Spray Foam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428169 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Spray Foam Market Size

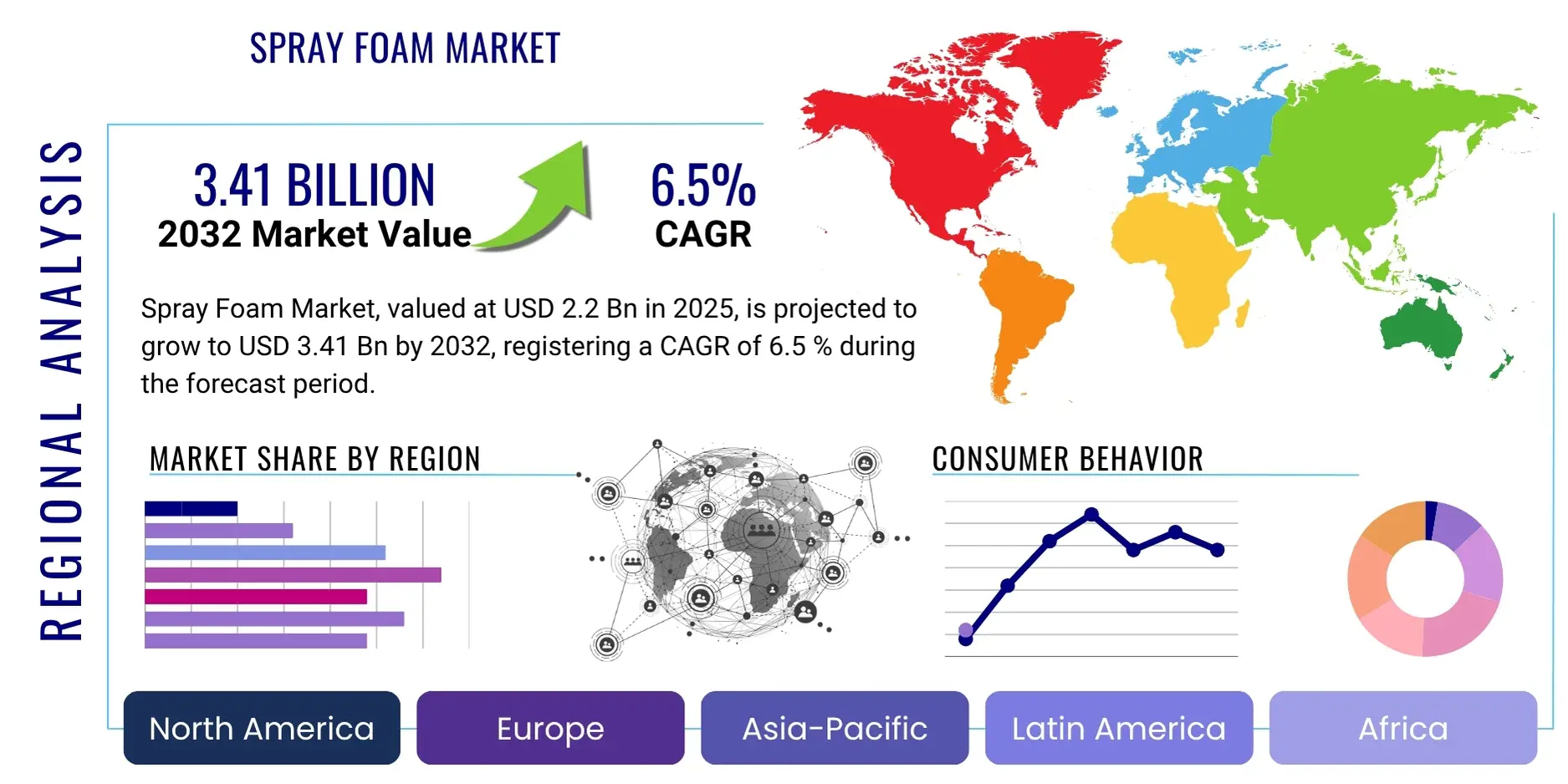

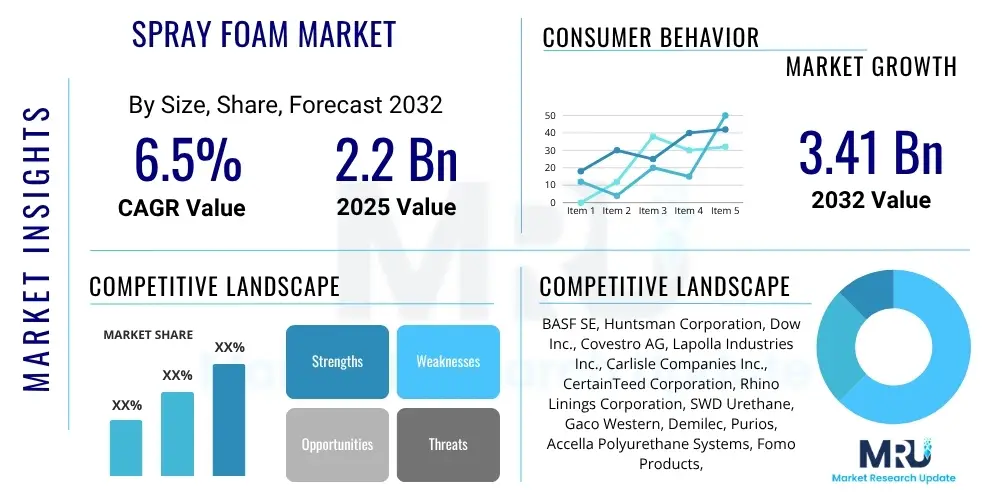

The Spray Foam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 2.2 Billion in 2025 and is projected to reach USD 3.41 Billion by the end of the forecast period in 2032. This growth trajectory is underpinned by increasing global awareness concerning energy efficiency, coupled with stringent building codes and expanding construction activities across both residential and commercial sectors. The superior insulation properties and versatility of spray foam are key factors contributing to its consistent market expansion, positioning it as a preferred solution for modern construction and retrofitting projects aimed at enhancing thermal performance and reducing carbon footprints.

Spray Foam Market introduction

The spray foam market encompasses advanced insulation and sealing materials, primarily polyurethane and polyisocyanurate based, applied as a liquid that expands and hardens into a solid foam. This innovative product serves as a highly effective thermal barrier and air sealant in various construction and industrial applications. Its unique properties, including high R-value per inch, air barrier capabilities, and moisture resistance, make it an increasingly popular choice over traditional insulation materials.

Product descriptions of spray foam typically categorize it into two main types: closed-cell and open-cell. Closed-cell spray foam is a dense, rigid material with a high R-value, offering excellent structural integrity, vapor barrier properties, and resistance to water. Open-cell spray foam, conversely, is lighter, more flexible, and provides an effective air barrier while allowing for some moisture permeability. Both types deliver significant benefits, including substantial energy savings, improved indoor air quality by preventing allergen and pollutant infiltration, and enhanced soundproofing.

Major applications for spray foam span across residential, commercial, and industrial construction, primarily for wall, roof, attic, and floor insulation. Beyond insulation, it is widely used for air sealing cracks and gaps in building envelopes, providing continuous thermal protection. The market's driving factors include the escalating demand for energy-efficient buildings, favorable government regulations promoting sustainable construction practices, increasing disposable incomes leading to better quality housing, and a growing emphasis on green building certifications globally.

Spray Foam Market Executive Summary

The Executive Summary for the Spray Foam Market reveals a robust growth outlook, driven by critical business trends centered on sustainability and energy conservation. Manufacturers are increasingly investing in research and development to create more environmentally friendly formulations, such as bio-based and low-VOC (Volatile Organic Compound) spray foams, aligning with global green building initiatives. Furthermore, the market is witnessing strategic collaborations and mergers among key players, aimed at expanding geographic reach and enhancing product portfolios to meet diverse application demands. The emphasis on smart construction technologies that integrate insulation solutions seamlessly is also a significant business trend influencing market dynamics.

Regional trends indicate North America and Europe as mature markets with high adoption rates, fueled by strict energy efficiency codes and a strong focus on retrofitting existing structures. The Asia Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization, substantial infrastructure development projects, and a burgeoning middle class seeking modern and energy-efficient housing solutions. Latin America, the Middle East, and Africa are also showing promising growth, attributed to increasing construction activities and a rising awareness regarding the long-term benefits of superior insulation in mitigating extreme climatic conditions.

Segment trends highlight the dominance of the closed-cell spray foam segment due to its superior insulating properties and structural benefits, particularly in demanding applications. However, the open-cell segment is also gaining traction for its cost-effectiveness and sound-attenuating capabilities. In terms of end-use, the residential construction sector continues to hold the largest market share, driven by new home construction and renovation projects. The commercial and industrial segments are witnessing accelerated adoption, especially in large-scale projects where stringent energy performance standards and durability are paramount, reflecting a comprehensive market expansion across all major verticals.

AI Impact Analysis on Spray Foam Market

The integration of Artificial Intelligence (AI) within the spray foam market is poised to revolutionize several aspects, addressing common user questions related to precision, efficiency, safety, and sustainability. Users frequently inquire about how AI can enhance the accuracy and consistency of spray foam application, minimize material waste, and improve overall project timelines. There is also significant interest in AI's potential to ensure installer safety by monitoring environmental conditions and optimizing equipment performance, as well as its role in developing next-generation, sustainable foam formulations. The overarching expectation is that AI will streamline operations, reduce costs, and elevate the quality of insulation projects, thereby extending the lifespan and performance of spray foam installations.

Key themes emerging from these inquiries include the potential for AI-driven robotics in automated application, which could lead to unprecedented levels of precision and uniformity, particularly in complex architectural designs. Concerns often revolve around the initial investment required for AI implementation, the need for skilled personnel to manage these advanced systems, and data privacy issues. However, the anticipated benefits, such as predictive maintenance of spray foam equipment to prevent downtime and real-time quality control checks, generally outweigh these concerns, signaling a positive outlook for AI adoption within the industry. Expectations are high for AI to facilitate smarter material logistics and inventory management, ensuring timely availability of components and reducing supply chain disruptions.

Ultimately, the consensus among market participants is that AI will act as a significant catalyst for innovation and operational excellence in the spray foam sector. It is expected to not only optimize the application process but also contribute to a deeper understanding of material performance under various conditions, enabling the development of tailor-made solutions. This shift towards intelligent systems is anticipated to enhance competitive advantages for early adopters and set new benchmarks for efficiency and reliability in the insulation market. The potential for AI to drive more sustainable practices through optimized resource utilization and waste reduction also stands out as a critical area of interest and development.

- AI-powered robotics for automated, precise application, minimizing human error and material waste.

- Real-time quality control and inspection using computer vision to ensure uniform foam density and coverage.

- Predictive maintenance algorithms for spray foam equipment, optimizing uptime and reducing operational costs.

- Supply chain optimization through AI, predicting demand and managing raw material inventories more efficiently.

- Enhanced safety monitoring during installation, alerting to hazardous conditions or improper application techniques.

- AI-driven simulation and material science for developing advanced, more sustainable bio-based foam formulations.

- Data analytics for performance monitoring of installed spray foam, providing insights for future product improvements and energy savings.

DRO & Impact Forces Of Spray Foam Market

The Spray Foam Market is significantly influenced by a confluence of drivers, restraints, and opportunities, collectively forming the impact forces shaping its trajectory. One of the primary drivers is the escalating global emphasis on energy efficiency in buildings. As energy costs rise and environmental concerns mount, property owners and developers are increasingly opting for superior insulation solutions like spray foam to reduce heating and cooling loads, thereby lowering utility bills and carbon footprints. This push is further amplified by government regulations and mandates for energy-efficient construction, particularly in developed regions.

However, the market also faces notable restraints. The high initial installation cost of spray foam compared to traditional insulation materials can deter some budget-conscious consumers or smaller construction projects. Furthermore, volatility in raw material prices, primarily for polyols and isocyanates derived from petrochemicals, can impact manufacturing costs and market stability. Health concerns related to the off-gassing of chemicals during and immediately after installation also present a challenge, necessitating strict safety protocols and ventilation measures, which can add to project complexity and public perception issues.

Despite these challenges, substantial opportunities exist for market expansion. The growing trend of green building initiatives and certifications, such as LEED, provides a significant avenue for spray foam adoption due to its superior performance in achieving energy conservation goals. Innovations in bio-based and low-VOC foam formulations offer a promising pathway to address environmental and health concerns, attracting a broader customer base. Moreover, the vast market for retrofitting existing residential and commercial structures to meet modern energy efficiency standards presents a continuous demand for spray foam, allowing for significant market penetration and sustainable growth over the forecast period.

Segmentation Analysis

The spray foam market is comprehensively segmented to provide a granular understanding of its diverse applications, material compositions, and end-use industries. This segmentation is crucial for stakeholders to identify niche markets, assess competitive landscapes, and formulate targeted growth strategies. The market is primarily bifurcated by product type, focusing on the chemical structure and resulting properties of the foam, and by end-use industry, reflecting the major sectors where spray foam solutions are deployed.

Further segmentation includes various applications, detailing where the spray foam is physically installed within a structure or system, such as walls, roofs, or attics. This granular breakdown helps in analyzing the demand drivers specific to each application area and understanding regional consumption patterns. Each segment presents unique market dynamics influenced by regulatory environments, construction practices, and specific performance requirements, driving innovation and product development tailored to these distinct needs. The intricate interplay between these segments defines the overall market structure and future growth opportunities.

- By Type:

- Closed-cell Spray Foam

- Open-cell Spray Foam

- Other (e.g., Hybrid Spray Foam, specific low-density variants)

- By End-Use Industry:

- Residential Construction (single-family homes, multi-family dwellings)

- Commercial Construction (offices, retail, educational institutions, healthcare facilities)

- Industrial Construction (warehouses, manufacturing plants, agricultural buildings)

- Agricultural (storage facilities, livestock enclosures)

- Other (e.g., Automotive, Marine, Refrigeration)

- By Application:

- Wall Insulation (interior and exterior walls)

- Roofing Insulation (flat and sloped roofs)

- Attic Insulation (unconditioned and conditioned attics)

- Floor Insulation (crawl spaces, subfloors)

- Air Barrier Systems

- Sealants and Adhesives

Value Chain Analysis For Spray Foam Market

The value chain for the spray foam market begins with upstream activities, primarily involving the procurement and processing of raw materials. Key components include polyols (derived from petroleum or bio-based sources), isocyanates (such as MDI and TDI), and various additives like catalysts, blowing agents, flame retardants, and surfactants. Manufacturers of these chemical precursors play a critical role, as their pricing and supply stability directly impact the cost structure and production capabilities of spray foam producers. Research and development in this upstream segment are crucial for developing sustainable and high-performance components, fostering innovation throughout the value chain.

Moving downstream, the value chain progresses to the manufacturing and formulation of the two-part spray foam systems by specialized chemical companies. These companies blend the raw materials into A-side (isocyanate) and B-side (polyol blend) components, which are then packaged and distributed. This stage often involves quality control processes, product testing, and adherence to industry standards and certifications. The distribution channel then takes over, which can be direct from manufacturer to large contractors, or indirect through a network of distributors, wholesalers, and specialized retailers who supply smaller contractors and DIY enthusiasts. The effectiveness of this network is vital for market penetration and accessibility.

Finally, the value chain culminates in the installation and end-use of spray foam. Certified and trained spray foam contractors are responsible for the precise application of the product, ensuring optimal performance and safety. Their expertise in mixing ratios, surface preparation, and equipment operation is paramount for achieving the desired insulation and air sealing properties. Direct channels involve manufacturers selling directly to large-scale construction firms or providing installation services themselves, while indirect channels rely on an extensive network of independent contractors. The ongoing maintenance, performance monitoring, and eventual disposal or recycling of spray foam at the end of a building's lifecycle represent further downstream activities, though less formalized than initial application, contributing to the product's overall lifecycle impact.

Spray Foam Market Potential Customers

The potential customers for spray foam insulation are diverse and span across various sectors, primarily centered around those requiring enhanced energy efficiency, superior thermal performance, and robust building envelopes. The largest segment of end-users are residential property owners, including both new home builders and homeowners engaged in renovation or retrofitting projects. These buyers are motivated by the promise of significant long-term energy savings, improved indoor comfort, and a healthier living environment due to better air quality and moisture control. Developers of multi-family dwellings also represent a substantial customer base, seeking to offer energy-efficient units that attract discerning tenants and buyers.

Another significant group of potential customers comprises commercial building owners and developers. This includes proprietors of office buildings, retail establishments, educational institutions, healthcare facilities, and hospitality venues. For these customers, spray foam offers not only energy cost reduction but also compliance with stringent building codes, achieving green building certifications (like LEED), and creating more comfortable and productive environments for occupants. The durability and longevity of spray foam are also attractive, minimizing maintenance needs over the building's lifespan.

Furthermore, industrial and agricultural sectors represent a growing segment of potential customers. Industrial facilities, such as manufacturing plants, warehouses, and cold storage units, benefit from spray foam’s ability to maintain stable temperatures, prevent condensation, and create airtight seals, which is crucial for sensitive equipment or perishable goods. In agriculture, it is used in barns, storage silos, and animal enclosures to regulate temperature and humidity, improving conditions for livestock and crops. These diverse end-users are driven by both economic incentives through operational cost reductions and performance requirements specific to their specialized environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2032 | USD 3.41 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Huntsman Corporation, Dow Inc., Covestro AG, Lapolla Industries Inc., Carlisle Companies Inc., CertainTeed Corporation, Rhino Linings Corporation, SWD Urethane, Gaco Western, Demilec, Purios, Accella Polyurethane Systems, Fomo Products, Icynene-Lapolla, Spray Foam Solutions Inc., Versi-Foam, QuadFoam, General Coatings Manufacturing Corp., NCFI Polyurethanes |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spray Foam Market Key Technology Landscape

The spray foam market's technological landscape is characterized by continuous innovation aimed at enhancing product performance, sustainability, and application efficiency. A pivotal area of development involves advancements in polymer chemistry, particularly in the formulation of polyols and isocyanates. Manufacturers are heavily investing in creating low-VOC (Volatile Organic Compound) and bio-based polyols derived from renewable resources such as soy, castor, or sugar cane. These innovations address growing environmental concerns and regulatory pressures, making spray foam a more attractive option for green building projects by reducing its carbon footprint and improving indoor air quality.

Another significant technological trend is the development of advanced blowing agents. Traditionally, HFCs (hydrofluorocarbons) were used, but due to their high global warming potential, there has been a shift towards HFOs (hydrofluoroolefins) and other environmentally friendlier alternatives with ultra-low GWPs. These new blowing agents not only reduce environmental impact but also often improve the thermal performance and cell structure of the foam, leading to higher R-values and better insulation efficacy. Research is also focused on developing hybrid foam systems that combine the best properties of both open-cell and closed-cell foams, offering tailored solutions for specific application requirements such as sound dampening with robust thermal resistance.

Beyond material science, technological advancements extend to application equipment and digital integration. Smart spray foam machines are emerging, equipped with sensors and software that monitor and control mixing ratios, temperature, and pressure in real-time. This precision technology minimizes material waste, ensures consistent application quality, and enhances installer safety by providing immediate feedback on operating parameters. The integration of Building Information Modeling (BIM) and drone technology for pre-installation site analysis and post-installation quality inspection further streamlines processes, making spray foam application more efficient, reliable, and integrated into modern construction workflows, ultimately driving greater adoption across various sectors.

Regional Highlights

- North America: This region is a mature and leading market for spray foam, driven by stringent energy efficiency codes (e.g., ASHRAE standards), a large existing building stock requiring retrofitting, and robust new construction activities. The U.S. and Canada show high adoption rates due to consumer awareness and government incentives for sustainable building practices.

- Europe: Europe exhibits strong growth, fueled by ambitious climate targets, the "Renovation Wave" strategy, and a dense regulatory framework promoting nearly zero-energy buildings (NZEB). Countries like Germany, France, and the UK are key players, with a focus on improving the energy performance of residential and commercial properties.

- Asia Pacific (APAC): APAC is the fastest-growing market, characterized by rapid urbanization, massive infrastructure development, and increasing disposable incomes. Countries such as China, India, and Southeast Asian nations are witnessing a surge in construction, driving demand for energy-efficient insulation solutions to cope with diverse climatic conditions.

- Latin America: This region presents significant growth potential, with increasing investments in residential and commercial construction projects, particularly in Brazil, Mexico, and Argentina. Growing awareness of energy conservation and the need for durable building materials in varying climates are key market drivers.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth due to large-scale construction developments, including smart cities and hospitality projects, coupled with extreme climatic conditions necessitating effective insulation. Government initiatives aimed at energy conservation and diversification from oil economies are also boosting market demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spray Foam Market.- BASF SE

- Huntsman Corporation

- Dow Inc.

- Covestro AG

- Lapolla Industries Inc.

- Carlisle Companies Inc.

- CertainTeed Corporation

- Rhino Linings Corporation

- SWD Urethane

- Gaco Western

- Demilec

- Purios

- Accella Polyurethane Systems

- Fomo Products

- Icynene-Lapolla

- Spray Foam Solutions Inc.

- Versi-Foam (RHH Foam Systems, Inc.)

- QuadFoam

- General Coatings Manufacturing Corp.

- NCFI Polyurethanes

Frequently Asked Questions

Analyze common user questions about the Spray Foam market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is spray foam insulation and how does it work?

Spray foam insulation is a highly effective chemical product applied as a liquid that expands rapidly into a solid, monolithic foam, creating an air-tight seal and a robust thermal barrier within a building's structure. It functions by conforming to the contours of cavities, sealing all gaps and cracks, thereby preventing air leakage which is a primary source of energy loss. Its superior performance is attributed to an excellent R-value (thermal resistance) per inch and its ability to create a seamless barrier that significantly improves a building's overall energy efficiency and indoor climate control.

What are the primary benefits of using spray foam in construction?

The primary benefits of integrating spray foam into construction projects are multifaceted, offering significant improvements over traditional insulation methods. These include superior thermal insulation properties leading to substantial energy savings by minimizing heat transfer, drastically reduced air leakage which enhances the building's envelope integrity, and augmented structural strength for walls and roofs. Additionally, spray foam contributes to improved indoor air quality by blocking common allergens, pollutants, and moisture infiltration, and provides exceptional soundproofing capabilities, creating quieter and more comfortable living or working environments. Its long-term durability and resistance to mold and pests further contribute to its appeal and value.

Are there any health or safety concerns associated with spray foam?

While cured spray foam is considered inert and non-toxic, health and safety considerations primarily revolve around the installation phase due to the release of volatile organic compounds (VOCs), particularly isocyanates, during the chemical reaction. Proper installation requires strict adherence to safety protocols, including comprehensive ventilation of the work area, mandatory use of personal protective equipment (PPE) by installers, and vacating the premises by occupants during and immediately after application for a specified period (typically 24-72 hours). Reputable contractors are trained to mitigate these risks, ensuring a safe application process and a healthy indoor environment once the foam has fully cured.

How does spray foam compare to traditional insulation materials like fiberglass or cellulose?

Spray foam typically outperforms traditional insulation materials such as fiberglass and cellulose in several critical aspects. It boasts a higher R-value per inch, offering superior thermal resistance in a thinner application. Its unique ability to expand and seal all gaps makes it an unmatched air barrier, significantly reducing drafts and uncontrolled air infiltration, which is often a weakness for batt or blown-in insulation. While initial installation costs for spray foam can be higher, its long-term benefits in terms of energy savings, moisture resistance, and contribution to structural integrity often provide a more favorable return on investment. Fiberglass and cellulose generally offer a lower upfront cost but may not achieve the same level of air sealing or thermal performance without additional measures.

What factors drive the growth of the spray foam market globally?

The global spray foam market's robust growth is propelled by several key factors. Paramount among these is the escalating demand for energy-efficient buildings driven by rising energy costs and increasing environmental consciousness among consumers and policymakers. Stringent government regulations and building codes promoting sustainable construction practices and green building certifications, such as LEED, further incentivize its adoption. The expansion of both residential and commercial construction sectors, particularly in rapidly developing economies, creates a continuous need for high-performance insulation. Moreover, continuous innovations in product formulations, including the development of bio-based and low-VOC options, enhance its appeal and market penetration, positioning spray foam as a crucial component in modern, sustainable building design.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Spray Foam Insulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Spray Foam Insulation Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Closed Cell Foam, Open Cell Foam), By Application (Residential, Commercial, Industrial, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager