Structured Cabling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427847 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Structured Cabling Market Size

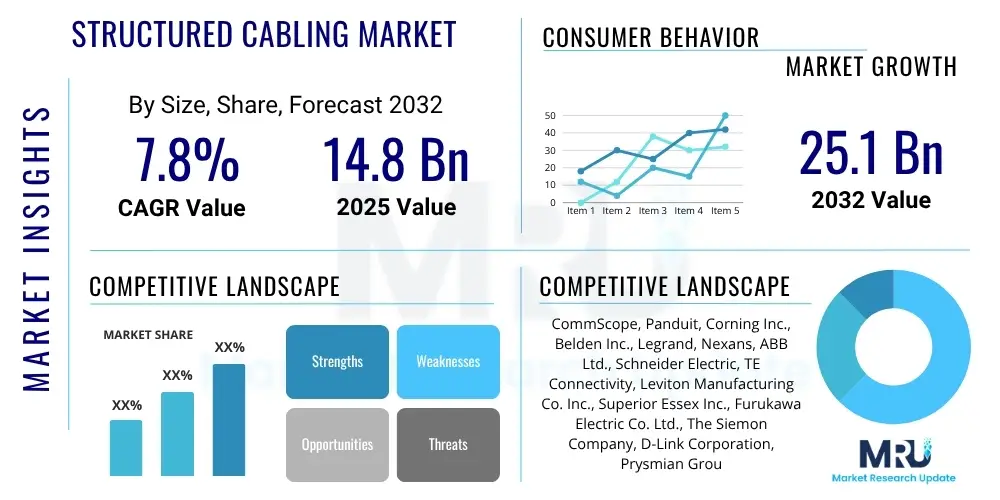

The Structured Cabling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 14.8 billion in 2025 and is projected to reach USD 25.1 billion by the end of the forecast period in 2032.

Structured Cabling Market introduction

The structured cabling market encompasses the foundational infrastructure that supports modern communication networks within buildings and data centers. It provides a standardized and organized approach to cabling, integrating voice, data, video, and various management systems over a unified infrastructure. This systematic approach ensures optimal performance, reliability, and scalability for a wide array of digital applications. Products typically include copper cables (like Category 6, 6A, and 8), fiber optic cables (single-mode and multi-mode), patch panels, connectors, racks, and cable management accessories, all designed to meet specific industry standards and bandwidth requirements. The adoption of structured cabling is critical for any organization seeking to establish a robust, flexible, and future-proof network environment capable of handling increasing data demands.

Major applications of structured cabling span across diverse sectors, including commercial offices, residential buildings, data centers, industrial facilities, healthcare institutions, and educational campuses. In commercial settings, it facilitates seamless communication and data transfer across multiple departments, supporting VoIP, video conferencing, and high-speed internet. Data centers heavily rely on structured cabling for interconnecting servers, storage devices, and networking equipment, where high-density and low-latency solutions are paramount. The benefits are extensive, including enhanced network performance, simplified troubleshooting, reduced operational costs, increased flexibility for future upgrades and moves, and improved aesthetics through organized cable runs. A well-designed structured cabling system forms the backbone of digital transformation initiatives, enabling efficient deployment of new technologies and applications with minimal disruption.

The market is primarily driven by the escalating demand for high-speed internet connectivity, the proliferation of data centers globally, the rapid adoption of cloud computing services, and the continuous expansion of the Internet of Things (IoT) ecosystem. With businesses increasingly relying on bandwidth-intensive applications and services, the need for robust and reliable network infrastructure becomes non-negotiable. Furthermore, the global trend towards smart buildings and smart cities is fueling the demand for structured cabling systems that can integrate various building management, security, and automation systems onto a single network platform. The ongoing deployment of 5G technology also necessitates significant upgrades to backhaul and access network infrastructure, often involving high-capacity fiber optic cabling, further propelling market growth.

Structured Cabling Market Executive Summary

The structured cabling market is witnessing substantial growth, propelled by the relentless pace of digital transformation across industries and the exponential rise in data traffic. Business trends indicate a strong shift towards higher bandwidth solutions, with Category 6A and Category 8 copper cables gaining traction for enterprise networks, while fiber optic solutions dominate data center and campus backbone deployments. There is an increasing focus on pre-terminated solutions to expedite installation and enhance reliability, alongside a growing emphasis on intelligent infrastructure management (IIM) systems that provide real-time visibility and control over the physical layer. Sustainability considerations are also becoming paramount, driving demand for energy-efficient materials and environmentally conscious manufacturing practices within the industry, influencing procurement decisions and supply chain dynamics significantly.

Regional trends highlight the Asia Pacific (APAC) as a rapidly expanding market due to widespread urbanization, industrialization, and significant government investments in digital infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe continue to be mature markets, characterized by ongoing upgrades to support advanced technologies such as edge computing, 5G deployments, and sophisticated smart building initiatives, often driven by stringent regulatory frameworks and a strong focus on data security and privacy. Latin America and the Middle East & Africa (MEA) regions are emerging as high-growth potential markets, fueled by increasing internet penetration, cloud adoption, and large-scale infrastructure projects aimed at modernizing communication networks and supporting economic diversification efforts.

Segmentation trends reveal a clear bifurcation in demand based on application and end-user vertical. Data centers remain a critical segment, demanding ultra-high-density fiber optic cabling and advanced thermal management solutions to support ever-increasing processing power and storage requirements. The commercial and residential segments are seeing increased adoption of Power over Ethernet (PoE) enabled cabling for IP-based devices such as security cameras, access control systems, and smart lighting, simplifying power delivery and data transmission. Within product types, fiber optic cables are exhibiting the highest growth rate, driven by their superior bandwidth capabilities and immunity to electromagnetic interference, making them ideal for backbone and long-distance applications. Copper cabling, however, maintains its stronghold in horizontal distribution and desktop connections due to cost-effectiveness and ease of installation, particularly for applications requiring less extreme bandwidth.

AI Impact Analysis on Structured Cabling Market

Common user questions regarding AI's impact on structured cabling often revolve around whether AI will automate away the need for physical infrastructure, how cabling systems must adapt to support AI workloads, and if AI can optimize cable management. Users are concerned about the longevity of their current cabling investments in an AI-driven future and curious about the specific requirements AI places on network performance, such as ultra-low latency and immense bandwidth. The overarching theme is a desire to understand the transformative effect of AI, not as a replacement for physical networks, but as a catalyst for evolution, demanding more sophisticated and higher-performing structured cabling solutions that can reliably transmit vast quantities of data for real-time processing and learning algorithms. The expectation is that AI will necessitate smarter, more resilient, and potentially self-optimizing network infrastructures.

- AI drives exponential data growth, demanding higher bandwidth and lower latency cabling infrastructure.

- Increased density of AI/ML servers in data centers requires high-performance fiber optic cabling for inter-server connectivity.

- AI workloads necessitate advanced cooling and power distribution, pushing the adoption of high-power PoE++ and efficient cable management.

- AI-powered network analytics can optimize cabling routes, identify bottlenecks, and predict maintenance needs, enhancing network reliability.

- Smart building AI systems integrate with structured cabling for efficient management of IoT devices, sensors, and actuators.

- AI will accelerate the development and adoption of intelligent infrastructure management (IIM) systems, leveraging data from the physical layer.

- Demand for edge computing, often driven by AI applications, requires robust and scalable structured cabling solutions at distributed locations.

DRO & Impact Forces Of Structured Cabling Market

The structured cabling market is significantly shaped by a combination of key drivers, restraints, and opportunities, alongside broader impact forces. A primary driver is the pervasive digital transformation across all industry verticals, compelling organizations to upgrade their network infrastructure to support advanced digital operations, cloud services, and real-time data analytics. The explosive growth of data traffic, fueled by video streaming, big data, and machine learning applications, necessitates higher bandwidth and more reliable cabling systems. Furthermore, the rapid expansion of the Internet of Things (IoT) and the global rollout of 5G networks are creating unprecedented demand for robust, high-performance structured cabling to connect countless devices and facilitate seamless communication, extending network reach and capacity beyond traditional boundaries.

Despite the strong growth drivers, several restraints pose challenges to market expansion. The high initial investment required for deploying or upgrading a structured cabling system can be a deterrent for small and medium-sized enterprises (SMEs) or organizations with limited budgets, particularly when considering advanced fiber optic solutions. The complexity of installation and maintenance, coupled with a persistent shortage of skilled technicians and installers, can lead to increased project costs and delays. Competition from wireless alternatives, such as Wi-Fi 6/6E and future wireless standards, presents a perceived threat, though structured cabling often serves as the essential backhaul for these wireless access points. Economic uncertainties and fluctuations in raw material prices (e.g., copper) also introduce market volatility and impact profitability for manufacturers and service providers, making strategic planning more challenging.

Opportunities for growth are abundant, particularly with the continued advancement and broader adoption of Power over Ethernet (PoE) technologies, which simplify power delivery to network-connected devices like IP cameras, access points, and LED lighting, expanding the scope of cabling applications. The proliferation of edge computing and micro-data centers, driven by the need for lower latency processing closer to data sources, creates new deployment scenarios for structured cabling. The industry also has a significant opportunity to innovate with sustainable cabling solutions, addressing environmental concerns and meeting corporate social responsibility objectives. Moreover, the integration of structured cabling with smart building automation systems and the development of intelligent infrastructure management (IIM) platforms offer avenues for enhanced network control, efficiency, and predictive maintenance, adding significant value for end-users and fostering further market penetration.

Segmentation Analysis

The structured cabling market is extensively segmented to reflect the diverse requirements and applications across various industries and technological landscapes. This segmentation allows for a granular understanding of market dynamics, enabling manufacturers and service providers to tailor their offerings to specific customer needs and industry standards. The primary bases for segmentation include product type, application, end-use vertical, and standards, each revealing distinct growth patterns and competitive landscapes. Analyzing these segments provides crucial insights into where investments are being made, which technologies are gaining prominence, and what specific market demands are driving innovation, from the foundational components to sophisticated end-user deployments that require specialized solutions.

- Product Type:

- Copper Cables: Includes Category 5e, Category 6, Category 6A, Category 7, Category 7A, and Category 8 cables. These are primarily used for horizontal runs, voice, and data transmission over shorter distances.

- Fiber Optic Cables: Comprises single-mode (OS1, OS2) and multi-mode (OM1, OM2, OM3, OM4, OM5) fibers, preferred for backbone connections, long-distance transmission, and high-bandwidth applications in data centers and campuses.

- Patch Panels: Used to connect and manage cable circuits, providing a flexible and centralized connection point for network infrastructure.

- Connectors & Cross-Connects: Includes RJ45 connectors, fiber optic connectors (LC, SC, MPO/MTP), and other termination hardware essential for connecting cables to network devices and patch panels.

- Racks & Enclosures: Physical structures designed to house, organize, and protect networking equipment and cabling, ensuring proper ventilation and security.

- Cable Management Accessories: Such as cable ties, trays, conduits, and raceways, vital for organizing and protecting cables, ensuring optimal performance and ease of maintenance.

- Application:

- Data Centers: High-density, high-performance cabling solutions for server-to-server, server-to-storage, and inter-rack connectivity, often dominated by fiber optics.

- Local Area Networks (LANs): Cabling for office buildings, campuses, and commercial spaces to support internal communication, internet access, and various IP-based services.

- Telecommunication Rooms: Centralized points within buildings where network equipment is housed and connected to the main backbone and horizontal cabling.

- Security Systems: Cabling for IP surveillance cameras, access control systems, and alarm systems, often utilizing PoE for combined data and power.

- Audio-Visual Systems: Infrastructure for projectors, displays, video conferencing, and digital signage, requiring specific cabling types for high-quality signal transmission.

- Industrial Automation: Robust and shielded cabling solutions for harsh industrial environments, connecting machinery, sensors, and control systems.

- End-Use Vertical:

- IT & Telecommunication: Core segment driven by data centers, network service providers, and enterprise IT infrastructure needs.

- BFSI (Banking, Financial Services, and Insurance): Demands high-security, reliable, and high-performance networks for critical financial transactions and data management.

- Healthcare: Requires robust and flexible networks for medical imaging, electronic health records (EHR), telemedicine, and interconnected medical devices.

- Residential & Commercial (Office, Retail, Hospitality): Supports smart home systems, office automation, point-of-sale systems, guest Wi-Fi, and building management systems.

- Industrial (Manufacturing, Oil & Gas): Cabling for factory automation, process control, supervisory control and data acquisition (SCADA) systems, often requiring industrial-grade solutions.

- Government & Education: Supports administrative networks, e-learning platforms, research facilities, and public safety communication systems.

- Energy & Utilities: Infrastructure for smart grids, remote monitoring of energy assets, and critical communication within power plants and distribution networks.

- Standards:

- TIA/EIA (Telecommunications Industry Association/Electronic Industries Alliance): North American standards (e.g., TIA-568) for commercial building cabling.

- ISO/IEC (International Organization for Standardization/International Electrotechnical Commission): International standards (e.g., ISO/IEC 11801) widely adopted globally.

- IEEE (Institute of Electrical and Electronics Engineers): Standards for Ethernet technologies (e.g., 802.3 for PoE).

- Category-Specific Standards: Focusing on performance specifications for Cat 6, Cat 6A, Cat 8, and various fiber types (OM3, OM4, OS2).

Value Chain Analysis For Structured Cabling Market

The value chain of the structured cabling market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user deployment and ongoing maintenance. The upstream segment primarily involves suppliers of fundamental raw materials such as copper for conductors, glass for optical fibers, and various plastics and polymers for cable jacketing and components. These raw material providers feed into component manufacturers who produce specialized connectors, patch panels, racks, and other passive network elements. The quality and availability of these raw materials directly impact the cost, performance, and lead times for the entire value chain, making strong supplier relationships and strategic sourcing crucial for market players to maintain competitive advantages and ensure consistent production flows.

Further along the chain, the manufacturing segment involves the actual production of copper and fiber optic cables, as well as the assembly of passive components into complete structured cabling systems. These manufacturers often specialize in specific product categories or market segments, adhering to rigorous industry standards like TIA/EIA and ISO/IEC to ensure interoperability and performance. Once manufactured, products move through various distribution channels. This includes direct sales to large enterprises or data center operators, indirect sales through a network of distributors and wholesalers who stock and resell products to a broader customer base, and Value-Added Resellers (VARs) who combine structured cabling products with installation services, network design, and other IT solutions. The efficiency of these distribution channels is vital for market reach and timely delivery, especially for large-scale projects requiring diverse components and integrated services.

The downstream segment of the value chain is dominated by system integrators and certified installers who design, install, test, and maintain structured cabling systems for end-users. These integrators play a critical role in ensuring that the cabling infrastructure meets specific application requirements, adheres to performance standards, and is future-proofed against evolving technological demands. End-users, encompassing a wide array of verticals from IT and telecommunications to healthcare and industrial, represent the final link, benefiting from the robust and reliable network infrastructure provided by the structured cabling system. The ongoing relationship often extends to post-installation services, including troubleshooting, upgrades, and maintenance contracts, highlighting the importance of long-term partnerships between integrators and clients to ensure sustained network performance and reliability throughout the lifecycle of the cabling infrastructure.

Structured Cabling Market Potential Customers

The potential customers for structured cabling solutions are incredibly diverse, spanning almost every sector that relies on modern communication and data transfer. At its core, any organization or entity requiring a reliable, high-performance, and scalable network infrastructure is a potential buyer. This includes large multinational corporations, small and medium-sized enterprises (SMEs), and public sector entities. IT departments and network administrators within these organizations are key decision-makers, as they are responsible for designing, implementing, and maintaining the network backbone. Data center managers represent a critical customer segment, given their continuous need for high-density, low-latency cabling to support server, storage, and networking equipment, often demanding the most advanced fiber optic solutions and efficient cable management systems to maximize operational efficiency and throughput.

Beyond traditional IT roles, building contractors and facility managers are significant buyers, particularly in the context of new construction or building renovation projects. They integrate structured cabling into the overall building infrastructure to support not only conventional data and voice but also building automation systems, security cameras, access control, and smart lighting solutions, often leveraging Power over Ethernet (PoE) technologies. Telecommunication service providers, including internet service providers (ISPs) and mobile network operators (MNOs), are constant customers, investing in structured cabling for their central offices, data aggregation points, and backhaul networks to support their vast customer bases and future-proof their service delivery capabilities, especially with the rollout of 5G and fiber-to-the-home initiatives.

Furthermore, a wide range of industry-specific end-users constitute a substantial customer base. Healthcare providers require robust and secure networks for electronic health records (EHR), medical imaging, and telemedicine. Educational institutions demand high-bandwidth networks for e-learning platforms, research, and campus-wide connectivity. Government agencies and public safety organizations need resilient and secure cabling for critical communications and data management. The retail sector uses structured cabling for point-of-sale systems, inventory management, and digital signage, while manufacturing plants rely on it for industrial automation, IoT integration, and process control. The banking, financial services, and insurance (BFSI) sector necessitates ultra-reliable and secure networks for transaction processing and data storage, highlighting the universal applicability and critical importance of structured cabling across the modern economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 14.8 Billion |

| Market Forecast in 2032 | USD 25.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CommScope, Panduit, Corning Inc., Belden Inc., Legrand, Nexans, ABB Ltd., Schneider Electric, TE Connectivity, Leviton Manufacturing Co. Inc., Superior Essex Inc., Furukawa Electric Co. Ltd., The Siemon Company, D-Link Corporation, Prysmian Group, Brand-Rex (Leviton), Paige Electric, OptiComm, Hubbell Incorporated, Sumitomo Electric Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structured Cabling Market Key Technology Landscape

The structured cabling market is in a continuous state of evolution, driven by the escalating demand for higher bandwidth, increased network speeds, and greater efficiency. A cornerstone of this technological landscape is the advancement in cable performance, with copper cabling pushing towards Category 8 standards to support 25G and 40G Ethernet over shorter distances, primarily in data center environments. Concurrently, fiber optic technology is evolving rapidly, with the widespread adoption of OM4 and the emergence of OM5 (Wideband Multimode Fiber) to support multiple wavelengths over a single fiber, drastically increasing capacity for parallel optics and short-reach data center interconnections. Single-mode fiber continues to be the preferred choice for long-distance backbone and campus-wide deployments due to its virtually limitless bandwidth potential and minimal signal loss over extended runs, solidifying its role as the future-proof option for core network infrastructure.

Another transformative technology is Power over Ethernet (PoE), which has seen significant advancements with the introduction of PoE+ (802.3at) and PoE++ (802.3bt), capable of delivering up to 60W and 100W respectively over standard Ethernet cables. This enables the power and data transmission for a broader range of IP-enabled devices, including high-definition security cameras, Wi-Fi 6 access points, LED lighting, and even thin clients, simplifying installations and reducing power infrastructure costs. The rise of pre-terminated cabling solutions is also a key technological trend, offering factory-tested, plug-and-play assemblies that significantly reduce installation time, minimize on-site labor costs, and enhance overall system reliability and performance by eliminating the inconsistencies often associated with field terminations. These solutions are particularly valuable in data center and large-scale commercial deployments where rapid deployment and guaranteed performance are paramount, accelerating project timelines and reducing implementation risks substantially.

Furthermore, the integration of intelligent infrastructure management (IIM) systems is revolutionizing how structured cabling networks are monitored and managed. IIM solutions leverage software and specialized hardware to provide real-time visibility into the physical layer, tracking connections, managing assets, and even automatically documenting changes. This intelligent approach helps organizations optimize network performance, enhance security, simplify troubleshooting, and plan for future capacity needs with greater accuracy. The emergence of Passive Optical LAN (POL) as an alternative to traditional copper-based enterprise networks, leveraging single-mode fiber to the desk, offers significant benefits in terms of extended reach, reduced space requirements, energy efficiency, and simplified management, making it an attractive option for new constructions and large campus environments. These technological advancements collectively contribute to making structured cabling systems more powerful, flexible, and intelligent, enabling them to meet the ever-increasing demands of the digital age and adapt to future innovations, ensuring robust and resilient network foundations for years to come.

Regional Highlights

- North America: This region stands as a significant driver of the structured cabling market, characterized by early adoption of advanced networking technologies and substantial investments in data center expansion. The presence of numerous technology giants, coupled with a strong emphasis on smart building initiatives and the continuous rollout of 5G infrastructure, fuels the demand for high-performance copper and fiber optic cabling solutions. The region is a hub for innovation, often leading in the implementation of intelligent infrastructure management systems and high-density cabling configurations to support cloud computing, AI, and edge computing applications. Stringent industry standards and a mature market ecosystem further bolster market growth.

- Europe: The European market for structured cabling is driven by ongoing digital transformation efforts, smart city projects, and regulatory frameworks emphasizing data security and network resilience, such as GDPR. Countries like Germany, the UK, and France are investing heavily in upgrading their IT infrastructure across commercial, residential, and industrial sectors. There is a notable trend towards energy-efficient and sustainable cabling solutions, aligned with the European Green Deal objectives. The adoption of Passive Optical LAN (POL) and advanced PoE technologies is also gaining traction, particularly in new building constructions and campus networks, contributing to steady market expansion.

- Asia Pacific (APAC): This region is projected to be the fastest-growing market for structured cabling, propelled by rapid urbanization, industrialization, and massive government investments in digital infrastructure. Countries like China, India, Japan, and Australia are experiencing unprecedented growth in data center construction, cloud service adoption, and IoT device proliferation. The expanding manufacturing sector and the increasing penetration of internet and mobile services across the region necessitate robust and scalable network foundations. Economic development and rising disposable incomes further stimulate demand for advanced communication systems in commercial and residential developments.

- Latin America: The structured cabling market in Latin America is witnessing steady growth, largely due to increasing internet penetration, widespread adoption of cloud computing services, and ongoing infrastructure development projects. Countries such as Brazil, Mexico, and Argentina are investing in modernizing their telecommunication networks and expanding their digital capabilities. The demand is particularly evident in the commercial and government sectors, driven by the need for improved connectivity and efficiency. While still developing compared to other regions, the market shows strong potential as economies mature and digital initiatives gain momentum, attracting international investment.

- Middle East and Africa (MEA): The MEA region is emerging as a significant market, fueled by ambitious smart city projects (e.g., NEOM in Saudi Arabia), diversification efforts away from oil economies, and substantial government investments in digital infrastructure. The deployment of 5G networks, expansion of data centers, and increasing adoption of cloud services across various sectors like oil & gas, healthcare, and education are key growth drivers. Countries like the UAE, Saudi Arabia, and South Africa are at the forefront of this digital transformation, creating substantial demand for advanced structured cabling solutions to support modern communication and data management requirements, enhancing regional connectivity and technological capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structured Cabling Market.- CommScope

- Panduit

- Corning Inc.

- Belden Inc.

- Legrand

- Nexans

- ABB Ltd.

- Schneider Electric

- TE Connectivity

- Leviton Manufacturing Co. Inc.

- Superior Essex Inc.

- Furukawa Electric Co. Ltd.

- The Siemon Company

- D-Link Corporation

- Prysmian Group

- Brand-Rex (Leviton)

- Paige Electric

- OptiComm

- Hubbell Incorporated

- Sumitomo Electric Industries, Ltd.

Frequently Asked Questions

What is structured cabling and why is it important?

Structured cabling is a standardized system of cabling and associated hardware that provides a comprehensive telecommunications infrastructure. It's crucial because it offers a reliable, flexible, and scalable foundation for all network communications (voice, data, video), simplifying management, reducing downtime, and supporting future technology upgrades.

How does structured cabling support emerging technologies like IoT and 5G?

Structured cabling is foundational for IoT and 5G. It provides the high-bandwidth, low-latency backhaul required for 5G base stations and Wi-Fi access points. For IoT, it delivers robust connectivity and often power (via PoE) to numerous sensors, smart devices, and edge computing nodes, ensuring efficient data collection and processing.

What are the key benefits of investing in a robust structured cabling system?

Investing in structured cabling provides numerous benefits including enhanced network performance and reliability, simplified troubleshooting, increased flexibility for future moves/adds/changes, reduced operational costs, better security, and a future-proof infrastructure capable of supporting evolving technological demands and increased data traffic.

What are the main types of cables used in structured cabling systems?

The main types are copper cables and fiber optic cables. Copper cables (e.g., Cat5e, Cat6, Cat6A, Cat8) are widely used for horizontal runs and desktop connections. Fiber optic cables (single-mode and multi-mode) are preferred for backbone, long-distance, and high-bandwidth applications, especially in data centers due to their superior speed and immunity to interference.

How does AI impact the future design and management of structured cabling?

AI significantly impacts structured cabling by driving demand for higher bandwidth and ultra-low latency, influencing design for dense AI/ML server environments. AI also enables intelligent infrastructure management (IIM) for predictive maintenance, optimized resource allocation, and automated network troubleshooting, making systems smarter and more efficient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager