Surface Inspection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430031 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Surface Inspection Market Size

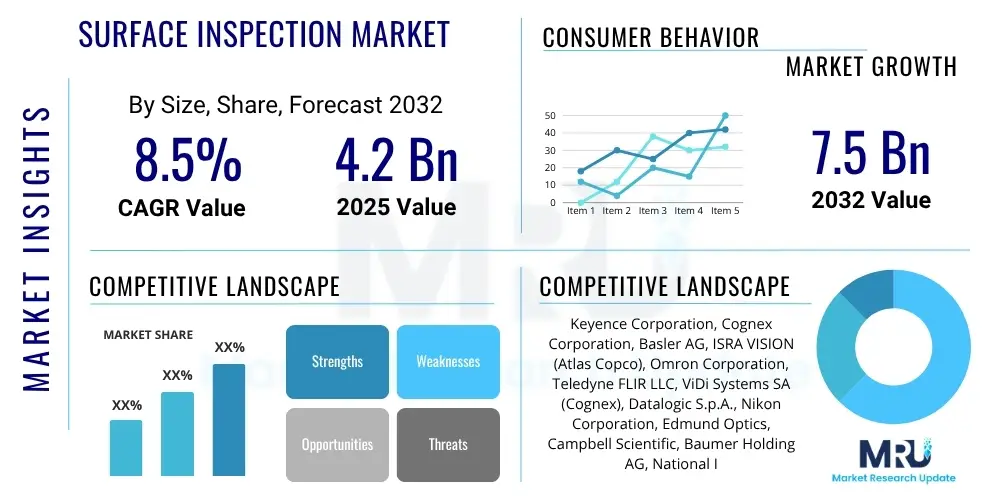

The Surface Inspection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2032.

Surface Inspection Market introduction

The Surface Inspection Market encompasses a sophisticated array of technologies and systems specifically engineered to detect, identify, and classify imperfections or anomalies present on the surfaces of various materials and manufactured goods. These systems are an indispensable cornerstone of modern quality assurance processes, playing a critical role in ensuring that products conform to stringent quality specifications, functional requirements, and aesthetic standards before they enter the market. Products in this market span a spectrum from fundamental visual inspection tools to highly advanced, fully automated solutions leveraging artificial intelligence and precision optics, scrutinizing surfaces for flaws such as scratches, dents, cracks, discoloration, contaminants, and dimensional inconsistencies. The primary objective is to move beyond subjective human inspection, offering objective, repeatable, and quantifiable defect analysis.

Major applications for surface inspection systems are pervasive across diverse industrial landscapes. The automotive sector utilizes these technologies for inspecting body panels, engine components, and interior finishes to guarantee both safety and cosmetic appeal. In electronics, critical inspections are performed on printed circuit boards (PCBs), semiconductor wafers, and connectors to ensure functional integrity and reliability. The metals, glass, and plastics industries rely on these systems for assessing surface finish, detecting material flaws, and verifying product uniformity. Furthermore, the pharmaceutical and medical device sectors employ surface inspection to validate tablet integrity, packaging seals, and the sterility of implants, where even minor defects can have profound implications for public health and safety. The pervasive need for meticulous quality control across these high-volume and high-stakes manufacturing environments underscores the market's significance.

The multifaceted benefits derived from the deployment of surface inspection solutions are significant. These systems lead to a substantial improvement in overall product quality, drastically reduce manufacturing waste by identifying defects early in the production cycle, and enhance operational efficiency by automating tedious and error-prone manual tasks. Beyond these direct benefits, they also facilitate compliance with ever-tightening industry regulations and international quality standards, thereby mitigating the risk of product recalls and associated financial penalties. The market's robust growth is fundamentally driven by the global imperative for industrial automation, particularly within the framework of Industry 4.0 initiatives, coupled with an increasing consumer demand for faultless products. Furthermore, ongoing advancements in imaging sensors, high-speed data processing, and artificial intelligence are continuously expanding the capabilities and economic viability of these sophisticated inspection solutions, making them more accessible and effective for a wider range of applications.

Surface Inspection Market Executive Summary

The Surface Inspection Market is currently experiencing dynamic growth and transformation, primarily influenced by accelerating global business trends centered on automation, digital integration, and intelligent manufacturing. A pronounced shift towards fully automated, high-precision inspection systems is observed across industries, driven by the desire to minimize human error, enhance operational throughput, and achieve superior levels of quality consistency. The market is also seeing increased investment in solutions that offer advanced data analytics and connectivity, positioning surface inspection as a key enabler for predictive maintenance and closed-loop quality control within smart factory ecosystems. These overarching business trends reflect a broader industrial movement towards greater efficiency, agility, and data-driven decision-making in production processes, making robust quality assurance more critical than ever.

From a regional perspective, the market dynamics are varied yet consistently show upward trajectories. The Asia Pacific (APAC) region stands out as a primary growth engine, fueled by its burgeoning manufacturing sector, substantial investments in industrial infrastructure, and the continuous expansion of electronics, automotive, and metals industries in countries like China, India, and Southeast Asia. North America and Europe, while representing more mature markets, demonstrate sustained demand driven by stringent quality regulations, ongoing modernization of existing industrial facilities, and a strong impetus towards adopting cutting-edge technologies like AI and 3D vision. These regions emphasize high-value manufacturing and the refinement of complex product lines, necessitating the most advanced and precise inspection solutions available. Other regions, including Latin America and the Middle East and Africa, are also exhibiting promising growth as their industrial bases develop and they seek to enhance product quality for local consumption and global competitiveness.

Segmentation trends within the Surface Inspection Market indicate a strong preference for automated systems, particularly Automated Optical Inspection (AOI) and advanced 3D inspection technologies, due to their unmatched speed, accuracy, and ability to handle complex geometries. The software segment is witnessing significant expansion, propelled by the integration of sophisticated image processing algorithms, artificial intelligence for defect classification, and advanced analytics platforms that convert raw inspection data into actionable business intelligence. Concurrently, the services segment, encompassing installation, maintenance, and customization, is crucial for optimizing system performance and ensuring long-term operational efficiency. These trends collectively highlight a market moving towards more integrated, intelligent, and customizable solutions that can meet the evolving and diverse quality control demands of modern manufacturing.

AI Impact Analysis on Surface Inspection Market

User inquiries regarding the profound impact of Artificial Intelligence (AI) on the Surface Inspection Market frequently center on its ability to revolutionize defect detection accuracy, accelerate inspection throughput, and drastically reduce reliance on subjective human judgment. Common concerns and expectations among users include how AI can effectively differentiate between critical and non-critical defects, minimize the incidence of costly false positives, and continuously adapt to new product variations or subtle manufacturing inconsistencies without extensive reprogramming. There is considerable interest in AI's potential to enable predictive maintenance through granular analysis of inspection data, optimize operational costs by improving first-pass yield, and provide scalable, adaptable solutions across diverse manufacturing environments. Users also express a keen interest in understanding the prerequisites for successful AI integration, such as data volume and quality, and the availability of skilled personnel, while anticipating a new era of highly robust and intelligent quality assurance capabilities.

Artificial intelligence is fundamentally transforming the surface inspection landscape by introducing an unprecedented degree of precision, speed, and analytical depth, moving beyond the limitations of traditional rule-based systems. AI-powered machine vision systems, particularly those leveraging deep learning algorithms such as Convolutional Neural Networks (CNNs), are exceptionally adept at processing immense volumes of complex visual data at speeds far exceeding human capabilities. These systems can identify intricate patterns, subtle texture variations, and nuanced anomalies that are often imperceptible or overlooked by human inspectors or simpler algorithms. This advanced perception capability significantly elevates the reliability of quality control, ensuring that only products meeting the most stringent quality benchmarks proceed through the manufacturing pipeline, which in turn leads to substantial reductions in rework, scrap rates, and overall production costs, directly impacting bottom-line profitability.

Moreover, AI algorithms introduce a paradigm of continuous learning and adaptive improvement into inspection processes. As these systems are exposed to more defect data, they refine their models, improving their ability to accurately classify novel defect types, distinguish between critical and non-critical flaws, and adapt to evolving product designs or process variations without requiring extensive manual recalibration or reprogramming. This inherent adaptability makes AI-driven surface inspection invaluable in dynamic manufacturing environments where product specifications frequently evolve, thereby fostering more resilient and future-proof quality assurance mechanisms. The strategic integration of AI also enables advanced predictive analytics, allowing manufacturers to identify nascent process issues or equipment malfunctions before they escalate into widespread defect generation, facilitating proactive intervention, process optimization, and a strategic shift towards preventive quality management within the broader Industry 4.0 framework.

- Enhanced defect detection accuracy through sophisticated deep learning algorithms that recognize complex patterns.

- Increased inspection speed and throughput, significantly reducing bottlenecks in high-volume production lines.

- Substantial reduction in false positives and false negatives, leading to more reliable and efficient quality control decisions.

- Automated, objective classification and quantification of diverse defect types, providing granular insights into quality issues.

- Enabling of predictive maintenance and process optimization by analyzing historical defect trends and correlating them with production parameters.

- Self-learning capabilities that allow systems to adapt to new products, materials, and evolving defect variations over time.

- Minimization of human error, fatigue, and subjectivity in repetitive or challenging inspection tasks.

- Seamless integration with existing factory automation, robotic systems, and Industrial IoT (IIoT) ecosystems for holistic quality management.

- Optimization of manufacturing processes through real-time feedback loops derived from AI-powered defect data analysis.

DRO & Impact Forces Of Surface Inspection Market

The Surface Inspection Market is propelled by a robust set of drivers, primarily the accelerating global adoption of Industry 4.0 principles and smart manufacturing initiatives, which emphasize automation, data exchange, and real-time decision-making in production. Manufacturers worldwide are making significant investments in automated solutions to bolster efficiency, reduce soaring labor costs, and achieve unparalleled levels of product quality and consistency, making advanced surface inspection an indispensable component of modern, digitized production lines. Concurrently, increasingly stringent quality and safety regulations across critical industries such as automotive, aerospace, electronics, and medical devices necessitate meticulous and verifiable defect detection, thereby expanding the demand for high-precision, compliant inspection systems. Furthermore, relentless innovation in sensor technology, ranging from higher-resolution cameras and more sensitive detectors to advanced optical systems, coupled with breakthroughs in image processing software, acts as a significant market driver, enabling systems to detect progressively smaller and more complex defects with superior reliability and speed, continuously pushing the boundaries of what is technically achievable in quality assurance.

Despite these powerful drivers, the market faces several notable restraints that could temper its otherwise expansive growth trajectory. The high initial capital outlay required for acquiring and implementing advanced automated surface inspection systems, which includes costs for sophisticated hardware, specialized software licenses, and complex integration services, often presents a significant financial barrier. This barrier is particularly pronounced for small and medium-sized enterprises (SMEs) operating with constrained capital budgets, making it challenging for them to justify the upfront investment, despite the potential long-term benefits in quality and efficiency. Additionally, the inherent technical complexity involved in deploying, configuring, and maintaining these highly sophisticated systems demands specialized expertise in fields such as machine vision, optics, AI, and automation. A persistent shortage of skilled personnel proficient in operating, programming, and troubleshooting advanced machine vision solutions further exacerbates this restraint, hindering broader market adoption and optimal system utilization across various industrial sectors.

Notwithstanding the challenges, substantial opportunities exist for significant market expansion and continued innovation within the surface inspection domain. The transformative potential of integrating artificial intelligence (AI) and machine learning (ML) capabilities into inspection systems presents a paramount opportunity, enabling systems to learn from vast datasets, predict potential quality issues, reduce false positives, and perform sophisticated predictive analytics for comprehensive process optimization. The ongoing proliferation of the Internet of Things (IoT) facilitates seamless connectivity and data exchange, allowing for remote monitoring, centralized data analysis, and scalable, interconnected inspection solutions across multiple production sites. Moreover, the burgeoning industrialization and manufacturing growth in emerging economies, particularly in Asia Pacific and Latin America, offer untapped market potential, creating demand for both advanced and cost-effective, scalable inspection technologies tailored to diverse local market needs. The evolution of new manufacturing techniques, such as additive manufacturing (3D printing) and advanced composite material production, also creates novel inspection challenges and thus new, specialized market niches for highly customized surface inspection solutions capable of addressing unique and complex defect geometries and material characteristics.

Segmentation Analysis

The Surface Inspection Market is rigorously segmented across multiple dimensions, providing a granular and insightful framework for understanding its intricate structure, diverse technological offerings, and varied end-user applications. This comprehensive segmentation is critical for market stakeholders, including manufacturers, integrators, and investors, to accurately identify specific growth opportunities, formulate targeted product development strategies, and design effective market entry and competitive positioning approaches. Each segmentation category highlights distinct aspects of the market, reflecting the different ways in which surface inspection solutions are designed, deployed, and utilized to address specific quality control challenges across the industrial landscape.

The segmentation by component underscores the intricate technological ecosystem underpinning surface inspection, differentiating between the tangible hardware elements, the intelligent software driving operations, and the essential services that ensure successful deployment and ongoing performance. Concurrently, the segmentation by type reflects the diverse methodological approaches to surface inspection, each optimized for detecting particular kinds of defects or analyzing specific material properties. For instance, Automated Optical Inspection (AOI) systems excel at visual surface flaws, while Automated X-ray Inspection (AXI) delves into subsurface structural integrity, showcasing the specialized nature of these technological solutions. These distinctions are vital for understanding the technological competencies and strategic focus areas of market participants.

Furthermore, segmenting the market by application allows for a clear understanding of the specific defect types or quality parameters that are being addressed, such as crack detection, dimensional verification, or contamination analysis, which helps in identifying solution-specific demand. The end-use industry segmentation is particularly crucial as it highlights the diverse operational environments, regulatory requirements, and material-specific challenges faced by different sectors, from the high-volume precision of electronics manufacturing to the critical safety standards of pharmaceuticals. This detailed categorization enables market players to tailor their solutions to the unique needs of each industry, offering specialized features, certifications, and support that are pertinent to their target customers, thereby maximizing market relevance and penetration.

- By Component:

- Hardware (Cameras High-Resolution, Specialized Optics, Advanced Lighting Systems, Frame Grabbers, High-Performance Processors, Material Handling Systems)

- Software (Image Processing Algorithms, AI and Machine Learning Algorithms, Control and Automation Software, Data Reporting and Analytics Tools, System Integration Modules)

- Services (System Installation and Integration, Preventative Maintenance and Repair, Operator and Technical Training, Customization and Consulting, Software Updates and Support)

- By Type:

- Automated Optical Inspection (AOI)

- Automated X-ray Inspection (AXI)

- 3D Surface Inspection (Laser Triangulation, Structured Light)

- Hyperspectral Imaging

- Infrared Thermography

- Manual Visual Inspection Systems (Assisted and Unassisted)

- By Application:

- Crack Detection

- Scratch and Dent Detection

- Dimensional Inspection and Measurement

- Contamination and Foreign Material Detection

- Surface Roughness and Texture Analysis

- Defect Classification and Grading

- Textile and Material Flaw Detection (e.g., weave defects, holes)

- By End-Use Industry:

- Automotive (Body, Engine Components, Interior, Paint)

- Electronics and Semiconductors (Wafers, PCBs, ICs, Displays)

- Metals and Machinery (Sheet Metal, Forgings, Welds, Castings)

- Glass (Flat Glass, Bottles, Displays, Optics)

- Plastics and Rubber (Films, Molded Parts, Extruded Profiles)

- Food and Beverage (Packaging Integrity, Foreign Object Detection, Product Consistency)

- Pharmaceuticals and Medical Devices (Tablets, Vials, Syringes, Implants, Packaging)

- Aerospace and Defense (Turbine Blades, Composites, Critical Components)

- Paper and Printing (Web Inspection, Print Quality, Coating Defects)

- Textiles (Fabric Flaws, Weave Defects, Color Uniformity)

Value Chain Analysis For Surface Inspection Market

The value chain for the Surface Inspection Market commences with robust upstream activities, which are critical for supplying the foundational technologies and components necessary for advanced inspection systems. This segment primarily involves manufacturers of high-performance cameras, including CCD and CMOS sensors, specialized optical lenses (such as telecentric, macro, and wide-angle), and advanced lighting solutions (e.g., LED, laser, UV, IR, structured light) that are specifically designed to illuminate defects. Additionally, component suppliers provide high-speed frame grabbers, powerful industrial processors, and sophisticated graphic processing units (GPUs) essential for rapid image acquisition and real-time data processing. Software developers also form a vital upstream component, offering foundational image processing libraries, AI/ML frameworks, and operating system kernels that empower the intelligence of subsequent system integration. The innovation and quality originating from these upstream providers directly dictate the capabilities, cost-efficiency, and ultimate performance benchmarks of the final surface inspection solutions.

Midstream activities in the value chain involve the intricate processes of designing, assembling, and integrating these disparate components into fully functional and optimized surface inspection systems. This phase is predominantly executed by specialized system integrators, Original Equipment Manufacturers (OEMs) focusing on machine vision, and dedicated solution providers who possess deep expertise in optics, robotics, and automation. These entities are responsible for selecting the appropriate cameras, lenses, and lighting, developing or customizing application-specific software, calibrating the entire system for optimal performance, and ensuring seamless integration with existing manufacturing lines and industrial control systems. The midstream players often engage in significant research and development to create proprietary algorithms and custom hardware configurations that address unique challenges posed by specific materials, defect types, or production environments. Rigorous testing and validation are performed at this stage to guarantee the accuracy, repeatability, and robustness of the assembled inspection solutions before their deployment to end-users.

Downstream activities center on the effective distribution, installation, commissioning, maintenance, and long-term support of surface inspection systems for end-users. Distribution channels are diverse, ranging from direct sales forces employed by major manufacturers for large-scale, complex projects requiring close client engagement, to extensive networks of authorized distributors and value-added resellers (VARs) who provide localized sales, integration, and support services, thereby expanding market reach and catering to regional specificities. After-sales services are paramount in this market, encompassing comprehensive operator training, preventative maintenance schedules, rapid technical support, software updates, performance calibration, and system upgrades. These services are crucial for ensuring the sustained optimal performance and maximizing the return on investment for end-users throughout the product's lifecycle. Moreover, there is an increasing trend towards offering cloud-based monitoring, remote diagnostics, and predictive maintenance services, which leverage IoT connectivity to enhance responsiveness, minimize downtime, and provide proactive support, thereby contributing significantly to customer satisfaction and fostering long-term business relationships.

Surface Inspection Market Potential Customers

The Surface Inspection Market caters to an expansive array of potential customers, predominantly comprising manufacturing enterprises across virtually every industrial sector that upholds stringent quality control as a core operational imperative. These end-users are intrinsically motivated by the critical need to detect and eliminate product defects, significantly reduce manufacturing waste and associated costs, elevate overall product reliability, and ensure unwavering compliance with increasingly rigorous industry standards, regulatory mandates, and discerning customer expectations. The vast diversity of modern manufacturing processes, materials, and product complexities dictates that potential buyers span a wide spectrum, from multinational corporations operating extensive global production lines to highly specialized niche manufacturers focusing on the intricate production of high-precision, low-volume components. Ultimately, any entity whose product quality directly impacts functionality, safety, aesthetic appeal, or market reputation is a prime candidate for surface inspection solutions.

Key segments of potential customers are deeply embedded in some of the world's largest and most technologically advanced industries. The automotive sector represents a significant customer base, requiring immaculate surface finishes for vehicle body panels, critical structural integrity for engine and drivetrain components, and flaw-free surfaces for interior parts to ensure both safety and brand prestige. Similarly, the electronics and semiconductor industry constitutes a vital customer segment, where surface inspection is indispensable for detecting micro-defects on semiconductor wafers, verifying the integrity of solder joints on printed circuit boards (PCBs), and ensuring the precise placement and quality of integrated circuits (ICs) and other minute components, all of which are critical for device functionality and reliability. Manufacturers of consumer goods, including those producing glass, plastics, and metals, are also prominent buyers, leveraging these systems to detect cosmetic imperfections, structural flaws, and dimensional variances that could compromise product appeal, durability, or performance in the hands of the end-user.

Furthermore, industries where product quality is directly linked to public health and safety represent high-value potential customers. The pharmaceutical and medical device industries, for instance, mandate exceptionally meticulous surface inspection for verifying tablet coatings, ensuring the integrity of sterile packaging, detecting flaws in syringes and vials, and confirming the pristine surface quality of medical implants. In the food and beverage sector, surface inspection systems are increasingly crucial for verifying packaging seal integrity, detecting foreign contaminants, and ensuring consistency in product appearance and quality. The aerospace and defense industry relies on these systems for inspecting critical components that operate under extreme stress, where even a microscopic defect could lead to catastrophic failure. Essentially, any industry where surface quality directly correlates with product performance, safety, aesthetic appeal, regulatory compliance, or competitive advantage actively seeks advanced surface inspection solutions to optimize their production processes and deliver consistently superior products to market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 7.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keyence Corporation, Cognex Corporation, Basler AG, ISRA VISION (Atlas Copco), Omron Corporation, Teledyne FLIR LLC, ViDi Systems SA (Cognex), Datalogic S.p.A., Nikon Corporation, Edmund Optics, Campbell Scientific, Baumer Holding AG, National Instruments, Stemmer Imaging AG, SmartRay GmbH, ADLINK Technology Inc., CyberOptics Corporation, LMI Technologies Inc., Coherix Inc., Matrox Imaging |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surface Inspection Market Key Technology Landscape

The Surface Inspection Market is defined by a dynamic and continuously evolving technological landscape, driven by an unwavering pursuit of higher precision, increased speed, and enhanced versatility in defect detection and analysis. At its foundational core, the technology revolves around advanced machine vision systems, which integrate a sophisticated interplay of high-resolution industrial cameras (e.g., CCD and CMOS sensors with various interfaces like GigE Vision and CameraLink), specialized optical lenses designed for specific magnification and distortion correction (telecentric, macro, fixed focal), and diverse, often programmable, illumination techniques. These lighting methods, including brightfield, darkfield, coaxial, diffuse dome lighting, and structured light projection, are meticulously chosen and engineered to optimally highlight specific types of surface defects by manipulating incident light and shadow patterns, thereby maximizing image contrast and clarity for subsequent defect identification.

The integration of advanced image processing software forms another critical cornerstone of the technological landscape, transforming raw visual data into actionable quality intelligence. These software platforms leverage an array of sophisticated algorithms for feature extraction, pattern recognition, and precise defect classification. The advent and rapid maturation of artificial intelligence (AI) and deep learning (DL) have profoundly revolutionized this area, enabling systems to learn from vast datasets of defect images, distinguish between subtle and complex surface anomalies, and adapt to new defect types with unprecedented accuracy. Deep learning models, particularly Convolutional Neural Networks (CNNs), are exceptionally adept at categorizing defects with higher reliability, significantly reducing the costly false positives and false negatives that often plague traditional, rule-based machine vision systems. Furthermore, AI capabilities are extending to quantify the severity of defects, moving beyond simple presence/absence detection to provide a more nuanced and quantitative assessment of product quality, thereby supporting more informed decision-making.

Beyond core vision and AI, the market is aggressively adopting several other cutting-edge technologies. 3D imaging technologies, such as laser triangulation and structured light projection, are gaining significant traction, providing precise height, depth, and volumetric information about surfaces. This allows for the reliable detection of defects like dents, warpage, raised features, or missing material that might be invisible or ambiguous in 2D inspection. Hyperspectral imaging is emerging as a powerful tool for detailed material characterization and the detection of subtle chemical variations, contaminants, or coatings on surfaces that are not discernable by visible light alone. Robotics and advanced automation play a crucial role in enabling automated sample handling, precise multi-angle inspection of complex parts, and seamless integration into automated production lines. The strategic convergence of these technologies, coupled with high-performance computing (GPUs) and seamless integration with Industrial IoT (IIoT) platforms for data collection and cloud connectivity, defines the cutting edge of surface inspection, enabling predictive quality analytics and closed-loop quality control within the broader framework of Industry 4.0 and smart factories.

Regional Highlights

The global Surface Inspection Market demonstrates significant regional variations in growth, adoption rates, and technological sophistication, primarily influenced by distinct levels of industrialization, prevailing economic conditions, national investment in advanced manufacturing, and the stringency of local regulatory frameworks. Each geographical region presents unique drivers and market dynamics, contributing diverse opportunities and challenges for industry stakeholders and shaping localized market strategies.

- North America: This region represents a highly mature and technologically advanced market for surface inspection. Growth is primarily driven by substantial investments in high-value manufacturing sectors such as automotive, aerospace, defense, and medical devices, all of which demand exceptionally stringent quality control and high precision. The presence of leading technology providers, strong R&D capabilities, and stringent regulatory standards (e.g., FDA requirements for medical products) further stimulate the adoption of sophisticated, AI-powered automated inspection systems. High labor costs also compel industries to invest in automation, reinforcing the market for surface inspection solutions.

- Europe: Europe is another well-established and innovation-driven market, characterized by robust industrial automation trends and a strong emphasis on maintaining high-quality, high-efficiency production across its core manufacturing sectors, including automotive, machinery, electronics, and food and beverage. Countries like Germany, with its formidable industrial base and proactive embrace of 'Industry 4.0' initiatives, are at the forefront of adopting advanced surface inspection technologies. The region also benefits from a strong focus on regulatory compliance, sustainability in manufacturing, and a continuous push towards modernizing existing industrial infrastructure with cutting-edge inspection solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Surface Inspection Market. This explosive growth is predominantly fueled by rapid industrialization, the continuous expansion of manufacturing capabilities, and substantial foreign direct investment pouring into major economies like China, India, Japan, South Korea, and Southeast Asian nations. The booming electronics, automotive, and metals industries in the region generate immense demand for cost-effective, high-speed, and efficient quality control solutions. The sheer volume of production, coupled with a growing emphasis on meeting international quality standards for export-oriented goods, makes APAC a critical and dynamic market for surface inspection system providers.

- Latin America: This region constitutes an emerging market for surface inspection technology, characterized by increasing industrialization and concerted modernization efforts in key economies such as Brazil and Mexico. The automotive manufacturing sector, alongside burgeoning food processing and packaging industries, represents significant contributors to market demand as regional manufacturers strive to enhance product quality, improve operational efficiency, and boost their competitiveness on a global scale. While the adoption rates of advanced inspection systems are currently lower compared to more developed regions, there is substantial potential for sustained growth as industrial infrastructure develops and awareness of the benefits of automation and superior quality control intensifies.

- Middle East and Africa (MEA): The MEA market for surface inspection is currently in its nascent stages but is demonstrating gradual expansion, particularly in countries committed to diversifying their economies beyond traditional oil and gas sectors. Growing investments in manufacturing, infrastructure development projects, and a nascent but increasing emphasis on industrial quality standards are progressively creating new market opportunities. The adoption of advanced inspection technologies is anticipated to accelerate as industrial capabilities mature and local industries seek to optimize production processes and meet quality expectations, especially in emerging sectors like construction materials, metals processing, and packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surface Inspection Market.- Keyence Corporation

- Cognex Corporation

- Basler AG

- ISRA VISION (Atlas Copco)

- Omron Corporation

- Teledyne FLIR LLC

- ViDi Systems SA (Cognex)

- Datalogic S.p.A.

- Nikon Corporation

- Edmund Optics

- Campbell Scientific

- Baumer Holding AG

- National Instruments

- Stemmer Imaging AG

- SmartRay GmbH

- ADLINK Technology Inc.

- CyberOptics Corporation

- LMI Technologies Inc.

- Coherix Inc.

- Matrox Imaging

Frequently Asked Questions

What is surface inspection and why is it important?

Surface inspection is the process of detecting and classifying defects or irregularities on material surfaces using automated or manual methods. It is crucial for maintaining product quality, reducing manufacturing waste, ensuring compliance with industry standards, and enhancing operational efficiency across various industrial sectors by preventing defective products from reaching the market.

How is AI transforming the surface inspection market?

AI significantly enhances surface inspection by enabling more accurate and faster defect detection through deep learning algorithms, reducing false positives and negatives. It facilitates automated defect classification, allows systems to learn from data, adapt to new product variations, and provides predictive insights for process optimization and preventive quality control.

Which industries are the primary adopters of surface inspection technology?

Primary adopters include the automotive, electronics and semiconductors, metals and machinery, glass, plastics and rubber, food and beverage, and pharmaceutical and medical device industries. These sectors require high precision, stringent quality control, and often high-volume production, making surface inspection indispensable for their operations.

What are the main types of surface inspection systems available?

The main types include Automated Optical Inspection (AOI), Automated X-ray Inspection (AXI), 3D surface inspection (e.g., laser triangulation, structured light), hyperspectral imaging, infrared thermography, and various forms of manual visual inspection systems. Each type is tailored to detect specific kinds of defects or analyze different material properties.

What are the key challenges in implementing surface inspection systems?

Key challenges include the high initial investment costs for advanced hardware and software, the technical complexity associated with integrating these systems into existing production lines, the ongoing need for skilled personnel to operate and maintain them, and the crucial task of accurately differentiating between critical and non-critical defects to avoid unnecessary rejections or costly escapes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager