by rapid urbanization and infrastructure development, presents fertile ground for market penetration and expansion. Strategic partnerships and the development of customizable, aesthetically diverse product lines also represent key avenues for future growth, allowing companies to cater to a broader spectrum of architectural styles and consumer preferences.

Segmentation Analysis

The Siding Market is comprehensively segmented based on material type, application, and end-use, providing a granular view of market dynamics and consumer preferences across different categories. This segmentation helps in understanding the diverse landscape of exterior cladding solutions, ranging from traditional options like wood and stucco to modern advancements such as fiber cement and engineered wood. Each segment is influenced by factors like cost-effectiveness, durability, aesthetic appeal, and regional climatic conditions, leading to varied adoption rates and market shares across the globe. Analyzing these segments is crucial for stakeholders to identify growth opportunities and tailor product development strategies.

By material, the market is broadly categorized into vinyl, fiber cement, wood, metal, stucco, brick, and other specialized materials like engineered wood. Vinyl siding, known for its affordability and low maintenance, holds a significant market share. Fiber cement is highly valued for its durability, fire resistance, and aesthetic versatility, mimicking various natural materials. Wood siding continues to be popular for its natural look but requires more maintenance. Metal siding, particularly aluminum and steel, offers robust protection and is favored in certain commercial and industrial applications. Each material type addresses specific needs related to budget, climate, and architectural style, creating a diverse competitive landscape.

In terms of application, the market is primarily divided into residential and commercial sectors. The residential segment, encompassing single-family homes, multi-family dwellings, and apartment complexes, represents the largest share due to the sheer volume of housing units and ongoing renovation activities. The commercial segment includes office buildings, retail spaces, industrial facilities, and institutional structures, often requiring more specialized, durable, and fire-resistant siding solutions. Furthermore, the market is segmented by end-use into new construction and repair & remodeling. The repair & remodeling segment consistently demonstrates resilience, driven by aging infrastructure, property value enhancement, and changing aesthetic trends, often exhibiting more stable growth compared to the cyclical nature of new construction.

- By Material:

- Vinyl Siding

- Fiber Cement Siding

- Wood Siding (e.g., Cedar, Pine, Redwood)

- Metal Siding (e.g., Aluminum, Steel)

- Stucco Siding

- Brick Siding

- Engineered Wood Siding

- Others (e.g., Stone Veneer, Composites)

- By Application:

- Residential

- Commercial

- By End-Use:

- New Construction

- Repair & Remodeling

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Australia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa)

Siding Market Value Chain Analysis

The Siding Markets value chain is a complex network spanning raw material sourcing to final installation and after-sales support, involving numerous stakeholders. It begins with upstream activities focused on the extraction and processing of fundamental raw materials, such as polymers for vinyl, cement for fiber cement, wood, or metals. These materials are then transformed by manufacturers into finished siding products. The midstream involves distribution channels, including wholesalers, distributors, and retailers, who facilitate the movement of products to end-users. Downstream activities primarily encompass professional installers, contractors, and builders who provide installation services, directly impacting customer satisfaction and project success. Both direct and indirect sales channels play crucial roles in market penetration and product accessibility.

Upstream analysis reveals a critical dependency on the availability and pricing of basic inputs. For instance, vinyl siding manufacturers rely heavily on petrochemical companies for PVC resins, making them susceptible to crude oil price fluctuations. Fiber cement producers depend on suppliers of cement, cellulose fibers, and sand. Wood siding companies are influenced by forestry and lumber industries, where sustainability practices and timber prices are key considerations. The efficiency and cost-effectiveness of these upstream processes directly influence the final product cost and competitive positioning within the market, necessitating robust supply chain management and strategic sourcing to mitigate risks and ensure consistent quality.

Downstream activities are equally vital, focusing on how products reach the ultimate consumer and are installed. This segment primarily involves a diverse ecosystem of distributors, building material retailers (e.g., Home Depot, Lowes), and specialized siding contractors. Distributors act as intermediaries, bridging manufacturers with contractors and retailers, offering logistical support and warehousing. Contractors are the direct point of contact for many end-users, responsible for advising on material selection, precise installation, and ensuring adherence to building codes. The effectiveness of these distribution and installation networks directly impacts market reach, customer service quality, and brand reputation, highlighting the importance of strong partnerships and skilled labor throughout the value chain.

Distribution channels in the siding market are multifaceted, combining both direct and indirect approaches. Direct sales involve manufacturers selling directly to large builders, commercial developers, or even directly to consumers through online platforms, offering greater control over pricing and customer relationships. However, the majority of sales occur through indirect channels, leveraging an extensive network of wholesalers, building material suppliers, and independent retailers. These intermediaries provide crucial services like regional warehousing, localized sales support, and credit facilities, enabling broader market penetration and efficient service delivery. The optimal choice of distribution channel often depends on the manufacturers scale, target market, product type, and strategic objectives, influencing market access and overall operational efficiency.

Siding Market Potential Customers

The Siding Market primarily caters to a diverse range of end-users and buyers, each with distinct needs, preferences, and purchasing behaviors. These potential customers span across residential property owners, commercial enterprises, and the professional construction industry, including builders, developers, and remodeling contractors. Understanding these customer segments is fundamental for manufacturers and service providers to effectively tailor their product offerings, marketing strategies, and distribution channels. The decision to purchase siding is often driven by a combination of aesthetic desires, performance requirements such as durability and energy efficiency, and budget considerations, making a deep understanding of customer segments essential for market success.

In the residential sector, potential customers include individual homeowners undertaking renovation projects, first-time homebuyers, and existing homeowners looking to upgrade or repair their properties. Homeowners are increasingly seeking siding solutions that offer enhanced curb appeal, require minimal maintenance, and contribute to energy savings. Their choices are influenced by architectural styles, local climate conditions, and prevailing design trends. Builders and real estate developers constitute another significant residential customer group, requiring siding materials for new home construction and multi-family developments. For these professionals, factors like ease of installation, material availability, and overall project cost-effectiveness are paramount, alongside product quality and warranty provisions.

The commercial sector comprises property owners, facility managers, and commercial developers who require siding for office buildings, retail establishments, industrial facilities, and institutional structures. For these customers, factors such as extreme durability, fire resistance, low long-term maintenance costs, and brand image consistency are often prioritized over purely aesthetic considerations. Commercial projects frequently demand high-performance materials capable of withstanding harsh environmental conditions and meeting stringent commercial building codes. Additionally, a growing segment of potential customers includes government agencies and public sector organizations that require siding for public buildings, schools, and infrastructure projects, often guided by strict procurement policies and sustainability mandates, emphasizing long-term value and environmental responsibility.

Professional contractors and remodeling companies also represent a crucial segment of potential customers, as they act as intermediaries and decision-makers for many end-users. These professionals are primarily concerned with the quality, reliability, and ease of installation of siding products, as these factors directly impact project timelines, labor costs, and client satisfaction. Their purchasing decisions are often influenced by manufacturer support, product availability, technical specifications, and the ability of the siding material to meet diverse client demands and architectural requirements. Therefore, building strong relationships with this segment through training, technical support, and competitive pricing is vital for manufacturers to expand their market reach and secure sustained business growth within the siding industry.

Siding Market Key Technology Landscape

The Siding Markets technology landscape is continuously evolving, driven by innovations in material science, manufacturing processes, and digital integration, aiming to enhance product performance, sustainability, and ease of installation. Key technological advancements include the development of advanced composite materials, smart siding solutions incorporating IoT sensors, and improvements in manufacturing techniques such as co-extrusion and fiber cement formulation. These technologies address crucial market demands for greater durability, superior energy efficiency, reduced maintenance, and enhanced aesthetic versatility, while also responding to environmental concerns through sustainable production methods and recyclable materials. The continuous pursuit of technological innovation is central to maintaining competitiveness and meeting future building requirements.

Material science plays a pivotal role in shaping the modern siding landscape. Innovations in composite materials combine the best properties of different substances, creating siding that is more resistant to impact, moisture, pests, and UV degradation than traditional options. For instance, engineered wood siding utilizes advanced binders and coatings to achieve the natural look of wood with significantly improved durability and lower maintenance. Similarly, advancements in fiber cement technology have led to products with enhanced flexibility, reduced weight, and superior paint adherence. These material innovations are crucial for extending product lifespans, reducing lifecycle costs, and providing aesthetically diverse options that cater to a wide range of architectural styles and environmental challenges.

Manufacturing technologies are also undergoing significant transformations. Techniques like co-extrusion in vinyl siding production allow for multi-layered panels with different properties—for example, a durable outer layer for weather resistance and a lighter inner layer for cost efficiency. The integration of automation and robotics in manufacturing facilities improves precision, reduces labor costs, and enhances production speed and consistency. Furthermore, the industry is increasingly adopting sustainable manufacturing practices, such as closed-loop recycling for certain materials and processes that reduce water and energy consumption, aligning with global environmental objectives and consumer preferences for eco-friendly building solutions. These process improvements are essential for cost-effective production and maintaining high quality standards.

The advent of smart technologies is beginning to revolutionize the siding market, leading to the development of "smart siding." This innovative concept involves integrating sensors and Internet of Things (IoT) capabilities directly into siding panels. These sensors can monitor critical environmental factors such as temperature, humidity, and wind speed, as well as detect moisture intrusion, structural shifts, or even pest activity. Data collected from smart siding can provide homeowners and building managers with real-time insights into a buildings performance and structural health, enabling proactive maintenance and improved energy management. While still in nascent stages, this technology holds immense potential for enhancing building safety, optimizing energy consumption, and transforming property management practices, pushing the boundaries of traditional building envelopes.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by a robust residential construction sector, substantial repair and remodeling activities, and a high consumer propensity for home improvement investments. The demand is strong for durable, low-maintenance materials like vinyl and fiber cement, alongside a growing interest in energy-efficient and aesthetically versatile options. Regulatory frameworks promoting energy efficiency also contribute to market growth.

- Europe: The European market is characterized by a strong emphasis on sustainability, energy efficiency, and stringent building regulations. Countries like Germany, the UK, and France are leading in the adoption of eco-friendly and high-performance siding materials. Renovation projects form a significant part of the market, fueled by aging housing stock and government incentives for energy-efficient retrofits.

- Asia Pacific: Emerging as the fastest-growing market, Asia Pacific is propelled by rapid urbanization, significant infrastructure development, and rising disposable incomes, particularly in China, India, and Southeast Asian nations. The demand for new residential and commercial buildings is immense, favoring cost-effective and durable siding solutions. Local manufacturing capabilities and increasing awareness of modern building techniques are key drivers.

- Latin America: This region is experiencing steady growth, supported by increasing economic stability, urbanization, and investments in residential and commercial construction projects. Countries like Brazil and Mexico present considerable opportunities. The market is developing, with a growing preference for resilient and visually appealing siding materials that can withstand diverse climatic conditions.

- Middle East & Africa (MEA): The MEA market is projected to witness considerable growth, driven by ambitious construction and infrastructure development projects, especially in the UAE and Saudi Arabia. The demand for durable, heat-resistant, and aesthetically pleasing siding materials is high, catering to rapid urban expansion and the development of new cities. Economic diversification initiatives further bolster the construction sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Siding Market.- James Hardie Industries PLC

- Cornerstone Building Brands, Inc. (formerly Ply Gem)

- Louisiana-Pacific Corporation (LP Building Solutions)

- CertainTeed LLC (a Saint-Gobain company)

- Georgia-Pacific LLC

- Alside (a brand of Associated Materials, LLC)

- Kaycan Ltd.

- Westlake Royal Building Products

Frequently Asked Questions

Analyze common user questions about the Siding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most popular types of siding materials available?

The most popular siding materials include vinyl, known for its affordability and low maintenance; fiber cement, prized for its durability and fire resistance; wood, chosen for its natural aesthetic; and engineered wood, which offers woods look with enhanced performance. Metal, stucco, and brick are also widely used, each offering distinct benefits in terms of cost, appearance, and protection.

How much does new siding typically cost?

The cost of new siding varies significantly based on material type, square footage, regional labor rates, and installation complexity. Vinyl siding generally represents a more economical option, while fiber cement, brick, or high-end wood can be more expensive. Its crucial to obtain multiple quotes that include both material and labor costs for an accurate estimate tailored to your project.

What are the key benefits of installing new siding?

Installing new siding offers numerous benefits, including enhanced curb appeal and increased property value, superior protection against harsh weather elements, and improved energy efficiency through better insulation, which can lead to reduced utility bills. Modern siding materials also offer increased durability and often require minimal maintenance, saving time and money in the long run.

How long does siding typically last, and what maintenance is required?

Siding lifespan varies by material: vinyl can last 20-40 years, fiber cement 30-50 years, and wood 20-40 years with proper care. Maintenance typically involves periodic cleaning to prevent mold and mildew, inspection for damage, and timely repairs. Wood siding may require more frequent painting or staining, while vinyl and fiber cement are generally low-maintenance.

How does siding contribute to a homes energy efficiency?

Siding significantly contributes to a homes energy efficiency by forming an insulating barrier that reduces heat transfer between the interior and exterior. Insulated siding, in particular, offers superior thermal performance, helping to maintain stable indoor temperatures and reducing the workload on HVAC systems. This leads to lower energy consumption and decreased heating and cooling costs throughout the year.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cladding and Siding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- PVC Modifier Market Size Report By Type (ACR (acrylic based polymer), MBS (Methacrylate Butadiene Styrene), CPE (Chlorinated Polyethylene), Others), By Application (Pipes & fittings, Film & sheet, Siding & trim, Injection molding, Windows & doors, Fence, deck & rail, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Vertical Siding Market Statistics 2025 Analysis By Application (Entryways, Low Porch Walls, Gables, Dormers, Other), By Type (BOARD & BATTEN, CHAMFER BOARD, TRIPLE 3-1/3", BEADED TRIPLE 2", IRONMAXDOUBLE 5", UNIVERSAL TRIPLE 4"), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- PVC Modifier Market Statistics 2025 Analysis By Application (Pipes & fittings, Film & sheet, Siding & trim, Injection molding, Windows & doors, Fence, deck & rail), By Type (ACR (acrylic based polymer), MBS (Methacrylate Butadiene Styrene), CPE (Chlorinated Polyethylene)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fiber Cement Siding Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Shingle Fiber Cement Siding, Sheet Form Fiber Cement Siding, Lap Siding Fiber Cement Siding, Stucco or Brick Fiber Cement Siding), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager