Sterile Medical Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430489 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Sterile Medical Packaging Market Size

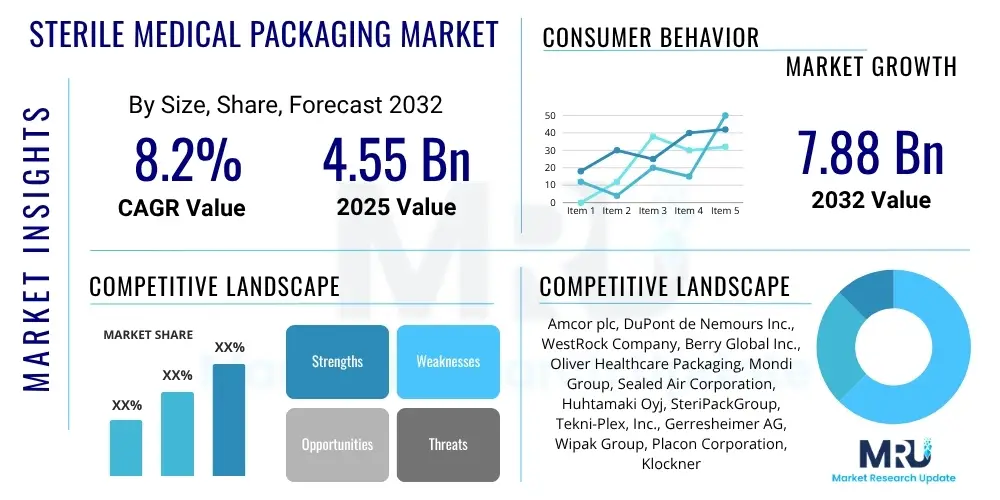

The Sterile Medical Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2025 and 2032. The market is estimated at USD 4.55 Billion in 2025 and is projected to reach USD 7.88 Billion by the end of the forecast period in 2032.

Sterile Medical Packaging Market introduction

The Sterile Medical Packaging Market encompasses a comprehensive range of materials and sophisticated technologies engineered to preserve the sterility of medical devices, pharmaceutical formulations, and in-vitro diagnostics. This critical process begins at manufacturing and extends through sterilization, transportation, storage, and ultimately, to the point of clinical use. The primary function of such packaging is to establish an impermeable barrier against microbial contamination, while simultaneously offering robust protection against physical damage, maintaining the chemical integrity of sensitive contents, and ensuring compliance with stringent regulatory requirements. The unwavering integrity of sterile packaging is fundamental within healthcare, directly influencing patient safety outcomes and upholding global health standards by preventing hospital-acquired infections (HAIs) and preserving product efficacy.

The product landscape within this specialized market is extensive, featuring flexible solutions such as films, pouches, and bags, predominantly fabricated from advanced plastics like polyethylene, polypropylene, and polyethylene terephthalate, known for their barrier and processing versatility. Concurrently, rigid packaging forms include precision-engineered trays, clamshells, vials, and ampoules, which may utilize high-grade glass, intricate thermoformed plastics, or specialized paperboards. The judicious selection of materials and specific package designs is meticulously determined by the product's intended sterilization method, such as ethylene oxide, gamma irradiation, or steam, coupled with the product's intrinsic physical attributes and the rigorous regulatory mandates applicable in various geographies. Ongoing innovation in packaging materials focuses intensely on developing enhanced barrier properties, optimizing breathability for gas sterilization processes, and perfecting mechanisms for aseptic presentation, which is crucial for preventing contamination during clinical procedures.

Major applications for sterile medical packaging span across the vast and expanding global healthcare ecosystem, encompassing the secure containment of complex surgical instruments, life-saving implants, precision syringes, advanced catheters, vital diagnostic kits, and a wide array of pharmaceutical and biopharmaceutical products. The tangible benefits derived from resilient and reliable sterile packaging are profound and multi-layered. Foremost, it acts as a bulwark for patient safety by drastically reducing the risk of infection, thereby extending the viable shelf life of sensitive medical products. Furthermore, it guarantees unwavering adherence to exacting international regulatory frameworks, including those set forth by the FDA, EMA, and ISO standards, which dictate the highest levels of product safety and quality assurance. This market is propelled by a confluence of influential factors, notably the burgeoning global healthcare expenditure, an escalating volume of surgical procedures driven by aging demographics and the increasing prevalence of chronic diseases, and an ever-tightening landscape of regulatory mandates that demand superior product safety and quality. These cumulative drivers actively stimulate continuous innovation and expansion within the sterile medical packaging sector, underscoring the critical need for unparalleled reliability and advanced protective capabilities in healthcare packaging.

Sterile Medical Packaging Market Executive Summary

The Sterile Medical Packaging Market is characterized by dynamic business trends, marked by a significant shift towards sustainable and eco-friendly packaging solutions. Manufacturers are increasingly investing in research and development to introduce recyclable, biodegradable, and renewable materials, aiming to mitigate the environmental impact of medical waste without compromising sterility or product integrity. There is also a growing demand for customized packaging solutions that cater to specific medical device geometries and pharmaceutical dosage forms, enhancing protection, usability, and regulatory compliance. Furthermore, digitalization is influencing business processes, with greater emphasis on supply chain transparency, traceability through advanced labeling, and efficient inventory management, all contributing to streamlined operations and reduced costs within the highly regulated healthcare sector. The competitive landscape is evolving, with both established players and emerging innovators striving to differentiate through technological advancements, strategic partnerships, and focused efforts on achieving regulatory excellence in diverse global markets.

Regionally, the market exhibits varied growth trajectories and maturity levels. North America and Europe currently represent the largest and most mature markets, driven by advanced healthcare infrastructures, high per capita healthcare spending, and stringent regulatory environments that mandate high-quality sterile packaging. These regions are leaders in adopting innovative materials and advanced packaging technologies. Conversely, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly expanding healthcare sectors, increasing medical tourism, a burgeoning middle-class population demanding better healthcare access, and significant investments in medical device and pharmaceutical manufacturing capabilities. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by improving healthcare access, increasing governmental healthcare spending, and a growing reliance on imported medical products, which necessitates robust sterile packaging solutions to ensure product integrity during extended supply chains. Each region presents unique challenges and opportunities, influenced by economic development, healthcare policies, and local regulatory frameworks.

Segmentation trends reveal significant shifts across various categories. In terms of materials, plastics, particularly polyethylene and polypropylene, continue to dominate due to their versatility, barrier properties, and cost-effectiveness, though there's a discernible move towards high-performance plastics and multi-layer films for enhanced protection. However, the market is also witnessing increasing adoption of paper and paperboard for specific applications, driven by sustainability goals. By product type, bags and pouches maintain a leading share, reflecting their widespread use for diverse medical products, while thermoformed trays and blister packaging are experiencing robust growth due attributed to their superior product visibility and protection for delicate devices. Furthermore, Ethylene Oxide (EtO) sterilization remains a prevalent method, though alternatives like E-beam and gamma sterilization are gaining traction due to concerns over EtO's environmental and health impacts, and the increasing volume of products that can withstand radiation. The end-use segment continues to be led by pharmaceutical and biopharmaceutical companies and medical device manufacturers, who are the primary consumers of sterile packaging, with hospitals and clinics also representing significant and growing end-users requiring point-of-care sterile solutions.

AI Impact Analysis on Sterile Medical Packaging Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sterile Medical Packaging Market frequently revolve around how AI can enhance efficiency, ensure higher quality, and improve regulatory compliance in this highly critical sector. Common questions highlight expectations for AI in automating inspection processes, optimizing supply chain logistics, and enabling more intelligent material selection for packaging. Users are particularly interested in AI's role in predictive maintenance for complex packaging machinery, which could significantly reduce downtime and operational costs. Concerns often include the initial high investment required for AI integration, potential data privacy issues given the sensitive nature of medical data, and the impact on the workforce, specifically regarding job displacement versus augmentation. The overarching theme is a desire to understand how AI can elevate precision, reduce errors, and ultimately contribute to safer patient outcomes within the constraints of strict regulatory oversight and cost pressures.

- Automated quality control and defect detection through computer vision systems, significantly reducing human error and improving inspection speed.

- Predictive maintenance for packaging machinery, leveraging sensor data to anticipate equipment failures, minimize downtime, and optimize operational efficiency.

- Supply chain optimization and traceability by analyzing vast datasets to enhance inventory management, reduce waste, and provide real-time tracking of sterile products.

- Smart material design and selection, using AI algorithms to simulate material performance under various sterilization conditions, identifying optimal packaging compositions for specific medical products.

- Enhanced regulatory compliance monitoring and documentation, as AI can process and analyze complex regulatory texts, ensuring packaging designs and processes meet current standards and streamlining audit readiness.

- Personalized and on-demand packaging solutions, driven by AI insights into patient needs and localized market demands, leading to more efficient and customized production runs.

- Optimization of sterilization cycles and processes, where AI can fine-tune parameters for different products, ensuring maximum sterility efficacy with minimal material degradation.

DRO & Impact Forces Of Sterile Medical Packaging Market

The Sterile Medical Packaging Market is predominantly driven by the escalating global demand within the healthcare industry, a trend fueled by an aging population, the rising prevalence of chronic and infectious diseases, and continuous advancements in medical technology, all of which necessitate more sophisticated and reliable sterile packaging solutions. The increasing number of surgical procedures performed worldwide, coupled with the growing preference for minimally invasive surgeries that require specialized instruments, directly contributes to the demand for sterile packaging. Furthermore, stringent regulatory standards imposed by health authorities like the FDA, EMA, and ISO bodies mandate the use of high-quality, validated sterile packaging to ensure product safety and prevent healthcare-associated infections. This regulatory pressure compels manufacturers to invest in advanced packaging materials and processes, thereby acting as a significant market driver. The expansion of the pharmaceutical and biotechnology sectors, particularly in novel drug delivery systems and biologics, also boosts the need for specialized sterile packaging that can protect sensitive formulations and maintain their efficacy throughout their shelf life and distribution.

Despite robust growth drivers, the market faces several notable restraints. A primary concern is the relatively high cost associated with manufacturing and validating sterile medical packaging, largely due to the use of specialized materials, complex production processes, and rigorous quality control measures. These costs can particularly impact smaller medical device or pharmaceutical companies. Environmental concerns also present a significant restraint; the vast majority of sterile packaging materials are plastic-based, contributing to plastic waste and increasing pressure on manufacturers to adopt more sustainable alternatives, which often come with higher price tags and technological hurdles. Furthermore, the intricate and continually evolving global regulatory landscape poses a compliance challenge, requiring significant investments in research, testing, and documentation to meet diverse regional and international standards. This complexity can hinder market entry for new players and slow down product innovation. Lastly, volatility in the prices of raw materials, such as polymers and paper, can impact production costs and profit margins for packaging manufacturers, introducing an element of financial uncertainty into the market.

Opportunities within the Sterile Medical Packaging Market primarily revolve around innovation in sustainable and smart packaging solutions. The growing global emphasis on environmental sustainability is creating a strong impetus for the development and adoption of biodegradable, compostable, and recyclable packaging materials that do not compromise on sterility or barrier properties. This shift offers a significant avenue for market expansion and differentiation. Moreover, the integration of smart packaging technologies, such as RFID tags, NFC sensors, and time-temperature indicators, presents a substantial opportunity to enhance traceability, anti-counterfeiting measures, and real-time monitoring of product integrity throughout the supply chain. These technologies can provide crucial data points for product safety and logistics optimization. Emerging markets in Asia Pacific, Latin America, and the Middle East & Africa offer untapped potential, driven by improving healthcare infrastructure, rising disposable incomes, and increasing access to advanced medical treatments. Technological advancements in sterilization methods and aseptic processing techniques also create opportunities for packaging manufacturers to develop compatible and more efficient packaging solutions. The confluence of these opportunities, alongside a strong regulatory push for higher standards, is expected to fuel significant market expansion and diversification.

Segmentation Analysis

The Sterile Medical Packaging Market is comprehensively segmented to provide granular insights into its diverse components, categorized primarily by material type, product type, the sterilization method employed, and the end-use industry utilizing these crucial packaging solutions. This detailed segmentation allows for a nuanced understanding of market dynamics, identifying key growth areas, technological advancements, and shifts in consumer preferences across the healthcare value chain. Each segment reflects specific functional requirements, regulatory considerations, and cost-effectiveness, enabling both manufacturers and end-users to make informed decisions regarding material selection, design innovation, and strategic investments. The interplay between these segments also highlights the continuous evolution of packaging technologies driven by demands for enhanced sterility, increased shelf life, improved patient safety, and greater environmental sustainability.

- By Material:

- Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others (e.g., Polycarbonate, Nylon)

- Paper and Paperboard

- Glass

- Metal (e.g., Aluminum foil)

- Others (e.g., Tyvek, Non-woven materials)

- Plastics

- By Product Type:

- Bags and Pouches

- Sterilization Pouches

- Form-Fill-Seal Bags

- Header Bags

- Trays

- Thermoformed Trays

- Injection Molded Trays

- Clamshells

- Vials and Ampoules

- Blister Packaging

- Wraps (e.g., CSR Wraps)

- Others (e.g., Bottles, Syringes, Tubes)

- Bags and Pouches

- By Sterilization Method:

- Gamma Sterilization

- E-beam Sterilization

- Ethylene Oxide (EtO) Sterilization

- Steam Sterilization (Autoclave)

- Radiation Sterilization (e.g., X-ray)

- Others (e.g., Hydrogen Peroxide Gas Plasma, Dry Heat)

- By End-Use Industry:

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Manufacturers

- In-Vitro Diagnostics Manufacturers

- Hospitals and Clinics

- Contract Sterilization Services Providers

- Others (e.g., Research Laboratories, Academic Institutions)

Value Chain Analysis For Sterile Medical Packaging Market

The value chain for the Sterile Medical Packaging Market initiates with upstream activities involving the sourcing and processing of raw materials, which are foundational to the entire packaging ecosystem. Key raw material suppliers provide a diverse range of primary components, including various types of polymers such as polyethylene, polypropylene, and PET for plastic films and rigid containers. They also supply specialized papers and paperboards with specific barrier and sterilization compatibility properties, high-grade glass for vials and ampoules, and metals like aluminum foil for laminated structures. These suppliers play a critical role in innovation, focusing on developing new materials that offer enhanced barrier properties, improved sustainability profiles, and better compatibility with advanced sterilization techniques. Their ability to provide consistent quality and meet stringent specifications is paramount, as any compromise at this stage can impact the final product's sterility and integrity. The competitive landscape among raw material providers often drives material innovation and cost efficiencies, directly influencing the downstream packaging manufacturing processes.

Further down the value chain, these raw materials are transformed by converters and specialized packaging manufacturers into finished sterile packaging products. This stage involves complex manufacturing processes such as extrusion, thermoforming, injection molding, printing, and lamination to create various product types including bags, pouches, trays, blisters, and wraps. Packaging manufacturers are responsible for designing solutions that not only maintain sterility but also offer user-friendly aseptic presentation, robust physical protection, and clear labeling for regulatory compliance and traceability. They work closely with medical device and pharmaceutical companies to develop customized packaging solutions that are compatible with specific sterilization methods and product characteristics. This segment of the value chain is characterized by significant capital investment in advanced machinery, cleanroom environments, and quality assurance systems to meet the exacting demands of the healthcare industry. Innovation here often focuses on improving manufacturing efficiency, reducing material usage, and enhancing the functional attributes of the packaging.

The distribution channel for sterile medical packaging is multifaceted, primarily involving both direct and indirect sales approaches to reach end-users. Direct sales are common for large-volume customers, such as major pharmaceutical companies, global medical device manufacturers, and large hospital networks, where manufacturers engage directly to provide tailored solutions, technical support, and long-term supply agreements. This direct relationship fosters closer collaboration on design and innovation. Conversely, indirect distribution channels involve a network of specialized distributors and wholesalers who cater to a broader range of smaller healthcare facilities, clinics, pharmacies, and contract manufacturing organizations (CMOs) or contract research organizations (CROs). These distributors often maintain inventories of standard sterile packaging products, providing logistical support and regional accessibility. E-commerce plays a limited but growing role, primarily for standardized or less complex sterile packaging components, with the emphasis remaining on secure, reliable, and compliant delivery methods due to the sensitive nature of the products. The efficiency and reliability of these distribution channels are critical in ensuring that sterile medical products reach their final destination without compromising their integrity or delaying vital healthcare services.

Sterile Medical Packaging Market Potential Customers

The primary end-users and buyers within the Sterile Medical Packaging Market constitute a broad spectrum of entities across the global healthcare ecosystem, all sharing a fundamental need for packaging that guarantees product sterility and safety. Foremost among these are pharmaceutical and biopharmaceutical companies, which rely heavily on sterile packaging for a vast array of products, including injectable drugs, vaccines, biologics, and sterile formulations. These companies require packaging that ensures drug stability, compatibility with complex drug compounds, and compliance with stringent pharmacological regulations. Their demand is for high-barrier films, pre-filled syringe systems, vials, and ampoules that protect against contamination and preserve the efficacy of their often sensitive and high-value products throughout their shelf life and distribution channels. The growth in novel drug development and personalized medicine further intensifies their need for innovative and specialized sterile packaging solutions, driving continuous market demand.

Another major segment of potential customers includes medical device manufacturers, who utilize sterile packaging for a wide range of products from surgical instruments and implants to diagnostic tools and catheters. For these manufacturers, packaging must not only maintain sterility but also protect against physical damage during transport and handling, facilitate easy and aseptic presentation in clinical settings, and withstand various sterilization methods without degradation. The increasing complexity and miniaturization of medical devices necessitate highly customized packaging designs that offer superior protection and functionality. Hospitals and clinics also represent significant direct end-users, requiring sterile packaging for supplies, instruments that are re-sterilized in-house, and for managing inventory of disposable medical products. Additionally, in-vitro diagnostics (IVD) manufacturers, contract sterilization services providers, and various research laboratories and academic institutions also form a crucial part of the customer base, each requiring specialized sterile packaging solutions tailored to their unique operational needs and regulatory obligations. The diverse needs of these end-users underscore the market's dynamic nature and the continuous drive for innovation in sterile medical packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.55 Billion |

| Market Forecast in 2032 | USD 7.88 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, DuPont de Nemours Inc., WestRock Company, Berry Global Inc., Oliver Healthcare Packaging, Mondi Group, Sealed Air Corporation, Huhtamaki Oyj, SteriPackGroup, Tekni-Plex, Inc., Gerresheimer AG, Wipak Group, Placon Corporation, Klockner Pentaplast, CCL Industries Inc., 3M Company, Orchid Orthopedic Solutions, Sonoco Products Company, Nelipak Healthcare Packaging, Becton Dickinson and Company (BD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sterile Medical Packaging Market Key Technology Landscape

The Sterile Medical Packaging Market is continuously evolving through the integration of advanced technologies aimed at enhancing sterility assurance, improving product integrity, and optimizing supply chain efficiencies. A pivotal technological advancement is the development of high-performance barrier films and laminates, which are engineered with multi-layer structures and specialized coatings to provide superior protection against moisture, oxygen, and microbial penetration. These advanced materials are crucial for extending the shelf life of highly sensitive medical products and pharmaceuticals, offering enhanced compatibility with diverse sterilization methods, and ensuring chemical inertness to prevent interaction with the packaged contents. Innovations in these films also focus on properties like peel strength, puncture resistance, and clarity, which are essential for safe aseptic presentation in clinical environments, making them indispensable for modern medical applications.

Another significant technological trend shaping the market is the rise of smart packaging solutions, which integrate active and intelligent features directly into the packaging. This includes the incorporation of RFID (Radio Frequency Identification) tags, NFC (Near Field Communication) chips, and various indicators such as time-temperature indicators (TTIs), sterilization indicators, and integrity sensors. These technologies enable real-time tracking and tracing of sterile products throughout the entire supply chain, providing invaluable data for inventory management, anti-counterfeiting measures, and ensuring regulatory compliance. Smart packaging can alert users to potential breaches in sterility or adverse environmental conditions, thereby enhancing product safety and reducing waste from compromised goods. The ability to monitor environmental conditions and product status wirelessly contributes significantly to improving logistical efficiency and ensuring the integrity of medical products from manufacturer to patient.

Furthermore, aseptic filling and packaging systems represent a critical technology, especially for sterile pharmaceutical products and sensitive biologics that cannot withstand terminal sterilization. These systems operate in highly controlled, sterile environments, preventing microbial contamination during the filling and sealing processes. Advances in automation and robotics are also transforming the packaging lines, leading to high-speed, precision operations that minimize human intervention, reduce the risk of error, and increase throughput while maintaining the highest levels of sterility. Alongside these, continuous advancements in sterilization techniques, such as enhanced e-beam and gamma irradiation processes, and innovative gas plasma sterilization methods, demand compatible and resistant packaging materials. The integration of advanced analytics and AI for process optimization, predictive maintenance of packaging machinery, and automated visual inspection systems further solidifies the technological landscape, collectively aiming to achieve unparalleled levels of safety, efficiency, and compliance in sterile medical packaging.

Regional Highlights

- North America: This region holds a dominant share in the Sterile Medical Packaging Market, driven by its robust and technologically advanced healthcare infrastructure, significant healthcare expenditure, and the presence of numerous leading pharmaceutical and medical device manufacturers. The United States, in particular, leads in innovation and adoption of advanced packaging solutions due to stringent regulatory frameworks imposed by the FDA, which mandate high standards for sterile medical products. The increasing prevalence of chronic diseases, a growing geriatric population, and a high volume of surgical procedures further propel market growth. Additionally, a strong focus on research and development, coupled with rapid adoption of new technologies and materials, positions North America as a key influencer in global market trends, emphasizing both product safety and supply chain efficiency.

- Europe: Europe represents another major market for sterile medical packaging, characterized by a well-established healthcare system, stringent EU directives and regulations (such as MDR and IVDR), and a strong emphasis on sustainability. Countries like Germany, France, and the UK are at the forefront of medical device manufacturing and pharmaceutical production, fostering high demand for sophisticated sterile packaging. The region is increasingly focused on developing eco-friendly and recyclable packaging solutions to align with broader environmental goals without compromising sterility. Europe's proactive approach to adopting advanced sterilization technologies and its commitment to quality assurance contribute significantly to market expansion. The collaborative efforts between industry players and regulatory bodies ensure a consistent drive towards innovation and compliance, maintaining the region's strong market position.

- Asia Pacific (APAC): The Asia Pacific region is anticipated to exhibit the fastest growth rate in the Sterile Medical Packaging Market during the forecast period. This accelerated growth is primarily attributed to rapidly expanding healthcare infrastructures, increasing healthcare expenditure, a large and growing population, and rising medical tourism across countries like China, India, Japan, and South Korea. These nations are becoming significant manufacturing hubs for medical devices and generic pharmaceuticals, leading to a surge in demand for sterile packaging materials and services. Government initiatives to improve healthcare access and quality, coupled with a growing awareness of patient safety, are also key drivers. While regulatory frameworks are developing, the increasing adoption of international standards is pushing for higher quality sterile packaging, creating immense opportunities for both local and international players.

- Latin America: The Sterile Medical Packaging Market in Latin America is an emerging region, experiencing gradual but consistent growth. This growth is fueled by improving economic conditions, increased investment in healthcare infrastructure, and a rising awareness regarding healthcare standards and patient safety. Countries like Brazil, Mexico, and Argentina are witnessing an expansion of their pharmaceutical and medical device manufacturing capabilities, along with an increase in surgical procedures. While the market is currently smaller compared to North America and Europe, the demand for high-quality sterile packaging is steadily increasing due to global market influences and efforts to align with international regulatory practices. Opportunities exist for manufacturers to cater to the growing local demand and to establish regional distribution networks.

- Middle East and Africa (MEA): The MEA region is characterized by a developing healthcare sector, with varying levels of infrastructure and regulatory maturity across different countries. The demand for sterile medical packaging is predominantly driven by increasing government spending on healthcare, efforts to modernize medical facilities, and a growing reliance on imported medical devices and pharmaceuticals. Gulf Cooperation Council (GCC) countries, in particular, are investing heavily in healthcare tourism and developing world-class medical facilities, thereby boosting the demand for high-quality sterile packaging. The region presents significant growth potential, although challenges such as diverse regulatory landscapes, political instability in some areas, and infrastructure limitations need to be addressed. As healthcare access improves and local manufacturing capabilities expand, the market for sterile medical packaging is expected to grow steadily in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sterile Medical Packaging Market.- Amcor plc

- DuPont de Nemours Inc.

- WestRock Company

- Berry Global Inc.

- Oliver Healthcare Packaging

- Mondi Group

- Sealed Air Corporation

- Huhtamaki Oyj

- SteriPackGroup

- Tekni-Plex, Inc.

- Gerresheimer AG

- Wipak Group

- Placon Corporation

- Klockner Pentaplast

- CCL Industries Inc.

- 3M Company

- Orchid Orthopedic Solutions

- Sonoco Products Company

- Nelipak Healthcare Packaging

- Becton Dickinson and Company (BD)

Frequently Asked Questions

What are the primary drivers propelling the growth of the Sterile Medical Packaging Market?

The Sterile Medical Packaging Market is primarily driven by the expanding global healthcare industry, marked by an aging population and a rise in chronic diseases requiring more medical interventions. Increased surgical procedures, coupled with stringent regulatory standards from bodies like the FDA and ISO, are crucial factors necessitating high-quality sterile packaging. Additionally, the continuous innovation in medical devices and pharmaceuticals, particularly in complex and sensitive formulations, further fuels the demand for advanced and reliable sterile packaging solutions to ensure product integrity and patient safety throughout the product lifecycle, from manufacturing to point of use.

Which types of materials are predominantly used in sterile medical packaging, and what are their key advantages?

The Sterile Medical Packaging Market predominantly utilizes a diverse range of materials, each selected for specific applications and sterilization methods. Plastics, including polyethylene (PE), polypropylene (PP), and PET, are widely used due to their versatility, excellent barrier properties, and cost-effectiveness, offering flexibility for various forms like pouches, films, and rigid trays. Paper and paperboard materials, often in combination with films, provide breathability for gas sterilization and are favored for their sustainability profile. Glass is essential for vials and ampoules, ensuring chemical inertness for sensitive pharmaceuticals. Specialized materials like Tyvek, known for its high strength, breathability, and microbial barrier properties, are critical for maintaining sterility for a broad spectrum of medical devices requiring gas or radiation sterilization, offering robustness and reliability.

How do global regulations and standards impact the Sterile Medical Packaging Market?

Global regulations and standards exert a profound impact on the Sterile Medical Packaging Market, acting as both a driver for quality and a significant barrier to entry. Regulatory bodies such as the FDA (United States), EMA (Europe), and international standards organizations like ISO (e.g., ISO 11607 for packaging for terminally sterilized medical devices) impose rigorous requirements on materials, design, manufacturing processes, and validation of sterile packaging. These regulations ensure product safety, efficacy, and patient protection by mandating strict barrier properties, integrity testing, and compatibility with sterilization methods. Compliance necessitates extensive testing, documentation, and continuous monitoring, driving manufacturers to invest heavily in R&D, quality control systems, and regulatory affairs expertise. This landscape shapes market trends, encouraging innovation in compliant and high-performance packaging solutions while raising the cost and complexity of product development and market entry.

What are the key trends currently shaping the future of the Sterile Medical Packaging Market?

The Sterile Medical Packaging Market is being shaped by several transformative trends. A major trend is the accelerating shift towards sustainable packaging solutions, driven by growing environmental concerns and regulatory pressures, leading to increased adoption of recyclable, biodegradable, and renewable materials. The integration of smart packaging technologies, such as RFID, NFC, and various indicators, is enhancing traceability, anti-counterfeiting measures, and real-time monitoring of product integrity throughout the supply chain. Customization and personalization of packaging are also gaining traction, catering to the specific needs of complex medical devices and sensitive pharmaceutical formulations. Furthermore, advancements in automation and robotics in packaging lines, coupled with the application of AI for quality control and predictive maintenance, are improving efficiency, reducing errors, and ensuring higher standards of sterility, collectively propelling the market towards more innovative and efficient solutions.

In what ways does sustainability factor into the Sterile Medical Packaging Market, and what challenges does it present?

Sustainability is an increasingly critical factor in the Sterile Medical Packaging Market, driven by heightened environmental awareness, regulatory pressures, and corporate social responsibility initiatives. It involves developing and utilizing packaging materials that are recyclable, biodegradable, compostable, or derived from renewable resources, aiming to reduce the environmental footprint of medical waste. This trend is leading to innovations in materials science and packaging design. However, integrating sustainability presents significant challenges: ensuring that eco-friendly alternatives maintain the same high level of sterility, barrier properties, and physical protection as traditional materials is paramount. Additionally, these sustainable solutions often come with higher manufacturing costs and require new validation processes, creating a delicate balance between environmental responsibility, regulatory compliance, cost-effectiveness, and the absolute necessity of patient safety. Overcoming these challenges requires substantial investment in research, development, and strategic partnerships across the value chain to meet both ecological goals and stringent healthcare demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager